Managing finances effectively is vital for small businesses. It enables small business owners to track business expenses and see where every dollar is going and identify ways to reduce costs and increase profitability.

A small business expense spreadsheet offers an organized method to monitor business expenses. This simple but powerful tool helps in categorizing spending, forecasting budgets, and preparing for tax season.

By using a spreadsheet, small businesses can keep a close eye on their financial health. They can also make data-driven decisions to steer their company toward growth and success.

Expense spreadsheets can vary in complexity, from basic expense report templates that track daily expenditures to tax expense spreadsheets to more detailed sheets that include monthly or annual budgets.

These spreadsheets serve as a central location for all financial data, streamlining the process of expense tracking and reporting.

Enough said. Here are 4 favorite expense tracking templates and spreadsheets for small businesses + 1 handy alternative!

5 free small business expense spreadsheets

Small businesses can benefit greatly from utilizing expense spreadsheets to track their financial activities. Free templates available online can simplify the process of monitoring and reporting expenditures.

1. Smartsheet's Small Business Expense Report Template

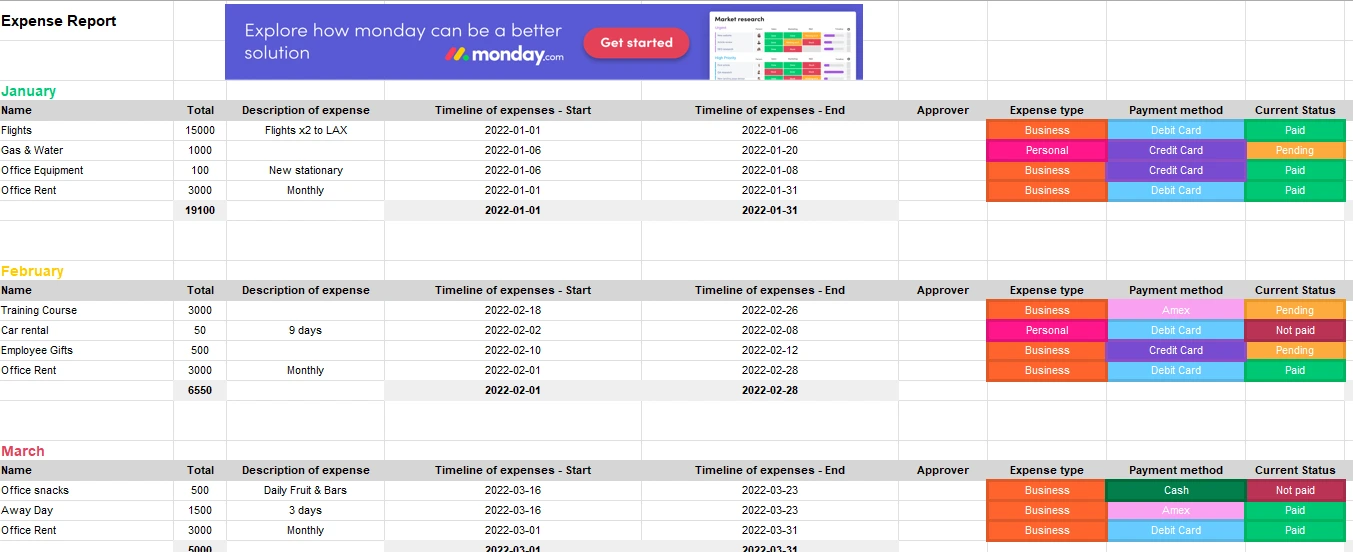

This spreadsheet from Smartsheet is perfect for tracking business expenses and can also serve as an expense report that you hand out to your team for when you need to reimburse employees.

This spreadsheet tracker will automatically calculate total expenses when you enter a sum into one of the cells, so it's ready to go, right out of the box.

To use this business expenses spreadsheet, go to File -> Make a Copy.

2. Monday's Excel Spreadsheet Expense Tracker

If you're a fan of Monday.com and/or prefer Excel over Google Sheets, then you'll be pleased to see this addition to our lineup. Columns include Description of Expenses incurred, Timeline of Expenses, Total Expenses, Approver, Expense Type, Payment Method, etc.

