Are you tired of searching through file cabinets and folders or trying to find one missing receipt among all the paper clutter on your desk? If so, it's time to organize those receipts. Having a system in place will save time by eliminating the grueling search.

Here, we'll walk you through converting paper receipts into e-receipts and how to organize receipts electronically.

Why should you organize receipts electronically?

Business owners aren't the only ones who benefit from electronic organizations. Individuals can also benefit from any paperwork they have that they want to keep organized.

Here's how electronic organization can benefit business owners and individuals:

Quicker to organize, access, and store receipts and other documents

Electronic receipts are more straightforward to organize and much more accessible than paper receipts.

With digital storage, users can add their receipts to a digital file folder and tag them with keywords. This makes the data easily searchable and accessible—much more straightforward than finding a document in a stack of papers.

This means that digital receipts can be accessed anywhere there is access to the internet. This results in easier management of financial or business expenses even while on the go.

The receipts are also accessible from smartphones, tablets, or computers and do not fade, get lost, or become destroyed by water, fire, or other environmental factors.

Saves time, making it a more efficient process

With the ability to use keywords and tags to search for a specific receipt or document, you can find a particular receipt instantly based on the date, vendor, amount, or any other tagged information.

Declutters and saves on space

Paper receipts can quickly accumulate in your home or office and cause clutter. Digitizing your receipts frees up space and declutters your mind. This transition from physical receipts to a digital system supports a more minimalist, organized lifestyle and workspace.

Enhances security

Paper receipts are vulnerable to loss, theft, and damage from elements like water or fire. Electronic storage offers a safer alternative to physical receipts, especially with encryption and secure backup options. These documents should always be readily available, even after a disaster or hardware failure.

Simplifies expense tracking and reporting

E-receipts make tracking expenses and preparing financial reports easier for individuals and firms. Digital tools and apps can automate expense report categorization, making it even easier to observe spending patterns, budgets, and financial statements.

Immediate sharing and collaboration

Electronic receipts can easily be shared with an accountant, financial advisor, or member in a snap, making it easier to collaborate and stay on top of financial matters.

Legal acceptance and compliance

Most jurisdictions accept electronic receipts as a valid tool for documenting taxes and laws.

Scalability

Electronic receipt organization can also quickly grow with your business and personal needs, especially since an increasing volume of receipts doesn't take up much space in the digital world.

How can you organize receipts electronically?

Here's a step-by-step guide on how to organize receipts electronically.

Step 1: Choose your tools

First, decide on the tools to scan and store your documents.

Here are a few:

Mobile apps: There are receipt-scanning apps to organize receipts and expense reports. These apps use your phone's camera to snap pictures of your receipts and contain features to organize and categorize expenses.

Storage of digitized receipts: Storage is the next step after digitizing all the receipts. In this case, cloud storage services enable access from anywhere with a device that has an internet connection.

Step 2: Establish a consistent scanning routine

Decide whether you will use an app to scan or outsource your receipts and have a service manage them. Schedule a time to scan your paper receipts if you do your scanning. You may even scan receipts the minute an expense is incurred so that they don't pile up and you end up losing or overlooking a receipt.

Step 3: Organize your digital receipts

When you store receipts electronically, be sure to organize your receipts as well. This makes it easier to retrieve them later for things like returns, warranties, credit card statements, or even taxes.

The following can be of help in organizing your receipts:

Use descriptive file names. The file name should indicate the date bought, the vendor's name, and the reason for the expense. This makes the document easily searchable and accessible.

Categorize and tag: Many scanning apps and cloud storage services allow users to categorize or tag the files. Group like receipts (e.g., groceries, office supplies, travel) together and tag them with their labels.

Create a folder structure: Place receipts in folders by year and category. This allows you to archive older receipts and retrieve them easily later, if necessary.

Step 4: Ensure security and accessibility

Your digital receipts contain sensitive information, so securing them is essential.

Backup your data: Use a cloud storage service that can automatically back up your data, or use an external hard drive to back up your receipts manually.

Encrypt your files: For receipts containing sensitive information like credit cards, ensure the platform uses encryption to safeguard the data.

Availability: Make sure that you can access your receipts from different devices. These cloud storage solutions offer access to your receipts from a smartphone, tablet, or computer - all over the world and anywhere you are connected to the internet.

