If you’re a small business owner, then you know how important it is to keep track of transactions.

Using a small business sales receipt template not only standardizes your receipt-creation process but also provides a clear record of important customer details such as the payment method used, items purchased, and the total amount paid.

This can be useful for record-keeping, tax write-offs, inventory management, and providing proof of purchase to your customers.

In this guide, we’ll cover everything you need to know about small business sales receipts, share our favorite small business sales receipt templates, and go over some tips to manage the receipts you generate for your company.

Why do small businesses need sales receipts?

Sales receipts serve as essential records of transactions for both small businesses and their customers.

As a small business owner, having a sales receipt template can help you quickly and consistently document sales, ensuring efficient record-keeping and a seamless customer experience.

When you use a receipt template, such as a cash receipt, invoice template, or payment receipt template, you provide your customers with proof of purchase that details the goods or services they’ve paid for.

Sales receipts are important for several reasons:

They allow your customers to track their purchases, maintain warranty records, return or exchange items, and keep track of their spending.

Receipts protect your customers from potential disputes regarding payments or the quality of goods and services they have received.

Transaction receipts serve as a crucial record for small business accounting purposes.

They help you maintain accurate records of sales transactions, allowing you to track cash payments and credit card payments and monitor your inventory levels.

Accurate record-keeping simplifies the process of calculating and filing taxes, as well as tracking tax write-offs related to your business expenses.

Providing customers with sales receipts helps build trust and confidence in your business, and a well-organized sales receipt also demonstrates professionalism and attention to detail, particularly when customers purchase and sell digital products.

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. Try free for 30 days!

Get Started TodayWhat should be on a sales receipt?

In this section, we’ll discuss the key components every small business sales receipt template should include.

1. Header information

The header of your sales receipt should contain information about your business, such as your business name, company logo, address, and contact information.

This helps your customers quickly identify the receipt and provides them with a point of contact should they have any questions or concerns.

Below is an example of a receipt header:

John Doe’s Antique Shop 1234 Lolly Lane, Columbus, Ohio 43004 123-456-7890 [email protected]

2. Purchased items and prices

In the items purchased and price section, there should be a list of the items purchased by the customer along with their descriptions, quantities, and unit prices.

Any discounts or special offers applied to the purchase should also be listed here.

Here’s what that might look like:

Item 1 – Description – Quantity x Unit Price = Subtotal

Item 2 – Description – Quantity x Unit Price = Subtotal

Discount (if applicable)

3. Payment and tax details

The next part of a sales receipt should clearly state the payment type used, such as cash, credit card, or check.

If applicable, include the check number or the last four digits of the credit card number. Calculate the sales tax, if any, and add it to the subtotal of the purchased items.

Then, display the total amount of money due.

Check out the example below:

Payment Method: Cash / Credit Card / Check (last **** of the card or check number)

Subtotal: $X.XX

Sales Tax: $X.XX

Total Amount: $X.XX

4. Sales receipt footer

The footer section is where the receipt number, date, and any additional messages or notes (e.g., a thank you note or your business’s return policy page) are added.

This helps you keep track of your receipts and adds a personal touch for your customers.

Here’s an example of what this section might look like:

Receipt Number: ######

Receipt Date: MM/DD/YYYY

Thank You for Your Business!

Your Return Policy or additional message

With these elements in your small business sales receipts, you’ll have a comprehensive, professional, and easy-to-understand record of sales transactions for both you and your customers.

Best small business sale receipt templates in 2024

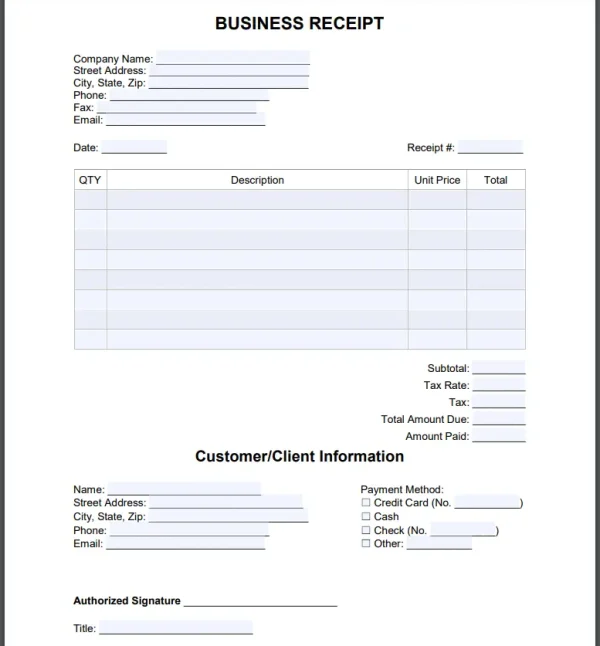

1. eForms Business Receipt Template

eForms Business Receipt Template

This small business sales receipt template is a simple, free form to acknowledge the sale of goods and services from your business.