While Monday's business expenses template is only available as an Excel file, you can easily upload it to Google Sheets and use it as a Google spreadsheet as well.

3. Vertex 42 Income and Expense Tracking Worksheet

If you're looking for a monthly business expense spreadsheet that will also let you track income in the same view, then Vertex 42's worksheet might be a good fit for your needs.

You can track expenses as well as income as single line items, all inside of the same spreadsheet. To use the template, go here and then click on the "Use Template" button.

4. Smartsheet's Annual Expenses Spreadsheet for Small Businesses

Interested in a spreadsheet for the whole year? This lovely spreadsheet from Smartsheet gives you a column for each month's income and expenses, which will make it easy for you to visually compare each month's expenses incurred and income earned.

Expense categories are divided into overall categories and smaller sub-categories. For example, Housing contains Rent/Mortage, Property Taxes, etc. While Utilities contains Cable, Internet, etc.

To use this spreadsheet, click on "File -> Make a Copy"

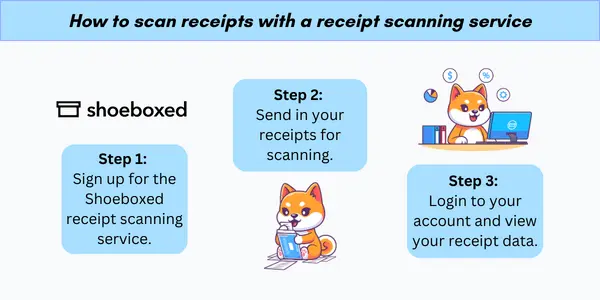

5. Shoeboxed, a small business expense spreadsheet alternative

Don't want to track expenses manually? We hear you. While some people thrive on using business expense tracking spreadsheets, others might prefer a more automated method.

If you'd like to forgo manual entry entirely, consider Shoeboxed!

