Accounting is the process of tracking, recording, and reporting a company’s financial information.

Without a system to organize this financial information, a business would never know how much income versus expenses they were generating.

Thankfully, there are tools that can alleviate the burden of these financial tasks for small business owners in any industry, providing a sense of control and relief by assisting in accounting management through automating various financial processes.

In this article, we will cover what an accounting tool is, why it is essential, what to look for when choosing it, and the accounting tools every business owner should incorporate into their company.

What are accounting tools?

In the United States alone, there are over 33 million small businesses, making up a staggering 99% of all firms. For these countless businesses, managing finances efficiently is crucial. This is where accounting tools come in to helps small business owners track and record financial activities.

These tools can help record transactions, do bank reconciliation, keep track of accounts receivable and payable, generate payroll, handle invoicing, and produce financial statements so that you can gauge business expenses and profit. Additionally, accounting tools contribute to accounting management by automating and streamlining financial processes, including AP automation, invoice process automation, workflow automation, PO automation, and payment automation.

Since accounting tasks are monotonous, repetitive, and time-consuming, the goal is to make the business run more efficiently, which will free up more time for the business owner to spend on other areas, such as evaluating business performance and growth.

Why are accounting tools essential? 8 reasons

So, how exactly do accounting tools benefit small business owners?

Overall, these tools are designed to streamline processes using automation. Accounting tools improve accounting management by automating repetitive tasks and reducing errors.

In doing so, accounting tools can affect your business’s operations in many ways.

1. Accounting tools save time

First off, streamlining processes can save you an enormous amount of time.

Streamlining processes cuts down on having to enter information repetitively.

An effective financial tool will automatically record the data and sync it with other accounting tools that you are using.

This makes completing accounting tasks much faster, freeing up valuable time for small business owners to focus on other aspects of their business, enhancing their productivity and efficiency.

What would usually take hours to do manually, like updating a monthly timesheet, can be done in minutes with just a few clicks.

2. Accounting tools reduce the cost of business operations

Reducing the cost of business operations goes hand-in-hand with the benefit of saving time.

The less time spent on a task, the less money you will have to pay an employee to complete it, contributing to your business’s financial stability and security.

3. Accounting tools reduce human errors

Accounting tools are a big plus when it comes to reducing human errors.

The more financial data a human enters, the higher the risk for human error.

That’s why the tools that automate and mainstream data are so effective at minimizing errors.

Humans usually enter The data once, and the accounting tool does the rest.

As long as the human correctly enters the data into the tool, the accounting tool ensures that the data is dispersed and mainstreamed in the correct format.

4. Accounting tools generate financial statements and invoices

Without financial statements, a business would never know where it stands financially.

Accounting tools can generate financial statements such as cash flow statements, cash flow forecasting, balance sheets, and profit and loss reports with just a click of a button—the same goes for invoicing.

Without these tools, manually entering the data for each report and invoice could take hours.

5. Accounting tools make filing taxes easier

Filing taxes can be chaotic, especially when pulling together all of the required supporting financial data.

Accounting and bookkeeping tools make this process much easier by organizing receipts and other financial data for filing taxes.

6. Accounting tools integrate with other applications to reduce duplicate entries

If your accounting tools work together and complement each other, you’ll save yourself a lot of time and headaches.

Financial tools that seamlessly integrate with other software and applications negate the need to make duplicate entries into each platform.

Accounting tool integration also allows for real-time tracking across all accounting system platforms.

7. Accounting tools provide 24/7 access to data

Cloud-based tools allow you to work and access data from anywhere.

If traveling or on the road, you can still check customer payments, financial documents, or any other data without being in the office.

8. Accounting tools offer a simple scalability solution

As your business grows, there’s a lot involved in onboarding new clients and adding new employees.

With accounting tools, you can upgrade your plan to accommodate your growing business.

This keeps your business running smoothly without any interruptions during periods of growth.

What considerations are there for small business owners when choosing accounting tools?

Accounting tools generally fit into any business or industry in one way or another.

When choosing tools for your specific business, make sure that they maximize as many of the previously listed benefits as possible.

Below are the key things you will want to consider when choosing the most efficient tool for your business:

1. The features that would serve your business best

One of the most important things to look for in accounting tools is the features they offer.

