Business expense management is a core aspect of running a successful enterprise, and having an effective tool to track these expenses can be immensely beneficial.

Excel templates for business expense tracking provide a structured way for businesses to record and manage their costs. These templates also help businesses gain insights into spending patterns and are a handy solution for small businesses looking to streamline their financial processes.

We've selected our favorite free Excel templates for tracking business expenses, plus 1 great alternative you'll want to know about.

6 best free business expense Excel templates

Here are the best expense spreadsheets for Excel that you can use to track business expenses.

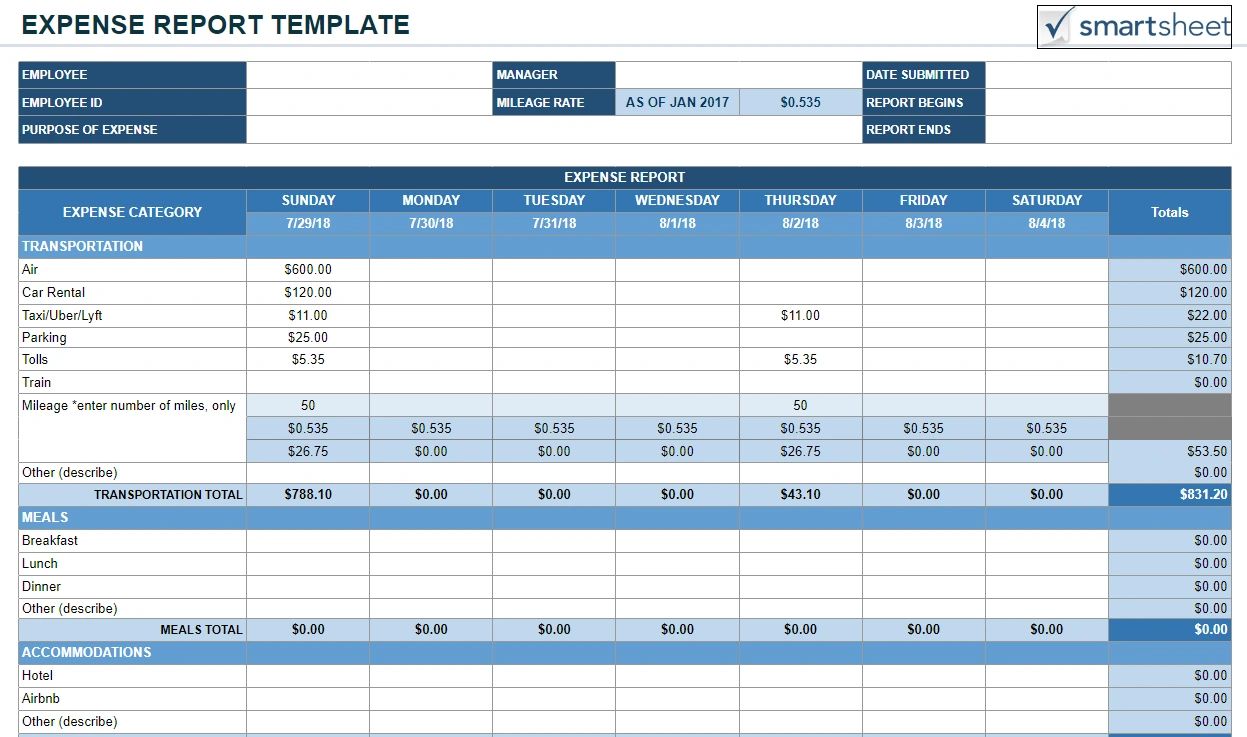

1. Smartsheet's Excel expense report template

This basic business expense report template is practical for tracking team expenses. It allows easy reimbursement of expenses incurred and tax deduction tracking, enhancing financial organization.

Sections include Reporting Period, information for listing who submitted the report, and expense details.

