Bookkeeping and accounting make many small business owners cringe in distaste. Worrying about the less fun aspects of running a business, such as tracking business expenses and income, generating financial statements, tax preparation, and more, can seem daunting. Still, they don’t have to stay that way.

A step-by-step approach to accounting in the trucking industry will make the process go off without a hitch. Learn more about trucking bookkeeping and accounting, how to set up a proper accounting system, and avoid many pitfalls.

Bookkeeping vs. accounting for trucking companies

The line between bookkeeping and accounting is somewhat blurred, with the two functions similar, though distinct from one another. For instance, though a bookkeeper wouldn’t perform the functions of an accountant, an accountant can perform the functions of a bookkeeper.

Generally speaking, bookkeeping for trucking companies involves maintaining the general ledger with day-to-day transactions within the business. The process is routine and administrative, which does not require critical thinking. Since little training is required for small businesses to perform this function successfully, many truck drivers complete this alone.

On the other hand, accounting will require more training and knowledge of finance. Accountants use financial information generated through the bookkeeping step to develop financial statements, perform cash flow analysis, and use the financial data to file a tax return.

Most importantly, during the accounting phase, a business will generate financial reports in the form of:

Income statement

Statement of cash flows

Statement of shareholders’ equity

Together these statements disclose the financial health of the company and allow the company to make decisions about its future.

More often, there is more at stake regarding the accounting aspect of running a trucking company. The IRS does not take fondly to wrongly filed business reports. If you're just starting out as an owner-operator of a trucking business, you could also consider outsourcing your accounting and bookkeeping to someone knowledgeable.

Step-by-step how to start accounting for trucking companies

Below, we’ll review the steps necessary for self-employed truck drivers to take in order to establish a trucking accounting system.

How to setup your accounting and recordkeeping system for your trucking business: List of accounts by You Drive U / TWA ft. Kenny LongStep 2. Decide on a entity structure.

The default structure of small businesses is a sole proprietorship, which means owner operators will immediately fall into this category without even filing paperwork.

Though it’s simple and convenient, there is a liability risk. Owner operators, as sole proprietors, bear the risk should someone decide to sue the trucking company.

Running a trucking business comes with potential hazards and it is often better to form a different type of entity. A limited liability company (LLC) or a corporation are better suited for a transportation business.

See also: LLC vs. LLP vs. Sole Proprietorship: Choosing a Business Structure and Why It Matters

How to Start a Transportation Business: An Easy Guide

Step 3. Accounting basis

A self employed truck driver has to choose between two most common types of accounting: cash basis accounting and accrual basis accounting. The type of accounting chosen in the beginning will have a significant impact on tax return and preparation.

Put simply, cash basis accounting means writing down a transaction when money changes hands. When a payment is received for a service, such as a delivery, trucking businesses using cash basis accounting would enter the information into the general ledger. Business expenses would be treated the same.

Accrual basis accounting, on the other hand, means writing down transactions whether income or expenses when they take place, rather than when money changes hands. Though accrual basis accounting is more work, it records profitability more accurately.

It’s important to note, that though it is possible to change the accounting method later, it’s troublesome and requires permission from the IRS by filing Form 3115—so choose wisely.

Step 4. Track and document.

An owner operator, like any other small business owner, will need to document all income and business expenses. Trucking companies need to be very vigilant when it comes to correct record keeping.

Truck drivers will incur many different trucking expenses when on the road, with many of them being tax deductible. The only way to prove that, however, is with documentation. An owner operator needs to focus on maintaining records of the following:

Fuel purchases

Meals

Lodging

Truck washing

Tolls, parking, and extra fees

Truck maintenance

IRS classifies semi-trucks as qualified nonpersonal use vehicles which means companies need to use actual costs rather than employing the standard mileage method. Keep receipts on hand for three years for audit proof.

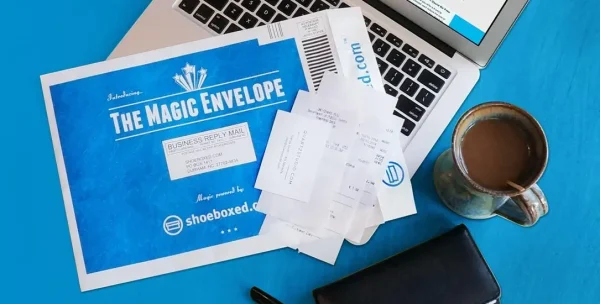

This is where a service like Shoeboxed’s Magic Envelope comes in handy—particularly for truck owner operators. Shoeboxed’s Magic Envelope is a prepaid envelope that can sit on your dashboard, collecting receipts during a long haul.

At the end of the month, send in your Magic Envelope, and get all your receipts scanned, verified, and sorted into 15 common tax categories.

Stuff all your receipts into Shoeboxed’s Magic Envelope for easy outsource scanning

Hit the road with Shoeboxed ⛟

Stuff receipts into the Magic Envelope while on the road. Then send them in once a month to get scanned. Expense reports don’t get easier than this! 💪🏼 Try free for 30 days!

Get Started TodayStep 5. Take care of tax obligations.

No one wants to think about filing taxes, but a trucking business must make quarterly estimated tax payments which will cover income and self-employed taxes. Failing to keep up with this requirement will result in penalities and interests on a federal and state level.

Truck drivers are up against other tax obligations as well, which is dependent on the size and length of trips. These obligations include the International Fuel Tax Agreement (IFTA) and the Heavy Use Vehicle Tax (HVUT). IFTA applies to those who drive across state lines or weigh more than 26,000 pounds or has at least three axels.

Part of IFTA reports are fuel purchases and trips reported quarterly. In some cases, an annual fee is also assessed. To remain in compliance, it’s important to file IRS Form 2290.

