Multiple income streams are an excellent means for increasing your savings over time. The flip side is that your tax liability typically increases along with the increase in income. The more you owe in taxes, the less income you get to keep.

However, with the most efficient tax-saving financial instruments and strategies, you can at least maximize the money in your pocket. Tax-saving tools play an essential role in shaping your financial future. How much you owe the government will depend heavily on what you do with your money.

What are tax saving instruments?

The best way to save money is to discover the most effective ways to save on taxes. These tax-saving instruments allow you to reduce tax liability by taking advantage of various investments, credits, and deductions. Not only do these tax benefits save you money, but they are also beneficial in other ways.

Why are tax benefits significant?

Tax benefits are essential to you as an individual and society as a whole.

Here are some of the ways tax-saving instruments can benefit everyone:

Reduces tax liability: A tax benefit allows individuals and businesses to reduce the taxes they owe to the government. This benefit frees up more money for spending, saving, or investing, which, as a result, contributes to economic growth and prosperity.

Encourages specific behaviors: Tax-saving instruments often promote certain behaviors or activities that benefit society. For example, governments may offer tax deductions or credits for charitable giving, homeownership, education expenses, or investment in specific industries like renewable energy.

Supports economic growth: Tax benefits can stimulate economic growth by encouraging individuals and businesses to engage in activities that contribute to economic development, such as investing in infrastructure, research and development, or job creation.

Promotes social goals: Tax benefits can promote social goals such as income redistribution, poverty alleviation, and support for specific demographic groups such as families with children, senior citizens, or individuals with disabilities. For example, tax credits like the Earned Income Tax Credit (EITC) are designed to provide financial assistance to low-income working families.

Attracts investment: Tax saving instruments can attract investment capital by making investments more attractive from a tax perspective. This incentive can stimulate investment in real estate, small businesses, or economic development zones, creating jobs and revitalizing underserved communities.

Competitiveness: Tax benefits can enhance the competitiveness of businesses and industries by reducing their overall tax burden compared to competitors in other jurisdictions. This can help attract investment, encourage innovation, and promote business expansion, ultimately contributing to economic competitiveness on a global scale.

Tax benefits are crucial in shaping economic behavior, promoting social goals, and fostering economic growth and prosperity. However, it's essential for governments to carefully design and implement tax policies to ensure they are fair, equitable, and effectively achieve their intended objectives.

What are the best tax-saving tools for 2024?

There are several tax-saving instruments and strategies available to individuals and businesses.

Here are some tax-saving tools that we have implemented and that you should consider for 2024:

1. Optimize your paycheck withholdings

Optimizing paycheck withholding is the most apparent tax-saving financial planning strategy.

Here's a basic overview of how it works and some things to consider to optimize your withholdings.

Understanding paycheck withholding: When you start a job, you typically fill out a Form W-4, which tells your employer how much federal income tax to withhold from your paycheck. The amount withheld is based on your filing status, the number of allowances you claim, and any additional withholding you would like.

Claiming the appropriate allowances: The more allowances you claim on your W-4, the less tax is withheld from your paycheck. However, if you claim too many allowances, you might owe taxes when you file your return. Conversely, if you claim too few, you might receive a large refund, but you'll have given the government an interest-free loan.

Consider life changes: It's essential to review and update your W-4 whenever your personal or financial situation changes. These changes include getting married or divorced, having children, buying a house, or experiencing other major life events that can affect your tax liability.

Using the IRS Withholding Estimator: The IRS provides a helpful tool called the Withholding Estimator that can help you determine the right amount of withholding based on your circumstances. It considers factors such as multiple jobs, self-employment income, and deductions.

Balancing risk and benefit: Adjusting your withholding to minimize tax payments throughout the year can free up cash flow, which you can use for investments, debt repayment, or other financial goals. However, you must avoid under-withholding and owing penalties or interest.

Seeking professional advice: If you have a complex financial situation or are trying to figure out how to optimize your withholding, consider consulting with a tax professional. They can provide personalized advice tailored to your specific circumstances.

While optimizing your paycheck withholding can be an effective tax-saving strategy, it's just one piece of your financial plan.

2. Retirement accounts

Contributing to retirement accounts such as 401(k)s, Traditional IRAs, or Roth IRAs can offer significant tax benefits. Contributions to Traditional IRAs and 401(k)s are typically tax-deductible, reducing your taxable income in the year of contribution.

Roth IRAs don't provide an upfront tax deduction, but qualified withdrawals in retirement are tax-free. For example, with a Roth IRA, you can invest money tax-free. In other words, it's a tax-free way to save for retirement. You can contribute after-tax dollars up to $6,500 in 2023 or $7,000 in 2024, plus an additional $1,000 catch-up contribution if you're 50 or older. When you reach the age of 59.5, you can withdraw money from a Roth IRA tax-free as long as your account has been opened for at least five years.

