Starting an Uber business can be rewarding for those looking for a flexible career or supplementary income.

Setting up a taxi service company like an Uber business model is one of the best business ideas because it involves fewer investments than most startup businesses.

Uber drivers play a vital role in ridesharing services by providing safe, reliable, and convenient ground transportation and services for corporate and individual clients.

According to Uber, their platform averaged nearly 26 million daily trips in 2023.

With the increasing demand for ridesharing services, now is an excellent time to learn how to start an Uber business.

Is an Uber-like taxi business profitable?

Starting an Uber-like business can be profitable, but it depends on several factors, including location, operational costs, competition, and management.

Drivers earn a percentage of the revenue generated from the fare for each ride, with Uber taking a commission (usually around 25-30%). Fares vary based on distance, time, and demand (surge pricing).

Uber often offers incentives, bonuses, and exclusive promotions to drivers who complete a certain number of rides or drive during peak hours.

The more passengers drivers transport, the higher the revenue generated from the fares and the more money you can make.

So, operating in areas with high ride demand, such as urban centers, tourist destinations, and event venues, can significantly increase your earnings.

How can you start a taxi business like Uber?

Starting an Uber-like business is pretty straightforward.

Here is a step-by-step guide to help you get started:

Step 1: Understand Uber’s taxi business model

Before diving into this line of taxi services, it's crucial to understand how an Uber-like business model operates. Uber connects drivers with passengers through its app, taking a commission from each fare.

It's very similar to a taxi service except you use your own car. As a driver, you earn money based on the trips you complete.

Step 2: Conduct market research on an Uber-like taxi business

Once you understand the Uber-like taxi business model, it's time to begin your market research, target customers, and choose a business and revenue model for your taxi services. This step is where business consultants can come in handy with their expertise and advice.

Step 3: Meet the requirements for an Uber-like taxi business

Once you've researched the market, you must meet the requirements for an Uber-like taxi business.

There are specific requirements that drivers and their vehicles must meet for a business like Uber.

For drivers:

Age and license: You must meet the minimum age requirement to drive in your city and have a valid driver’s license.

Driving experience: Typically, you need at least one year of licensed driving experience. In some cities, you might need more.

Vehicle: Your car must meet Uber's requirements, which vary by service level.

Background check: You must pass a background check, including your driving record and criminal history.

For vehicles:

Inspection: Your vehicle must pass an Uber vehicle inspection.

Insurance: You need personal auto insurance and Uber’s insurance coverage.

Registration: Your vehicle must be properly registered.

Step 4: Set up business operations

With a business like Uber, you'll also need to consider the legal structure, how the finances will be managed, and how you'll market your services.

Legal structure:

Decide on a legal structure for your business (e.g., sole proprietorship, LLC, corporation). Taxi services are generally set up as a general partnership for small-scale service companies or as a limited liability company for larger companies.

Register your business and obtain any necessary licenses, such as a commercial license and permits.

Financial management:

Open a business bank account separate from your personal account.

Keep detailed records of all expenses and income.

Consider hiring an accountant or using accounting software to manage your finances.

Marketing:

Market your services to attract both drivers and passengers.

Maintain an online presence through social media and a business website.

Step 5: Sign up to drive for the Uber-like taxi business

Once the requirements have been met, go to the Uber website, download the Uber driver taxi app, and sign up to become a driver. Provide all necessary documents and information, including your driver’s license, vehicle registration, insurance proof, and photo.

Step 6: Get your vehicle ready

Ensure your vehicle meets the typical taxi business safety standards. This includes the inspection, maintenance, and amenities like phone chargers to enhance the passenger's experience.

Step 7: Complete the onboarding process for your taxi service

Once you have signed up and provided all necessary documentation, you must complete Uber’s onboarding process.

Step 8: Start driving

Once approved, you can start accepting ride requests through the Uber taxi app. To maintain a high rating, provide excellent customer service. Most passengers will choose their driver based on their superior services and ratings.

Step 9: Expand your business model for your taxi service

If you want to scale up from being a single driver to managing a fleet in a business like Uber, follow these steps:

Hire drivers:

Recruitment: Find reliable and professional drivers. They must meet Uber’s driver requirements.

Training: Provide training to ensure they understand how to use the Uber app, company policies, and customer service expectations.

Manage vehicles:

Fleet management: Purchase or lease additional vehicles. Ensure they all meet Uber’s requirements.

Maintenance: Regularly inspect your fleet to ensure all vehicles are in good condition.

