Wondering how to track business expenses for self-employed individuals and small business owners?

A spreadsheet tailored for tracking income and expenses can simplify this process, provide a clear view of the business’s financial health, and serve as a tool for tax season preparation.

Automation features in these spreadsheets can also aggregate data, calculate totals, and help visualize financial trends over time. For self-employed people, staying on top of these numbers is not just about organization; it is about maximizing potential tax deductions and understanding the business's fiscal performance.

Having an organized system for managing self-employed income and expenses can alleviate the stress of financial record-keeping and equip business owners with the intelligence needed to make informed decisions that affect the sustainability and growth of their enterprises.

This article covers a roundup of the best spreadsheets we could find for small business owners + 1 great service you won't want to miss!

Best free self-employed expense small business spreadsheets

Here are our favorite spreadsheets for self-employed individuals and small business owners looking to track business costs and stay on top of their tax liability. From an independent contractor expenses spreadsheet to one that helps with tax categorization, this list has you covered!

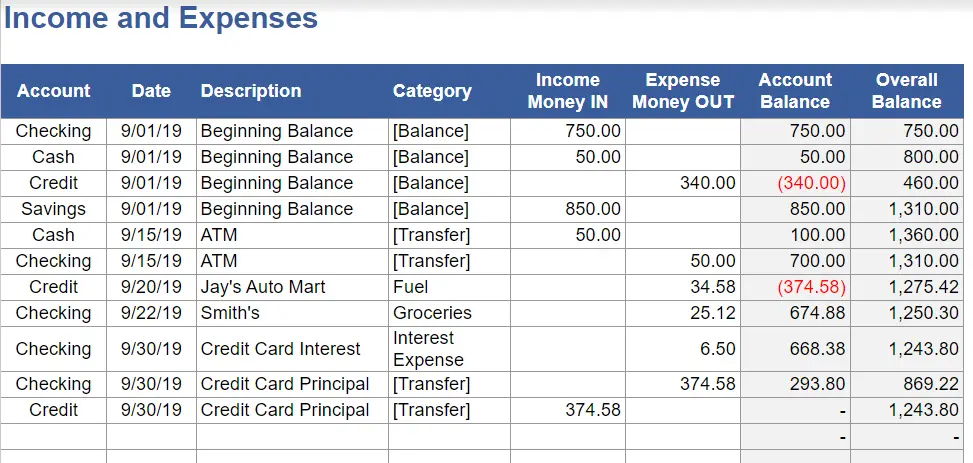

1. Vertex42's income and expense worksheet

This straightforward income and expense worksheet includes columns for date, description, category, money coming in, money going out, the account balance, and overall balance.

To use this template in Google Sheets, click on the Use Template button in the link below. The same tracker is also available as a Microsoft Excel spreadsheet template using the same link.

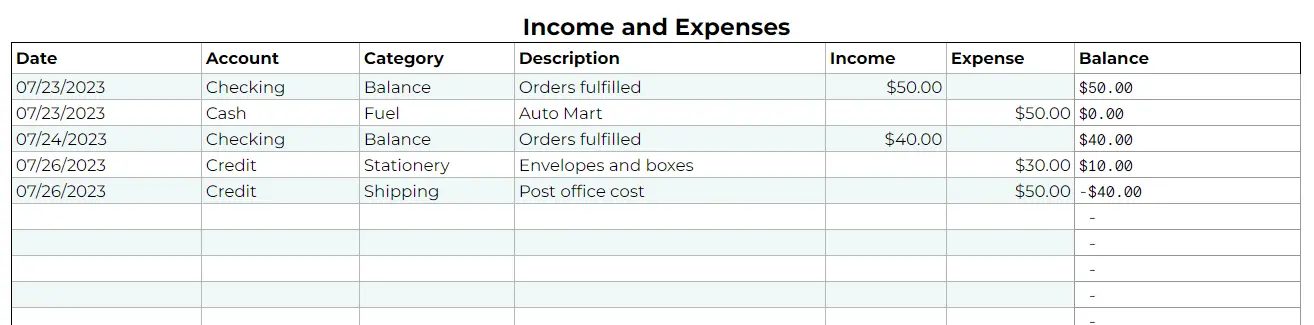

2. Small business income and expense spreadsheet by Driversnote

This worksheet can be used for daily expense tracking or monthly expenses, and it includes columns for date, account, category, description, income, expenses, and balance.

Small business income and expense spreadsheet by Driversnote

Make a copy of the template using the link below.

