According to the Small Business Administration (SBA):

70% of small businesses struggle with receipt management, including loss and damage.

25% of businesses have issues during audits because of poor receipt records.

60% of business owners say switching to digital receipt management makes record keeping and audit readiness much easier.

Managing expenses is key to staying financially healthy as a small business owner.

Organizing and storing receipts is the last thing most small business owners want to do because it is tedious and time-consuming.

Here, we will show you the best method we've found to simplify receipt storage management.

Why store receipts?

Receipts play a crucial role in different aspects of business operations such as financial health and regulatory compliance.

Here are some reasons we've found why storing business receipts is essential.

1. For auditing your company

Keeping track of your receipts is key to audit preparation. Filing receipts as they come in and organizing by date ensures you have the proof to back up your expenses and deductions so you don’t get into disputes over your taxes.

2. To find cost savings

Organizing your receipts can reveal patterns of spending and areas for cost reduction and profit increase. Learning how to organize business receipts is key to keeping financial documents in order and reducing stress during tax season. Reviewing your expenses regularly will also lead to better financial decisions and resource allocation.

3. To improve financial management

Storing receipts systematically gives you a clear view of your business’s financial state. It also supports record keeping, essential for budgeting, forecasting, and financial planning.

What are the different types of business receipt storage?

The various types of storage solutions will depend on the format of the receipt.

1. Paper receipts

Storage method: Use files and folders to create a paper filing system for physical receipts. File regularly and consistently.

Problems/benefits: Paper receipts can get messy and fade or damage over time.

2. Electronic receipts

Storage method: Convert to a digital system to automate your receipt organization. Store electronic receipts, such as credit card statements, bank statements, and email receipts, in a digital format.

Problems/benefits: Digital receipts are easier to manage, less likely to get lost or damaged, and can be accessed and sorted quickly.

What is the best method to store business receipts?

Here is the best method we have found to store receipts.

1. Use a receipt scanner

Benefits: Scanning and digitizing paper receipts frees up physical space and reduces clutter. They also create a more accessible and searchable archive of receipts. Using a receipt scanner like Shoeboxed to organize receipts electronically means you can easily access and convert paper receipts to digital for complete organization.

Best practices: Use a good-quality scanner to ensure the digital copies of your receipts are clear and readable. File these digital receipts into a folder on your computer or cloud storage for easy access.

2. Categorize and sort receipts

Benefits: Categorize receipts by type (e.g., travel, office supplies) and sort by date for better financial organization and management. This makes it easier to track spending and prepare for tax season.

Best practices: Create categories that match your business expenses. Use folders or digital labels to keep receipts sorted and easily accessible.

3. Use technology (email, accounting software, etc.)

Benefits: Using technology to store and organize receipts makes it easier and reduces errors. Email receipts can be saved from your inbox, and accounting software can automate many parts of receipt management.

Best practices: Check your email regularly for receipts and forward them to your storage system. Use accounting software that integrates with your receipt management system.

4. Create a habit and policies

Benefits: Organizing receipts weekly reduces stress and ensures your records are always current. Create clear policies for expense reports and employee reimbursement to promote transparency and accountability.

Best practices: Schedule a weekly time to organize and review your receipts. Create and communicate policies for how employees should handle and submit receipts.

5. Cloud and automation

Benefits: Cloud storage is a secure and convenient way to store and manage receipts. Automation software can simplify the process, improve cash flow, and reduce manual work.

Best practices: Store your digital receipts in a reliable cloud storage like Google Drive or Dropbox. Use automation tools to back up and organize your receipts regularly.

How can you leverage technology to store receipts?

Digital receipt management tools make storing and organizing business receipts easy.

Let’s take a look at how Shoeboxed, an award-winning receipt scanner and organizer, handles business receipts.

Shoeboxed turns your receipts into data with automatic data extraction for storage, expense reporting, tax prep, and so much more.

Here’s how to store your receipts with Shoeboxed.

