Managing finances can be challenging for any independent contractor, and Uber drivers are no exception. They face various expenses, from vehicle maintenance and fuel to insurance and taxes.

Accurately tracking these expenses is crucial for understanding actual earnings and tax preparation. An Uber driver expenses spreadsheet is one option for monitoring car expenses. Drivers use it to systematically record their income and operational costs, providing a clear view of their net profit over time.

Here are 4 favorite expense tracking templates for Uber drivers + 1 simple alternative you won't want to miss!

Top 4 free Uber driver expense spreadsheet templates

When looking for tools to manage the financial aspects of ridesharing services, Uber drivers have several options for tracking expenses and income.

Here are 4 free Uber driver expense spreadsheet templates, along with their features and download links:

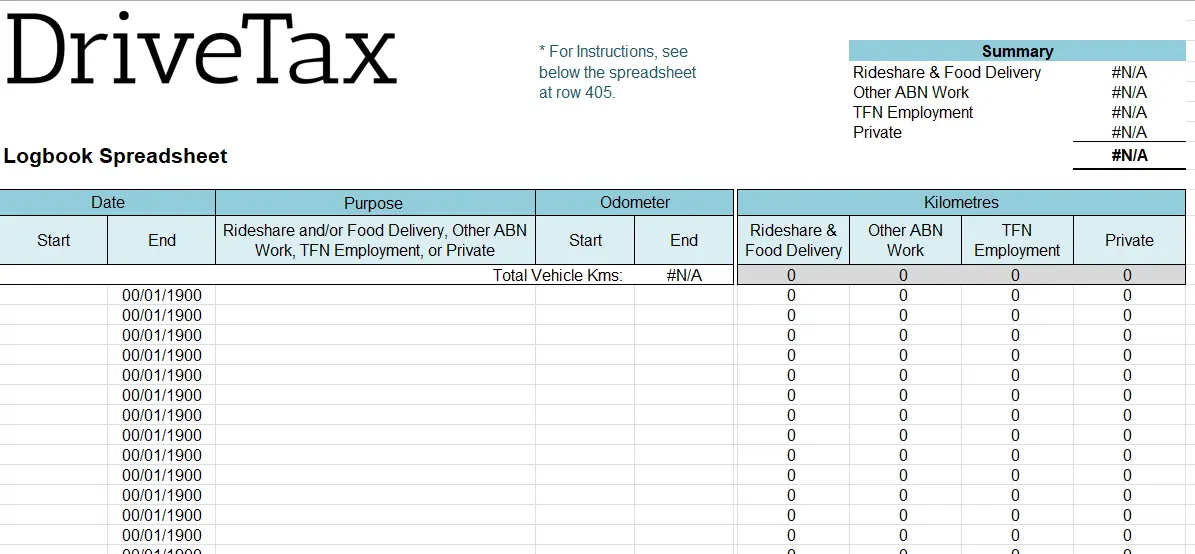

1. DriveTax Australia's Uber spreadsheet for Excel

This free spreadsheet by DriveTax Australia tracks income and expenses, calculates tax, and includes quarterly and annual summaries.

There is a logbook sheet where you can track your mileage and a separate sheet for tracking annual income.

To download the free spreadsheet, input your name and email address, and then they'll email the spreadsheet to you.

