In today's gig economy, freelancers, rideshare drivers, and small business owners often navigate the complexities of tracking travel expenses. Shoeboxed and QuickBooks Online mileage trackers are pivotal tools designed to alleviate the burdens of mileage documentation.

This article explores the features, benefits, and overall efficiency of the Shoeboxed and QuickBooks mileage tracker apps and then compares the two to discover which is right for you.

Why is mileage tracking essential?

Mileage tracking is essential for several critical reasons, especially for individuals and companies whose operations involve significant travel.

Here are the main reasons why mileage tracking is crucial:

Tax deductions

For businesses and self-employed individuals, mileage tracking is vital for tax deductions. The IRS allows taxpayers to deduct vehicle expenses for business-related travel, but accurate records are necessary to substantiate these claims.

Reimbursements

Many companies reimburse employees for mileage incurred while using personal vehicles for business purposes. Accurate mileage tracking ensures that employees are reimbursed fairly and accurately for their expenses.

Financial management

Tracking mileage can help businesses manage their finances better by providing clear insight into the costs associated with vehicle use. This information is critical for budgeting, forecasting, allocating resources, and making informed financial decisions.

Compliance and legal requirements

For certain businesses, logging mileage is a regulatory or legal requirement.

Operational efficiency

By analyzing mileage data, companies can identify trends, optimize routes, reduce fuel consumption, and minimize vehicle wear and tear.

Cost control

Mileage tracking helps businesses understand the actual cost of travel and vehicle maintenance, allowing them to seek ways to reduce these costs.

Enhanced accountability

For businesses with fleets or multiple employees who drive for work purposes, mileage tracking provides a way to monitor where and how vehicles are being used.

Shoeboxed

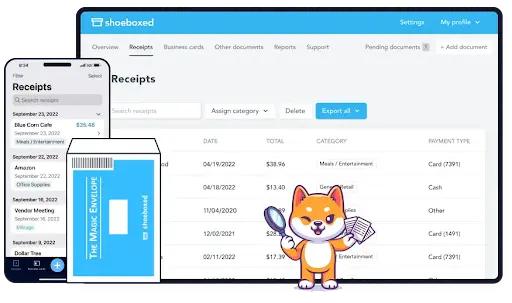

Over a million businesses use Shoeboxed's mileage tracker app and other expense management features.

For professionals whose work involves significant travel—such as consultants, salespeople, and rideshare drivers—keeping precise mileage records is necessary for reimbursement and tax deductions.

Shoeboxed, primarily known for its expense management solutions, offers customers a mileage tracker to simplify all related tasks.

Key features of Shoeboxed's mileage tracker

Shoeboxed's mileage tracker is designed with simplicity and efficiency in mind.

Here are its primary features:

Mileage capture

Shoeboxed is one of the best mileage tracking apps since you can control the miles you track.

Unlike some competitors that use automatic tracking via GPS, Shoeboxed requires users to take a more hands-on approach. This approach allows for greater control and may be preferred by users concerned about privacy or battery usage.

To track mileage with Shoeboxed, follow these instructions:

Go to 'Trips' on the app.

Click the 'start mileage tracking' button.

Start driving, and the app will save your location.

Click 'stop trip' when you reach your destination.

Review the trip summary, which includes the date, trip purpose, editable mileage, deductible rate data, and route.

Click 'done' once you have reviewed and approved the data.

Track mileage with Shoeboxed 🚗

Track mileage using your phone’s built-in GPS for unmatched ease and accuracy. 💪🏼 Try free for 30 days!

Get Started TodayIntegration with expense management:

There is no additional fee for Shoeboxed's mileage tracker app. The mobile app to track mileage is included with all of the other expense management features.

The mileage tracker integrates seamlessly with Shoeboxed's receipt scanning system. This integration allows users to attach fuel receipts and other travel-related expenses directly to each trip log, creating a comprehensive travel expense record.

Mileage tracking mobile app

Shoeboxed is also a mobile app that scans receipts on the road.

