Efficient business credit card receipt management is crucial for maintaining financial health and driving success in today's fast-paced business environment. One way for businesses to manage expenses is by using corporate credit cards.

With numerous transactions occurring daily across various departments and projects, keeping track of receipts can quickly become overwhelming without a structured approach.

What is business credit card receipt management?

Learning how to manage business expenses efficiently is crucial since small business ownership is how most families and communities build wealth.

According to Consumer Finance, to further enhance the Consumer Finance Protection Act and to boost the economy, the Consumer Finance Protection Bureau recently passed a rule to help small businesses gain access to the credit they need by increasing transparency in the lending market.

Business credit card receipt management involves systematically collecting, capturing, organizing, tracking, and storing corporate credit card transaction receipts. It encompasses the procedures and tools to ensure accurate record-keeping, financial regulation compliance, and streamlined expense management.

What can a corporate credit card be used for?

A business credit card is issued to company employees for business-related expenses. How employees use a corporate credit card varies depending on the policies set by the company and the terms of the credit card agreement.

Here are some common uses for business credit cards:

Travel expenses

Travel expenses include airfare, hotel accommodations, rental cars, and other travel-related expenses incurred while employees travel for business.

Meals

Corporate credit cards may be used to cover the cost of meals with clients, business partners, or colleagues and expenses related to business meetings or events.

Office supplies and equipment

Corporate credit cards can be used to purchase office supplies, equipment, and other necessary items for business operations.

Professional services

Professional services include fees for consulting, legal, or accounting services.

Training and development

Expenses related to employee training, seminars, conferences, and professional development activities are usually eligible for payment with a corporate credit card.

Business subscriptions and memberships

A corporate credit card may pay for business-related subscriptions, memberships, and licenses.

Marketing and advertising

Expenses related to marketing campaigns, advertising, promotional materials, and sponsorships may be charged to a corporate credit card.

Utilities and telecommunications

Payments for utilities, internet services, phone bills, and other essential business communications services may be covered using a corporate credit card.

Business insurance

Premiums for business insurance policies, such as general or professional liability insurance, may be paid with a corporate credit card.

Employees must adhere to the company's expense policies and guidelines when using a corporate credit card to ensure that expenses are legitimate, properly documented, and within budget.

Additionally, companies with corporate cards may impose restrictions on certain purchases or set spending limits for individual corporate cardholders to control costs, manage expenses, and mitigate risks.

What are the risks of corporate credit cards?

While corporate credit cards offer numerous benefits for small businesses, they also have inherent risks.

Here are some common risks we've seen associated with corporate credit cards:

Fraud and unauthorized charges

Corporate credit cards are susceptible to fraud, including unauthorized charges, card skimming, and identity theft. Fraudulent transactions can result in financial losses for the company and damage its reputation.

Employee misuse

Employees may misuse corporate credit cards for personal expenses or unauthorized purchases. This can lead to the misuse of company funds, increased costs, and violations of company policies.

Overspending

Employees may overspend or exceed budgetary limits when using corporate credit cards without proper oversight and controls. Overspending can strain the company's financial resources and negatively impact its bottom line.

Non-compliance

Failure to comply with internal policies, industry regulations, or legal requirements related to corporate credit card usage can result in penalties, fines, and legal liabilities for the company. Non-compliance may include improper expense reporting, inadequate documentation, or unauthorized purchases.

Data breaches

Corporate credit card information stored by merchants or third-party vendors may be vulnerable to data breaches and cyberattacks. A data breach can compromise sensitive cardholder data, expose the company to liability, and damage its reputation.

Disputed charges and chargebacks

Disputed charges or billing errors on corporate credit card statements can lead to disputes between the company, vendors, or credit card issuers. Unresolved disputes may result in chargebacks, financial losses, and strained vendor relationships.

Interest and fees

If corporate credit card balances are not paid in full each month, the company may incur interest charges, increasing the overall cost of using credit. High-interest rates and penalty fees on corporate cards can impact the company's financial health and cash flow.

Dependency on individual cardholders'

Companies may become overly dependent on individual employees who hold corporate credit cards, mainly if these employees are responsible for essential purchases or expense reporting. This dependency can create operational risks if key personnel leave the organization or misuse their cards.

Lack of transparency

Without adequate transparency into corporate credit card usage and expenses, management may lack visibility into spending patterns, making it challenging to identify inefficiencies, control costs, and make informed business decisions.

Organizations should implement robust controls, policies, and monitoring mechanisms for corporate credit card usage to mitigate these risks.