The eForms Business Receipt Template is customizable and available for download as a PDF, Word, or ODT document and includes the following info:

Business information.

Date.

Receipt number.

Quantity, description, unit price, and total of goods or services.

Subtotal, tax, total amount due, and total amount paid.

Customer information.

Method of payment.

Authorized signature.

Price: Free

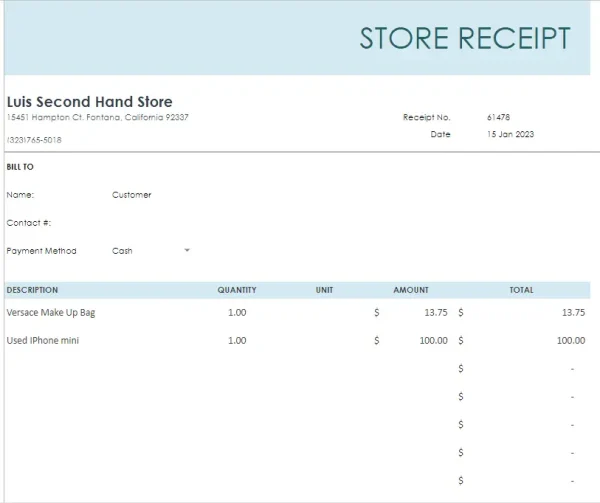

2. Template.net Store Receipt

Template.net Store Receipt in Google Sheets

For store owners, the Template.net Store Receipt is a great option! It’s customizable with your logo and information and has a little more color to it than the other options on our list.

You can easily download this template via Excel or Google Sheets, and it includes the following information:

Logo and store information.

Customer name and information.

Description and price of goods sold.

Subtotal, tax, and discounts.

Grand total.

Thank you note.

Price: Free

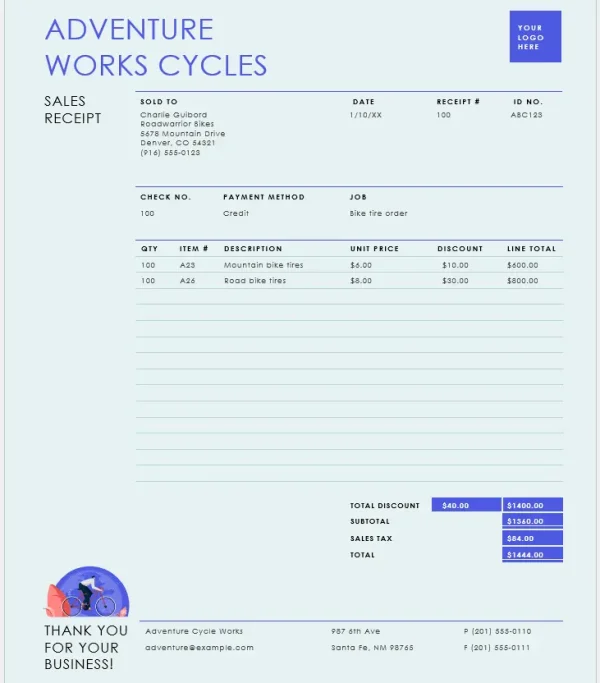

3. Microsoft Business Receipt

Microsoft Business Receipt template

Out of all of the receipt templates, this one’s our favorite. It’s brought to you by Microsoft, is modern, colorful, and includes the most important details for transactions.

This printable receipt template is available for download as a Word document and has the following info:

Logo.

Customer and business information.

Receipt and ID numbers.

Method of payment.

Quantity, item number, unit price, discount, and line total of goods sold.

Total discount, subtotal, sales tax, grand total.

Customizable thank you note.