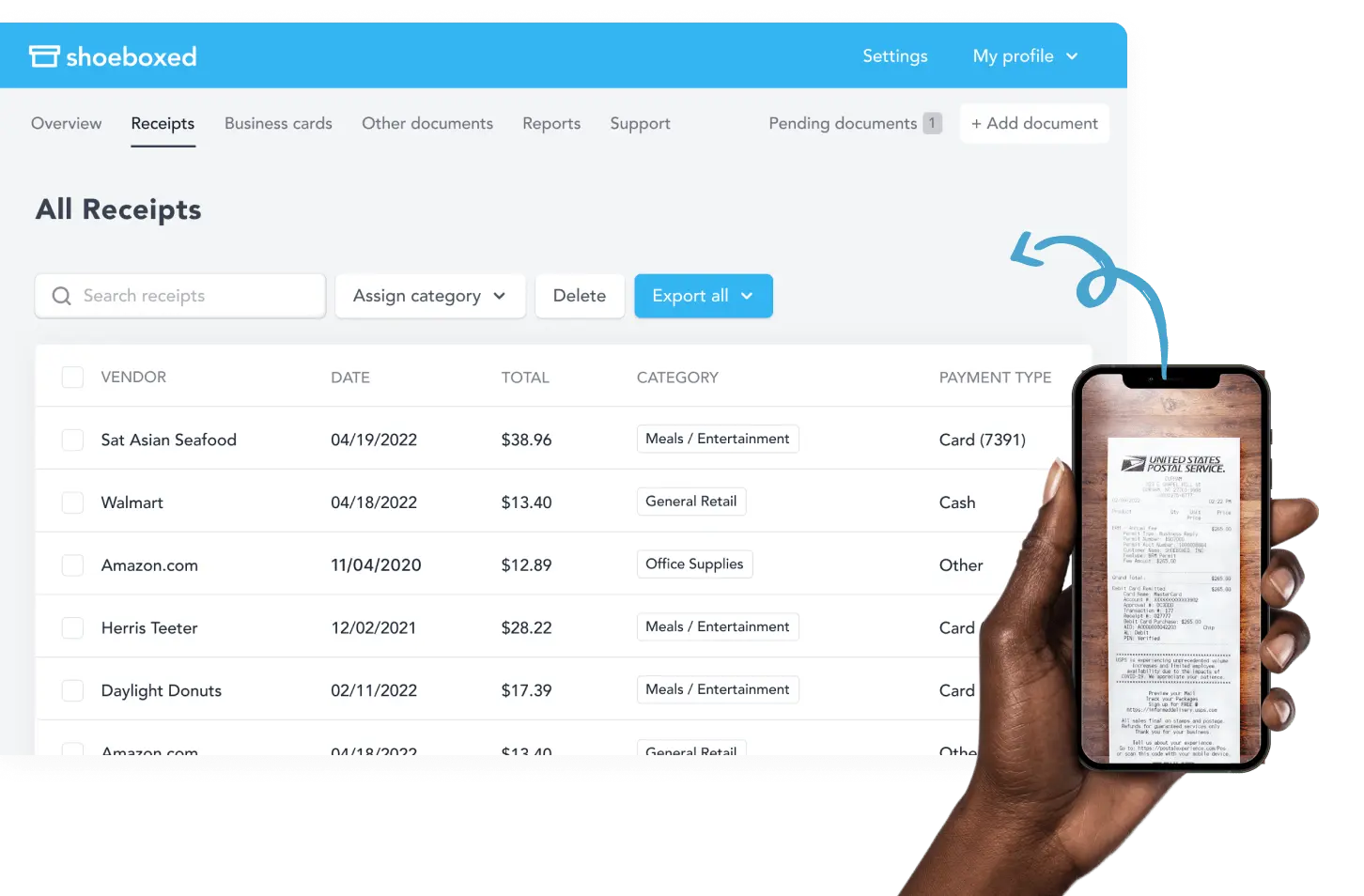

With Shoeboxed's receipt scanner app, simply snap a picture and upload it to your Shoeboxed account, and Shoeboxed's team will extract and verify the expense data from your receipts, assigning the expense one of 15 common tax categories.

For those who want an even easier method for getting receipts in their accounts, Shoeboxed's Magic Envelope service does just that.

Simply stuff your receipts into Shoeboxed's postage-prepaid envelopes and outsource receipt scanning to the pros.

Shoeboxed is the only receipt scanner app that will handle both your paper receipts and your digital receipts—saving customers up to 9.2 hours per week from manual data entry!

Stop doing manual data entry 🛑

Outsource receipt scanning to Shoeboxed’s scanning service and free up your time for good. Try free for 30 days! ✨

Get Started TodayWhat else can Shoeboxed do?

Shoeboxed has been voted as the best receipt scanner app for tax season by Hubspot and given the Trusted Vendor and Quality Choice awards by Crozdesk.

A quick overview of Shoeboxed's award-winning features:

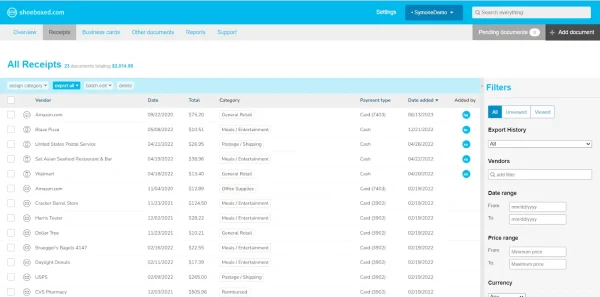

a. Mobile app and web dashboard

Shoeboxed’s mobile app lets you snap photos of paper receipts and upload them to your account right from your phone.

Shoeboxed also has a user-friendly web dashboard to upload receipts or documents from your desktop.

b. Gmail receipt sync feature for capturing e-receipts

Importing e-receipts to your Shoeboxed account is as easy as syncing your Gmail with Shoeboxed, using Shoeboxed's special Gmail Receipt Sync feature.

Shoeboxed’s Gmail Receipt Sync grabs all receipt emails and sends them to your account for automatic processing! These receipts are then labeled as Sent to Shoeboxed in your Gmail inbox.