This includes establishing clear guidelines for card issuance, spending limits, expense reporting, and reconciliation and implementing technology solutions and training programs to promote responsible corporate card usage and mitigate fraud and compliance risks. Regular auditing and oversight are essential to identify and address potential issues proactively.

How can corporate credit cards centralize business expenses?

Corporate credit cards should be implemented to centralize business expenses. Centralizing expenses helps streamline the expense management process and gives the finance teams greater visibility and control over company spending.

In our experience, utilizing a corporate credit card to centralize business expenses is the way to go.

Here are some steps to take when using a corporate credit card to centralize business expenses:

Establish a corporate credit card program: Implement a corporate credit card program within your organization, specifying guidelines, policies, and procedures for card issuance, usage, and reconciliation. Communicate these policies to employees to ensure compliance.

Assign cards to employees: Issue corporate credit cards to designated employees or departments responsible for business-related purchases. Consider assigning cards based on job roles, departments, or project teams to facilitate expense tracking and accountability.

Set spending limits: Establish spending limits for each corporate credit card based on your budget, employee roles, or specific expense categories. These limits help prevent overspending and ensure that purchases align with company priorities.

Define expense categories: Categorize expenses based on business needs and accounting requirements, such as travel, meals, and office supplies. Standardize expense categories across the organization to facilitate reporting and analysis.

Require receipts and documentation: Employees must provide receipts and documentation for all corporate credit card transactions. Set clear guidelines for receipt submission, including deadlines and acceptable formats, to ensure accurate expense reporting and reconciliation.

Implement expense management software: Implement an expense management platform that integrates with corporate credit card programs to streamline expense tracking, reporting, and approval workflows. These tools can automate expense categorization, receipt capture, and reimbursement processes, saving time and reducing errors.

Review transactions regularly: Monitor corporate credit card transactions to identify unauthorized or non-compliant purchases. Conduct periodic audits or reviews to ensure adherence to company policies and detect any discrepancies or fraudulent activity.

Centralize expense data: Consolidate all corporate credit card transactions and expense data into a centralized system or database for easy access and analysis. This centralization enables better visibility into company spending patterns, facilitates budget management, and supports informed decision-making.

Integrate with accounting systems: Integrate corporate credit card transactions with your organization's accounting or ERP (enterprise resource planning) system to streamline financial reporting and reconciliation processes. This integration ensures accuracy and consistency in financial data across the organization.

Provide training and support: Offer training sessions or resources to educate employees on how to use corporate credit cards effectively, adhere to expense policies, and maximize the benefits of centralized expense management. Provide ongoing support and guidance to address any questions or concerns.

By implementing these strategies, businesses can leverage corporate credit cards to centralize and approve spending, manage business expenses, improve efficiency, and maintain financial control.

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. Try free for 30 days!

Get Started TodayHow do you create a corporate credit card expense policy?

Creating a corporate credit card expense policy is crucial for establishing clear guidelines and expectations regarding using company-issued credit cards for business expenses.

Here, we've outlined the steps to create an effective corporate credit card expense policy:

Identify objectives and scope: Determine the goals of the expense policy, such as controlling costs, ensuring compliance with regulations, and promoting responsible spending. Define the scope of the policy, including which employees are eligible for corporate credit cards and the types of expenses that are allowable.

Establish eligibility criteria: Define criteria for determining which employees can receive corporate credit cards. Consider factors such as job roles, levels of responsibility, travel requirements, and spending authority. Communicate eligibility requirements to employees.

Define permissible expenses: Outline the costs for employees to charge to their corporate credit cards. Common categories include travel, accommodations, meals, transportation, office supplies, and professional development.

Set spending limits: Establish spending limits for individual employees or departments to control costs and prevent overspending. Specify limits based on expense categories, employee roles, or project budgets. Consider setting both transaction limits and monthly or annual spending caps.

Provide guidance on documentation: Specify the documentation requirements for corporate credit card transactions, including submitting receipts, invoices, and expense reports. Define acceptable formats for documentation and establish deadlines for submission.

Outline approval procedures: Define the process for obtaining approval before making certain purchases or exceeding spending limits. Specify who has authority to approve expenses, such as supervisors, managers, or finance personnel, and establish approval workflows.

Address compliance and fraud prevention: Include provisions to ensure compliance with company policies, industry regulations, and legal requirements. Implement controls to prevent fraud, such as transaction monitoring, expense audits, and reporting procedures for suspicious activity.

Provide guidance on card use: Corporate credit cards should be used responsibly and ethically. Prohibit the use of cards for personal expenses or non-business-related purchases. Encourage employees to exercise sound judgment and discretion when using company funds.

Communicate policy to employees: Communicate the corporate credit card expense policy to all employees who are eligible to receive cards. Provide training and educational resources to ensure that employees understand their responsibilities and obligations under the policy.