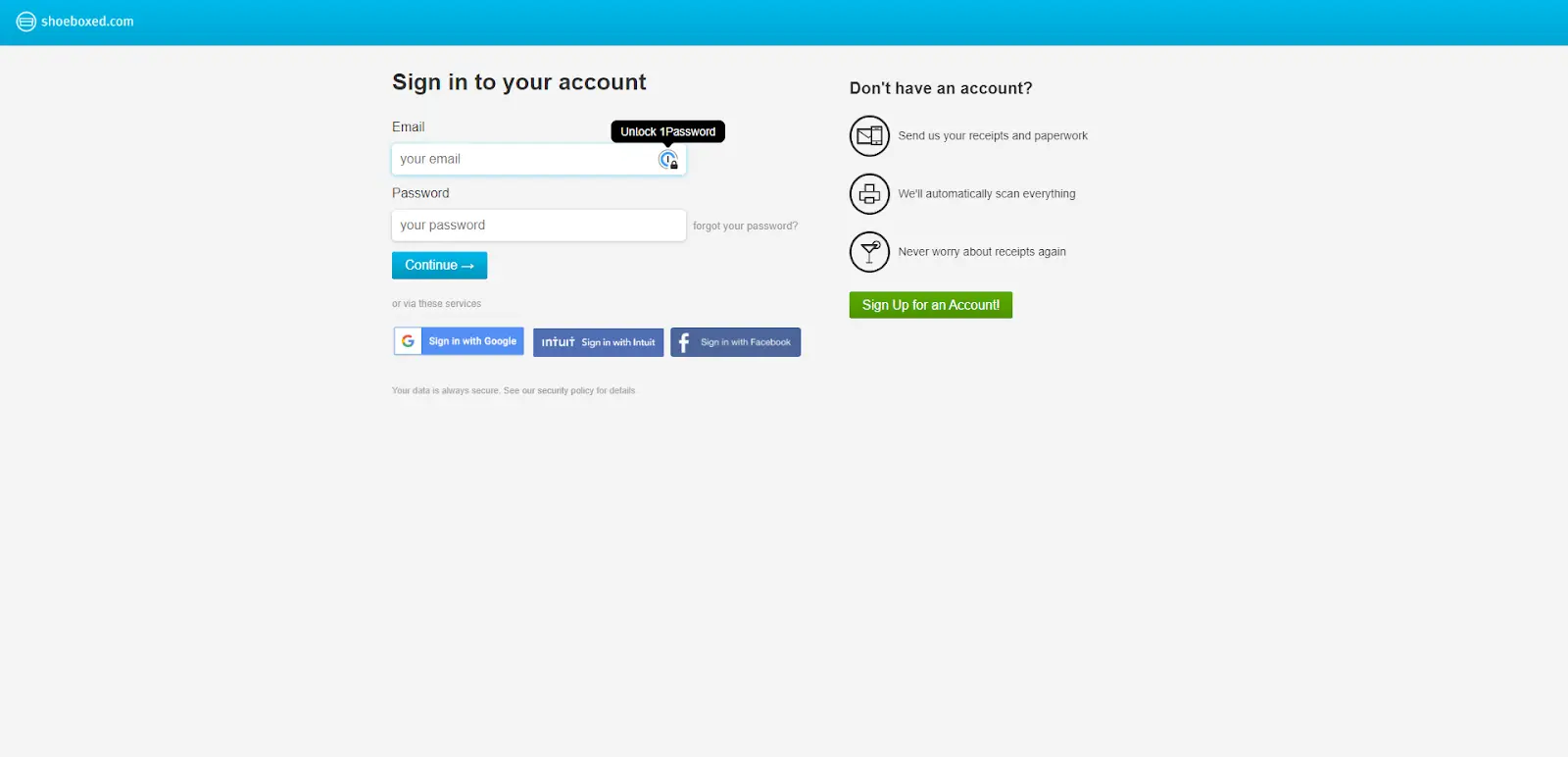

Step 1: Set up your Shoeboxed account

Creating an account

Action: Sign up for Shoeboxed on their website or mobile app.

Benefit: Setting up an account gives you access to all the Shoeboxed features, including scanning, organizing, and storing receipts.

Step 2: Scan and digitize receipts

Using the mobile app

Action: Download the Shoeboxed mobile app on your phone. Use the app to take photos of your paper receipts and upload them into your account.

Benefit: The mobile app allows you to digitize receipts on the go, so all receipts are captured immediately after a purchase and are available from anywhere.

