Becoming a DoorDash driver can be a great way to dip your toes in the water of the workforce, make extra money, or fill up your free time with a productive side hustle.

That said, when you work with DoorDash, you’re your own boss—and that means you’re responsible (and liable to the IRS) for the time and resources you spend dashing.

If that sends a chill down your spine, we’ve got your back.

In this guide, we’re going to review the best mileage tracking apps for DoorDash and cover everything you need to know to efficiently track your miles, reduce your tax liability, and responsibly report your income to the IRS!

Does DoorDash track the mileage of drivers?

DoorDash does not track the mileage of drivers—at least not in a way that really benefits drivers.

DoorDash will only send mileage information during tax season, which isn’t the best way to maximize your tax deductions, as it doesn’t account for miles you spend offline.

That’s why a separate mileage tracker app that records your time spent driving for DoorDash is recommended so you have total control over the trips you log and can account for the miles DoorDash may not record.

Track mileage with Shoeboxed 🚗

Track mileage using your phone’s built-in GPS for unmatched ease and accuracy. Expense reports don’t get easier than this! 💪🏼 Try free for 30 days!

Get Started TodayWhy is it important to track the miles you drive for DoorDash?

Tracking the miles you drive for DoorDash can help you reduce your tax liability

In the gig world, both rideshare and delivery drivers are considered independent contractors.

When you’re an independent contractor, you essentially work for yourself, and with that comes responsibilities regarding taxes and deductions.

1. You maximize your tax deductions

Tracking your mileage directly affects your tax deductions.

The IRS allows independent contractors to deduct business-related expenses, and business mileage used for actual expenses is an essential part of these deductions.

By accurately tracking all your miles driven for DoorDash deliveries, you can maximize your tax deductions and potentially lower your tax bill.

Keeping a detailed and accurate mileage log is necessary for claiming deductions at the standard mileage rate established by the IRS.

This rate changes periodically and covers not only your gas cost but also depreciation, maintenance, and insurance expenses.

If you don’t track your mileage correctly, you may miss out on a significant tax deduction that could save you a lot of money in the long run.

2. Should you be audited by the IRS, tracked miles can protect you

The IRS requires that you keep a record of your personal and business trips and-related mileage to validate your tax deductions.

Accurate and organized records will give you the confidence and proof needed should the IRS ever ask for documentation to support your claims.

What to look for in the best mileage tracking apps

When choosing a mileage tracking app for your DoorDash deliveries, there are several features to consider.

Accurate GPS tracking: Ensure the app uses a reliable GPS system to accurately track your mileage without glitches or inconsistencies.

Automatic mileage tracking and manual mileage tracking: Automatic tracking saves time and records your drives without input from you, while manual tracking allows more control over the data you log.

Integrations with other apps, such as accounting tools.

Expense and income tracking: This allows you to keep track of your DoorDash earnings and any work-related expenses easily.

Notes: Consider apps with note-taking options for added context when needed.

Using a mileage tracking app or apps for drivers with the right features can help you make the most out of your time with DoorDash.

How we chose the best mileage tracker for DoorDash

In order to select the best mileage tracker for DoorDash, we focused on key factors that are crucial for independent contractors:

Ease of use: The mileage tracker should be user-friendly, offering a simple and intuitive interface. This allows you to track your mileage with minimal effort and time, ensuring your focus remains on your DoorDash deliveries.

Automatic and manual tracking abilities: We chose apps that automatically and/or manually tracked mileage to give drivers more control over the miles they log.

Integration with gig apps: We prioritized mileage trackers that were designed to work seamlessly with DoorDash and other gig economy platforms, like Uber Eats and Instacart. This ensures that the tracker accurately captures all your work-related mileage.

Reporting capabilities: The best mileage trackers should offer comprehensive reporting features. This includes the ability to download and export your data, which can be invaluable when it’s time to file your taxes or expenses.

Value for money: Finally, we considered the cost of the mileage trackers, comparing their prices and features. We aimed to recommend those that offer a good balance between affordability and functionality.

With this in mind, let’s jump into the reviews!

