As a small business owner, you know the importance of using the right tools to streamline your business operations, save time and increase efficiency in the workplace.

QuickBooks is one of the most popular tools for small business owners to manage their accounting and bookkeeping business processes, and if you’re here, you probably use it yourself.

There are numerous add-ons and integrations that can make QuickBooks Online even more powerful for your business.

These add-ons are designed to work seamlessly with your QuickBooks software, automating various aspects of your daily workflow and improving your bookkeeping, invoicing, data entry, and more.

Let’s dive into some of the best QuickBooks add-ons and discover how they can benefit your business.

How do you choose the best QuickBooks integration for you?

As with most things, there’s the good, the bad, and the ugly when it comes to QuickBooks apps.

Some Quickbooks apps and integrations work seamlessly with your account to help you manage your business expenses, monitor business growth, and predict future outcomes, while others don’t really offer much in the way of financial management.

The best QuickBooks integration for you will depend on your needs—do you need online time tracking, recurring billing, or project tracking?

Knowing your needs and looking for integrations with the following abilities will help you choose the right add-on for your business.

User-friendliness: The top QuickBooks apps will be easy to use and navigate. Ideally, add-ons should be automated, but if there’s any manual work involved, the process should be seamless and straightforward so you can save time and focus on growing your business.

Scalability: As your business demands increase, so should the usefulness of your add ons. Whether you have an e commerce business or a brick-and-mortar store, having accurate data and helpful tools at your disposal as you grow is essential.

Industry-specific functions: Are you a construction business, trucker, bookkeeper or accountant, a retail shop, or in another industry that has specific needs? Make sure the add-on you choose offers helpful features for your business and isn’t just another generalized accounting software.

Multi-currency compatibility: If you do business outside of the US, you’ll want your integrations to be able to accommodate the various currencies.

With these tips in mind, let’s jump into the best integrations for QuickBooks users!

1. Shoeboxed – Best for receipt management

Shoeboxed has been trusted by over 1 million business owners since 2007.

Managing multiple files and receipts can be a hassle when you’re a business tracking sales and expenses throughout the week.

Luckily, Shoeboxed can integrate with QuickBooks Online to make receipt management straightforward and easy.

Shoeboxed is a receipt-scanning app that has helped over 1 million businesses organize their receipts.

With Shoeboxed, you simply snap a photo of your receipts, which then go through a human verification and digitization process, and are uploaded to your Shoeboxed account.

From there, you can categorize your receipts and manually export them to your QuickBooks for effortless accounting. This helps you stay organized and saves valuable time when managing business expenses.

Shoeboxed’s Magic Envelope Service

Shoeboxed also offers The Magic Envelope—the perfect a mail-in receipt scanning service for Quickbooks.

When you choose the Magic Envelope, Shoeboxed will send you a postage-pre-paid envelope for you to stuff your receipts into.

You’ll send your receipts to the scanning facility where they will be turned into digital data, uploaded to your Shoeboxed account, and automatically categorized into 15 editable tax categories.

Then, you can select the envelope you want to upload to QuickBooks and export the receipt data to your account.

Step-by-step of sending Shoeboxed’s Magic Envelope

Break free from manual data entry ✨

Use Shoeboxed’s Magic Envelope to ship off your receipts and get them back as scanned data in a private, secure cloud-based account. 📁 Try free for 30 days!

Get Started TodayTIP: If you have more receipts than will fit in the Magic Envelope, you can request that more envelopes be sent to your business each month.

You can also stick your receipts in a box, tape the Magic Envelope to the top, and Shoeboxed will cover the postage.

Pros:

Magic Envelope service gives businesses a hands-off approach to receipt management.

Snap photos of receipts on the go.

Categorize your receipts for tax time.

The integration with QuickBooks Online is quick and easy.

Helps businesses stay on top of customer purchases and business expenses.

Have an organized, solid paper trail to claim the maximum tax deductions for your business.

Cons:

Integration is not automatic. You must manually select the receipts you want to export to QuickBooks Online.

Pricing:

The Digital Download Only Starter Plan is $4.99/month, up to $19.99/month for the Pro digital plan.

Plans that include the Magic Envelope start at $18/month, up to $54/month. Plans that include the Magic Envelope are available for purchase on desktop only.

30-day free trial.

2. QuickBooks Payroll – Best for automating payroll

QuickBooks Payroll

This in-house payroll service automates tax calculations, employee payments, and compliance with labor laws.

QuickBooks Payroll seamlessly integrates with your business accounting software and you can set it up to pay payroll automatically to free up your time.

This add-on offers same-day direct deposits so you can pay employees on your schedule and some plan feature time tracking so you can pay for billable hours.

