As an independent contractor, you have to dot your i’s and cross your t’s in every aspect of your business in order to stay compliant with all the rules and regulations of being self-employed.

Invoices are one piece of the puzzle that’s important to get right.

If you’re a new freelancer or independent contractor, we’ve got you covered! We’ll discuss everything you need to know about creating invoices and share the best free invoice templates that you can download and begin using right away.

Who can use contractor invoice templates?

An independent contractor is anyone who works with another business or takes on clients without by employed by them.

That means if you’re a freelance writer, construction contractor, gardener, architect, roofer, or anyone else under the sun providing goods or services as a self-employed entity, you can use these contractor invoice templates.

What should be on a contractor invoice?

An independent contractor invoice should include:

A header identifying the document as an invoice, along with the invoice number and date.

Your business information including your name, company address, business logo, and contact information.

The customer’s name, address, and contact information.

The service you provided and the goods required to complete that service, along with the amounts and number of hours worked.

The total amount due by the customer and payment terms including acceptable payment types, payment deadlines, flat rate fees, late fee policies, etc.

How to generate invoices for clients, TheBuffNerds

5 best free contractor invoice templates in 2023

Now that you know the key points of invoicing as an independent contractor, let’s explore the 5 best free contractor invoice templates that you can download and use right away!

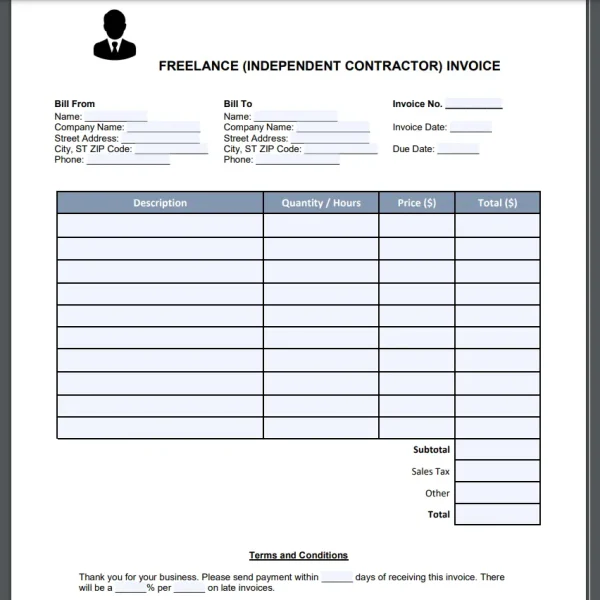

1. eForms Freelance (Independent Contractor) Invoice

eForms Freelance Invoice Template

The eForms Freelance Invoice is a free, editable template that’s downloadable as a PDF or Word document.

This contractor invoice template includes everything you need to provide to your clients and keep for your records including company and customer info, invoice number and invoice date, due date, description of the goods or services provided with amounts, sales tax, total amount, and terms and conditions.

The second page of the eForms Invoice lists payment types including cards, bank transfers, and PayPal, all of which are editable to include or exclude various payment types.

2. Invoice Simple General Contractor Invoice Template

Invoice Simple free template

This contractor invoice template from Invoice Simple is free to download, simple to customize with your own logo, and includes all of the information you need to request payment from your customers.

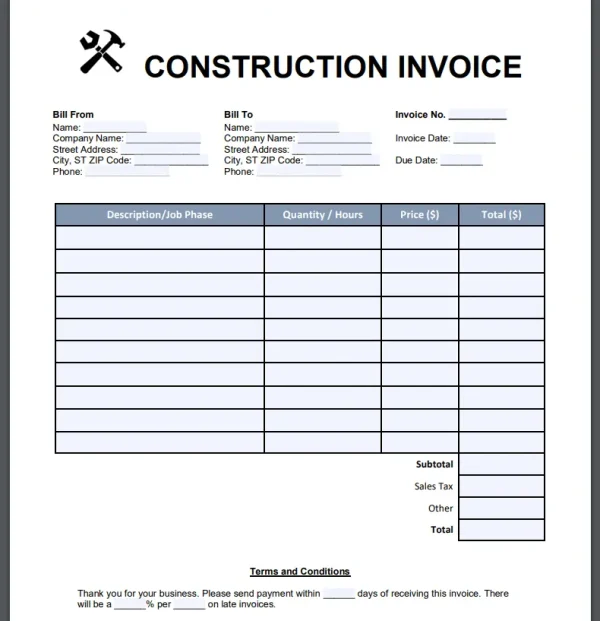

3. eForms Construction Invoice Template

Construction invoice template

If you’re a contractor looking for a construction invoice template, this one’s for you!

