Managing financial transactions efficiently is crucial for individuals and businesses in the digital age.

Credit card receipts play a fundamental role in this process as proof of payment for purchases made with a credit card.

This article covers everything you need to know about credit card receipts, including an example of how tools like Shoeboxed can optimize your handling and organization of these documents.

What is a credit card receipt?

A credit card receipt is a physical or digital record issued after a credit card transaction. It details the purchase, including the date, merchant name, amount, and the last four digits of the card number.

Why are credit card receipts essential?

A credit card receipt is crucial for:

Record-keeping: They serve as proof of expenditure for individuals and businesses.

Reconciliation: Businesses use them to match expenses against their credit card statements.

Tax purposes: Receipts provide documentation for deductible expenses and tax filings.

Fraud prevention: They help verify the legitimacy of a credit card or transaction information and detect unauthorized spending.

What are the different types of credit card receipts?

At least two copies come with each valid credit card transaction.

Merchant copy: The merchant copy is retained by the merchant for accounting and returns processing.

Customer copy: The customer copy is given to the cardholder for personal account record-keeping and returns.

What are the essential elements of a credit card receipt?

Every credit card receipt includes the following transaction details:

Merchant’s information: Name, address, and contact details.

Transaction date and time: When the transaction occurred.

Amount: Total cost, including itemization of purchases if available.

Credit card details: Typically, the last four digits of the account number are the card number.

Authorization code: Confirms the transaction has been approved.

Signature line: Physical store receipts have a space for the cardholder's signature. A credit card company can match the signature with what they have on file if needed.

Are customers still required to sign a credit card receipt?

Recent updates in payment processing rules have made it generally no longer required for customers to sign credit card receipts for most transactions in the United States. It's up to the credit card company whether a signed receipt is required.

Major credit card companies like Visa, MasterCard, Discover, and American Express have made customer signatures optional for merchants. This change reflects technological advancements, such as EMV chip cards and contactless payments, which provide more robust security against fraud than signatures.

Reasons for the change

There are several reasons that companies have shifted toward a ‘no signature’ policy on credit card receipts.

Enhanced security: The shift to EMV chip technology has significantly reduced credit card fraud. Chips generate a unique transaction code for each operation, which is more secure than a handwritten signature.

Increased convenience: Removing the signature requirement speeds up the checkout process and improves the customer experience, especially in high-volume retail environments.

Technological advancements: With the rise of mobile and contactless payment options, the traditional signature has become less relevant as these technologies offer security measures.

Exceptions and considerations

There are a few exceptions where signatures may be required.

Merchant discretion: While not required by the card networks, some merchants may choose to continue requiring signatures for their reasons, such as reducing chargebacks or because of specific industry practices (e.g., luxury goods or high-value services).

High-value transactions: For particularly high-value purchases, some businesses may still ask for a signature as an added security measure or to comply with their internal policies.

International transactions: The rules on signatures can vary internationally. In some countries, signatures might still be required, depending on local laws and payment infrastructure.

Impact on business

For a business, the move away from signatures can mean:

Less paperwork: As digital records of transactions become more prevalent, businesses can reduce the amount of paper they use and manage.

Streamlined operations: Transactions can be processed more quickly without verifying and storing signatures, leading to shorter lines and faster service.

Adaptation to new systems: Businesses need to update their payment systems to accommodate the no-signature rule and ensure that staff are trained on new procedures.

What are the legal and compliance considerations?

Privacy and retention are the two main things to keep in mind when addressing the legal and compliance aspects of credit card receipts.

Privacy: Credit card receipts should only show the last four digits of the card account number to comply with PCI DSS (Payment Card Industry Data Security Standard) regulations.

Retention: Both businesses and individuals should retain credit card receipts for a specified period, typically determined by tax laws or the statute of limitations for audits.

Digital management of credit card receipts with Shoeboxed

Managing physical receipts can be cumbersome and inefficient in an increasingly paperless world. Shoeboxed is designed to digitize paper receipts and manage electronic receipts and other financial documents.