3. Bonsai's 1099 expenses spreadsheet for self-employed individuals

Bonsai's free expenses spreadsheet for self-employed is tailored specifically for small business owners and independent contractors looking to track income and expenses incurred ahead of tax time.

Bonsai's 1099 expenses spreadsheet for self-employed individuals

Various tabs in this spreadsheet template provide a daily business expense tracker and help categorize expenses for filling out Schedule C and maximizing self-employment tax deductions.

To use this free template, make a copy of it using the link below.

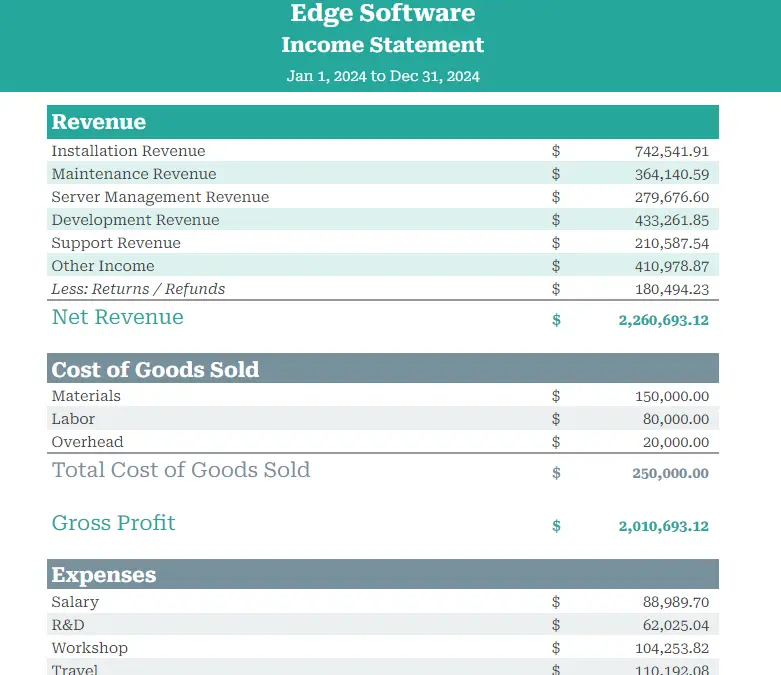

4. Coefficient income and expenses template

This worksheet provides a section for revenue, cost of goods sold, expenses, and net income.

Coefficient income and expenses template

While there are only so many expense categories in this worksheet, you can customize it further by adding more business-related expenses after making a copy of the template.

See also: Company Expenses Template: 4 Free Expense Templates + Bonus

5. Car expenses spreadsheet template

For anyone who drives a lot for work, there are templates that help individuals track car expenses using the actual expense method and the standard method. There are also mileage expense spreadsheets and vehicle expense logs to consider.