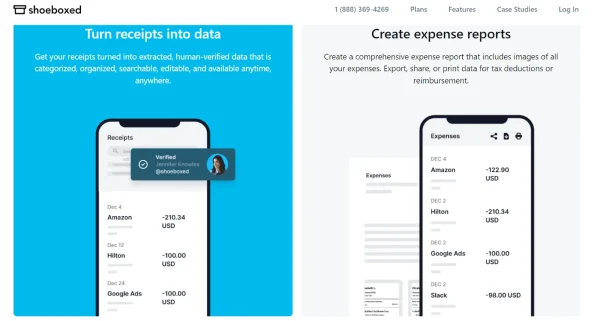

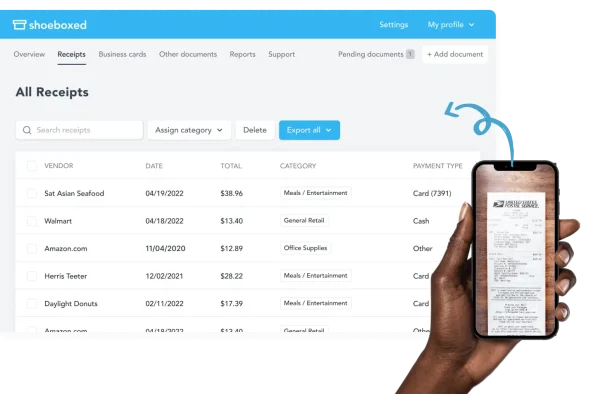

Shoeboxed features a receipt-scanningapp that makes it easy to manage receipts on the go. Drivers use their smartphone's built-in camera to capture a snapshot of the receipt. The receipt then uploads into the driver's Shoeboxed account and is automatically categorized.

Magic Envelope

Shoeboxed lets you outsource receipt scanning with the Magic Envelope.

Shoeboxed offers a unique service with its Magic Envelope. This service lets drivers outsource their receipt scanning for tolls, parking, and other business-related expenses, making tracking costs easy on the road.

Drivers can keep the envelope on their car dashboard and fill it with receipts as they pay for gas, meals, etc. This convenient envelope helps prevent receipts from getting lost or damaged.

Hit the road with Shoeboxed 🚗

Stuff receipts into the Magic Envelope while on the road. Then send them in once a month to get scanned. 💪🏼 Try free for 30 days!

Get Started TodayAuto categorizes receipts

Shoeboxed auto-categorizes mileage and other expenses.

Miles are turned into receipts and auto-categorized with Shoeboxed. There are 15 preset tax categories, or you can create custom categories. Filter options make expenses easily searchable and accessible.

Trip details can be added

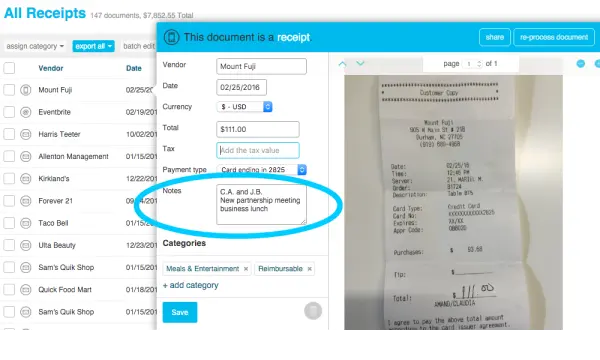

Trip details can be included for each receipt under the notes section.

Trip details can be included under the notes section with each mileage receipt and edited whenever needed.

Turn any document into a digital record

Shoeboxed scans and digitizes other types of documents as well.

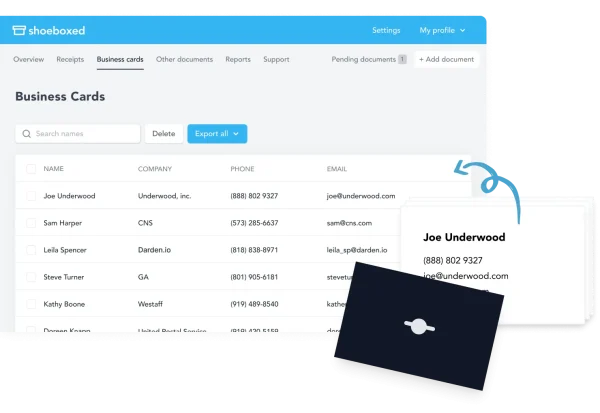

Shoeboxed digitizes mileage receipts and other documents such as permits, licenses, and business cards.