Price: Free

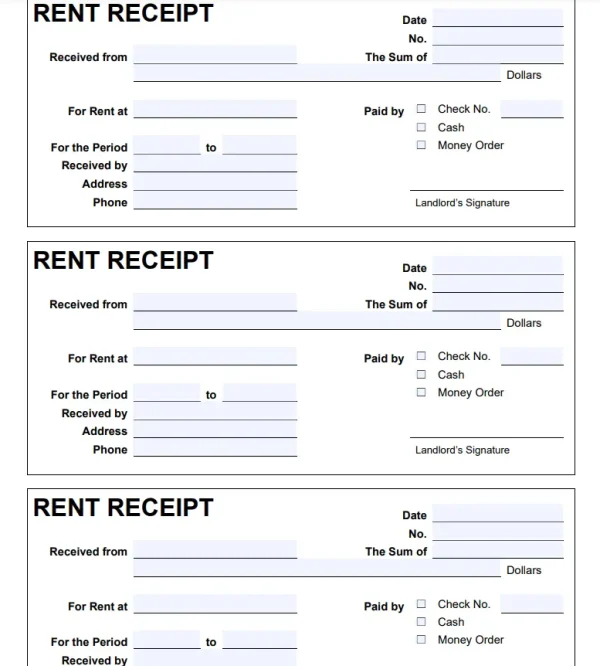

4. eForms Rent Receipt Template

eForms Rent Receipt Template

If you’re a small business owner that owns rental properties, this rent receipt template from eForms is a must-have!

This rent receipt template is available for download as a PDF, Word doc, or ODT file and includes everything you need to keep a record of rental income and give your tenants proof of payment, including:

Date, No., and Sum.

Rental property name.

Renter information.

Landlord information and signature.

Payment type.

Price: Free

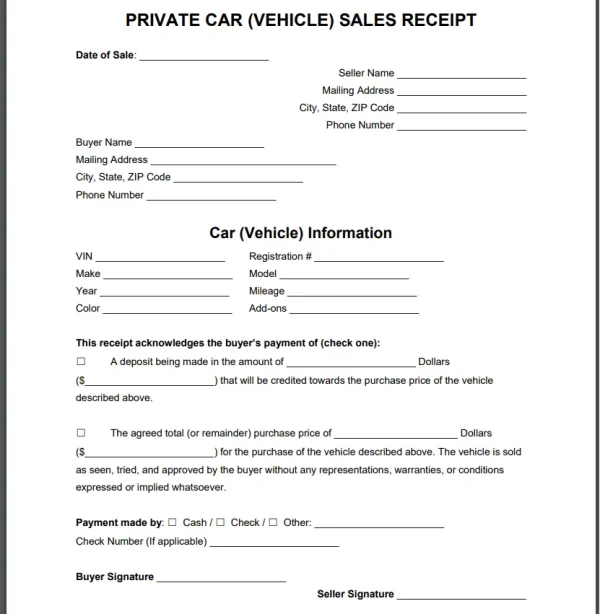

5. UsefulPDF Car Sales Receipt Template

UsefulPDF Car Sales Receipt Template

If you own a small car lot or flip and sell used cars, the car sales receipt template from UsefulPDF is a quick and easy way to prove a transaction was made for you and your buyers.

This template page is free to download, available in .PDF or .DOCX form, and includes the following information:

Date of sale.

Buyer and seller information.

Vehicle information.

Acknowledgment of payment made for downpayment or total purchase price.

Payment type.

Buyer and seller signatures.

Price: Free

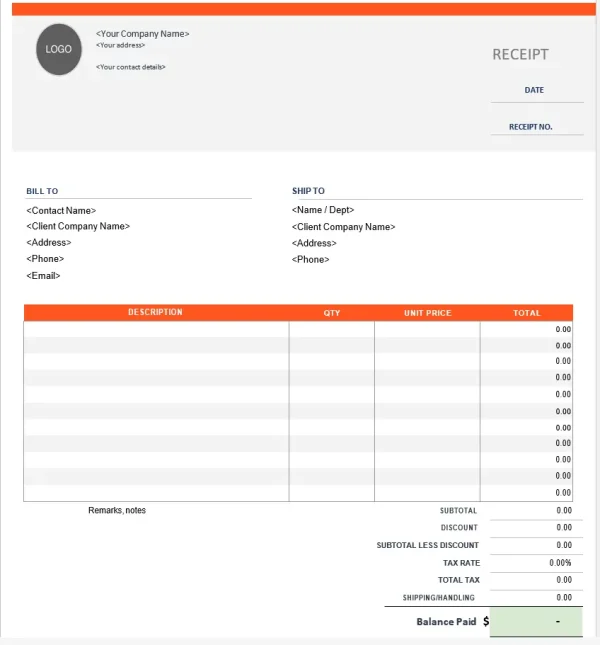

6. InvoiceSimple Cash Receipt Template

InvoiceSimple Cash Receipt Template

This cash receipt template is free to use from InvoiceSimple and is a great way to create a paper trail for the purchases your customers make in cash.