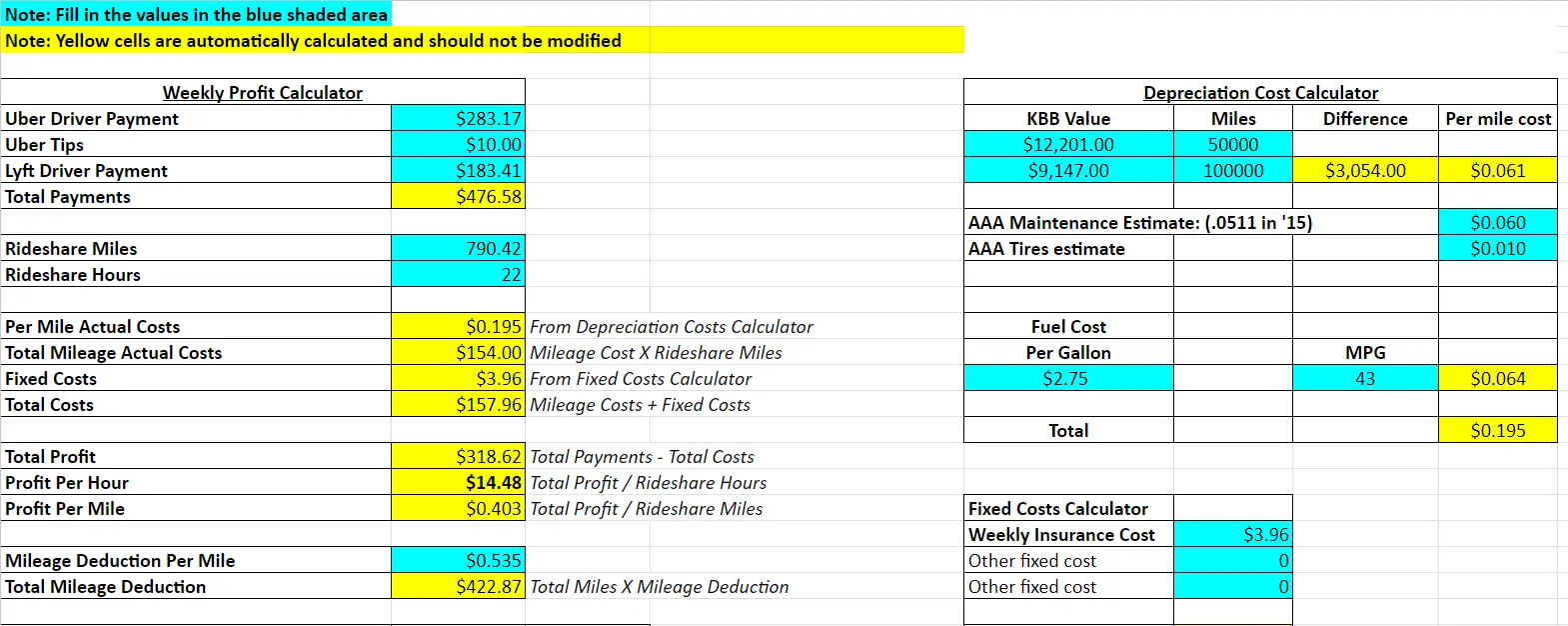

2. The Rideshare Guy’s income and expenses spreadsheet

This income and expenses spreadsheet created by The Rideshare Guy is a Google document spreadsheet but can be downloaded and used in Microsoft Excel.

It includes automatic profit or loss calculation and GST calculation for quarterly BAS, detailed weekly earning tracking, and comprehensive tax expense calculations.

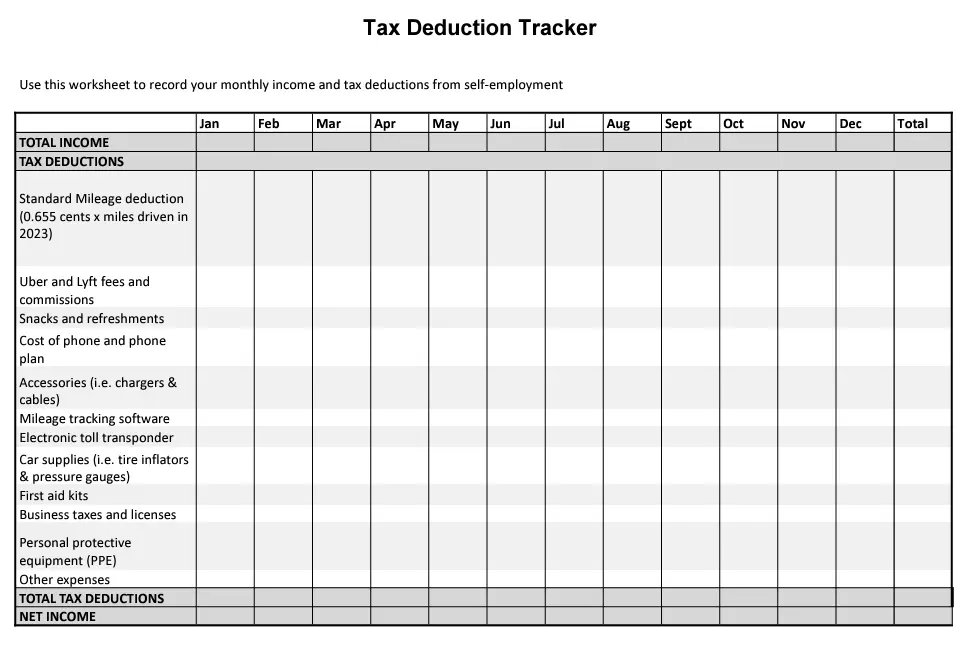

3. Tax Outreach's tax deductions worksheet

Tax Outreach has created a tax deductions worksheet for Uber and other rideshare drivers, available as a PDF.