7 best mileage tracking apps for DoorDash in 2024

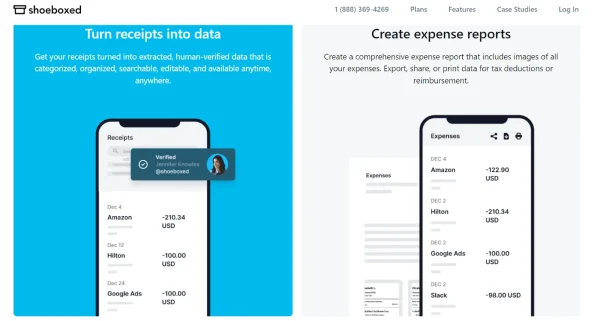

1. Shoeboxed – Best for expense management and tax prep

Track miles, keep up with expenses, and create reports for tax season from the Shoeboxed app.

Shoeboxed is our overall top pick for mileage tracking, receipt scanning, tax preparation, and expense reimbursement.

This app is for dedicated Dashers with a serious DoorDash side hustle and features multiple ways to track miles and manage the expenses you incur while out on the road.

How does Shoeboxed’s free mileage tracker work?

Shoeboxed’s mileage tracker

Shoeboxed’s free mileage tracker is convenient and straightforward to use, which is a must for those who drive for work.

Once you sign up for Shoeboxed, tracking miles is as easy as:

Opening the Shoeboxed app.

Tapping the “Mileage” icon.

Clicking the “Start Mileage Tracking” button.

And driving!

After clicking "start mileage tracking", Shoeboxed begins to track your location and miles and saves your route as you go.

(It’s a good idea to drop pins if you make stops along your trip. This helps to keep the mileage tracking precise.)

If you make any stops along the way and have to pay for parking, for example, you can still snap a photo and upload that receipt to your Shoeboxed account without stopping the mileage tracker.

At the end of a trip, tap the “End Mileage Tracking” button.

Shoeboxed will create a summary of your trip that includes the date, editable mileage and trip name, and your tax deductible and rate information.

Click “Done” to approve the summary and generate a receipt with your trip information, including a photo of your route on the map.

Shoeboxed will auto-categorize your trip under the mileage category for safekeeping.

How else can the Shoeboxed app benefit Dashers?

Not only can you track the mileage you spend DoorDashing, but you can also snap photos of any receipts from parking, tolls, insulated bags, car inspections, repairs, and any other expenses directly related to your partnership with DoorDash.

Shoeboxed will digitize your paper receipts and automatically organize them under 15 tax categories to make tax time easier.

You can also edit these expense categories, and add tags and descriptions for each purchase to further categorize your expenses.

If you ever need to call up a particular receipt, you can find what you need with Shoeboxed’s advanced search and filter features that allow you to sort receipts based on date, vendor, payment type, and more.

Example of a CSV expense report from Shoeboxed.

When tax season rolls around, you can export the receipts related to your DoorDashing gig into a detailed expense report to give to your accountant.

Expense reports are also immensely helpful in the event of an audit and help protect your tail.

Shoeboxed’s expense reports come with receipts attached so you always have photo evidence of the money you spent.

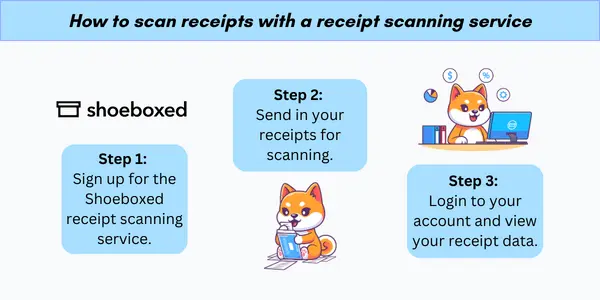

Shoeboxed’s Magic Envelope service and how it works

Shoeboxed’s Magic Envelope outsources receipt-scanning

Aside from the app features and mileage tracker, Shoeboxed also offers a service called the Magic Envelope. The Magic Envelope allows you to outsource your receipt scanning.

This is a fantastic tool for large-city-dwelling Dashers who rack up a lot of expenses by the end of the year.

When you opt for a plan that includes the Magic Envelope, Shoeboxed will send you a postage-pre-paid envelope each month for you to mail your receipts in.

Depending on how many receipts you have each month, 1 envelope may not be enough, in which case you can get another free of charge.

Once your receipts reach the scanning facility, the team at Shoeboxed will scan and digitize your receipts, check the data for accuracy, and upload them to your account under the tax categories.

You can also request that the team put your receipts under custom categories.

To do this, you would need to separate the receipts and attach a note with instructions on how to categorize your expenses.

