Tracking business expenses is fundamental to managing a company's financial health. Efficient expense management helps keep a record of spending and serves in budgeting and tax preparation.

Google Sheets has emerged as a versatile tool for businesses looking to streamline their expense tracking process. With real-time collaboration features and customizable templates, it’s an excellent option for businesses of all sizes.

By using a business expenses spreadsheet to record expenses incurred, companies can create detailed records that are easy to update and share among team members. This simplicity aids in monitoring cash flows and finding areas where business owners can realize cost savings.

We've gathered the top 4 free templates + 1 simple way to track expenses you won't want to miss!

Top free business expense trackers for Google Sheets

The following are some standout templates for managing expenses in Google Sheets, designed for small business owners and independent contractors.

1. Spreadsheet Point’s expense tracker for Google Sheets

This expense tracker from Spreadsheet Point is a comprehensive tool for quickly recording and monitoring business expenditures.

Designed to clearly show expenses against one's budget and income in the same spreadsheet, this expense sheet helps aid in better financial decision-making. Users can categorize expenses, attach receipts, and visualize data with embedded charts on the overview page.

Make a copy of the expense tracker using the following link:

2. Business budget template by Smartsheet

This is a budget template for small businesses that shows your budget against your actual expenses.

There's also a section for expenses, with categories that are common to business operations.

Make a copy of this template using the following link:

3. Coefficient’s monthly expense report

This monthly expense report template by Coefficient is a good option for organizations that perform monthly financial reviews. Simplifying the process of compiling and discerning expense data over a monthly period, this template includes fields for categorization, automatic summaries, and accumulation of expenses over time, which assists in efficient expense analysis and reporting.

With tabs for every month, along with an overview tab, businesses can tailor this expense tracker template to suit their unique expense monitoring needs.

4. An annual business expense budget template by Business.com

This budget template by Business.com displays a month-by-month look at your income and expenses. With tabs for the annual budget, monthly budget, monthly actuals, and an overview page that brings everything together.

5. Bonus: Shoeboxed, a better way to do expense tracking

Small business owners and independent contractors who want the simplest way to organize receipts and expenses for tax purposes may want to consider Shoeboxed.

Shoeboxed has been voted as the best receipt scanner app for tax season by Hubspot and given the Trusted Vendor and Quality Choice awards by Crozdesk.

Shoeboxed's receipt scanner app extracts key information from scanned receipts. The extracted data is then verified by Shoeboxed data verification team, then categorized, tagged, and stored securely in the cloud.

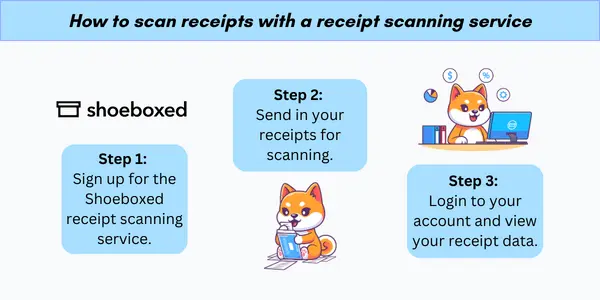

Shoeboxed also offers a receipt scanning service that allows business owners to outsource data entry of paper receipts.

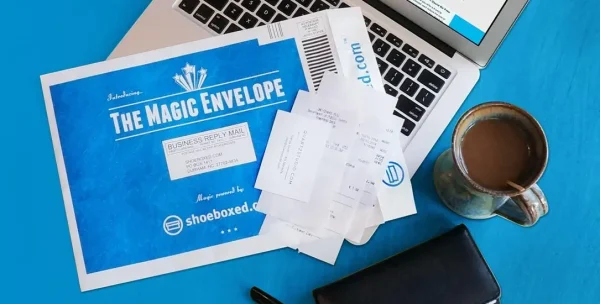

Starting from $18 per month, individuals receive a postage-prepaid Magic Envelope that you stuff receipts into.

At the end of the month, simply send the Magic Envelope in, and the Shoeboxed team will scan all your data and categorize it into 15 common tax categories. Easy peasy.

