Trucking expenses can be challenging to track and manage, especially for small business owners who are just entering the industry.

Many factors impact the overall cost of starting and running a trucking company, including fixed expenses like vehicle payments, permit costs, insurance, and licensing fees, as well as variable expenses such as fuel, vehicle maintenance, tolls, and taxes.

Keeping track of these expenses is essential for accurate financial management and decision-making, which is why a trucking expenses spreadsheet can be a valuable tool for a trucking business owner-operator.

A well-designed trucking expenses spreadsheet enables owner-operators to monitor and analyze their expenses effectively, which can ultimately improve their bottom line.

Using spreadsheets has been shown to help businesses save time and money, reduce errors, and better plan for the future.

A recent study revealed that over 70% of small businesses use spreadsheets, proving the importance of utilizing accurate and reliable tools for financial management.

A carefully crafted trucking expenses spreadsheet can empower trucking business owners to make informed decisions and optimize their operations.

Trucking expenses spreadsheet basics

1. The importance of tracking expenses

Tracking expenses in the trucking industry is crucial for the success of any trucking or transportation business.

Accurate record-keeping allows business owners to monitor their cash flow, make informed financial decisions, and keep track of both fixed and variable expenses.

A trucking expenses spreadsheet is a useful tool for managing these essential and profitable aspects of your business.

2. Fixed expenses vs variable expenses

In a trucking expenses spreadsheet process, there are two primary types of expenses: fixed expenses and variable expenses.

Understanding the difference between these two categories is important for accurate record-keeping and meaningful financial analysis.

What are fixed expenses?

Fixed expenses include costs that remain relatively constant over time, regardless of the number of miles driven or deliveries made.

Examples of fixed expenses in a trucking business are:

Vehicle payments

Permit costs

Insurance

Licensing fees

Physical damages

Miscellaneous expenses

What are variable expenses?

Variable expenses, on the other hand, are costs that fluctuate depending on the usage of your trucks or the distance driven.

These expenses directly correlate with the amount of work your trucking business receives.

Examples of variable expenses include:

Fuel

Vehicle maintenance

Tolls

Taxes

By properly organizing your trucking expenses spreadsheet with these two categories, you can easily analyze your business’s financial performance and identify areas for potential cost savings.

What are the top trucking expenses spreadsheets online?

In this section, we’ll explore some of the top free trucking expenses spreadsheets available online.

These resources can help trucking business owners and operators better manage their accounting processes, trucking bookkeeping, expenses, and financial data.

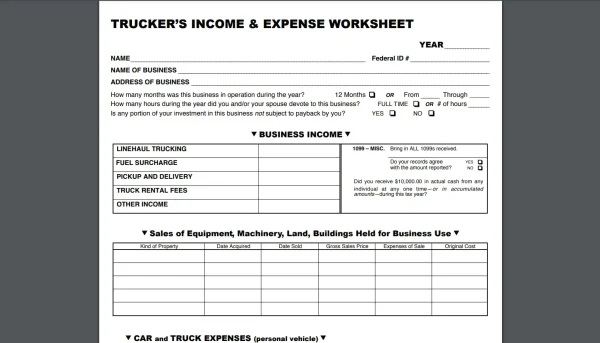

1. Trucker’s Income & Expense Worksheet

Trucker’s Income and Expense Worksheet PDF

The Trucker’s Income & Expense Worksheet is a comprehensive trucking expense PDF form that allows truckers to organize, budget, and record their income and expenses.

Worksheets like these covers a wide range of information, including mileage, fuel costs, maintenance, and other miscellaneous expenses related to trucking.

The form can be filled out and printed, making it an easy-to-use tool for managing trucking finances.

2. Financial projections template for a trucking company

Trucking Financial Projections Forecast by ProjectionHub.

The Trucking Financial Projections Forecast is a helpful tool for creating financial projections for trucking companies.

This resource allows trucking business owners to input their current and projected expenses to create a financial forecast for their business.

The template covers various aspects of the trucking industry, including revenue, operating expenses, debt financing, and more.

3. Build your own spreadsheet for trucking

For those interested in building their trucking expenses spreadsheet, the YouTube tutorial below offers a detailed guide on creating a custom trucking expenses spreadsheet in Excel.