Pros:

Seamlessly integrates with QuickBooks Online.

Pay your employees automatically on a fixed schedule.

Tax penalty protection up to $25,000 (not included in all plans).

QuickBooks payroll calculates, files, and pays your payroll taxes.

Time tracking for employee hours (certain paid plans).

File 1099-MISC and 1099-NEC forms through QuickBooks payroll.

Cons:

Only the Premium and Elite plans offer time tracking for employees.

Tax penalty protection is only available in the Elite plan.

HR support and workers’ comp administration are not available for the basic Core plan.

The cost of the plans might be too expensive for some businesses.

Pricing:

Payroll Core – $22.50/month for 3 months, then $45/month

Payroll Premium – $37.50/month for 3 months, then $75/month

Payroll Elite – $62.50/month for 3 months, then $125/month

3. BILL – Best for invoicing customers and paying bills

BILL integration on the QuickBooks app store.

BILL integrates with QuickBooks to automate the invoicing process, see invoice details make payments, and receive funds easily.

This add-on alerts you to accounts receivable, syncs all of your bills across platforms (from your email to BILL, then to QuickBooks), allows you to pay bills directly and lets you add approvers to accept or deny payment requests on behalf of your company.

Pros:

Have complete transparency in your incoming and outgoing invoices.

Add approvers to your BILL account to approve and pay for business expenses.

Invoices sent to your email will be automatically synced to BILL.

Pay your bills directly through BILL.

Automatically syncs with QuickBooks when you create a new bill or send out a payment.

Recognizes duplicate bills.

Cons:

Customers complain that there’s a lot to be desired when it comes to customer service.

Some instances of bills not syncing with QuickBooks.

Adding users to an admin account can be clunky.

Pricing:

$55/month per user (unlimited users)

$0.49 per ACH transaction and $1.69 per check

4. QuickBooks Time – Best for tracking billable hours

QuickBooks Time.

QuickBooks Time integrates with your QuickBooks accounting software, ensuring that all billable hours are accurately logged and billed to clients.

With this add-on, you and your employees can track, submit, and approve billable hours wherever you go using the mobile app.

You can also set up reminders, create schedules, and manage your employees with geofences to remind them to clock in or clock out at job sites.

Pros:

Create reports to predict job costs and payroll.

Use built-in GPS and geofencing features to remind employees to track hours when they reach a job site.

Create and share work schedules with your employees

Activity feed to stay up-to-date with your employees on projects.

-

Timesheet solutions for industry-specific time tracking (construction/

contractors, home health, accounting and tax services, government contracting, legal services, and tech and IT).

QuickBooks Time is included with QuickBooks Payroll if you choose the Premium or Elite plans.

Cons:

The location tracking noticeably depletes the battery life of company tablets and mobile phones.

Employees can only track time for one project at any given time.

The Time Premium plan does not include mileage tracking, activity feed, or geofencing.

Monthly costs can add up depending on how many employees you have.

Pricing:

Time Premium – $10/month plus $8/month per user

Time Elite – $20/month plus $10/month per user

5. QuickBooks Online Inventory Tracking – Best for managing stock

Keep track of your inventory with QuickBooks.

QuickBooks Online Inventory Tracking offers advanced features such as multi-channel sales tracking and detailed reporting so you can automate your inventory management.

With QuickBooks’ inventory management, you can keep track of every item you have in your inventory and the products you buy and sell.

This QuickBooks app tracks inventory in real-time as you sell products or buy inventory for your business, and QuickBooks will alert you when your inventory runs low and it’s time to order more.

QuickBooks also syncs with Amazon, Etsy, Shopify, and other online retailers so you can seamlessly transfer your business data.

Pros:

Real-time inventory status updates.

Alerts when stock is running low.

Automatically converts purchase orders into bills when you reorder stock.

Get inventory insights and reports on your inventory and best-selling products.

Sync with online retailers like Amazon, Etsy, and Shopify.

Cons:

Lacks industry-specific features for inventory management.

The cost per month may be steep for small businesses.

Pricing:

Plus – $42.50/month for 3 months, then $85/month

Advanced – $100/month for 3 months, then $200/month

6. A2X – Best for e-commerce accounting

A2X for QuickBooks

A2X is one of the best QuickBooks add on options.

This add on is accounting software for e-commerce sites such as Amazon, Shopify, and Etsy designed to manage your online transactions, reduce manual data entry, and simplify your financial records.

This integration can help you maintain an accurate cash flow and efficiently process payments from your customers.

Pros:

A2X posts summaries of sales and fees from Amazon, eBay, Etsy, and others automatically into your QuickBooks.

An easy way to account for the sales you make through e-commerce sites.