3. Health Savings Accounts (HSAs)

HSAs offer three times the tax benefits: earnings grow tax-free, contributions are tax-deductible, and withdrawals for qualified medical expenses are tax-free. HSAs are available to individuals with high-deductible health insurance plans and can be used to save for current and future medical costs.

A Health Savings Account (HSA) can be a powerful tax-saving tool. Here's how it works and how it can help you save on taxes:

Tax-deductible contributions

One of the primary benefits of an HSA is that contributions are tax-deductible. This means the money you contribute to your HSA is subtracted from your taxable income, reducing your annual tax liability. This deduction applies regardless of whether you itemize or take the standard deduction.

Contributions can be made to your account every year. The limit for 2023 is up to $3,850 for individuals and families, $7,750, and $4,150 in 2024 for individuals and families, $8,300.

Tax-free growth

Any interest or investment earnings within your HSA are tax-free. This allows your account balance to grow over time without being eaten away by taxes, similar to a retirement account like a 401(k) or IRA.

Tax-free withdrawals for qualified medical expenses

The most significant tax advantage of an HSA is that withdrawals are tax-free when used for qualified medical expenses. These expenses include doctor's visits, prescription medications, dental care, vision care, and other eligible costs. This means that your contributions are tax-deductible, and you can also withdraw the money tax-free as long as it's used for qualified medical expenses.

Long-term savings and retirement planning

Unlike flexible spending accounts (FSAs), which typically have a "use it or lose it" rule at the end of the year, HSA funds roll over from year to year and can be invested for long-term growth. This makes HSAs an attractive option for saving for future medical expenses, including those in retirement.

Triple tax advantage

HSAs offer what's often called a "triple tax advantage." Contributions are tax-deductible, earnings grow tax-free, and withdrawals for qualified medical expenses are tax-free. This makes HSAs one of the most tax-efficient ways to save on healthcare costs.

Portability

HSAs are owned by the individual, not the employer, meaning the account stays with you even if you change jobs or retire. This gives you flexibility and control over your healthcare savings.

To maximize the tax-saving benefits of an HSA, it's essential to contribute the maximum allowable amount each year and to use the funds for qualified medical expenses whenever possible. Additionally, consider investing your HSA funds for long-term growth to maximize the tax-free earnings potential.

4. 529 College Savings Plan

529 College Savings Plans allow for tax-free growth and withdrawals when funds are used for qualified education expenses such as tuition, room and board, and books. Some states offer tax deductions or credits for contributions to 529 plans.

5. Municipal bonds

Local governments issue municipal bonds to fund various projects. Interest earned on municipal bonds is typically exempt from federal income tax. A tax exemption from state and local taxes may also apply to interest earnings.

6. Real estate investments

Real estate investments offer several tax benefits, including depreciation deductions, mortgage interest deductions, and the ability to defer capital gains taxes through strategies like 1031 exchanges.

8. Charitable giving

Donations to qualified charitable organizations are tax-deductible, providing a tax benefit while supporting causes you care about. Additionally, donating appreciated assets can prevent capital gains taxes on the appreciation.

9. Life insurance plans

Life insurance can serve as a tax-saving strategy in several ways, depending on the type of policy and how it's utilized. Life insurance offers tax-free death benefits, tax-deferred cash value growth, and tax-free insurance policy loans.

10. Required Minimum Distributions (RMDs)

Required Minimum Distributions (RMDs) are withdrawals that traditional IRA and 401(k) account holders must take annually after reaching a certain age (currently 73, as of 2023). These distributions are subject to income tax, and failing to take RMDs can result in significant penalties. While RMDs themselves don't directly save you money on taxes, proper planning and strategies around them can help optimize your tax situation. Here's how:

Tax-deferred growth Traditional IRAs and 401(k)s allow for tax-deferred growth, meaning you only pay taxes on the gains once you withdraw the funds. This can lead to significant growth over time as your investments compound without being diminished by taxes each year.

Lower tax brackets in retirement Many retirees are in a lower tax bracket during retirement than their working years. By deferring taxes on contributions to retirement accounts, individuals can save on taxes if they withdraw funds during retirement when their tax rate is lower.

RMD strategies While RMDs are mandatory, there are strategies to minimize their impact on your tax liability. For example, if you have multiple retirement accounts, you can take the RMD from only one account, potentially minimizing the tax burden by spreading out withdrawals. Additionally, you may strategically time your RMDs to coincide with years when your income is lower, helping to reduce the tax impact.