Step 5: Maintain your digital receipts

Maintaining your digital receipt system involves regular review and cleanup:

Regularly review. Periodically, review all your receipts to remove duplicates, fix misfiled documents, and delete those you no longer need.

Stay compliant: Check your jurisdiction's requirements regarding how long you should keep receipts for business expenses or tax deductions, and ensure the digital copies meet any criteria needed for documentation.

Step 6: Use your digital receipts for budgeting and analysis

With all your receipts organized and easily accessible, you can use this data for business or personal finance management:

Track spending: Use your e-receipts to track your spending. Many apps categorize expenses to let users see where their money is going.

Budget analysis: Review categorized receipts and expense reports for areas of cutbacks or reallocation of funds that would better assist you in meeting your financial objectives.

Organize like a pro ✨

Use Shoeboxed’s Magic Envelope to ship off your receipts and get them back as scanned data in a private, secure cloud-based account. 📁 Try free for 30 days!

Get Started TodayWhat is the best app for you to store receipts?

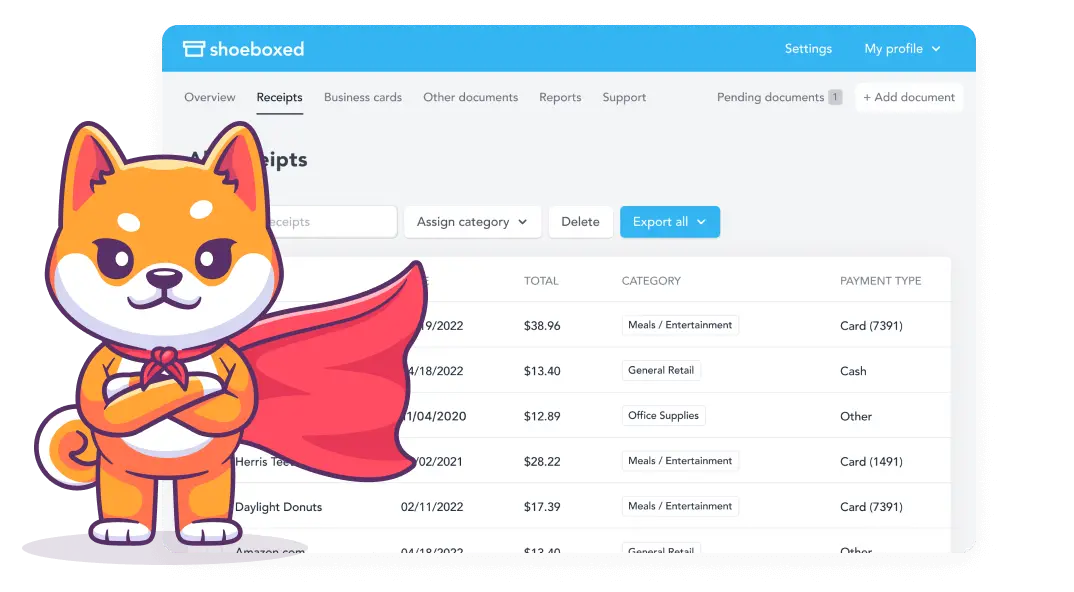

Shoeboxed is the perfect receipt scanner and organizer for organizing and storing receipts electronically. It's designed to scan and organize receipts efficiently.

Learn how to organize receipts electronically with Shoeboxed.

Organizing receipts electronically streamlines the expense management process. It allows for better spending tracking, tax preparation, and maintaining a clutter-free space. Shoeboxed is a versatile tool that streamlines digitization and receipt organization.

Here's a guide on how to use Shoeboxed for effective electronic receipt organization:

