It’s essential to stay up-to-date on the annual IRS 2024 tax brackets and rates so that you can plan accordingly.

These new tax brackets adjust for inflation annually and are based on the Chained Consumer Price Index(C-CPI).

In 2022, the average inflation rate was 8%, an increase of 3.3% from 2021.

Inflation affects the value of credits, deductions, and income thresholds yearly.

In this post, we’ll look closely at the new income tax brackets for 2024 and various strategies to lower taxable income and taxes owed.

What is the historical perspective of federal income tax brackets over time?

Examining the history of federal income tax brackets can provide important information on how our current system was established and what has shaped it throughout the years.

The first tax brackets were set up over a century ago to finance wars but have since changed multiple times due to factors such as economic, social, and political influences.

Variations in taxes come from alterations made by lawmakers and other external forces, including inflation rates, recessions, and general economic trends.

Looking back at these events, we learn why taxes are set up with its current system.

What is the progressive tax system?

The U.S. follows a progressive tax system, where the more income you earn, the higher your relevant rate of taxation.

This mechanism ensures that those earning more significant amounts pay their fair share in taxes compared with lower earners.

For this policy to function effectively, it’s important to note that all income levels aren’t subject to taxation at the same rate.

Instead, different levels correspond with certain thresholds, tax brackets, and tax rates.

These separate income tax rates ensure that citizens who generate higher incomes contribute more significant percentages from their total earnings towards paying taxes than individuals with less money do.

How to break down the IRS 2024 tax brackets

The IRS periodically adjusts the seven federal tax brackets to account for inflation and other economic changes.

In 2024, the tax rates will remain the same as in 2023 at 10%, 12%, 22%, 24%, 32%, 35% and 37%.

However, the income limits increase in 2024 for each rate.

Because of changes in taxable income, changing federal income tax brackets, and changes in federal income tax rates from year to year, you could find yourself in a different tax bracket than the year before.

IRS 2023 Income Tax Brackets

Tax Rate |

Single Individuals |

Married Filing Jointly |

Head of Household |

10% |

Up to $11,000 |

Up to $22,000 |

Up to $15,700 |

12% |

$11,000 to $44,725 |

$22,000 to $89,450 |

$15,700 to $59,850 |

22% |

$44,725 to $95,375 |

$89,450 to $190,750 |

$59,850 to $95,350 |

24% |

$95,375 to $182,100 |

$190,750 to $364,200 |

$95,350 to $182,100 |

32% |

$182,100 to $231,250 |

$364,200 to $462,500 |

$182,100 to $231,250 |

35% |

$231,250 to $578,125 |

$462,500 to $693,750 |

$231,250 to $578,100 |

37% |

$578,125 and up |

$693,750 and up |

$578,100 and up |

IRS 2023 Income Tax Brackets

IRS 2024 Income Tax Brackets

Tax Rate |

Single Individuals |

Married Filing Jointly |

Head of Household |

10% |

Up to $11,600 |

Up to $23,200 |

Up to $16,550 |

12% |

$11,600 to $47,150 |

$23,201 to $94,300 |

$16,550 to 63,100 |

22% |

$47,150 to $100,525 |

$94,300 to $201,050 |

$63,100 to $100,500 |

24% |

$100,525 to $191,950 |

$201,050 to $383,900 |

$100,500 to $191,950 |

32% |

$191,950 to $243,725 |

$383,900 to $487,450 |

$191,950 to $243,700 |

35% |

$243,725 to $609,350 |

$487,450 to $731,200 |

$243,700 to $609,350 |

37% |

$609,350 and up |

$731,200 and up |

$609,350 and up |

IRS 2024 Income Tax Brackets

For example, if we look at an individual who is filing as single with an income of $45K in 2023, they will fall into the tax rate of 22%, while this same person in 2024 with the same amount of income will be subject to a tax rate of 12%.

This example shows us how important it is to stay updated on the latest federal tax rates and brackets to understand how every adjustment impacts us financially.

How does inflation affect income thresholds?

