Tracking mileage is an essential task for those who use their vehicles for business purposes. Mileage tracker templates in Google Sheets offer a convenient and efficient way to record and calculate miles traveled for work-related activities.

These digital logs simplify the process by providing a structured format. Users can input their data and have calculations done automatically.

The advent of Google Sheets mileage log templates has transformed a traditionally laborious process into a streamlined digital routine. Users can quickly set up their tracker, input trip details, and customize the log according to their specific needs. The templates are designed to handle essential calculations, thus providing accurate results for reporting purposes.

If you're looking for a mileage tracker spreadsheet, we've got you covered. Here are our top picks!

Top free mileage trackers using Google Sheets

Google Sheets offers a variety of free templates to help individuals and businesses track mileage. These templates are designed for individuals to use to record distances traveled for work-related activities, manage expenses, and ensure accurate reimbursement or tax deductions for their vehicle.

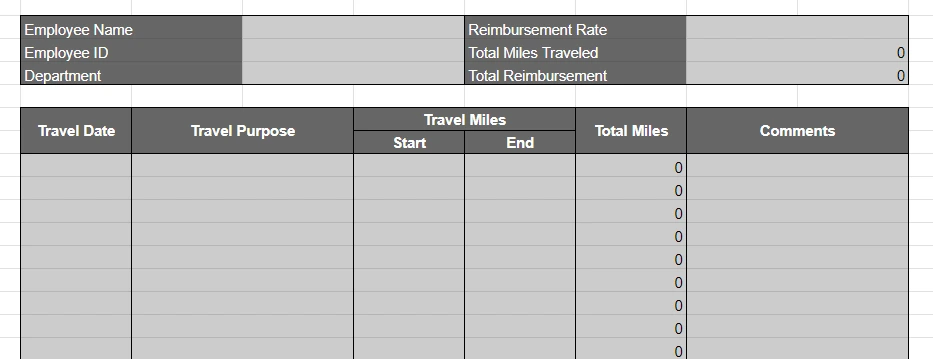

1. Spreadsheet Point Mileage Log Template

This template facilitates mileage tracking for employer reimbursement or tax purposes, resembling traditional ledgers in function. You can track employee name, ID, department, reimbursement rate, travel purpose, travel date, number of miles traveled, etc.

To use this mileage log, you'll be asked to make a copy of the spreadsheet to your Google Drive account.