Qualified Charitable Distributions (QCDs) Taxpayers 70½ or older can directly transfer up to $100,000 per year from an IRA to a qualified charity without including the distribution in their taxable income. This can satisfy part or all of your RMD while reducing your taxable income, potentially lowering your overall tax liability.

Estate planning Properly managing RMDs as part of your estate plan can help minimize the tax burden on your heirs. For example, if you anticipate leaving a sizable inheritance, strategically planning RMDs and other withdrawals can help reduce the tax impact on your beneficiaries.

It's important to note that the specifics of how RMDs impact your taxes will depend on your financial situation, including other sources of income, deductions, credits, and changes in tax laws. Consulting with a financial advisor or tax professional can help you develop a personalized strategy to optimize your tax situation in retirement.

11. Tax credits and tax deductions

Tax credits and deductions are tax-saving instruments for reducing tax liability, but they work slightly differently.

Individuals

Tax Deductions:

A tax deduction reduces your taxable income, lowering the income subject to taxation. Deductions are subtracted from your gross income to determine your adjusted gross income (AGI). The lower your AGI, the less tax you owe. For example, if you have $50,000 in income and $10,000 in deductions, your taxable income would be reduced to $40,000.

Common tax deductions include:

Standard Deduction: A set amount that taxpayers can subtract from their income based on filing status.

Itemized Deductions: Expenses such as mortgage interest, property taxes, state and local taxes, charitable contributions, and medical expenses.

Tax Credits:

Unlike deductions, which reduce the income subject to tax, tax credits directly reduce your tax liability on a dollar-for-dollar basis. This means that if you have a $1,000 tax credit, it will reduce your tax bill by $1,000. Tax credits can be either refundable or non-refundable:

Refundable Tax Credits: If the amount of the credit exceeds your tax liability, you can receive the excess amount as a refund. For example, if you owe $800 in taxes but qualify for a $1,000 refundable tax credit, you would receive a $200 refund.

-

Non-refundable Tax Credits: These credits can reduce your tax liability to zero, but any excess credit cannot be refunded. For example, if you owe $800 in taxes and qualify for a $1,000 non-refundable tax credit, your tax liability would be reduced to zero, but you would not receive any refund for the remaining $200. Common tax credits include:

Child Tax Credit: Provides a credit for each qualifying child under 17.

Earned Income Tax Credit (EITC): Provides credit for low to moderate-income individuals and families.

American Opportunity Tax Credit (AOTC): Provides a credit for qualified education expenses for eligible students.

Small business deductions and credits

Small business owners may be eligible for various tax deductions and credits, such as the Qualified Business Income Deduction (QBI), which allows certain pass-through business owners to deduct up to 20% of their qualified business income. Designated expenses can also be deducted from the business's taxable income to minimize tax liability.

With the tax-saving options of deductions and credits, taxpayers can effectively lower their tax bills and keep more of their hard-earned money. Understanding each deduction and credit's eligibility requirements and limitations is essential to maximizing your tax savings. Consulting with a tax advisor or financial planner can help you navigate the complex tax code and identify savings opportunities by reducing tax liability.

How to track your deductible expenses

Deductions are a tax-saving instrument that can save individuals and business owners significant money. However, to claim a deduction, you must save your receipts as supporting evidence for the expenses and deductions you claim.

A receipt scanning service or app is the best way to track, organize, and store these expenses.

