A budget binder is a tangible way to monitor your finances, track where your money is going, and see where you can cut back to build your wealth.

With a budget binder, you can consolidate your finances, set goals for your savings, and monitor the spending habits of your family in one place.

No matter if you’re working to get out of debt or are in a good place (and want to stay there), a budget binder can help you be proactive and accountable for your spending habits and financial future.

In this guide, you’ll learn the basics of budgeting, read reviews of the best budget binders, and get tips to slay your financial goals this year!

What are the basics of budgeting?

1. Set your financial goals

The first step to controlling your expenses is to set clear, achievable goals.

Having a plan for your future will help you visualize where you want your finances to be both in the short and in the long term.

Below is a list of common goals to aim for:

Pay off debts.

Build an emergency fund.

Save for a vacation.

Put back money for college.

Save for retirement.

Save for a downpayment on a house.

When you write down your goals and keep tabs on your progress, you’re more likely to be successful than if you set goals on a whim without any way to hold yourself accountable.

2. Track money coming in (income)

Keeping track of your income is essential for successful budgeting.

As the money mogul, Dave Ramsey, once said, “A budget is telling your money where to go instead of wondering where it went.”

You need to know exactly how much money is coming in each month so that you can allocate it to where it’s needed the most.

Document and keep all records of income in one place, including:

Tracking your income will give you a clear starting point and help you create a realistic monthly budget.

3. Track money going out (expenses)

Having a detailed summary of all of your expenses will give you a clear-cut answer as to where you’re overspending.

Start by listing out your fixed expenses. Fixed expenses are expenses that say consistent from month to month.

Following are some examples of fixed expenses:

Rent or mortgage

Utilities

Subscriptions

Once you have your fixed expenses organized, you’ll need to identify your variable expenses. Variable expenses are expenses that can change from week to week or month to month.

Below are a few examples of variable expenses:

Groceries

Entertainment

Transportation

While your fixed expenses won’t change often, your variable expenses will.

It’s a good idea to track and update your variable expenses each week to stay on top of your spending habits.

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. Try free for 30 days!

Get Started TodayMoney management strategies

Money management strategies are proven to help people manage their finances alongside meeting an achievable goal, such as savings goals.

The 3 most popular money management strategies include sinking fund methods, pay-off debt methods, and spending control techniques.

Let’s briefly go over each strategy type below.

1. Sinking fund method

Sinking funds are used to save money for a specific expense or goal.

This method is achieved by setting aside a certain amount of money each month and allows you to gradually save for your goal without feeling overwhelmed or pressured.

2. Pay off debt methods

Debt prevents you from being financially independent.

The debt snowball method and the debt avalanche methods are designed to help you pay off your debt in a timely, effective manner.

The debt snowball method focuses on paying off the lowest debts first and still making the minimum payments on larger debts.

This approach helps you build momentum by eliminating the number of debts one at a time.

The debt avalanche method is where you pay off the largest debts or the debts with the highest interest rates to save you more money in the long run.

3. Spending control techniques

Controlling your spending is essential for successful money management.

Some spending control techniques include:

Tracking your expenses: Record every purchase to give yourself a visual representation of the money going out.

Using cash or a debit card: Avoid overspending by only using the money you have in your account.

Eliminating impulse purchases: Give yourself at least 24 hours to rethink the purchase before buying something you didn’t plan for.

How can Shoeboxed help you budget?

Shoeboxed can help you manage your receipts and create your budget

When you use multiple credit cards, debit cards, cash, and money apps to pay for your expenses, keeping track of the money leaving your wallet can become a mammoth task.

Tracking the money you spend is even harder when you’re trying to juggle mountains of paper receipts and sift through digital receipts in your inbox.

When you keep records of your receipts, it makes it easier to audit your expenses and scrutinize your budget and spending habits.

This is where Shoeboxed comes in!

Shoeboxed is a receipt-scanning app that allows you to snap photos of your receipts on the go and digitize and categorize your expenses on one platform.

What are Shoeboxed’s features?

With Shoeboxed, you can take photos of your paper receipts directly from the app, auto-import digital receipts from your Gmail, or upload receipts from your computer files to your Shoeboxed account online.

No matter how you choose to upload your receipts, every receipt you import to your account has its data pulled using smart OCR technology and is human-verified for accuracy.