Regularly review and update: Review the corporate credit card expense policy to ensure it remains relevant and practical. Update the policy as needed to reflect changes in company operations, industry standards, or regulatory requirements.

By following these steps, businesses can create a comprehensive corporate credit card expense policy that promotes responsible employee and corporate spending throughout, ensures compliance, and supports efficient employee expense and management practices.

How do I manage my business credit card receipts?

Managing your business credit card receipts effectively is essential for maintaining accurate financial records, tracking expenses, and ensuring compliance with tax and accounting regulations.

Here are the best steps we've found to help you manage your business credit card receipts:

Collect receipts: Ensure you collect receipts for all transactions using your business credit card. This includes physical receipts (such as paper receipts from in-person purchases) and digital receipts (such as email receipts from online transactions).

Organize receipts: Establish a system for organizing your receipts to make them easy to access and review. You can organize receipts chronologically, by expense category, or by vendor, depending on your preferences and business needs.

Digitize receipts: Consider digitizing receipts to reduce paper clutter and make them easier to manage. You can use a scanner or a mobile scanning app to capture digital images of your paper receipts or opt for email receipts for online transactions whenever possible.

Use expense management software: Invest in an expense management platform or app that can help you streamline the receipt management process. These tools often include receipt scanning, expense categorization, and integration with accounting software, making tracking and managing your business expenses more manageable.

Record receipt information: For each receipt, record critical details such as the transaction date, the amount spent, the vendor name, and a brief description of the expense. This information will help reconcile your credit card statements and prepare financial reports.

Reconcile receipts with statements: Regularly reconcile your credit card receipts with your credit card statements to ensure that all transactions are accounted for and accurate. Flag any discrepancies or unauthorized charges for further investigation.

Archive receipts: Archive your receipts securely for future reference and auditing purposes. You can store digital receipts in a cloud-based storage solution or a dedicated folder on your computer and keep physical receipts in a file cabinet or storage box.

Dispose of receipts securely: Once you no longer need a receipt, dispose of it securely to protect sensitive information. If you discard paper receipts, consider shredding them to prevent identity theft or fraud.

Train employees: If you have employees who are authorized to use your business credit card, make sure to train them on the importance of proper receipt management and provide guidance on how to collect, organize, and record receipts effectively.

By following these steps, you can effectively manage your business credit card receipts and maintain accurate financial records for your business.

This accounting system will help you track and manage expenses well, monitor cash flow, manage employee expenses, and ensure compliance with tax and accounting requirements.

How can you streamline managing business credit card receipts?

Expense management software is the best method for streamlining travel and expense management processes.