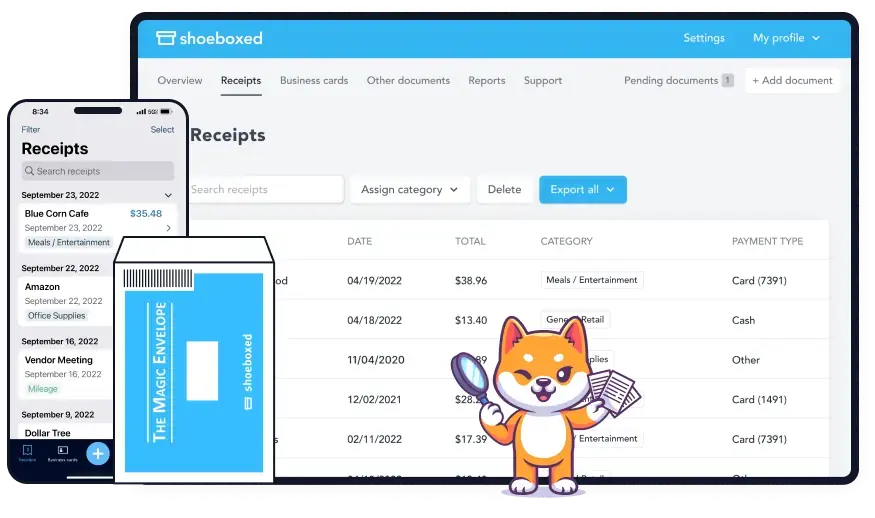

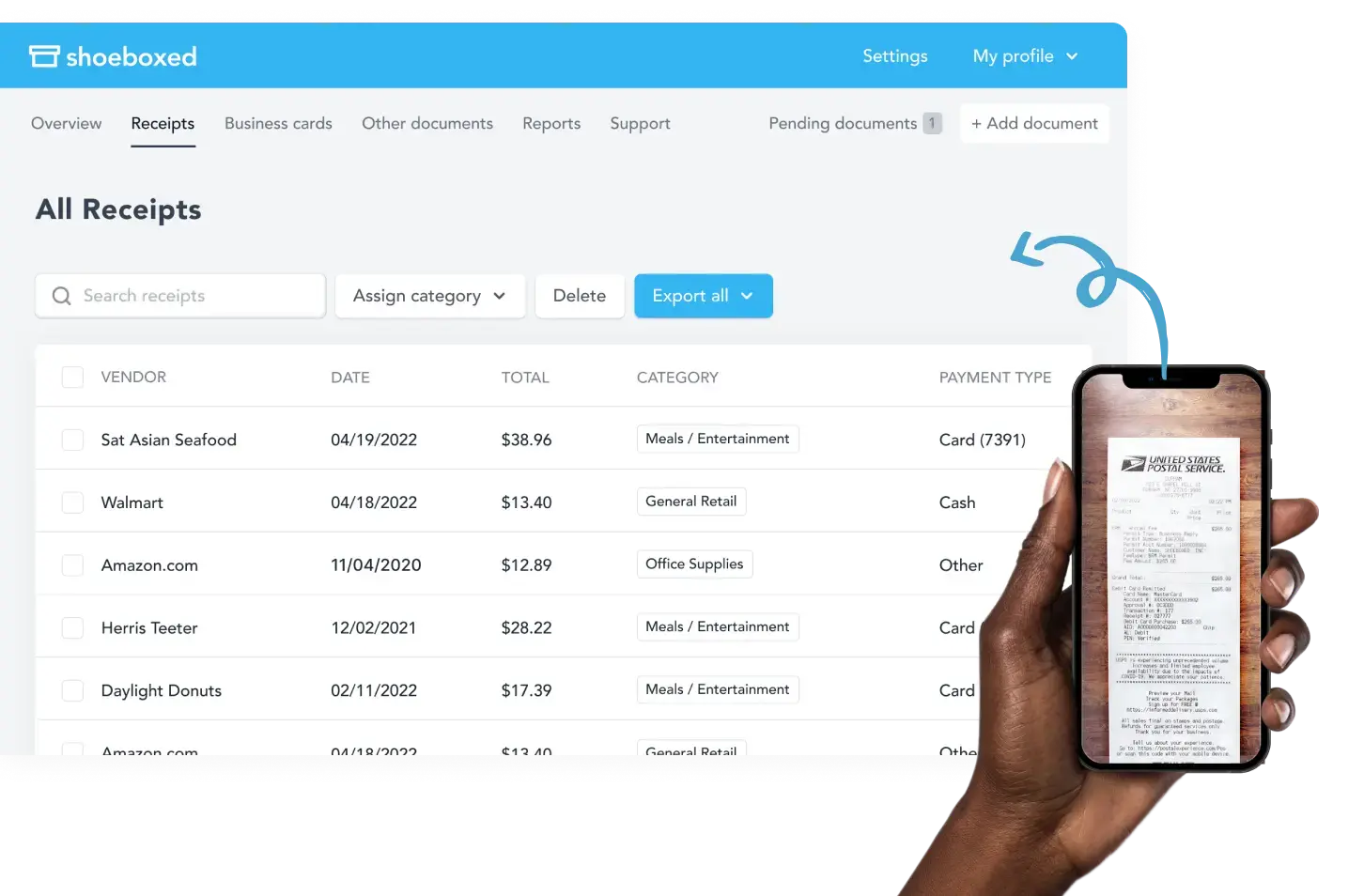

Over a million businesses use Shoeboxed as a receipt scanner.

Shoeboxed is a two-for-one app and service that scans, organizes, and stores receipts for expense reporting and tax prep.

Shoeboxed is an app or service for expense management.