1. Categorization and filters

Receipts are automatically categorized under 15 editable tax categories, which you can further categorize with tags specific to your budget, such as groceries, utility bills, car maintenance, school loans, rent, and so on.

If you ever want to see how your spending is doing in specific categories, you can advance search your receipts or filter them based on date, category, vendor, payment type, and more.

2. Expense reports

Example of a CSV expense report from Shoeboxed

Shoeboxed allows you to automatically create detailed PDF or CSV expense reports with images of the receipts attached so you can get a clear overview of the money you’ve spent.

3. Unlimited free sub-users

Add an unlimited number of free sub-users to your account to record their expenses.

This is a great way to keep all of the receipts from the family in one place.

What’s the Magic Envelope, and how does it work?

Shoeboxed’s Magic Envelope outsources your receipt-scanning

Shoeboxed also offers a receipt-scanning service called the Magic Envelope.

When you opt for a plan that includes the Magic Envelope, you’ll receive a postage-pre-paid envelope in the mail each month for you to send your receipts in.

Once your receipts reach the scanning facility, they’re scanned, verified for accuracy, and uploaded to your account under the appropriate tax categories.

You can even request that the team at Shoeboxed put your receipts under specific categories by separating your receipts with a paper clip and a note detailing how to organize your documents.

How to send a Shoeboxed’s Magic Envelope

Break free from paper clutter ✨

Use Shoeboxed’s Magic Envelope to ship off your receipts and get them back as scanned data in a private, secure cloud-based account. 📁 Try free for 30 days!

Get Started TodayHow can Shoeboxed help during tax season?

If you have a personal accountant, Shoeboxed makes filing your taxes easier than ever before.

You can simply add your accountant to your Shoeboxed profile to review your expenses or create an expense report to share with them during tax season.

If you’re ever audited, you can rest assured knowing that all of your receipts are stored in one place and are easy to find.

Now that you know the basics of budgeting and the importance of keeping receipts, let’s dive into our reviews of the best budget binders!

6 best budget binders in 2024

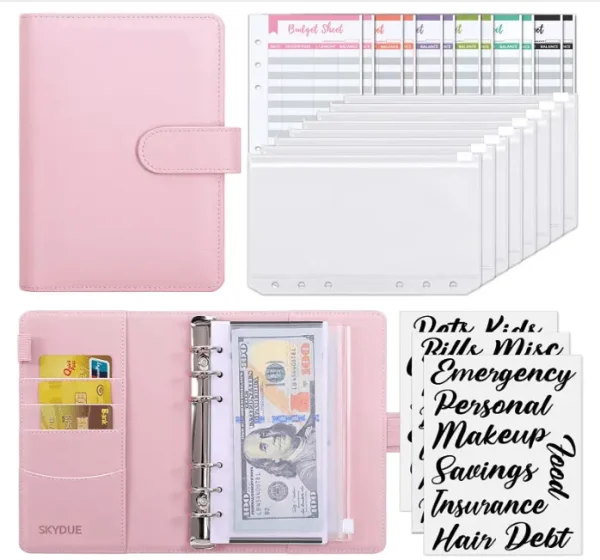

1. SKYDUE Budget Binder

SKYDUE Budget Binder, Amazon

The SKYDUE Budget Binder is our top pick for 2024. We loved this binder and thought it was a great budget buy.

This budget binder came with binder pockets, adorable stickers to label your finances, cash envelopes, expense budget sheets, and a built-in wallet to put your cards or money in.

The SKYDUE is a pocket-sized binder that was easy to carry in our purse or bring along on shopping trips.

Pros:

Budget-friendly. Had everything we needed without an outrageous cost.

Comes in 18 colors.

Doesn’t feel cheap.

Compact and easy to carry.

Built-in wallet for when you’re on the go.

Easy to organize with labels.

20+ expense categories including emergency, savings, debt, utilities, and household.

Cons:

We wish they had included blank labels for custom categories.

