Understanding the Internal Revenue Service's (IRS) receipts requirements is crucial for individuals and businesses when managing taxes. Keeping accurate records and receipts is essential for preparing accurate tax returns and defending against audits.

This article explores the IRS's guidelines for receipt requirements, detailing what needs to be kept, how long to keep it, and why it's essential.

What is a business tax receipt?

A business receipt is a document that serves as proof of a financial transaction between two parties. Business receipts are crucial for accounting and tax purposes, helping track expenses, manage budgets, and prepare financial statements.

Business receipts are often provided in physical form, printed on paper, or electronically, such as in an email or a downloadable file from a website. They are essential for both the issuer and the receiver to confirm the transaction details, ensure proper accounting, and resolve any discrepancies that might arise later.

What receipts for business expenses should you keep?

The IRS requires taxpayers to keep documentary evidence to support deductions or credits on their tax returns. This evidence generally includes receipts, bills, canceled checks, payroll records, and other documentary evidence.

Specifically, the IRS suggests keeping business receipts of the following expenses:

Employee salaries and benefits

Mortgage interest

Rent or lease

Meals

Professional fees

Travel and transportation expenses

Professional fees

Bank fees

Insurance

Utilities

Research and development costs

Advertising and marketing expenses

In addition to receipts, other documents for expenses that you want to hang on to include the following:

Sales slips

Paid bills

Invoices

Deposit slips

Canceled checks

Cash register tapes

Receipt books

What detailed information is required on receipts?

For a receipt to be useful for tax purposes, it should ideally include:

The date of the transaction.

The amount paid.

The name and address of the seller or service provider.

A detailed description of the services or goods provided.

Provide proof of payment (e.g., the last four digits of the credit card used or an indication of cash or check).

What's the difference between electronic vs. paper receipts?

The IRS accepts electronic records from taxpayers who prefer to retain receipts digitally. According to Rev. Proc. 97-22, the IRS allows taxpayers to store documents electronically if they are easily accessible and can be reproduced without altering or deteriorating the electronic files.

How long should you keep business receipts?

The period you should keep your documents depends on the action, expense, business event, and document records. Generally, the IRS recommends keeping records for three years from filing your original return or two years from paying the tax, whichever is later. However, some documents should be kept longer:

Keep records for seven years if you file a claim for a loss from worthless securities or bad debt deduction.

Keep records indefinitely if you do not file a return or a fraudulent one.

Employment tax records should be kept for at least four years after the tax is due or paid, whichever is later.

Never lose a receipt again 📁

Join over 1 million businesses organizing & scanning receipts, creating expense reports, and reclaiming multiple hours every week—with Shoeboxed.✨

Get Started TodayWhy is compliance important?

Keeping compliant with IRS requirements is crucial.

Adequate record-keeping helps you:

Prepare your tax returns accurately and efficiently.

If the IRS questions a specific deduction or income on your return during an audit, provide answers.

Claim all eligible tax deductions and credits.

How do I manage and organize my business tax receipts?

Managing and organizing tax receipts efficiently is crucial for smooth operations, accurate bookkeeping, and successful tax filings.

Here’s a step-by-step approach to handle this effectively:

1. Dedicate time to expense management

Set aside weekly or monthly time slots specifically for managing and organizing receipts.

2. Verify credit card statements

Regularly compare your receipts against your statements to ensure all transactions are accounted for and recorded correctly. This helps identify any discrepancies or fraudulent charges early.

3. Habit formation

Develop a routine habit of processing receipts after transactions occur. This habit can prevent the buildup of unrecorded expenses and makes income tax preparation easier.

4. Regularly update your account

Make it a practice to frequently update your accounting software with new receipt data. This ensures that your financial statements are always current and reflect all expenses incurred.

5. Use color-coding

Implement a color-coding system for digital folders or physical files. For example, different colors can be used for different types of expenses or different projects. This visual organization can help you quickly locate specific documents.

6. Use apps to track mileage and travel expenses

Apps like Shoeboxed can track travel distances and calculate mileage expenses.

7. Review your system regularly

You can periodically evaluate the effectiveness of your receipt management system. Look for ways to improve efficiency, such as upgrading software, reorganizing file systems, or integrating new tools.

8. Review tax law changes

9. Stay informed about changes in tax regulations that could affect your business expenses and deductions.

10. Keep a log of cash payments

Maintain a detailed log of cash transactions, as these do not automatically appear in electronic banking records. Document the date, amount, and purpose of each cash expenditure.

11. Educate your team

Ensure all team members who incur business expenses are trained in these practices. Please provide them with the necessary tools and resources to comply with your business’s expense management system.

How can I leverage technology to manage and organize my business tax receipts?