To protect taxpayers from excessive taxation due to inflation, the government readjusts income thresholds annually.

These adjustments prevent bracket creep, which occurs when higher taxes are imposed on individuals even though their income hasn’t increased.

How does inflation affect standard deductions?

Inflation also affects the value of standard deductions on a yearly basis.

Here are the standard deductions for 2023 and 2024.

2023 |

2024 |

|

Single filers |

$13,850 |

$14,600 |

Married filing jointly |

$27,700 |

$29,200 |

Head of household |

$20,800 |

$21,900 |

Standard deductions for 2023 and 2024

For 2023 filings, the standard deduction for single filers is $13,850; in 2024, the standard deduction for the same filing is $14,600.

The standard deduction went up in 2024 to account for inflation and to remain proportionate to the income limits for each tax rate.

What is the impact of 2024 on married couples filing jointly?

Married couples filing jointly should take note of the changes to tax brackets and income thresholds that will affect their taxes.

In 2024, married couples filing jointly have increased adjusted income ranges with a maximum highest tax rate of 37% for incomes exceeding $731,200 versus $693,750 in 2023.

The standard deduction for these joint filers increases by $1,500 in 2024 to $29,200, with an additional allowance of $1,550 offered if both partners are 65 or above.

What are the changes in 2024 for individual and married filing separate filers?

For the 2024 tax year, single and married filing separately have increased adjusted income ranges with a maximum highest tax rate of 37% for incomes exceeding $609,350 versus $578,125 in 2023.

The standard deduction went from $13,850 in 2023 to $14,600 in 2024.

How to navigate your federal income tax bracket

Your federal income tax bracket is calculated based on filing status and taxable income.

Knowing how these tax brackets work can help taxpayers make better tax decisions, such as taking advantage of deductions that could move them into a lower bracket.

What is the role of an itemized or standard deduction?

The total tax obligation is impacted by filing status, taxable income, and the deduction method chosen, such as a standard or itemized deduction.

In 2024, single filers can take advantage of a standard deduction of $14,600, while married couples filing jointly can deduct an even higher amount – $29,200.

Tax deductions reduce the net earnings subject to taxation, leading to lower taxes.

There may be cases when people gain more from itemizing their deductions by listing individual expenses like medical costs, state & local fees, mortgage interest payments, etc., instead of taking the automatic ‘standard’ deduction.

The key is to see which option works in your favor by looking into each carefully before making a decision on which to choose.

What are strategies to lower your tax liability?

There are several ways for taxpayers to lower their tax liabilities.

Tax deductions such as charity contributions, property taxes, or mortgage interest can all help reduce the amount owed on taxes by lowering the taxable income.

This option reduces the net earnings subject to taxation, leading to lower taxes.

Some tax credits, such as the earned income credit or child support, offer dollar-for-dollar reductions in one’s overall tax liabilities.

Deductions and credits can lower your tax liability significantly.

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. Try free for 30 days!

Get Started TodayHow can taxpayers maximize tax credits and deductions?

Tax credits and deductions are a great way to reduce the money you owe in taxes.

Tax credit amounts can be taken directly off your tax bill, while income tax deductions lower taxable income for the year.

The key is knowing which deductions and credits are available and which ones apply to you.

What are some common tax credits for 2024?

Tax credits are a great way to minimize taxes owed.

Remember, a tax credit gives a dollar-for-dollar reduction on your tax bill.

Here are some of the most common tax credits for 2024 broken down by category.

Family and Dependent Credits

Earned Income Tax Credit (EITC)

Child Tax Credit

American Opportunity Tax Credit

Lifetime Learning Credits

Adoption credit

Vehicle Credits

Clean Vehicle Credit

Electric Car Credit

Income and Savings Credit

Saver’s Credit

Foreign Tax Credit

Homeowners Credits

Residential Energy Credits

Home Improvement Credit

Health Care Credits

Premium Tax Credit

Tax credits can either increase your tax refund, reduce the amount of tax owed, or give you a refund even if you don’t owe any tax.

