If you’re looking for a flexible way to make money on the side or want to take the plunge into self-employment, Instacart can be a great way to do that.

But when you shop for Instacart, you technically work for yourself—and when you work for yourself, you’re responsible for your taxes and deductions.

Keeping a log of the miles you drive shopping for Instacart can help you accurately report on your income and reduce your tax liability.

In this guide, we review the best Instacart mileage tracker apps and answer common questions from Instacart shoppers!

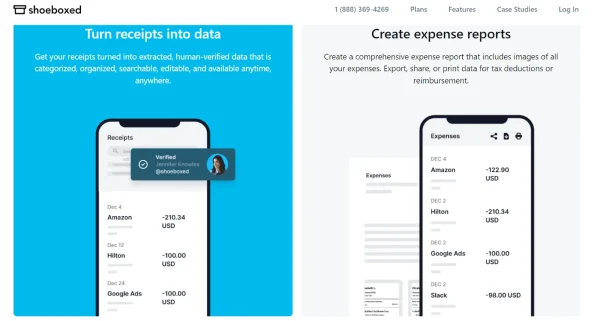

1. Shoeboxed – Best for receipt and miles tracking

Shoeboxed is trusted by over 1 million individuals and businesses to track miles and expenses.

When you’re darting back and forth between batches, the last thing you want is to fiddle with a clunky mileage tracker.

Shoeboxed’s mileage tracker makes manually tracking your Instacart mileage easier than ever.

After you sign up for Shoeboxed, you can start tracking miles in seconds:

Open the Shoeboxed app.

Tap the “Mileage” icon.

Click the “Start Mileage Tracking” button.

And drive!

Whenever you start a trip, Shoeboxed tracks your location and miles and saves your route as you drive.

As you make stops at stores and customer locations, you can drop pins to make tracking more precise.

At the end of a drive, you’ll click the “End Mileage Tracking” button to create a summary of your trip. Each summary will include the date, editable mileage and trip name, and your tax deductible and rate info.

Click “Done” to generate a receipt for your drive and get a photo of your route on the map. Shoeboxed will automatically categorize your trip under the mileage category in your account.

Track mileage with Shoeboxed 🚗

Track mileage using your phone’s built-in GPS for unmatched ease and accuracy. Expense reports don’t get easier than this! 💪🏼 Try free for 30 days!

Get Started TodayReceipt capture, advanced search, and expense reports

Example of a CSV expense report from Shoeboxed

Crowned the “#1 best receipt tracking app” of 2024 by Forbes, and given the Trusted Vendor and Quality Choice awards by Crozdesk, Shoeboxed is first and foremost a receipt management app.

So not only can you claim deductions with the miles you log using Shoeboxed, but you can also write off any Instacart-related expenses thanks to Shoeboxed’s receipt features.

Simply snap photos of the receipts you get from parking, tolls, insulated bags, and vehicle expenses incurred while working and Shoeboxed will digitize and automatically organize them under 15 tax categories.

The tax categories are editable; you can add tags and descriptions for each expense to further categorize your purchases.

Shoeboxed also has advanced search and filters so you can sort and find receipts based on date, vendor, payment type, and more.

When it’s tax season, you can use Shoeboxed’s expense reporting feature to create a detailed report of your Instacart expenses (including miles) to give to your accountant.

Shoeboxed’s expense reports come with receipts attached so you always have proof of purchase for your business expenses.

The Magic Envelope and how it benefits Instacart shoppers

Outsource your receipt scanning with the Magic Envelope

If you’re in a big city, you probably generate a lot of receipts from parking and tolls.

These expenses aren’t reimbursed by Instacart, but they are tax deductible—and the last thing you want to lose is a tax receipt.

With Shoeboxed’s Magic Envelope, you can outsource your receipt scanning without worrying about losing a receipt again.

When you buy a plan that includes the Magic Envelope, Shoeboxed will send you a postage-pre-paid envelope each month for you to mail your receipts in.

Once your receipts reach Shoeboxed’s scanning facility, they’ll be scanned, human-verified, and uploaded to your account under the tax categories (or specific categories of your choosing).