Then, consider which features would be of the most benefit to your business.

Do you need a tool to track inventory or generate payroll? Do you need a tool that offers multi-currency support?

Making a list of the features you need is the first step in narrowing down your business’s possibilities.

The next step is to find the tool that explicitly offers the features you’re looking for.

Below is a list of some of the features that most business owners look for in financial tools:

Invoice creation and management

Expense management

Tracking revenue

Generating financial statements

Tracking inventory

Inventory cost management

Generating purchase orders

Calculating taxes

Generating and tracking budgets by project

Task assignment to teams

Monitoring the progress of a project

Business performance tracking

Generating custom reports

Tracking contact information for customers

Managing interactions with customers

Tracking opportunities for sales

Workflow automation and advanced reporting to enhance accounting management

2. How easy the accounting tool is to use

If you need help with accounting, the last thing you need are accounting tools that are difficult and clunky to navigate.

Read reviews and see if the tool offers a free trial.

Take some time to familiarize yourself with the application by doing a test run to see if you are comfortable using the tool.

The more comfortable you navigate an accounting tool, the more you use it in your day-to-day business operations.

Remember that you may need to train others in your business to use the tool, too.

3. How accessible the accounting tool is

Accounting tools that are accessible 24/7 from anywhere are a huge benefit, especially if you travel frequently.

A cloud-based application with an easy-to-use mobile app is the best solution for those constantly on the go.

4. The scalability of the tool

Business growth is on every business owner’s radar.

Be sure to choose tools that grow with your business.

Tools offering multiple plans with additional users and features are ideal for scaling your business.

This way, the scaling process will be simple and will not interrupt your daily business operations.

5. How much the tool costs

As with anything, you must be able to justify the cost of the accounting tool and ensure that the benefits are worth the price.

An accounting tool that’s expensive upfront may be well worth the money in the long run.

That said, the best accounting and bookkeeping tools don’t necessarily have to be the most expensive ones.

When choosing a tool for your business, consider your needs and budget.

6. If the accounting tool has integration capabilities

Some of the best accounting tools are designed with various integration capabilities.

Remember that the more automated you are, the more your business will run more efficiently.

Consider the other applications you use or would like to implement and find accounting tools that integrate with these systems.

What are the best accounting tools for businesses? Top 10 tools

There are many accounting tools to choose from, but for time’s sake, we’ve chosen the top 10 accounting tools that can be used in any industry or business. These tools excel in various aspects of accounting management, including AP automation, invoice process automation, workflow automation, PO automation, and payment automation.

1. Shoeboxed - Best scanning service

Businesses can automate their operations using an app or outsource their receipt and document management to Shoeboxed.

Shoeboxed contributes to accounting management by digitizing and organizing receipts and documents, streamlining financial processes and improving workflow efficiency.

Shoeboxed is a two-in-one receipt scanner used by over a million businesses.

Digitizes receipts and documents

Small business owners handle many receipts and documents to ensure accurate financial records, comply with legal regulations, and manage operations efficiently.

Digitizing receipts and documents reduces paper clutter and manual entry and makes the scanned items more accessible.

All receipts and documents are stored in the cloud, so they’re available anywhere, which reduces the risk of lost paperwork.

Never lose a receipt again 📁

Join over 1 million businesses organizing & scanning receipts, creating expense reports, and reclaiming multiple hours every week—with Shoeboxed.✨

Get Started TodayMobile app

With Shoeboxed, lawyers can use the camera on their mobile device to scan, digitize, and upload receipts and documents into their Shoeboxed account.

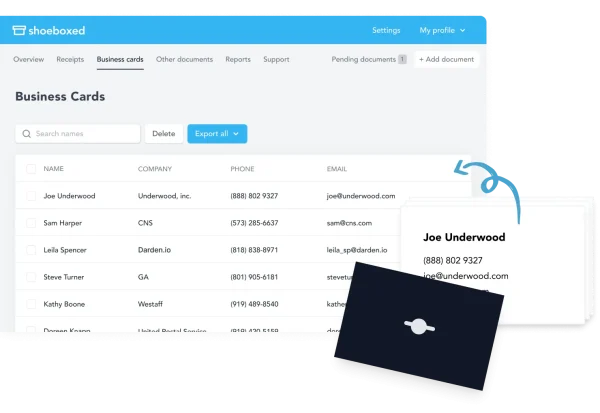

Business card management

Business owners collect many business cards from colleagues, financial institutions, and potential clients.