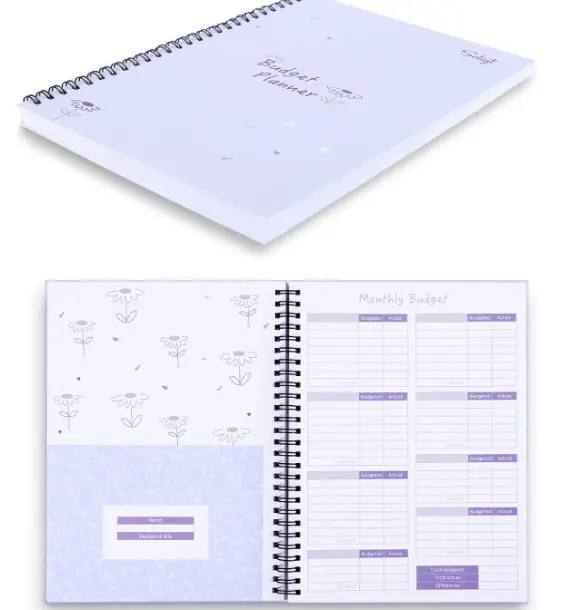

2. SOLIGT Budget Planner

SOLIGT Budget Planner, Amazon

The SOLIGT Budget Planner is a more detailed solution for your financial needs and helps to organize your money on a daily, monthly, and yearly basis.

This budget planner includes pockets for each month, tabs to label months, an annual budget, a bill tracker, a debt tracker, a savings tracker, an income and expense tracker, and calendars.

Pros:

Cute design.

Budget-friendly.

Pockets to store bills and other documents for each month.

Trackers for all of your financial goals.

Calendars to mark special occasions, due dates, etc.

Yearly planner.

Cons:

Some reviews stated a month was missing from the planner, but that wasn’t our experience.

3. SOUL MAMA Budget Binder

SOUL MAMA Budget Binder, Amazon

Our favorite part about the SOUL MAMA Budget Binder is that it uses a cash envelope system to give you better control over your finances.

Along with budget sheets, you get 10 money envelopes labeled for self-care, debt, savings, gift, emergency, vacation, utilities, household, food, and miscellaneous purchases.

Pros:

11 fun and modern designs to choose from.

Budget-friendly purchase.

Budget sheets.

Labeled clear money envelopes.

Cash envelope system to give you more control of your finances.

Cons:

We would’ve liked more customization over the binder pockets.

4. Nokingo Budget Planner

Nokingo Budget Planner, Amazon

The Nokingo Budget Planner is another one of our favorites.

We thought this planner had everything we needed to effectively manage our budget, including financial goals and strategies sheets, savings trackers, debt trackers, monthly and yearly budgets, daily expense sheets, holiday spending sheets, and spending summaries.

We also really liked the colored tabs for navigating the planner, the quick start guide to using the planner effectively, and the pockets for storing important documents.

Pros:

4 pastel colors and designs.

Great price.

Convenient size.

Has everything you need to plan out your finances for the year.

Easy to navigate.

Tons of categories for expenses, including food, health, household, and transportation.

Cons:

Though there are a lot of categories to put expenses under, they’re pre-filled. We would’ve preferred more customization.

5. Simplified Monthly Budget Planner

Simplified Monthly Budget Planner, Amazon

The Simplified Monthly Budget Planner is just that—simple. And that’s why it made our list!

If you don’t need all the bells and whistles, this planner is a great option and includes the bare bones of monthly budgeting.

Each page has a place for your budget goal, income, fixed and additional expenses, and notes for the month.

Pros:

The most affordable binder on our list.

Available in black or pink.

Simple to use.

A convenient size for bringing along on shopping trips.

Monthly budget sheets.

Cons:

Not the best for someone who does a lot of pre-planning and complex budgeting.

6. Convend Budget Binder

Convend Budget Binder, Amazon

The Convend Budget Binder is another great option for simple household budgeting.

This binder comes with label stickers so you can categorize expenses under housing, food, car, gas, personal, entertainment, and more. It also comes with blank labels to add your own categories.

The best part about the Covend binder is that it comes with envelopes for cash, bills, and cards so you have everything you need in one place while you shop.

Pros:

23 fun colors and designs.

Easy on the wallet.

Category stickers.

Blank labels for personalization.

Cash, bill, and card envelopes.

Budget sheets.

Cons:

Not much room for extreme budgeting or customization. More of a basic option.

How do you make a DIY budget binder?

If our top picks didn’t quite cut it, you can always opt to DIY a custom budget binder that suits your financial needs and matches your style.

