A financial audit is a systematic and independent examination of an organization’s financial statements, processes, and accompanying documentation by impartial auditors who adhere to specific criteria and professional standards.

During the financial audit process, auditors review financial transactions and records, test internal controls, conduct tests to verify the accuracy of the organization’s financial statements and evaluate the organization’s compliance with relevant laws, regulations, and accounting standards.

The audit’s outcome is a report containing the auditor’s opinion on whether the financial statements fairly present the organization’s financial position, results of operations, and cash flows.

Therefore, a comprehensive financial audit checklist can be critical in simplifying these tasks, ensuring adherence to regulatory requirements, helping companies identify and address potential issues, and promoting transparency and integrity in financial reporting by outlining clear steps and expectations for auditors and company management.

What are the four different types of financial audits?

There are various types of financial audits, each serving a different purpose.

The most common types include internal, external, financial statement, and nonprofit audits.

1. Internal financial audit

An internal audit is conducted by a company’s employees or by hiring external professionals to assess the effectiveness of internal controls, risk management, and governance processes.

This type of audit helps businesses identify and address potential issues within their financial and operational systems.

Internal audits can bring numerous benefits to a company, such as enhancing efficiency, reducing the risk of fraud, and promoting a culture of accountability and compliance.

What Checklists Do You Need for your Internal Audit? by Auditor Training Online

2. External financial audit

An independent, certified public accountant or an audit firm performs an external financial audit.

The primary goal of an external audit is to assure the accuracy and reliability of a company’s financial statements.

Laws or regulations usually require these audits for publicly traded companies and specific private organizations.

External audits help investors, regulators, and other stakeholders gain confidence in the financial information presented by the company.

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. Try free for 30 days!

Get Started Today3. Financial statements audit

A financial statement audit examines a company’s financial statements to ensure they accurately represent its financial position and performance.

This type of audit may be conducted internally or externally, depending on the company’s size and regulatory requirements.

During the audit, auditors will review accounting records, invoices, and other financial documents to confirm the accuracy of information presented in the financial statements, like balance sheets, income statements, and cash flow statements.

1.5 – Financial Statement Auditing Process – An Overview of Auditing for Auditors by Patrick Lee

4. Nonprofit audit

Nonprofit organizations, such as charities and foundations, are also subject to financial audits, although the requirements and procedures may differ from those of for-profit entities.

Nonprofit audits assess the organization’s compliance with applicable laws, regulations, and donor agreements.

They also review the organization’s financial controls, evaluate the use of funds for program activities, and ensure accuracy in financial reporting.

Financial audits are critical in ensuring the integrity of financial information businesses and nonprofit organizations release.

Introduction to Nonprofit Audit Guide by National Council of Nonprofits

What are the three basic steps of an audit?

A financial audit involves a systematic process with distinct stages, each contributing to successfully evaluating an organization’s financial reporting and processes.

1. Planning phase

The planning phase is the initial stage of the audit, where auditors develop their audit plan and determine the scope of the audit.

During this stage, they review the organization’s financial records, identify risk areas, and select a suitable audit approach.

Adequate planning is crucial for the successful completion of the audit and may take a few weeks or months, depending on the complexity of financial records.

2. Execution phase

The execution phase involves auditors performing various tests and procedures to assess the accuracy and integrity of the organization’s financial information.

Some essential tasks during this stage include testing controls, gathering evidence, and evaluating data.

Auditors use different methodologies and techniques, such as sampling and substantive testing, to enhance the effectiveness of their examinations.

3. Reporting phase

The last stage in the process is the reporting phase.

After completing the audit procedures, the auditors document their findings in a financial audit report.

The comprehensive audit report summarizes the auditors’ work and highlights any discrepancies or weaknesses identified during the audit.

The final information is then shared with the organization’s management, who may be required to address any significant issues or deficiencies in the report.

Why is a financial audit performed?

An audit is essential for various reasons, including compliance with regulatory bodies, identifying risks, assessing financial performance, and building trust with investors and lenders.

1. Compliance

The primary purpose of a financial audit is to check for compliance with accounting standards and regulations such as the Generally Accepted Accounting Principles (GAAP).

For instance, in the United States, public companies must undergo external audits to verify compliance and meet the Securities and Exchange Commission (SEC) guidelines.

Regulatory compliance audits are performed to confirm compliance with all regulatory agencies that govern the business and should include filing local and federal taxes.

Adhering to these rules is crucial for legal reasons and maintaining the company’s reputation and credibility in the market.

2. Mitigate potential risks

Another significant reason for audits is to identify and mitigate potential risks.

Auditors examine the company’s internal controls, policies, and procedures to detect weaknesses or vulnerabilities that could lead to financial mismanagement or fraud.