👉 Download link: Free Mileage Log Template for Google Sheets

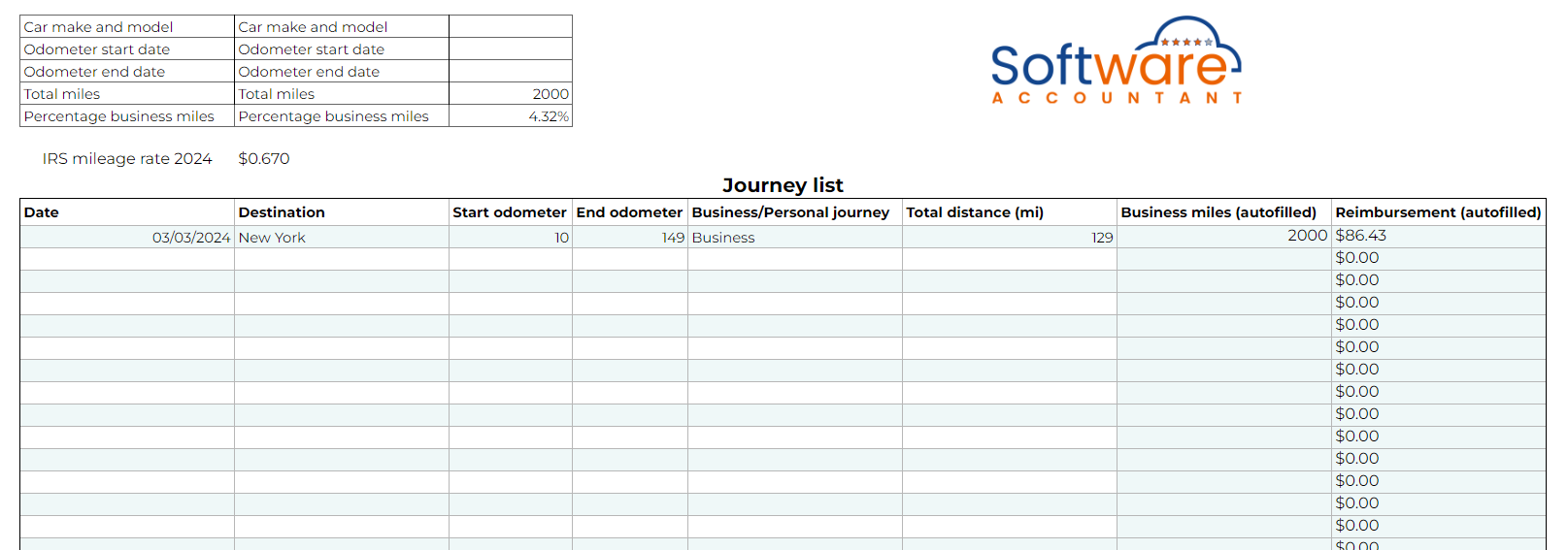

2. Software Accountant Google Sheets Mileage Log Templates

This preformatted spreadsheet is a little brighter then Spreadsheet Point's mileage report. And comes with more details, including car make and model, odometer start date and end date, and a field for the percentage of business miles.

We see this mileage log book being useful for employees who use the same car for both business and personal trips.

👉 Download link (You'll be asked to make a copy): Top Free Google Sheets Mileage Log Templates

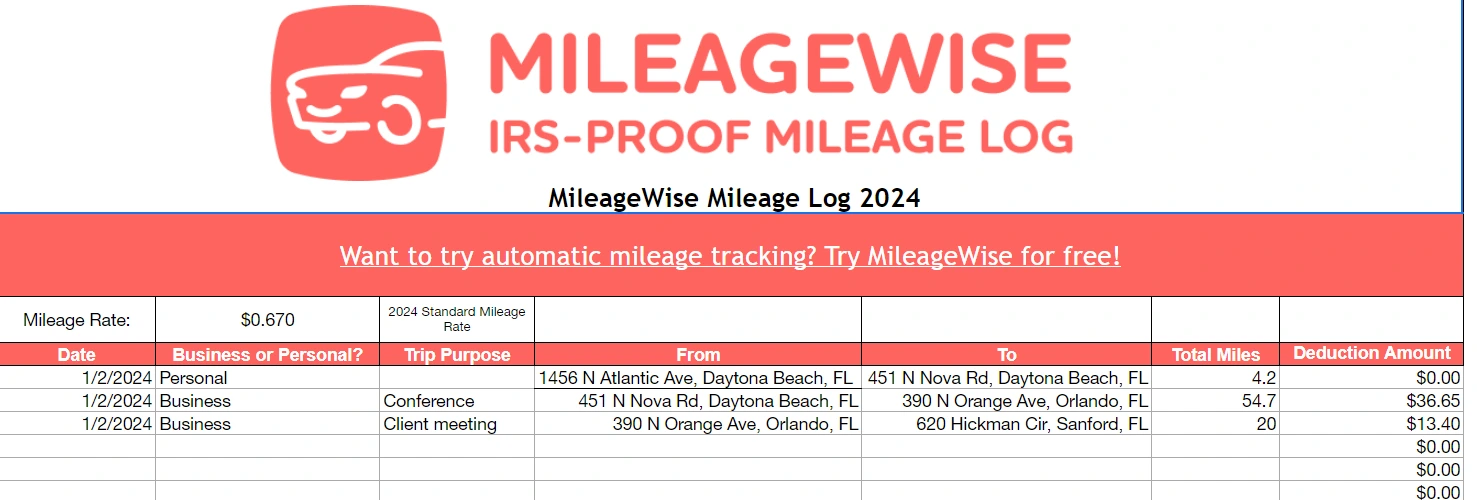

3. MileageWise Google Sheets Mileage Template

This vehicle mileage log not only logs miles but also calculates reimbursements based on IRS mileage rates. Field inputs include, trip purpose, date, business/personal, from/to, total miles, and deduction amount.

The bright salmon color might be jarring to some, but if you know your way around a spreadsheet, you can customize that without issue. To use this mileage log, you'll need to go to "File > Make a copy."