Uploading digital receipts

Action: Upload digital receipts (e.g., email receipts, PDFs) to your Shoeboxed account via the app or web interface.

Benefit: Having all your digital receipts in one place, organized, and accessible.

Or outsource the scanning to Shoeboxed's Magic Envelope service

Magic Envelope

Action: With Shoeboxed’s Magic Envelope service, you can mail in large batches of receipts. Shoeboxed will scan and digitize them for you, saving you the time and effort of scanning each one individually. This service is perfect for managing a large volume of receipts without the hassle of manual scanning.

Benefit: Perfect for managing a large volume of receipts without scanning each one individually or having to do it yourself.

Shoeboxed is the only receipt scanner app that will handle both your paper receipts and your digital receipts—saving customers up to 9.2 hours per week from manual data entry!

Never lose a receipt again 📁

Join over 1 million businesses organizing & scanning receipts, creating expense reports, and reclaiming multiple hours every week—with Shoeboxed.✨

Get Started TodayEmail receipts

Gmail plugin

Action: The Gmail plugin automatically sends receipts from your Gmail inbox to your Shoeboxed account. Otherwise, you can forward your receipts from other inbox platforms directly to your Shoeboxed account.

Benefit: Automating the forwarding of email receipts means no digital receipt is missed, and everything is organized.

Step 3: Auto-categorize and organize receipts

Automatic data extraction

Action: Shoeboxed’s OCR technology extracts key information from each receipt, such as vendor, date, amount, and category.

Benefit: Automation saves time and ensures accuracy, so it's easier to track expenses.

Custom categories

Action: Create custom categories for your receipts (e.g., travel, office supplies) to match your business needs.

Benefit: Categorizing receipts tailored to your business helps with financial reporting and makes it easier to find specific expenses.

Step 4: Auto generates expense reports

Automated expense reports

Action: Shoeboxed auto-generates expense reports with just the click of a button.

Benefit: Automating expense reports reduces manual data entry, minimizes errors, and ensures expense reports are up-to-date and accurate.

Step 5: Integrate with accounting software

Connecting to accounting tools

Action: Connect Shoeboxed to your accounting software, such as QuickBooks, Xero, or other compatible platforms.

Benefit: Seamless integration means your receipt data is automatically synced to your accounting system, reducing manual data entry and improving financial accuracy.

Step 6: Regularly review and backup receipts

Routine review

Action: Review your digital receipts regularly to make sure they are categorized correctly and up-to-date.

Benefit: Regular reviews help keep records accurate and prepared for audits or financial reporting.

Cloud backup

Action: Use Shoeboxed’s cloud storage to back up your receipts automatically.

Benefit: Cloud storage means your receipts are safe, secure, and accessible anywhere.

Turn receipts into data with Shoeboxed ✨

Try a systematic approach to receipt categories for tax time. Try free for 30 days!

Get Started TodayWhat are the IRS guidelines for storing receipts?

The IRS says:

Retention period: Keep receipts for 3 years from the date you file your tax return or 2 years from the date you paid the tax, whichever is later.

Audit ready: Properly stored receipts can substantiate deductions during an audit and reduce penalties.

Frequently asked questions

1. How does Shoeboxed help with business receipts?

Shoeboxed makes receipt organization easy by allowing you to scan and upload receipts using your smartphone. The app extracts key data, categorizes expenses, and stores them in the cloud so your receipts are always organized and accessible.

2. Why digitize receipts?

Digitizing receipts is important because they can fade or get lost. Digital receipts are easier to organize, search, and access. Digital platforms like Shoeboxed integrate with accounting software, so financial management is simplified, and your records are always up to date.

In conclusion

Efficiently storing business receipts is key to keeping financial records accurate so you always know where your business stands. Using Shoeboxed for digital automation streamlines your receipt management and protects your business from financial errors.

Caryl Ramsey has years of experience assisting in bookkeeping, taxes, and customer service. She uses various accounting software to set up client information, reconcile accounts, code expenses, run financial reports, and prepare tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple receipt capture methods: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad, and Android) to snap a picture while on the go—auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports, including IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports, and more—with Shoeboxed.

Try Shoeboxed today!