MileIQ is a popular app designed for accurate mileage tracking so drivers can maximize their tax deductions and keep a detailed mileage log of their personal and business trips.

Whether you’re a rideshare driver, small business owner, or an employee who often covers business miles, you can benefit from the MileIQ app (or the best MileIQ alternatives).

In this MileIQ mileage tracker review, we’ll cover everything you need to know to make an informed decision and choose the right mileage-tracking app for you!

What are MileIQ’s key features?

MileIQ offers two separate sets of plans for individuals and teams.

Each plan is slightly different and won’t include all the features, but here’s a quick overview:

Features for individuals

MileIQ for individuals

1. Automatic mileage tracking

The MileIQ mobile app uses GPS tracking and automatic drive detection. It runs in the background of your Android or IOS device whenever you’re on the road for business purposes.

2. Classify trips

At the end of the drive, MileIQ generates a report for you to categorize trips as personal or business mileage—just swipe left for personal drives and right for business drives!

This makes it effortless to log mileage and distinguish which drives you can use for tax purposes.

3. Tax-compliant mileage reports and maps

MileIQ features detailed maps of drives and custom reports so you can be reimbursed for your business trip and confidently claim a tax deduction.

Reports include business drives, personal trips, and parking expenses and show your routes. Once generated, reports can be sent directly to your boss or accountant with a simple tap.

4. Custom mileage rates and work hours

MileIQ automatically sets the tax-compliant mileage rate, or you can set custom mileage rates right from the app.

5. Multiple vehicles

If you use multiple vehicles for work, you can set custom mileage rates for each, generate mileage reports, and track mileage for business drives easily.

Features for teams

MileIQ for teams

Team plans offer the same key features as the individual plans, in addition to the following:

1. Multiple administrators

If you’re managing a team of drivers or own a small business, you’ll probably want to have another admin or two to approve reimbursements.

MileIQ lets users add multiple admins to their accounts to approve reimbursements.*

*Only in select plans.

2. Driver management and team locations

Admins can also add and remove drivers from their accounts, manage subscriptions, and set team locations.

Team locations allow business owners and managers to set locations that drivers make frequent trips to.

3. Advanced reports and report reminders

In addition to the reporting features above, team plans include start and end addresses for each drive, the ability to send your drivers report reminders, and view detailed drivers’ data and reports directly from the MileIQ dashboard.

You might also like: Mileage Tracker Google Sheets Templates: Top 5 Picks

How much does MileIQ cost per year?

MileIQ offers two tiers of pricing: Individual plans and Team plans.

Depending on the plan you choose and how many employees you have, MileIQ can cost between $71.88/year and $120/year+.

It’s important to note that, for Team plans, the monthly rate is per person.

1. Individual plans

MileIQ plans for individuals

Individual plans are best for self-employed or freelance drivers (think Doordash, Uber Eats, and Instacart).

a. Free version

Get 40 free drives per month with MileIQ’s free version.

The free version includes the following features:

Automatic mileage tracking.

Reporting.

This option could be great for those just starting with a part-time delivery gig or employees who occasionally travel for work.

b. Unlimited version

The Unlimited version is $5.99/month and includes the following:

Automatic mileage tracking.

Reporting.

An unlimited number of drives.

The Unlimited plan is best for freelancers or independent contractors who often drive for work.

2. Team plans

MileIQ team plans

Team plans are ideal for businesses with multiple employees traveling for work.

a. Teams Lite

The Teams Lite plan comes in at $5 per user/month and includes the following:

Automatic mileage tracking.

The ability to add and remove drivers.

Billing.

Teams Lite is perfect for small businesses or businesses that don’t have a large team of traveling employees.

b. Teams

MileIQ’s Teams plan is $8 per user/month and offers the following:

Automatic mileage tracking.

The ability to add and remove drivers.

Billing.

Driver reports.

A reporting dashboard.

The Teams plan is ideal for businesses that don’t need a slew of features but could benefit from driver reports.

c. Teams Pro

The final plan offered for teams is $10 per user/month and offers the following perks:

Automatic mileage tracking.

The ability to add and remove drivers.

Billing.

Reporting dashboard.

Consolidated reports.

Report reminders.

Multiple admins.

Team Locations.

Integrations and API.

Custom mileage reimbursement rates.

Teams Pro is ideal for companies that often make deliveries, travel between locations, or send employees away on business trips.

Does MileIQ drain your battery?

One of MileIQ’s biggest complaints is its battery drainage. MileIQ uses GPS to track your mileage and drives, which means it can do a number on your battery life.

Though, you can soften the blow if you have a car charger.

MileIQ will only impact your battery while it’s running, so you won’t have to worry about a constantly dying phone when it’s not in use.

What are MileIQ’s pros?

Has a free version and plans crafted for individuals and teams of drivers.

Excellent support team should you encounter problems with your subscription.

