Farmers constantly seek ways to streamline operations and financial management in agriculture's dynamic and demanding world. This necessity has led to the increasing adoption of QuickBooks.

This leading accounting software can be tailored to the farming community's unique accounting needs with its default yet customizable chart of accounts for farms.

Why should farmers use accounting software?

Farmers should use accounting software for several crucial reasons. It significantly aids in streamlining their financial management and improving the overall efficiency of their farm management.

Here are the key reasons we think adopting accounting software is beneficial for farmers:

Enhanced financial organization: Farming involves numerous financial transactions, from purchasing seeds and equipment to selling produce and managing payroll. Accounting software helps organize these transactions systematically, making it easier to track income and expenses, thereby reducing the likelihood of financial disarray.

Time and cost efficiency: Manual bookkeeping is time-consuming and prone to errors. Accounting software can automate many farmers' financial processes, such as invoicing, bill payments, and payroll, saving significant time and reducing the costs associated with manual record-keeping.

Improved financial analysis and decision-making: Accounting software provides real-time financial data and reports, such as profit and loss statements, balance sheets, and cash flow analyses. This immediate access to financial information allows farmers to make more informed and timely business decisions, such as identifying profitable crops, planning for seasonal fluctuations, and allocating resources more efficiently.

Tax preparation and compliance: Tax season can be stressful, especially when dealing with complex agricultural subsidies, grants, and regulations. Accounting software helps simplify tax preparation by organizing financial records and ensuring that all transactions are accurately recorded and easily accessible. This organization saves time and helps ensure compliance with tax laws and regulations, potentially avoiding costly penalties.

Budgeting and forecasting: Accurate and financial forecasting can greatly benefit farming operations. Accounting software enables farmers to create detailed budgets, monitor financial performance against these budgets, and adjust their strategies accordingly. This foresight can be valuable in managing farming's cyclical nature and planning for future investments or expansions.

Inventory management: Many farm accounting software solutions offer beneficial inventory management features for farmers. They can track the quantities and costs of seeds, fertilizers, feed, and other supplies, monitor stock levels, and plan purchases more effectively.

Access anywhere and data security: Modern accounting software often offers cloud-based options, allowing farmers to access their financial information from anywhere, whether in the field, at the market, or home. This accessibility is paired with robust data security measures, which protect sensitive financial information from unauthorized access or loss.

Integration with other systems: Accounting software can often be integrated with other farm management systems, such as production tracking, market pricing tools, and payroll services. This integration provides a holistic view of the farm's operations and enhances overall efficiency and control.

Using accounting software can transform the financial management of farm finances in a farming operation, leading to better organization, more informed decision-making, and improved economic health and sustainability of the farm.

What should you consider when choosing farm accounting software?

Choosing the right farm accounting software requires careful consideration of various factors specific to your farming operation's needs, size, and complexity.

We have found several essential aspects to consider for your farm business:

Specific farming needs: Evaluate your farm's particular needs. Are you dealing with crops, livestock, or both? Different types of farming may require accounting software with various features, such as inventory management for seeds and feed, crop yield tracking, or livestock management.

User-friendliness: The software should be easy to use and understand, especially if you or your staff are unfamiliar with complex accounting principles. Look for software with an intuitive interface, multi-user features, and good customer support.

Cost: Consider the software's cost, including the initial purchase price, subscription fees, and additional costs for updates, additional users, or extra features. Ensure the cost is within your budget and appropriate for your farm's size and profitability.

Integration capabilities: Check if the farm accounting software can integrate with other systems you may be using, such as payroll services, CRM systems, or your bank account. Integration can save time and reduce errors by automating data entry and syncing information between systems.

Accessibility: Determine whether you need the farm accounting software accessible from multiple locations or devices. If you need to access your financial data while in the field or away from the office, consider a cloud-based solution that offers mobile access.

Customization: Look for software that can be customized to fit the unique aspects of your farming operation. This could include a custom chart of accounts, reports, fields, or tracking options matching the specific crop types, livestock, or equipment you manage. Setting up accounts that categorize farm transactions that mimic your tax return's Schedule F tax forms will make tax season a breeze.

Reporting capabilities: Effective reporting is crucial for understanding your farm’s financial health. Ensure the farm accounting software can generate a wide range of reports such as a profit and loss statement, balance sheet, and cash flow statement. It should also offer reports specific to farming, like production costs and seasonal analysis.

Scalability: Consider whether the software can grow with your farm. If you plan to expand your operation, ensure the software can accommodate additional users, more complex operations, or additional features as needed.

Data security and backup: Ensure the software provides strong data security measures, especially if you opt for a cloud-based solution. Also, check how the software backs up data to prevent loss in computer failure, hacking, or other disasters.

Regulatory compliance: Ensure the farm accounting software complies with relevant agricultural financial regulations, tax laws, and reporting requirements. This is important for maintaining legal compliance and making tax reporting easier.

Reviews and recommendations: Look for reviews from other farmers or agricultural businesses using the software. Personal recommendations can help you understand a solution's practical benefits and drawbacks.

