The Internal Revenue Service (IRS) allows individuals to deduct car and truck expenses on their taxes, provided these costs relate to work activities.

To facilitate this, the IRS provides specific guidance on reporting income or loss from a business on Schedule C, which encompasses reporting car and truck expenses.

Taxpayers must choose between the standard mileage rate and the actual expense method to claim these deductions correctly.

The standard mileage rate simplifies the process by allowing taxpayers to deduct a set amount per business mile driven, as detailed in IRS Publication 463.

Alternatively, the actual expense method requires taxpayers to tally all vehicle-related expenses, including gas, repairs, and insurance. This method can be more complex but potentially yield more significant deductions if meticulous records are kept.

Choosing which method to use depends on various factors, such as the amount of business usage, the cost of the vehicle, and the type of expenses incurred.

We’ve gathered here free worksheets you can use to help you calculate your vehicle expenses, plus we introduce 1 excellent service you won’t want to miss.

Top free car and vehicle expense worksheets

Organizing and tracking car and truck expenses is essential for individuals and businesses looking to maintain accurate financial records. Several free worksheets are available to streamline this process.

1. Fox Tax Service's Auto Expense Worksheet

The Auto Expense Worksheet from Fox Tax Service allows for detailed mileage and actual expenses reporting with additional inputs for license plate taxes and interest expenses.

2. Pace and Hawley's Vehicle Expense Worksheet

This Vehicle Expense Worksheet is produced by Pace & Hawley, LLC. It emphasizes the IRS requirement for mileage logs and provides separate sections for each vehicle's business use.

3. PDVCPA's Tax Car and Truck Worksheet

This car and truck worksheet, created by PDVCPA, is formatted for the 2021 tax year and provides comprehensive sections for documenting vehicle-related expenses.

4. TemplateData's Auto Expense Report

While this isn’t a worksheet, TemplateData offers a versatile Free Auto Expense Report Template suitable for tracking repairs and maintenance. Employers and employees benefit from detailed sections for recording driving time and maintenance costs.

Each worksheet provides unique features to assist users in compliantly reporting their vehicle expenses for personal or business purposes.

Bonus: Shoeboxed, an expense management service for professional drivers

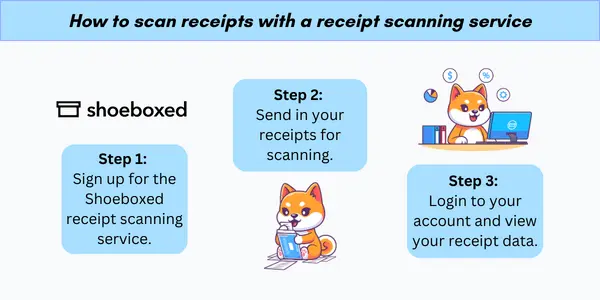

Shoeboxed is a receipt management service that simplifies expense tracking for professional drivers. It offers a streamlined approach to managing and maintaining records of all driving-related expenses.

Professional drivers often have many expenses on the road, such as fuel, meals, and maintenance costs.

Keeping track of all these receipts can be a challenge, but with Shoeboxed’s Magic Envelope service, they just need to stuff all their receipts into the prepaid envelope provided by Shoeboxed and send it in.

Shoeboxed’s data entry team will then scan, categorize, and organize these receipts digitally.

So, instead of having to manually enter expense data, truck drivers can spend more time focusing on their primary job!

Here’s how that would work: Keep a Magic Envelope in the seat next to you as you drive, and after you fill up for gas or leave that drive-in, slip the receipt into the prepaid envelope. At the end of the month, send the envelope in, and you won’t have to go near a spreadsheet again!

Pros

“Set and forget” expense reporting—use the Magic Envelope to store your receipts, ship at the end of your route, and get them scanned and uploaded to your account.

Accurate mileage tracking that can be included in expense reports.

Add multiple users to a single account for FREE.

Store digital copies of related documents for loads, including invoices, warranties, contracts, and other important documents.

Importing e-receipts to your Shoeboxed account is as easy as syncing your Gmail with Shoeboxed, using Shoeboxed's special Gmail Receipt Sync feature.

Integrate with other software, such as QuickBooks, for tax reporting and accounting purposes.

Used and trusted by professional drivers.

Cons

Plans that include the Magic Envelope cannot be purchased through the mobile app.

Price

Plans that include the Magic Envelope start at $18/month, up to $54/month.