The MileIQ dashboard is modern and easy to navigate.

Log as many trips as you want (select plans only).

Great for rideshare drivers, business owners, employees, and anyone else who drives for work.

Managers can monitor all of their drivers from the web dashboard.

Automatically tracks mileage and will automatically classify familiar routes.

Easily create, review, and send reports for tax deductions and reimbursements right from the app.

Add and remove drivers and admins and access their data from the web dashboard.

Available for download on the Apple App Store and Google Play store.

What are MileIQ’s cons?

Can quickly become costly for small businesses. The price adds up for large teams.

Doesn’t offer features such as expense tracking.

Tracks personal miles, which can be annoying if you use it for work.

Only 40 drives per month with the free version and limited features.

No option to plan routes.

You can set business hours, but there is no clock-in or clock-out feature.

Other mileage-tracking apps

MileIQ isn’t for everyone, and it doesn’t offer some of the features of the other mileage-tracker apps out there.

In this section, we’ll quickly cover the best mileage-tracking app alternatives that are great for claiming tax deductions, expense tracking, custom categories, and more!

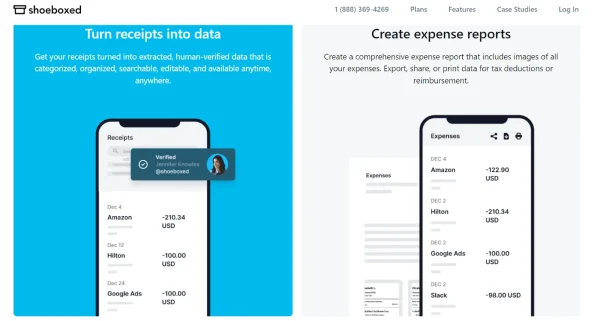

1. Shoeboxed – Best for expense management

Log your miles, track expenses, and create reports right from the Shoeboxed app.

Shoeboxed is the best mileage tracker for tracking miles, scanning business receipts, and prepping for taxes.

Shoeboxed’s mileage tracker is manual and tracks your location and miles whenever you start a trip. As you drive, the app saves your route.

At the end of a trip, Shoeboxed creates a summary with the date, editable trip name and mileage, and tax-deductible and rate. Once approved, the app will generate a receipt with the drive information, save a photo of your route on the map, and categorize it under the mileage category.

Track mileage with Shoeboxed 🚗

Track mileage using your phone’s built-in GPS for unmatched ease and accuracy. Expense reports don’t get easier than this! 💪🏼 Try free for 30 days!

Get Started TodayExpense tracking

When you or your drivers make a business-related purchase or have to pay for parking or tolls, take a photo of the receipt with Shoeboxed for effortless expense management. The mileage tracker will keep tracking your trip as you record expenses.

Receipt info is automatically pulled and classified under 15 editable tax categories.

Search features and tax prep

Example of Shoeboxed expense report

Pull up any receipt in seconds with Shoeboxed’s search and filters.

Shoeboxed also has an expense reporting feature that makes tax season a breeze. In minutes, you can export receipts into a report for your accountant or employer.

Expense reports come with receipts attached as proof of purchase should you or your business ever be audited.

The Magic Envelope

Shoeboxed offers the Magic Envelope service that allows users to outsource their receipt scanning and management.

With Magic Envelope plans, Shoeboxed sends a monthly postage-pre-paid envelope for users to mail their receipts. When receipts reach the scanning facility, they’re scanned and uploaded to accounts under the appropriate tax categories.

Pros:

Easy-to-use manual mileage tracker that saves your trips as you drive.

Edit drive details and leave notes describing the trip.

Miles are turned into receipts for expense reporting and automatically categorized.

Advanced search and filter for tax reporting.

Track mileage and digitize business receipts without skipping a beat.

Expense reports come with receipts attached for employers or tax season.

Integrates with accounting software, including QuickBooks, Xero, Wave Accounting, and more.

Magic Envelope is great for independent contractors or teams that often get receipts for parking, tolls, and business expenses.

Unlimited number of free sub-users.

Not just for expense management. You can also keep digital copies of other business documents, such as business cards, licenses, and permits.

Cons:

The mileage tracker isn’t automatic. However, this does give you more control over which miles are tracked.

Pricing:

Start Up – $22/month OR $18/month (billed annually) for unlimited users + Magic Envelope.

Professional – $45/month OR $36/month (billed annually) for unlimited users + Magic Envelope.

Business Plan – $67/month OR $54/month (billed annually) for unlimited users + Magic Envelope.

Starter Plan – $4.99/month for unlimited users (doesn’t include Magic Envelope).

Light Plan – $9.99/month for unlimited users (doesn’t include Magic Envelope).

Pro Plan – $19.99/month for unlimited users (doesn’t include Magic Envelope).

Visit Shoeboxed’s pricing page to learn more about the Magic Envelope plans.

