Understanding how to track and manage indirect construction costs will help minimize unnecessary expenditures and drive business growth.

Here's a quick overview of direct costs vs. indirect costs and how construction businesses can make informed decisions to control these costs.

Overview of indirect construction costs

Indirect construction costs are overhead costs not directly associated with physical construction activities. They are occasionally referred to as an “indirect cost” or "soft costs" in the construction industry.

It's important to account for both direct and indirect costs when estimating the total cost of a construction project.

The following table summarizes the primary distinctions between direct and indirect costs in the context of construction projects.

Indirect Costs in Construction |

Direct Costs in Construction |

Administrative salaries |

Materials (concrete, steel, wood, plumbing fixtures, electrical wiring) |

Office rent |

Labor (direct labor costs for construction workers) |

Utilities |

Equipment |

Insurance |

Subcontractor services (related directly to construction activities) |

Permits |

|

General office supplies |

Direct costs are directly attributable to the construction activity and include materials, labor, equipment costs, and subcontractor services.

Indirect costs, on the other hand, are necessary for the business operations of the construction company but can’t be directly tied to a specific project. For example, administrative expenses, office rent, office equipment, transportation costs, utilities, indirect labor costs, health insurance, and more.

Let’s dig a little deeper.

What are indirect costs in construction?

Indirect costs in construction refer to overhead expenses that aren’t directly tied to a specific construction project but are necessary for the overall operation of the construction company.

These costs are typically not easily traceable to a particular project and include administrative salaries, office rent, utilities, insurance costs, permits, and general office supplies.

Indirect costs are essential for running any construction business and are typically allocated across multiple projects based on a predetermined allocation method.

Indirect costs can also be affected by the duration and complexity of the project. Longer projects may incur higher indirect costs due to extended use of equipment and facilities.

Some further examples of indirect costs in the context of construction include:

Salaries for supervisors and administrative staff

Expenses related to job site security

Training and safety programs for workers

Office rent and utilities for the construction company

Depreciation of construction equipment over time

What are direct costs in construction?

Direct costs in construction are expenses that can be specifically attributed to a particular construction project. These costs typically include materials, labor, equipment, and subcontractor services directly related to the construction activities.

Direct costs are essential for estimating the total project cost and are typically itemized and accounted for separately from indirect costs such as overhead and administrative expenses.

Examples of a direct cost in construction may include concrete, steel, wood, plumbing fixtures, electrical wiring, and direct labor costs for construction workers.

See also: Project Cost Tracker: Free Templates to Stay Within Budget

Best practices for managing indirect costs

Understanding and monitoring indirect costs are crucial for accurate project budgeting and ensuring financial success.

Here are some best practices to implement before and during your project.

1. Conduct a preliminary cost estimation

In construction projects, cost analysis encompasses methods that ensure financial resources are utilized effectively.

Indirect cost allocation consists of preliminary estimates, ongoing budget management, and scrutinizing changes in order scope.

Preliminary cost estimation, or job costing, involves analyzing expected expenses and material costs that will emerge during a construction project before the actual work begins.

These estimations provide a baseline for project costs. And then the construction accounting team must also incorporate indirect costs like site security, utilities, and insurance.

A comprehensive early estimate can help set the stage for a project's financial feasibility and success.

2. Track expenses, budget, and implement cost control

Budgeting and cost control are the continuous processes of comparing actual costs to the budgeted amounts, and managing expenses throughout the lifecycle of a construction project.

This step involves periodic financial reviews ensuring that costs—such as overhead allocation and equipment depreciation—are within the set budget, and any discrepancies are addressed promptly.

Tracking expenses can be done via accounting software, a construction cost tracker, a construction expense tracker, or an expense management service like Shoeboxed.

Shoeboxed is a service designed to assist contractors in managing their indirect construction costs efficiently.

Indirect costs in the construction sector can be numerous and variable, complicating the tracking process.

Shoeboxed simplifies this by offering a tailored solution to receipt and expense management.

Used by over 1 million businesses in the US, this service is particularly adept at handling the complexity of indirect costs, which may encompass everything from office supplies to vehicle maintenance.

