Employees who use their money for business expenses expect to be reimbursed quickly. These business expenses incurred may include client lunches, such as meals at a local restaurant or taking a client out to dinner at a fancy place; business travel expenses, like airfare and hotel stays; and office supplies, like printer ink and paper.

This process starts when an employee submits an expense report to the company. The finance department reviews the report, checks the expenses, and ensures they comply with company policy. Once approved, the finance department processes the reimbursement, and the employee is paid back for their costs.

How can you make expense reporting a more efficient process?

What is an expense report?

Expense reporting is a process that organizations and individuals use to track and manage many business expenses incurred during business activities. This includes compiling and documenting expenses related to travel, meals, entertainment, office supplies, and other business-related expenditures. Effective expense reporting ensures financial transparency, aids in budgeting and forecasting, and ensures compliance with tax regulations.

Why do you need expense reports?

An expense report is business critical. Expense reports are a way to track business spending, manage costs, create company budgets, and get accurate reimbursements.

1. An expense report tracks business spending.

Expense reports track expenses so the company can see how much is spent and on what. Tracking expenses keeps the business in the black and on budget.

2. An expense report controls cost.

Expense reports are a way to control costs. Cost control starts with reviewing expense reports. This review tracks business expenses and helps you see where money is being spent in each expense category. Expense reports help identify ways to reduce spending in certain business areas.

3. An expense report creates budgets.

Staying within budget is the key to any business. Expense reports create a more realistic budget. You can use expense reports to find the average cost of expense categories from previous years and base your new budget on those numbers.

4. An expense report ensures accurate reimbursements.

Accurate reimbursements are essential for the employer and the employee submitting the expense report. When an employee uses their own money for business expenses, it’s only fair that the business reimburses them the same amount, as long as it’s within company expense policy. This policy ensures that your financial commitment to the business is respected and valued.

As an employee, it's your responsibility to ensure that your expense report is valid and accurate. Inaccurate or fraudulent reporting can have serious consequences for the business and yourself, so it’s crucial to be honest and meticulous when reporting expenses.

5. An expense report sets a precedence.

Expense reports set and standardize what can and can’t be expensed and how expenses are reported. Generally, business expenses include costs directly related to the business, such as travel expenses, meals with clients, and office supplies. Personal expenses, such as groceries or personal entertainment, are usually not eligible for reimbursement. This way, employees know what will be reimbursed and what won’t before they put their money on the line.

6. An expense report validates expenses.

Expense reports validate employee expenses. Having an expense report makes it easy for employers to see how much is spent, where it’s being spent, and if it’s within the company's expense policy. With receipts attached, expense reports are proof of where, when, and how the expenses were incurred.

7. An expense report validates a tax deduction.

Many of the expenses employees incur are tax deductible. But to deduct them, you need supporting evidence, such as receipts, to prove the expenses are legitimate. Expense reports track—and provide the supporting evidence for—deductible expenses. It makes deducting expenses on the business tax return so much easier.

What’s in an expense report?

Basic information should be in every expense report.

Here’s the list:

Employee name, contact info, department

Amount and date of each receipt that matches the attached receipt

Expense type (mileage, meals, office supplies)

Who the expense was incurred from

Where the expense was incurred (business name and location)

The project or client the expense is for

Category or account of purchase

Any other details about the expense

Subtotal for each expense category

Total expense including tax

How do you report costs?

Expense reports are submitted monthly or quarterly. A monthly expense report documents and summarizes ongoing costs and employee reimbursement of expenses incurred within a month.

Once submitted, it’s reviewed for accuracy and legitimacy.

Then, it is approved or rejected based on company policy.

If approved, the reimbursement is issued. The reimbursement is then recorded as a business expense, and all reports and receipts are filed away for audits.

Yearly expense reports summarize the deductible expenses on the business tax return.

1. Manual expense reports

Expense reports can be created through a standardized expense report form.

Most businesses create an expense report template for their employees because it makes expense tracking easier.

Creating expense reports also ensures the company gets the information it needs from its employees.

In the expense report template, the employee will include the following:

Their name

Contact info

Date

Department

Expenses and details of the costs are then recorded in chronological order.

Then, the employee adds up the subtotal of each category and the total, including tax.

The report is submitted for approval once the receipts are attached.

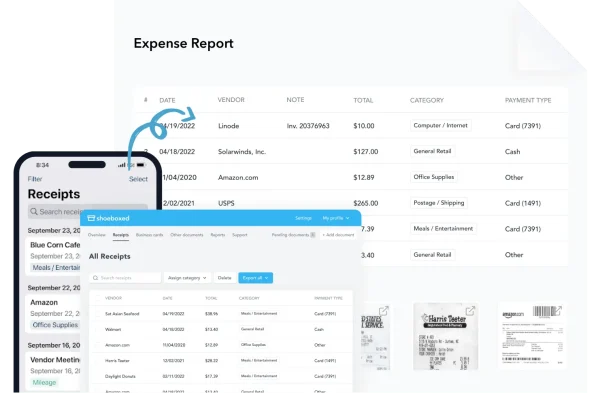

2. Expense reporting software

Those who find manual expense reporting too time-consuming and tedious turn to automated expense reporting.

