Expense management doesn't have to be complicated; automated expense reporting makes it a breeze! With just a few clicks, businesses can quickly and accurately capture their expenditures without worrying about keeping up with paper receipts.

This technology also grants real-time visibility into costs for better oversight of money spent. This is why many businesses are already taking advantage of the ease of automated expense management systems for expense reporting: simplicity reigns when managing expenses.

Why automate expense management?

Expense management has long been a painstaking requirement of business operations, with manual expense management involving tedious spreadsheets, paper receipts, and time-consuming approval processes for employees and finance teams alike. According to Business Travel News, one survey suggests that up to 43% of companies still use manual processes to manage their expense reports.

Automated expense reporting software is now available to streamline this process. Automation allows businesses to gain better control over their expenses while benefiting from improved accuracy and compliance and real-time visibility into costs.

Advantages of automated expense reports

The transition to automated employee expense report solutions brings many advantages, such as faster reimbursement turnaround times and integration with accounting systems that can save money and human resources.

Automation helps increase efficiency by reducing cost per transaction while mitigating associated risks due to increasingly vital compliance requirements. Automated expense reporting also ensures employee financial records are accurate & up-to-date.

Drawbacks of manual expense reports

Manual input of employee expenses into a spreadsheet and submission for approval can be time-consuming and full of errors, with the risk arising from false or inflated employee reports not being monitored by compliance policies.

Automated systems make it easier to record, track, and verify claims quickly, minimizing paperwork associated with submitting reimbursement requests manually - ultimately saving employees' and businesses' precious resources when monitoring expenditures, costs, or receipts on one platform.

The evolution of expense reporting

The development of more automated expense management software systems has revolutionized how businesses handle their expenses. This technology has replaced manual and labor-intensive processes, providing employees with faster and more cost-effective reporting methods that save time on data entry and allow them to focus elsewhere in business operations. Modern expenditure-tracking solutions boast robust analytics features that optimize financial decision-making while delivering accuracy for accounting tasks.

The drive towards improved efficiency over traditional manual expense reports, often slow or error-prone due to reliance solely upon human effort, is the drive that has necessitated this change. Automation allows for quick categorization and integrated software connections, which streamline transactions.

What are the critical features of automated expense reporting systems?

Automated expense management software has various features to simplify the expense report process. These features include scanning receipts, quickly importing integrated credit cards, and streamlining an expense report submission.

Customizable workflows like spending rules and request/approval dashboards help to show spending trends, improve expense management, and enhance approval processes while reducing the time spent by finance teams administering reimbursements.

A significant benefit is their ability to link directly with the company's accounting system and software so that all financial information can be reported uniformly without errors or discrepancies.

Receipt scanning and digital storage

Automated expense reporting systems offer a significant advantage: scanning and storing receipts digitally. Automation eliminates any hassle associated with paper receipt filing and shortens the time spent completing reports, as manual data entry is no longer necessary.

Digital storage of receipts also eliminates piles of paper and improves accuracy because errors like incorrect or misinterpreted information can be minimized during automated entries. Digital storage makes it easier for people to access records quickly while organizing, generating expense reports, and managing expenses.

Expense report streamlined approval workflows

An automated expense management reporting system provides a user-friendly dashboard for requests and approvals, featuring customizable workflows and spending rules. Automation allows for increased real-time visibility into the entire expense management process, which leads to quicker reimbursements and simplifies the tax and auditing processes.

Integration with accounting software

Integrating automated expense reporting systems with accounting software is critical to providing accurate financial reports. Automation creates a consistent system for managing expenses across the business and promotes data transferability between central financial accounting programs.

What is an example of automated expense management software?

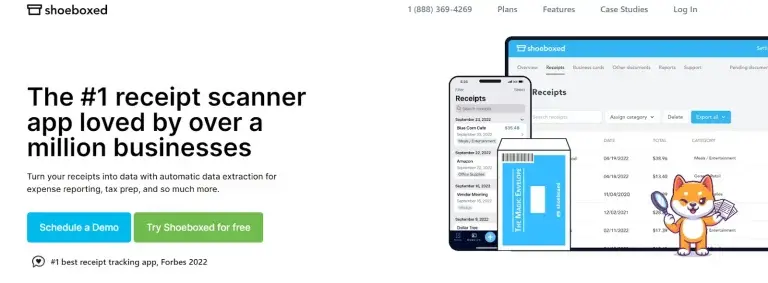

Shoeboxed is an excellent example of an automated expense reporting process. With Shoeboxed, you can turn receipts into data with automatic data extraction for expense reporting and tax prep.