👉 Download link: Mileage Log Google Sheets Template

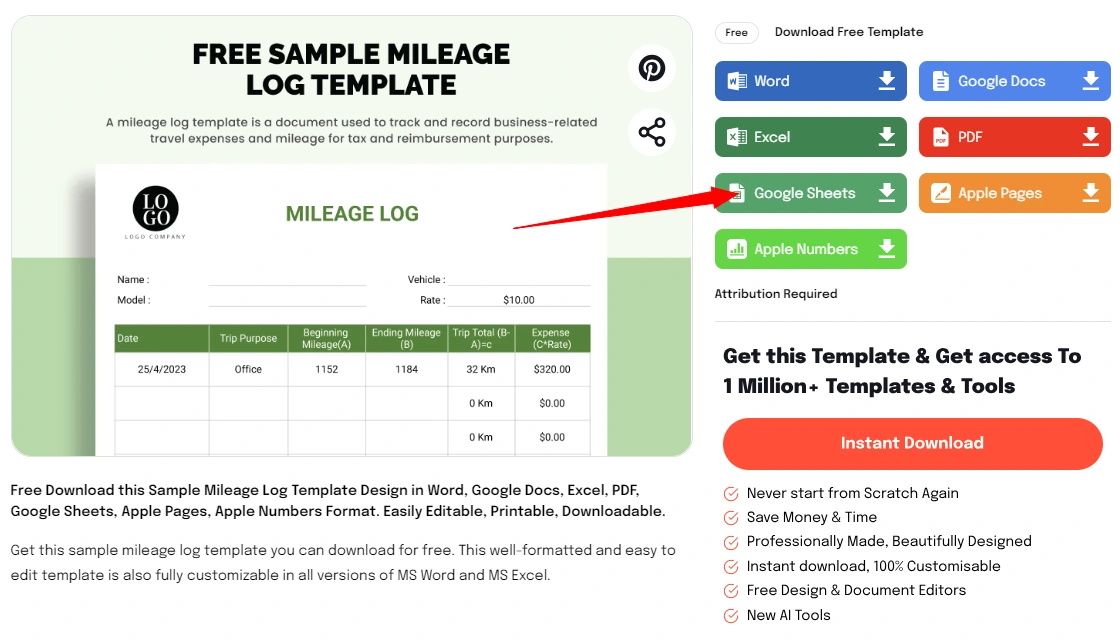

4. Free Sample Mileage Log Template by Template.net

This mileage log from Template.net is nicely designed and let's you add your company's logo to it. Fields include: Name, car model, vehicle, rate, date, trip purpose, beginning mileage and ending mileage, etc.

To download this template for free, you'll be asked to sign in with your Google account and then you can make a copy of the template.

👉 Download link: Free Mileage Log Template

5. Shoeboxed, a handy mileage tracker Google Sheets alternative

If you're looking for a way to to track mileage for business trips while on the go—and are eager to skp manual Google Sheets reports—Shoeboxed has a free-to-use mileage tracker inside of their expense tracking app!

Digital log maintenance—All trips and related data are stored digitally, which facilitates easy access and organization.

Expense tracking—Apart from mileage, Shoeboxed can track other expenses which may be crucial for tax calculations or reimbursements.

Report generation—Users can generate comprehensive reports for mileage and expenditures with ease.

Gmail receipt sync—Importing e-receipts to your Shoeboxed account is as easy as syncing your Gmail with Shoeboxed, using Shoeboxed's special Gmail Receipt Sync feature.

To use the mileage tracker for free, you would download the Shoeboxed app and choose the DIY plan, which is forever free!

Alternatively, if you've been looking for a complete expense tracking solution for your business, then consider choosing a paid plan, so you can outsource manual data entry for good!

Track mileage with Shoeboxed 🚗

Track mileage using your phone’s built-in GPS for unmatched ease and accuracy. Expense reports don’t get easier than this! 💪🏼 Try free for 30 days!

Get Started TodayWhat else can Shoeboxed do?

Shoeboxed has been voted as the best receipt scanner app for tax season by Hubspot and given the Trusted Vendor and Quality Choice awards by Crozdesk.