Insurance: Obtain commercial insurance to cover all your vehicles and drivers.

Step 10: Monitor and improve

This step is often overlooked but crucial to a successful business like Uber. Continuously monitor market research and business operations and seek ways to improve. Collect feedback from drivers and passengers to make necessary adjustments and enhance service quality.

What tools are needed for a successful Uber business model?

Starting and running a successful business like Uber requires various tools and resources to effectively manage operations, finances, and customer service.

Here’s a list of our favorite tools for an Uber-type business, including how Shoeboxed can play a pivotal role:

1. Smartphone and Uber driver app

First, you'll need a smartphone to download Uber's driver app.

Smartphone

A reliable smartphone is essential for accessing apps, receiving ride requests, navigating, and communicating with passengers.

Apps

The Uber app is your primary tool for managing ride requests, tracking earnings, and accessing Uber’s support and resources.

2. Vehicle maintenance tools

While the driver taxi app consists of all the essential basic features, such as managing ride requests, navigating to destinations, and tracking earnings, using additional apps can enhance efficiency, safety, and overall business management.

Vehicle maintenance apps

Vehicle maintenance apps can help you keep track of vehicle maintenance schedules, service history, and alerts for upcoming services.

GPS and navigation apps

While the Uber app includes navigation, having backup navigation apps can be helpful in case of app issues or finding alternate routes.

3. Financial management tools

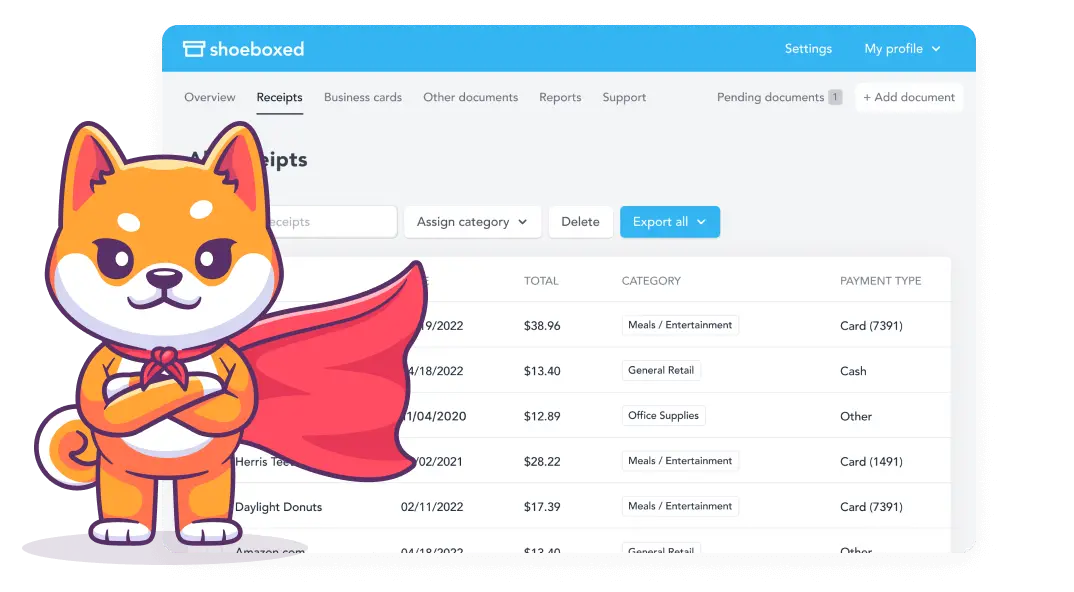

Apps like Shoeboxed, an expense management app, allow you to scan and organize receipts, categorize expenses, and generate expense reports. This is particularly useful for managing fuel, maintenance, and other business-related expenses and simplifies tax preparation.

Shoeboxed

Shoeboxed is a valuable tool for managing receipts and expenses, especially for an Uber business.

Shoeboxed is the best app for boosting your Uber business earnings.

Shoeboxed is a receipt scanner app used by over a million businesses, including Uber drivers.

Expense tracking

Shoeboxed is a comprehensive expense management app for drivers.

Shoeboxed excels in expense tracking. Uber drivers often have various business-related expenses, such as fuel, vehicle maintenance, and food purchases.

Shoeboxed's app helps drivers track these expenses by allowing them to scan, digitize, and categorize their receipts while on the go. Drivers can snap a picture of the receipt with their phone's camera and upload it directly into their Shoeboxed account.