To use this worksheet, you would include monthly summaries for each deductible category. The second page includes a mileage log for those who use the standard deduction instead of the actual car and truck expenses.

4. Lyft driver record keeping Google spreadsheet by Rideshare Diva

Created for Lyft drivers, but the spreadsheet can be used for Uber drivers.

This is a spreadsheet that helps you track estimated earnings and expenses and includes a week-by-week mileage log.

Make a copy of the file to begin using to track your expenses for your tax return.

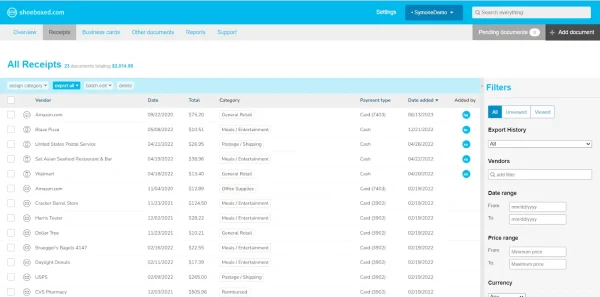

5. Bonus: Shoeboxed, a professional driver's best friend!

Hate spreadsheets? Don’t have time for manual entry? Want an easy alternative?

Rideshare drivers often have many expenses on the road, such as fuel, meals, and maintenance costs.

Keeping track of all these receipts can be a challenge, but with Shoeboxed’s Magic Envelope service, they just need to stuff all their receipts into the prepaid envelope provided by Shoeboxed and send it in.

Shoeboxed’s data entry team will scan, categorize, and organize these receipts digitally.

So, instead of manually entering expense data, Uber and Lyft drivers can spend more time focusing on their primary job!

Here’s how it would work: Keep a Magic Envelope in the seat next to you as you drive. After you fill up for gas or leave that drive-in, slip the receipt into the prepaid envelope. Send the envelope in at the end of the month, and you won’t have to go near a spreadsheet again!

Pros

“Set and forget” expense reporting—use the Magic Envelope to store your receipts, ship at the end of the month, and get them scanned and uploaded to your account.

Accurate mileage tracking can be included in expense reports.

Add multiple users to a single account for FREE.

Importing e-receipts to your Shoeboxed account is as easy as syncing your Gmail with Shoeboxed, using Shoeboxed's special Gmail Receipt Sync feature.

Store digital copies of related documents, such as warranties, contracts, and more.

Integrate with other software, such as QuickBooks, for tax reporting and accounting purposes.

Used and trusted by professional drivers.

Cons

Plans that include the Magic Envelope cannot be purchased through the mobile app.

Price

Plans that include the Magic Envelope start at $18/month, up to $54/month.

30-day free trial.

Note: All annual plans are charged upon sign-up and come with a full money-back guarantee if the plan is terminated at any point within the first 30 days.

Shoeboxed is the only receipt scanner app that will handle both your paper receipts and your digital receipts—saving customers up to 9.2 hours per week from manual data entry!

Hit the road with Shoeboxed 🚗

Stuff receipts into the Magic Envelope while on the road. Then send them in once a month to get scanned. 💪🏼 Try free for 30 days!

Get Started TodayWhat else can Shoeboxed do?

Shoeboxed has been voted as the best receipt scanner app for tax season by Hubspot and given the Trusted Vendor and Quality Choice awards by Crozdesk.

A quick overview of Shoeboxed's award-winning features:

a. Mobile app and web dashboard

Shoeboxed’s mobile app lets you snap photos of paper receipts and upload them to your account right from your phone.