Specify the description of the job or project phases, the hours spent on labor, the total cost, terms and conditions, and more with this free downloadable template.

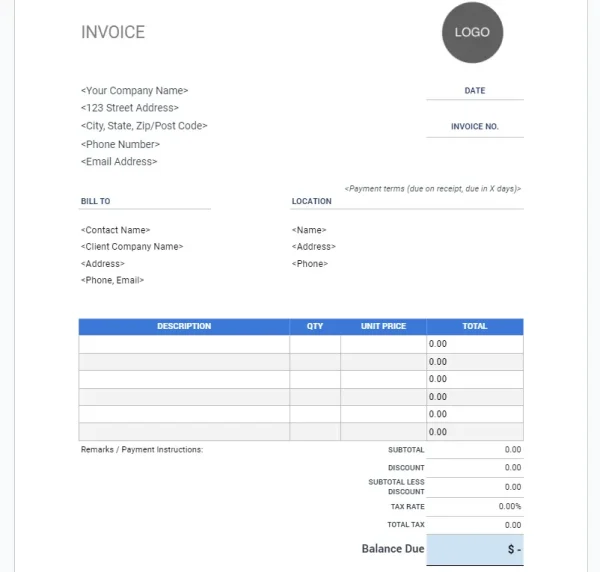

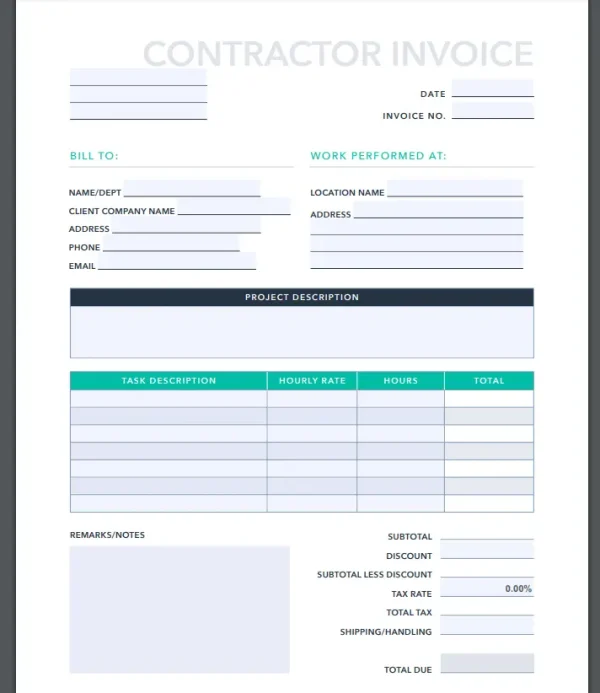

4. Hubspot Contractor Invoice Template

Hubspot Contractor Invoice Template

This professional contractor template is brought to you by Hubspot.

Include your business info, the customer’s info and location, task description, hourly rate, and more in this colorful, sleek downloadable.

Available for download in PDF and Excel.

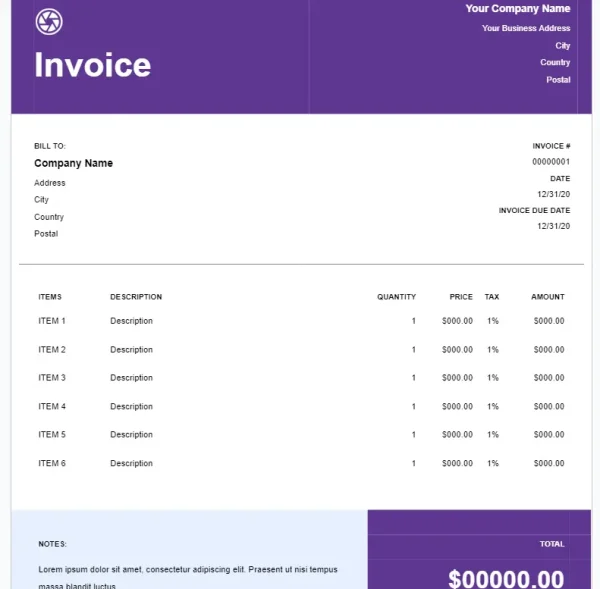

5. Wave Accounting PDF Invoice Template

Wave invoice template

Another professional invoice template with a modern look.

