Managing expenses rigorously is crucial in the construction industry, as projects are complex and come with many moving parts.

A construction expense tracker serves as a vital tool for project managers and contractors to monitor job costs, helping construction companies adhere to budgets throughout the life cycle of a construction project.

What is a construction expense tracker?

Construction costs can be tracked using a spreadsheet, which is a manual method, or software, which is a digital automated method.

a. The spreadsheet method

Construction expense tracker spreadsheets or templates typically come pre-formatted with common categories and cost items, allowing for detailed expense tracking and effective budget management from start to finish.

b. The software method

The software method typically includes an automated expense tracking system, promoting precise cost tracking and reducing the administrative burden of manually entering and recording costs.

Top 4 free construction expense tracker templates

A construction expense tracker template can help project managers stay up-to-date and within budget.

The following templates enable efficient cost control by offering structured, user-friendly spreadsheets for keeping track of costs.

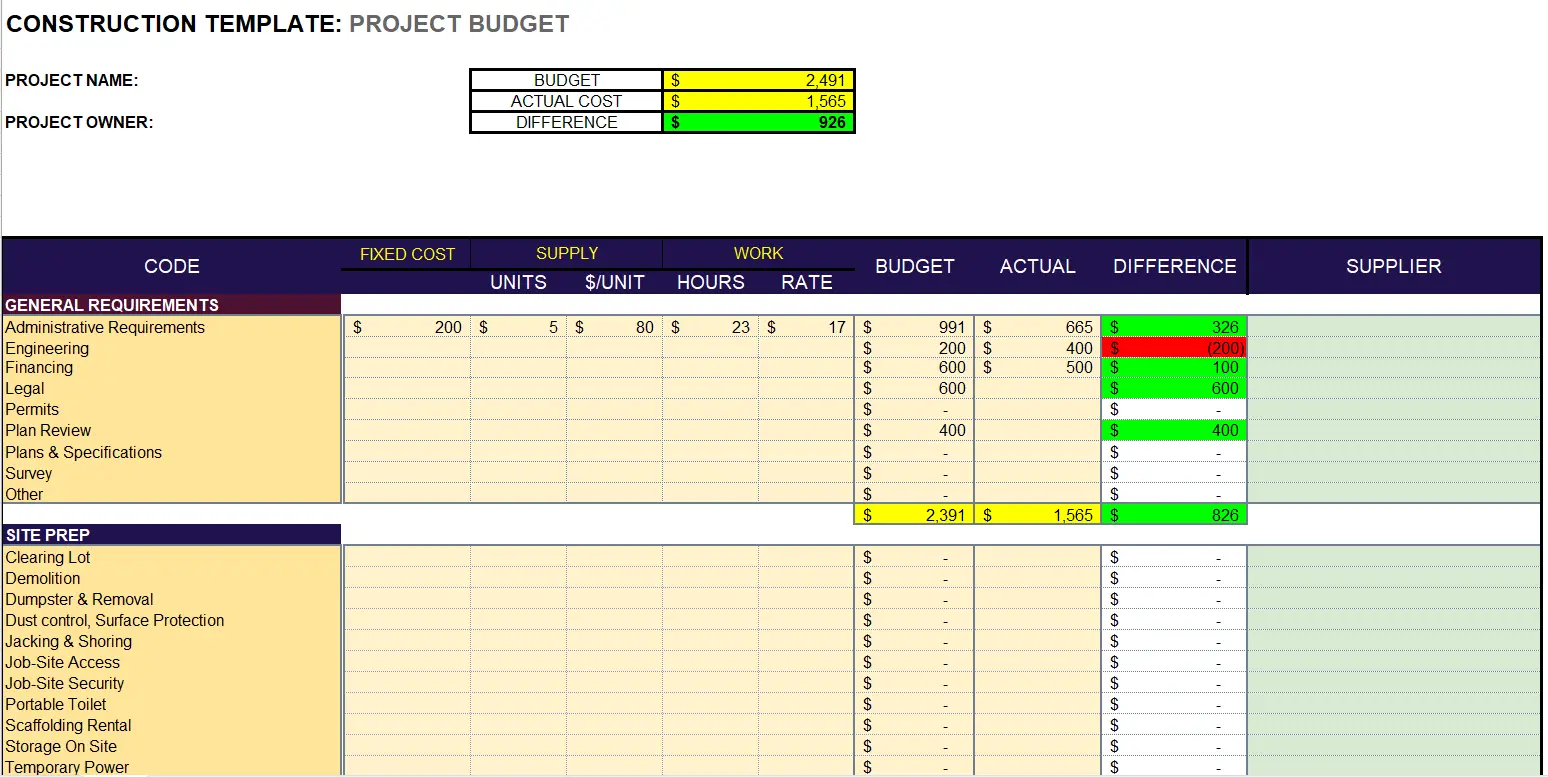

1. SINC Construction Project Budget Free Template

The SINC Construction Project Budget Template is an ideal choice for contractors looking to keep a close eye on project finances. It offers detailed expense categorization and the ability to compare estimated and actual costs.

The spreadsheet is available as a downloadable Excel template.

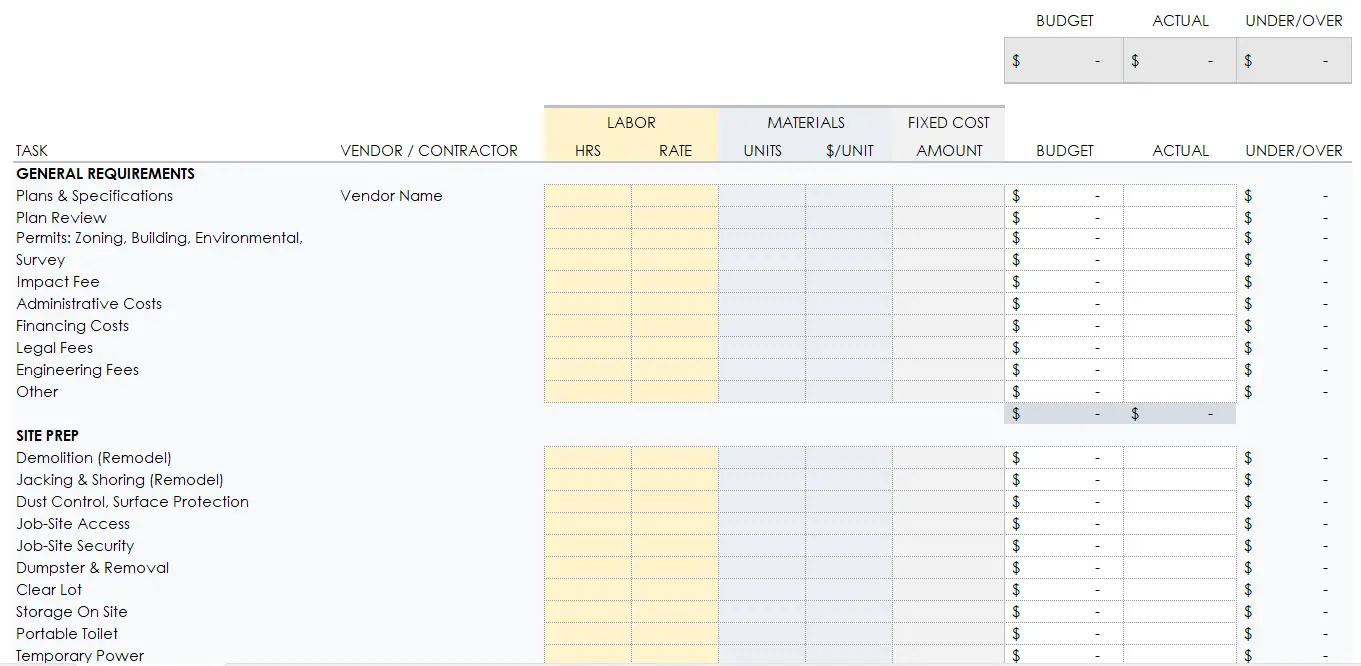

2. Construction Budget Template by Smartsheet

Smartsheet’s template stands out for its comprehensive approach to budgeting. It provides a breakdown of costs across different construction phases and in-built formulas for total cost calculations. If you're looking for something that will help you get a hold of the financial aspect of construction project management, check this one out.