All monthly plans come with a 30-day free trial.

All annual plans are charged upon sign-up and come with a full money-back guarantee if the plan is terminated at any point within the first 30 days.

Shoeboxed is the only receipt scanner app that will handle both your paper receipts and your digital receipts—saving customers up to 9.2 hours per week from manual data entry!

Hit the road with Shoeboxed 🚗

Stuff receipts into the Magic Envelope while on the road. Then send them in once a month to get scanned. 💪🏼 Try free for 30 days!

Get Started TodayHow to calculate car and truck expenses

When preparing a car and truck expenses worksheet, one must choose between the Actual Expense Method and the Standard Mileage Rate. Both methods require meticulous record-keeping and have their own sets of allowable deductions.

a. Actual expense method

Under the actual expense method, individuals can deduct the actual costs of operating the vehicle.

This includes various expenses such as depreciation, licenses, gas, oil, repairs, and insurance.

To accurately calculate these expenses, one must keep thorough records of each expenditure throughout the year.

For example:

Depreciation—Must be calculated based on the initial cost of the vehicle and its expected life.

Gas and oil—All receipts from fuel purchases should be kept.

This deduction method may yield higher deductions for those with more expensive operational costs.

b. Standard mileage rate

The standard mileage rate allows for a simpler calculation, where one deducts a set amount for each mile driven for business purposes.

For example, the standard rate for 2023 is 65.5 cents per mile. This rate covers all vehicle operating costs, including depreciation, gas, oil, and others.

Recordkeeping for this method primarily involves tracking the miles driven for business.

The IRS provides the standard mileage rates each year, which must be applied to the total business mileage for the year to determine the deduction. The choice between this method and actual expenses often depends on the cost-benefit as per individual situations.

Special considerations

When tackling car and truck expenses for tax purposes, one must consider the implications of leased vehicles, depreciation, and the Section 179 deduction. These factors can significantly impact the allowable deductions.

a. Leased vehicles

For leased vehicles, taxpayers must use the standard mileage rate for the entire lease period (including renewals) if it is chosen in the first year.

One must include lease inclusion amounts as income if the vehicle's fair market value exceeds a certain threshold. This is to account for reducing lease payments into deductible expenses.

b. Depreciation

Taxpayers must be mindful of car, truck, and van depreciation limits.

The first-year limit on the depreciation deduction for vehicles placed in service during the tax year is subject to annual adjustment. Additionally, they must allocate the depreciation amount over multiple years, which reflects the usage of the vehicle for business purposes over its useful life.

c. Section 179 deduction

The Section 179 deduction allows businesses to deduct the full purchase price of qualifying vehicles as an expense for the year they were placed in service.

However, the deduction is subject to several limitations and thresholds, such as the vehicle’s weight and the business income generated—it cannot exceed the taxpayer's business income for the year.

Frequently asked questions

What is a car and truck expenses worksheet?

A car and truck expenses worksheet is a tool used by individuals or businesses to calculate and report expenses related to the use of vehicles for business purposes.

Are there templates available for truck driver expenses?

There are free truck driver expense spreadsheet templates available. These templates help truck drivers streamline the tax preparation process by keeping their income and expenses well-organized.

Can actual expenses and standard mileage both be claimed?

Vehicle expenses can be calculated using actual expenses or the standard mileage rate, but not both simultaneously. The choice depends on what is most beneficial for the taxpayer's situation.

Choosing the best option requires consideration of the total mileage and the percentage of business use for the vehicle.

Break free from manual data entry ✨

Use Shoeboxed’s Magic Envelope to ship off your receipts and get them back as scanned data in a private, secure cloud-based account. 📁 Try free for 30 days!

Get Started TodayIn closing

Managing car and truck expenses can streamline one's tax filing process and save money.

Spreadsheets and worksheets enable individuals and business owners to account for vehicle-related outlays. Schedule C documents a business's profit or loss and includes sections for car and truck expenses.

Taxpayers should ensure they have duly followed the IRS guidelines and maintain accuracy in their records. Each step in the management of car and truck expenses plays a part in the larger picture of financial clarity and responsibility, both personal and professional.

Careful documentation and understanding of vehicle expense deductions can significantly affect overall tax obligations.

Tomoko Matsuoka is managing editor for Shoeboxed, MailMate, and other online resource libraries. She covers small business tips, organization hacks, and productivity tools and software.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!