A company can protect itself from potential financial losses and damage to its reputation by addressing these issues.

3. Assess performance

Financial audits also enable businesses to assess their financial performance effectively, providing a transparent, impartial evaluation of their financial reporting and management.

This evaluation helps management identify areas for improvement or realign their strategies to ensure the company’s financial health.

According to the Journal of Accountancy, 91% of audit committee members and 79% of executives say financial statement audits flag opportunities to improve business performance.

4. Assurance for investors and lenders

Investors and lenders rely on audits to gain assurance of a company’s financial health and integrity.

These stakeholders need accurate and reliable financial information, as it influences their decision-making and confidence in the company.

A clean financial audit report can attract more investors, improve a company’s access to capital, and enhance its competitive advantage.

What is an efficient method of preparing for a financial audit?

Preparing for a financial audit can be overwhelming, but utilizing available resources will simplify the process.

1. Use a comprehensive financial audit checklist

We have found that a comprehensive financial audit checklist is one of the best resources for preparing your company for a financial audit.

A financial audit checklist is a document that contains a list of tasks that must be completed during the financial auditing process.

This checklist ensures that all the required documents and processes are covered so taxpayers know what to expect and will be prepared for the audit.

2. Pull together all required documentation requested in the financial audit checklist

All necessary documents, including financial reports, statements, ledgers, and other supporting papers, mentioned in the financial audit checklist should be located before the audit and kept in a folder.

When preparing for a financial audit, it is crucial to gather all relevant documents, such as the following:

Budgets and financial statements

Associated revenue entries

Cost of sales entries

Company’s general ledger

Transactions documentation, such as bank statements and reconciliations with account balances

Trial balance

Pending payments

Receivables and payables

Bylaws and minutes of meetings

Expense approvals

Accrual accounts

Bank notes

Invoices and receipts

Detailed aging reports

Contracts and agreements such as security and lease

Tax documents and filings

Payroll expenses

Fixed Assets and inventory records

Following a systematic approach, such as an audit checklist, is invaluable throughout the preparation.

3. Organize documents

Systematically organizing these documents makes it easier for auditors to review and verify the company’s financial records.

Additionally, it saves time and effort during the audit.

A Financial Audit Preparation Checklist can significantly aid this process, ensuring a thorough and efficient audit experience.

![Financial Audit Prep Checklist [PDF]](http://images.ctfassets.net/38kjycu662tu/1Hd1yAO1As47yAHErC5RaQ/92e5ed1c07827023b7db1c336efe8d50/FINANCIAL-AUDIT-PREPARATION-CHECKLIST-min-600x849.webp)

Financial Audit Prep Checklist [PDF]:

Financial Audit Preparation Checklist - ShoeboxedIs there any software that is particularly helpful during the financial audit process?

We have also found that utilizing software solutions can significantly improve the efficiency and accuracy of the financial audit process, especially when going through the financial audit checklist.

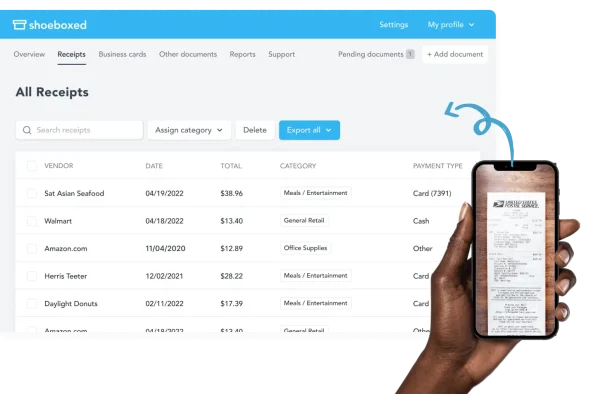

One such tool is Shoeboxed, which offers powerful features to assist auditors in tracking receipts and expenses effectively when reviewing the financial reporting processes.

Shoeboxed improves the efficiency of tracking documents for the financial audit checklist.

Digitizes physical receipts

Shoebox allows users to digitize physical receipts or other documents using an electronic system such as a phone to scan or upload photos, making organizing and accessing expenses with their associated receipts easier during an audit.

Shoeboxed digitizes physical receipts and makes them easily searchable for audits.

Instead of manually flipping through hundreds of receipts, a receipt can be accessed immediately with a filtered search by date, vendor, type of expense, or amount.