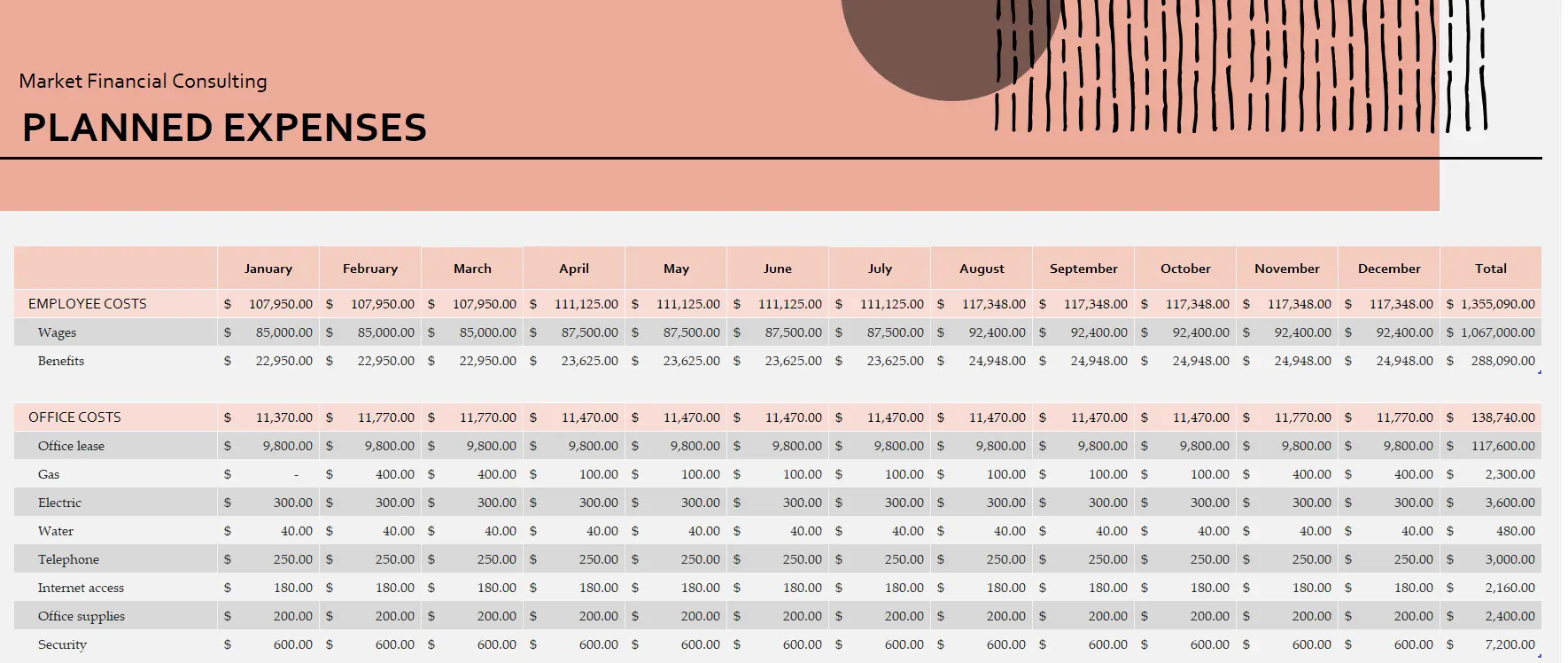

2. Microsoft's business expenses template for Excel

Microsoft has created an Excel spreadsheet that you can use as a monthly business expense spreadsheet or an annual expenses spreadsheet.

This template includes spreadsheets for Actual Expenses, Expense Variances, and an overview sheet that displays your monthly expenses in a graph.