This template includes everything you and your customers need at the end of a project, including items, description, quantity, price, tax, amount, and more.

Available for download on Google Docs, Google Sheets, Word, PDF, and Excel.

You may be interested in: Bookkeeping for Independent Contractors.

What are the best invoice generator options?

Invoice generators are free online tools that you can use to create invoices on the fly.

Here’s a list of the best options:

Invoice Generator– A quick, easy, and customizable invoice generator that you can use for free.

Invoices Simple– Customize free invoice templates with colors, online payments and acceptable payment types, taxes, discounts, photos, and more.

Invoice Maker– A simple, free invoice generator without all the bells and whistles. Quick and to the point!

Invoice Home– Choose from various templates to create free invoices for your clients.

Though not as comprehensive as invoicing software, these invoice generators are easy to use and get the job done.

What is the best invoicing software?

Invoicing software implements various aspects of your business financials into one system. Below are brief overviews of the best invoicing software options.

1. Freshbooks – Most user-friendly

FreshBooks invoicing homepage

In our experience, FreshBooks is the most user-friendly option for independent contractors that aren’t familiar with accounting.

FreshBooks combines accounting, payroll, time tracking, expenses, mileage, projects, estimates, and more into one comprehensive software suitable for small business owners.

The invoices are customizable, can be set as recurring, and you can even request deposits and get your bill paid directly through Freshbooks (which links to your bank account).

Pricing:

Lite: $8.50/month for the first 3 months, then $17/month.

Plus: $15/month for the first 3 months, then $30/month.

Premium: $27.50/month for the first 3 months, then $55/month.

Select: Customized pricing.

2. QuickBooks – Best for scalability

QuickBooks is an accounting software with invoicing features

QuickBooks is another popular, all-in-one accounting and invoice solution for a contractor business or general contractors.

We found that the invoicing feature is easy to use, highly customizable, and you can use QuickBooks Time to add billable hours automatically to your invoice.

QuickBooks invoicing also alerts you whenever customers view and pay your invoices.

Pricing:

Simple Start: $9/month for the first 3 months*, then $30/month.

Essentials: $16.50/month for the first 3 months*, then $55/month.

Plus: $25.50/month for the first 3 months*, then $85/month.

Advanced: $60/month for the first 3 months*, then $200/month.

Add payroll for an additional cost.

30-day free trial.

*As of this review, plans are 70% off for the first 3 months. Discounts may change.

3. Zoho Invoice – Best for freelancers on a budget

Zoho Invoice homepage

Zoho Invoice is the best invoicing software for freelancers and small businesses on a tight budget.

We liked that it’s completely free to use with customizable templates, recurring billing, payment reminders, and more.

Zoho also offers features for creating quotes, time tracking, expense management, and much more.

Price: Free.

BONUS: Shoeboxed – Best for expense tracking and digital backups

Shoeboxed has been trusted by over 1 million businesses to organize expenses and digitize documents

Though Shoeboxed isn’t technically an invoicing software, it still has some helpful features that can assist your money management process!

Shoeboxed is a receipt-scanning app that lets you snap photos of your business receipts on the go, categorize and filter your expenses by project or customer, create expense reports for tax time, and keep a digital record of your invoices.

Every receipt you scan is automatically categorized under 15 editable tax categories, which you can then further customize with tags like the client or project name.

This software is a great way to keep up with the money you spend on a project and safely store backups of all of your important business-related documents.

With Shoeboxed’s Magic Envelope service, you can mail your receipts, invoice copies, contracts, and more to be scanned and uploaded into your account.

You can even add an unlimited number of free sub-users to your account to add receipts, invoice details, and other documentation for a project, or your accountant to review your expenses at tax time.