The video demonstrates step-by-step instructions on setting up the spreadsheet, adding categories for various expenses, saving it, and organizing the data for easy analysis.

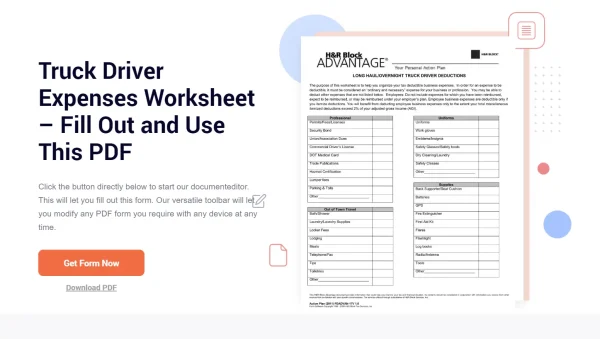

4. Truck Driver Expenses Worksheet

Download the Truck Driver Expenses Worksheet PDF.

The Truck Driver Expenses Worksheet is a simple and straightforward PDF form designed for truck drivers to record their expenses.

This form allows drivers to record information such as trips, load numbers, odometer readings, and expenses like fuel, food, and lodging.

The worksheet can be printed and filled out by hand, making it a convenient tool for managing trucking expenses.

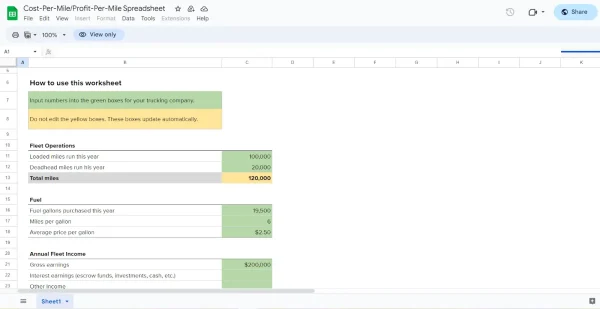

5. Cost-Per-Mile/Profit-Per-Mile Spreadsheet

Cost-Per-Mile and Profit-Per-Mile Spreadsheet for truckers

The Cost-Per-Mile/Profit-Per-Mile Spreadsheet is a free trucking expenses spreadsheet that provides a simple and intuitive way to calculate the cost-per-mile and profit-per-mile calculations for trucking businesses.

Users can input data on their trips, miles driven, revenue, and various expenses to calculate valuable financial metrics for their trucking operations.

The spreadsheet can be easily customized to accommodate individual business needs.

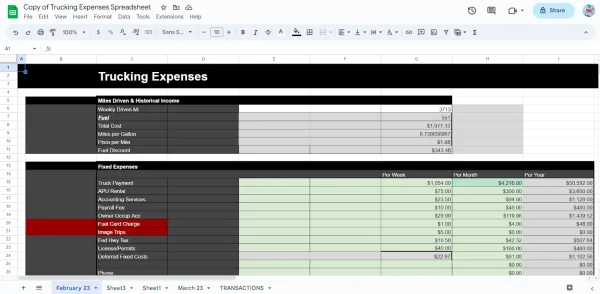

6. Spreadsheet Point trucking expenses spreadsheet

Trucking expenses spreadsheet template by Spreadsheet Point

The Spreadsheet Point trucking expenses spreadsheet features variable and fixed expenses and uses formulas to calculate the totals of each category.

This spreadsheet for truckers is a free-to-copy-and-use Google Sheet template with various trucking-related categories such as fuel, truck payments, and licenses and permits to help you organize and keep track of your weekly, monthly, and annual expenses.

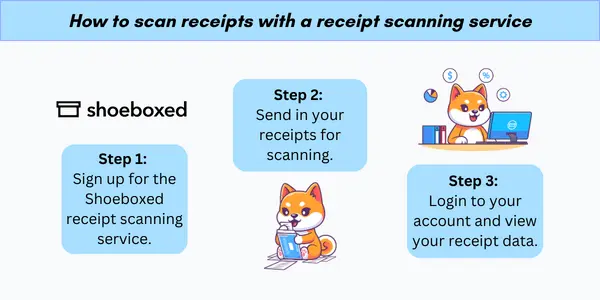

7. Bonus: Shoeboxed for receipt tracking while on the road!

Shoeboxed is used by businesses across various industries for their receipt-tracking needs.