How to send Shoeboxed’s Magic Envelope

Break free from manual data entry ✨

Use Shoeboxed’s Magic Envelope to ship off your receipts and get them back as scanned data in a private, secure cloud-based account. 📁 Try free for 30 days!

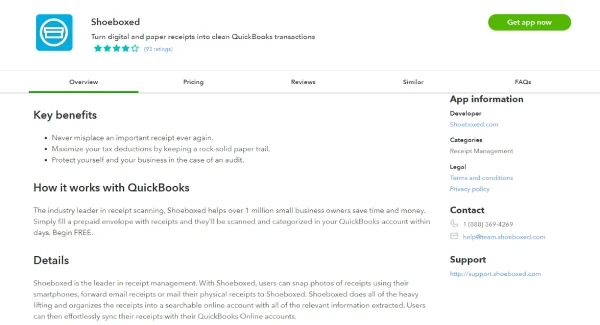

Get Started TodayShoeboxed software integrations

Shoeboxed also integrates with various accounting software to make keeping up with your finances even easier.

If you use QuickBooks, Xero, or Wave to manage your finances, you can integrate Shoeboxed with your account to upload organized receipts for detailed expense tracking and reporting.

Pros:

Mileage tracker is easy to use.

You can edit the miles you drive after a trip.

Miles are turned into receipts for reporting and auto-categorized under mileage.

Filter your receipts for mileage, auto repairs, and other business expenses for tax time.

Track mileage and snap photos of receipts for expenses simultaneously.

Comprehensive PDF and CSV file expense reports with receipts attached.

Integrates with accounting software like QuickBooks.

Shoeboxed’s Gmail Receipt Sync grabs all receipt emails and sends them to your account for automatic processing! These receipts are then labeled as Sent to Shoeboxed in your Gmail inbox.

Magic Envelope can be a great service for city-dwelling Dashers that receive lots of receipts for parking, tolls, and other expenses.

An unlimited number of free sub-users. This is good for adding your accountant or an auditor to your Shoeboxed account to review your expenses.

Cons:

Mileage tracker isn’t automatic. You’ll have to manually start and stop the tracking process. On the bright side, this gives you more control over your trips!

Pricing:

Start Up – $22/month OR $18/month (billed annually) for unlimited users + Magic Envelope service.

Professional – $45/month OR $36/month (billed annually) for unlimited users + Magic Envelope service.

Business Plan – $67/month OR $54/month (billed annually) for unlimited users + Magic Envelope service.

Starter Plan – $4.99/month for unlimited users (Digital Only plan. Doesn’t include Magic Envelope).

Light Plan – $9.99/month for unlimited users (Digital Only plan. Doesn’t include Magic Envelope).

Pro Plan – $19.99/month for unlimited users (Digital Only plan. Doesn’t include Magic Envelope).

Visit Shoeboxed’s pricing page to learn more about what all of the Digital + Magic Envelope plans offer.

NOTE: The Start Up, Professional, and Business plans are only available on desktop. The Starter, Light, and Pro plans are available on the Shoeboxed mobile app only.

Shoeboxed is the only receipt scanner app that will handle both your paper receipts and your digital receipts—saving customers up to 9.2 hours per week from manual data entry!

Stop doing manual data entry 🛑

Outsource receipt scanning to Shoeboxed’s scanning service and free up your time for good. Try free for 30 days! ✨

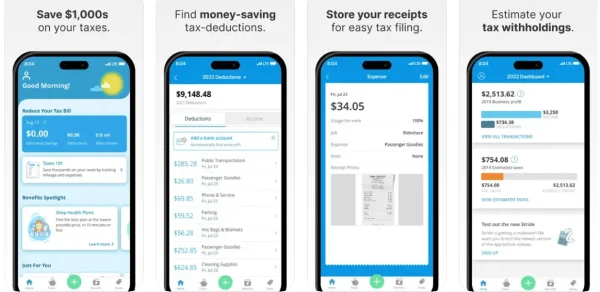

Get Started Today2. Stride – Best free mileage tracker

Stride app, Apple App Store

Based on our experience with it, Stride is the best free mileage tracker app out there. All of Stride’s features are free to use and extend beyond just tracking your miles.

Milage tracking

When it comes to mileage tracking, Stride’s interface is easy to use and navigate.

Though the app doesn’t automatically track trips, drives start and end with a simple click of a button.

After your drive, Stride automatically calculates your approximate tax deduction for the distance traveled and logs the time you spent on the road.

