Being an independent contractor has its perks. You're the boss, setting your own hours and enjoying a level of freedom that employees don’t have. However, it also means taking on the responsibility of handling your own financial matters, such as benefits, taxes, and retirement planning.

According to McKiney’s, American Opportunity Survey, 36% of the workforce or 58 million Americans are independent contractors.

As an independent contractor, you hold the reins of your financial affairs. This sense of empowerment allows you to steer your finances and chart a course for a secure future.

What is an independent contractor?

An independent contractor is self-employed and contracted to provide services to or perform work for another entity, someone not hired as an employee.

This means anyone who uses an independent contractor’s services doesn’t have to provide employee benefits or take out any withholding from their paychecks.

The client only has to issue a 1099-Misc to the contractor if they earned more than $600 during the tax year.

Since independent contractors are not employees and don’t receive employee benefits, they must take the initiative to get health insurance, plan for retirement, and pay their taxes, including payroll taxes.

Why is bookkeeping important for independent contractors?

Independent contractors have to pay self-employment taxes and income tax.

They must track their business expenses to deduct them from their income on their tax return. Proper documentation of these expenses is crucial to taking advantage of various tax deductions during tax filing.

For independent contractors, a robust bookkeeping system is not just a necessity; it’s a lifeline. It ensures that every financial aspect is meticulously tracked, providing a safety net that leaves no room for oversight or surprises.

What accounting method should independent contractors use?

Before filing your tax return, you must choose the correct accounting method. This decision can impact your financial management. By understanding the benefits of each process, you can make an informed decision that’s right for your business.

Here are the two primary accounting methods:

Cash basis. Cash basis records income when it’s received and expenses when paid.

Accrual basis. The accrual basis records income and expenses when they are earned and incurred, respectively. It gives a company a better projection for the future.

How do independent contractors pay their taxes?

Independent contractors are considered a single-member limited liability company (LLC) or a sole proprietor for tax purposes.

Income and expenses are reported on Form 1040 under Schedule C.

The business expenses can offset some of the gross profit and reduce some of the tax liability. Additionally, independent contractors are responsible for their tax payments, including unemployment taxes, unlike employees who have their employer withhold taxes from their wages.

Estimated taxes

Since independent contractors don’t have taxes withheld from their paychecks, they must pay self-employment taxes quarterly.

They also have to pay Social Security and Medicare taxes.

You need to plan for this and set aside money so it’s available before the tax deadline.

Do independent contractors have to track everything?

One of the most critical tasks for an independent contractor is to track every financial transaction.

That means every transaction that brings money in and out of the business account(s).

This is especially important if you get audited.

Accurate financial tracking is particularly beneficial for small business owners, helping them maintain order, handle tax estimates, and ensure they get paid on time.

Here are some examples of income and expenses that most independent contractors track with their bookkeeping system:

Website costs

Accounting software

Internet costs

Phone bills

Client payments

Office rent

Hours they worked on a project

Completed jobs

Paid invoices

Office equipment

Bank transfers

When tracking expenses, the IRS considers a business expense anything necessary and ordinary to the business.

There should be a receipt for every expense and an efficient system for organizing and storing all business receipts.

Since this can be a pain and time-consuming, an excellent option for organizing receipts is to digitize them using a service like Shoeboxed, which digitizes, organizes, and stores the receipts for you.

Don’t combine business with personal expenses

As an independent contractor, you should establish a separate business bank account when tracking expenses and income.

This will separate your business transactions from your personal expenses.

This separation of transactions will make it much easier when tax season comes around or if you get audited.

How can accounting software help independent contractors with bookkeeping?

Accounting software is more than just a tool; it's a trusted ally for independent contractors. It simplifies bookkeeping, making it less time-consuming and more accurate, instilling confidence in your financial records.

Independent contractors are responsible for everything since they are the sole business owner.

Accounting software can at least take some of that responsibility off your plate.

Here are the ways we have found that accounting software helps with bookkeeping:

1. Accounting software gives you more accurate financial records, makes it easier to invoice clients, and tracks unpaid accounts.

2. Accounting software gives you financial reports to make sound business decisions and keeps your financial records organized.

3. Accounting software helps you calculate your tax estimates and makes it easy to reconcile your bank transactions.

4. Accounting software automates and streamlines your data, saving you time and money.

How can you simplify bookkeeping for independent contractors?