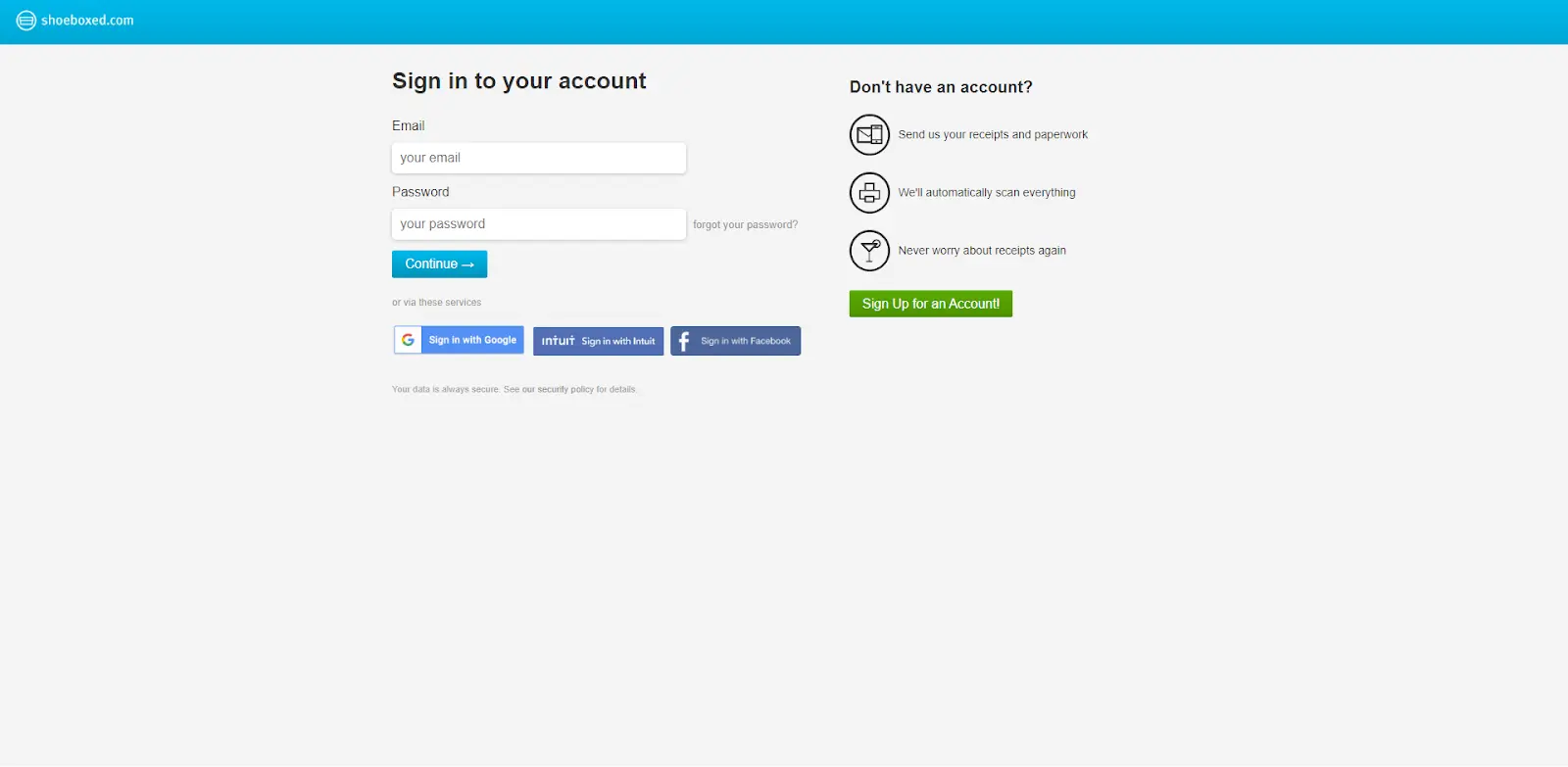

Sign up and set up

Shoeboxed offers affordable plans.

Create a Shoeboxed account and select a plan that fits your needs and preferences. Once your account is active, familiarize yourself with the dashboard and settings to navigate the central hub for managing and tracking receipts, generating reports, and customizing categories.

Capture your receipts

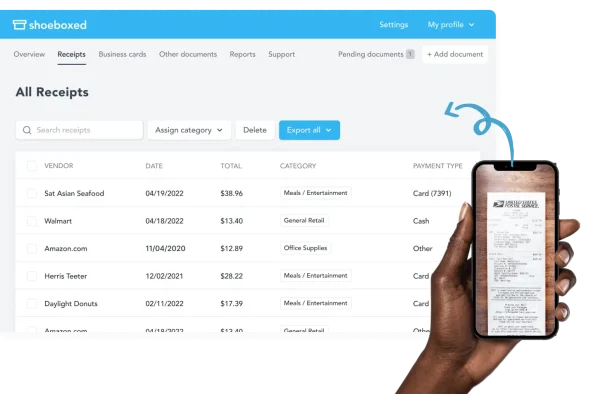

Now, you're ready to convert paper receipts into scanned receipts. Shoeboxed provides various methods to digitize, organize, and store receipts. One method is using a mobile phone app.