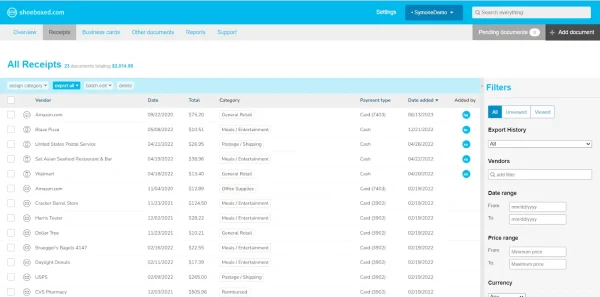

Once your expenses are scanned into your Shoeboxed account and organized into digital records, you can create and export a CSV file and open it in Excel.

Your previous expenses will be automatically included in your spreadsheet and categorized into columns for the receipt date, store, notes, currency, totals, payment type, and more.

Links to images of your receipts are also included in the spreadsheet for easy access should you ever be audited.

Shoeboxed is the only receipt scanner app that will handle both your paper receipts and your digital receipts—saving customers up to 9.2 hours per week from manual data entry!

Break free from manual data entry ✨

Use Shoeboxed’s Magic Envelope to ship off your receipts and get them back as scanned data in a private, secure cloud-based account. 📁 Try free for 30 days!

Get Started TodayWhat else can Shoeboxed do?

Shoeboxed has been voted as the best receipt scanner app for tax season by Hubspot and given the Trusted Vendor and Quality Choice awards by Crozdesk.

A quick overview of Shoeboxed's award-winning features:

a. Mobile app and web dashboard

Shoeboxed’s mobile app lets you snap photos of paper receipts and upload them to your account right from your phone.

Shoeboxed also has a user-friendly web dashboard to upload receipts or documents from your desktop.

b. Gmail receipt sync feature for capturing e-receipts

Importing e-receipts to your Shoeboxed account is as easy as syncing your Gmail with Shoeboxed, using Shoeboxed's special Gmail Receipt Sync feature.

Shoeboxed’s Gmail Receipt Sync grabs all receipt emails and sends them to your account for automatic processing! These receipts are then labeled as Sent to Shoeboxed in your Gmail inbox.

In short, Shoeboxed pulls the receipt data from your email, including the vendor, purchase date, currency, total, and payment type, and organizes it in your account.

Your purchases will even come with images of the receipts attached!

c. Expense reports

Expense reports let you view all of your expenses in one cohesive document. They also make it simple to share your purchases with your accountant.

Shoeboxed makes it easy to export your yearly expenses into a detailed report. All expenses come with receipts attached.

You can also choose certain types of receipts to include in your expense report. Just select the receipts you want to export and click “export selected.”

d. Search and filter

Call up any receipt or warranty in seconds with advanced search features.

Filter receipts based on vendors, date, price, currency, categories, payment type, and more.

e. Accounting software integrations

Export expenses to your accounting software in just a click.

Shoeboxed integrates with 12+ apps to automate the tedious tasks of life, including QuickBooks, Xero, and Wave Accounting.

f. Unlimited number of free sub-users

Add an unlimited number of free sub-users to your account, such as family members, employees, accountants, and tax professionals.

g. Mileage tracker for logging business miles

After you sign up for Shoeboxed, you can start tracking miles in seconds:

Open the Shoeboxed app.

Tap the “Mileage” icon.

Click the “Start Mileage Tracking” button.

And drive!

Whenever you start a trip, Shoeboxed tracks your location and miles and saves your route as you drive.

As you make stops at stores and customer locations, you can drop pins to make tracking more precise.

At the end of a drive, you’ll click the “End Mileage Tracking” button to create a summary of your trip. Each summary will include the date, editable mileage and trip name, and your tax deductible and rate info.

Click “Done” to generate a receipt for your drive and get a photo of your route on the map. Shoeboxed will automatically categorize your trip under the mileage category in your account.

h. The Magic Envelope

Outsource your receipt scanning with the Magic Envelope!

The Magic Envelope service is one of Shoeboxed's most popular features, particularly for businesses, as it lets users outsource their receipt management.

When you sign up for a plan that includes the Magic Envelope, Shoeboxed will mail you a pre-paid envelope for you to send your receipts in.