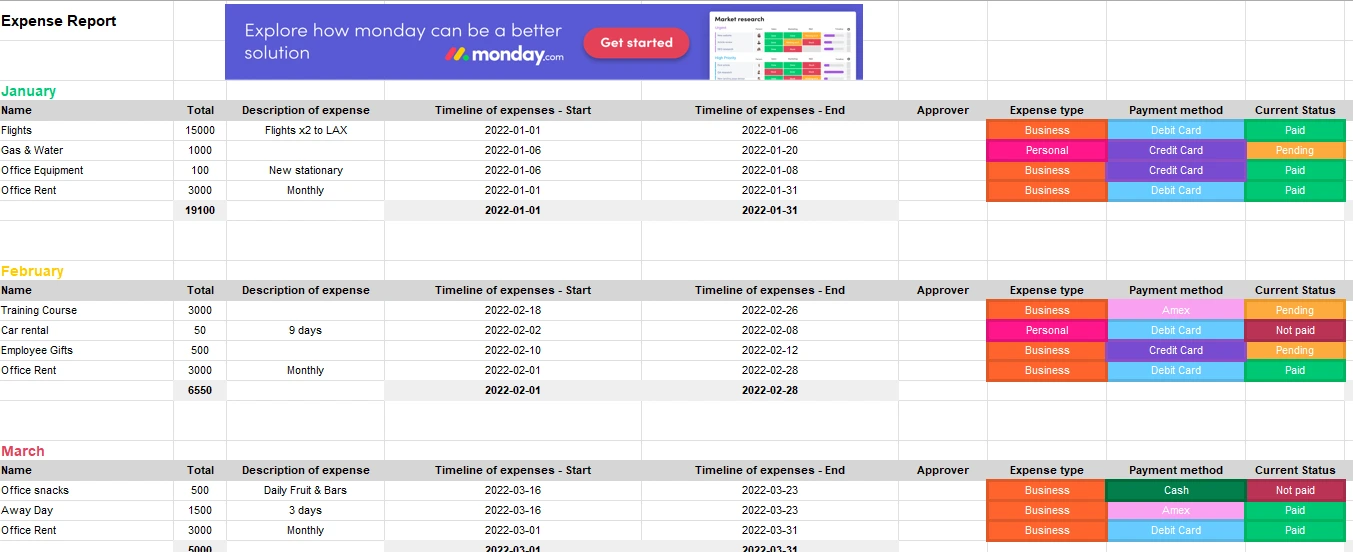

3. Monday.com’s business expenses spreadsheet for Excel

Ideal for tracking various business expenses, this spreadsheet format presents key columns like date, expense description, category, and amount.

Additional fields can be added for specific expense types.

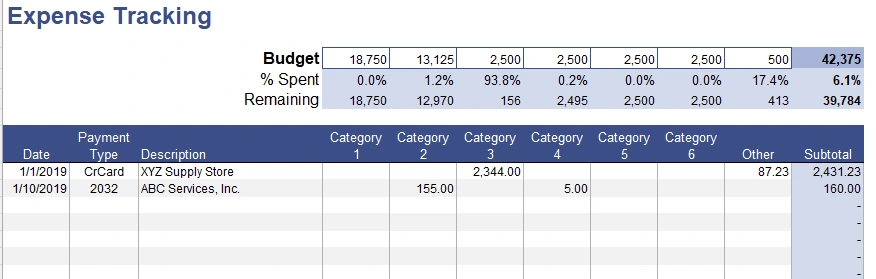

4. Vertex42’s free expense tracking worksheet for Excel

This expense sheet provides a simple approach to tracking expenses individually or business-wide.

Vertex42’s template helps maintain transparency in financial management by including a field where you can add your monthly budgeted amount. As expenses are listed, you can see how much of your monthly budget remains.

5. Shoeboxed, a small business expense spreadsheet alternative

Don't want to track expenses manually? We hear you. While some people thrive on using business expense tracking spreadsheets, others prefer a more automated method.

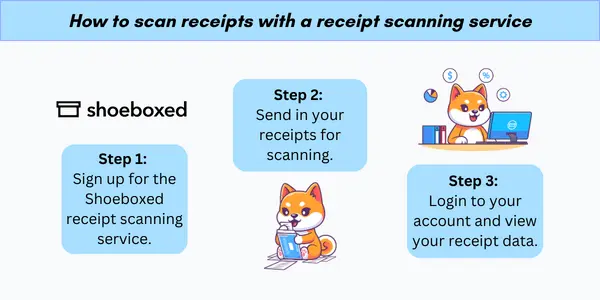

If you'd like to forgo manual entry entirely, consider Shoeboxed!