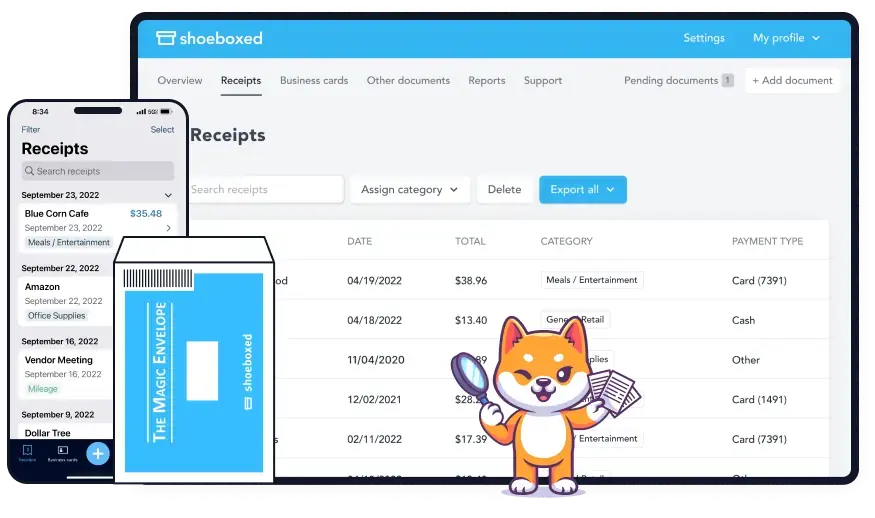

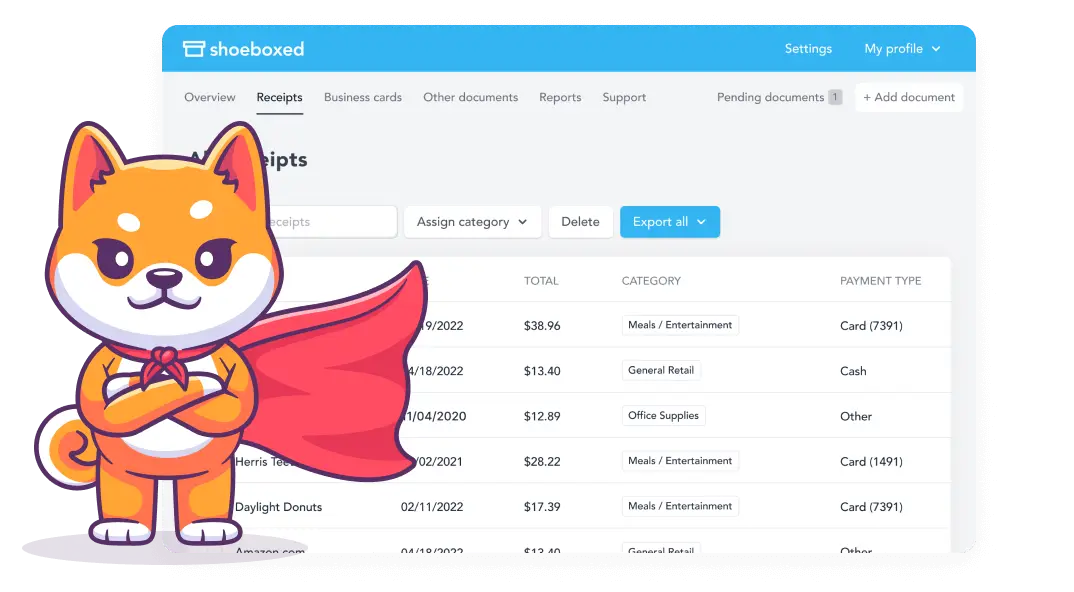

Shoeboxed is a popular expense management tool that helps businesses streamline the process of managing receipts, including those from business credit cards.

Shoeboxed streamlines your expense management process.

Here's how you can streamline managing business credit card receipts with Shoeboxed:

Sign up for Shoeboxed

Create an account on the Shoeboxed platform by signing up on their website or through their mobile app. Choose the plan that best fits your business needs.

Shoeboxed is a receipt scanning app and a receipt scanning service.

Use receipt scanning

Use Shoeboxed's receipt scanning feature to capture digital images of paper receipts. You can use the Shoeboxed mobile app to snap photos of receipts on the go or mail physical receipts in Shoeboxed's Magic Envelope for scanning and digitization. Shoeboxed is the only expense management software that offers a service like the Magic Envelope.

Receipts sent to Shoeboxed will automatically show up in your account.

Forward email receipts

Forward email receipts directly to your Shoeboxed account for processing. Shoeboxed will extract relevant information from the email receipts and categorize them accordingly.

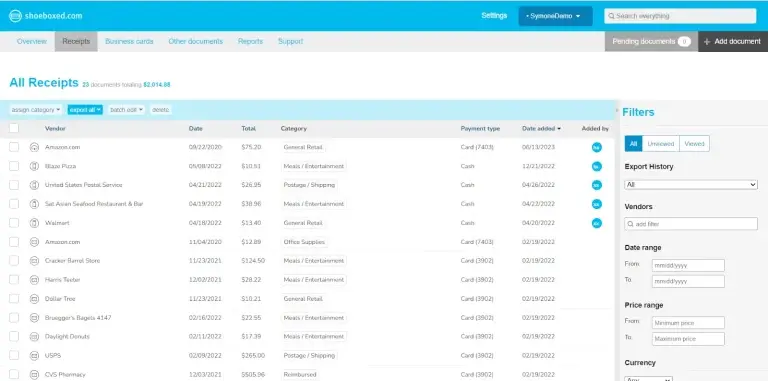

Shoeboxed organizes your receipts by date, amount, vendor, and tax category.

Organize receipts

Categorize and organize receipts within Shoeboxed based on expense categories, projects, or clients. Tag receipts with relevant labels to make them easy to search and retrieve later.

Shoeboxed works with tools you already use.

Export data to accounting software

Export receipt data from Shoeboxed to your accounting software or expense management system. Shoeboxed integrates with popular accounting platforms such as QuickBooks, Xero, and FreshBooks, allowing seamless transaction data and transfer.

Review and approve expenses

Review and approve expenses within Shoeboxed before exporting them to your accounting software. Verify that all transactions are accurate, properly categorized, and compliant with company policies.