You can download this template in Excel, Google Docs, Google Sheets, or Word, and it includes:

Logo and company info.

Client information.

Shipping information.

Description, quantity, unit price, and total of goods sold.

Notes.

Subtotal, discount, tax, and shipping cost.

Balance paid.

Price: Free

You might be interested in: Independent Contractor Invoice Template. Stop by this article to get the best free invoice template downloads for independent contractors and small businesses!

How do I write a receipt for a small business?

If you’re a small company that likes doing business the old-fashioned way, you may be wondering how to write receipts by hand.

Writing and using different types of receipts for your small business is easy to do and you can provide your customers with personalized receipts in just a few steps.

Step 1: Choose a sales receipt template or use a receipt book

Sales receipt templates, like the ones we listed above, are perfect for small businesses that like to leave a personal touch with each transaction.

You can even customize receipt templates to include your business information like the business name, logo, address, and contact details before printing them.

Alternatively, you can use a receipt book to write receipts for your customers.

Receipt books have a carbon copy behind each receipt you write, so you automatically create two copies while writing a single receipt—a copy for your business and a copy for the customer.

Here’s what writing a receipt looks like with a receipt book:

How to write a receipt, Robbie SpiegelStep 2: Print your receipts (if using a template)

If you’re using a receipt template, you’ll need to print it.

Be sure that the receipt date and a unique receipt number are included for quick reference and tracking.

Step 3: Write the receipt details

Begin listing the purchased items, including their description, quantity, and unit price.

Calculate the total cost for each item and add them up to find the total amount paid before taxes.

Don’t forget to include any applicable sales tax to determine the final amount of money due.

In the payment type section, indicate whether the purchase was made using cash, credit card, or check.

For credit card transactions, it’s helpful to include the last four digits of the card number for reference.

For check payments, write down the check number to keep track of the payment.

Step 4: Give your customer a copy

Provide the customer with the receipt and keep a copy of the printable receipt for your business records.

Keeping a copy of all of the receipts you generate will act as documentation of sales transactions and as a reference for any potential questions or returns down the line.

How do you write a receipt for a cash sale?

Writing a receipt for a cash sale is virtually the same process as writing a receipt for an item bought with any other type of purchase method.

Under the payment type section, specify the payment is being made in cash and include the date of the transaction.

If there are any taxes or discounts paid, make sure to list those, as well.

Finally, calculate the total amount of money due and write it down at the bottom of the receipt.

Once the receipt is complete, provide your customer with the cash receipt.

Keep a copy of the cash receipt for your records to track sales transactions and for possible tax write-offs later on.

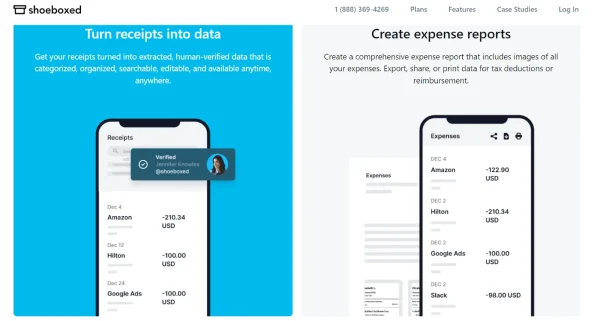

How can Shoeboxed help you manage your business receipts?

Shoeboxed is trusted by over 1 million small businesses to organize receipts

Shoeboxed is a receipt-scanning app and service that digitizes and categorizes your business receipts and other business-related documents.

Not only is it a great place to store the receipts you generate for your customers, but it’s also a fantastic way to organize the receipts you receive from suppliers or other business expenses.

What are Shoeboxed’s features?

Shoeboxed offers an app and a web platform for you to manage and upload your receipts to your account.

1. Shoeboxed’s mobile app

Shoeboxed’s mobile app is available for download on iPhone and Android

The Shoeboxed app lets you snap photos of receipts from business expenses to be turned into digital data and uploaded to your account.

Each receipt you photograph has its data extracted using smart OCR technology, is human-verified for accuracy, and automatically categorized under 15 editable tax categories that you can further organize with tags specific to the transaction.