The Shoeboxed mobile app takes photos of business cards. It then extracts and digitizes the contact information.

All digitized business cards are stored in a central cloud-based database, making contact information accessible anywhere.

The contact information that was extracted becomes searchable, so you can quickly find specific contacts when needed.

Shoeboxed allows you to export contact information to various CRM systems so all your business contacts are organized and accessible within your preferred customer relationship management tools.

Contacts can also be exported as CSV files and imported into other contact management systems or email clients.

Magic Envelope service

Business owners who don't have time to scan their receipts, business cards, or documents, can outsource the task to Shoeboxed. Shoeboxed provides a free postage-paid Magic Envelope that can be filled with batches of receipts and mailed to Shoeboxed's processing center for them to scan, human-verify, and upload into your designated account.

Shoeboxed is the only receipt scanner app that will handle both your paper receipts and your digital receipts—saving customers up to 9.2 hours per week from manual data entry!

Break free from paper clutter ✨

Use Shoeboxed’s Magic Envelope to ship off your receipts and get them back as scanned data in a private, secure cloud-based account. 📁 Try free for 30 days!

Get Started TodayGmail plug-in

The Shoeboxed Gmail plugin automatically detects and extracts receipts from your inbox and turns them into organized expense records.

The plugin categorizes expenses from email receipts to track and organize all business expenses.

Business owners who don’t have a Gmail account can forward email receipts to their Shoeboxed account for automatic processing and categorization.

Organizes and categorizes

For receipt management, once uploaded, Shoeboxed organizes and categorizes receipts into tax or custom categories such as office supplies, utilities, travel expenses, etc.

Business owners can create custom tags and categories to suit their bookkeeping needs, so they have tailored financial oversight.

Receipts and documents become part of a searchable database so you can quickly find what you need when you need it.

This auto-categorization saves business owners time, reduces errors, and helps track spending and manage budgets.

Expense reports

Shoeboxed generates expense reports that give businesses insight into their spending so they can plan budgets and perform financial analysis.

Tracks mileage

Shoeboxed has a mileage tracking feature that logs business trips so you can claim mileage deductions.

Detailed mileage reports can be generated to track and claim mileage deductions.

Integrates with accounting software

Shoeboxed integrates with accounting software like QuickBooks, Xero, and Wave to transfer and sync data seamlessly.

Shoeboxed syncs digitized receipts and expense reports with your accounting software, making bookkeeping and tax time a breeze.

Tax preparation and compliance

Receipts are stored in a format accepted by the IRS, making tax preparation smoother and audit-proof. Shoeboxed helps track deductible expenses, ensuring that all eligible deductions are claimed. It generates tax-friendly reports summarizing deductible expenses, aiding in accurate and efficient tax filing.

Accurate and organized records make responding to audits and inquiries from tax authorities or regulatory bodies easier.

Enhanced collaboration with free sub-users

With a Shoeboxed account, businesses can add unlimited free sub-users so colleagues and accountants can access Shoeboxed and work on bookkeeping, documents, and accounting tasks.

Different levels of access and permissions can be set for each user so sensitive financial data is protected.

Pros:

Allows users to take photos of receipts, email them, or mail them in prepaid envelopes for scanning and digitization. This feature simplifies receipt management by automating data entry.

All receipts are stored securely in the cloud, making them easily accessible and reducing the risk of losing important documents.

Categorizes expenses automatically, which helps in organizing and tracking business expenses efficiently.

Generates expense reports that provide insights into spending patterns, aiding in financial analysis and planning.

Integrates with popular accounting software like QuickBooks, Xero, and Wave, allowing for easy data transfer and synchronization.

Stores receipts in a format accepted by the IRS, making tax preparation smoother and audit-proof.

Helps track deductible expenses, ensuring that all eligible deductions are claimed.

Cons:

The mileage tracker isn’t automatic. You’ll have to manually start and stop it, which actually gives you more control over tracking since you will need to separate business and personal miles.