The spreadsheet is available as a downloadable Excel template.

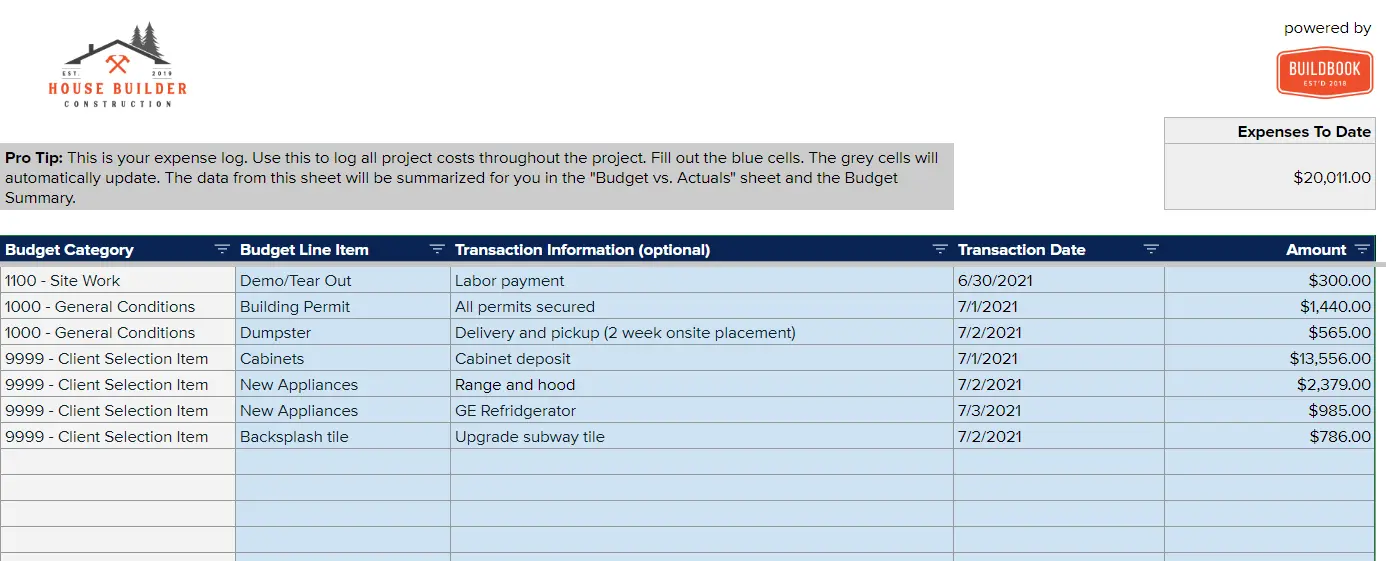

3. BuildBook Construction Budget Template

BuildBook offers simplicity in its construction budget template, which is perfect for small to medium-sized projects. Its main features include easy tracking of labor and material expenses and customizable categories.

You'll be asked to provide your name, email, phone number, and industry, and then you'll be able to access the Google spreadsheet. From there, make a copy of the spreadsheet and begin logging your expenses.