Follow the steps below to make your own budget binder at home!

Step 1: Gather your supplies

To make your own budget binder, you’ll need:

A 3-ring binder.

6 pocket dividers to collect bills (use the front side for one month and the back side for another).

Colorful pens, pencils, and highlighters for customization.

A hole punch or sheet protectors for your papers.

Colored page markers.

You can also use stickers, a binder pencil pouch, binder cash envelopes, or anything else to personalize your budget binder to meet your money goals!

Step 2: Find a free budget binder printable that suits your needs

Free printables are an easy way to jumpstart your budget binder and have your different expenses organized right out of the gate.

Below is a list of our favorite free expense budget sheets:

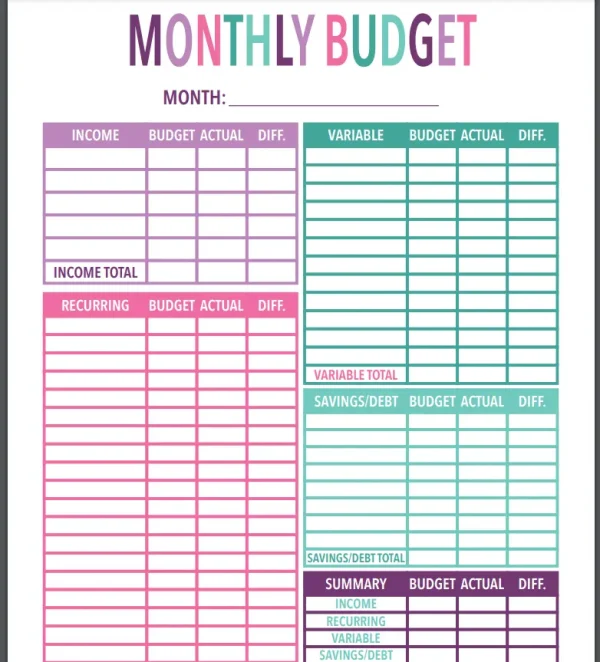

a. Free Organizing Printables’ budget binder with cash envelopes

Monthly Budget page from Free Organizing Printables

Create colorful, cute, and comprehensive budget binders (with cash envelopes!) by downloading the free printable from Free Organizing Printables.

This printable budget binder includes pages for:

Financial goals

Foldable cash envelopes

Monthly reviews

Monthly budgeting

Recurring bills

Charitable contributions

Savings

Tackling debt

Managing accounts

We love everything this printable set has to offer, and it’s our #1 pick for free printables!

b. Abby Organizes free printables for budget binders

Tracking Expenses page from Abby Organizes

Abby Organizes brings you a free printable budget binder set without all the bells and whistles.

If you prefer to keep things simple when it comes to managing your money, you’ll like this cutesy set!

With the Abby Organizes printable, you’ll get:

A pretty-in-pink cover

A goal-setting sheet

Recurring expenses tracker

Monthly expenses tracker

A monthly check-in

If you’re looking for a way to make budgeting easier, this set is the way to go with its straightforward categories and only a handful of printables!

Keep in mind that you’ll have to print additional pages for each month.

c. Carrie Elle free printable budget planner

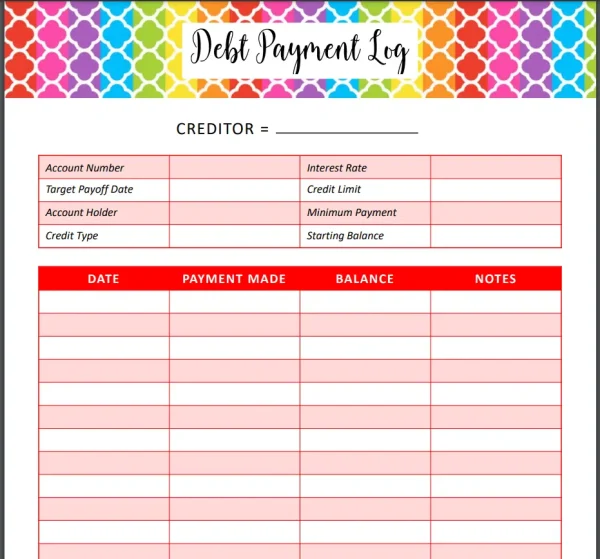

Debt page from Carrie Elle.