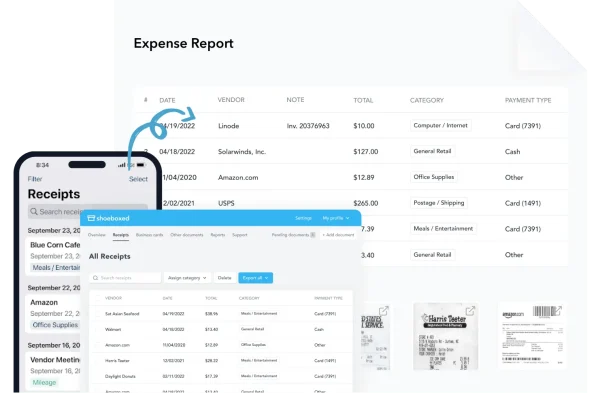

Shoeboxed turns your data into expense reports for reimbursements and tax deductions.

Generate reports

Use Shoeboxed to generate detailed expense reports based on your credit card receipts. Customize reports to include specific periods, expense categories, or projects.

Track spending trends

Monitor spending trends and patterns across your business credit card transactions using Shoeboxed's reporting tool. Identify areas for cost savings, budget optimization, or policy enforcement.

Shoeboxed will keep you organized and compliant.

Stay compliant

Ensure compliance with tax regulations, accounting standards, and internal policies by maintaining accurate and organized records of your business credit card receipts in Shoeboxed. Keep track of receipts for auditing and reporting purposes.

By leveraging Shoeboxed to streamline managing business credit card receipts, you can simplify expense management, improve accuracy, and save time for your business.

Turn receipts into data with Shoeboxed ✨

Try a systematic approach to receipt categories for tax time. Try free for 30 days!

Get Started TodayDoes a corporate credit card make expense management easier?

Yes, a corporate credit card can make expense management more accessible for both employees and employers in several ways:

Streamlined payment process

Corporate credit cards enable employees to make business-related purchases directly, eliminating the need to use personal funds and seek reimbursement. This simplifies the payment process and reduces administrative overhead associated with reimbursement procedures.

Real-time tracking

Many corporate credit card issuers offer online account management platforms that provide real-time transaction visibility. Employers can monitor employee spending as it occurs, allowing for better oversight and control over expenses.

Automated reporting

Corporate credit card statements often come with detailed transaction reports, making it easier for employees to categorize expenses and for employers to generate accurate financial reports. Some credit card issuers also integrate with accounting software, further streamlining the reporting process.

Expense policy enforcement

Companies can set spending limits, restrictions, and expense policies directly within the corporate credit card program. This helps ensure employees adhere to company guidelines when purchasing, reducing the risk of overspending or non-compliance.

Centralized management

Corporate credit cards can be issued to specific employees or departments, allowing for centralized management of expenses. This facilitates budget tracking, auditing, and reconciliation processes.

Enhanced security

Corporate credit cards often come with security features such as fraud monitoring, purchase alerts, and the ability to quickly deactivate lost or stolen cards. This helps protect against unauthorized transactions and reduces the risk of financial losses.

Integration with expense management tools

Many corporate credit card programs integrate with expense management software, further streamlining the expense report management and reimbursement process. This integration can automate receipt capture, expense report categorization, and approval workflows.

A corporate credit card can simplify employee expense management by providing a convenient payment method, offering real-time tracking and reporting capabilities, enforcing expense policies, and enhancing security measures. These benefits ultimately contribute to improved efficiency, cost control, and compliance within the organization.

Lighten the Load

Learn How a Multi-Campus Church Reclaims 20 Hours a Month with the Shoeboxed App

Read the case studyFrequently asked questions

What are some best practices for managing business credit card receipts?

Best practices for managing business credit card receipts include digitizing receipts with a platform like Shoeboxed, categorizing expenses, reconciling transactions regularly, implementing approval workflows, centralizing receipt storage, conducting periodic audits, providing employee training and support, and leveraging technology solutions for automation and efficiency.

Why is business credit card receipt management essential?

Effective receipt management is essential for financial accuracy, regulation compliance, cost control, reimbursement, and operational efficiency. It ensures businesses maintain reliable financial records, adhere to internal policies and external regulations, identify cost-saving opportunities, facilitate timely reimbursements, and streamline administrative processes.

In conclusion

Business credit card receipt management is vital to maintaining financial transparency, accountability, and organizational control. By adopting efficient receipt management practices and leveraging technology solutions, businesses can streamline expense processes, enhance accuracy, and optimize resource allocation, ultimately driving financial stability and business growth.

Caryl Ramsey has years of experience assisting in different aspects of bookkeeping, taxes, and customer service. She uses a variety of accounting software for setting up client information, reconciling accounts, coding expenses, running financial reports, and preparing tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports, including IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports, and more—with Shoeboxed.

Try Shoeboxed today!