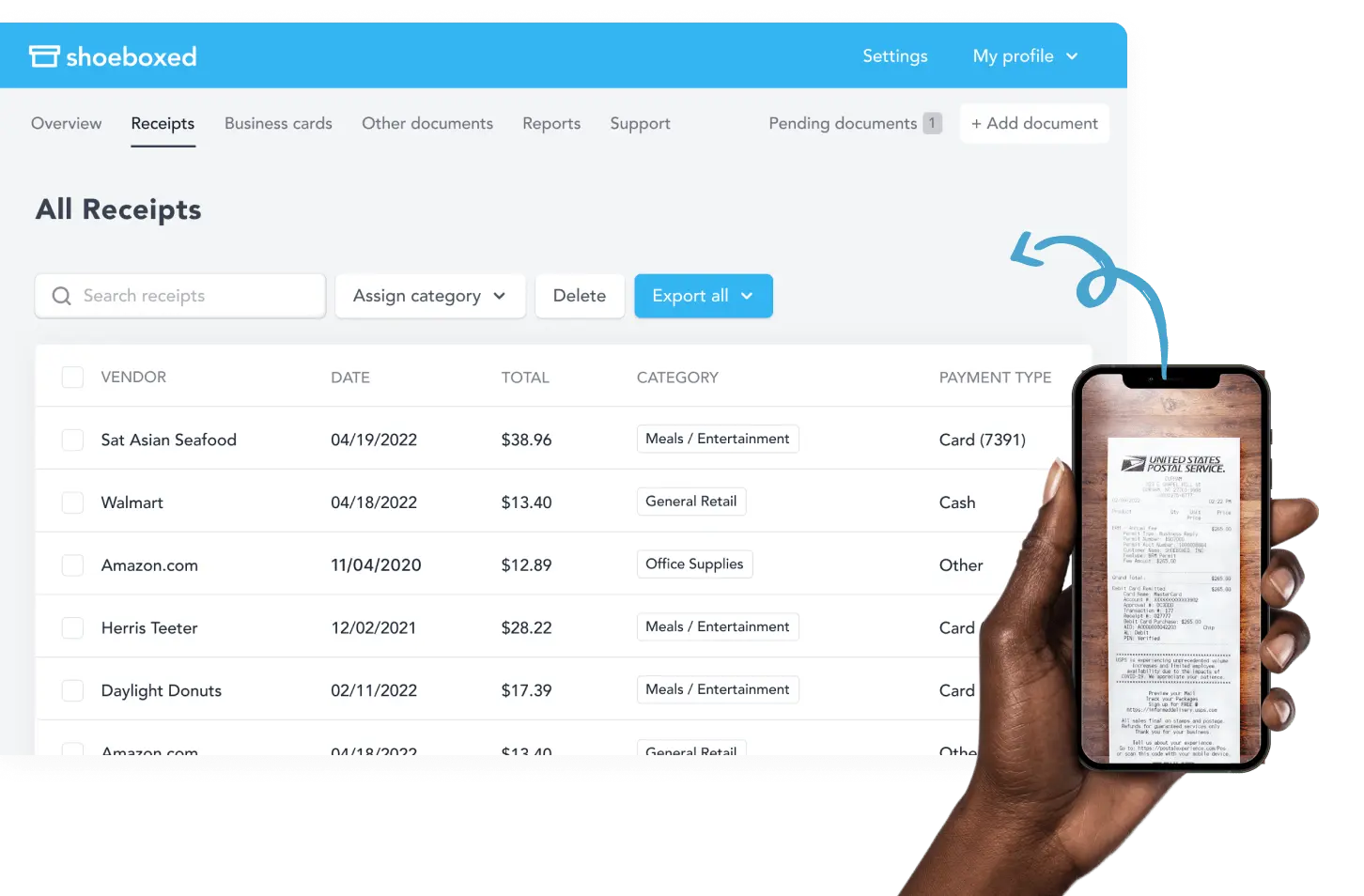

With Shoeboxed's receipt scanner app, you can simply snap a picture and upload it to your Shoeboxed account. Shoeboxed's team will extract and verify the expense data from your receipts, assigning the expense one of 15 common tax categories.

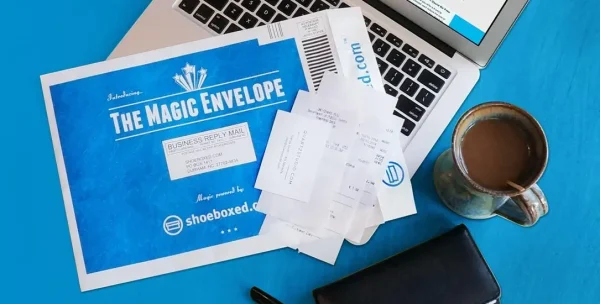

For those who want an even easier method for getting receipts in their accounts, Shoeboxed's Magic Envelope service does just that.

Simply stuff your receipts into Shoeboxed's postage-prepaid envelopes and outsource receipt scanning to the pros.