A quick overview of Shoeboxed's award-winning features:

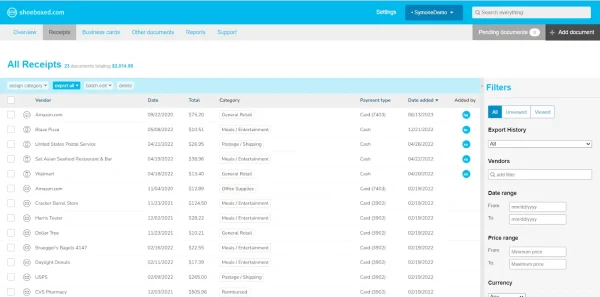

a. Mobile app and web dashboard

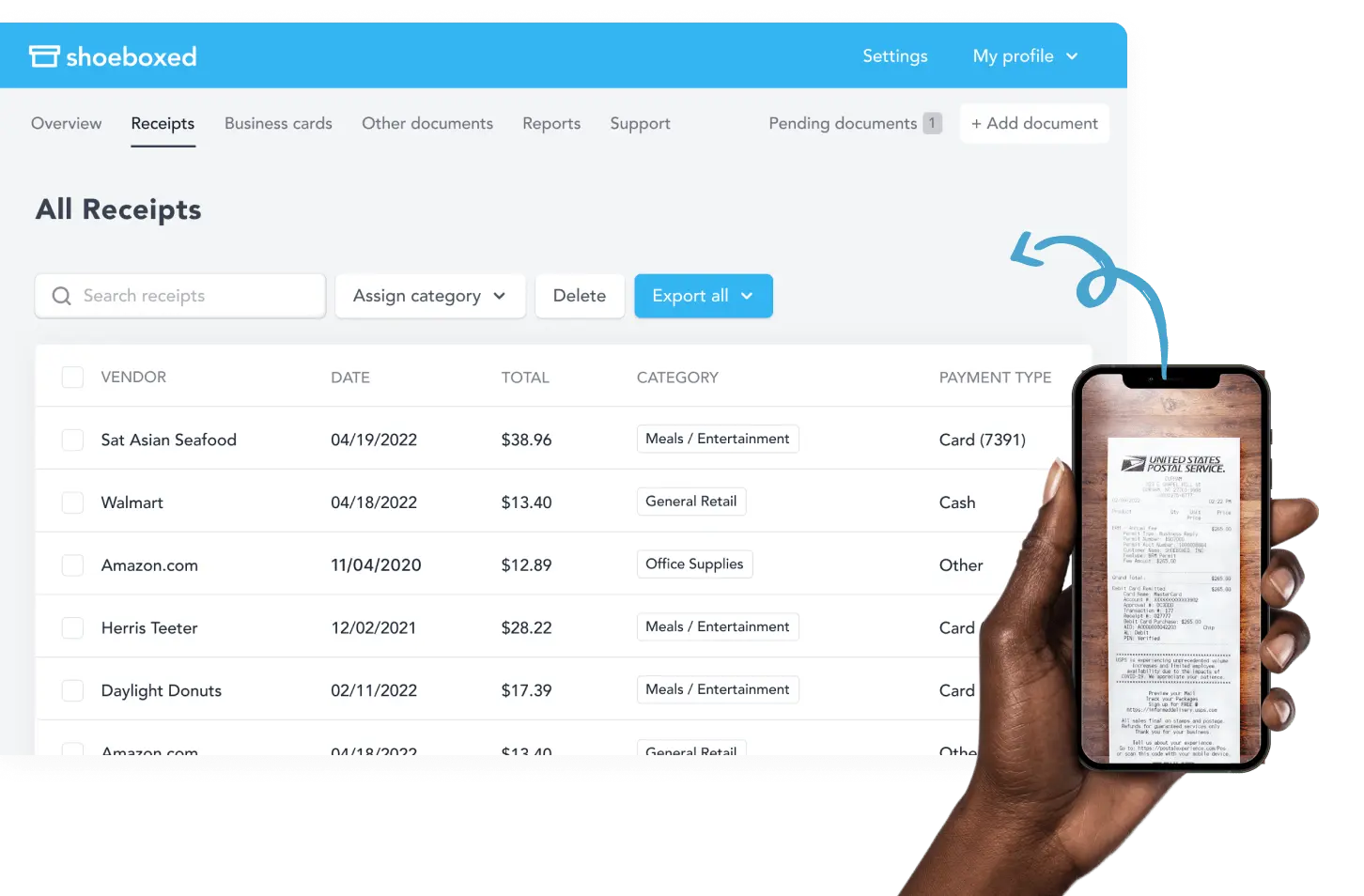

Shoeboxed’s mobile app lets you snap photos of paper receipts and upload them to your account right from your phone.

Shoeboxed also has a user-friendly web dashboard to upload receipts, warranties, contracts, invoices, and other documents from your desktop.

b. Gmail receipt sync feature for capturing e-receipts

Importing e-receipts to your Shoeboxed account is as easy as syncing your Gmail with Shoeboxed, using Shoeboxed's special Gmail Receipt Sync feature.

