So, what is the best tax preparation software for professionals? It depends on various factors, such as the business's specific needs, the types of returns handled, user interface preferences, and budget considerations. There isn't a one-size-fits-all answer.

Several tax preparation software options are considered top choices for professionals due to their comprehensive features, user-friendly interfaces, robust support, and reliability. The following sections detail these tax preparation software options, highlighting their key features, target users, platform availability, and pricing structures. This information will help professionals decide which software aligns best with their specific needs and preferences.

What is tax preparation software?

Tax preparation software is specialized software designed to assist professionals in efficiently and accurately preparing tax returns. These tax professional software packages typically offer a range of features to streamline the tax preparation process, including data entry, calculation of tax liabilities, electronic filing (e-filing), and integration with other accounting or financial software.

Critical features of tax preparation software for professionals should include these key features:

Comprehensive tax forms and schedules: The software should support various tax forms and schedules, including those for individual taxpayers and businesses.

Automated data import: Many tax preparation software programs allow for the automatic import of financial data from sources such as accounting software, banks, brokerage accounts, and payroll providers. This helps minimize manual data entry and reduces the risk of errors.

Tax planning tools: Some software packages include tools that help professionals identify tax-saving opportunities, optimize deductions and credits, and plan for future tax liabilities.

Accuracy and compliance: Tax preparation software should be up-to-date with current laws and regulations to ensure accurate calculations and compliance with IRS and state tax requirements.

E-filing capabilities: Most tax preparation software allows for electronic filing (e-filing) of tax returns, which can speed up the filing process and reduce errors compared to paper filing.

Client management features: The software should include features for organizing information, tracking deadlines, and managing communications.

Security and data protection: Given the sensitive nature of tax information, tax preparation software should have robust security measures to protect client data and ensure compliance with privacy regulations.

What are the different types of tax preparation software?

Tax preparation software comes in various types, each tailored to different users and needs. Here are the main types:

Desktop software: Traditional desktop tax preparation software is installed locally on a computer and operates offline. Users purchase or subscribe to the software and receive updates periodically. Desktop software typically offers robust features and is suitable for individuals and professionals. Examples include TurboTax Desktop, TaxAct Desktop, and H&R Block Tax Software.

Online/web-based software: Online tax preparation software operates through a web browser and is hosted on remote servers. Users access the software via the Internet and can work on tax returns from any device with an Internet connection. Online software often offers similar features to desktop software but provides the added flexibility of remote access and collaboration. Examples include TurboTax Online, TaxAct Online, and H&R Block Online.

Professional/professional suite: Professional tax preparation software is designed specifically for tax professionals, accountants, and tax preparation firms. These software packages offer advanced features tailored to the needs of tax professionals, such as support for multiple users, client management tools, workflow management, and integration with other accounting software platforms. Examples include Drake Tax, UltraTax CS, ProSystem Fx Tax, and CCH Axcess Tax.

Enterprise/enterprise suite: Enterprise tax preparation software is designed for larger enterprises with complex tax needs and high volumes of tax returns. These software packages offer scalability, advanced features for handling complex tax scenarios, multi-user support, centralized management, and integration with other enterprise software systems. Examples include CCH Axcess Tax for Enterprises and Thomson Reuters Checkpoint.

Free file software: The IRS provides free file tax preparation software in partnership with private companies. It's available to lower-income taxpayers and offers free electronic filing (e-filing) of federal tax returns. Free file software typically provides basic features for simple tax returns and may have income eligibility requirements. Examples include Free File Fillable Forms, TurboTax Free File Program, and TaxAct Free File.

Mobile apps: Tax preparation apps allow users to prepare and file tax returns using smartphones and tablets. These apps often offer simplified interfaces and essential features for straightforward tax situations. Users can take photos of tax documents, answer questions, and e-file tax returns directly from their mobile devices. Examples include TurboTax Mobile, TaxAct Express, and H&R Block Tax Prep and File.

Each type of tax preparation software has advantages and limitations, so it's essential to consider your specific needs and preferences when choosing the right tax pro software for you or your business.

How does tax preparation software work for professionals?

Tax software for professionals provides a digital platform to assist professionals in the tax filing process by efficiently and accurately preparing tax returns.