Shoeboxed is used by over a million businesses for automated expense reporting.

With Shoeboxed, you get two options for one price: a receipt-scanning app and a receipt-scanning service, depending on how you want to use it.

Take a photo of your paper receipts with your mobile device, and Shoeboxed will store receipts digitally.

You can use their mobile app as a receipt scanning app for easy and quick uploads into a Shoeboxed account, which keeps digitized receipts all in one place. The app features OCR technology that converts printed text from restaurants or store receipts into searchable data.

As a receipt scanning service, you can mail your receipts in a pre-paid envelope, also known as the Magic Envelope, to their processing facility, and they will scan and humanly verify each receipt into your Shoeboxed account.

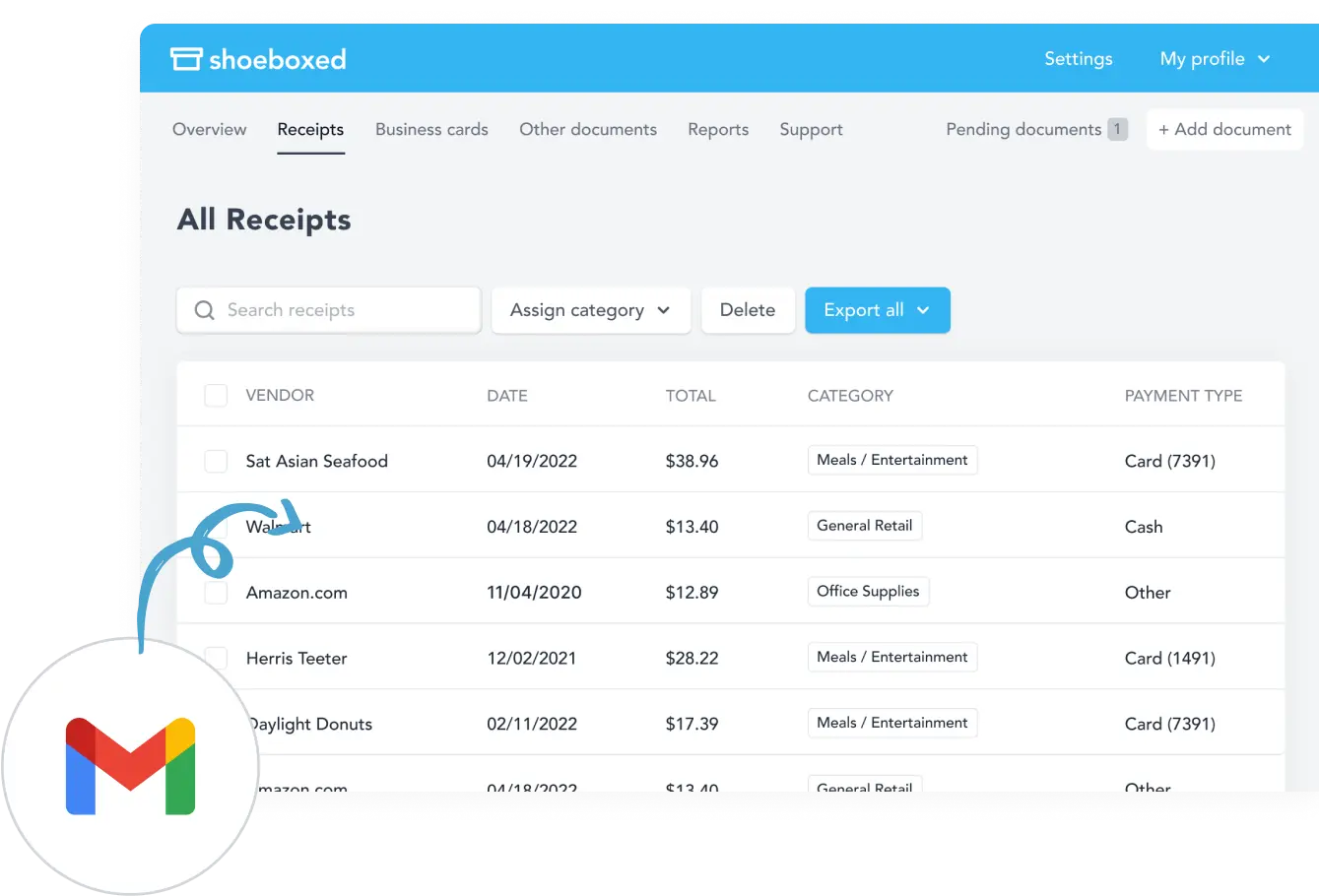

Whichever option you choose, data is categorized, editable, organized, searchable, and available anytime, anywhere.