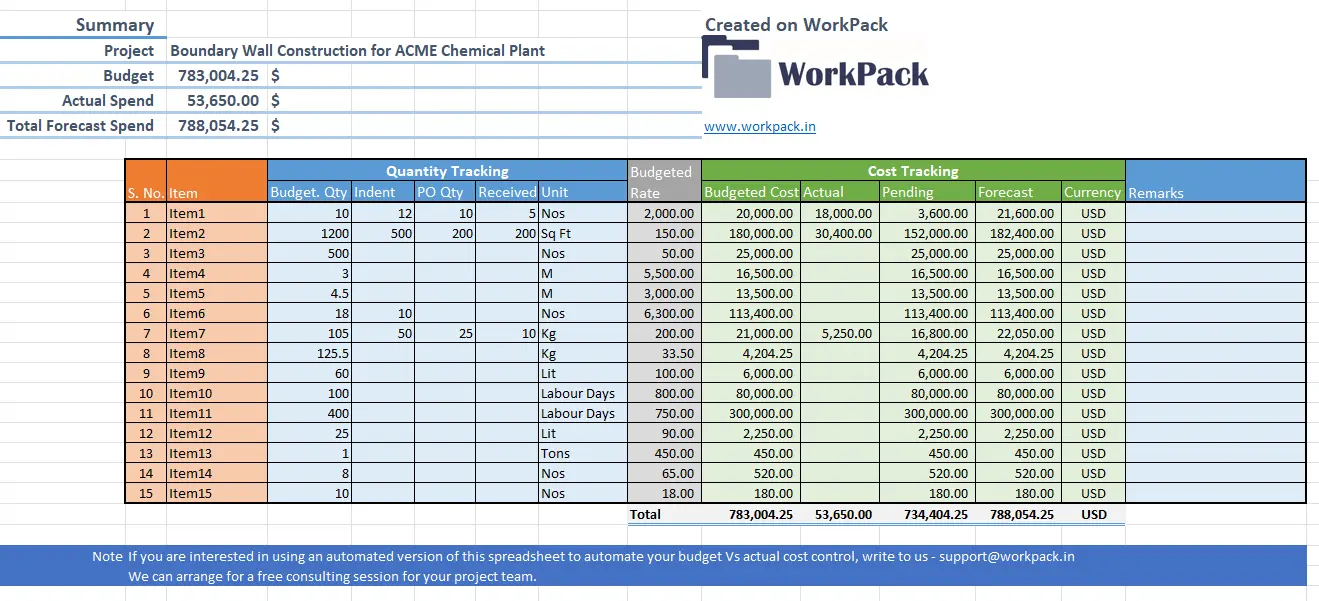

4. Workpack Construction Project Cost Control Excel Template

This template from Workpack emphasizes cost control for construction projects, allowing for rigorous financial monitoring. It offers monitoring of budget variance and visual summaries through charts.

The spreadsheet is available as a downloadable Excel template.

Bonus: Shoeboxed for receipt tracking while on site!

Shoeboxed is used by businesses across various industries for their receipt-tracking needs.

Hate spreadsheets? Don’t have time for manual entry? Want an easy alternative?

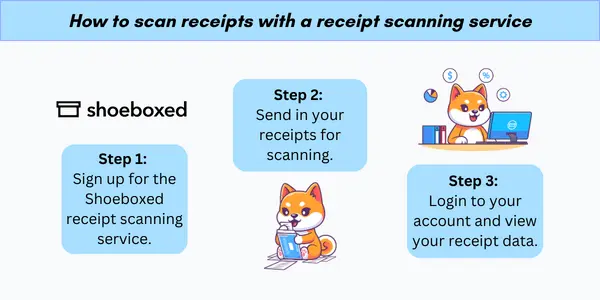

Shoeboxed provides an innovative solution with its receipt scanning service, digitizing physical receipts for expense tracking. Its main features include automated entry of receipt information and integration with accounting software for streamlined expense management.

Construction professionals often have a lot of expenses on the road, going to and from construction sites.

Keeping track of all these receipts can be a challenge, but with Shoeboxed’s Magic Envelope service, they just need to stuff all their receipts into the prepaid envelope provided by Shoeboxed and send it in.

Shoeboxed’s data entry team will then scan, categorize, and organize these receipts digitally.

So, instead of having to manually enter expense data, construction workers can spend more time focusing on their primary job!

Here’s how that would work: Keep a Magic Envelope in the seat next to you as you drive, and after you fill up for gas or leave that drive-in, slip the receipt into the prepaid envelope. At the end of the month, send the envelope in, and you won’t have to go near a spreadsheet again!

Shoeboxed is the only receipt scanner app that will handle both your paper receipts and your digital receipts—saving customers up to 9.2 hours per week from manual data entry!

Hit the road with Shoeboxed ⛟

Stuff receipts into the Magic Envelope while on the road. Then send them in once a month to get scanned. 💪🏼 Try free for 30 days!

Get Started TodayWhat else can Shoeboxed do?

Shoeboxed has been voted as the best receipt scanner app for tax season by Hubspot and given the Trusted Vendor and Quality Choice awards by Crozdesk.

A quick overview of Shoeboxed's award-winning features:

a. Mobile app and web dashboard

Shoeboxed’s mobile app lets you snap photos of paper receipts and upload them to your account right from your phone.