Digitizing receipts reduces the need for manual data entry, which minimizes the risk of error and makes finding receipts much easier

Never lose a receipt again 📁

Join over 1 million businesses organizing & scanning receipts, creating expense reports, and reclaiming multiple hours every week—with Shoeboxed.✨

Get Started TodayCategorizes expenses

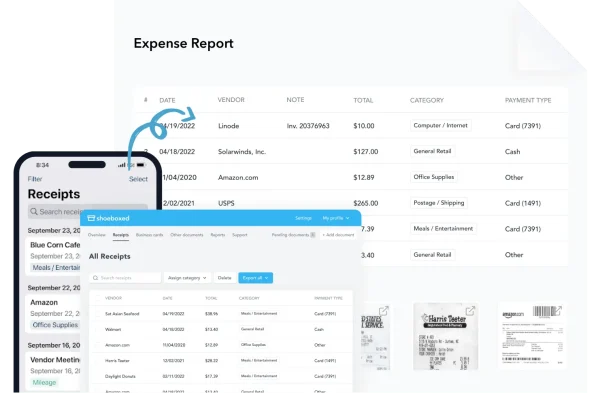

In addition to receipt management, Shoeboxed simplifies categorizing and analyzing financial transactions.

Expenses are automatically categorized into 15 tax categories, or users can establish custom categories and assign appropriate labels to expenses.

This feature ensures that financial data is automatically and systematically organized, facilitating a smoother audit process.

Creates expense reports

Shoeboxed also makes reviewing expense reports and other documents more efficient during an audit.

Shoeboxed separates expenses into tax categories, making auditing more efficient.

Auditors and business owners can easily access expense reports with images of the attached receipts or any other tax document scanned into your Shoeboxed account.

With Shoeboxed, scanned images of receipts are accepted by the Internal Revenue Service and the Canada Revenue Service in case of an audit.

Integrates with accounting software

Shoeboxed also integrates with popular accounting software like QuickBooks, Wave, and Xero.

Shoeboxed integrates with other popular software such as QuickBooks.

This feature allows financial data to be automatically synchronized between platforms, ensuring uniformity in transaction documentation and reducing the possibility of manual errors when being reviewed during an audit.

Provides an audit trail

Furthermore, the software provides a detailed audit trail, ensuring the expense management process is transparent and easy to track.

The audit trail includes information on the date, time, user, and actions taken for each transaction, providing a clear view of the financial records.

By implementing tools like Shoeboxed in the financial audit process, auditors can enhance efficiency and accuracy while reducing manual tasks and saving time.

These advantages ultimately lead to a more streamlined and effective audit experience.

Shoeboxed Demo by Shoeboxed YouTube

Frequently asked questions

What are the essential components of a small business financial audit?

A small business financial audit thoroughly examines the company’s financial records and four primary financial statements. There are several key components to consider when conducting this type of audit. First, the auditor should verify the accuracy of the financial descriptions by comparing them with underlying documentation, such as invoices and receipts. By digitizing receipts, Shoeboxed makes it easy to search and access any receipt or document that has been scanned into your account. Next, the auditor should assess the company’s internal control systems, ensuring proper authorization, recording, and monitoring procedures are in place. Additionally, the auditor should evaluate the company’s compliance with relevant tax laws and regulations.

Which financial documents should be prepared for an internal audit?

Gathering and preparing a comprehensive set of financial documents is essential for an internal audit. This typically includes the company’s balance sheet, income statement, cash flow statement, and equity statement. Additionally, businesses should provide detailed accounts payable and accounts receivable records and any supporting documentation related to assets, liabilities, and equity. Finally, it may be necessary to provide schedules for changes in notes payable and reconciliations of net assets, grant revenues, or deferred expenses.

How can a company ensure adequate financial controls during an audit?

To ensure adequate financial controls during an audit, a company should focus on three main areas: preventing fraud and errors, detecting irregularities, and correcting deficiencies. A strong segregation of duties and a system of authorization should be implemented to avoid fraud and mistakes. This helps to ensure that no single individual can control all aspects of a transaction and limits the opportunity for fraud or errors. Detecting irregularities involves implementing monitoring and review procedures to assess the effectiveness of the company’s financial controls regularly. This may include establishing an audit committee that meets periodically to review financial processes, reports, and results. Correcting deficiencies involves taking appropriate action to address any identified shortcomings or weaknesses in the financial control system. This could include revising policies and procedures, providing additional employee training, or implementing new technology to enhance the company’s financial control systems.

Conclusion

A financial audit checklist is a valuable tool for auditors and business owners, as it can streamline the financial auditing process, help identify potential areas for improvement, such as enhancing a company’s financial standing, and foster a culture of accountability.

Companies can minimize financial risk and enhance overall operational efficiency by regularly updating the audit checklist and tailoring it to specific needs.

Caryl Ramsey has years of experience assisting in different aspects of bookkeeping, taxes, and customer service. She uses a variety of accounting software for setting up client information, reconciling accounts, coding expenses, running financial reports, and preparing tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!