Magic Envelope service

Keep Shoeboxed's free Magic Envelope in the car for receipts while on the road.

Shoeboxed is a top driver choice because it offers something the other apps don't.

The unique thing about Shoeboxed is its Magic Envelope.

If you don't want to do the scanning yourself, Shoeboxed will do it for you. Drivers can keep the Magic Envelope on their car's dashboard, filling it with receipts as expenses occur, such as gas, etc., and then mail them in the postage-paid envelope to Shoeboxed. The receipts will be scanned, human-verified, and uploaded to your Shoeboxed account.

Shoeboxed is the only receipt scanner app that will handle both your paper receipts and your digital receipts—saving customers up to 9.2 hours per week from manual data entry!

Mileage tracking app

Shoeboxed's mileage tracker is simple and accurate.

Shoeboxed is also a mileage tracker app that uses your phone's built-in GPS.

Once you sign up for Shoeboxed, open the app, tap the 'Mileage' icon, click the 'Start Mileage Tracking' button, and start driving! After clicking 'Start Mileage Tracking,' Shoeboxed begins tracking your location and miles and saving your route as you go.

It’s a good idea to drop pins if you make stops along your trip. This helps keep the mileage tracking precise. For example, if you make any stops along the way and must pay for parking, you can still snap a photo and upload that receipt to your Shoeboxed account without stopping the mileage tracker.

Tap the 'End Mileage Tracking' button at the end of a trip. Shoeboxed will create a trip summary that includes the date, editable mileage and trip name, and tax-deductible and rate information. Click 'Done' to approve the summary and generate a receipt with your trip information, including a photo of your route on the map.

Shoeboxed will auto-categorize your trip under the mileage category for tax purposes.

Track mileage with Shoeboxed 🚗

Track mileage using your phone’s built-in GPS for unmatched ease and accuracy. 💪🏼 Try free for 30 days!

Get Started TodayOrganization and categorization

Shoeboxed will keep all receipts organized and categorized for drivers.

Once the receipts are uploaded, Shoeboxed automatically categorizes expenses into 15 tax or customized categories.

Tax preparation

Shoeboxed boosts your Uber earnings by maximizing tax deductions.

Shoeboxed simplifies tax preparation for drivers by providing them with accurate and organized expense records. During tax season, drivers can easily access their digitized receipts and generate expense reports for tax deductions. Shoeboxed means more money in your pocket during tax season.

Shoeboxed has been voted as the best receipt scanner app for tax season by Hubspot and given the Trusted Vendor and Quality Choice awards by Crozdesk.

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. Try free for 30 days!

Get Started TodayTime-saving for busy drivers

Shoeboxed saves busy Uber drivers a lot of time.

Manually inputting receipts into an expense tracking system can be time-consuming. Shoeboxed saves drivers time by allowing them to quickly capture and digitize receipts using their smartphones or sending them off to Shoeboxed in a Magic Envelope for Shoeboxed to scan for you.

One bookkeeper even said she saved 900 hours a year using Shoeboxed.

Stop doing manual data entry 🛑

Outsource receipt scanning to Shoeboxed’s scanning service and free up your time for good. Try free for 30 days!✨

Get Started TodayIntegrations with accounting software

Shoeboxed imports expense data by integrating with other tools you already use to maintain consistency across all platforms.

Shoeboxed integrates with various accounting and financial management software, such as QuickBooks and Xero. This integration allows drivers to import expense data into their preferred accounting software seamlessly.

Advanced accessibility

Shoeboxed allows drivers to access their data anytime, anywhere.

The Shoeboxed app is accessible anytime, anywhere, allowing Uber-like delivery drivers to manage their expenses on the go. Whether at home, on the road, or waiting for their next delivery, drivers can easily access their expense records and stay on top of their finances.

Shoeboxed provides drivers a convenient and efficient solution for tracking and managing business expenses. Shoeboxed helps drivers save time, reduce paperwork, and maintain financial control over their business operations by digitizing receipts, organizing expense records, and simplifying tax preparation.

4. Insurance and compliance tools

Apps that manage your insurance or help you comply with the required regulations of a business like Uber or a cab company are also useful.

Insurance management apps

You can use apps provided by your insurance company to manage policy details, claims, and renewals.

Compliance tracking

Stay compliant with local regulations using tools or services that offer reminders for document renewals, inspections, and other regulatory requirements.

5. Customer service and communication tools

Customer feedback and communication tools can help enhance customer service.