Shoeboxed also has a user-friendly web dashboard to upload receipts, warranties, contracts, invoices, and other documents from your desktop.

b. Gmail receipt sync feature for capturing e-receipts

Importing e-receipts to your Shoeboxed account is as easy as syncing your Gmail with Shoeboxed, using Shoeboxed's special Gmail Receipt Sync feature.

Shoeboxed’s Gmail Receipt Sync grabs all receipt emails and sends them to your account for automatic processing! These receipts are then labeled as Sent to Shoeboxed in your Gmail inbox.

In short, Shoeboxed pulls the receipt data from your email, including the vendor, purchase date, currency, total, and payment type, and organizes it in your account.

Your purchases will even come with images of the receipts attached!

c. Expense reports

Expense reports let you view all of your expenses in one cohesive document. They also make it simple to share your purchases with your accountant.

You can also choose certain types of receipts to include in your expense report. Just select the receipts you want to export and click “export selected.”

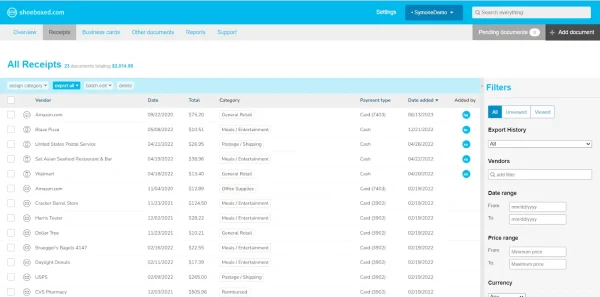

d. Search and filter

Call up any receipt or warranty in seconds with advanced search features.

Filter receipts based on vendors, date, price, currency, categories, payment type, and more.

e. Accounting software integrations

Export expenses to your accounting software in just a click.

Shoeboxed integrates with 12+ apps to automate the tedious tasks of life, including QuickBooks, Xero, and Wave Accounting.

f. Unlimited number of free sub-users

Add an unlimited number of free sub-users to your account, such as family members, employees, accountants, and tax professionals.

g. Mileage tracker for logging business miles

After you sign up for Shoeboxed, you can start tracking miles in seconds:

Open the Shoeboxed app.

Tap the “Mileage” icon.

Click the “Start Mileage Tracking” button.

And drive!

Whenever you start a trip, Shoeboxed tracks your location and miles and saves your route as you drive.

As you make stops at stores and customer locations, you can drop pins to make tracking more precise.

At the end of a drive, you’ll click the “End Mileage Tracking” button to create a summary of your trip. Each summary will include the date, editable mileage and trip name, and your tax deductible and rate info.

Click “Done” to generate a receipt for your drive and get a photo of your route on the map. Shoeboxed will automatically categorize your trip under the mileage category in your account.

See also: Shoeboxed vs. QuickBooks Mileage Tracker: Navigating the Race

h. The Magic Envelope

Outsource your receipt scanning with the Magic Envelope!

The Magic Envelope service is one of Shoeboxed's most popular features, particularly for businesses, as it lets users outsource receipt management.

When you sign up for a plan that includes the Magic Envelope, Shoeboxed will mail you a pre-paid envelope for you to send your receipts in.

Once your receipts reach the Shoeboxed facility, they’ll be digitized, human-verified, and tax-categorized in your account.

Have your own filing system?

Shoeboxed will even put your receipts under custom categories. Just separate your receipts with a paper clip and a note explaining how you want them organized!

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. Try free for 30 days!

Get Started TodayWhat to know about construction expenses

Construction costs are generally classified under two common categories: direct costs and indirect costs.

a. Direct costs

These expenses are directly attributed to the project, such as labor, materials, and equipment.

Labor: Includes wages, benefits, and payroll taxes. Labor costs will often represent a significant portion of the total project budget.

Materials: Cost of construction materials and supplies required for the project.

Equipment: Rental or purchase costs for machinery and tools essential for project completion.

b. Indirect costs

Indirect costs are not directly tied to a specific construction task but support the project as a whole.

Administrative expenses: Costs related to the general running of the construction project, including offices and staff.