Sales revenue and fees are automatically reconciled to the numbers found in your bank accounts.

Sales are aggregated by SKU, product type, or country.

Cons:

Only imports e-commerce sales to QuickBooks bi-weekly so you can’t see where your company stands on a day-to-day basis.

Customer complains about pricing.

Pricing:

Amazon – 4 plans starting at $19/month

Shopify – 3 plans starting at $19/month

Etsy – 5 plans starting at $19/month

Walmart – 3 plans starting at $69/month

eBay – 5 plans starting at $19/month

BigCommerce – 5 plans starting at $19/month

Multiple Sales Channels – 3 plans starting at $79/month

How A2X can automate e-commerce accounting

7. Method CRM – Best for improving customer relations

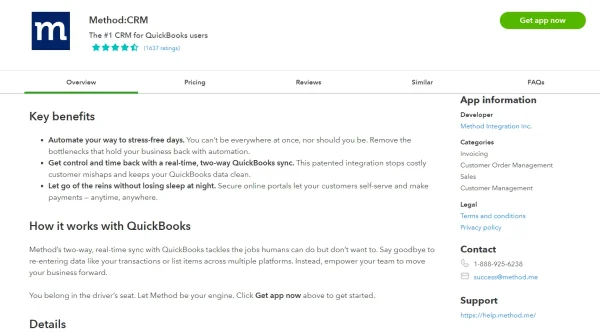

Method CRM for QuickBooks.

Customer Relationship Management (CRM) tools help you organize and manage your customer data, leading to improved customer relations and increased sales.

Method CRM is a reliable CRM integrated with QuickBooks that enables users to get validated customer data and help them better understand their customers’ needs and preferences.

With this integration, you can track essential customer data such as contact information, sales history, and upcoming tasks or appointments.

Pros:

Works with all versions of QuickBooks, including QuickBooks desktop software.

Responsive and helpful customer service.

Syncs customer information, payments, invoices, and more to QuickBooks.

Online customer portal to stay current with your business, view estimates, and pay due invoices. Payments automatically sync with QuickBooks.

Create invoices, sales orders, capture e-signatures, and more.

Respond to customer emails and chats.

Cons:

Price can add up depending on how many users you add to your account.

Pricing:

Contact Management – $25/month per user (paid annually) OR $28/month per user (paid monthly)

CRM Pro – $44/month per user (paid annually) OR $49/month per user (paid monthly)

CRM Enterprise – $74/month per user (paid annually) OR $85/month per user (paid monthly)

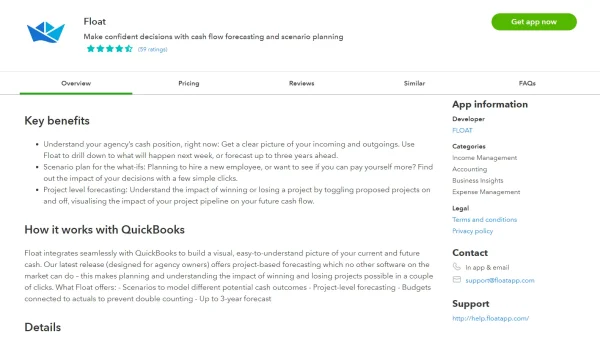

8. Float – Best for financial forecasting

Float can help you with financial forecasting.

Keeping your business afloat is easier with QuickBooks apps like Float.

Float is a QuickBooks integration that helps you get a clear picture of your business’s finances with financial forecasting, what-if scenarios, and project management insights into how various opportunities could impact your bottom line.

Pros:

Keep up with your business’s cash flow daily, weekly, and monthly.

Seamlessly integrates with QuickBooks.

Understand the impact winning or losing a project will have on your business.

Get a bird’s eye view of your income and expenses.

Make more impactful decisions with what-if scenarios.

Cons:

Float is located in the UK, so if you’re in the US, customer service can be difficult to reach during normal business hours.

Pricing:

Medium (Team of 3) – £49/month (20% off when paid annually)

Large (Team of 10) – £99/month (20% off when paid annually)

Extra-large (Team of 10) – £199/month (15% off when paid annually)

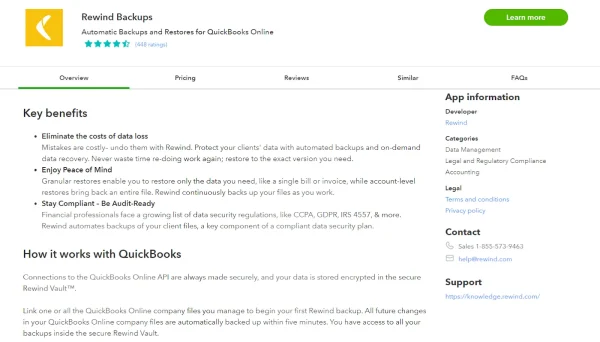

9. Rewind Backups – Best for document backups

Never lose important information with Rewind Backups.