Customer feedback tools

Although Uber provides feedback mechanisms within the app, additional tools can be used to gather more detailed feedback and improve service quality.

Communication tools

Other apps can help manage communications with other drivers (if you’re managing a fleet) and handle customer inquiries effectively.

Productivity and scheduling tools

Apps for managing pickups and tasks are essential for drivers so that no one or thing falls through the cracks.

Calendar and scheduling apps

Use other apps to schedule driving hours, manage appointments, and keep track of important dates.

Task management apps

Other apps can better manage tasks, track progress, and stay organized, especially if you’re managing multiple drivers or vehicles.

6. Marketing and promotion tools

Last but not least, you can't grow your own Uber business without promoting it.

Social media management

With a business like Uber, additional apps can help manage social media accounts, schedule posts, and engage with customers to promote your business.

Website and branding

Create a simple website to showcase your services, provide contact information, attract customers, and build your brand.

What will it cost to start your own Uber business?

You should know how much it will cost to start your business so that you can plan to finance it. Be sure to take vehicle costs and driver compensation into account.

Vehicle costs

Purchase or lease: The cost of buying or leasing vehicles.

Depreciation: Vehicles lose value over time, affecting long-term profitability.

Insurance: Both personal and commercial auto insurance costs.

Maintenance: Regular maintenance and repairs to keep vehicles in good condition.

Fuel: Fuel expenses can vary significantly based on mileage and fuel prices.

Driver compensation

If you hire drivers, you must pay them a portion of the earnings.

Consider the cost of recruiting, training, and retaining drivers.

How can you cut costs?

Cutting costs will put more money back into your pocket. This is especially crucial when starting and dealing with a tight budget. Tax deductions and efficient operations are two areas that can save you a lot of money.

Tax deductions

Expenses like fuel, maintenance, insurance, and depreciation can be tax-deductible, reducing tax liability.

Efficient operations

Low operational costs through efficient vehicle maintenance, fuel management, and insurance policies can improve profitability.

How can you get set up on the Uber app?

Open your Uber app, tap Account, choose Wallet, and scroll down to Add Business Profile under Ride Profiles. Enter your business email address. Select or add the payment method you want to use for business rides. Select your expense provider, and you'll be ready to roll.

What should you know about competition and the market with a business like Uber?

Research demographic information so you can focus on high-demand areas.

Competition

In highly competitive markets, fares might be lower, making it harder to attract passengers.

Understanding local demand and positioning your service effectively can help mitigate competition risks.

Market conditions

Economic factors, local regulations, and changes in demand (e.g., during a pandemic) can affect profitability.

How can you create a business profile?

To create a business profile, Open the Uber app and tap “Account.” Tap “Wallet,” then scroll down to “Ride Profiles.” Tap “Start using Uber for business” or “Add another business profile.” Follow the prompts to create your business profile. Optional: Select your company's expense provider to enable automatic receipt forwarding (you'll receive an email to complete the linking process).

What factors should you consider when establishing a business model and marketing strategies?

There are several key elements to remember regarding risk and revenue.

Single driver vs. fleet management

Your profit margins might be thinner as a single driver, but your operational risks are lower.

Managing a fleet can yield higher profits but requires significant investment and efficient management.

Dynamic pricing

Taking advantage of Uber’s surge pricing during peak times can significantly increase revenue.

Customer service

Providing excellent customer service can lead to more customers, higher ratings, more tips, and repeat customers.