Receipts always get noticed in your inbox.

You can also auto-import receipts from Gmail to Shoeboxed so that receipts stay visible in your inbox.

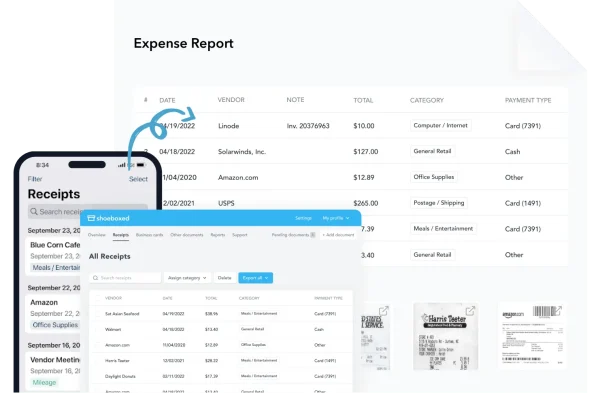

You can quickly generate expense reports with just a few clicks.

You can then create comprehensive expense reports that include images of each expense. Data from the automated expense reporting process can be exported, shared, or printed for reimbursement payment or tax deductions.

Shoeboxed integrates with other accounting software for the ultimate experience in expense management.

Integration with tools you already use lets you say goodbye to manual, painful data entry and missing receipts. Shoebox integrates with other accounting systems such as QuickBooks, Wave, and Xero platforms so that your information remains unified, compliant, and accurate.

Turn receipts into data with Shoeboxed ✨

Try a systematic approach to receipt categories for tax time. Try free for 30 days!

Get Started TodayWhat are the top benefits of implementing automated expense reporting?

Automated expense management and reporting provide many advantages, such as accuracy and compliance with corporate protocols. It facilitates precise tracking of expenses, leading to improved reliability for the organization's finances. Automated expenditure management systems versus manual expense management also increase productivity while reducing costs.

Automated expense reports guarantee conformity since they actively enforce company rules into their core functioning - thereby avoiding illegitimate transactions or expenditures that could undermine the legitimacy of an expense report.

Enhanced accuracy and reduced errors in expense reports

Automated systems improve the process of expense reporting and minimize errors. Manual data entry is unnecessary, eliminating potential risks such as fewer errors, incorrect entries, overlooking important details, or misinterpreting information due to fatigue or distractions.

Automated solutions offer numerous benefits. They automate expense categorization and approval processes while enforcing adherence to corporate policies to prevent any expense fraud.

Increased productivity

Automated expense reporting can significantly improve productivity by minimizing employees' time submitting expenses and finance teams processing and approving them. According to the Work Market 2020 In(Sight) Report, 53% of employees say automating tasks saves up to 2 hours daily, and 78% of business leaders say automation saves 3 hours daily. The Global Business Travel Association (GBTA) confirms that an average of 20 minutes could be recuperated for each expense report using expense management automation.

Aside from saving time, implementing expense management tools minimizes operating costs, enhances compliance, offers consistency from integrations, and increases productivity.

Improved compliance and expense fraud detection

Automated expense reporting systems are beneficial for promoting adherence to company policies and detecting expense fraud. These tools allow businesses to check their claims against those rules in real-time, creating automated approval workflows that digitally capture all receipts and generate reports instantly.

This combination of features helps make the process more efficient while securing its integrity by catching any improper or fraudulent expenses early on. Not only does this promote compliance, but it also reinforces the overall trustworthiness of all incoming employee expense reports.

What are some essential tips for choosing the proper automated expense reporting software?

Choosing the right tools for proper automated expense reporting with all the various options can be overwhelming. Nevertheless, there are some decisive points to take into account that will help guide your decision, such as compatibility, features, scalability, adaptivity, ease of use, and customer support.