By considering these factors, you can choose farm accounting software that fits your current farm accounting needs and supports the growth and efficiency of your farming operation over time.

Why QuickBooks for farmers?

QuickBooks offers a comprehensive suite of farm accounting features designed to meet the specific demands of the agricultural sector. From tracking crop production costs to managing livestock expenses, QuickBooks enables farmers to monitor their financial health precisely.

QuickBooks Desktop and QuickBooks Online provide critical insights into profitability, sales, expense management, and seasonal cash flow variations, which are crucial for making informed decisions in farming operations.

We have found that the business benefits of using the QuickBooks app for farmers include:

Ease of use: The software's user-friendly interface allows farmers to navigate it easily without extensive accounting knowledge. It also offers features for multiple users if the farm has employed a staff.

Customization and specific farming needs: QuickBooks allows users to customize their farm income and expense categories on the chart of accounts to suit the unique aspects of a farm business, such as different types of crops, livestock, and agricultural equipment.

Connect your bank to view real-time data: With QuickBooks, a farmer can automatically view their bank statement, as well as their bank transactions, in real-time.

Inventory management: The software helps track sales, inventory levels, and costs, ensuring efficient resource management.

Financial reporting: Farmers can generate detailed financial reports, including the profit and loss statement, balance sheet, and cash flow statement, to understand their business's financial status comprehensively.

Accessibility: Farmers can access their financial data and inventory from the field, office, or away from the office, depending on which software they use, QuickBooks Desktop or QuickBooks Online.

Integration: QuickBooks for farmers can integrate with other systems you may be using, such as payroll, CRM systems, or a document management system like Shoeboxed.

Why should farmers enhance QuickBooks with Shoeboxed?

Integrating Shoeboxed, a digital expense tracking and document management solution, has further revolutionized how farmers approach their financial management.

While QuickBooks efficiently handles farm accounting and financial management, integrating Shoeboxed can significantly enhance its capabilities, particularly in expense tracking and document management. Shoeboxed is a cloud-based solution that effortlessly allows farmers and small businesses to digitize receipts and business documents.

By integrating Shoeboxed with their QuickBooks software, farmers can enjoy several added benefits:

Streamlined expense tracking

While QuickBooks offers an app, Shoeboxed offers two-for-one, an app and a service.

What QuickBooks does for expense tracking

QuickBooks offers a web dashboard and a mobile app for computer uploads and phone capture of receipts. While QuickBooks can organize receipts, manual data entry is still involved.

QuickBooks automatically pulls data from your receipts, but you may still have to edit the information to ensure accuracy. You will also have to manually categorize each receipt within the software, matching it to specific accounts, customers, or projects.

QuickBooks provides a broader range of accounting features, including expense tracking, but it does not specialize in receipt scanning like Shoeboxed. Receipts can be imported from Shoeboxed to QuickBooks.

What Shoeboxed does for expense tracking

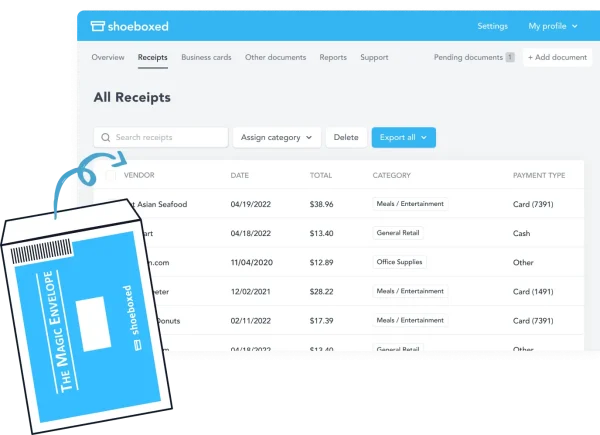

Shoeboxed specializes in scanning, digitizing, and categorizing receipts and expenses.

Shoeboxed's app captures clear images of receipts with its OCR technology, automatically pulls information, and turns it into digital data.

Once processed, the receipts are uploaded to your Shoeboxed account and automatically categorized into one of fifteen tax categories. You can also create custom categories to organize your receipts further.

This information can then be exported to accounting software like QuickBooks.

Unlike QuickBooks, where you have to categorize your expenses each time manually, Shoeboxed learns your organization patterns and automatically sorts expenses under tax categories

Shoeboxed focuses on ensuring that all expenses are accurately accounted for and categorized, making it highly useful for audit preparation and tax season.

The Magic Envelope is unique only to Shoeboxed.

Farmers can also use Shoeboxed as a service, mailing their receipts to the processing center and letting Shoeboxed do the rest. The Magic Envelope, unique to Shoeboxed, allows users to outsource their receipt scanning and organization.

After you sign up for a plan that includes the Magic Envelope, you receive a prepaid postage envelope each month to mail your receipts. Once they reach Shoeboxed's scanning facility, the receipts are turned into digital data, human-verified, and uploaded into your account under a tax or custom category.