Other features for DoorDashers

Besides mileage tracking, Stride also offers:

Resources for finding health plans, including dental, vision, and life insurance.

Receipt scanning.

The insurance resources are a helpful feature for those who plan to be self-employed for the long haul.

We appreciated the handy suggestions to cover DoorDash drivers’ needs.

Receipt scanning

Stride also allows you to take photos of your receipts for tax filing. When you snap photos of business receipts, you get the option to edit the job and expense fields and add any notes about the purchase for future reference.

The downside is that expenses aren’t super customizable and the features are basic compared to other receipt scanners, like Shoeboxed.

Pros:

An unlimited number of free drives.

Find insurance that meets your needs as an independent contractor.

Estimated tax deductions on the miles you drive.

Link your bank account and automatically find write-offs.

User-friendly app that’s easy to navigate.

Simple start-and-stop tracking.

Cons:

Doesn’t offer automatic mileage tracking. You’ll have to manually start and stop your trips.

The receipt scanning feature doesn’t have many options for customization.

Pricing: Free app

3. Gridwise – Best for insights and multiple side gigs

Gridwise, Apple App Store

Gridewise is a free GPS mileage tracking app that has all the best features for those with more than one side hustle. It’s also the first app on our list that offers automatic mileage tracking!

If you drive for DoorDash and other meal delivery services, Gridewise is 100% the app for you.

Gridwise allows you to track miles, expenses, and earnings when you work with:

DoorDash

Uber Eats

Grubhub

And over a dozen more delivery apps.

Insights for delivery drivers

Our favorite features are the insights you get on your income, the best locations to work, and the most active delivery times so you can maximize and keep tabs on your earnings.

You can also compare how you’re doing with the drivers near you to see where you can improve and make more money.

Gridewise also has features for:

Tax prep.

Gas-saving and rewards.

Advanced insights.

And more with the paid version.

Pros:

Free version has everything you need to effectively log your miles and track income and expenses.

Unlimited automatic mileage tracking.

Insights into your income and expenses.

Find hot spots for meal delivery.

Great if you have multiple side gigs.

Cons:

App has a lot of features so there’s a bit of a learning curve.

The paid subscription isn’t really necessary for DoorDashers (better for rideshare drivers).

Only works with specific companies, so you can’t log miles for other businesses.

Pricing:

Free app

Get more out of the app for $9.99/month or $95.99/year (it’s tax-deductible!)

4. TripLog—Best for automatic mileage tracking

TripLog, Apple App Store

TripLog is another business mileage tracker that can help you easily track DoorDash miles and record expenses.

Automatic mileage tracking

This app uses Google Maps to track miles automatically. You can also choose to use manual tracking.

If you don’t want to start your trip manually, you have a few auto-start options:

MagicTrip – Runs in the background and starts 1-2 minutes after you start driving and stops after 5 minutes of no motion detection.

Car Bluetooth – Starts tracking once you drive faster than 5 MPH and connect to your vehicle via Bluetooth. Tracking ends when you disconnect from Bluetooth.

Plug-N-Go – Starts tracking once you drive faster than 5 MPH and plug your phone into your car charger. Tracking ends when you unplug your phone.

We really liked that you can choose which automatic option to go with.

The Plug-N-Go was our favorite, as we didn’t have to worry about the tracker draining our battery while driving.

Income and expense tracking features

TripLog also has tabs for fuel, expense, and income tracking to help you organize your money and write off deductible business expenses.

This app has a receipt-scanning option for fuel and expense receipts so you have a visual record of the money you spent.

Our biggest complaints

Despite the pros, we couldn’t help but notice how dated the interface is. Though the app isn’t difficult to navigate, we feel that it could use an upgrade to simplify tracking.

The free version also left much to be desired.

Only the paid plan offers unlimited receipt uploads and trips, the ability to link your bank and card, and OCR scanning technology for receipts (which means you’ll have to manually enter the receipt data, yourself).

With the free version, you only get 40 expense uploads and trips per month—which is fine for extra side money but not great if your full-time job is Dashing.

Pros:

Automatically track your drives or choose to manually start tracking.

Various ways to track the miles you drive.

Keep up with income and expenses via receipts.

Get insight into your drives through reports.

The premium version offers a web-based platform.

Cons:

Only 40 expense uploads and trips per month. Unlimited receipt uploads are only with the paid plan.

Bank and credit card integration is not included in the free plan.