Hate spreadsheets? Don’t have time for manual entry? Want an easy alternative?

Truck drivers often have a lot of expenses on the road, such as fuel, meals, and maintenance costs.

Keeping track of all these receipts can be a challenge, but with Shoeboxed’s Magic Envelope service, they just need to stuff all their receipts into the prepaid envelope provided by Shoeboxed and send it in.

Shoeboxed’s data entry team will then scan, categorize, and organize these receipts digitally.

So, instead of having to manually enter expense data, truck drivers can spend more time focusing on their primary job!

Here’s how that would work: Keep a Magic Envelope in the seat next to you as you drive, and after you fill up for gas or leave that drive-in, slip the receipt into the prepaid envelope. At the end of the month, send the envelope in, and you won’t have to go near a spreadsheet again!

Pros

“Set and forget” expense reporting—use the Magic Envelope to store your receipts, ship at the end of your route, and get them scanned and uploaded to your account.

Accurate mileage tracking that can be included in expense reports.

Add multiple users to a single account for FREE.

Store digital copies of related documents for loads, such as invoices, warranties, contracts, and more.

Importing e-receipts to your Shoeboxed account is as easy as syncing your Gmail with Shoeboxed, using Shoeboxed's special Gmail Receipt Sync feature.

Integrate with other software, such as QuickBooks, for tax reporting and accounting purposes.

Used and trusted by truckers.

Cons

Plans that include the Magic Envelope cannot be purchased through the mobile app.

Price

Plans that include the Magic Envelope start at $18/month, up to $54/month.

All monthly plans come with a 30-day free trial.

All annual plans are charged upon sign-up and come with a full money-back guarantee if the plan is terminated at any point within the first 30 days.

Shoeboxed is the only receipt scanner app that will handle both your paper receipts and your digital receipts—saving customers up to 9.2 hours per week from manual data entry!

Hit the road with Shoeboxed ⛟

Stuff receipts into the Magic Envelope while on the road. Then send them in once a month to get scanned. Expense reports don’t get easier than this! 💪🏼 Try free for 30 days!

Get Started TodayWhat else can Shoeboxed do?

Shoeboxed has been voted as the best receipt scanner app for tax season by Hubspot and given the Trusted Vendor and Quality Choice awards by Crozdesk.

A quick overview of Shoeboxed's award-winning features:

a. Mobile app and web dashboard

There are many ways to upload receipts to Shoeboxed.

Shoeboxed’s mobile app lets you snap photos of paper receipts and upload them to your account from your phone.

Shoeboxed also has a user-friendly web dashboard so you can drag and drop receipts or documents from your desktop.

b. Gmail receipt sync feature for capturing e-receipts

Importing e-receipts to your Shoeboxed account is as easy as syncing your Gmail with Shoeboxed, using Shoeboxed's special Gmail Receipt Sync feature.

Shoeboxed’s Gmail Receipt Sync grabs all receipt emails and sends them to your account for automatic processing! These receipts are then labeled as Sent to Shoeboxed in your Gmail inbox.

In short, Shoeboxed pulls the receipt data from your email, including the vendor, purchase date, currency, total, and payment type, and organizes it in your account.

Your purchases will even come with images of the receipts attached!

c. Expense reports

Expense reports let you view all of your expenses in one cohesive document. They also make it simple to share your purchases with your accountant.

Shoeboxed makes it easy to export your yearly expenses into a detailed report. All expenses come with receipts attached.

You can also choose certain types of receipts to include in your expense report. Just select the receipts you want to export and click “export selected.”

d. Search and filter

Call up any receipt or warranty in seconds with advanced search features.

Filter receipts based on vendors, date, price, currency, categories, payment type, and more.

e. Accounting software integrations

Export expenses to your accounting software in just a couple of clicks.