Pricing:

Plans start at $18 per month, with a 30-day free trial available.

Stop doing manual data entry 🛑

Outsource receipt scanning to Shoeboxed’s scanning service and free up your time for good. Try free for 30 days!✨

Get Started Today2. Oracle NetSuite - Best for advanced features

Oracle NetSuite is a cloud-based accounting software platform that offers advanced accounting features.

This accounting tool tracks and automates a vast array of accounting processes.

Oracle NetSuite offers all essential financial functions, billing management, accounting compliance, financial planning and projections, and international tools.

Oracle NetSuite manages billing operations for hybrid, usage-based, subscription, and transaction business models.

The billing management tools include advanced revenue and compliance functions.

NetSuite complies with accounting standards, including ASC 605, 606, and IFRS 15.

Revenue and reporting management functions, such as auditing, reclassifying, recognition, allocation, and forecasting, can be automated.

NetSuite supports more complex compliance, operational, and regulatory operations as you scale your business.

NetSuite also offers a risk management assessment to avoid any significant pitfalls before they happen.

NetSuite helps you manage international transactions and any associated compliance requirements.

NetSuite offers multiple language interfaces and multi-currency support.

The multi-currency management system supports more than 190 currencies and accounts for real-time conversion for the current exchange rate.

With their forecasting, budgeting, and planning features and real-time analytics, NetSuite allows businesses to plan their financial operations for the future.

Pros:

Oracle databases can handle large amounts of data and are scalable to meet growing business needs.

Oracle ERP Cloud offers a comprehensive suite of applications including financials, project management, procurement, and risk management.

Efficient data processing capabilities for large-scale enterprise environments.

Cons:

The initial cost of implementation can be high, including licensing fees, hardware, and setup.

The complexity of Oracle systems can lead to lengthy and challenging implementation processes.

Integrating with non-Oracle systems can sometimes be challenging and require additional resources.

Pricing:

$999 per month plus $99 per user, per month.

3. Xero - Best integration platform

Xero is one of the best accounting tools for small business owners and professionals on the go.

Not only does Xero offer the same basic accounting features as other accounting software, but it also has phenomenal integration capabilities.

Xero integrates with over 700 apps. With that many apps, you know you'll be covered in various categories.

Some of these categories include the following:

CRM

Time tracking

Practice management

Point-of-sale

Payroll

Xero can fill in the gaps with app integration for those who don't have a strong grasp of accounting.

Xero supports many add-ons, apps, and integrations.

Some of these include the following:

Hubdoc

Stripe

HubSpot CRM integration,

Microsoft Outlook

Google Contacts

Xero Practice Manager

WorkflowMax

Shopify

Xero Analytics Plus

Xero Workpapers

Xero also allows you to connect with your bank accounts for easy reconciliations.

Pros:

Xero's interface is clean and easy to navigate, making it accessible for users with varying levels of accounting knowledge.

Provides a comprehensive dashboard with real-time updates on financial data, including cash flow, bank balances, and expenses.

Xero can connect directly with bank accounts to automatically import and reconcile bank transactions.

Built-in payroll features support compliance with local tax laws and regulations.

Cons:

Some users may find the initial setup and learning process challenging, particularly if they are not familiar with accounting software.

While the interface is user-friendly, mastering some of the more advanced features can take time.

Xero primarily offers online support, and some users may find the lack of direct phone support inconvenient.

While support is available 24/7, response times can vary, which may be frustrating for users with urgent issues.

Pricing:

Plans run anywhere from $13-$70/month

4. AccountEdge - Best scalability

AccountEdge Pro is one of the best accounting tools for small business owners looking to grow their businesses.

AccountEdge is excellent for small businesses onboarding new clients, adding additional employees, and experiencing more complex accounting needs.

They offer the following four plans:

AccountEdge Basic

AccountEdge Pro

Priority Zoom

Priority ERP

AccountEdge Basic is a standard bookkeeping tool designed for Desktop Windows or Mac and can be used by a single user.

AccountEdge Pro is a more powerful tool for Desktop Windows or Mac and can be utilized by multiple users.

Priority Zoom is a cloud-based starter ERP software that can accommodate up to 5 users.

