One of the most common New Year’s resolutions is to save money, but without proper planning and the right resources, you can set yourself up for failure before the clock strikes midnight.

Here are 5 of the best budgeting tools for couples to get their finances under control in 2024.

1. Honeydue – Best free budgeting app

Honeydue homepage.

Honeydue is one of the best budget apps for couples with shared finances.

Not only does it have a cute name, but it’s also a free way for couples to collaborate on their finances across multiple devices.

With Honeydue, couples can use the app to keep tabs on bank accounts, loans, and investments. Honeydue supports over 20,000 financial institutions!

With the app’s bill reminder feature, you can also ensure that bills are paid before they’re overdue.

This budget app also has a built-in chat function to stay up-to-date with your significant other (SO) about transactions.

Pros:

Free app (which means you won’t have to budget for a couples budgeting app).

Available for IOS and Android users.

Connect multiple accounts, including your checking account, joint account, retirement accounts, and investment accounts.

Supports 20,000 financial institutions across 5 countries.

Access your bills and finances through the app and work together wherever you are.

Chat in-app to discuss transactions.

Bill-reminder feature that nudges you or your SO when it’s time to pay.

Safe to use and requires a PIN or FaceID to access your information.

Keep individual accounts and joint accounts separate.

Cons:

Can’t access Honeydue via desktop.

Includes ads, and there’s no option for an ad-free version.

Pricing: Free

2. EveryDollar – Designed by Dave Ramsey

EveryDollar homepage.

Dave Ramsey is a trusted spokesman for financial literacy, and his EveryDollar app is one of the most downloaded personal finance app out there to help you “Act your wage.”

Though you must use the premium version to access most of the app’s features, EveryDollar is the most thorough option out of all the couples budgeting apps on our list.

With EveryDollar premium, you and your partner can customize your budget, build your savings, connect bank and other financial accounts, plan your paychecks, and set goals.

You’ll also get access to financial coaching, budget reports, and more to develop your financial proficiency.

Our biggest complaint with this one is that the free version is limited to customized budgeting and savings, but it can still be useful if all you need is a basic budget app.

Pros:

A thorough budgeting app with tons of helpful features.

Designed by the Money Matters man himself.

Connect bank accounts to track spending and income.

Plan ahead with advanced paycheck planning features.

Set and reach common financial goals.

Multiple customizable expense categories.

Offers resources for financial coaching.

Budget reports and advanced financial tools.

Cons:

The free version is limited to basic budgeting and savings functions.

The paid version may not fit into every couple’s budget.

Pricing:

Free

Premium – $17.99/month OR $79.99/year

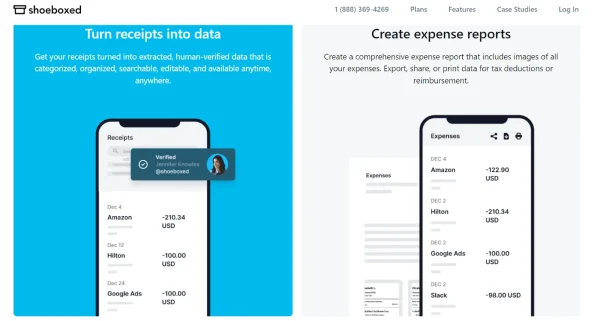

3. Shoeboxed – Best for receipt management

Turn receipts into data with the Shoeboxed app.

Tracking the money you and your SO spend can be difficult when you have mounds of paper receipts and digital receipts sent to your email.

Receipt management is a double-edged sword. Keeping records of your receipts makes monitoring your budget and spending easy, but you also end up with a ton of paper shoved in a drawer somewhere.

This is where Shoeboxed comes in!

Shoeboxed is a receipt-scanning app and service that allows you to digitize your receipts and categorize your expenses right from your phone.

Shoeboxed’s features

With Shoeboxed, you can photograph your receipts directly from the app, automatically import digital receipts from your Gmail, or upload receipts from your desktop to your account.

a. Categorization and filters

Shoeboxed automatically categorizes receipts under 15 editable tax categories. From there, you can add tags specific to your budget.