Receipt uploads don’t use OCR technology in the free version.

Basic receipt-scanning and expense reporting features compared to other options, like Shoeboxed.

Dated app interface.

Pricing:

Free app

Premium features for $4.99/month (billed annually)

5. QuickBooks Self-Employed – Best for complex accounting needs

QuickBooks Self-Employed app, Apple App Store

QuickBooks Self-Employed is trusted by millions of small business owners and independent contractors around the world.

This app is a comprehensive, all-in-one accounting software that’s ideal for those that need a solution for complex bookkeeping needs.

What QuickBooks Self-Employed offers

QuickBooks Self-Employed covers every aspect of your work as an independent contractor, including:

Receipt and expense tracking and organization.

Tax deductions.

Invoices.

Payments and bank transfers.

And, of course, mileage tracking.

So, how does the mileage tracking compare to the other mileage tracking apps on our list?

Tracking miles with QuickBooks

Mileage tracking is automatic when you use QuickBooks Self-Employed. Once you start driving, QuickBooks automatically kicks on and ends when you idle.

After your trip, QuickBooks estimates the potential deductions you racked up during your trip.

According to QuickBooks, “QuickBooks Self-Employed users have found billions in potential tax deductions by using this automatic mileage tracker.”

That sounds like a deal to us!

QuickBooks integrations

If you already use QuickBooks for your accounting, you can opt for another receipt-scanning and mileage-tracking app.

Shoeboxed is a fantastic option, as it syncs with QuickBooks to easily organize your tax receipts, including receipts for mileage.

Pros:

Automatic mileage tracking.

Calculates potential tax deductions from your trips.

Snap photos of receipts from expenses.

An all-in-one solution for self-employed bookkeeping.

Cons:

You can’t use the mileage tracker unless you already use QuickBooks.

Not the most budget-friendly option for a part-time gig.

May have more features than you need or are looking for.

Pricing:

Self-Employed: $15/month.*

Self-Employed Tax Bundle: $25/month.*

Self-Employed Live Tax Bundle: $35/month.*

*Save 50% on your first 3 months when you sign up.

6. Hurdlr – Best for battery life

Hurdlr app, Apple App Store

If you’re worried about mileage apps with automatic tracking draining your battery life (which they do), then Hurdlr is your best bet.

Hurdlr is another great mileage and expense tracking app that was designed to not drain your phone’s battery, “even with heavy usage,” according to the brains behind Hurdlr.

So, what else does Hurdlr offer?

Good for DoorDashers and other marketplaces

Hurdlr allows you to track miles for DoorDash, Uber, Lyft, Amazon Flex, Instacart, and more. It can even be used as an app for freelance truckers, which we thought was pretty cool.

If you work for more than just DoorDash, Hurdlr’s got you covered. You have the option to track miles for all of the businesses you work for.

Mileage tracking and reports

Mileage tracking is a piece of cake with Hurdlr.

Tracking runs in the background, so whenever you go on a trip, Hurdlr automatically logs the time you spend out on the road.

The downside to this is that it’ll also log your personal driving, so you’ll have to work around that.

All of your trips are added to what we think is a pretty sleek interface. From the mileage tab, you can find reports that show your trips.

You can filter your trips based on the year, month, week, or custom date ranges for whenever you’re filing your taxes.

Track expenses, income, and tax estimates (for a price)

If you opt for the Premium version, your world opens up to expense, income, and tax tracking.

For expense and income tracking, you can integrate your bank and payment methods with your Hurdlr account for efficient money management.

Alternatively, you can snap photos of your receipts or manually enter the amount of the expense or income.

You can also complete your Hurdlr tax profile to view your tax calculations.

Pros:

Auto or manual mileage tracking.

Won’t drain battery life.

Reports that detail the miles you spent on the road.

Filters to sort your trips for expense reporting.

Link your bank account, Stripe, PayPal, Square, and more to auto-track expenses and income.

Account integrations with FreshBooks and other software.

Attach receipts to expenses or income statements.

Cons:

Can only track expenses and income and receive tax estimates with the Premium version.

Receipt function isn’t as comprehensive as other options.

Pricing:

Free

Premium for $100/year

7. Everlance – Best for kickbacks

Everlance app, Apple App Store

Everlance is the mileage and expense app that’s actually partnered with DoorDash.

Everlance is a good app that records your miles and creates reports so you can get reimbursed for business expenses, but that doesn’t mean it’s the be-all and end-all of automatic tracking apps.