Here's how it typically works:

Data entry and import: Professionals gather financial information and tax documents such as W-2 forms, 1099s, receipts, and other relevant documents. They then manually enter this information into the tax preparation software or import it electronically from accounting software, banks, brokerage accounts, or payroll providers. Many software packages offer automated data import features to streamline this process and reduce manual entry errors.

Tax forms and calculations: This tax software provides access to a comprehensive library of tax forms, schedules, worksheets, and instructions to prepare tax returns, including those for individuals, businesses, estates, trusts, and other entities. Professionals enter data into the appropriate forms, and the software calculates tax liabilities, deductions, credits, and other tax-related figures.

Error checking and compliance: Tax software includes built-in error-checking features to identify common mistakes, inconsistencies, or missing information in the tax return. The software also ensures compliance with current tax laws, regulations, and filing requirements, helping to minimize the risk of errors or audits.

Tax planning and optimization: Some tax software packages include tax planning tools to help professionals identify tax-saving opportunities, optimize deductions and credits, and plan for future tax liabilities. These tools may include scenario analysis, tax projection calculators, and personalized tax advice based on the financial situation.

E-filing and reporting: Once the tax return is complete and reviewed for accuracy, professionals can electronically file (e-file) the return directly from the tax software to the IRS and state tax authorities. The tax software generates electronic filing forms and schedules, transmits the return securely, and provides confirmation of receipt. The tax software may also generate client reports, summaries, and other documentation for record-keeping and client communication.

Client management and collaboration: Tax preparation software often includes features for managing information, organizing tax documents, tracking deadlines, and communicating with others. Some software packages also support collaboration and sharing of documents between professionals and their clients through secure client portals or other communication channels.

What is the best professional tax preparation software in 2024?

Choosing the best tax preparation software for professionals depends on various factors, such as specific needs, the size of your business, your budget, and the complexity of tax returns you typically handle.

In our experience, here are some of the top options widely used by tax professionals:

1. Drake Tax

Drake Tax is a feature-rich software for professionals.

Drake Tax is a professional tax preparation software developed by Drake Software. It's the best tax software for its wide range of features.

Here's an overview of Drake Tax:

What is Drake Tax?

Drake Tax is primarily a desktop-based tax preparation software with a comprehensive platform designed specifically for professionals.

Critical features of Drake Tax:

Activity tracking

Corporate/business returns

Data verification

Exception notification

Tax calculation

Tax forms, including over 7,700 federal & state forms, schedules

Billing & invoicing

Data import/export

Tax planning

Client organizers

Tax filing

K-1 reporting

Electronic filing

Accounting practices

Payroll

Diagnostic tools like LinkBack and DoubleCheck

Who is Drake Tax best for?

Drake Tax is best for large enterprises that need various features.

Pricing:

Pricing for Drake Tax starts at $355 pay per return.

2. Shoeboxed

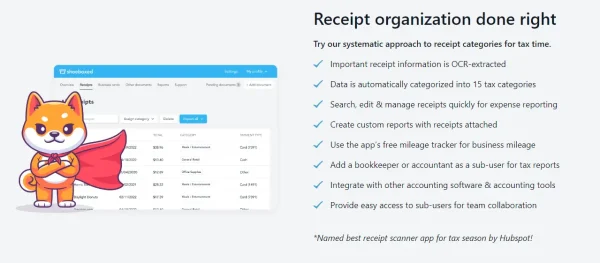

Shoeboxed is the best receipt and expense management tax software.

Shoeboxed is not a tax preparation software like Drake Tax; it’s a receipt and expense management solution that can complement tax preparation software.

What is Shoeboxed?