Best practices for trucking accounting

Trucking accounting, like any portion of running a business, is time and energy consuming. Keeping up with some best practices will help make that aspect of running a business a little easier.

Truckers! Do Your Accounting the CORRECT WAY by Trucking Accountant1. Leverage a software program

Trucking businesses have various software program options such as accounting software and trucking management software, at their disposal to assist with day-to-day tasks. Investing in the right software program with different important features will greatly ease burdens and helps avoid waisting precious resources.

First, trucking management apps and softwares is one of the go-to programs for trucking companies. This type of software will become a central hub of a trucking operation, helping manage paperwork and other responsibilities such as:

Create invoices

Collect payments

Paying bills

File quarterly IFTA reports

Work as dispatch operations or fleet management; dispatching other drivers

Extract data from an electronic logging device

An accounting software solution is also available for trucking companies. Investing in a trucking accounting software can help navigate important accounting information such as generating detailed reports and trucking expense spreadsheets, determining company cash flow, and helping with the overall accounting cycle.

A free demo might be the way to go for those who are hesitant in the investment, but there’s no doubt the business use is invaluable.

Receipt retention is a key component of collecting documentation while leveraging software. Shoeboxed‘s receipt scanner will have your receipts tidy in no time while assisting with expense reporting, tax prep, and so much more.

Stop doing manual data entry 🛑

Outsource receipt scanning to Shoeboxed’s scanning service and free up your time for good. Try free for 30 days! ✨

Get Started Today2. Stick to a schedule

Whether you choose to complete all of your tasks weekly or monthly, make sure you give yourself enough time to log your transactions accurately in a timely fashion. Leaving such tasks for last minute will cause mistakes, headaches, and misrepresented information.

3. Use fuel cards

IFTA compliance is a unique business accounting feature for trucking companies. A fuel card works much the same as any other credit card, however, it is tied to a unique driver number and can provide fuel discounts.

These card can help immensely with organization, tracking, and displaying information that will be needed for IFTA reporting. For companies using a software program, the two can link together most of the time, making the process seamless.

4. Consult with an accounting expert

Reaching out to an expert such as a CPA might be a prudent step when it comes to tax preparation and trucking accounting services. Trucking bookkeeping and accounting are full-time jobs all by themselves, making it next to impossible to do both trucking and accounting together.

The expert you hire does not have to work full-time but can be on call to help with specialized services and questions, keeping down on the total cost. Remember to work only with those individuals familiar with trucking accounting features and your specific line of work.

Common pitfalls

Trucking bookkeeping and accounting comes with a set of challenges, requiring a certain level of training and expertise. Without such training, it’s important to remember which mistakes to avoid and how.

a. Procrastination

Whether you are using trucking accounting software or not, leaving it all to the last minute is a common mistake made by many small businesses. Leaving logging transactions, even for a small fleet, to complete right before key deadlines will create more havoc.

Log expenses and income as they happen, keeping up with understanding your trucking company’s cash flow at all times, rather than only during tax time.

b. Misunderstanding deductions

Saving more money during tax time is something every individual and company strives to achieve. Some CPAs even find themselves floundering when it comes to the unique deductions presented by the trucking industry.

As an example, small business owners can expense only 50% of meal expenses, but truckers can take up to 80% of the actual cost or their per diem allowances. The same is true for miles driven and cost per mile incurred. When in doubt, reach out to a professional versed in this type of accounting.

Frequently asked questions

What is transportation accounting?

Transportation accounting is a crucial piece of the accounting industry. In more detail, it includes:

• Monitoring freight costs

• Payment benefits

• Freight invoices

• Expected costs

• Invoice consolidation

Accountants focused in this field can assist with analyzing accounts receivable, reviewing accounts payable, and many more tasks related to the trucking business.

What records should a trucking business retain?

DOT, or Department of Transportation, and the IRS have various requirements when it comes to document retention. However, some of the most important documentation include:

• Information tracked by electronic logging devices

• Trip records

• Bills of lading and manifests

• Expenses incurred by driver

• Payroll records

• Qualifications and performance data

• Drug and alcohol tests (usually refer to larger fleets)

• Vehicle maintenance records

Keep in mind that the IRS has specific policies surrounding the length of time documents needs to be retained. Many times, the rule will state 3 years, however, there are exceptions which go as high as 7 years or even 10. It’s best to read up on specific types of documentation or reach out to a tax professional with any further questions. Consider investing in a document scanner for truckers to digitalize all paperwork as it comes in.

What is the best way to track all business related functions?

Trucking companies have an added bonus of using two types of software: trucking management software and accounting software to help manage the wealth of information.

The first, will help manage the fleet in many aspects such as freight billing, manage customers, receive payments or partial payments, and more. Software designed for accounting will have accounting features to provide detailed reports, earnings, loss statements, and more.

Many such software work as a web based platform, making access easy from anywhere be it a phone, tablet, or computer. For smaller businesses, it gives you the flexibility of managing every aspect of the business on the go, while at the same time sending critical data to an expert for a second opinion.

In closing

One last thought before we close: Should you hire a professional? For some, reaching out for assistance will be a no-brainer. Most small business owners, trucker or not, don’t have experience with maintaining a company’s accounting, making the task difficult.

Rather than floundering about, potentially missing essential deadlines, an accounting expert can help paint an accurate picture of your company without placing a huge monetary burden on you, especially when used in conjunction with the right software. You can also read up on accounting blogs to familiarize yourself with the process.

Agata Kaczmarek has held a passion for writing since early childhood. A professional writer for many years, Agata specializes in writing articles and blogs focused on finance as someone who holds a Masters Degree in Accounting and Finance.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!