Assessing software features and compatibility

When deciding on automated expense reporting software, examining the key features and their compatibility with your enterprise's current structures and procedures is imperative. It would be best to have a system that offers capabilities such as receipt scanning, sorting and categorizing expenses, and integration with other accounting programs. The expense management automation should also be easy to use with comprehensive performance tracking abilities.

Compatibility is another thing to consider. The software must mesh easily with existing financial infrastructures and operations for effortless data transfer and uniform expenditure management throughout your company structure.

Considering scalability and flexibility

When selecting automated expense software tools, it is essential to consider scalability and flexibility. As your company grows, so will its demand for reliable reporting on business expenses. It would be best to have a tool to grow with the business while maintaining performance and accuracy.

A scalable program should be capable of dealing with an increase in business, costs, and users, while a flexible one should adjust to various needs during business operations and growth. Look out for customizable options that also offer integrations.

Evaluating ease of use and user support

When searching for automated expense reporting software, you should consider two vital elements of software: usability and user support. The system should provide an intuitive experience with simple steps to manage expenses, upload attachments like receipts or vouchers, and submit expense reports for approval.

There should also be comprehensive resources that guide users on how to operate the application. These resources include training material such as tutorial videos, manuals, and customer service in case of queries.

By thoroughly assessing these factors before making your decision, you ensure a smooth transition during implementation while providing your employees with a positive use of the tool when submitting their spending reports.

Are there any real-life case studies of companies benefiting from automated expense reports?

Large and small businesses have found considerable cost savings, increased efficiency, higher accuracy levels, and enhanced compliance when incorporating this technology into their business operations.

To better appreciate its impact on our daily lives, we must look at how it has affected other companies firsthand.

Small business success story

Dimitri Fostinis is the Director of The Voyagers Talent Agency. He travels frequently and has to keep up with his business expenses while away. He averages around 700 receipts a year. He needed a platform to consolidate his business expenses while traveling and quickly generate expense reports.

Dimitri now sends all his receipts in a Magic Envelope to Shoeboxed's processing center. Here, they can human-verify and log them into their account, where the expenses are categorized. He can generate expense reports whenever needed with just the click of a button.

He estimated he would pay around $1,000-$1,500 monthly to have someone categorize his receipts for expense reports. With Shoeboxed, he saves a tremendous amount of time and money.

This automated expense management system enabled him to expedite and streamline the expenditure reporting procedure. It was also instrumental in improving accuracy and saving time and money, which is invaluable for businesses of all sizes.

The implication is that businesses can significantly benefit from such automated expense management systems when creating and processing expense reports, especially given the associated paperwork burden they commonly encounter within more traditional expense report management processes. The advantages are clear: it drastically reduces time spent on tedious tasks while still providing a complete accounting record for accurate tracking purposes.

Never lose a receipt again ✨

Join over 1 million businesses scanning receipts, creating expense reports, and reclaiming multiple hours every week—with Shoeboxed.

Get Started TodayFrequently asked questions

What is automated expense reporting?

Automated expense reporting streamlines the submission of accurate and up-to-date expense reports and reduces risks such as data entry errors or policy violations while significantly decreasing manual effort. Digital solutions, such as Shoeboxed, enable fast processing of expenses with less likelihood of expense fraud.

What is automatic expense tracking?

Automatic business expense tracking is valuable for monitoring business expenses across bank accounts, credit cards, and investments. This feature helps keep track of all spending associated with the company and automatically organizes it into categories for easier reporting.

What are the drawbacks of manual expense reports?

Manual expense reporting is tedious, prone to mistakes, and can strain employee-company relationships, making it inefficient.

In closing

Expense management is now easier than ever with automated expense reporting. It provides businesses with significant advantages, including reduced time spent managing expenses, greater accuracy and fewer mistakes, improved productivity, and compliance with regulations. As business operations become more complex, the need for effective expense control increases.

By utilizing advanced automation technology, specialized software such as Shoeboxed allows companies to make their processes faster while also ensuring financial responsibility remains intact. Automated expense reporting streamlines the financial process, increasing accuracy and reducing errors. It also enhances productivity while preventing fraud, resulting in cost savings and reliable records.

If you want a more efficient process for managing your business expenses, incorporate an automated expense management solution such as Shoeboxed into your business.

Caryl Ramsey has years of experience assisting in different aspects of bookkeeping, taxes, and customer service. She uses a variety of accounting software for setting up client information, reconciling accounts, coding expenses, running financial reports, and preparing tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!