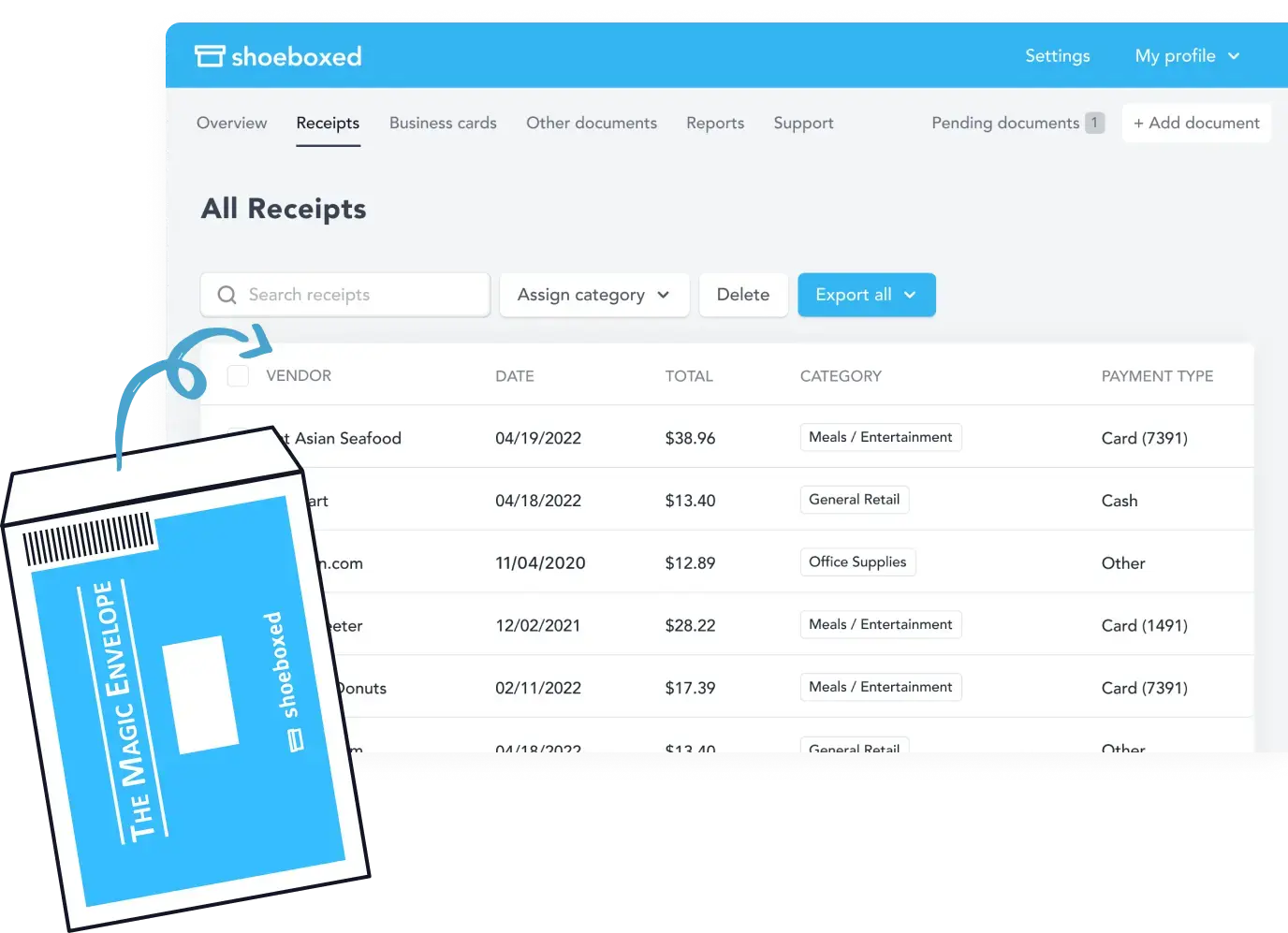

As a service, you can send your receipts to Shoeboxed in a prepaid envelope called The Magic Envelope and have them scanned, human-verified, and uploaded into a Shoeboxed account where they will be stored and organized.