If you want to see your monthly spending in a certain category, just filter your receipts based on date, category, vendor, payment type, and more.

b. Expense reports

When you select certain expenses, Shoeboxed will create detailed PDF or CSV expense reports with receipts attached so you can have all of your expenses in one cohesive document.

c. Unlimited free sub-users

Shoeboxed offers unlimited free sub-users, so you can add your spouse to your account to record their expenses without paying extra.

The Magic Envelope

Outsource receipt scanning with the Magic Envelope service.

Shoeboxed also offers a receipt-scanning service called the Magic Envelope.

After signing up for a Magic Envelope plan, Shoeboxed will send you a postage-pre-paid envelope in the mail each month for you to stuff your receipts in.

When your envelope reaches the scanning facility, your receipts are scanned, verified, and uploaded to your account under your chosen tax or custom categories.

This is a great option for couples who generate tons of paper receipts or even small business owners who often make company purchases or keep customer receipt records.

Break free from paper clutter ✨

Use Shoeboxed’s Magic Envelope to ship off your receipts and get them back as scanned data in a private, secure cloud-based account. 📁 Try free for 30 days!

Get Started TodayShoeboxed and tax prep

If you’re an independent contractor or you and your spouse have a business, Shoeboxed makes filing your taxes a piece of cake.

Just add your accountant to your Shoeboxed account (free of charge) to view your expenses or send them an expense report during tax season.

If you’re ever audited, all your receipts are stored in one place and easy to find.

Pros:

Expenses are categorized under 15 editable tax categories.

Add unlimited free sub-users to your account (partner, accountant, tax professional, etc.)

Create expense reports with the click of a button.

Access your receipts online or through the app.

Digitize your paper receipts in seconds with Shoeboxed’s receipt scanner.

Free mileage tracker to track business miles (great for self-employed couples).

Outsource receipt scanning with the Magic Envelope.

Auto-import digital receipts from your Gmail.

Cons:

Doesn’t offer advanced budgeting features.

Pricing:

Start Up – $22/month OR $18/month (billed annually) for unlimited users + Magic Envelope.

Professional – $45/month OR $36/month (billed annually) for unlimited users + Magic Envelope.

Business – $67/month OR $54/month (billed annually) for unlimited users + Magic Envelope.

Starter – $4.99/month for unlimited users (doesn’t include Magic Envelope).

Light – $9.99/month for unlimited users (doesn’t include Magic Envelope).

Pro – $19.99/month for unlimited users (doesn’t include Magic Envelope).

Visit Shoeboxed’s pricing page to learn more about the Magic Envelope plans.

NOTE: The first 3 plans are only available on desktop. The following plans are available on the Shoeboxed mobile app.

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. Try free for 30 days!

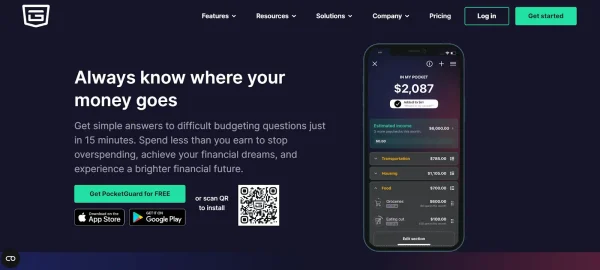

Get Started Today4. Pocketguard – Best for reports and insights

Pocketguard homepage.

The Pocketguard budgeting app is a comprehensive way to track income, bills, and net worth and customize your budget—regardless of whether you use the free or premium version.

Though Pocketguard Premium offers advanced features (such as unlimited connected accounts), the free version is a great app for couples to use when starting their budgeting or debt-tracking journies.

With Pocketguard, couples can create debt payoff plans, set savings goals, get insights and reports into spending habits, track cash, and more right from their phones.

Pros:

Available for download on both the App Store and Google Play.

Net worth reports.