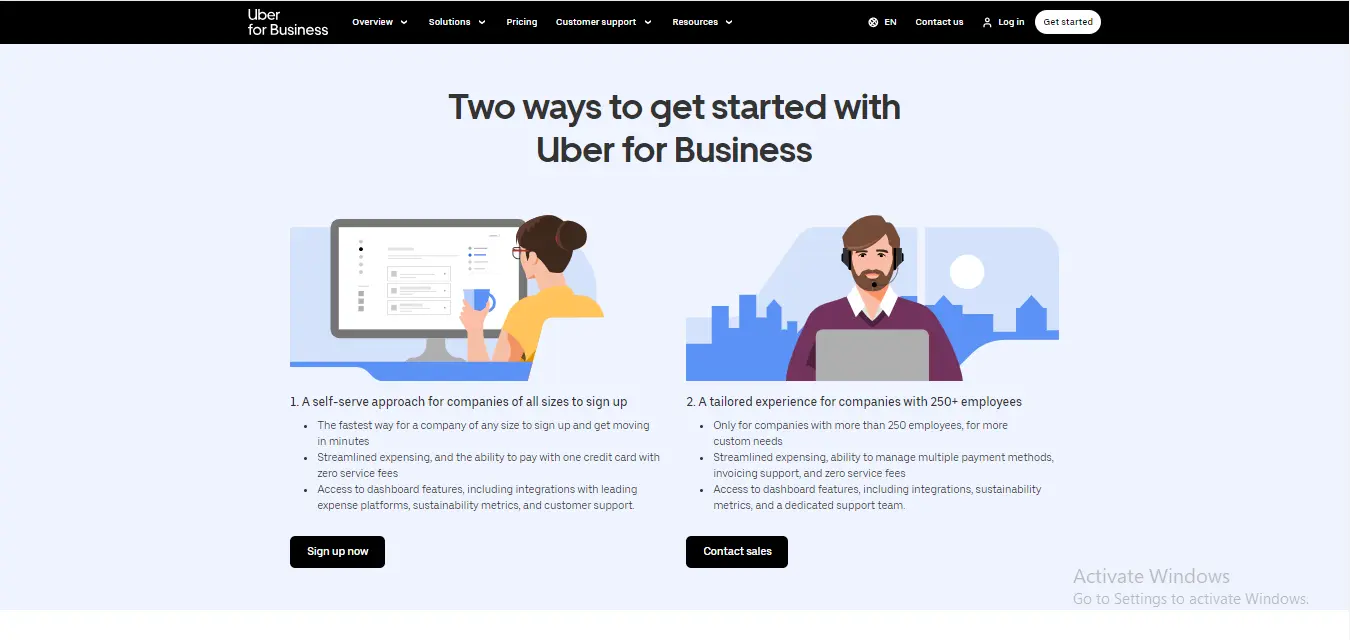

What is Uber for Business?

Uber for Business is a platform designed to help companies manage and streamline their transportation needs. It offers various services tailored to businesses' needs, providing a convenient and efficient way to handle employee travel, client transportation, and other mobility requirements.

Uber for Business offers a comprehensive solution for managing corporate transportation needs. By providing centralized billing, customizable travel policies, and seamless integration with expense management systems, Uber for Business simplifies arranging and managing employee travel.

The Uber for Business platform’s safety features, global reach, and efficiency benefits make it an attractive option for businesses looking to enhance their transportation solutions and improve the overall employee experience.

What are some things to consider down the road?

Even from the very start of your business, you should always consider the potential for future challenges so that you can be somewhat prepared for them.

Scalability

Growing your business by adding more vehicles and drivers can increase revenue, but it also requires careful management of additional costs and logistics.

Technological adaptation

Staying updated with Uber’s platform changes and utilizing new and advanced features that can help maximize earnings.

Legal and regulatory compliance

Ensuring compliance with local regulations, including driver background checks and vehicle inspections, is crucial to avoid fines and legal issues.

Frequently asked questions

How can I profit from my Uber business?

The more passengers drivers transport, the higher the revenue generated from the fares and the more money they can make. So, operating in areas with high ride demand, such as urban centers, tourist destinations, and event venues, can increase earnings.

Tracking expenses for tax deductions will decrease your tax liability and save you money. Using tools in addition to the Uber app will help you run a more efficient business, saving you money in the long run.

What is the best expense provider app for Uber drivers?

Shoeboxed is the best driver expense provider with its convenient and efficient solution for tracking and managing business expenses. Shoeboxed helps drivers save time, reduce paperwork, and maintain financial control over their business operations by digitizing receipts, organizing expense records, and simplifying tax preparation. Shoeboxed offers many benefits to drivers when utilized as an expense provider.

In conclusion

An Uber business can be profitable, especially in areas with high demand for ride-sharing services. However, profitability depends on effective cost management, strategic planning, and understanding the local market conditions.

Starting small, monitoring expenses, providing excellent service, and gradually scaling up can help you build a successful and profitable Uber business. Regularly reviewing and adjusting your business strategy in response to market trends and operational challenges will also play a crucial role in sustaining profitability.

Caryl Ramsey has years of experience assisting in bookkeeping, taxes, and customer service. She uses various accounting software to set up client information, reconcile accounts, code expenses, run financial reports, and prepare tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple receipt capture methods: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad, and Android) to snap a picture while on the go—auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports, including IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports, and more—with Shoeboxed.

Try Shoeboxed today!