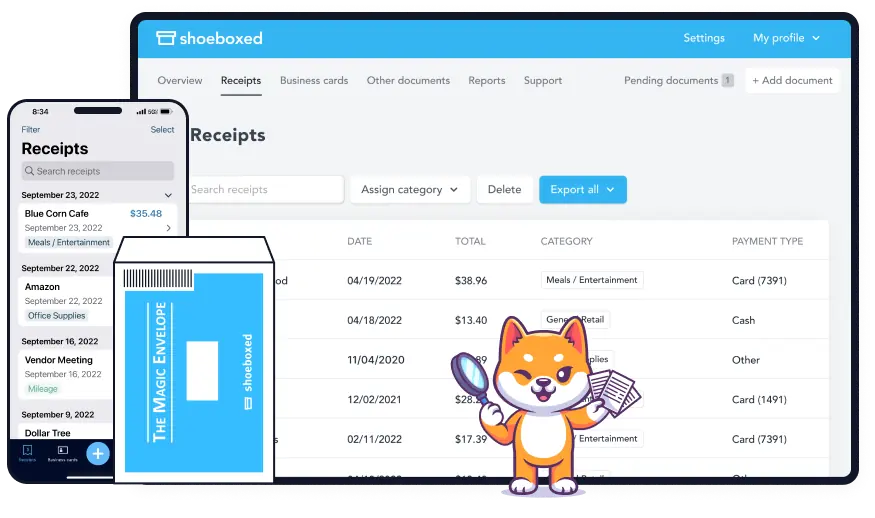

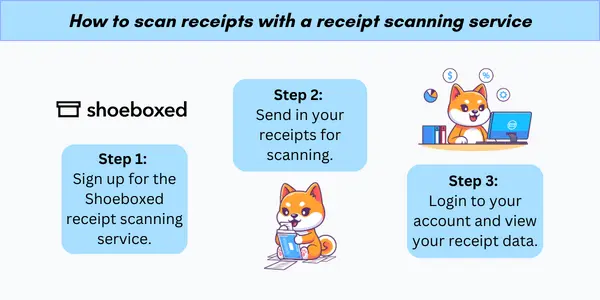

6. Shoeboxed, a small business expense spreadsheet alternative

Don't want to track expenses manually? We hear you. While some people thrive on using business expense tracking spreadsheets, others might prefer a more automated method.

If you'd like to forgo manual entry entirely, consider Shoeboxed!

With Shoeboxed's receipt scanner app, you can simply snap a picture and upload it to your Shoeboxed account. Shoeboxed's team will extract and verify the expense data from your receipts, assigning the expense one of 15 common tax categories.

For those who want an even easier method for getting receipts in their accounts, Shoeboxed's Magic Envelope service does just that.

Simply stuff your receipts into Shoeboxed's postage-prepaid envelopes and outsource receipt scanning to the pros.

Shoeboxed is the only receipt scanner app that will handle both your paper receipts and your digital receipts—saving customers up to 9.2 hours per week from manual data entry!

Break free from manual data entry ✨

Use Shoeboxed’s Magic Envelope to ship off your receipts and get them back as scanned data in a private, secure cloud-based account. 📁 Try free for 30 days!

Get Started TodayWhat else can Shoeboxed do?

Shoeboxed has been voted as the best receipt scanner app for tax season by Hubspot and given the Trusted Vendor and Quality Choice awards by Crozdesk.

A quick overview of Shoeboxed's award-winning features:

a. Mobile app and web dashboard

Shoeboxed’s mobile app lets you snap photos of paper receipts and upload them to your account from your phone.

Shoeboxed also has a user-friendly web dashboard to upload receipts or documents from your desktop.

b. Gmail receipt sync feature for capturing e-receipts

Importing e-receipts to your Shoeboxed account is as easy as syncing your Gmail with Shoeboxed, using Shoeboxed's special Gmail Receipt Sync feature.

Shoeboxed’s Gmail Receipt Sync grabs all receipt emails and sends them to your account for automatic processing! These receipts are then labeled as Sent to Shoeboxed in your Gmail inbox.

In short, Shoeboxed pulls the receipt data from your email, including the vendor, purchase date, currency, total, and payment type, and organizes it in your account.

Your purchases will even come with images of the receipts attached!

c. Expense reports

Expense reports let you view all of your expenses in one cohesive document. They also make it simple to share your purchases with your accountant.

Shoeboxed makes it easy to export your yearly expenses into a detailed report. All expenses come with receipts attached.

You can also choose certain types of receipts to include in your expense report. Just select the receipts you want to export and click “export selected.”

d. Search and filter

Call up any receipt or warranty in seconds with advanced search features.

Filter receipts based on vendors, date, price, currency, categories, payment type, and more.

e. Accounting software integrations

Export expenses to your accounting software in just a click.

Shoeboxed integrates with 12+ apps to automate the tedious tasks of life, including QuickBooks, Xero, and Wave Accounting.

f. Unlimited number of free sub-users

Add an unlimited number of free sub-users to your account, such as family members, employees, accountants, and tax professionals.

g. Shoeboxed's mileage tracker

After you sign up for Shoeboxed, you can start tracking miles in seconds:

Open the Shoeboxed app.

Tap the “Mileage” icon.

Click the “Start Mileage Tracking” button.

And drive!

Whenever you start a trip, Shoeboxed tracks your location and miles and saves your route as you drive.

As you make stops at stores and customer locations, you can drop pins to make tracking more precise.

At the end of a drive, you’ll click the “End Mileage Tracking” button to create a summary of your trip. Each summary will include the date, editable mileage and trip name, and your tax deductible and rate info.

Click “Done” to generate a receipt for your drive and get a photo of your route on the map. Shoeboxed will automatically categorize your trip under the mileage category in your account.

See also: Shoeboxed vs. QuickBooks Mileage Tracker: Navigating the Race

h. The Magic Envelope

Outsource your receipt scanning with the Magic Envelope!

The Magic Envelope service is one of Shoeboxed's most in-demand features, particularly for businesses, as it lets users outsource their receipt management.