Bank account and savings accounts integration is unlimited (up to 2 with the free plan).

Insights and spending reports are available in both the free and premium versions.

Offers more features in the free plan than other budgeting apps on our list.

Extensive transaction history (3 months in the free plan; 6 months in the premium plan).

Track expenses made with cash.

Web dashboard.

Cons:

There’s a learning curve for navigating the web dashboard.

The app has a lot going on. You’ll have to get used to it before you can be proficient.

Pricing: Free, or purchase a premium plan.

Monthly – $7.99/month

Annual – $34.99/year

Lifetime – $79.99 one-time payment

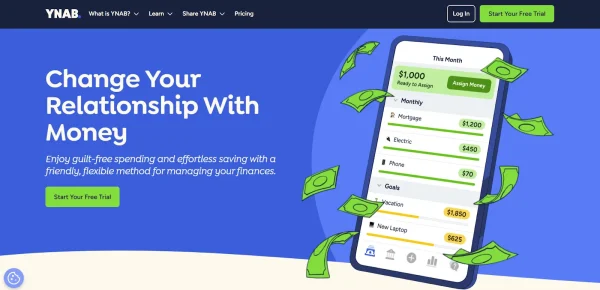

5. YNAB – Best for serious savers

YNAB homepage.

With nearly 50,000 downloads on the Apple App Store, it’s no surprise that YNAB, aka You Need a Budget, made our list of top budgeting apps for couples.

YNAB is “A wealth-building tool at your fingertips” and allows couples to manage their money online or offline, on the phone or computer.

This is one of those budget apps with everything—bank reconciliation, debt repayment, customized budgeting plans, split transactions, bank integration… you name it. It even helps you pay down your credit cards.

We loved YNAB’s modern app and web interfaces. It’s a breeze to navigate and honestly makes budgeting fun by helping you manage your expenses in a way that makes sense.

Pros:

Modern, easy-to-navigate app and web dashboard.

Automatically pulls your financial data from your bank account (choose from over 12k banks).

34-day free trial to see if YNAB is right for you.

Access your money plan from your phone, computer, or tablet.

Budget together with your SO.

Budget categories are customizable to suit your unique lifestyle.

Custom reports that show your spending habits, net worth, and income and expense ratios month-by-month.

Cons:

No free option. On the plus side, there are no ads.

No way to automatically pay bills or get bill reminders.

Pricing:

Monthly Plan – $14.99/month

Annual Plan – $8.25/month ($99/year)

How do couples keep track of finances?

Whether you’re newlyweds or going on your 20th anniversary, navigating how to be on the same page, setting spending limits, agreeing on financial goals, and overall just learning to manage money as a team can be overwhelming.

Here are some steps you can take as a couple to start a household budget:

Step 1: Decide what money you want to share

While some couples will want to go all-in and connect bank accounts, investment accounts, and other financial accounts, others will only be comfortable sharing some of their finances.

Decide what you and your better half are comfortable sharing:

Do you want to share all of your expenses, including spending habits?

Do you only want to share living expenses like rent, the mortgage, or bills?

Do you have a collective goal you want to save for, and that’s it?

Setting clear boundaries is the first step to healthily and effectively combining your finances.

Step 2: Determine your combined income

Once you know where you want to go with your collective money management, determine your combined income.

This will give you a starting point to determine how much money you have to go towards your expenses.

Step 3: Calculate your expenses

Calculate the total of the expenses you want to share the responsibility for and decide how your joint income will be divided up.

For example, if you each have debt, decide how much of your collective income should go towards paying down which debts.

Now is the time to lay out your necessary expenses, as well, such as groceries, housing, insurance, utilities, and car payments.

Step 4: Set an end goal

Do you have an end goal that you want to meet together?

Managing money as a couple can help you reach joint money goals quicker, such as paying bills that are overdue, getting out of debt, saving for a house, starting a family, or having a nest egg for retirement.

Rather than just affording today, prepare for a financially stable tomorrow.

Step 5: Budget your money

Now that you know your shared expenses and end goals, get your priorities in order, and budget your money accordingly.