Shoeboxed integrates with 12+ apps, including QuickBooks, Xero, and Wave Accounting, to automate tedious life tasks.

f. Unlimited number of free sub-users

Add an unlimited number of free sub-users to your account, such as family members, employees, accountants, and tax professionals.

g. Mileage tracker for logging business miles

After you sign up for Shoeboxed, you can start tracking miles in seconds:

Open the Shoeboxed app.

Tap the “Mileage” icon.

Click the “Start Mileage Tracking” button.

And drive!

Whenever you start a trip, Shoeboxed tracks your location and miles and saves your route as you drive.

As you make stops at stores and customer locations, you can drop pins to make tracking more precise.

At the end of a drive, you’ll click the “End Mileage Tracking” button to create a summary of your trip. Each summary will include the date, editable mileage and trip name, and your tax deductible and rate info.

Click “Done” to generate a receipt for your drive and get a photo of your route on the map. Shoeboxed will automatically categorize your trip under the mileage category in your account.

h. The Magic Envelope

Outsource your receipt scanning with the Magic Envelope!

The Magic Envelope service is the most popular Shoeboxed feature, particularly for businesses, and lets users outsource their receipt management.

When you sign up for a plan that includes the Magic Envelope, Shoeboxed will mail you a pre-paid envelope for you to send your receipts in.

Once your receipts reach the Shoeboxed facility, they’ll be digitized, human-verified, and tax-categorized in your account.

Have your own filing system?

Shoeboxed will even put your receipts under custom categories. Just separate your receipts with a paper clip and a note explaining how you want them organized!

Stop doing manual data entry 🛑

Outsource receipt scanning to Shoeboxed’s scanning service and free up your time for good. Try free for 30 days! ✨

Get Started TodayHow do you create a trucking expenses spreadsheet?

1. Categorize your expenses

A comprehensive trucking expenses spreadsheet should include various categories to accurately track expenses.

Some of the primary expense categories to consider are:

Fuel: The cost of diesel or gasoline consumed by the truck

Insurance: Premiums paid for coverage on the truck, cargo, and driver

Tolls: Charges incurred for using roads, bridges, or tunnels

Tires: Expenses related to tire purchases, replacements, or repairs

Taxes: Federal, state, or local taxes associated with trucking operations

Repairs: Costs incurred for maintaining or fixing the truck

See also: Tax Expense Spreadsheet: Top 5 Free Templates

2. Input data

To begin, scan your receipts using document and app scanners for truckers, then input the data pertaining to each expense category into designated columns. For example, you could create columns for date, category, and amount.

Depending on the level of detail you’re looking for, you may also add columns for individual expense items within each category, such as fuel type, insurance provider, or tire condition.

Ensure that you enter the data accurately and consistently, using a standard date format and currency.

Regularly updating the data will help you to maintain an up-to-date overview of your trucking expenses.

3. Calculate totals

Once you’ve categorized and input the data, it’s time to calculate totals for each expense category.

Using formulas or built-in functions, you can determine the sum per column.

You can also calculate monthly or yearly totals to assess trends and streamline budgeting decisions.

In addition to calculating totals, it can also be helpful to determine your average cost per mile.

To do this, divide your total expenses by the number of miles driven over a specific period.

This information will be valuable in identifying areas for improvement and evaluating the overall cost-efficiency of your operation.

By creating a detailed trucking expenses spreadsheet, tracking various expense categories, inputting the data accurately and consistently, and calculating totals, you’ll be better equipped to manage your trucking expenses and improve your financial performance.

See also: Printable Expense Tracker: Top 5 Free Templates

How do you budget and analyze your trucking business’s financials?

1. Set a budget

Setting a budget for your trucking business is crucial to ensure you allocate funds efficiently and maintain profitability.

Start by breaking down expenses into fixed and variable costs.

To recap, fixed costs are expenses that remain consistent each month, such as truck loans or lease payments, insurance premiums, permits, licenses, registration, rent, cellphone and internet service, and parking or storage fees (source).

Variable costs, on the other hand, fluctuate based on the number of miles driven and may include fuel, maintenance, and repairs.

To create a budget:

List all fixed and variable expenses.

Estimate revenue from hauling loads and any additional income sources.