Project managers and general contractors can simply stuff receipts into Shoeboxed's postage-prepaid Magic Envelopes and then send them in for the Shoeboxed team to scan, upload, categorize and verify the data.

Shoeboxed is the only receipt scanner app that will handle both your paper receipts and your digital receipts—saving customers up to 9.2 hours per week from manual data entry!

Stop doing manual data entry 🛑

Outsource receipt scanning to Shoeboxed’s scanning service and free up your time for good. Try free for 30 days! ✨

Get Started TodayWhat else can Shoeboxed do?

Shoeboxed has been voted as the best receipt scanner app for tax season by Hubspot and given the Trusted Vendor and Quality Choice awards by Crozdesk.

A quick overview of Shoeboxed's award-winning features:

a. Mobile app and web dashboard

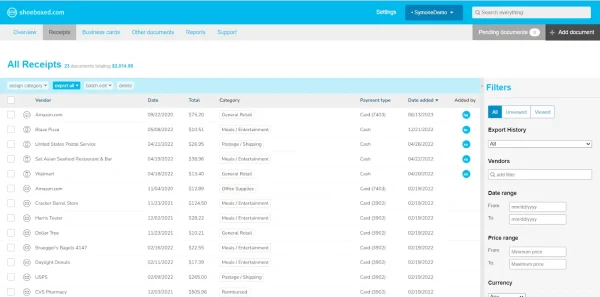

Shoeboxed’s mobile app lets you snap photos of paper receipts and upload them to your account right from your phone.

Shoeboxed also has a user-friendly web dashboard to upload receipts, warranties, contracts, invoices, and other documents from your desktop.

b. Gmail receipt sync feature for capturing e-receipts

Importing e-receipts to your Shoeboxed account is as easy as syncing your Gmail with Shoeboxed, using Shoeboxed's special Gmail Receipt Sync feature.

Shoeboxed’s Gmail Receipt Sync grabs all receipt emails and sends them to your account for automatic processing! These receipts are then labeled as Sent to Shoeboxed in your Gmail inbox.

In short, Shoeboxed pulls the receipt data from your email, including the vendor, purchase date, currency, total, and payment type, and organizes it in your account.

Your purchases will even come with images of the receipts attached!

c. Expense reports

Expense reports let you view all of your expenses in one cohesive document. They also make it simple to share your purchases with your accountant.

You can also choose certain types of receipts to include in your expense report. Just select the receipts you want to export and click “export selected.”

d. Search and filter

Call up any receipt or warranty in seconds with advanced search features.

Filter receipts based on vendors, date, price, currency, categories, payment type, and more.

e. Accounting software integrations

Export expenses to your accounting software in just a click.

Shoeboxed integrates with 12+ apps to automate the tedious tasks of life, including QuickBooks, Xero, and Wave Accounting.

f. Unlimited number of free sub-users

Add an unlimited number of free sub-users to your account, such as family members, employees, accountants, and tax professionals.

g. Mileage tracker for logging business miles

After you sign up for Shoeboxed, you can start tracking miles in seconds:

Open the Shoeboxed app.

Tap the “Mileage” icon.

Click the “Start Mileage Tracking” button.

And drive!

Whenever you start a trip, Shoeboxed tracks your location and miles and saves your route as you drive.

As you make stops at stores and customer locations, you can drop pins to make tracking more precise.

At the end of a drive, you’ll click the “End Mileage Tracking” button to create a summary of your trip. Each summary will include the date, editable mileage and trip name, and your tax deductible and rate info.

Click “Done” to generate a receipt for your drive and get a photo of your route on the map. Shoeboxed will automatically categorize your trip under the mileage category in your account.