Shoeboxed is the only receipt scanner app that will handle both your paper receipts and your digital receipts—saving customers up to 9.2 hours per week from manual data entry!

Break free from manual data entry ✨

Use Shoeboxed’s Magic Envelope to ship off your receipts and get them back as scanned data in a private, secure cloud-based account. 📁 Try free for 30 days!

Get Started TodayWhat else can Shoeboxed do?

Shoeboxed has been voted as the best receipt scanner app for tax season by Hubspot and given the Trusted Vendor and Quality Choice awards by Crozdesk.

A quick overview of Shoeboxed's award-winning features:

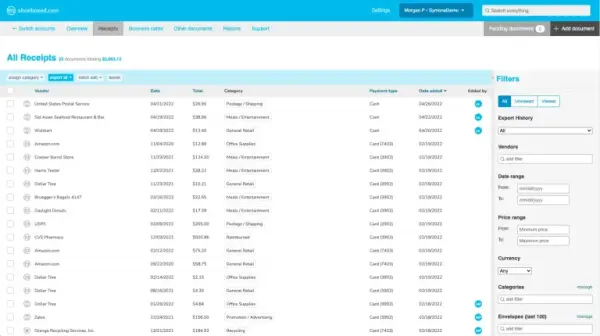

a. Mobile app and web dashboard

Shoeboxed’s mobile app lets you snap photos of paper receipts and upload them to your account from your phone.

Shoeboxed also has a user-friendly web dashboard to upload receipts, warranties, contracts, invoices, and other documents from your desktop.

b. Gmail receipt sync feature for capturing e-receipts

Importing e-receipts to your Shoeboxed account is as easy as syncing your Gmail with Shoeboxed, using Shoeboxed's special Gmail Receipt Sync feature.

Shoeboxed’s Gmail Receipt Sync grabs all receipt emails and sends them to your account for automatic processing! These receipts are then labeled as Sent to Shoeboxed in your Gmail inbox.

In short, Shoeboxed pulls the receipt data from your email, including the vendor, purchase date, currency, total, and payment type, and organizes it in your account.

Your purchases will even come with images of the receipts attached!

c. Expense reports

Expense reports let you view all of your expenses in one cohesive document. They also make it simple to share your purchases with your accountant.

You can also choose certain types of receipts to include in your expense report. Select the receipts you want to export and click “export selected.”

d. Search and filter

Call up any receipt or warranty in seconds with advanced search features.

Filter receipts based on vendors, date, price, currency, categories, payment type, etc.

e. Accounting software integrations

Export expenses to your accounting software in just a click.

Shoeboxed integrates with 12+ apps to automate tedious tasks, including QuickBooks, Xero, and Wave Accounting.

f. Unlimited number of free sub-users

You can add an unlimited number of free sub-users to your account, such as family members, employees, accountants, and tax professionals.

g. Mileage tracker for logging business miles

After you sign up for Shoeboxed, you can start tracking miles in seconds:

Open the Shoeboxed app.

Tap the “Mileage” icon.

Click the “Start Mileage Tracking” button.

And drive!

Whenever you start a trip, Shoeboxed tracks your location and miles and saves your route as you drive.

As you make stops at stores and customer locations, you can drop pins to make tracking more precise.

At the end of a drive, you’ll click the “End Mileage Tracking” button to create a summary of your trip. Each summary will include the date, editable mileage and trip name, and your tax deductible and rate info.

Click “Done” to generate a receipt for your drive and get a photo of your route on the map. Shoeboxed will automatically categorize your trip under the mileage category in your account.

h. The Magic Envelope

The Magic Envelope service is one of Shoeboxed's most in-demand features, particularly for businesses, as it lets users outsource their receipt management.

When you sign up for a plan that includes the Magic Envelope, Shoeboxed will mail you a pre-paid envelope for you to send your receipts in.

Once your receipts reach the Shoeboxed facility, they’ll be digitized, human-verified, and tax-categorized in your account.

Have your own filing system?

Shoeboxed will even put your receipts under custom categories. Just separate your receipts with a paper clip and a note explaining how you want them organized!

Never lose a receipt again 📁

Join over 1 million businesses organizing & scanning receipts, creating expense reports, and reclaiming multiple hours every week—with Shoeboxed.✨

Get Started TodayHow to set up your business expense template

When setting up a basic business expenses spreadsheet, consider the template structure to make it easy for you to fill out and use.