IRS-compliant logs

Shoeboxed helps you maintain compliance with the IRS.

Shoeboxed ensures that all mileage logs comply with IRS standards, making them valid for tax reporting purposes. This compliance is crucial for users who rely on accurate mileage tracking to claim business expense deductions on their tax returns.

Customizable reports

Shoeboxed generates detailed expense reports.

Users can generate customized reports that include their mileage and associated expenses. These reports offer a detailed overview of travel expenditures and are helpful for reimbursements and tax preparation. Expense reports even have images of receipts attached for reimbursements or your accountant.

Unlimited free sub-users

Unlike other QuickBooks products, with Shoeboxed, you can add unlimited free sub-users to your account.

Integrates with other popular accounting software.

Shoeboxed integrates with QuickBooks and Xero.

Shoeboxed seamlessly integrates with Xero, QuickBooks Online, and Wave accounting software.

Advantages of using Shoeboxed's mileage tracker

Simplified record keeping: Users take a more hands-on approach when logging trips to ensure their records are accurate and tailored to their needs. This method gives users complete control over what is recorded and when.

Enhanced expense tracking: Combining mileage with direct expense data (e.g., fuel receipts) provides a holistic view of travel costs, which is ideal for budgeting and financial planning.

Ease of use: Shoeboxed's user interface is straightforward, making it accessible even to non-tech-savvy users.

Best of both worlds: Shoeboxed users who already use QuickBooks Online can have the best of both worlds because Shoeboxed integrates seamlessly with QuickBooks.

Potential drawbacks

There’s no way to automatically track mileage, which makes it easier to separate personal from business trips.

Pricing

Shoeboxed offers different pricing tiers, starting at approximately $18 per month for a basic plan, which includes the mileage tracker.

Shoeboxed demo

QuickBooks Online mileage tracking

Mileage tracking is built into the QuickBooks Online mobile app.

The QuickBooks Online mileage tracker utilizes GPS technology in your vehicle or smartphone to automatically detect when you start driving and to track mileage data.

Features and functionality

Automatic detection

The QuickBooks mobile app is designed for automatic mileage tracking.

The QuickBooks mobile app starts recording your trip as soon as you begin driving and saves mileage data such as your start and end location and times.

Easy categorization

Swipe left for business mileage.

With QuickBooks Online, a swipe can easily classify trips as business or personal. Swipe left for business mileage.

Comprehensive integration

The mileage data feeds into QuickBooks Online.

QuickBooks mileage tracker is fully integrated with QuickBooks Online, ensuring that mileage data feeds directly into your financial records.

IRS-compliant mileage reports

QuickBooks Online mileage tracker creates detailed mileage reports.

The automatic mileage tracking app will generate mileage reports that comply with IRS requirements. These reports include the date of the logged drive, the vehicle, the total miles driven, and the total tax deduction.

Advantages of using QuickBooks Online mileage tracker

Increased accuracy: The QuickBooks Online app is designed to track mileage automatically. Automated tracking provides accurate data for tax and reimbursement purposes.

Time efficiency: The need for manual trip logging is eliminated, freeing up time for other business activities.

Financial insight: The QuickBooks Online mileage tracker helps users understand their spending patterns and make better financial decisions by providing a clear picture of travel expenses.

Potential limitations

Dependency on technology: The mileage tracker's effectiveness depends on your smartphone's GPS function, which might not work well in areas with poor signal.

Battery and data usage: Continuous use of GPS can drain the phone’s battery quickly and consume significant data.

Doesn't display the route: It doesn't show the route you took; it only shows the start and end points.

Auto tracking also logs personal miles: This can be a bit of a headache if you only want to track business mileage.

Sub-users: The QuickBooks Online mobile app doesn't allow for the addition of unlimited free sub-users to your account.

Cost-effectiveness

QuickBooks Online mileage tracker is included within various subscription levels of a QuickBooks Online account, with prices starting at approximately $15 per month.

Shoeboxed vs QuickBooks Online mobile app

Shoeboxed and QuickBooks Online offer mileage tracker solutions but cater to different needs and preferences.