Safety and training: Expenses incurred to ensure safety protocols are met and staff training.

c. Expense allocation methods

Some other expense allocation methods related to construction cost management include the following:

Fixed costs: A method where costs are not subject to change regardless of the project's time or scope.

Time & materials (T&M): Time and material costs are variable based on the actual materials used and labor time spent on the project.

Expense allocation methods require diligent documentation and review to ensure accuracy and efficiency. A tailored expense tracker or receipt management software helps track expenses for simple to complex projects and provides a cohesive financial overview.

See also:

Best practices for expense management for construction projects

Effective management of construction expenses is critical for successfully executing a project within its budget. A diligent approach to tracking costs and the strategic use of digital tools can facilitate this process.

1. Know the difference between Excel vs. Google Sheets

While they both perform similar functions, Excel requires a paid subscription. Whereas Google Sheets is free to use.

Excel's robust features are suited for complex data analysis and offline access, while Google Sheets offers real-time collaboration online. An Excel template specifically designed for construction expense tracking can provide a structured and customizable approach to budget management.

2. Consider expense management software to ensure accuracy

Expense management software like Shoeboxed effectively allows construction managers to stay on top of project costs.

With Shoeboxed's unlimited users feature, teams of any size can access the same account, log expenses, and create expense reports in one place.

Shoeboxed users have multiple options for how they can log expenses, including the following:

mailing in physical receipts in the free Magic Envelope

emailing receipts into their account

using the receipt scanner app

or dragging and dropping into the account

Expenses for multiple projects can be individually tagged so that you can keep track of various project costs in one account.

Shoeboxed makes it easy to keep track of expenses from the entire team. Receipts and expenses can be tagged with expense categories as they are logged. Alternatively, each employee or team can be given a sub-account to keep expenses separate.

Stop doing manual data entry 🛑

Outsource receipt scanning to Shoeboxed’s scanning service and free up your time for good. Try free for 30 days! ✨

Get Started Today3. Regular updates and maintenance

If you've chosen to use a spreadsheet to keep track of construction costs, keep the construction expense tracker up to date.

Each entry should be dated and involve a detailed description of the expense to ensure clarity and accountability.

Make sure you have an established process for the following:

Daily reconciliation: Compare expenses entered with receipts and invoices.

Audit trail: Keep a change log to track who made changes and when.

4. Data security and backup

Data security is critical when dealing with financial tracking.

Using cloud-based platforms like Google Sheets offers advantages such as encrypted data storage and regular updates to keep security tight.

Additionally, one should implement a backup system to safeguard against data loss.

Most expense management software will provide these data security and backups as part of their offerings.

Frequently asked questions

What is a construction cost worksheet?

A construction cost worksheet is a tool construction professionals use to monitor project expenses systematically. It can be as a Google Sheets or Excel document and includes categorizing costs, budget estimates, and actual expenditures.

How can someone track construction costs effectively?

Costs can be tracked using specialized cloud-based software designed for construction projects. The software often provides automation and integrations to streamline expense logging and reporting.

What are the steps in creating a construction project budget?

Creating a construction budget involves:

Establishing the project's financial framework.

Conducting data analysis and research related to costs.

Adjusting budget details based on findings.

Completing a pre-construction checklist.

Establishing contracts with detailed financial agreements.

In closing

Whether you’re using a spreadsheet or construction cost tracking software, expense trackers help track project costs give managers an overview of the project's financial status.

A comprehensive construction expense tracker benefits project managers and stakeholders by providing a way to track costs and keep an eye on every dollar spent. It aids construction operations by ensuring that all financial aspects of the construction process are monitored, costs are minimized, and budget compliance is maintained.

Benefits to maintaining a robust expense management system include:

Consistency: Maintaining a consistent record of expenses.

Transparency: Providing all parties with visibility into financial dealings.

Accountability: It establishes a trail for auditing and addressing discrepancies.

In implementing these tools, one can smoothen the financial aspect of project management, keep costs under control, and lay the groundwork for a financially sound construction project.

Tomoko Matsuoka is managing editor for Shoeboxed, MailMate, and other online resource libraries. She covers small business tips, organization hacks, and productivity tools and software.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!