Features of Shoeboxed for credit card receipt management

Scan

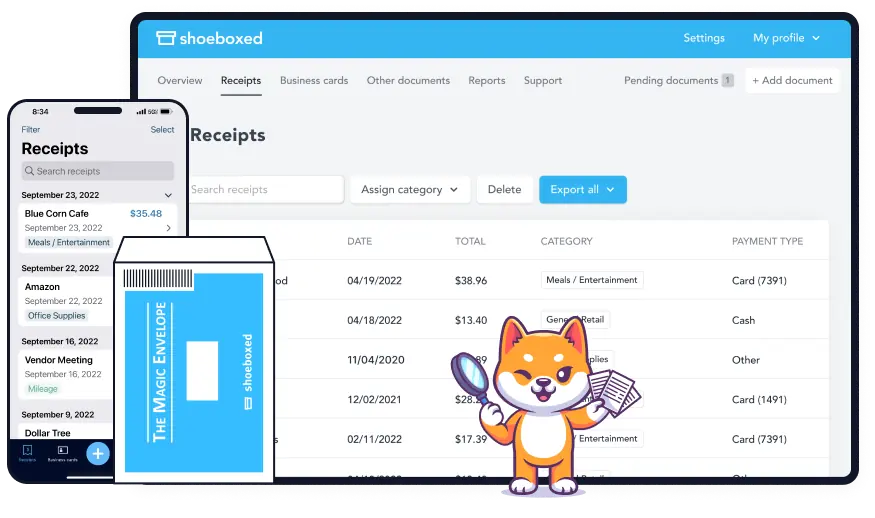

Shoeboxed allows users to scan a credit card printed receipt using its app and smartphone camera.

Magic Envelope

If you prefer to outsource the scanning, you can fill a pre-paid postage Magic Envelope with printed receipts and mail it to Shoeboxed, and they will scan, human-verify, and upload the receipts into your account.

Hit the road with Shoeboxed 🚗

Stuff receipts into the Magic Envelope while on the road. Then send them in once a month to get scanned. 💪🏼 Try free for 30 days!