Shoeboxed also has a user-friendly web dashboard to upload receipts or documents from your desktop.

b. Gmail receipt sync feature for capturing e-receipts

Importing e-receipts to your Shoeboxed account is as easy as syncing your Gmail with Shoeboxed, using Shoeboxed's special Gmail Receipt Sync feature.

Shoeboxed’s Gmail Receipt Sync grabs all receipt emails and sends them to your account for automatic processing! These receipts are then labeled as Sent to Shoeboxed in your Gmail inbox.

In short, Shoeboxed pulls the receipt data from your email, including the vendor, purchase date, currency, total, and payment type, and organizes it in your account.

Your purchases will even come with images of the receipts attached!

c. Expense reports

Expense reports let you view all of your expenses in one cohesive document. They also make it simple to share your purchases with your accountant.

Shoeboxed makes it easy to export your yearly expenses into a detailed report. All expenses come with receipts attached.

You can also choose certain types of receipts to include in your expense report. Just select the receipts you want to export and click “export selected.”

d. Search and filter

Call up any receipt or warranty in seconds with advanced search features.

Filter receipts based on vendors, date, price, currency, categories, payment type, and more.

e. Accounting software integrations

Export expenses to your accounting software in just a click.

Shoeboxed integrates with 12+ apps to automate the tedious tasks of life, including QuickBooks, Xero, and Wave Accounting.

f. Unlimited number of free sub-users

Add an unlimited number of free sub-users to your account, such as family members, employees, accountants, and tax professionals.

g. Mileage tracker for logging business miles

After you sign up for Shoeboxed, you can start tracking miles in seconds:

Open the Shoeboxed app.

Tap the “Mileage” icon.

Click the “Start Mileage Tracking” button.

And drive!

Whenever you start a trip, Shoeboxed tracks your location and miles and saves your route as you drive.

As you make stops at stores and customer locations, you can drop pins to make tracking more precise.

At the end of a drive, you’ll click the “End Mileage Tracking” button to create a summary of your trip. Each summary will include the date, editable mileage and trip name, and your tax deductible and rate info.

Click “Done” to generate a receipt for your drive and get a photo of your route on the map. Shoeboxed will automatically categorize your trip under the mileage category in your account.

h. The Magic Envelope

The Magic Envelope service is one of Shoeboxed's most in-demand features, particularly for businesses, as it lets users outsource their receipt management.

When you sign up for a plan that includes the Magic Envelope, Shoeboxed will mail you a pre-paid envelope for you to send your receipts in.

Once your receipts reach the Shoeboxed facility, they’ll be digitized, human-verified, and tax-categorized in your account.

Have your own filing system?

Shoeboxed will even put your receipts under custom categories. Just separate your receipts with a paper clip and a note explaining how you want them organized!

See also: 4 Best Uber Mileage Tracker Apps for Logging Business Miles

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. Try free for 30 days!

Get Started TodayOverview of Uber driver expenses

Tracking expenses is a crucial aspect of managing the finances of an Uber driver. Expenses typically fall into several categories:

Vehicle costs—These include the purchase price, loan interest, lease payments, and depreciation. Additionally, expenses related to maintenance, such as oil changes, tire rotation, and general repairs must be accounted for.

Fuel—A significant variable cost that fluctuates based on the distance driven and fuel efficiency of the vehicle.

Insurance—There may be a need for specialized ride-share insurance, which differs from standard auto insurance in coverage and cost.

Licenses and fees—These encompass the cost of licenses and regulatory fees required to operate legally within service areas.

Equipment—The initial and replacement costs of equipment such as smartphone mounts, chargers, and dash cams.

Miscellaneous expenses—These include cleaning and sanitization products, refreshments for passengers, and other incidental costs that improve the customer experience.

Uber drivers should retain all receipts and maintain a detailed record as they occur. This organized approach aids in accurate profit or loss calculations and is essential during tax season, ensuring every permissible deduction is captured.

See also:

Top Apps for Taxi Drivers to Enhance Efficiency and Earnings

Taxi Receipt: Importance, Format, and How to Manage Receipts

How to create an expense tracking spreadsheet

Many Uber drivers use spreadsheets to capture all relevant expenses that are common for a ride-share service. For example, a spreadsheet may automatically calculate GST to be included in a quarterly BAS summary (Business Activity Statement).

When constructing a spreadsheet to track Uber driver expenses, do the following:

1. Set up sections and categories

Here are some common sections to include in your spreadsheet.