Set aside funds for unforeseen expenses or emergencies.

Monitor and adjust the budget as needed to reflect changes in the trucking industry, market trends, or business goals.

2. Analyze profit and loss

A Profit and Loss (P&L) statement is an essential tool for tracking your trucking business’s financial health (source).

Typically prepared every 3 months or annually, a Profit & Loss statement helps you understand your net income by listing out revenue and expenses during a specific period.

To analyze your P&L statement:

Compare monthly and annual revenue to expenses to determine net income (positive or negative).

Identify areas where expenses have increased or decreased, and investigate the reasons behind those changes.

Evaluate the effectiveness of cost-cutting measures or growth strategies.

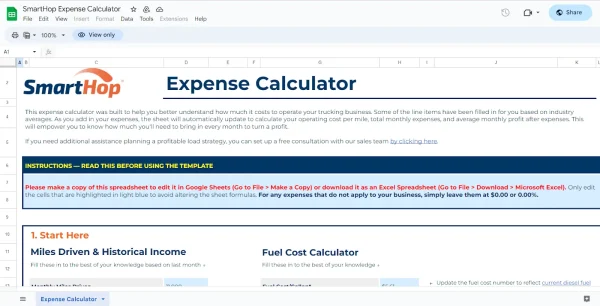

Using a trucking expenses spreadsheet or tools such as SmartHop’s Expense Calculator can make this process easier by automating calculations and providing insights into your operating costs.

SmartHop’s Expense Calculator for trucking companies

3. Review profit margins

Profit margin is a key financial metric that reflects the profitability of your trucking business. It’s calculated by dividing net income by revenue and expressed as a percentage.

By reviewing profit margins, you can assess the efficiency of your operations and identify potential areas for improvement.

Here are some tips to increase profit margins:

Optimize routes for fuel efficiency and minimize tolls or other expenses.

Negotiate better rates with clients, suppliers, or service providers.

Invest in preventive maintenance to reduce the likelihood of costly repairs.

Regularly reviewing your budget, P&L statement, and profit margin will help you maintain control over your trucking business’s financial health, enabling you to make informed decisions to support growth and long-term success.

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. Try free for 30 days!

Get Started TodayFrequently asked questions

Trucking expenses spreadsheets are a crucial tool for any trucking business, helping to manage finances effectively.

Here are some of the most frequently asked questions related to trucking expenses spreadsheets.

What are the main trucking expenses to include in a spreadsheet?

The main trucking expenses can be divided into fixed and variable expenses.

Fixed expenses typically include equipment bank payments, insurance premiums, permits, accounting fees, and property leases.

Variable expenses cover items such as fuel, maintenance, tires, and tolls.

It’s essential to list all relevant trucking expenses in the spreadsheet to ensure accurate financial tracking and planning.

How do you calculate trucking cost per mile?

To calculate trucking cost per mile, you’ll need to add up all fixed and variable expenses and then divide that sum by the total miles driven in a given period (such as monthly or yearly).

This calculation will provide an average cost per mile, which is crucial for understanding the profitability of your trucking business.

A free trucking cost per mile calculator is available to help streamline this process.

What is the easiest way to keep track of expenses?

The easiest way to keep track of expenses is to use a well-organized spreadsheet or specialized trucking expenses software.

Numerous free trucking expenses spreadsheet templates are available for download, enabling you to customize and maintain a detailed expense record.

Regularly updating the spreadsheet ensures accurate expense tracking and simplifies financial reporting.

With a comprehensive trucking expenses spreadsheet and an understanding of the key financial aspects, managing a trucking business becomes more efficient and less stressful, ultimately contributing to overall business success.

In conclusion

When you’re the owner operator of a trucking company, keeping up with your business’s finances can be harder than it needs to be without the right tools and technology.

Luckily, there are plenty of helpful trucking expenses spreadsheet templates as well as apps for truckers that you and your employees can use to stay on top of expenditures, budget your spending, and prepare for the future.

Hannah DeMoss is a staff writer for Shoeboxed covering organization and digitization tips for small business owners. Her favorite organization hack is labeling everything in her kitchen cabinets, and she can’t live without her mini label maker machine.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!