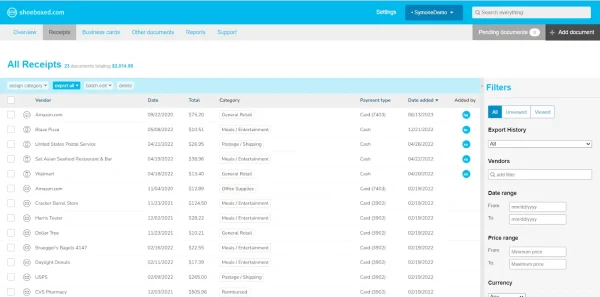

2. Shoeboxed’s web platform

Example of Shoeboxed’s web dashboard from a demo account

When you sign up online, you’ll get access to Shoeboxed’s web dashboard (the app is also included).

On the Shoeboxed web platform, you can upload receipts and documents from your computer to your account for safekeeping.

You can also sync your Gmail with your account and access any digital receipts sent to your inbox from both the app and the desktop version.

3. Advanced search and filter function

Both Shoeboxed’s app and web platform let you advance search for documents or receipts so you can find what you need in seconds.

If you want to view receipts under a specific category or from a particular vendor, you can filter your receipts based on date, vendor, payment type, category, and more.

4. Free mileage tracker

Shoeboxed’s in-app mileage tracker

Shoeboxed also has a free built-in mileage tracker that you can use to accurately track the miles you spend on the road for business.

This is an awesome tool if you invoice clients for travel or you have employees that are required to travel for work.

Shoeboxed’s mileage tracker turns miles into receipts and automatically categorizes them under “mileage” for quick reference.

You can add your employees to your account to track their miles, upload business-related receipts, and create expense reports detailing their purchases (more on this later), which makes reimbursement for travel a breeze.

5. Unlimited free sub-users

When you sign up for Shoeboxed, you can add an unlimited number of free sub-users to your account.

Employees and accountants are two popular sub-users that we often see added to accounts, as it makes it easier to keep track of business expenses and have a smooth tax season.

Keep in mind that all sub-users will be able to see the receipts and documents added to your account, so if you don’t want employees seeing sensitive information, you’ll need to have separate Shoeboxed accounts for employee documents and other business-related documents and receipts.

6. Expense reports

An example of a CSV expense report from Shoeboxed

As we mentioned earlier, you and your employees can create expense reports for reimbursement, tax time, or just to get a comprehensive overview of your expenses.

Shoeboxed allows you to create expense reports through the app and online in PDF form or as a CSV file.

Expense reports are automatically organized with your receipt information and come with images of each receipt attached to their respective expense.

Users can share expense reports via email with a simple click of a button.

7. Accounting software integrations

Shoeboxed also integrates with accounting software you may already use, such as QuickBooks and Xero, to simplify your accounting processes.

Receipts are neatly organized and uploaded to your accounting software within minutes.

The Magic Envelope service and how it helps business owners

Outsource your business receipt and document scanning with the Magic Envelope

If scanning your receipts and business documents by hand isn’t for you, Shoeboxed offers a service called the Magic Envelope.

With the Magic Envelope, small business owners can outsource their receipt and document scanning.

When you choose a plan that includes the Magic Envelope, Shoeboxed will send you a postage-pre-paid envelope in the mail each month for you to send your receipts in.

Once your receipts reach the scanning facility, the team at Shoeboxed will scan your receipts, human-verify them for accuracy, and upload them to your account under the 15 editable tax categories.You can also request that the Shoeboxed team organize your receipts under custom categories.

To do this, all you would need to do is separate your receipts and leave a note detailing how you want them to be categorized.

Break free from paper clutter ✨

Use Shoeboxed’s Magic Envelope to ship off your receipts and get them back as scanned data in a private, secure cloud-based account. 📁 Try free for 30 days!

Get Started TodayFrequently asked questions

What are sales receipts?

Sales receipts are documents that record the details of a sales transaction, including the items purchased, their unit price, and the total amount paid. They serve as proof of purchase for customers and help small businesses keep track of their sales, inventory, and tax deductions.

What should be on a sales receipt?

A sales receipt should include your business’ information, customer information, receipt number, receipt date, items purchased, payment method, total costs, and other relevant information such as warranties or return policies.

To conclude

Whether you opt for printable paper receipts or electronic receipts, choosing the right receipt template will ensure that your business is up-to-date on sales and inventory, has proof of tax-deductible expenses, and gives customers a record of their transactions.

If you need a way to store digital copies of your business receipts, give Shoeboxed a try!

Shoeboxed is perfect for digitizing and organizing the most important documents related to your business.

You might also like:

Hannah DeMoss is a staff writer for Shoeboxed covering organization and digitization tips for small business owners. Her favorite organization hack is labeling everything in her kitchen cabinets, and she can’t live without her mini label maker machine.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!