1. Chose your expense tracking platform

For many, Microsoft Excel is the go-to choice due to its wide array of functions and the ability to tailor spreadsheets to specific needs.

For those looking for collaboration and cloud storage, Google Sheets may be a preferred alternative. Google Sheets offers real-time editing and easy sharing options.

2. Create a basic template structure for your spreadsheet

An effective template must have a clear structure.

Headers: At the top, one should include headers such as Date, Description, Category, Amount, and Receipt.

Expense categories: Below, organize expenses into clear categories, for instance, travel, office supplies, and meals, to facilitate organization and future analysis.

Totals: Ensure there’s a section at the end of the template to calculate totals, making it easy to review monthly or annual spending.

Proper documentation with dates and descriptions assists in tracking expenses over time and provides context for each transaction.

3. Start expense tracking and data entry

Efficient data entry and accurate expense tracking are pivotal for managing business finances. Using Excel templates promotes the organization of financial transactions and assists in maintaining a clear financial record.

When inputting receipts and invoices into an Excel expense report template, it’s essential to capture all relevant details, such as the following:

Date: The date when the expense was incurred.

Vendor: The provider of the goods or services.

Amount: The total cost of the expense.

Category: The classification of the expense (e.g., travel, supplies).

Payment Method: How the expense was paid (e.g., credit card, cash).

To maintain clarity, each entry should correspond to a single row in the Excel spreadsheet.

For those who want automated receipt management and who want to eliminate manual data entry entirely, consider using Shoeboxed.

No matter what plan you're on, Shoeboxed offers unlimited users, so you can invite your whole team to log expenses as they come up. You can also add your bookkeeper or accountant to your account for easy tax reporting.

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. Try free for 30 days!

Get Started Today4. Analyze your business expenses

When managing a company’s finances, it is critical to accurately analyze business expenses. This analysis helps identify trends, cut unnecessary costs, and make informed budgetary decisions.

Two essential techniques for this process involve sorting and filtering data and visualizing expenses with charts in a business expense Excel template.

Sorting allows a company to organize expenses either in ascending or descending order.

A common approach is to sort by date to see the flow of expenses over time or by amount to highlight the largest to smallest expenditures.

Filtering, on the other hand, is used to display only the expenses that meet specific criteria.

For example, one can filter by categories such as travel, utilities, or salaries, providing a clear view of where funds are allocated.

Charts are great at instantly communicating financial data insights. Key types of charts include:

Pie charts: These are useful for showing the percentage breakdown of expenses by category.

Bar charts: Effective for comparing spending across different departments or time periods.

Line graphs: Ideal for tracking expense trends over time.

Visual representations help make data comprehension more intuitive and can highlight areas where spending may be reduced or need attention.

Best practices for optimizing the template for tax purposes

Here are some tips for optimizing your Excel template for tax purposes.

1. Create categories for standard tax deductions

Proper categorization within an Excel template aligns business expenses with corresponding tax codes, facilitating quick identification of tax-deductible items.

Users should set up columns for common categories such as travel, office supplies, and utilities.

A robust template may include drop-down lists for each category, ensuring data entry uniformity and simplifying year-end tax preparation reporting.

2. Track reimbursable expenses

Maintaining records of reimbursable expenses is essential for both reimbursement and tax considerations.

Separate columns or sheets within the template should track these expenses by date, amount, employee, and purpose.

Implementing formulas to aggregate totals for each category keeps the financial team apprised of pending reimbursements and aids in accurate tax filing.

3. Minimize errors

To reduce manual data entry and minimize errors, businesses can implement Excel features like data validation and form controls.

Drop-down lists ensure consistent entries for fields such as categories or payment methods.

Formulas can automatically calculate total expenses, and conditional formatting can highlight anomalies or categories that exceed budgeted amounts.

In closing

Adopting a robust Excel expense report template can assist businesses in maintaining accurate records for auditing purposes, ensuring compliance with policies, and controlling unnecessary spending.

With a clear representation of financial outflows, small business owners are better positioned to make informed decisions to improve financial health, forecast budget needs, and sustain fiscal discipline.

Tomoko Matsuoka is managing editor for Shoeboxed, MailMate, and other online resource libraries. She covers small business tips, organization hacks, and productivity tools and software.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!