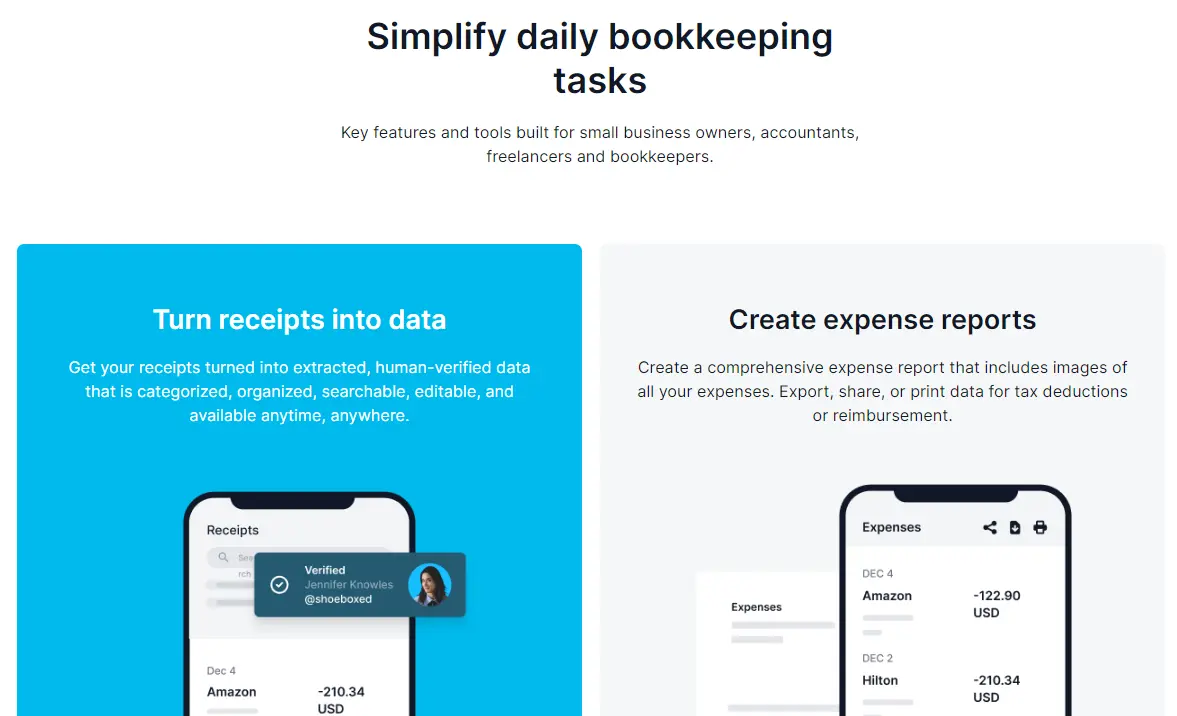

You can simplify bookkeeping for independent contractors by automating document and expense management.

Shoeboxed

Over a million businesses have automated their expense and document management with Shoeboxed.

Shoeboxed is a two-in-one receipt and document scanner.

With Shoeboxed, independent contractors can use an app or outsource their receipt and document management.

Digitizes receipts and documents

Independent contractors have many receipts and documents to keep up with and organize, including the following:

Invoices

Sales receipts

Business expense receipts

Marketing and advertising

Tax and compliance documents

Legal and contractual agreements

Bank and credit card statements

Sales orders

Digitizing these items reduces paper clutter and manual entry.

Mobile app

To digitize, independent contractors can use their mobile devices and Shoeboxed's app to scan and upload receipts and documents to a designated Shoeboxed account.

All receipts and documents are stored in the cloud, so they’re available anywhere, which reduces the risk of lost paperwork.

Magic Envelope service

Or, if you don't have time to keep up with the scanning, Shoeboxed provides a free postage-paid Magic Envelope that independent contractors can fill with batches of receipts and mail to their processing center. They will scan, human-verify, and upload the receipts into your account.

The Magic Envelope conveniently fits on top of your car's dashboard, glove box, or briefcase so that when you are on the road, you can immediately fill it with receipts for gas, supplies, etc., before you can lose a receipt.

Shoeboxed is the only receipt scanner app that will handle both your paper receipts and your digital receipts—saving customers up to 9.2 hours per week from manual data entry!

Hit the road with Shoeboxed 🚗

Stuff receipts into the Magic Envelope while on the road. Then, send them once a month for scanning. 💪🏼 Try free for 30 days!

Get Started TodayOrganizes and categorizes

Once receipts and documents are uploaded, Shoeboxed automatically organizes and categorizes the scanned data into tax or customized categories.