Mobile phone app

Capture receipts while on the go with Shoeboxed's mobile app.

You can scan receipts with Shoeboxed's mobile app. The Shoeboxed app allows you to take pictures of your receipts with your smartphone's camera, and then the app takes care of the rest. The app saves receipts for automatic upload to your account. Of course, you can always upload them onto your laptop or desktop computer.

Mail-in service

Use Shoeboxed's Magic Envelope to mail your receipts in to be processed.

Shoeboxed also provides a unique mail-in service. Shoeboxed's mail-in service is invaluable for those with stacks of paper receipts or those who don't want to do their scanning.

Users can send their receipts in a prepaid envelope provided by Shoeboxed, known as the Magic Envelope, mail it, and have Shoeboxed scan, human-verify, and upload the receipts into their Shoeboxed account.

Break free from paper clutter ✨

Use Shoeboxed’s Magic Envelope to ship off your receipts and get them back as scanned data in a private, secure cloud-based account. 📁 Try free for 30 days!

Get Started TodayCategorize and organize

Shoeboxed organizes and categorizes receipts.

Shoeboxed organizes and categorizes your receipts into tax categories.

Shoeboxed's optical character recognition (OCR) technology extracts important details from your receipts (date, total amount, vendor, payment method). It automatically organizes them into tax categories, making tax prep and audits a breeze.

Integrate with your accounting software

Shoeboxed integrates with other popular accounting software.

Integrate Shoeboxed with tools you already use.

Shoeboxed integrates with QuickBooks to streamline expense management and ensure your data is consistent across all platforms.