Income—For earnings, including tips and bonuses.

Vehicle expenses—This section encompasses fuel, maintenance, insurance, and lease payments.

Operational costs—Including road tolls and parking fees.

Miscellaneous expenses—Such as snacks and drinks for passengers.

2. Setup columns

Designate columns for dates, descriptions, amounts, and notes. It's advisable to use separate columns for each expense category for clearer tracking.

3. Automate calculations:

Subtotals—Create formulas that compute the sum of expenses for each category.

Profit/loss—Deduct total expenses from income to calculate net profit or loss.

4. Track mileage

Include a section to log miles driven, which is crucial for tax deduction purposes.

If you're looking for a good mileage tracker, consider Shoeboxed. Not only will Shoeboxed scan and save your receipts in an IRS-approved manner, but their app also includes a free mileage tracker!

Track mileage with Shoeboxed 🚗

Track mileage using your phone’s built-in GPS for unmatched ease and accuracy. 💪🏼 Try free for 30 days!

Get Started TodayExpense tracking best practices for rideshare drivers

1. Regularly analyze expenses

A well-structured Uber driver expenses spreadsheet or a receipt management solution like Shoeboxed is an invaluable tool for regularly analyzing expenses.

Expenses related to vehicle operations are usually the most significant outlay. Fuel expense tracking is straightforward—drivers simply log the amount spent each time they fill up. Maintenance can be tracked by recording the services performed—oil changes, new tires, brake services, etc.—alongside their costs.

Insurance costs can vary depending on a driver's location, vehicle type, and driving history. This fixed monthly or yearly expense should be logged as it is invoiced.

Depreciation represents the loss in value of the vehicle over time. While this isn't an out-of-pocket expense, it affects a vehicle's resale value. Depreciation is generally calculated annually.

By analyzing these expenses regularly, a driver can identify potential savings, optimize their spending, and maintain a complete record for tax purposes.

2. Aim to improve profit margins

By diligently monitoring fuel costs, vehicle maintenance and repairs, and other expenses, drivers can analyze which expenses have the most impact and where they could potentially cut costs.

For instance, shopping for more affordable insurance or finding a fuel-efficient route can help them save money.

It is also advisable for drivers to account for depreciation and save for future vehicle replacement or repair, ensuring a more accurate reflection of long-term profitability.

3. Keep records for tax purposes

For accurate tax filing, Uber drivers must maintain comprehensive records. Essential documentation includes income, expenses, and mileage.

Income: Track all earnings, including tips and bonuses. Keep detailed records for each pay period.

Mileage: It's crucial to log every mile driven for business. A driver can utilize the standard mileage deduction rate or actual expenses, but records must be meticulous and unambiguous.

Expenses: Document all business-related expenditures.

Note: Always attach receipts or relevant financial statements for verification or use Shoeboxed to store receipts as IRS-approved scans.

Documentation should reflect the driver's diligence in updating and preserving records in real-time. Maintaining this practice reduces the stress during tax season and maximizes deductions.

Frequently asked questions

What is an Uber driver expenses spreadsheet?

An Uber driver expenses spreadsheet is a tool for tracking rideshare drivers' expenses and income. It's crucial for efficient tax preparation and financial management.

How does one use a spreadsheet to track Uber driving expenses?

One typically enters data such as miles driven, fuel costs, vehicle maintenance, and other work-related expenses.

Is it better to use the standard mileage deduction or track actual expenses?

The better option can vary depending on the individual's situation. For some, the standard mileage deduction simplifies record-keeping and maximizes deductions. Others with high vehicle operating costs might benefit from itemizing actual expenses.

What is the standard mileage rate for 2023?

The standard mileage rate for 2023 is $0.655 per mile, covering gas, repairs, maintenance, and vehicle depreciation.

In closing

Keeping accurate records empowers drivers to track earnings and expenditures, ensuring a clear view of their financial health.

Through diligent record-keeping, one can identify areas for cost-saving, and drivers gain insights into patterns over time.

Effectively categorized expenses can lead to maximized tax deductions, as understood by IRS rules.

Tomoko Matsuoka is managing editor for Shoeboxed, MailMate, and other online resource libraries. She covers small business tips, organization hacks, and productivity tools and software.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!