Digital transformation in finance is a rapidly growing phenomenon reshaping how businesses manage their financial operations.

This transformation is driven by new technologies such as artificial intelligence (AI), machine learning (ML), blockchain, and robotic process automation (RPA).

These advancements make finance operations more efficient by automating manual tasks, improving data analytics, and enhancing decision-making capabilities.

As companies across industries strive to remain competitive in the digital era, they increasingly adopt digital solutions to streamline their finance operations.

What is digital transformation in the finance industry?

Digital transformation in finance refers to leveraging digital technologies to modernize financial services.

An example would be using technology to capture an image, extracting that information from the image, and transforming it into digital data instead of having to enter the information manually.

Data-driven decision-making

One of the critical factors driving digital transformation in finance is the increased need for efficient business operations that lead to quick and accurate data-driven decision-making.

Financial institutions use advanced technologies such as artificial intelligence, machine learning, and data analytics for business processes to gain valuable insights and make more informed decisions.

This helps enhance operational efficiency and enables organizations to deliver more personalized customer services.

Innovative technology solutions

In addition, digital transformation in finance has led to the development of a wide range of innovative financial products and services, such as receipt scanning, digital wallets, mobile banking, and robo-advisory platforms.

These services, along with CXM software, have made it easier for customers to access their financial information, improving customer experience.

As finance continues to evolve in the digital age, financial institutions must consistently adapt to remain competitive.

This includes investing in innovative technologies, redefining their strategies, and fostering a culture of digital transformation within the organization.

By doing so, finance organizations can ensure they are well-positioned to thrive in the ever-changing digital landscape of the financial industry.

What is the role of digital technology in digital finance transformation?

Digital finance transformation wouldn’t exist without the digital technology to back it up.

The impact of artificial intelligence and machine learning

Technology has quickly become a powerful driving force in the finance industry, with artificial intelligence (AI) and machine learning (ML) becoming increasingly important.

AI and ML have the potential to revolutionize financial processes, from receipt scanning and expense management to automating financial forecasts and risk assessments.

These technologies have a significant impact on data and business analysis.

This enables financial professionals to analyze data more quickly and make more informed decisions, ultimately improving efficiency and accuracy within the industry.

The potential of robotic process automation

Robotic Process Automation (RPA) is another technology that plays a crucial role in financial transformation.

RPA uses software robots to automate repetitive tasks throughout the finance function, from data entry to account reconciliations.

By integrating RPA into their processes, finance teams can reduce the time spent on mundane tasks, streamline workflows, and enhance overall efficiency.

Moreover, this automation allows businesses to reallocate resources to more value-added activities such as strategic financial planning and analysis.

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. Try free for 30 days!

Get Started TodayHarnessing the power of big data analytics

Financial services companies generate enormous amounts of data daily, which can be challenging to manage and analyze effectively.

However, big data analytics can help finance professionals unlock insights hidden within these sizable datasets.

By leveraging data analytics tools, a finance team can transform large volumes of unstructured data into actionable insights to drive business strategies and decision-making processes.

By doing so, they can improve financial reporting, monitor business expenses, and optimize their business operations.

Securely harnessing the power of cloud computing

Cloud computing has become a cornerstone technology in modern finance, providing a scalable and flexible platform for financial applications, data storage, and infrastructure.

However, security is a crucial concern for finance organizations adopting cloud technologies.

To securely harness the power of cloud computing, finance professionals must implement robust security measures, such as data encryption, access control policies, and ongoing security monitoring, to protect sensitive financial data and maintain compliance with relevant regulations.

Adopting AI, ML, RPA, big data analytics, and cloud computing will make finance functions more efficient, accurate, and agile, paving the way for a more strategic and value-adding role within organizations.

What is an example of digital transformation trends?

Businesses leverage innovative technology solutions with digital tools to facilitate digital finance transformation.

Receipt scanning apps

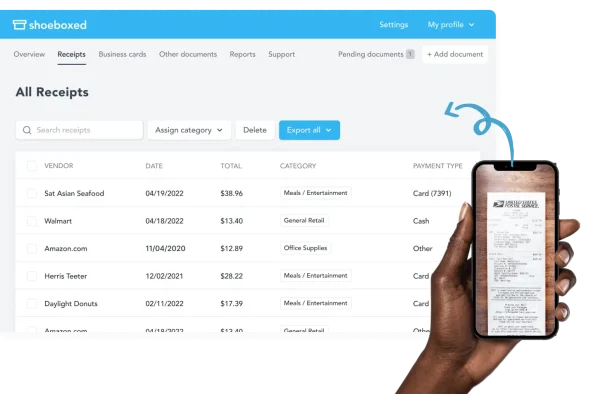

One example of digital finance transformation is the development of receipt-scanning apps.

Shoeboxed is a popular receipt-scanning app.

Shoeboxed is an example of digital transformation in finance.

Using OCR technology, these apps allow users to take pictures of their receipts or other documents with their smartphones and extract relevant information, such as the date, vendor, and amount spent.

Shoeboxed uses OCR technology to extract data.

This data is then human-verified and uploaded into a Shoeboxed account, where the data is automatically categorized and safely stored.

Data can be categorized into 15 pre-determined tax categories, or the user can create custom categories.