Let’s explore what Everlance has to offer Dashers.

Everlance’s mile tracking

Though Everlance is partnered with DoorDash, that doesn’t mean it’s exclusively for DoorDash.

Everlance allows users to track the mileage they spend working for companies such as Lyft, Uber, Instacart, Grubhub, other food services, and more.

Mile tracking is automatic or manual, and Everlance uses Google Maps to ping your location and track your route.

That said, you only get 30 free trips without the Premium version.

What we really liked about Everlance is that you can classify each of your drives as personal or work-related, so even if Everlance tracks a family vacation, it won’t get mixed up with your DoorDash trips.

Expense tracking and taxes

Everlance Premium offers expense tracking and tax help.

You can automatically track your expenses with Everlance by syncing your bank or card to your account or by manually adding an expense with a photo of your receipt attached (but that’s about as far as it goes with receipt capture).

When it comes to taxes, Everlance will calculate the estimated tax deductions for the miles you’ve driven and include other work expenses in your tax report.

You can then create expense reports, filter your miles and business expenses based on date, and export them via PDF, Excel, or CSV to your accountant during tax season.

Pros:

Automatic tracking + manual tracking option.

Classify drives as personal or work-related.

Track expenses and upload photos of your receipts.

Get automatic mileage deduction estimates.

Create expense reports for tax time.

Get 20% off your first year with the DoorDash promo code.

Cons:

Only 30 free trips without the Premium version. Other tracking apps offer unlimited miles for free.

You don’t get all of the features unless you have the paid subscription.

Receipt-scanning is sub-par compared to options like Shoeboxed.

Pricing:

Free

Premium: $5/month (billed annually)

Use this Dasher-exclusive link to get 20% off your first year of Everlance and “EVERDASH” at checkout.

See also: 3 Quick Ways to View Your Apple Card Statement

I didn’t track my mileage for DoorDash. Now what?

If you didn’t track the mileage you spent dashing, there’s still hope.

Now, keep in mind that you can’t just make up the miles you drove for DoorDash.

If you’re audited, the auditor will require you to have documentation that proves the miles you traveled in your vehicle were for work, or else you risk losing out on your mileage deductions.

So, you’ll need to find a way to zero in on the miles you spent working for DoorDash and the evidence to back up your claims.

Here are the next steps we recommend:

Step 1. Figure out which days you drove for DoorDash

DoorDash will have a log of the days you drove for them, along with the income you earned. Make note of the days you drove and how much money you made that day.

This is the first step and a great place to start.

Step 2. Calculate how many miles you drove for the year

Try to find the starting and ending points of your trips. Google Maps is probably your best bet here.

If you can get the starting and ending points of your drives, you can calculate the miles in between those locations.

Step 3. Collect evidence to back up your claims

Evidence includes:

Invoices of deliveries.

Records of routes from Google Maps or other mileage trackers.

Income statements from your bank account.

Records of drives and income from the DoorDash app.

Step 4. Create a mileage log for the tax year

Create a mileage log that breaks down each day you drove for DoorDash.

Your mileage log should include the date you drove, the total miles, why you were driving, and the locations.

Even if you didn’t proactively track your miles for the year, by following these steps you can claim tax deductions and have proof to back up your write-offs to the IRS.

The information provided in this section is for informational purposes only. Consult a tax professional for advice specific to your situation.

Integrating mileage tracking with other accounting tools

When you’re trying to stay on top of your finances as a DoorDash driver, it’s a great idea to integrate mileage tracking with accounting tools.

This combination provides you with a more efficient way to manage your expenses and increase your tax deductions.

QuickBooks integrations and mileage tracking

Integrate Shoeboxed with QuickBooks for seamless receipt tracking

If you use QuickBooks for your accounting, you can integrate apps with mileage tracking, or mileage tracker apps like Shoeboxed, into your software for accurate reporting during tax season.

QuickBooks also offers a mileage tracking feature that allows you to automatically log your business trips and calculate deductions.

Integrations with FreshBooks

While FreshBooks does not have a built-in mileage tracker, it efficiently integrates with third-party mileage tracking apps, including Shoeboxed.

Connecting your mileage-tracking app to FreshBooks ensures that your mileage expenses are accounted for in your financial reports.

By integrating mileage and expense tracking with other accounting tools, you can streamline your financial management and ensure compliance with tax regulations.