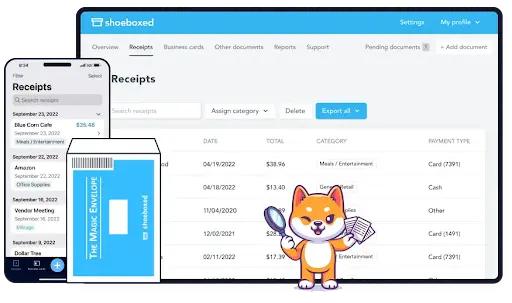

Farmers can use the mobile app to scan or mail their receipts to Shoeboxed, which digitizes and categorizes the expenses. The categorized accounts and expenses can then automatically sync with QuickBooks, ensuring accurate and up-to-date financial records.

The integration reduces the need for manual categorization, saving time and reducing the risk of errors.

Organized document management

QuickBooks for farmers alone comes up short in document management.

Document management is another essential feature that makes farm management much more straightforward.

What QuickBooks does for document management

QuickBooks lets users attach receipts and documents to transactions directly within the software, facilitating record-keeping and document management.

While it offers document storage capabilities, its features are less focused or extensive than Shoeboxed when managing various documents.

What Shoeboxed does for document management

Shoeboxed keeps all receipts and financial documents organized in one place, making accessing and managing them more accessible. This organization is especially beneficial during tax season or when preparing financial reports.

Their platform is designed for document management, particularly receipts and business documents. It stores digital copies of receipts and documents that are organized, editable, and searchable.

Shoeboxed ensures that scanned documents meet the IRS requirements for digital storage, meaning they are accepted as valid documentation for tax purposes.

Efficient fuel and mileage tracking

Track and automatically categorize mileage with Shoeboxed.

Mileage tracking is a bonus benefit to farmers.

What QuickBooks does for mileage tracking

QuickBooks also offers a mileage tracking feature, particularly in its Self-Employed and Online versions. It uses smartphone GPS to automatically track trips, which users can classify as business or personal.

Like Shoeboxed, QuickBooks calculates deductions based on trips and allows users to include them in their tax reports or invoices.

What Shoeboxed does for mileage tracking

Shoeboxed's mobile app provides a mileage tracking feature, allowing users to track their trips automatically using their phone's GPS or manually enter their travel details.

The app calculates the total deductible amount based on the standard mileage rate and automatically categorizes it, making it easy to claim mileage deductions during tax time.

Track mileage with Shoeboxed 🚗

Track mileage using your phone’s built-in GPS for unmatched ease and accuracy. Expense reports don’t get easier than this! 💪🏼 Try free for 30 days!

Get Started TodayAudit-ready documentation

Shoeboxed simplifies the process of preparing tax returns and audits.

Farmers are better prepared for tax audits with digitized receipts and categorized expenses. Shoeboxed ensures that all financial documents are IRS-accepted, providing peace of mind and compliance.

Turn receipts into data with Shoeboxed ✨

Try a systematic approach to receipt categories for tax time. Try free for 30 days!

Get Started TodayHow does Shoeboxed integrate with QuickBooks?

Shoeboxed integrates with Wave, Xero, and QuickBooks.

You can use QuickBooks and Shoeboxed each as a single system or integrate them and use them as a combined system.

To connect Shoeboxed to QuickBooks Online, perform the following steps:

Once logged into your Shoeboxed account, choose the receipts you want to export and click 'QuickBooks Online.'

Enter your QuickBooks login details and confirm the integration with Shoeboxed.

Click 'Export selected' or 'Export all' in Shoeboxed

Categorize receipts exported to QuickBooks

When the receipts are uploaded to QuickBooks from Shoeboxed, they will already be categorized with links to the receipt images for easy access.

See also: Shoeboxed vs. QuickBooks Mileage Tracker: Navigating the Race

Frequently asked questions

Is QuickBooks suitable for small and medium-sized farms?

Yes, QuickBooks can be suitable for both small and medium-sized farms. It offers a range of features that can be customized to suit the size and complexity of your farming operation. QuickBooks Online might be more appropriate for smaller farms due to its simplicity and accessibility, while medium-sized farms might benefit from the advanced features offered by QuickBooks Desktop versions.

The one thing it lacks is automatic line item categorization from scanned or uploaded receipts. You would need to integrate with Shoeboxed to access that feature.

Can QuickBooks track crop and livestock expenses separately?

Yes, QuickBooks separates different types of assets and expenses, including crops and livestock. You can set up separate accounts or use class tracking to monitor costs and revenues associated with each segment of your farm.

In conclusion

The combination of QuickBooks's best accounting software and Shoeboxed offers a powerful solution for farmers seeking to simplify their financial management and focus more on their core agricultural activities.

By leveraging the strengths and resources of both platforms, farmers can achieve greater efficiency, accuracy, and peace of mind in their financial operations. As the agricultural sector evolves, embracing technology like QuickBooks and Shoeboxed will become increasingly crucial for success and sustainability.

Caryl Ramsey has years of experience assisting in different aspects of bookkeeping, taxes, and customer service. She uses a variety of accounting software for setting up client information, reconciling accounts, coding expenses, running financial reports, and preparing tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple receipt capture methods: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports, including IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports, and more—with Shoeboxed.

Try Shoeboxed today!