Let Shoeboxed do the scanning for your when you send your receipts with the Magic Envelope

Break free from manual data entry ✨

Use Shoeboxed’s Magic Envelope to ship off your receipts and get them back as scanned data in a private, secure cloud-based account. 📁 Try free for 30 days!

Get Started TodayPros:

Easy-to-use Instacart mileage tracker.

Mileage tracker saves your route as you drive.

Edit your trip details.

Miles are turned into receipts for tax reporting and auto-categorized under mileage.

Filter your receipts for mileage and other business expenses to make tax time easier.

Snap photos of receipts for expenses without stopping the mileage tracker.

Shoeboxed’s Gmail Receipt Sync grabs all receipt emails and sends them to your account for automatic processing! These receipts are then labeled as Sent to Shoeboxed in your Gmail inbox.

Organized PDF and CSV file expense reports with images of receipts attached.

Integrates with QuickBooks.

Outsource your receipt scanning with the Magic Envelope.

Add an unlimited number of free sub-users to your account (such as your accountant).

Cons:

Mileage tracker is manual only, so the app won’t automatically log your drives, but this makes it easier to separate personal from business trips!

Pricing:

Start Up – $22/month OR $18/month (billed annually) for unlimited users + Magic Envelope service.

Professional – $45/month OR $36/month (billed annually) for unlimited users + Magic Envelope service.

Business Plan – $67/month OR $54/month (billed annually) for unlimited users + Magic Envelope service.

Starter Plan – $4.99/month for unlimited users (Digital Only plan. Doesn’t include Magic Envelope).

Light Plan – $9.99/month for unlimited users (Digital Only plan. Doesn’t include Magic Envelope).

Pro Plan – $19.99/month for unlimited users (Digital Only plan. Doesn’t include Magic Envelope).

Visit Shoeboxed’s pricing page to learn more about what all of the Digital + Magic Envelope plans offer.

NOTE: The Start Up, Professional, and Business plans are only available on desktop. The Starter, Light, and Pro plans are available on the Shoeboxed mobile app only.

2. Everlance – Best for multiple delivery gigs

Everlance app, Apple App Store

Everlance is a DoorDash partner that lets delivery drivers track Instacart mileage and the miles they spend working for other companies, like Lyft, Uber, and Grubhub.

Drivers can choose to track their miles manually or automatically. Everlance uses Google Maps to track your location so your routes are always accurately recorded.

The biggest downside to Everlance is that you only get 30 free trips with the free version, so you’ll have to upgrade to Premium pretty quickly.

Expense tracking and taxes

With Everlance Premium, you’ll not only be able to track your mileage, but you’ll also get access to expense tracking and tax help.

To track your expenses with Everlance, just sync your bank or card to your account or manually add an expense with a photo of the receipt.

As far as taxes go, Everlance calculates the estimated tax deductions for the miles you’ve driven and you can create expense reports for your accountant during tax season.

Pros:

Automatic and manual tracking.

Classify drives as personal or work-related.

Keep track of your business expenses and upload photos of receipts.

Get mileage deduction estimates.

Generate expense reports for tax time.

Cons:

Only 30 free trips without the Premium version. Other apps track unlimited miles for free.

Receipt-scanning leaves a lot to be desired.

Pricing:

Free.

Premium: $5/month (billed annually).

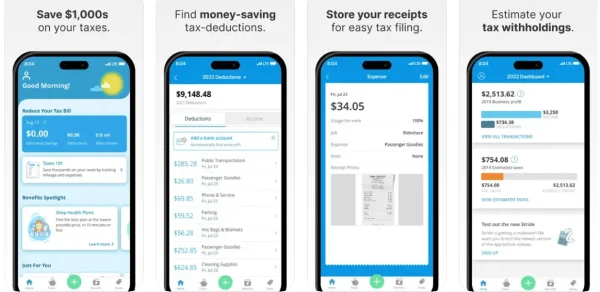

3. Stride – Best free mileage tracker

Stride app, Apple App Store

Stride is a free mileage and expense tracker that we couldn’t help being impressed with.

Stride is easy to navigate and starting and stopping trips is a breeze. Though Stride doesn’t offer automatic tracking, drives start and end with a single tap.

After each drive, Stride calculates your approximate tax deduction and records the time you spent delivering for Instacart.