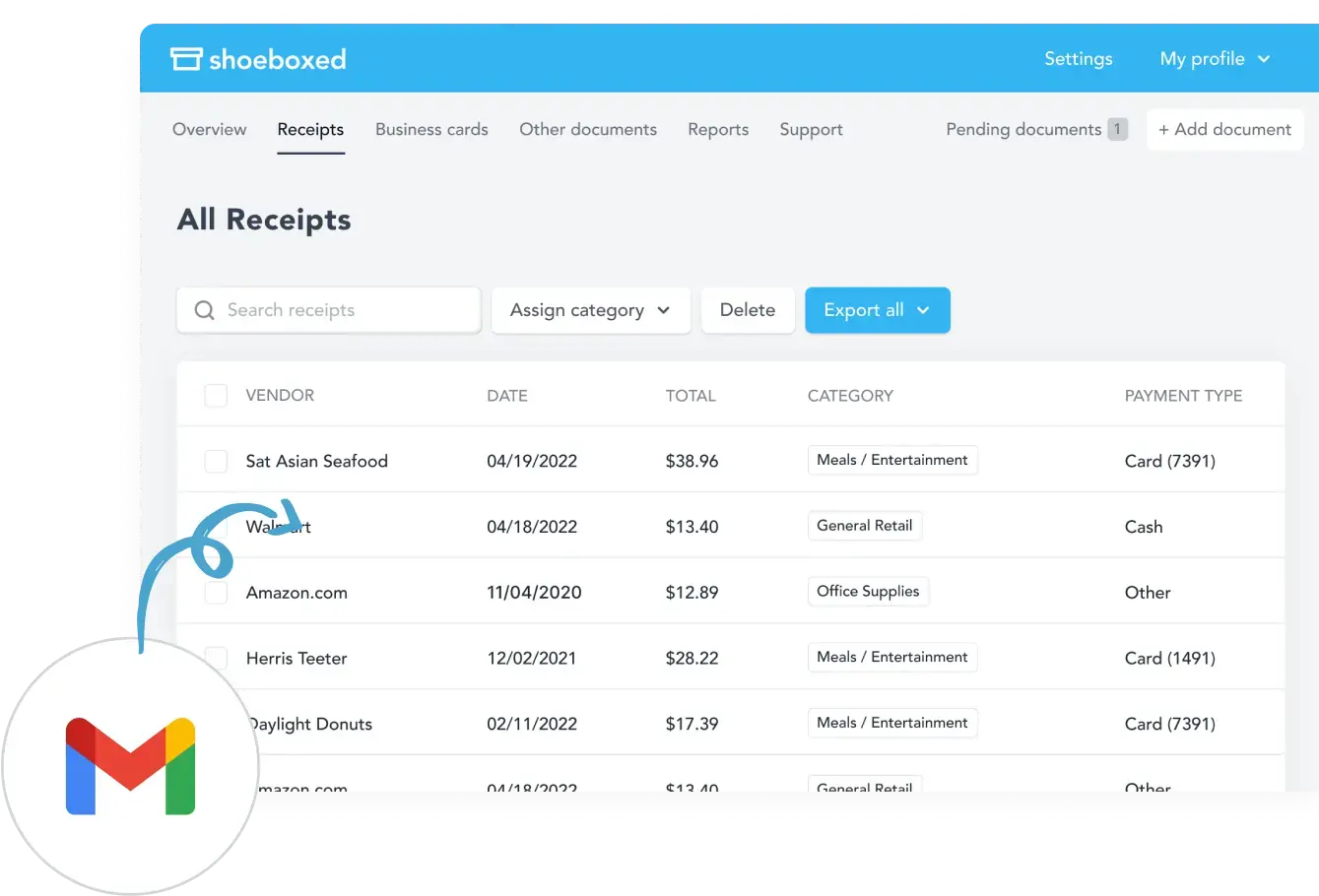

Get Started TodayGmail sync

If you have electronic credit card receipts sitting in a Gmail account, Shoeboxed has a Gmail sync feature where you can auto-import receipts from your Gmail account directly to your Shoeboxed account. From your emails, the receipts are forwarded directly to your unique Shoeboxed email address, which is automatically imported into your account.

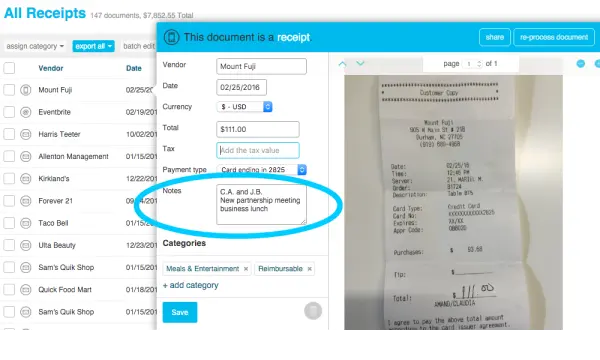

Notes

For a more detailed approach, you can add tags or notes to each receipt in Shoeboxed. This is particularly useful for credit card receipts to note the specific purpose of each transaction, such as distinguishing between different types of expenses or noting client-related expenditures.