Shoeboxed’s Gmail Receipt Sync grabs all receipt emails and sends them to your account for automatic processing! These receipts are then labeled as Sent to Shoeboxed in your Gmail inbox.

In short, Shoeboxed pulls the receipt data from your email, including the vendor, purchase date, currency, total, and payment type, and organizes it in your account.

Your purchases will even come with images of the receipts attached!

c. Expense reports

Expense reports let you view all of your expenses in one cohesive document. They also make it simple to share your purchases with your accountant.

You can also choose certain types of receipts to include in your expense report. Just select the receipts you want to export and click “export selected.”

d. Search and filter

Call up any receipt or warranty in seconds with advanced search features.

Filter receipts based on vendors, date, price, currency, categories, payment type, and more.

e. Accounting software integrations

Export expenses to your accounting software in just a click.

Shoeboxed integrates with 12+ apps to automate the tedious tasks of life, including QuickBooks, Xero, and Wave Accounting.

f. Unlimited number of free sub-users

Add an unlimited number of free sub-users to your account, such as family members, employees, accountants, and tax professionals.

g. Mileage tracker for logging business miles

After you sign up for Shoeboxed, you can start tracking miles in seconds:

Open the Shoeboxed app.

Tap the “Mileage” icon.

Click the “Start Mileage Tracking” button.

And drive!

Whenever you start a trip, Shoeboxed tracks your location and miles and saves your route as you drive.

As you make stops at stores and customer locations, you can drop pins to make tracking more precise.

At the end of a drive, you’ll click the “End Mileage Tracking” button to create a summary of your trip. Each summary will include the date, editable mileage and trip name, and your tax deductible and rate info.

Click “Done” to generate a receipt for your drive and get a photo of your route on the map. Shoeboxed will automatically categorize your trip under the mileage category in your account.

h. The Magic Envelope

Outsource your receipt scanning with the Magic Envelope!

The Magic Envelope service is one of Shoeboxed's most popular features, particularly for businesses, as it lets users outsource receipt management.

When you sign up for a plan that includes the Magic Envelope, Shoeboxed will mail you a pre-paid envelope for you to send your receipts in.

Once your receipts reach the Shoeboxed facility, they’ll be digitized, human-verified, and tax-categorized in your account.

Have your own filing system?

Shoeboxed will even put your receipts under custom categories. Just separate your receipts with a paper clip and a note explaining how you want them organized!

Shoeboxed is the only receipt scanner app that will handle both your paper receipts and your digital receipts—saving customers up to 9.2 hours per week from manual data entry!

Break free from paper clutter ✨

Use Shoeboxed’s Magic Envelope to ship off your receipts and get them back as scanned data in a private, secure cloud-based account. 📁 Try free for 30 days!

Get Started TodayHow to set up a mileage tracker for Google Sheets

Properly configuring a mileage tracker in Google Sheets is crucial for accurate record-keeping and reimbursement purposes. It ensures that all mileage data are systematically captured and calculated.

1. Create a new Google Sheet

To start setting up a mileage tracker, one must create a new Google Sheet. This can be done by going to the Google Sheets website and selecting the "+ Blank" option. Alternatively, you can choose "New" > "Google Sheets" from Google Drive. Make sure to name the spreadsheet appropriately for ease of identification and access.

2. Use a Google Sheets template for mileage tracking

Alternatively, users can leverage pre-made Google Sheets templates to streamline the setup process. Templates include preformatted columns and formulas, which simplify the recording of trips, business-related mileage, and expenses.

To use a template, navigate to the Template Gallery, and search for mileage log templates. Once a suitable template is selected, it can be customized according to specific needs. Users can find various free Google Sheets Mileage Log Templates that are designed to meet the requirements of different users for the year.

3. Design the mileage tracker

Creating a functional mileage tracker in Google Sheets involves careful design around key data entry fields and the application of appropriate formulas for automatic calculations.

Essential columns typically include:

Date: Records the day of the travel.

Purpose: Describes the reason for the trip.

Start mileage: Logs the vehicle's odometer reading at the start of the trip.

End mileage: Notes the odometer reading at the end of the trip.

Total miles: Calculated field showing the distance traveled.

Rate: Captures the applicable rate per mile (standard rate set by the IRS or organization-specific).