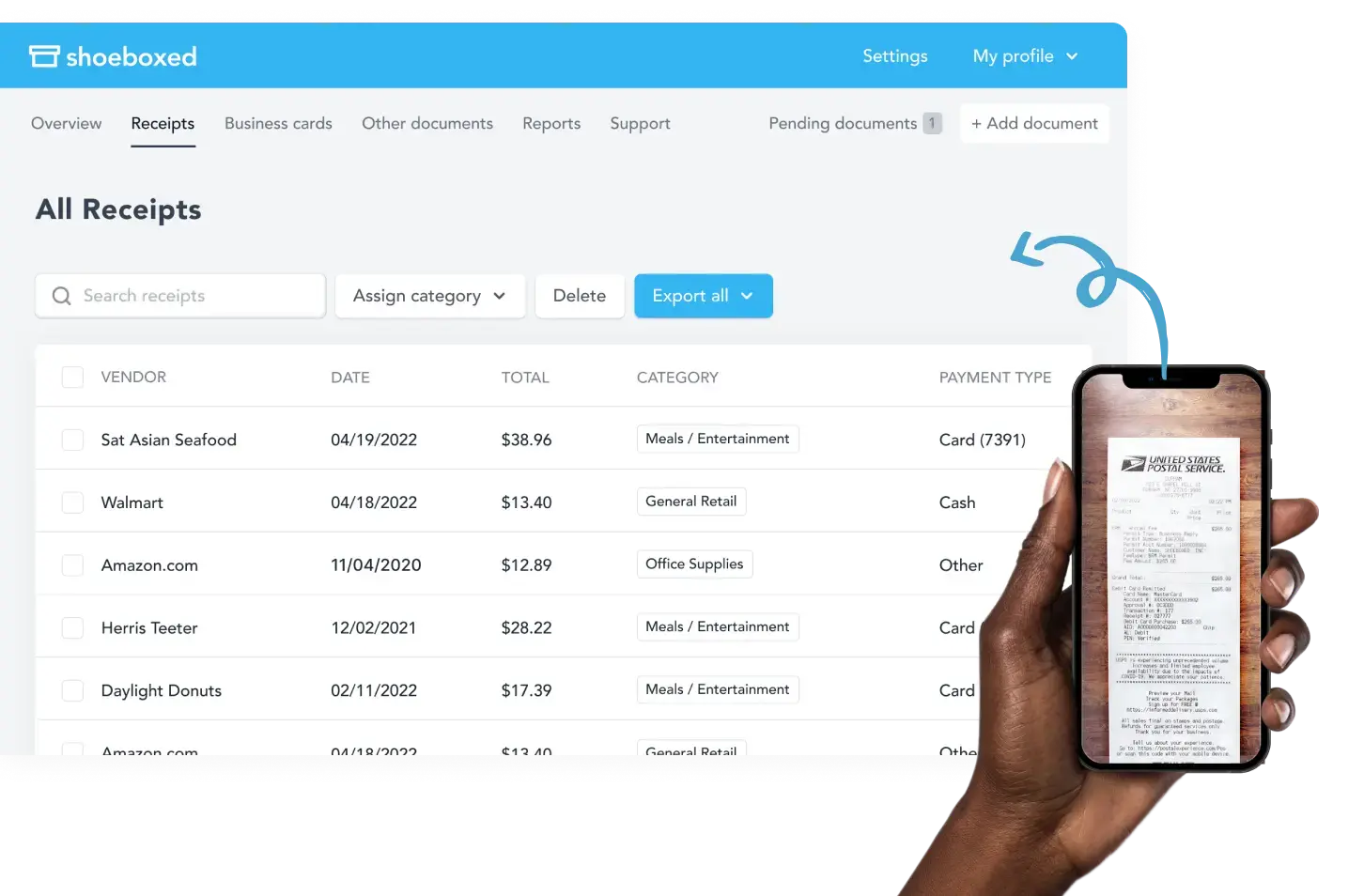

Shoeboxed tracks expenses on to go.

As an app, you can track expenses on the go using your phone's camera to take pictures of your receipts. The mobile app has OCR technology that converts printed text into searchable, editable data. The app uploads receipts and stores them in an account to keep them all in one place, and the data is available from anywhere at any time.