Pricing:

Start Up: $22/month OR $18/month (billed annually) for unlimited users + Magic Envelope service.

Professional: $45/month OR $36/month (billed annually) for unlimited users + Magic Envelope service.

Business Plan: $67/month OR $54/month (billed annually) for unlimited users + Magic Envelope service.

Starter Plan: $4.99/month for unlimited users (Digital Only plan. Doesn’t include Magic Envelope).

Light Plan: $9.99/month for unlimited users (Digital Only plan. Doesn’t include Magic Envelope).

Pro Plan: $19.99/month for unlimited users (Digital Only plan. Doesn’t include Magic Envelope).

Break free from paper clutter ✨

Use Shoeboxed’s app and scanning service to scan receipts and organize your wallet and office. Try free for 30 days!

Get Started TodayInvoicing mistakes to avoid

If you’re new to the world of independent contractors, there are a few mistakes you’ll want to keep an eye out for that can have a negative impact on your budding business.

1. Not keeping a backup

You’ll always want to keep a copy of the invoices you send to your customers as proof of payment requested and goods or other services rendered.

This not only keeps your records transparent, but it also helps your case in the event that a customer claims to not have been sent an invoice or that they haven’t received the goods or services from your business.

We recommend going digital with all of your invoice copies, as you’re less likely to lose digital documents, they’re easier to organize, and you can reduce the paper clutter you have in your office.

Use Shoeboxed to digitize and store your invoice copies

Shoeboxed is a receipt-scanning app and service, but it’s not only good for receipt scanning and management!

Aside from receipt-scanning, Shoeboxed also offers a service called the Magic Envelope.

When you choose a Shoeboxed plan that includes the Magic Envelope, you’ll receive a postage-pre-paid envelope to mail your paper copies of invoices in.

Shoeboxed’s Magic Envelope is a convenient way to outsource your receipt and document scanning.

Once the Magic Envelope arrives at Shoeboxed’s facility, each invoice will be scanned, human-verified for accuracy, and uploaded digitally to your account.

This is a convenient way to digitize your invoices without having to lift a finger, and you’ll never have to worry about losing a copy again!

If you need to find a specific invoice, you can filter through your backlog by date, envelope, or user.

You can even export your invoices and share them with customers, business partners, or whoever else might need a copy.

2. Delaying invoicing

It’s best to invoice your customers as soon as you’ve completed the work.

Not doing so could result in a handful of problems, from slowing down your income stream to creating an environment in which your customers don’t prioritize paying you for your work.

3. Incorrect or missing information

Your invoices should be precise and have everything a customer needs to recognize your business, get in touch with someone if needed, and know exactly what they’re paying for and how much.

According to Zoho, incorrect invoice information can even “result in payment disputes and … discredit a business.”

4. Not providing multiple payment options

Not all of your customers will pay with a credit card, cash, or PayPal.

You’ll want to provide multiple payment options for your customers so you can make the process more convenient for your clients and promptly receive compensation.

5. Sneaking in hidden fees

If there’s one surefire way to hurt your business’s reputation, it’s by including hidden fees on your invoices.

Never blindside your customers with inconspicuous fees. Honesty is the best policy and will ensure happy, returning customers.

Frequently asked questions

Do I need an invoice from a 1099 contractor?

Yes. If you receive services, materials, or goods from a 1099 contractor, you should receive an invoice with the business name and information, the goods or services provided, and the total amount due.

How do I write a self-employed invoice?

If you’re self-employed, your invoices should include an original invoice number and date, your business name, address, and contact information, the customer’s name and address, the goods or services provided, the cost of each good or service, and the total amount.

Final thoughts

Whether it’s for a construction project, blog posts, or landscaping, an independent contractor invoice template can give you a professional appearance and ensure project transparency and prompt payment for your work.

These templates will help you set foot on the right track and software like Shoeboxed, FreshBooks, QuickBooks, and Zoho can take your accounting, receipt organization, and invoicing to a new level as your business grows.

Hannah DeMoss is a staff writer for Shoeboxed covering organization and digitization tips for small business owners. Her favorite organization hack is labeling everything in her kitchen cabinets, and she can’t live without her mini label maker machine.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!