Business owners can create custom tags and categories to suit their bookkeeping needs so they have tailored financial oversight.

Receipts and documents become part of a searchable database so you can quickly find what you need when you need it.

Auto-categorization saves independent contractors time, reduces errors, and helps track spending and manage budgets.

Never lose a receipt again 📁

Join over 1 million businesses organizing & scanning receipts, creating expense reports, and reclaiming multiple hours every week—with Shoeboxed.✨

Get Started TodayGenerates expense reports

Shoeboxed generates detailed expense reports for reimbursements and tax filings.

Integrates with accounting software

Shoeboxed integrates with over 12 apps, including QuickBooks, Xero, and Wave, to automatically synchronize with your accounting software, making bookkeeping and tax time a breeze.

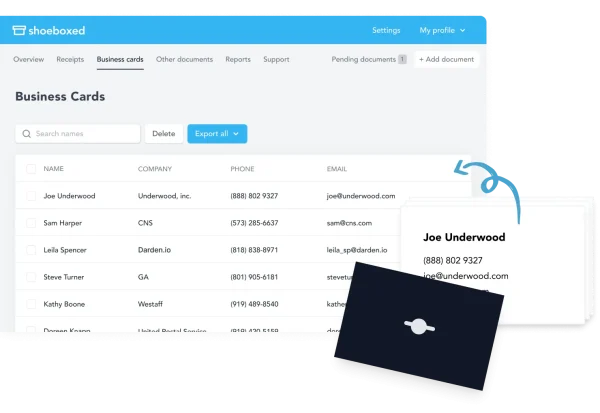

Business card management

Shoeboxed also scans business cards and other documents. It extracts and digitizes the contact information from a business card.

All digitized business cards are stored in a central cloud-based database, making contact information accessible anywhere.

The contact information that was extracted becomes searchable, so you can quickly find specific contacts when needed.

Shoeboxed allows you to export contact information to various CRM systems so all your business contacts are organized and accessible within your preferred customer relationship management tools.

Contacts can also be exported as CSV files and imported into other contact management systems or email clients.

Mileage tracker

Shoeboxed has a mileage tracking feature that logs business trips so you can claim mileage deductions.

Detailed mileage reports can be generated to track and claim mileage deductions.

By leveraging Shoeboxed, independent contractors can streamline their accounting process, save time, ensure accurate financial tracking, and ultimately focus more on their clients.

Stop doing manual data entry 🛑

Outsource receipt scanning to Shoeboxed’s scanning service and free up your time for good. Try free for 30 days!✨

Get Started TodayShould you hire a bookkeeper for your bookkeeping and accounting services?

Most independent contractors start out doing their books.

This is a great way to save cash when starting your business.

As the business grows, more things require your attention, like getting and keeping clients.

Hiring a bookkeeper will give you more time to focus on growing your business. Additionally, business consulting can provide essential bookkeeping services, financial planning, and timely advice to help you grow your business.

Bringing in a CPA is also helpful during tax time. Moreover, business consulting services offer expert advice and support for all business needs, including accounting, bookkeeping, and organizational support, ensuring accessibility, accuracy, and timeliness.

A CPA can review your year-end balance sheet, statement of cash flow, income statement, and other financial records, giving you valuable guidance on what to do going forward.

While it may cost more upfront, it will save you money in the long run.

Frequently asked questions

Do independent contractors need to hire a bookkeeper or accountant for their accounting services?

You don’t have to hire a bookkeeper or accountant, but it is very beneficial when filing and paying your taxes. Filing late or incorrect amounts of taxes can result in penalties and fines.

Can I use QuickBooks as an independent contractor?

Yes. QuickBooks Self-Employed is for independent contractors.

Does the IRS audit independent contractors?

Yes. The IRS audits independent contractors. That’s why it’s important to keep business and personal expenses separate by opening a separate bank account.

In conclusion

A good bookkeeping system is vital if you’re an independent contractor. Organized and up-to-date books will ensure clients are invoiced on time, accounts aren’t sitting around unpaid, bills are paid on time, and you’re meeting your tax obligations. This efficient bookkeeping system generates financial reports to help the business owner make sound decisions about the future.

Caryl Ramsey has years of experience assisting in bookkeeping, taxes, and customer service. She uses various accounting software for setting up client information, reconciling accounts, coding expenses, running financial reports, and preparing tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple receipt capture methods: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad, and Android) to snap a picture while on the go—auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports, including IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports, and more—with Shoeboxed.

Try Shoeboxed today!