Many businesses incur many expenses, and an expense management system makes creating, recording, and tracking reports much easier. This software can speed up the expense reporting process, make it more efficient, and reduce errors so that all expenses are recorded accurately. It will also improve the accuracy of your financial records and reduce the risk of non-compliance with tax and accounting rules.

Reports can be processed on the go with apps, bank accounts, debit cards, and credit cards, which can even be connected to expense reporting software.

Transactions from the statements are then converted into expenses.

Expense reporting software applications like Shoeboxed make it so much easier. They guide you through the required fields, group the business expenses into a report, and let you submit expense reports with the click of a button. This takes the burden of manual reporting off you so you can focus on more important things, like growing your business.

How can you simplify expense reporting?

The best way to make expense reporting less tedious is to automate expense management.

Shoeboxed - ideal for small business owners looking to simplify expense reporting

Shoeboxed is a powerful tool that can significantly streamline the expense reporting process.

Here’s how.

Automated receipt management

Shoeboxed allows users to digitize their receipts by taking photos with their mobile devices and uploading them to a designated Shoeboxed account using the app. That way, all of your receipts are in one place.

If you don't have time to scan, you can outsource your scanning to Shoeboxed. Just fill a pre-paid envelope with a batch of receipts and mail it to Shoeboxed's processing center. Their team will scan, human-verify, and upload receipts directly to your account.

You can also forward receipts directly from your inbox to your Shoeboxed account, use Shoeboxed's Gmail plug-in to auto-import e-receipts from your inbox to your Shoeboxed account or drag and drop receipts into the cloud using a desktop or laptop.

Break free from paper clutter ✨

Use Shoeboxed’s Magic Envelope to ship off your receipts and get them back as scanned data in a private, secure cloud-based account. 📁 Try free for 30 days!

Get Started TodayAutomatic categorization

Once receipts are uploaded into your account, Shoeboxed automatically extracts vital information (date, amount, vendor) and categorizes the expenses into 15 tax or customized categories.

Turn receipts into data with Shoeboxed ✨

Try a systematic approach to receipt categories for tax time. Try free for 30 days!

Get Started TodayAutomated expense reporting

Users can automatically generate expense reports with a click of a button directly from Shoeboxed, customized to meet their organization's specific needs. This simplifies the submission and approval process.

Integrates with expense reporting tools and accounting software

Shoeboxed integrates seamlessly with widespread expense reporting and accounting software like QuickBooks, Xero, and Wave. This allows users to import and categorize expenses easily, reducing manual entry.

Improved compliance

Shoeboxed stores receipts in a format accepted by the IRS, simplifying tax preparation and ensuring compliance.

Shoeboxed maintains a digital archive of all receipts and expense reports, creating a clear audit trail for financial transparency and regulatory compliance.

Time savings and efficiency

Shoeboxed can quickly process large receipts, especially for businesses with high transaction volumes.

The mobile app allows employees to quickly track and submit expenses, reducing the backlog of expense claims.

Integrating Shoeboxed into the expense reporting process can enhance efficiency, accuracy, and compliance.

By automating the receipt management process and integrating it with existing accounting systems, Shoeboxed helps businesses maintain clear and organized financial records, making expense reporting a seamless part of business operations.

Lighten the Load✨

Learn How a Multi-Campus Church Reclaims 20 Hours a Month with the Shoeboxed App

Read the case studyWhat are the benefits of expense reporting software?

There are many benefits to using expense reporting software such as Shoeboxed.

Some of these benefits include the following:

Automates generating reports, the submission process, and the approval and rejection process

Automatically sends up red flags if expenses are not compliant with company policy.

Weeds out expense reimbursement fraud

An efficient process for expense tracking

It makes cost control less tedious with the analytical reports

Frequently asked questions

What are the IRS rules for expense reports?

General rules on employee expenses for IRSC employees include the following:

The employees should provide contextual information about the costs incurred, like their amount, date of receipt, and purpose.

Expenses are due within 60 days after costs were collected.

You need to have supporting evidence, such as a receipt, to back up the expense

How do businesses use expense reports?

Businesses use expense reports to track and legitimize employee expenses and claim valuable tax deductions.

Businesses that keep a detailed record of these expenses can easily claim tax deductions.

All they have to do during tax time is calculate the monthly totals for each expense category.

In conclusion

Expense reports are vital to employees using their money for business-related expenses.

These reports are also important to employers who reimburse employees for the money they spend.

Knowing how to create expense reports for your business will help you keep track of the money flowing into and out of your company and better prepare for future spending and tax preparation.

Caryl Ramsey has years of experience assisting in different aspects of bookkeeping, taxes, and customer service. She uses a variety of accounting software for setting up client information, reconciling accounts, coding expenses, running financial reports, and preparing tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!