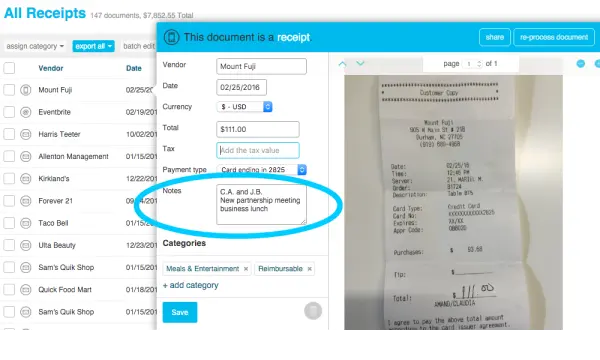

Shoeboxed is a digital tool designed to help businesses manage and organize their receipts and other financial documents, making it especially useful for handling tax receipts.

Here’s how Shoeboxed can assist with your business tax receipts:

1. Digitization of receipts

Shoeboxed means no more manual data entry.

The digitization of receipts means no more manual data entry. Shoeboxed allows you to scan your paper receipts using a mobile app or mail them directly to Shoeboxed in a prepaid postage envelope known as the Magic Envelope, where their service will scan receipts on your behalf. The Magic Envelope is a unique feature that only Shoeboxed offers.

This process converts your physical receipts into digital format, which can be more easily managed and organized, saving time and frustration.

Break free from manual data entry ✨

Use Shoeboxed’s Magic Envelope to ship off your receipts and get them back as scanned data in a private, secure cloud-based account. 📁 Try free for 30 days!

Get Started Today2. Receipt organization

Easily organize receipts electronically with Shoeboxed.

Once your receipts are digitized, Shoeboxed categorizes them based on type, date, vendor, amount, and other relevant details.

3. Data extraction and management

Shoeboxed extracts and manages the data for you.

Shoeboxed extracts key financial data from your receipts, such as vendor, date, amount, and payment type. This data is then made searchable and easily accessed for review or audits, saving time during tax season or financial reviews.

4. Integration with accounting software

Shoeboxed integrates with other popular accounting software.

Shoeboxed can integrate with accounting software like QuickBooks, Xero, and others.

5. Secure storage and access

Your digitized receipts are securely stored in the cloud, allowing you to access them anytime and anywhere.

6. Expense reporting

Shoeboxed makes expense reimbursement and income tax return prep much more straightforward.

Shoeboxed offers tools to create expense reports directly from the receipts you’ve scanned. These can be used for reimbursement or tax purposes.

7. Internal Revenue Service compliance

Shoeboxed helps keep you compliant with the IRS receipt requirements.

The digital copies created by Shoeboxed are accepted by the Internal Revenue Service and CRA, which means they are suitable for tax filing purposes.

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. Try free for 30 days!

Get Started TodayWhy is understanding the IRS business tax receipt requirements for business expenses essential?

Understanding the IRS receipt requirements is crucial, especially for business owners and individuals managing taxes effectively.

Here are some key reasons why it's important:

1. Ensuring tax compliance

The IRS has specific guidelines on what constitutes a valid receipt for tax purposes. Knowing these requirements helps ensure that the IRS will accept your documentation in the event of an audit. This is crucial to avoid penalties, interest, or additional taxes due to non-compliance.

2. Maximizing deductions

Proper receipts are necessary to claim tax deductions accurately. Understanding what details need to be included on a receipt can help ensure that all the required information about actual expenses is captured so that you are maximizing your eligible tax deductions.

When you deduct business-related expenses from your income on your income tax return, it lowers your taxable income, and you potentially pay less in taxes.

3. Preventing tax errors

Knowledge of tax-deductible expense and receipt requirements helps maintain accurate and compliant records. This reduces the likelihood of errors in tax filings, which can be costly and time-consuming to correct.

4. Facilitating accurate record-keeping

IRS-approved receipts are essential for maintaining detailed and precise financial records. These records are useful for tax purposes and budgeting, financial planning, and monitoring the financial health of a business.

5. Streamlining audits

In the event of an IRS audit, having the correct receipts organized according to IRS standards can streamline the audit process.

6. Reducing fraud

Understanding and adhering to receipt requirements helps prevent fraudulent claims.

7. Enhancing financial analysis

With adequately documented receipts, businesses can perform more accurate financial analyses and better understand customer demand and spending patterns. This leads to more informed decision-making and improved financial strategies.

Frequently asked questions

What counts as deductible business expenses on your tax return?

The following are some examples of a deductible expense on your tax return:

Employee salaries and benefits

Mortgage interest

Rent or lease

Meals

Professional fees

Travel and transportation expenses

Professional fees

Bank fees

Insurance

Utilities

Research and development costs

Advertising and marketing expenses

Why is a receipt for a business expense necessary?

A receipt for a business expense is important because it serves as backup documentation or as supporting documents for the business deduction that can be taken at tax time.

In conclusion

Proper documentation and adherence to IRS receipt requirements are not just a legal obligation but a prudent practice to ensure smooth tax filings and potentially save money. By maintaining organized records of your transactions and understanding the IRS’s requirements, you reduce the risk of audits and can take full advantage of tax benefits.

Caryl Ramsey has years of experience assisting in different aspects of bookkeeping, taxes, and customer service. She uses a variety of accounting software for setting up client information, reconciling accounts, coding expenses, running financial reports, and preparing tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!