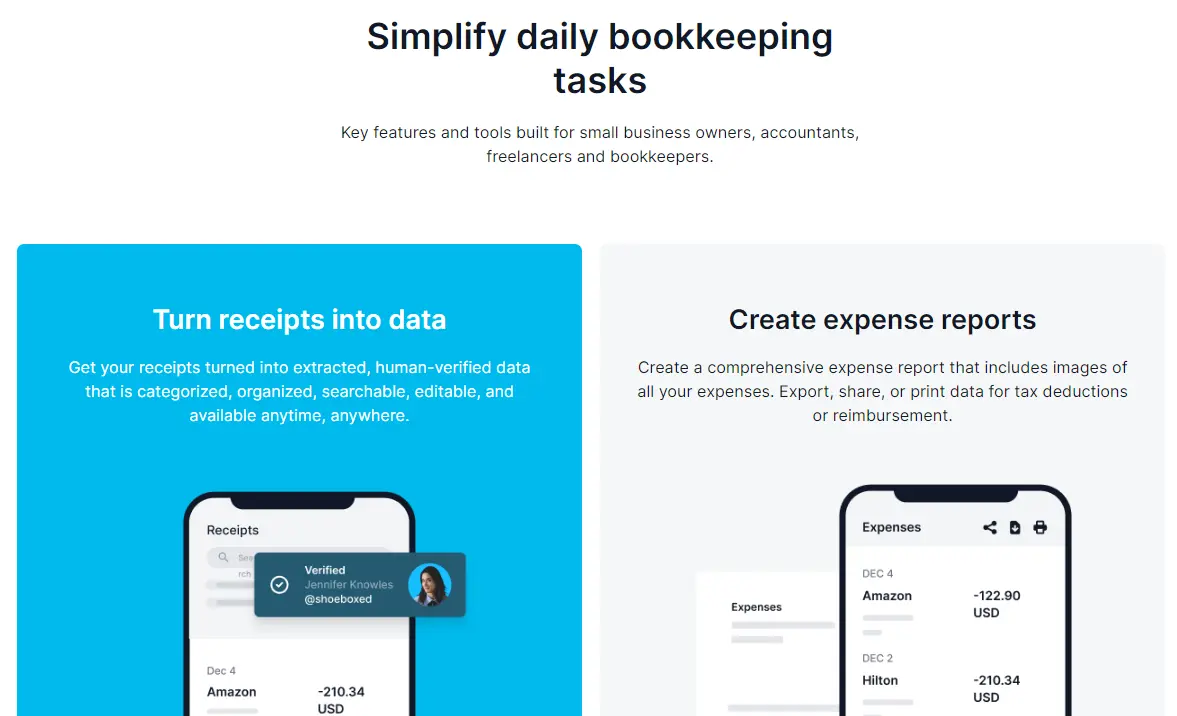

Shoeboxed is a cloud-based platform that helps individuals, small businesses, and professionals organize, digitize, and manage their receipts, expenses, and business documents. It offers features like receipt scanning, expense tracking, mileage tracking, and document storage to streamline financial record-keeping and simplify tax preparation.

Users simply stuff receipts into Shoeboxed's postage-prepaid Magic Envelopes, and send them off to get scanned at Shoeboxed's scanning facility.

The Shoeboxed team then notifies you when all your documents have been processed!

Critical features of Shoeboxed:

Receipt scanning: Users can scan paper receipts using a mobile device, mail, or email digital receipts to Shoeboxed. The platform extracts critical information from the receipts, such as date, amount, and merchant, and organizes them for easy access.

Expense tracking: Shoeboxed allows users to categorize and tag expenses, track spending trends, and generate expense reports. This helps users monitor their financial activity, identify tax-deductible expenses, and prepare for tax filing.

Mileage tracking: Shoeboxed offers mileage tracking features to help users track business-related travel expenses. Users can log mileage manually or use GPS tracking to capture mileage automatically.

Document storage: Shoeboxed provides secure cloud storage for digital copies of receipts, documents, and other financial records. Users can access their documents from any device with an internet connection, making retrieving information for tax preparation or audit purposes easy.

Integration with accounting software: Shoeboxed integrates with popular accounting software platforms such as QuickBooks, Xero, and Wave, allowing users to import expense data directly into their accounting software for reconciliation and reporting.

Who is Shoeboxed for?

Shoeboxed suits individuals, freelancers, small businesses, and professionals who want to outsource their receipt data entry and expense management process.

It benefits self-employed individuals, independent contractors, and small business owners who need to track expenses for tax purposes and maintain organized financial records.

Mobile or desktop?

Shoeboxed offers both mobile and desktop access. Users can use the Shoeboxed mobile app to scan receipts, track expenses, and manage documents.

The platform is also accessible via web browsers on desktop and laptop computers.

Shoeboxed combines award-winning service with a receipt scanner app.

Pricing:

Shoeboxed offers subscription plans with varying features and pricing tiers based on the volume of documents and receipts processed. Pricing typically ranges from a monthly fee for individual users to a higher subscription fee for businesses with multiple users and higher document processing needs.

Users can choose plans tailored to individuals, businesses, and accountants, with additional features such as mileage tracking and advanced reporting options. Pricing starts at $18 a month; details can be found on the Shoeboxed website.