Understanding all available options and their eligibility requirements is essential so you can take full advantage of these tax-saving strategies.

What are some common tax deductions for 2024?

Tax deductions minimize the amount of taxable income and, in turn, potentially move the taxpayer into a more favorable or lower tax bracket.

Here are some tax deductions for 2024 broken down by category.

Work-Related Deductions

Business Use of Home

Business Use of Car

Business Expenses

Itemized Deduction

Personal Property Tax

Real Estate Tax

Sales Tax

Gambling Loss

Interest Expense

Home Mortgage Interest

Moving Expenses

Miscellaneous Expenses

Education Deductions

Student Loan Interest

Work-related Education Expenses

Teacher Educational Expenses

Health Care Deductions

Medical expenses

Dental expenses

Health Savings Account (HSA)

Investment Related Deductions

Sale of Home

IRAs

Capital losses

Bad debt

Opportunity Zones

Forgiven debt

Deductions minimize the amount of taxable income before calculating the tax amount you owe.

How can I prepare for tax season?

As tax time nears, you should be preparing to file your taxes.

Preparing early and organizing everything can make filing taxes much less stressful when that time rolls around.

Here are some tips for getting ready.

1. Stay informed of tax law changes

It’s essential to regularly check for updates in tax regulations so that you’re not caught off guard with something that could affect you financially

The Internal Revenue Service (IRS) website, publications from accounting firms, and the U.S. Department of the Treasury websites are great places to look for current information on changes that can affect one’s taxes.

By subscribing to newsletters or e-news alerts about any tax changes, individuals can stay up-to-date with new laws about their liabilities and plan accordingly.

2. Organize receipts

If you’re itemizing or are a sole proprietor and have any Schedule C business expenses, then it’s important to gather and organize all receipts.

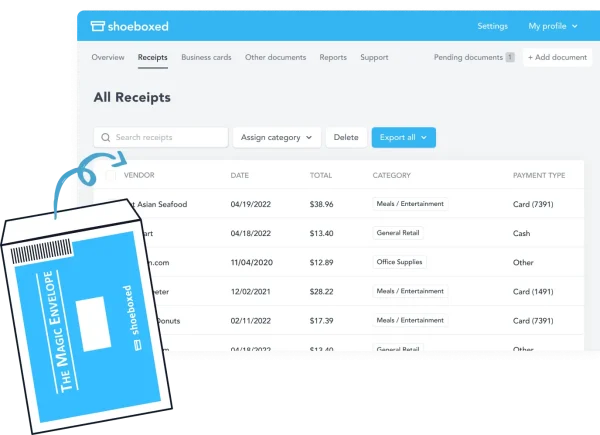

Shoeboxed can help with your itemized or work-related deductions.

Shoeboxed can help you prepare for the IRS 2024 tax brackets and deductions.

Shoeboxed is a tracking app that turns receipts into data and can automatically extract that data for expense reporting, tax prep, and audits.

With the app, receipts are scanned and uploaded into an account where they are divided into tax categories.

Mail your business receipts to Shoeboxed in their Magic Envelope.

Shoeboxed is both a receipt-scanning app and a receipt-scanning service.

The mobile app is used to scan and upload receipts with your phone so that you can keep track of all receipts in one place.

The app features OCR technology, which converts printed text into searchable data.

As a service, Shoeboxed clears your desk of receipt piles by mailing them to the processing center for free in a prepaid postage envelope called a Magic Envelope.

The receipts are scanned, verified, and uploaded at the processing center into an account under various tax categories.

Use your phone’s built-in GPS to track your business miles.

Shoeboxed also tracks business miles using your phone’s built-in GPS.

Simply, get Shoeboxed for Android or iPhone, and sign up for their receipt and mileage tracker.

Then, navigate to trips, start the mileage tracker, and stop when you reach your destination.

After editing and approving the data, click done, and the trip info is submitted to Shoebox as a receipt with the tax category for business mileage.