Priority ERP is a full ERP software that is either cloud-based or can be used on-premises by an unlimited number of users.

Pros:

AccountEdge supports multiple currencies, making it suitable for businesses that operate internationally or deal with foreign clients and suppliers.

AccountEdge offers a full suite of accounting features including accounts payable and receivable, inventory management, payroll, time billing, and general ledger.

Supports complex inventory tracking, including multi-location inventory, serial number tracking, and auto-build for assembled products.

Cons:

Being a desktop application, it lacks the accessibility and mobility of cloud-based solutions which can be accessed from anywhere.

The initial setup and configuration can be complex and time-consuming, especially for users who are not familiar with accounting software.

Compared to cloud-based accounting software, AccountEdge has fewer integrations with third-party applications and services.

Pricing:

Pricing runs from $20-$50/month

5. FreshBooks - Best for ease of use

FreshBooks is one of the most straightforward accounting tools to use.

This accounting software is a breeze for small business owners to set up and is simple to navigate.

Not only is FreshBooks an intuitive accounting software, but it also walks you through each process step-by-step.

FreshBooks is designed for business owners who don't have much of an accounting background.

The dashboard provides a straightforward overview of financial operations, and the vertical menu bar on the right is quick to access.

From the vertical menu bar, you can access settings, add additional companies, include products or services you offer, and access online payments.

The features are easy to access and use. Instead of making invoicing new clients a two-step process, you can create a new client while entering the data for the invoice.

The option to choose the currency on the invoice makes doing business globally much easier.

FreshBooks also offers a Quick Expense Creation feature, which allows you to create expenses right on the expense tab without having to click on another screen.

FreshBooks runs on many different web browsers, and it offers mobile apps for Android and iOS devices, making it convenient to access.

Pros:

User-friendly interface for multiple businesses.

The mobile app is available for iOS and Android to check on all businesses from anywhere.

Integration with numerous third-party apps.

Invoices that can be tailored to each individual business.

Sales tax management for multiple entities.

Online payments.

Cons:

Limited inventory and payroll features.

Restricted multi-currency support.

Limited users.

Pricing:

Plans run anywhere from $7.60-$24.00/month

6. QuickBooks - Most accessible

QuickBooks is one of the best and most popular accounting tools for accessibility.

With the QuickBooks mobile apps, you can access data 24/7, work from anywhere, and access financial reports on the go.

QuickBooks will automatically back up your data to the cloud and sync the information across your devices.

QuickBooks offers mobile apps and accessibility features, such as keyboard accessibility with shortcuts to common tasks.

The visual design is simplified for readability, and QuickBooks offers JAWS Screen-Reader Software (a script for assistive software).

Last but not least, one of the greatest accessibility features is documentation and virtual training for the visually impaired.

Pros:

Multiple businesses can be accessed under one login.

Real-time financial synchronization for updated sales data and financial status.

Calculates quarterly tax estimates for multiple entities.

Manages sales tax for multiple businesses.

Integrates with other financial management tools, such as Shoeboxed.

Cons:

Doesn’t offer financial statements with all of the businesses consolidated.

Doesn’t support multiple currencies.

Pricing:

Plans run from $15-$100/month

7. Kashoo - Best for tracking income and business expenses

There will always be business owners who are not comfortable connecting their bank accounts to their accounting tools—and that's perfectly understandable.

Kashoo is a great option for small business owners who want to track business expenses and income without integrating their bank accounts with accounting software.

Kashoo provides an option to connect with your bank accounts, but this accounting software works just as well, regardless of whether you integrate it with them.

The software is designed with a screen that combines income and expense management where you can record both at once, making it easier to manually enter both types of transactions.

The income and expense management feature makes it simple for small businesses to record transactions without connectivity.

Pros:

Multi-currency support.

User-friendly navigation for consultants with easy access to features.

Easy setup process.

Invoicing module with plenty of payment options.

Cons:

No sales report.

Provides only basic functionality.

Not many customization features for reporting.

Pricing:

Trulysmall Accounting: $216/year ($18/month)

Kashoo: $324/year ($27/month)

8. Wave Accounting - Best free accounting software

Wave Accounting is one of the best free accounting tools for small businesses.

Wave Accounting is ideal for small businesses starting out and with a limited cash flow.