Once your receipts reach the Shoeboxed facility, they’ll be digitized, human-verified, and tax-categorized in your account.

Have your own filing system?

Shoeboxed will even put your receipts under custom categories. Just separate your receipts with a paper clip and a note explaining how you want them organized!

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. Try free for 30 days!

Get Started TodayHow to create an expense tracker using Google Sheets

Expense spreadsheet templates for Google Sheets often come with predefined categories and formulas, enabling users just to input their data and let the sheet calculate totals automatically.

This level of automation and organization significantly reduces errors and saves time, allowing businesses to focus on strategic financial planning and analysis.

Since Google Sheets is part of the Google Workspace, you’ll be able to integrate with other tools and apps directly in Google Sheets.

The following are key steps to help you get set up and utilize the functionalities of Google Sheets.

1. Set up your own spreadsheet

The initial step is to launch Google Sheets and begin with a blank worksheet. Tip: Type “sheets.new” into your URL bar, and you’ll be taken to a new spreadsheet.

Alternatively, choose from one of the templates provided in this article. Make a copy of the template, and then begin customizing to your liking!

2. Create your own custom categories

Expenses should be categorized to allow granular analysis. For example, expense categories like "Office Supplies," "Travel," or "Payroll" can be tailor-made to fit the business structure.

Additionally, consider adding details, such as "Date," "Payment method," etc.

See also: Bill Tracker Template Google Sheets: Free Template + Bonus

3. Record expenses

Document each expense by date, category, and amount. Consistent recording is essential for accuracy and helps in financial assessment.

4. Generate overview charts

Google Sheets offers capabilities to translate data into visual charts, making it simpler to interpret spending patterns and trends. Select the data you want to visualize, go to Insert, and then click on Chart.

Stop doing manual data entry 🛑

Outsource receipt scanning to Shoeboxed’s scanning service and free up your time for good. Try free for 30 days! ✨

Get Started TodayFrequently asked questions

How can one start using an expense tracker in Google Sheets?

Users can begin by accessing expense tracker templates on Google Sheets, which provide a structured format for recording financial data.

Are these templates free to use?

There are many free templates available that offer various functionalities for tracking expenses.

Can expense trackers be customized?

Absolutely. Since Google Sheets is flexible, one can adjust columns, rows, and formulas to match their tracking needs. Expense spreadsheets can also be fully tailored to specific industries, such as trucking, Airbnb rentals, lawn care, real estate, and more.

How does one categorize expenses in these trackers?

Expenses can be categorized by type or category, such as utilities, rent, or office supplies, often in separate columns or tabs for clarity.

Can Google Sheets calculate sums and create financial summaries?

By using built-in formulas, Google Sheets can automatically calculate totals and provide summaries of monthly or annual expenses.

Are Google Sheets expense trackers accessible on mobile devices?

Google Sheets can be accessed on mobile devices, allowing users to update their expenses on the go through the Google Sheets app.

Where can one find instructions for setting up a business expense tracker?

Instructions are often provided in the templates themselves, or one can visit sites like Shoeboxed for more detailed guidance.

In closing

When it comes to managing finances, clarity and organization are paramount.

Google Sheets offers a robust and accessible platform for tracking expenses.

In harnessing expense tracking templates, businesses benefit from a variety of features such as the following:

Customization: Every company has unique needs; templates are easily tailored to fit specific requirements.

Accessibility: With the cloud-based structure of Google Sheets, team members can access and update data from anywhere.

Integration: Google Sheets works seamlessly with other Google Suite products, enhancing data analysis and reporting.

Beyond mere record-keeping, these spreadsheet templates provide the foundational support for deeper financial insights, enabling businesses to:

Analyze spending patterns

Forecast budget needs

Make data-driven decisions

Leveraging Google Sheets for expense tracking or a more automated solution like Shoeboxed is not just a matter of convenience but a strategic move for those aiming to stay organized and informed about their financial position.

Tomoko Matsuoka is managing editor for Shoeboxed, MailMate, and other online resource libraries. She covers small business tips, organization hacks, and productivity tools and software.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!