Shoeboxed mileage tracker app

Features: Shoeboxed offers a more hands-on system to track mileage, integrated seamlessly with its receipt scanning and expense management tools, resulting in the ultimate expense management system.

Pros:

Control and privacy: A more hands-on approach to tracking mileage allows users to control when and what they log in, offering privacy from constant GPS tracking.

Trip details: Trip details are editable; you can add notes describing the drive’s purpose.

Auto-categorized: Miles are turned into receipts for easy expense reporting and auto-categorized.

Accessible: Filter options for effortless searches.

Expense reports: Expense reports have images of receipts attached for employee reimbursement or your accountant.

Magic Envelope: Magic Envelope service lets independent contractors or employers outsource receipt scanning for parking, tolls, and other expense receipts.

Integrated expense management: Direct integration with Shoeboxed’s receipt management system creates a comprehensive record of travel expenses.

IRS compliance: Ensures all logs are IRS-compliant, which is crucial for tax purposes.

Integrates with QuickBooks: Shoeboxed users can have the best of both worlds since Shoeboxed seamlessly integrates with QuickBooks.

Digitize any document: In addition to receipts and miles, users can keep digital records of business documents, such as business cards, licenses, and permits.

Unlimited free sub-users: You can add unlimited free sub-users to your account.

Cons:

There is no way to automatically track mileage, which makes it easier to separate personal from business trips.

Pricing: The basic plan costs around $18 monthly, including mileage reports and tracking access.

QuickBooks mileage tracker

Features: The QuickBooks Online mobile app offers an automatic mileage tracking system that uses GPS on the user’s smartphone.

Pros:

Automation: Designed to automatically track mileage.

Integration with accounting: Seamless integration with QuickBooks Online accounting tools aids in comprehensive financial management.

High accuracy: GPS tracking minimizes human error and provides precise mileage records.

Cons:

Privacy concerns: Constant GPS tracking might raise privacy issues for some users.

Battery and data usage: Continuous GPS usage can quickly drain the phone's battery and consume significant data.

Less control over data with automation: Automation doesn't give users complete control over what is recorded and when.

Pricey: Pricey if you're just going to use it as a mileage tracker app.

Pricing: Included within QuickBooks’ Online subscription plans, starting from approximately $15 per month for basic features, including mileage tracking.

Comparison overview

Target audience:

Shoeboxed is ideal for individuals and small business owners who prefer complete control over their records and want a robust expense management system integrated with mileage tracking.

QuickBooks mobile app appeals more to those who value automation and are already using or plan to use QuickBooks Online for comprehensive business accounting.

Ease of Use:

Shoeboxed allows for easy hands-on management, which might appeal to users who are meticulous about their logs or who want more tailored data. The Magic Envelope also makes it easy for drivers to keep up with their receipts and outsource receipt scanning.

QuickBooks provides a "set it and forget it" solution to automate mileage tracking, which can make it more difficult to separate business mileage data from personal.

Accuracy and reliability:

Shoeboxed offers a more hands-on approach, which gives users more control over their data and allows them to tailor it more to their needs.

QuickBooks uses GPS to provide accurate travel logs automatically.

Cost:

Both services are priced similarly at their entry levels but offer different features beyond mileage tracking, with Shoeboxed offering a comprehensive approach to expense management.

Frequently asked questions

Will QuickBooks track mileage?

QuickBooks tracks mileage in the QuickBooks Online mobile app or QuickBooks self-employed.

With Shoeboxed, is mileage tracking an additional fee?

No, mileage tracking is not an additional fee with Shoeboxed. It's included with Shoeboxed's other features, making Shoeboxed a comprehensive expense management platform.

In conclusion

Choosing between Shoeboxed and a QuickBooks Online account for mileage tracking depends mainly on your company and specific needs—whether you prioritize a more hands-on approach, control, and comprehensive integration platform for expense reporting or prefer automatic tracking integrated with other accounting features.

Both platforms offer robust solutions, but your particular business operations, privacy preferences, and travel volume will dictate the most suitable option.

Caryl Ramsey has years of experience assisting in different aspects of bookkeeping, taxes, and customer service. She uses a variety of accounting software for setting up client information, reconciling accounts, coding expenses, running financial reports, and preparing tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports, including IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports, and more—with Shoeboxed.

Try Shoeboxed today!