In short, Shoeboxed pulls the receipt data from your email, including the vendor, purchase date, currency, total, and payment type, and organizes it in your account.

Your purchases will even come with images of the receipts attached!

c. Expense reports

Expense reports let you view all of your expenses in one cohesive document. They also make it simple to share your purchases with your accountant.

Shoeboxed makes it easy to export your yearly expenses into a detailed report. All expenses come with receipts attached.

You can also choose certain types of receipts to include in your expense report. Just select the receipts you want to export and click “export selected.”

d. Search and filter

Call up any receipt or warranty in seconds with advanced search features.

Filter receipts based on vendors, date, price, currency, categories, payment type, and more.

e. Accounting software integrations

Export expenses to your accounting software in just a click.

Shoeboxed integrates with 12+ apps to automate the tedious tasks of life, including QuickBooks, Xero, and Wave Accounting.

f. Unlimited number of free sub-users

Add an unlimited number of free sub-users to your account, such as family members, employees, accountants, and tax professionals.

g. Mileage tracker for logging business miles

After you sign up for Shoeboxed, you can start tracking miles in seconds:

Open the Shoeboxed app.

Tap the “Mileage” icon.

Click the “Start Mileage Tracking” button.

And drive!

Whenever you start a trip, Shoeboxed tracks your location and miles and saves your route as you drive.

As you make stops at stores and customer locations, you can drop pins to make tracking more precise.

At the end of a drive, you’ll click the “End Mileage Tracking” button to create a summary of your trip. Each summary will include the date, editable mileage and trip name, and your tax deductible and rate info.

Click “Done” to generate a receipt for your drive and get a photo of your route on the map. Shoeboxed will automatically categorize your trip under the mileage category in your account.

h. The Magic Envelope

Outsource your receipt scanning with the Magic Envelope!

The Magic Envelope service is one of Shoeboxed's most popular features, particularly for businesses, as it lets users outsource receipt management.

When you sign up for a plan that includes the Magic Envelope, Shoeboxed will mail you a pre-paid envelope for you to send your receipts in.

Once your receipts reach the Shoeboxed facility, they’ll be digitized, human-verified, and tax-categorized in your account.

Have your own filing system?

Shoeboxed will even put your receipts under custom categories. Just separate your receipts with a paper clip and a note explaining how you want them organized!

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. Try free for 30 days!

Get Started TodayHow to create your own small business expense spreadsheet

Proper setup of a small business expense spreadsheet is a strategic step in financial management. The following sections guide users through selecting appropriate software, establishing the spreadsheet's structure, and tailoring it to the unique needs of their business.

Step 1. Choose the right platform

The foundation of an effective expense spreadsheet is selecting the platform that best suits the business's needs.

Google Sheets is free to use and easy for beginners to quickly grasp and navigate. If you have a Microsoft 365 subscription, then Microsoft Excel is a prevalent choice due to its advanced features and flexibility.

Alternatively, if you're looking to automate expense tracking, consider expense tracking apps like Shoeboxed.

Step 2. Understand spreadsheet layout fundamentals

A well-organized layout is crucial for an expense spreadsheet.

Users should start with a clear and consistent structure, including columns for date, expense category, amount, payment method, and notes.

Each transaction should have its own row to ensure clarity. This essential framework forms the basis for a functional expense tracking system.

Step 3. Customize categories for your business

Each business is unique and thereby requires a tailored approach to expense tracking.

Users may need to add specific columns like client name or project code.

Importantly, if cash basis accounting is used, one could begin with a template designed for this method. This ensures columns for transaction description and number are included for comprehensive records.

Customization helps in reflecting the specific financial activities and requirements of the business.

By customizing your expense categories, you can tailor your expense spreadsheets to your specific industry. For example, check out the following spreadsheets for truckers, Airbnb hosts, lawn care specialists, real estate agents, etc.

See also: Printable Expense Tracker: Top 5 Free Templates

Income and Expense Worksheet: 4 Free Templates

Company Expenses Template: 4 Free Expense Templates + Bonus

What are expense tracking best practices that business owners should know?

Tracking expenses meticulously is crucial for a small business’s financial health. It involves recording every transaction to monitor spending and manage budgets effectively.