Usually, when accounting software applications say they're free, they really mean that the starter plan or a select few of the features are free.

However, with Wave Accounting software, the entire application is free.

This accounting tool will only cost you money if you accept payments via Wave Payments or use their payroll application.

Wave offers above-average invoice processing, 12 different financial reports, customer management, and the option to integrate your bank accounts with the software application.

Wave Accounting makes setting up small business accounting convenient and affordable.

Pros:

Free software for multiple entities.

Simple interface with easy-to-navigate features between businesses.

Automatic data backups.

Cons:

Limited integrations for multiple entities.

Lacks advanced features like inventory management.

Pricing:

Runs from $0-$16/month

9. Gusto - Best payroll software

Gusto Payroll is one of the best financial tools when it comes to payroll software for small businesses.

Gusto is an efficient payroll accounting tool with many features and mobile phone apps for use whenever you're out and about.

Gusto Payroll includes standard features such as automatic tax processing, tax filing at all three levels, onboarding new employees, pay stubs, and accounting software integrations.

Along with the standard payroll features, you can manage human resources, enroll in health benefit plans, and manage retirement plans.

Pros:

Streamlines the onboarding process with digital document signing, new hire checklists, and welcome emails.

Integrated time tracking and PTO management features simplify attendance and leave management.

Helps businesses stay compliant with labor laws and regulations by providing alerts and updates.

Cons:

While Gusto provides a comprehensive suite of features, the cost can be higher for very small businesses or startups compared to some other payroll solutions.

The setup process can be complex for businesses transitioning from another payroll system, requiring careful data entry and configuration.

Pricing:

Plans run from $40-custom pricing/month

10. TSheets (QuickBooks Time) - Best accounting software for time tracking

Are you looking for one of the best time-tracking tools available?

Then TSheets is everything you could ever need.

Timesheets can be tracked from anywhere at any time and integrated with QuickBooks Online or Xero.

TSheets also allow you to review and approve timesheets quickly since they are online.

This accounting tool manages shifts that change weekly and even notify employees when their shifts are posted or changed.

You can also attach projects, tasks, or jobs along with the shifts.

Pros:

Integrates seamlessly with QuickBooks, making it easy to sync time tracking data for payroll processing and accounting. Also integrates with other popular software like Xero, Gusto, and Square.

Automates timesheet submissions and approvals, reducing administrative work and errors in payroll processing.

Allows for detailed job tracking and shift scheduling, helping managers allocate resources efficiently.

Cons:

Can be relatively expensive for small businesses or those with a large number of employees, as costs increase with the number of users.

While the interface is user-friendly, the breadth of features can be overwhelming for new users, requiring a learning period to fully utilize the software.

Pricing:

Plans run from $20-$40/month

Frequently asked questions

What is the purpose of accounting tools?

Accounting tools aim to automate as many accounting tasks as possible when managing financial reports and data while remaining compliant with tax and legal regulations.

This saves small business owners a lot of time concentrating on other aspects of their business.

What can accounting tools do for your business?

Accounting tools are used for expense management, bill management, tax management, time tracking, inventory accounting, online payments, vendor management, payroll processing, cash management, project management, and financial planning.

Do you need a professional accountant if you have access to financial tools?

Financial tools will never replace the expertise of professional accountants.

While the tools will help you manage daily, professional accountants can offer advice on making the most out of your business.

There is no replacement for a professional accountant, especially around tax time.

In conclusion

There are plenty of accounting tools out there that will make your small business accounting process less time-consuming.

Automation is the key to running a business efficiently.

The more automation tools you incorporate into your small business, the more time you’ll have to concentrate on your customers, business performance, and growth.

Accounting tools contribute significantly to accounting management by automating and streamlining financial tasks such as AP automation, invoice process automation, workflow automation, and payment automation.

Caryl Ramsey* has years of experience assisting in bookkeeping, taxes, and customer service. She uses various accounting software for setting up client information, reconciling accounts, coding expenses, running financial reports, and preparing tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS.*

____________________________________________________________________

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple receipt capture methods: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad, and Android) to snap a picture while on the go—auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports, including IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports, and more—with Shoeboxed.

Try Shoeboxed today!