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. Try free for 30 days!

Get Started Today3. UltraTax CS

Save time preparing tax returns with UltraTax CS.

From our experience, UltraTax CS is the best tax software for larger enterprises and more complicated returns. Developed by Thomson Reuters, UltraTax CS offers comprehensive features to streamline the tax preparation process and meet the needs of all professionals.

Here's an overview of UltraTax CS:

What is UltraTax CS?

UltraTax CS is a cloud-based tax preparation software for professionals designed to automate and streamline corporate workflows and document management.

Critical features of UltraTax CS:

Multi-monitor flexibility allows professionals to view information from up to 4 separate screens simultaneously.

Data Sharing

Document management

E-filing Capabilities: UltraTax CS allows users to electronically file (e-file) tax returns directly from the software to the IRS and state tax authorities. It generates electronic filing forms and schedules, transmits the return securely, and provides confirmation of receipt.

Advanced tax capabilities

Multi-state processing of tax return preparation

E-signature add-on for signatures from anywhere on mobile devices

Asset management

Compliance management

Data storage management

K-1 reporting

Tax planning

Data verification

Data import/export

Workflow management

Tax calculations

Integration with Accounting Software: UltraTax CS integrates with other Thomson Reuters accounting and tax software solutions, such as CS Professional Suite and Checkpoint, allowing seamless data exchange and workflow integration.

Who is UltraTax CS for?

UltraTax CS is ideal for freelancers and small, mid-sized, and large enterprises.

Pricing:

Pricing for UltraTax CS varies depending on factors such as the number of users, the number of returns prepared, and any additional features or services selected. UltraTax CS typically involves an annual subscription fee, with options for add-on modules or services. For specific pricing information, users should contact Thomson Reuters directly or visit their website for the most up-to-date details.

4. CCH Axcess Tax

CCH Axcess Tax software is a fully integrated tax software solution.

CCH Axcess Tax is a professional tax preparation software developed by Wolters Kluwer. It's the best tax software for scalability from small to mid-sized businesses.

Here's an overview of CCH Axcess Tax:

What is CCH Axcess Tax?

CCH Axcess Tax is an all-in-one cloud-based tax preparation software with a fully integrated compliance, tax preparation, and workflow solution.

Critical features of CCH Axcess Tax:

Tax preparation

Compliance management

Workflow management

Document management

K-1 import

Client collaboration tools

Integration with crypto tools

Powerful tax research tools

Robust diagnostic tools

Who is CCH Axcess Tax for?

CCH Axcess Tax suits professional tax preparers with small to mid-sized firms.

Pricing:

One of the biggest complaints from customers is the need for more transparency on their pricing. You will have to contact Wolters Kluwer directly for pricing.

5. Intuit ProSeries Tax

Intuit ProSeries is straightforward software that can be used anytime from anywhere.

Intuit ProSeries Tax is a professional tax preparation software developed by Intuit. It's the best tax software for accuracy due to its robust diagnostic tools.

Here's an overview of Intuit ProSeries Tax:

What is Intuit ProSeries Tax?

Intuit ProSeries Tax is a cloud-based tax preparation software designed for tax preparation, filing e-forms, and tracking tax filing errors. The tax form bar allows inputting tax return information, locating and fixing mistakes, and streamlining data operations. There are over 1,000 diagnostic tools to pinpoint errors and show you where to fix them.

Critical features of Intuit ProSeries Tax:

Multi-user access

E-signature

Status tracking

Multi-year e-filing capabilities

Data import

Encrypted PDF files

Tax planner

Custom billing options

Graphs and charts

Client checklists

Task scheduler

Advanced diagnostic tools

What is Intuit ProSeries Tax for?

Intuit ProSeries Tax is best for freelancers and small business owners.

Pricing:

Pricing for Intuit ProSeries Tax starts at $579 per year and varies depending on the number of returns filed and features.

6. TaxAct Professional

TaxAct Professional is an affordable tax preparation software designed for individuals and professionals. It's one of the best tax software programs for its cost-effectiveness.

Here's an overview of TaxAct Professional:

What is a TaxAct Professional?

TaxAct Professional is a desktop and mobile tax preparation platform that serves the needs of both individuals and professionals. Its user-friendly interface and affordability make it an excellent option for individuals and for professionals; it offers a comprehensive suite for handling a high volume of returns.