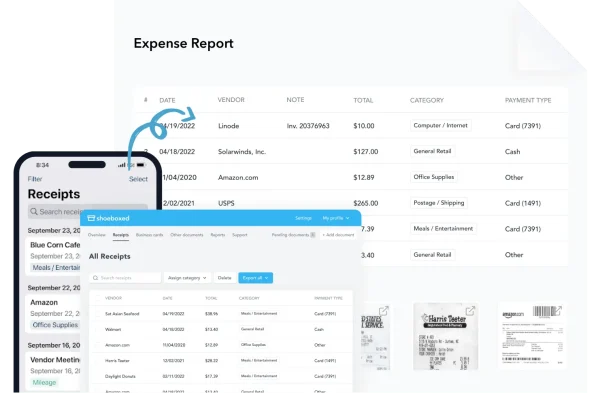

Create comprehensive expense reports from your mobile device or the web.

With Shoeboxed, you can send expense reports and images of the receipts from the web or your mobile device.

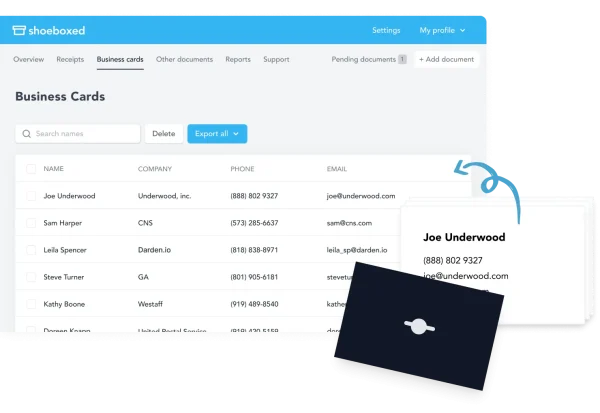

With Shoeboxed, turn your business cards into an online contact list.

Another great feature is clearing the business cards off your desk and creating an online database for your business contacts.

The contact information can then be sent to any email or CRM program.

Shoeboxed works with tools you already use.

The good thing is that Shoeboxed works with the tools you already use.

With QuickBooks, users can sync their receipts with their QuickBooks Online accounts.

Shoeboxed offers an excellent plan for start-ups and freelancers.

Shoeboxed offers a great plan for individuals, start-ups, and freelancers.

You can also use Shoeboxed for personal use to scan and upload important documents so that you have them all in one place.

Never lose a receipt again 📁

Join over 1 million businesses organizing & scanning receipts, creating expense reports, and reclaiming multiple hours every week—with Shoeboxed.✨

Get Started Today3. Plan for tax payments

Proactive tax planning is essential for successfully handling financial obligations and avoiding incurring charges or fines.

It’s best to allocate funds throughout the year so that you don’t experience a monetary strain when it comes time to pay.

If applicable in your case, making estimated payments on taxes that are not withheld can be very beneficial as this will ensure timely payment of dues without accruing extra costs due to delinquent installments.

Planning ahead and being organized should help make filing taxes a worry-free process with minimal stress involved.

Frequently asked questions

What are the 2024 tax brackets?

The IRS has established the 2024 tax brackets as 10%, 12%, 22%, 24%, 32%, 35% and 37%. This applies to all taxable income earned during the calendar year of 2024.

Why are income thresholds adjusted for inflation in the 2024 tax brackets?

To guarantee fairness for taxpayers, the income levels established by 2024 tax brackets will be updated yearly to reflect inflation. This ensures that people are not put in higher tax rates than they should due to their level of earning.

In conclusion

A thorough understanding of the IRS 2024 tax brackets and relevant credits/deductions, is essential for managing taxes and financial planning.

Staying up-to-date on tax changes can be beneficial to ensure you take full advantage of potential savings come tax season.

Caryl Ramsey has years of experience assisting in different aspects of bookkeeping, taxes, and customer service. She uses a variety of accounting software for setting up client information, reconciling accounts, coding expenses, running financial reports, and preparing tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!