With these colorful printables, you’ll be tasting the rainbow as you organize your financial documents and manage your money!

Get ahold of your finances with pages for:

Quarterly recurring expenses

Monthly recurring expenses

Monthly budget

Utility bills

No-spend tracking

Debt payments

Total debts owed

Debt payoff goal

Yearly summary

We love the highly visible way to track money with this printable set, and the bright colors and fun patterns make us feel extra happy!

Step 3: Put your budget binder together

Now that you have your supplies and your printables, it’s time to put your binder together.

You’ll want to start with your binder cover and then organize each category (recurring expenses, budget, debt, financial goals, etc.) into separate months.

Keep everything related to your goals and savings together, debts and budget constraints together, and expenses together to make finding what you need easier.

You can also put your pages in alphabetical order to organize your binder.

Use your page markers to note where your budget sheets, money organizer, binder pockets, etc. are so that you’re not flipping through pages trying to find what you need.

If your binder is easy to use, you’re more likely to use it!

Step 4: Get in the habit of using your binder

According to Scott Frothingham from Healthline, “It can take anywhere from 18 to 254 days for a person to form a new habit and an average of 66 days for a new behavior to become automatic.”

In short, developing a habit can take a long time.

The key to getting the most out of your binder is by intentionally using it until it feels like second nature.

Below are a few tips to help you get into the habit of using your binder:

As soon as you receive money, give it a place in your budget.

Budget your money down to 0. Every cent should have its place (savings, debt repayment, bills, and so on).

Check your budget daily and know where and how much you can spend today.

Whenever you spend something, record it in your expense budget sheets.

Set a daily reminder on your phone to budget your finances.

By following these tips, you’ll be pulling out your binder for every dollar that enters or leaves your pocket!

What are some tips and tricks for effective budgeting?

1. Breaking the paycheck-to-paycheck cycle

According to the CNBC Your Money Financial Confidence Survey, “More than half, or 58%, of all Americans are now living paycheck to paycheck.”

Living paycheck to paycheck is a common and stressful problem for many families, but by implementing a few strategies into your daily routine, you can get more out of your money.

Creating a monthly budget will help you track your income and expenses and identify areas where you can cut back and increase your savings.

You’ll also want to focus on creating an emergency fund. This can take some time, but having an emergency fund can save you future stress.

Aim to save at least 3 to 6 months’ worth of living expenses to give yourself a cushion for unexpected expenses or loss of income.

How to stop by living paycheck to paycheck2. Strategies for saving money

There are endless ways to save money and improve your financial situation.

Here are a few strategies to consider:

Automate your savings: Set up automatic transfers from your checking account to your savings account every payday. This ensures you save money consistently before you have a chance to spend it.

Cut back on expenses: Review your spending habits and determine areas where you can cut back. Be willing to make sacrifices in order to reach your financial goals.

Use coupons and discounts: Take advantage of sales and discounts when shopping for groceries, clothing, or other items. This can help you save a significant amount of money over time.

3. Analyze your spending habits

To make the most of your budgeting efforts, you need to analyze your spending habits.

Start by tracking your expenses for a month to get an accurate picture of where your money goes.

Then, categorize your spending to identify areas where you can make improvements.

For example, let’s say you notice that you spend a large chunk of your income on dining out or entertainment.

By cooking at home and finding free ways of entertainment, you can cut back on unnecessary spending and free up those funds to put towards your financial goals.

Frequently asked questions

What should be in a budget binder?

A budget binder should include your monthly budget, income tracker, debt tracker, savings tracker, and future financial goals.

Are budget binders good?

Whether you’re in debt or are looking to save for a goal in your life, a budget binder is a creative and tangible way to record all of the money coming in and out of your pocket.

In conclusion

When it comes to managing your finances, a budget binder is one of the most convenient, customizable, and motivating ways to stay on top of your budget and improve your financial standing.

In addition to your budget binder, Shoeboxed is an excellent way to track your expenses, organize your receipts, and get an analytical overview of the money you spend!

Hannah DeMoss is a staff writer for Shoeboxed covering organization and digitization tips for small business owners. Her favorite organization hack is labeling everything in her kitchen cabinets, and she can’t live without her mini label maker machine.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!