Organization

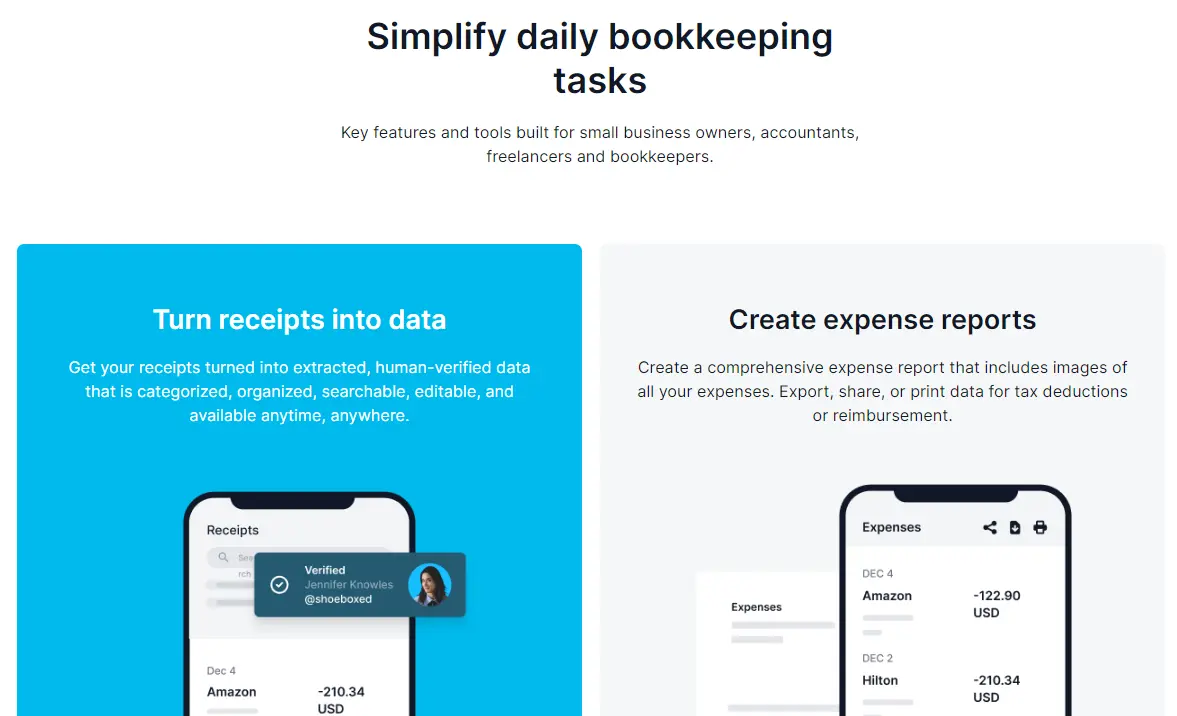

The app uses OCR (Optical Character Recognition) to extract critical data from the credit card receipts, which are then categorized into 15 pre-selected or customized categories before being digitally stored.

Once expenses are assigned categories, you can generate detailed expense reports for reimbursements or tax purposes.

Integration with accounting software

Shoeboxed integrates with accounting software such as QuickBooks, Xero, and others. By managing your credit card receipts in Shoeboxed, you can ensure that all transaction data is accurately reflected and easily transferable to your central accounting system for comprehensive financial tracking and tax purposes.

Secure storage

All receipts are stored securely in the cloud with Shoeboxed, ensuring they are accessible from anywhere and compliant with data protection regulations.

Audit-ready

Shoeboxed ensures that digital copies of receipts are compliant with IRS standards, making them audit-ready and suitable for tax purposes.

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. Try free for 30 days!

Get Started TodayWhat are the benefits of using Shoeboxed for credit card receipts?

Shoeboxed provides the following benefits to businesses and individuals:

Efficiency: Automates the process of receipt management, saving time and reducing errors.

Accessibility: Provides easy access to receipts when needed, which is beneficial during financial reviews or audits.

Space saving: Reduces physical storage needs of printed receipts by converting all receipts into digital format.

Environmental Impact: Supports paperless operations, aligning with eco-friendly business practices.

Lighten the Load✨

Learn How a Multi-Campus Church Reclaims 20 Hours a Month with the Shoeboxed App

Read the case studyFrequently asked questions

Are customers still required to sign credit card receipts?

Major credit card issuers like Visa, MasterCard, Discover, and American Express have phased out the requirement for signed receipts on debit and credit card transactions in many regions. This change reflects advancements in credit card payments and security technologies such as EMV chips and contactless payments, providing more robust security against fraud than signatures.

How long should customers keep credit card receipts?

Both businesses and individuals should retain old receipts for a specified period, typically determined by tax laws or the statute of limitations for audits. The IRS typically recommends that you or your business hold onto old receipts for at least three years.

In conclusion

Credit card receipts are more than just pieces of paper; they are vital records and documentation that support financial management and compliance. With the help of tools like Shoeboxed, individuals and businesses can transform how they handle these documents, enhancing efficiency for taxes and audits.

Caryl Ramsey has years of experience assisting in bookkeeping, taxes, and customer service. She uses various accounting software for setting up client information, reconciling accounts, coding expenses, running financial reports, and preparing tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad, and Android) to snap a picture while on the go—auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports, including IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports, and more—with Shoeboxed.

Try Shoeboxed today!