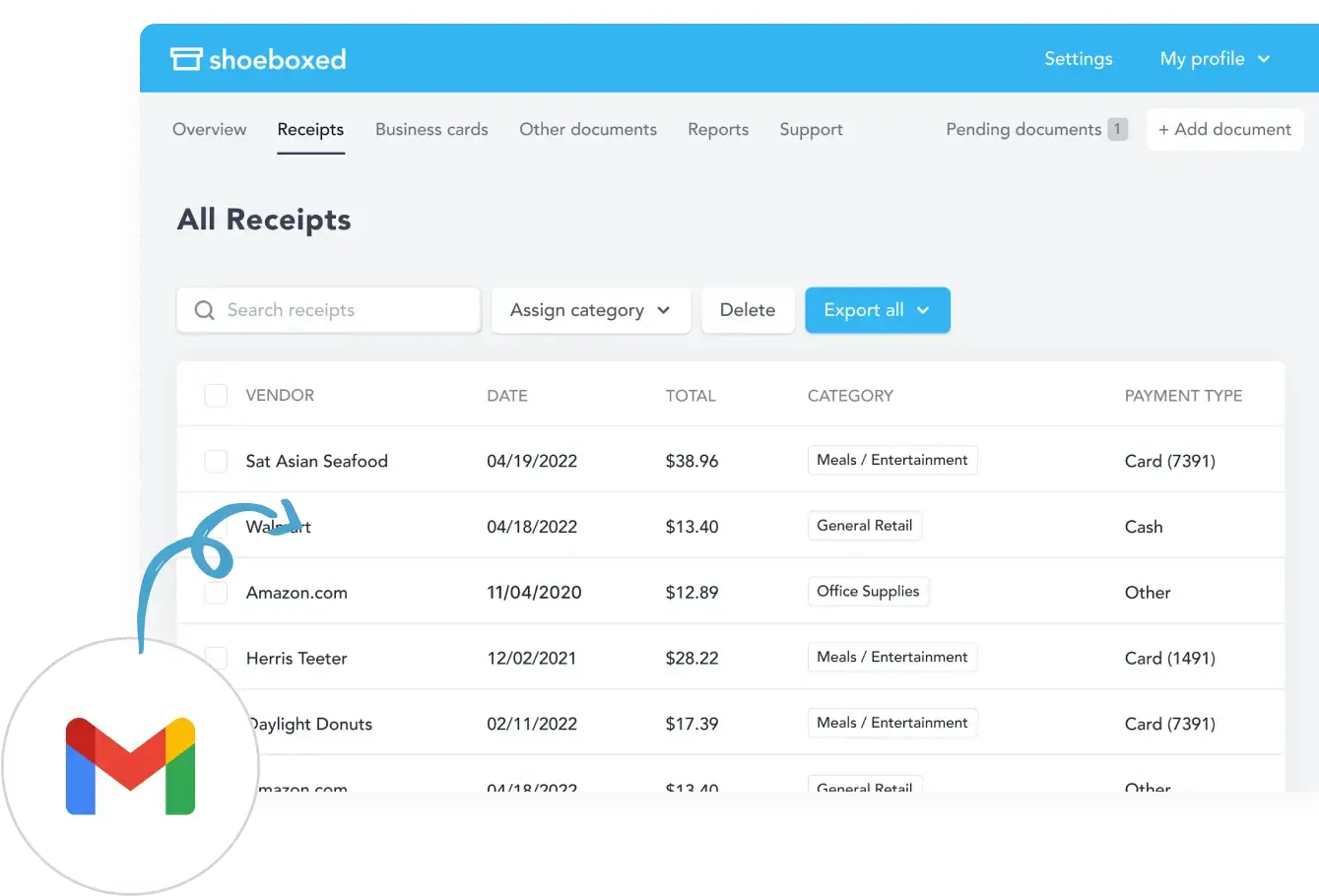

Shoeboxed auto-imports receipts from your Gmail account.

With their Gmail plugin, you can auto-import receipts from your Gmail account to the Shoeboxed dashboard. The plugin locates e-receipts in your inbox and sends them to your Shoeboxed account.

You will be given a designated Shoebox email address when you sign up. You can forward receipts to this email address, and they will automatically appear in your Shoeboxed account.

Receipts can be forwarded to your Shoeboxed email address.

You can also upload receipts from your desktop or laptop. This can be done using the drag-and-drop method, which allows you to submit multiple receipts simultaneously.

Shoeboxed turns business mileage into a deduction.

You can use your phone's built-in GPS to track your business mileage accurately, which is also considered a tax deduction.

Shoeboxed will even automatically organize your receipts into tax categories.

Once the receipts are uploaded into your account, they are automatically organized into 15 different tax categories. You can even create custom categories.

Turn receipts into data with Shoeboxed ✨

Try a systematic approach to receipt categories for tax time. Try free for 30 days!