This approach will ultimately save you time and help you maximize your deductions as a DoorDash driver.

How do you stay tax compliant when working with DoorDash?

During tax season, staying compliant with tax laws is essential for maximizing your deductions and minimizing your taxable income.

Here are some tips to make tax time easier for you.

1. Always track your business miles

Keeping a record of the miles you drive for DoorDash deliveries will allow you to claim the IRS mileage rate, which can significantly reduce your taxable income.

2. Keep a record of other work-related expenses

In addition to miles driven, you’ll want to track other expenses related to your work as a DoorDash driver.

Some of these expenses include:

Tolls.

Parking fees.

Vehicle maintenance.

Cellphone usage while working.

Insulated delivery bags.

It’s important to keep accurate records and receipts for these expenses, as they can be used to further reduce your taxable income.

How to File Taxes for DoorDash Drivers, More FinanceHow can you manually track mileage?

Should your mileage expense tracking app not be up to par, you can use manual mileage tracking methods to keep track of your expenses as a Dasher.

There are several ways manually track mileage and work-related expenses.

Let’s discuss some of the most popular options below.

1. Use a spreadsheet

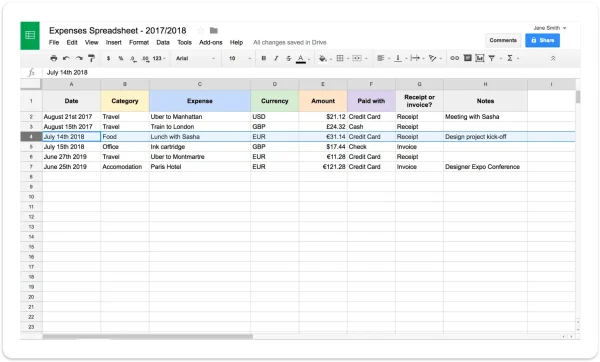

Example of an expense spreadsheet for independent contractors.

Creating a dedicated independent contractor spreadsheet, such as in Google Sheets, allows you to easily record your mileage for each DoorDash delivery.

You can create columns for the date, starting odometer reading, ending odometer reading, total miles driven, and notes regarding the purpose of the drive.

This method gives you full control over your data and makes calculating the total miles driven for tax purposes easy.

2. Keep a written mileage log

Another option is to maintain a written mileage log in a notebook or logbook.

This approach requires you to jot down essential information, such as the date, starting and ending odometer readings, total miles driven, and where you drove.

While this method might seem old-fashioned, it can be beneficial for those who are worried about losing digital data or prefer a tangible log they can quickly reference.

3. Document odometer readings

Recording the number of miles on your odometer before and after your trips is one way to calculate the miles you drive for DoorDash.

You can also make a habit of recording your odometer reading before each DoorDash delivery and at the end of your shift.

You can then calculate the miles driven for each delivery and store this information in a spreadsheet or written log.

This method may offer fewer details than the other options but still provides an accurate mileage record for your tax deductions.

By using one of these manual unlimited automatic mileage tracking methods, you can confidently and accurately account for all your DoorDash miles.

Frequently asked questions

Is there a mileage tracker for DoorDash?

DoorDash does not have its own mileage tracking app for Dashers, though it does provide drivers with mileage at the end of the year for taxes. It’s best to track the miles you drive for DoorDash using a third-party app like Shoeboxed, Everlance, Hurdlr, or Stride. Or setting up a Google Sheets mileage tracking sheet.

What is the best app to track your mileage for DoorDash?

The best apps to automatically track your mileage for DoorDash include Stride, Gridwise, TripLog, and Hurdlr. Shoeboxed is also great for tracking mileage and DoorDash-related expenses, such as vehicle repairs.

In conclusion

There are a ton of great automatic tracking apps out there that you can use on your DoorDash adventures, but if you ask us, our favorites come down to Shoeboxed, Stride, and Gridwise.

Shoeboxed is our top pick for serious Dashers who need help with tax prep and rack up a bunch of receipts related to business spending.

We recommend Stride for DoorDashers on a budget who still need a modern, comprehensive app with helpful features.

Lastly, Gridwise is our favorite for those that need to organize and keep up with the miles they spend on various side gigs.

Hannah DeMoss is a staff writer for Shoeboxed covering organization and digitization tips for small business owners. Her favorite organization hack is labeling everything in her kitchen cabinets, and she can’t live without her mini label maker machine.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!