There are many ways to budget your money, such as with the envelope budgeting system or the 50/30/20 method.

What is the envelope method?

The envelope method of budgeting money hinges on creating different spending categories and sticking to them.

You gather envelopes for various spending categories and put cash in each for monthly spending. When the money runs out (say, for dining out), you’re not allowed to spend in that category until the next month.

What is the 50 30 20 budget for couples?

The 50/30/20 budgeting method is designed to give every dollar a purpose.

According to this method, you split expenses into 3 categories:

Needs (food, utilities, clothing, insurance, shelter, car/debt payments).

Wants (dining out, entertainment, streaming services).

Savings (emergency fund, long-term savings goals).

50% of your take-home pay should go towards needs, 30% should go towards wants, and 20% should be put into savings accounts for savings goals.

Step 6: Use a budgeting tool or joint bank account

If you want to go the digital route, using a personal finance app or the same account at the bank makes it easy to monitor account balances, track spending, and get a broader financial picture of your combined finances.

Want to learn more about budgeting as a couple? Check out what Dave Ramsey has to say:

Dave Ramsey’s budgeting how to guide

Why budgeting is important for couples

When you become a couple, you share big parts of your personal lives in order to build a new life together. For many couples, this includes finances.

Here’s why budgeting is important for couples:

1. You prioritize and reach your goals together

One of the biggest plus sides to budgeting as a couple is that you get to prioritize and reach end goals as a team.

Whether your goal is to build your joint wealth, prepare for a family, have a down payment for a home, be debt-free, or travel the world, making goals happen when you’re transparent about your income and everyday spending habits is easier.

2. Money problems are resolved quicker

When you combine your incomes, you get a clearer picture of how to allocate funds to pay off debt more promptly. Less debt equals more money to build your lives and collective dreams.

If one or both of you have bad spending habits, you can also hold each other accountable when you’re open about the money you’re bringing in and your budget.

3. You’ll be more prepared for emergency expenses

It’s generally recommended that you have between 3 and 6 months of living expenses safely tucked away should you find yourself in an emergency.

Combining your income will build up your emergency fund quicker and ensure a secure financial future.

Is 20,000 enough for an emergency fund?

$20,000 would equate to around $4,000 a month in living expenses. If that’s about how much you spend, you would have approximately 5 months’ worth of living expenses saved up.

4. You’ll be able to visualize money coming in and going out

…Which means you can make your money work for you rather than against you.

When you know exactly how much is coming in and where it’s being spent, you can cut out unnecessary expenses and allocate your money in order to get ahead.

Break free from manual data entry ✨

Use Shoeboxed’s Magic Envelope to ship off your receipts and get them back as scanned data in a private, secure cloud-based account. 📁 Try free for 30 days!

Get Started TodayFrequently asked questions

What is the best way to budget as a couple?

Budgeting as a couple begins with determining how much of your individual incomes you want to combine, calculating expenses, budgeting your funds, and using a budgeting tool (like an app) to avoid overspending.

Is there a budget app you can share with spouse?

Honeydue, EveryDollar, and Pocketguard are all budget apps that you can share with your significant other. You can even use apps like Shoeboxed to manage receipts and keep up with spending that way.

Final thoughts

When it comes down to it, our top 3 budgeting apps for couples fall down to Honeydue, Everydollar, and Shoeboxed.

Honeydue is the best option if you’re looking for a free way to split expenses, keep track of joint bank accounts, separate finances, and pay recurring bills on time.

EveryDollar is ideal for those who want access to advanced budgeting options such as goal setting, financial coaching, and budget reports.

Shoeboxed is right for those wanting to keep up with receipts or for self-employed couples with personal and business expenses.

No matter which you choose, you can’t go wrong with any budgeting apps on our list!

Hannah DeMoss is a staff writer for Shoeboxed covering organization and digitization tips for small business owners. Her favorite organization hack is labeling everything in her kitchen cabinets, and she can’t live without her mini label maker machine.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!