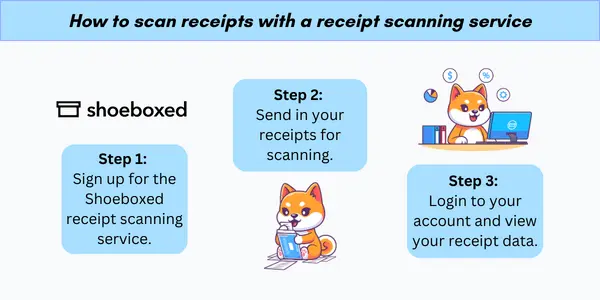

h. The Magic Envelope

Outsource your receipt scanning with the Magic Envelope!

The Magic Envelope service is one of Shoeboxed's most popular features, particularly for businesses, as it lets users outsource receipt management.

When you sign up for a plan that includes the Magic Envelope, Shoeboxed will mail you a pre-paid envelope for you to send your receipts in.

Once your receipts reach the Shoeboxed facility, they’ll be digitized, human-verified, and tax-categorized in your account.

Have your own filing system?

Shoeboxed will even put your receipts under custom categories. Just separate your receipts with a paper clip and a note explaining how you want them organized!

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. Try free for 30 days!

Get Started Today3. Practice change order analysis

Change order analysis is critical to assess the financial impact of any alterations to the original construction plans.

This process includes evaluating the cost implications of labor, materials, or timeline changes.

Analyzing these categories can mitigate the risks associated with budget overruns due to unplanned project variations.

4. Establish clear communication and coordination

Clear communication channels and coordination between various stakeholders facilitate seamless operations and help prevent delays that can result in increased unexpected expenses and indirect costs.

Regular meetings, transparent and timely dissemination of information, and a point of contact for queries contribute to efficient project management.

Construction projects benefit from a communication hierarchy that keeps each branch of the construction process in touch with the rest. Make sure you have designated the following key communicators for your construction project.

Project Manager: Central communication figure

Team Leaders: Direct contact for specific teams

Client Liason: Regular updates and decision acquisition

Ensuring each team understands their responsibilities and timelines helps to avoid confusion and overlap in duties, thus keeping total indirect costs under control.

5. Identify and manage risks

Risk management plays a key role in safeguarding against unforeseen costs and delays in construction projects.

Risk identification in construction involves systematically uncovering factors that could negatively impact the project.

Project managers must do the following diligently:

Analyze project scope—A thorough review of the scope can unveil risks associated with complex tasks.

Study environmental factors—Site conditions and regulatory requirements can present significant risks.

Consult stakeholder input—Engaging with all stakeholders, including subcontractors and clients, helps to identify potential issues from varied perspectives.

To combat identified risks, construction projects should employ tailored risk mitigation strategies that include:

Improving efficiency—Software and workflow improvements can enhance staff productivity, reducing the chance of errors and delays.

Shopping for supplies—Seeking the best deals can substantially lower indirect costs.

Project management software—Integrating specialized software and apps for general contractors or construction workers aids in streamlining operations.

The goal is to create an environment where risks are identified and systematically reduced or eliminated, securing the project’s financial health and timetable.

Hit the road with Shoeboxed ⛟

Stuff receipts into the Magic Envelope while on the road. Then send them in once a month to get scanned. Expense reports don’t get easier than this! 💪🏼 Try free for 30 days!

Get Started TodayIn summary

Indirect costs in construction are the expenses not directly tied to physical labor or materials for a specific project. Still, they are essential for the overall management and execution of construction work.

These costs are sometimes overlooked when budgeting for future projects, yet they are crucial in ensuring that construction projects are completed efficiently and effectively.

Common examples of indirect costs include the salaries of supervisors, rental costs for construction equipment, and expenses related to job site utilities.

Recognizing these costs helps companies in the construction industry develop accurate project budgets and maintain healthy bookkeeping.

Since indirect costs can significantly impact a project's gross profit and margins, effective management of these expenses is vital for the project's overall success.

Companies must track indirect costs accurately and allocate them properly to ensure that bids and estimates reflect the total costs of completing various projects to maintain profitability.

Awareness and strategic planning can lead to more competitive bidding and better financial health for construction firms.

Tomoko Matsuoka is the managing editor for Shoeboxed, MailMate, and other online resource libraries. She covers small business tips, organization hacks, and productivity tools and software.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!