Amount: Total reimbursable amount or deductible expense, calculated automatically.

An intuitive layout for these columns simplifies the data entry process. One can also enhance the tracker with dropdown menus for repetitive fields like the purpose of travel, ensuring consistency and ease of use.

4. Implement formulas for calculations

Formulas are pivotal in streamlining the functionality of the mileage tracker. They perform calculations instantly, avoiding manual errors and saving time. Here's an overview of the fundamental formulas:

Total Miles: (=End Mileage - Start Mileage) – This calculates the miles driven for each trip.

Amount: (=Total Miles * Rate) – This derives the total amount for each trip based on the miles driven and the pre-determined rate.

Users can input these formulas into the Google Sheets mileage log template to enable automatic updates whenever new trip details are entered. Additional conditional formatting can be applied to flag discrepancies or incorrect data entries, ensuring accuracy and reliability.

The use of the SUM() function allows for the quick tallying of total miles traveled. Meanwhile, functions like ARRAYFORMULA() can apply formulas across multiple rows without the need to copy and paste, which is incredibly useful for calculating distances or costs dynamically across a log.

What are best practices for using Google Sheets as a mileage tracker?

In the realm of mileage tracking with Google Sheets, automating data entry can drastically improve efficiency. This can be achieved through connecting Google Forms for input or by importing data directly from GPS applications.

A. Integrating Google Forms

One can streamline the collection of mileage data by integrating Google Forms into their Google Sheets mileage log. This approach allows for the easy submission of travel details via a form, which then automatically populates the spreadsheet. To set this up, they should:

Create a Google Form, tailoring fields to capture relevant mileage data such as date, destination, and distance.

Link the form responses to a Google Sheet, ensuring real-time data transferal.

This method offers a tidy and error-reducing solution for manual entries.

B. Importing data from GPS Apps

Another effective automation strategy is to import data from GPS applications. Several apps can export trip details into a compatible format for Google Sheets, such as CSV or Excel files. Users can:

Utilize the IMPORTDATA or IMPORTRANGE functions within Google Sheets to fetch the requisite data from these exports.

Set up regular imports or employ scripts to trigger data importation when new data is available.

This ensures an up-to-date mileage log with minimal manual intervention.

C. Creating reports and charts

Users can create detailed reports and visual charts directly in Google Sheets. By summarizing mileage data, they can produce weekly, monthly, or yearly overviews. To do so, they may utilize pivot tables to aggregate the data and generate charts such as bar graphs or line charts to visually represent the information. These reports and charts can spotlight trends in travel for cost analysis or reimbursement purposes.

In closing

Interpreting mileage data can provide critical insights into one's driving habits or business travel expenses. Users should look at metrics like total distance driven, average distance per trip, and fuel efficiency over time. These specifics can inform decisions on optimizing routes, scheduling, and even budget forecasting.

Google Sheets requires users to create their own system for logging trips and calculating mileage. On the other hand, Shoeboxed provides a ready-to-go solution.

Users can classify trips, and have the added benefit of keeping all records digitally within Shoeboxed’s platform. This can be especially beneficial during tax season when detailed logs are necessary.

For businesses and individuals seeking an efficient way to track their vehicle mileage and manage related expenses, Shoeboxed can be a smart choice. Its automated system not only saves time but also improves the accuracy of mileage tracking.

See also: Shoeboxed vs. QuickBooks Mileage Tracker: Navigating the Race

Tomoko Matsuoka is the managing editor for Shoeboxed, MailMate, and other online resource libraries. She covers small business tips, organization hacks, and productivity tools and software.

Track mileage with Shoeboxed 🚗

Track mileage using your phone’s built-in GPS for unmatched ease and accuracy. Expense reports don’t get easier than this! 💪🏼 Try free for 30 days!

Get Started TodayAbout Shoeboxed!

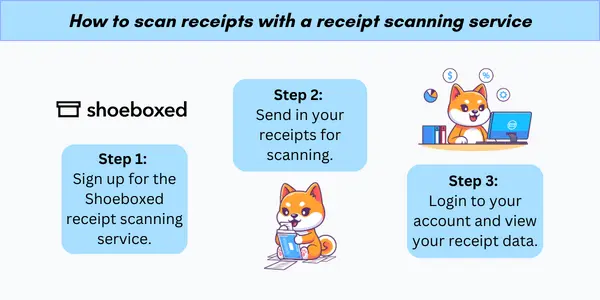

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!