Tax prep and resources

One of our favorite features about Stride’s mileage tracker app is that it offers resources to help Instacart drivers find health, dental, vision, and life insurance.

These resources can be especially helpful for those who want to work as an independent contractor long-term.

Stride also gives its users tax preparation help to make tax season less stressful.

Receipt scanning

Besides mileage tracking, Stride also allows you to track your expenses with receipt capture.

Every business receipt you photograph comes with editable job and expense fields and a place to add notes about the purchase.

Our only complaint is that the receipt-scanning function isn’t very customizable and the features are basic compared to other apps, like Shoeboxed.

Pros:

Track mileage for Instacart for free.

Find insurance plans that meet your needs.

Estimated tax deductions on your miles.

Link your bank account and find write-offs for expenses.

Simple start-and-stop tracking.

Cons:

No automatic mileage tracking.

The receipt scanning feature isn’t highly customizable.

Pricing: Free app.

4. Gridwise – Best for valuable insights

Gridewise app, Apple App Store

Gridewise is a free GPS mileage tracking app with delivery drivers in mind.

Not only can you get accurate reports on each of your deliveries, but you also receive insights into your income, the hottest locations to work, and the most active shopping times so you can maximize your earnings.

Gridewise also has features to prepare you for filing taxes, help you save money on gas, receive rewards, and advanced insights with the paid version.

Pros:

The free version has everything you need to log your miles.

Automatically track mileage (unlimited miles).

Insights into your income and expenses.

Find popular locations and times for grocery delivery.

Cons:

The paid subscription may have too many unnecessary features for an Instacart shopper (better for rideshare drivers).

Only works with Instacart and other delivery companies, so you can’t log the miles you drive for another business.

Pricing:

Free app.

Get more out of the app for $9.99/month or $95.99/year (it’s tax-deductible!)

5. QuickBooks Self-Employed – Best for independent contractors

QuickBooks Self-Employed app, Apple App Store

QuickBooks Self-Employed is an all-in-one tracking and accounting solution that full-time independent contractors can use for:

Receipt and expense tracking and organization.

Tax deductions.

Invoices.

Payments and bank transfers.

Mileage tracking.

QuickBooks’ mileage tracker

QuickBooks’ mileage tracker is automatic so when you start driving, QuickBooks automatically tracks and stops your trip when you idle.

After each drive, you’ll get an estimate of potential mileage deductions from your trip.

According to QuickBooks, “QuickBooks Self-Employed users have found billions in potential tax deductions by using this automatic mileage tracker.”

Pros:

Automatic mileage tracking app.

Calculates mileage deductions.

Take photos of your receipts and track expenses.

All-in-one solution for self-employed bookkeeping.

Cons:

Not the most budget-friendly option for part-time shoppers.

A lot of unnecessary features if you’re just looking for mileage-tracking apps.

Pricing:

Self-Employed: $15/month.*

Self-Employed Tax Bundle: $25/month.*

Self-Employed Live Tax Bundle: $35/month.*

*Save 50% on your first 3 months when you sign up.

See also: 4 Best Uber Mileage Tracker Apps for Logging Business Miles

Can I claim mileage for Instacart?

Instacart shoppers are considered independent contractors, which means they can lawfully claim mileage for Instacart on their taxes.

Since shoppers are technically self-employed, they must provide proof of each business expense they make and the miles traveled for work in order to claim deductions.

A mileage log with all of the details of your trips is necessary for writing off miles while receipts and invoices can be used as proof for business-related expenses.

Does Instacart track mileage?

The Instacart shopper app doesn’t provide shoppers with a daily or weekly review of the miles they drive. Instead, miles traveled are recorded under completed batches.

Instacart only tracks the miles shoppers drive:

Between grocery stores to fulfill an order.

From the grocery store to the customer’s home.

Instacart does not track the miles you drive from your house to the store.

Does Instacart pay for mileage?

While Instacart factors in miles to determine how much shoppers earn for a grocery order, Instacart does not offer mileage reimbursement to shoppers.

Instacart shoppers are considered independent contractors, so they essentially work for themselves.

This means that drivers are responsible for any vehicle-related expenses as well as calculating relevant tax deductions related to miles.

Why should I track my Instacart mileage?

Tracking the miles you drive with Instacart reduces your tax liability.