Get Started Today

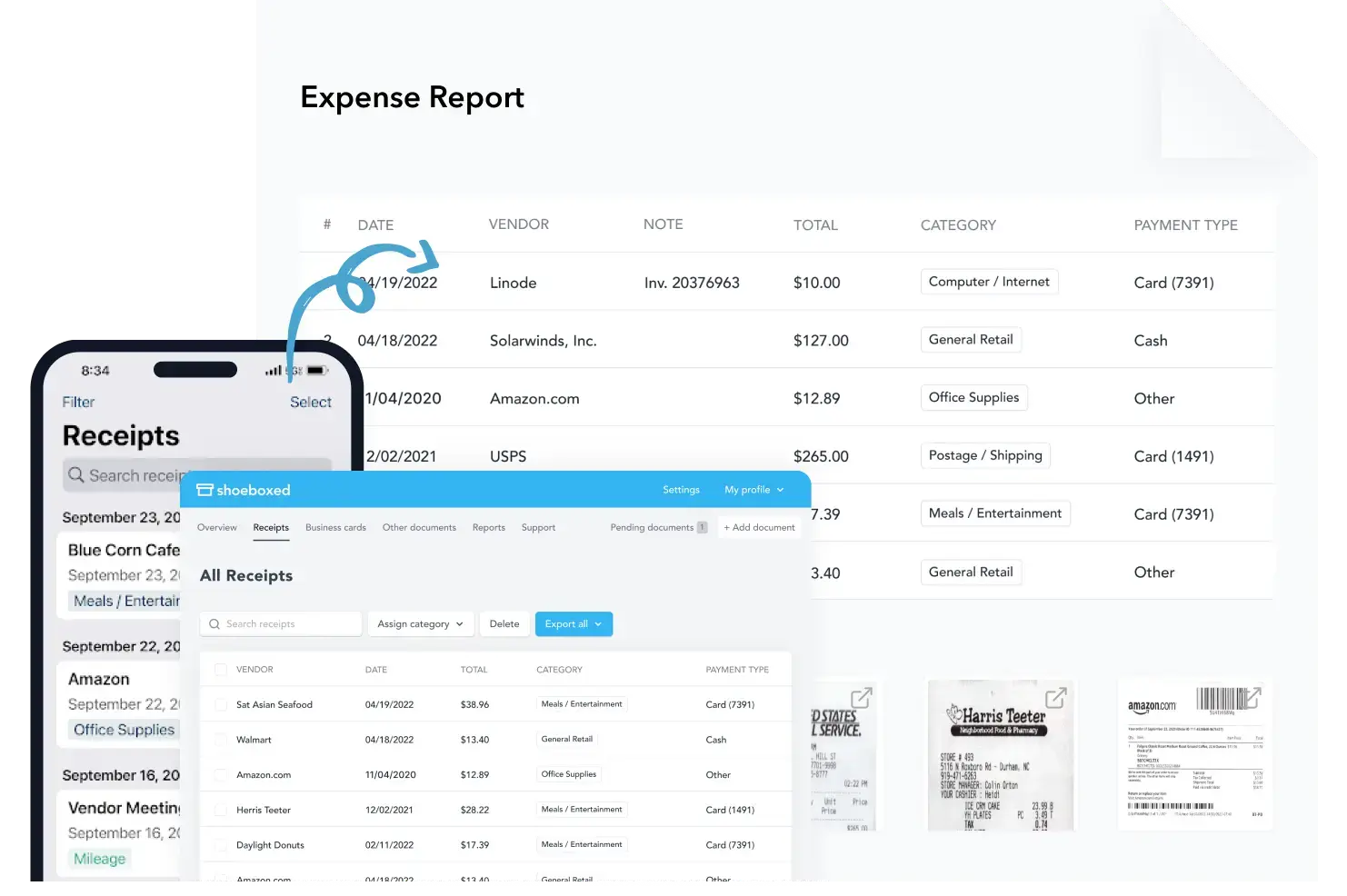

Shoeboxed creates expense reports that include images of your receipts.

With just a few clicks, you can create comprehensive expense reports that include images of your receipts from your mobile device or web.

With the Shoeboxed app, you can access data anytime from anywhere.

You can print, share, or export data for reimbursement or tax deductions.

You can integrate Shoeboxed with tools you already have on hand.

Shoeboxed also integrates with other software such as Xero, QuickBooks, Wave, and Evernote.

Shoeboxed also saves a lot of time and headaches during audits. One of Shoeboxed customers with a financial advisory firm stated, "Shoeboxed actually saved me during my IRS audit. They would ask me for the receipt, and I could go and type in the amount, and it would immediately pull the receipt up on Shoeboxed."

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. Try free for 30 days!

Get Started TodayFrequently asked questions

What are some of the best tax-saving investments?

The best tax-saving investment options include municipal bonds, mutual funds, life insurance plans, and traditional and Roth IRAs, which result in tax exemptions or tax-free returns.

How can I reduce my tax legally?

You can save tax legally by taking advantage of tax-saving instruments such as various investment options, deductions, and credits.

In closing

The key is to discover which tax-saving options pertain to your individual circumstances to maximize the money you save. While the best tax-saving instruments can significantly minimize your taxable income and tax liability, they also give financial security and serve as valuable options for meeting your goals for the financial year.

Caryl Ramsey has years of experience assisting in different aspects of bookkeeping, taxes, and customer service. She uses a variety of accounting software for setting up client information, reconciling accounts, coding expenses, running financial reports, and preparing tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports, including IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports, and more—with Shoeboxed.

Try Shoeboxed today!