When you sign up for a plan that includes the Magic Envelope, Shoeboxed will mail you a pre-paid envelope for you to send your receipts in.

Once your receipts reach the Shoeboxed facility, they’ll be digitized, human-verified, and tax-categorized in your account.

Have your own filing system?

Shoeboxed will even put your receipts under custom categories. Just separate your receipts with a paper clip and a note explaining how you want them organized!

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. Try free for 30 days!

Get Started TodayHow to create a small business expense spreadsheet

Creating a spreadsheet for tracking income and expenses is a great way to manage your personal finances or small business accounting.

Here's a step-by-step guide to creating a basic income and expenses spreadsheet using Microsoft Excel or a similar spreadsheet application like Google Sheets:

1. Getting started

Open your spreadsheet application and create a new blank worksheet.

Organize your spreadsheet layout. For example, label the first row with headings representing the columns beneath them. For example, "Date," "Description," "Category," "Income," "Expense," and "Balance."

You may want to freeze this top row to keep the headings visible as you scroll down. In Excel, you can do this by selecting the row, then going to View > Freeze Panes > Freeze Top Row.

2. Begin entering data

In the "Date" column, enter the date of the transaction.

In the "Description" column, write a brief description of the income or expense.

The "Category" column can be used to classify the transaction (e.g., "Salary," "Utilities," "Groceries").

Enter the amount in the "Income" column if the transaction is income, or in the "Expense" column if it’s an expense.

In the "Balance" column, you'll want to keep a running total of your funds. Start with an initial balance (if applicable) in the first row.

Below that, use a formula to calculate the balance by adding income and subtracting expenses from the previous balance. For example, if your initial balance is in cell E2, the formula in cell F3 would be `=F2+C3-D3` where C represents the Income column and D represents the Expense column.

This format helps in projecting future revenue and assessing periods of high or low income.

3. Format your spreadsheet

Use formatting tools to distinguish between income and expenses, such as different text colors or highlighting.

Bold the headings and use borders to define areas clearly.

Adjust column widths to ensure that all data is visible.

At the bottom of your income and expenses columns, you can create a total row that sums up all the data in those columns. Use the SUM function, for example, `=SUM(C2:C100)` for the Income column and `=SUM(D2:D100)` for the Expense column.

Consider using dropdown menus for the "Category" column to ensure consistency.

Best practices for business expense spreadsheets

Diligence in keeping accurate records of income and expenses helps business owners identify eligible tax deductions and prepare quarterly tax estimates, ensuring compliance and potential tax savings.

1. Know your deductible business expenses

A small business can reduce its taxable income by deducting business expenses that are both ordinary and necessary.

Examples of deductible expenses include office supplies, marketing costs, and travel expenses.

2. Prepare for quarterly tax estimates

Small business owners and freelancers commonly pay taxes on a quarterly basis.

These estimated tax payments must reflect the individual's expected adjusted gross income, deductible expenses, and credits for the year.

Failure to accurately estimate quarterly taxes can result in penalties, so diligent record-keeping and accurate calculations are key to financial stability.

3. Regular review and reconciliation

Regular review and reconciliation ensure that the information on the spreadsheet reflects the actual financial transactions of the business.

Business owners should schedule weekly sessions to go over all entries and monthly reconciliations to compare the spreadsheet data with bank statements and receipts.

This step is crucial to catching discrepancies early and adjusting entries accordingly.

4. Analysis of income and expenses

Effective analysis and reporting provide the foundation for understanding a business’s financial health and help to save money for the business owner. They use accurate spreadsheets for income and expenses as critical tools for making informed decisions.

Financial statements are pivotal for analyzing a small business's financial activities.

The income statement, balance sheet, and cash flow statement can be generated from well-kept spreadsheets. For instance, with a comprehensive small business expense report template, entrepreneurs can swiftly categorize transactions and compile them into financial statements.

5. Track your key performance indicators

Determining key performance indicators (KPIs) is essential for measuring business success.

Metrics such as net profit margin, return on assets, and current ratio are extracted from financial data within the spreadsheets.

In closing

Accurate financial records help sole proprietors and small business owners keep an eye on their upcoming tax bill.

Expense spreadsheets and expense management software like Shoeboxed are good options for those who want a DIY solution for tracking expenses.

Tomoko Matsuoka is managing editor for Shoeboxed, MailMate, and other online resource libraries. She covers small business tips, organization hacks, and productivity tools and software.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!