Though Instacart uses miles to determine how much a delivery pays, Instacart shoppers aren’t actually reimbursed for the miles they drive.

Tracking mileage is essential for reducing your tax liability and determining your vehicle’s depreciation so you can get a more accurate picture of how much you’re making with Instacart.

When you don’t track Instacart mileage you end up owing more money to the government, reducing your take-home pay unnecessarily.

TIP: Use a vehicle depreciation calculator, like this one, to determine your vehicle’s loss in value.

What deductions can I claim for Instacart?

1. Phone expenses

You have to use your phone for Instacart to find batches, message or call customers, make your deliveries, and track your miles.

That means you can write off:

Your phone (if purchased specifically for work).

Phone bills (fully or partially, depending on if you use your phone for personal reasons).

Phone accessories related to your work with Instacart (clips or chargers, for example).

Be sure to save any receipts you get for proof of purchase.

TIP: Use Shoeboxed for an accurate record of your purchase receipts. Shoeboxed can digitize paper receipts or automatically pull e-receipts from your inbox.

2. Insulated courier bags

Insulated bags keep customers’ orders warm or cold during transit.

These bags not only make it more convenient for you to carry orders and protect groceries from spoiling, but they’re also tax-deductible.

3. Tolls and parking

Any toll or parking fees that you pay while working are not reimbursed by Instacart, which makes them tax-deductible.

Keep a record of fees incurred through bank and card statements.

4. Roadside assistance

Roadside assistance is partially tax deductible for the miles you spend working.

If you drive your car for business and personal use, you’ll need to determine the business-to-non-business mileage ratio to find how much of your roadside assistance membership you can deduct from your taxes.

5. Insurance

Health insurance payments are deductible if you meet the following requirements:

You’re self-employed (you work with Instacart or other delivery services full-time).

You have a business profit.

You are unable to be covered by your spouse or an employer.

Learn how to pay less to the IRS with this webinar from Bench. Sign-up to Bench using this link, and get 30% off your first 3 months!

What if I forgot to track my mileage?

If you forgot to track your Instacart mileage, you may think you’ve missed your chance to claim the mileage deduction.

Fortunately, you can claim mileage without having a clear log from the year—you’ll just have to put in extra work for tax season.

If your expenses are audited, you must have documentation that proves the miles you wrote off were for work.

That means you’re going to have to do some digging to find evidence to back up your Instacart miles.

Follow the steps below to get started:

Step 1. Find the days you shopped for Instacart

In the Instacart app, you can find all of your completed batches. Each batch will have the total miles you drove to complete the order.

Make note of how many business miles you drove and the money earned for that day.

TIP: Revisit the previous year’s bank statements to find the money you earned for a batch.

Step 2. Collect evidence to prove your mileage

Evidence includes:

Invoices of deliveries.

Routes from Google Maps or a mileage tracker app.

Income statements from your bank.

Records of completed batches and income from the Instacart app.

Step 3. Create a mileage log

Once you have the miles you drove for Instacart and the documents to prove it, the final step is to create a mileage log.

Your mileage log should detail each day you shopped with Instacart and include the date you shopped, the total miles, why you drove, and the locations.

If you forgot to track your miles during the year, you can still claim the mileage deduction by following these steps.*

*For informational purposes only. Consult a tax professional for advice.

Frequently asked questions

Can I claim mileage for Instacart?

You can claim mileage for Instacart as long as you have the proof to back up your claims. This is where a mileage tracking app or mileage tracking sheet comes in handy. When you track your Instacart mileage with an app, you create a digital log of your miles that’s easy to access and show to the IRS.

How do I track my Instacart mileage?

Mileage tracking apps, like Gridwise, Shoeboxed, and Stride are the best way to track your Instacart mileage and prepare for tax season.

In conclusion

When you need to track mileage for Instacart, our go-to recommendations are Shoeboxed, Gridwise, and Stride for their user-friendly interfaces, accurate tracking, and features that allow you to track your expenses and get the most out of your time.

Hannah DeMoss is a staff writer for Shoeboxed covering organization and digitization tips for small business owners. Her favorite organization hack is labeling everything in her kitchen cabinets, and she can’t live without her mini label maker machine.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!