Rewind Backups was designed for businesses or bookkeepers who manage multiple company files.

This QuickBooks integration automatically backs up your most important business documents, such as bills, invoices, attachments, or files so that you never lose valuable company information again.

Pros:

Daily automatic backups.

If you remove transactions or data, you can restore whatever you need from Rewind Backups.

Reverse data entry mistakes.

A low-cost solution for businesses.

Great for bookkeepers and accountants.

Cons:

Backups can be finicky when in bulk.

Pricing:

1 Company File – $14/month

2-10 Company Files – $7/month

11-50 Company Files – $6/month

51+ Company Files – $5/month

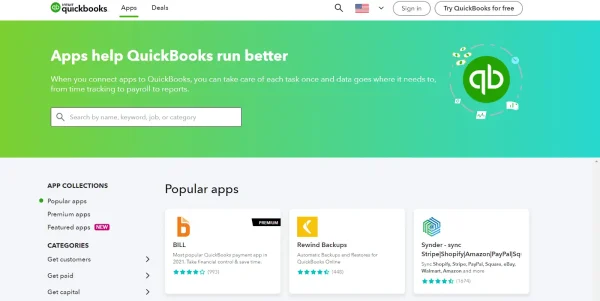

How do I add apps to QuickBooks?

Adding apps to your QuickBooks account and syncing your data is easier than you may think!

Follow these steps to get started:

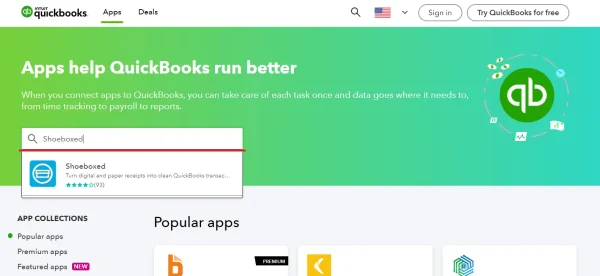

Step 1: Visit the QuickBooks app page.

QuickBooks apps page.

Step 2: Search the name of the add on you want to download or browse apps by searching a category.

Use the search bar to find relevant integrations.

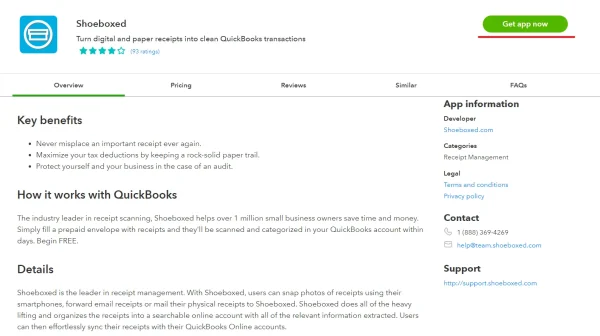

Step 3: Click the app you want to download, then click the green “Learn More” or “Get app now” button to the right.

Click the add-on to learn more about it or download the app.

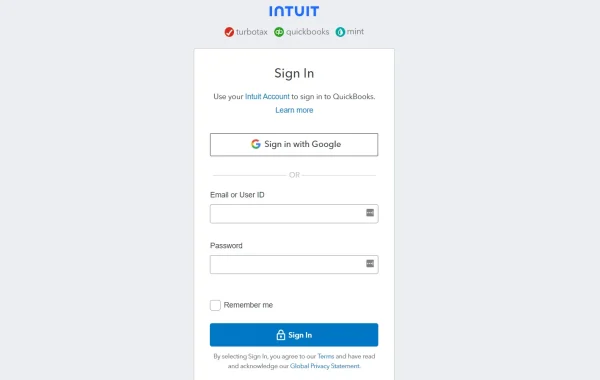

Step 4: Sign in, link to your QuickBooks account, and follow the steps on the following pages.

Sign into QuickBooks and follow the next steps

Conclusion

From time tracking, project management, and expense management to advanced accounting and reporting, these QuickBooks add ons will empower you as you manage your finances and streamline operations more effectively.

You can’t go wrong with any of these add-ons and it really comes down to your needs, but if you ask us, our top 3 recommendations would be Shoeboxed, Quickbooks Time, and Float so you can get a crystal clear view of your present and future finances.

Hannah DeMoss is a staff writer for Shoeboxed covering organization and digitization tips for small business owners. Her favorite organization hack is labeling everything in her kitchen cabinets, and she can’t live without her mini label maker machine.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!