Shoeboxed uses Secure Socket Layer (SSL), the same online encryption banks and medical services use.

Shoeboxed integrates with other popular apps

This app streamlines the expense tracking process and integrates with other finance-related software, such as accounting and invoicing platforms.

Receipt scanning apps offer a more efficient and accurate way for individuals and businesses to track their expenses than manual data entry.

By leveraging optical character recognition (OCR) technology, these apps can reduce errors and save users time when managing their finances.

Additionally, receipt scanning apps can store digital copies of receipts for future reference, helping users stay organized and reducing the need for physical storage.

This further enhances the user experience and simplifies financial management by allowing users to access all their financial information from a single application.

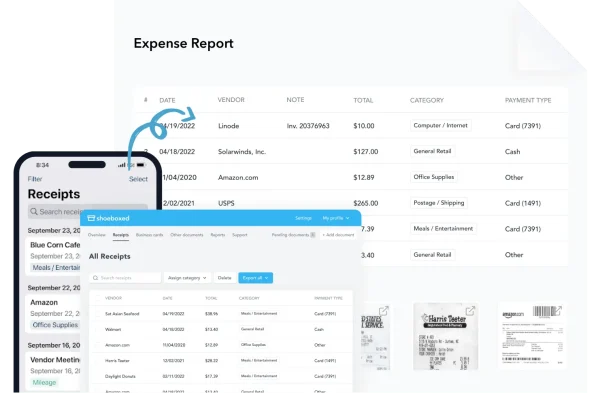

Shoeboxed can generate expense reports with just the click of a button.

With just a few clicks, comprehensive expense reports with receipt images can be created quickly from either the web or a mobile device.

Receipt scanning apps are an excellent example of digital transformation in the finance industry, offering improved efficiency, accuracy, and convenience for users while managing their expenses.

Stop doing manual data entry 🛑

Outsource receipt scanning to Shoeboxed’s scanning service and free up your time for good. Try free for 30 days! ✨

Get Started TodayHow can digital transformation in finance be successfully implemented?

We have found that ensuring a successful digital transformation in finance also requires developing digital competencies among team members.

This includes enhancing data literacy so that finance professionals can effectively understand, analyze, and communicate data-driven insights.

Finance leaders should invest in training programs and create a culture of continuous learning to ensure their teams have the skills needed for the digital age.

By addressing these aspects, the financial services industry can effectively navigate the challenges and opportunities that arise from the digital transformation journey, optimizing value creation for their organizations.

Shoeboxed Demo by Shoeboxed YouTube

How can the impact of digital transformation be determined?

Demonstrating ROI through concrete outcomes

The impact of digital transformation in the finance industry can be quantified by analyzing various performance metrics, such as cost reduction, revenue growth, and enhanced accuracy in forecasting.

Implementing a digital strategy in financial services leads to cost savings, more efficient processes, and better decision-making.

For instance, many financial institutions invest billions of dollars annually in digital transformation journeys, with varying return on investment (ROI) BCG.

Some concrete outcomes that indicate an improved ROI include the following:

Cost reduction: By automating manual tasks and implementing more efficient technologies, finance firms can significantly lower operational costs.

Revenue growth: Digital transformation enables financial institutions to develop and offer innovative products and services, increasing business opportunities and higher revenues.

Enhanced accuracy: By leveraging data analytics and machine learning, finance professionals can make more accurate forecasts and predictions, further optimizing business performance.

Digital Transformation in Financial Services by Deloitte US

Frequently asked questions

What are the key drivers of digital transformation in the financial industry?

There are several key drivers of digital transformation in the financial industry. These include increasing regulatory demands, competitive pressures from innovative fintech companies, evolving customer expectations, more financial service providers, and the rapid advancement of digital technologies. Financial institutions are seeking ways to be more efficient, agile, and customer-centric, which has led to adopting digital solutions such as Shoeboxed for expense management and redesigning traditional processes.

How does digital transformation impact financial processes and decision-making?

Digital transformation impacts financial processes and decision-making by introducing new capabilities, such as real-time data analysis, advanced analytics, and intelligent automation technologies such as OCR data extraction used by Shoeboxed, supporting better decision-making and more efficient operations. Digital solutions allow financial institutions to optimize their day-to-day operations, streamline compliance processes, improve risk management, and deliver personalized customer experiences. Furthermore, digital transformation enables finance professionals to focus on strategic activities by automating repetitive and manual tasks.

Which technologies are commonly employed in finance digital transformation initiatives?

Some of the standard technologies employed in finance companies’ digital initiatives include cloud computing, artificial intelligence (AI) and machine learning, robotic process automation (RPA), advanced analytics tools, distributed ledger technology (e.g., blockchain), and API-driven platforms. These technologies help optimize existing systems and processes and enable the development of innovative services and business models that can better serve the changing needs of customers and stakeholders.

Conclusion

This shift towards digital transformation enables finance professionals to focus on more strategic tasks, contributing to the overall growth and success of the organization.

Financial institutions should continuously assess their capabilities and strategies for digital transformation in finance to remain at the forefront of innovation and maintain their competitive edge in the market.

Caryl Ramsey has years of experience assisting in different aspects of bookkeeping, taxes, and customer service. She uses a variety of accounting software for setting up client information, reconciling accounts, coding expenses, running financial reports, and preparing tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!