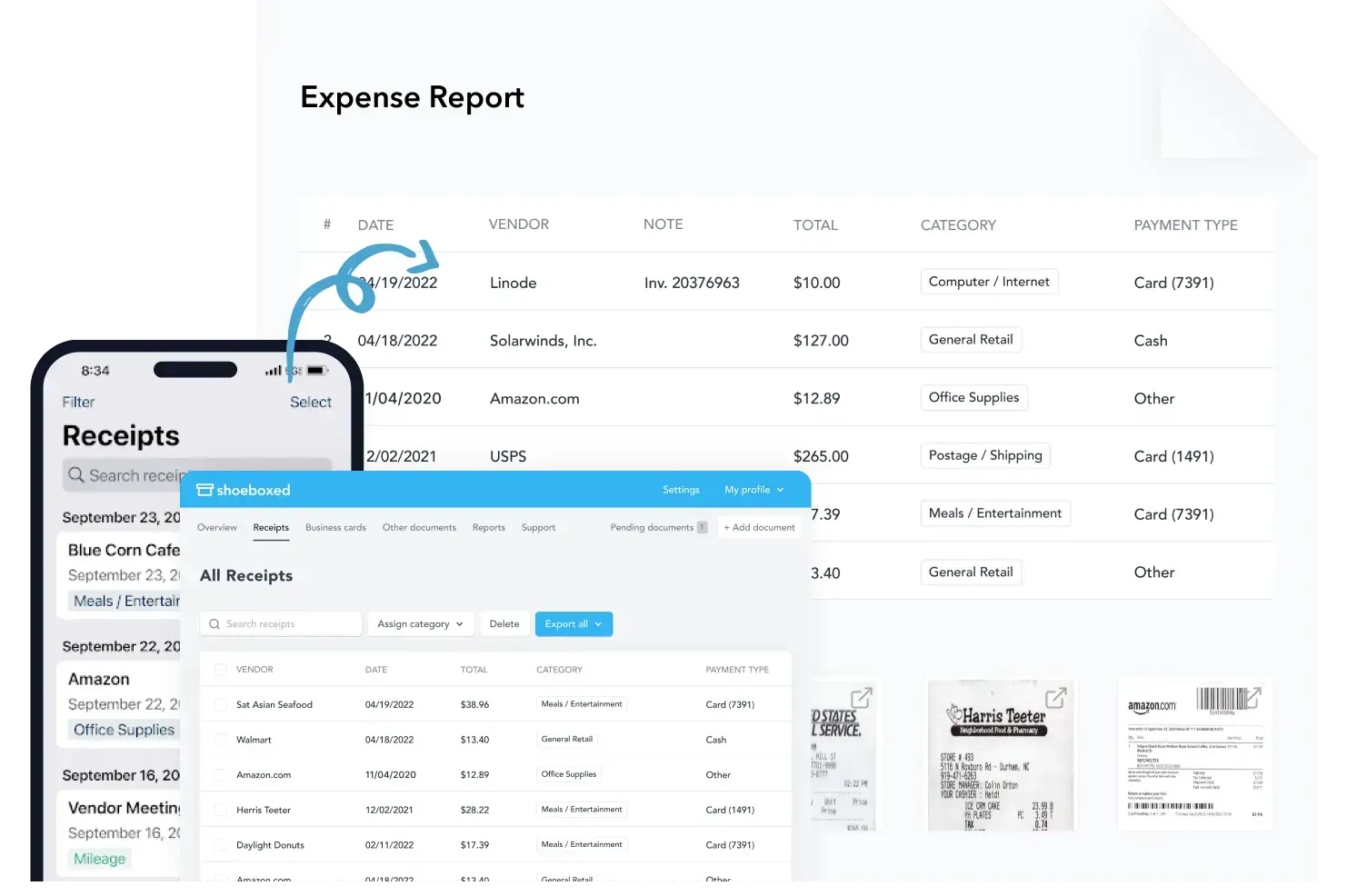

Create reports with useful insights

Shoeboxed provides snapshots of your financial status.

Shoeboxed provides a financial snapshot of your company with detailed reports.

Shoeboxed is not just for organization and storage; it's an essential tool for financial analysis. The platform generates expense reports, tracks spending trends, and analyzes expenses by category so that you know exactly where your money is going and where you stand financially.

Secure your data

Shoeboxed ensures your data is secure.

Your data is secure with Shoeboxed.

Shoeboxed does everything possible to ensure your account and data are secure. Users should do the same, such as regularly backing up their data and using strong passwords and two-factor authentication.

Stay compliant

Shoeboxed provides compliance with IRS-accepted receipts.

Shoeboxed helps maintain compliance with tax laws and regulations. For example, Shoeboxed's digital receipts are IRS-accepted in the US. To remain compliant, just follow IRS rules on how long it takes to store receipts electronically.

Turn receipts into data with Shoeboxed ✨

Try a systematic approach to receipt categories for tax time. Try free for 30 days!

Get Started TodayFrequently asked questions

How do small businesses keep track of receipts?

For small businesses, keeping track of business receipts electronically is a strategic move that can streamline operations, enhance financial management, and support growth.

Receipts are digitized, organized, and stored using receipt scanning apps, computer software, or services provided by platforms like Shoeboxed. They are then easily accessible whenever needed.

Are there any receipt tracking benefits for the individual?

Organizing receipts electronically can offer individuals a wide range of benefits, especially when managing personal finances, budgeting, and preparing for tax season. Some benefits include easier tracking and organization, space-saving, enhanced security, and convenient access.

Overall, transitioning to electronic receipt tracking can significantly improve your financial management, providing convenience and efficiency. It’s a step towards a more organized and digitally optimized approach to handling personal expenses.

Can I use electronic receipts for tax purposes?

Yes, electronic receipts can be used for tax purposes in many jurisdictions, including the United States, as long as they meet the requirements set forth by the tax authority.

For example, the Internal Revenue Service (IRS) in the U.S. accepts electronic receipts, provided they contain all the information required of a traditional paper receipt. This includes the amount, transaction date, place of purchase, and a detailed description of the purchased items or services.

Electronic receipts must be legible, reliable, and stored to be readily accessible for review or audit if requested. It's also important to ensure that the electronic storage system for keeping these records is secure and that backups are made to prevent data loss.

In conclusion

Learning how to organize receipts electronically can be a game changer for individuals and small business owners. Whether for personal use or business, organizing receipts electronically will save you a lot of time, money, and stress, especially during tax season and audits.

Caryl Ramsey has years of experience assisting in different aspects of bookkeeping, taxes, and customer service. She uses a variety of accounting software for setting up client information, reconciling accounts, coding expenses, running financial reports, and preparing tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple receipt capture methods: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports, and more—with Shoeboxed.

Try Shoeboxed today!