Here are some best practices that business owners should be familiar with.

1. Know what categories of business expenses to track

Every expense report should clearly categorize transactions. Common categories include:

Operating Expenses: Regular costs for running a business, such as rent, utilities, and payroll.

Capital Expenses: Investments in the business like equipment or property.

Cost of Goods Sold (COGS): Direct costs of producing goods sold by a business.

Miscellaneous Expenses: Unforeseen or irregular costs not covered by other categories.

Categories should align with a business's accounting practices for consistency.

See also: Project Cost Tracker: Free Templates to Stay Within Budget

2. Remember to include date and amount entries

Recording the precise date and amount on your expense sheet is vital:

Date: The exact date when the expense occurred.

Amount: The full transaction value in clear figures, without rounding off.

Accurate date and amount entries ensure a reliable financial timeline and budget tracking.

3. Don't forget vendor and description details

Clear vendor and description details support audit processes and expenditure reviews.

Vendor: The name of the entity from which the service or product was purchased.

Description: A brief explanation of the expense, providing context for its purpose.

4. Create summary tables

To create summary tables, one begins by compiling all monthly expenses into a cohesive table format.

The typical structure includes columns for Date, Category, Expense Detail, and Amount.

At the end of the table, a row is dedicated to the Monthly Total, offering a quick glance at the month's expenditures.

For the annual summary, data from each monthly table is aggregated.

This table is similar in format but extends to provide a Year-to-Date Total, which juxtaposes the expenses across different months. Here, categories may be adjusted to encompass annual operations.

5. Visualize data with charts and graphs

Visual tools like charts make it easy to quickly grasp your financial data.

Pie charts vividly delineate expenses by category, spotlighting areas where the business spends the most.

Line charts showcase the trend of expenses over time, aiding in identifying spending patterns across the year.

Bar charts can be beneficial for a side-by-side comparison of the same month across multiple years, lending insight into growth and seasonal trends.

By translating the summary tables into visual formats, small businesses can more easily grasp their financial trajectory and make informed decisions.

Tools for creating such visuals are often included in spreadsheet software, and templates with these features might be found on sites like monday.com.

6. Know relevant tax categories and rules

Tax deductible expenses are a type of expense that is deductible for a small business. These typically include:

Advertising and marketing fees

Office supplies and equipment

Travel and meal expenses for business purposes

Salaries and wages paid to employees and contractors

Each expense category comes with specific IRS rules and regulations. For example, meals with clients are only 50% deductible, while the full cost of office supplies is typically 100% deductible.

Non-deductible Expenses: Some expenses are not eligible for a tax deduction. These include:

Political contributions

Government fines and penalties

Personal expenses not directly related to operating the business

See also: Tax Expense Spreadsheet: Top 5 Free Templates

How to Create an Expense Tracker in Google Sheets

7. Consider integrating tax software

Small businesses often benefit from integrating their expense spreadsheets with tax software.

Tax preparation software can automatically categorize expenses, calculate deductions, and prepare tax forms.

When spreadsheet data is properly formatted and categorized, it can be imported into tax software to streamline the process of:

Compiling year-end financial statements

Estimating taxes owed

Filing tax returns efficiently and accurately

Integration simplifies tax preparation, reduces human error, and can assist businesses in capitalizing on all eligible deductions.

Break free from manual data entry ✨

Use Shoeboxed’s Magic Envelope to ship off your receipts and get them back as scanned data in a private, secure cloud-based account. 📁 Try free for 30 days!

Try Free for 30 DaysIn closing

Small business expense spreadsheets are essential tools that small businesses can use to evaluate the financial health and performance of their business. They allow for detailed tracking and analysis of expenditures, which are critical for making informed decisions.

By examining expense patterns over time, small business owners can discern whether certain costs are increasing, stable, or decreasing.

This insight is crucial as trends indicate areas that may require attention or can signal success in cost management efforts.

Tomoko Matsuoka is the managing editor for Shoeboxed, MailMate, and other online resource libraries. She covers small business tips, organization hacks, and productivity tools and software.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!