Critical features of TaxAct Professional:

Communication management

Automated data import

Document storage

Tax filing capabilities

Tax forms

Client management

Status tracking

Invoicing

Activity dashboard

Who is TaxAct Professional for?

TaxAct Professional is an excellent option for individuals, freelancers, and small business owners.

Pricing:

Pricing for TaxAct Professional starts at $150 per year.

7. TaxSlayer Pro

TaxSlayer Pro is an excellent option for just about any taxpayer.

TaxSlayer Pro is a professional-grade software popular choice for any taxpayer. It's the best tax software for versatility.

Here's an overview of TaxSlayer Pro:

What is TaxSlayer Pro?

TaxSlayer Pro is a desktop and mobile-based tax preparation software designed for individuals, business tax returns, payroll taxes, and human resources.

Critical features of TaxSlayer Pro:

Tax forms

Document management

Client management

Tax filing capabilities

Billing and invoicing

Client portal

Approval process control

Who is TaxSlayer Pro for?

TaxSlayer Pro is best for individuals, freelancers, small businesses, mid-size businesses, and large enterprises.

Pricing:

Pricing for TaxSlayer Pro starts at $1,295.

What are the benefits of tax preparation software for professionals?

Tax preparation software offers several benefits for accountants, professionals, and accounting firms:

Efficiency: Tax preparation software streamlines the tax preparation process, reducing the time and effort required to complete tax returns. Features such as automated data import, built-in calculations, error checking, and electronic filing (e-filing) help accountants work more efficiently and quickly complete tax returns.

Accuracy: Tax preparation software helps minimize errors and inaccuracies in tax returns by providing built-in error-checking features, up-to-date tax forms and calculations, and compliance with current tax laws and regulations. This helps ensure that tax returns are prepared accurately and minimizes the risk of audits or penalties.

Compliance: Tax preparation software helps ensure compliance with IRS and state tax filing requirements, deadlines, and regulations. The software stays up-to-date with tax law and regulation changes, assisting accountants in remaining current and avoiding potential compliance issues.

Tax planning and optimization: Many tax preparation software packages include tax planning tools to help accountants identify tax-saving opportunities, optimize deductions and credits, and plan for future tax liabilities. These tools provide valuable insights into the client's financial situation and help minimize tax liabilities.

Client data management: Tax preparation software often includes features for managing client information, organizing tax documents, tracking deadlines, and communicating with clients. This helps accountants stay organized, provide better client service, and maintain strong client relationships.

Scalability: Tax preparation software is scalable and can accommodate the needs of accounting firms of all sizes, from sole practitioners to large firms with multiple locations and a large client base. The software can handle a high volume of tax returns efficiently and effectively, allowing accounting firms to grow and expand their practice.

Security: Tax preparation software typically includes robust security measures to protect client data and ensure confidentiality. This provides data transmission encryption, secure client information storage, user authentication, and other security features to prevent unauthorized access or data breaches.

Never lose a receipt again 📁

Join over 1 million businesses organizing & scanning receipts, creating expense reports, and reclaiming multiple hours every week—with Shoeboxed.✨

Get Started TodayFrequently asked questions

What type of tax software should professionals use?

Professionals should use tax preparation software such as Drake Tax, Shoeboxed, UltraTax CS, CCH Axcess Tax, Intuit ProSeries Tax, TaxAct Professional, or TaxSlayer Pro.

What is the best tax preparation software for receipt and expense management?

Shoeboxed is the best tax preparation software for professionals regarding receipt and expense management. Shoeboxed automatically extracts information from your receipts and turns it into data for expense reporting and tax preparation. Receipts can be scanned with their app, or you can mail the receipts to Shoeboxed in their Magic Envelope, and they will scan them for you.

In conclusion

When determining what is the best tax preparation software for professionals, you need to consider several factors, such as your specific needs, the number of users, the size of your business, and your growth potential.

Tax preparation software offers professionals numerous benefits, including increased efficiency, accuracy, compliance, tax planning capabilities, client management features, scalability, and security. By leveraging tax preparation software, professionals can improve their productivity, provide better client service, and grow their practice more effectively.

Caryl Ramsey has years of experience assisting in different aspects of bookkeeping, taxes, and customer service. She uses a variety of accounting software for setting up client information, reconciling accounts, coding expenses, running financial reports, and preparing tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports, including IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports, and more—with Shoeboxed.

Try Shoeboxed today!