NOTE: The first 3 plans are only available on desktop. The following plans are available on the Shoeboxed mobile app only.

Break free from paper clutter ✨

Use Shoeboxed’s Magic Envelope to ship off your receipts and get them back as scanned data in a private, secure cloud-based account. 📁 Try free for 30 days!

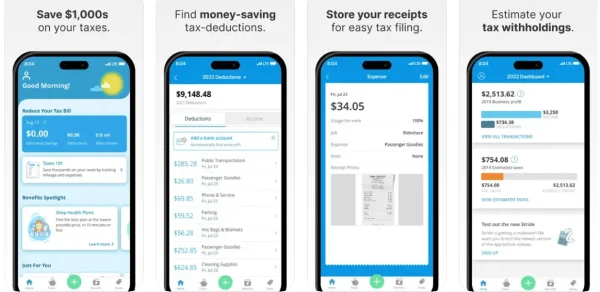

Get Started Today2. Stride – Best free mileage tracking app

Stride app, Apple App Store

Stride is one of the best free expense and mileage-tracking apps out there. Though it doesn’t have automatic expense tracking or mileage tracking, it’s still a great option for ensuring you have what you need to claim tax deductions.

Stride calculates the approximate tax deduction and records the time spent driving when a trip ends.

This mileage tracker app also offers resources to find health, dental, vision, and life insurance, which is useful for independent contractors. It’s also one of the only mileage trackers that offers its users tax prep help.

Besides mileage tracking, Stride’s receipt capture feature can be used to track expenses. Photographed business receipts include editable job and expense fields and a notes field to detail the purchase.

Pros:

Track mileage and expenses for free.

Find insurance plans to cover your medical needs.

Estimated tax deductions on all recorded drives.

Link your bank account and find write-offs.

Tracking miles is as easy as clicking a button.

Find deals near you on auto, dining, entertainment, wellness, home and business services, and more.

Cons:

Stride claims its mileage tracking is automatic, but you must manually start and stop trips.

The receipt scanning feature doesn’t automatically pull receipt information. It only saves a photo of your receipt. Details will have to be inserted manually.

Pricing: Free

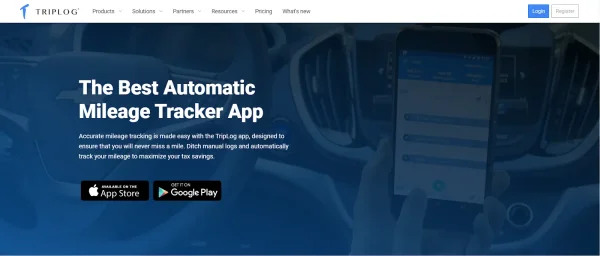

3. TripLog – Best for multiple tracking options

TripLog homepage

TripLog lets users track their miles automatically or manually and offers 3 auto-start options:

MagicTrip – Tracks 1-2 minutes after you start driving and ends after 5 minutes of no motion.

Car Bluetooth – Connects via Bluetooth and tracks when it detects a speed over 5 MPH. Tracking ends when Bluetooth is disconnected.

Plug-N-Go – Connects when your phone is plugged into the car charger and tracks when it detects a speed over 5 MPH. Tracking ends when your phone is disconnected.

This app also offers receipt scanning for fuel and business purchases and automatic expense tracking by linking your bank and card.

However, only the paid plans offer unlimited receipt uploads and trips, bank and card integration, and OCR scanning (you’ll have to manually enter the receipt data). Plus, you only get 40 expense uploads and monthly trips with the free version.

Pros:

Automatically or manually track drives with MagicTrip, Car Bluetooth, or Plug-N-Go features.

Receipt and automatic expense tracking.

Driver and route reports.

Web-based platform when you opt for a paid version.

Cons:

Free version only includes 40 expense uploads and trips/month.

The free version doesn’t allow you to integrate your bank and credit card.

Receipt uploads don’t automatically pull information in the free version.

The receipt-scanning and expense-reporting features are low-quality.

App is dated.

For teams, TripLog can get pricy.

Pricing:

Lite – Free version

Premium – $5.99/month

Teams – $10 per user/month

Enterprise – $15 per user/month

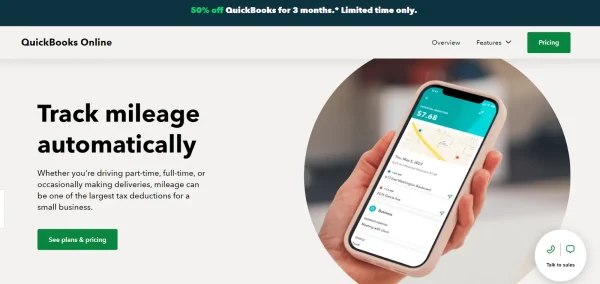

4. QuickBooks Self-Employed – Best for independent contractors

QuickBooks Online mileage tracker

QuickBooks Self-Employed is an accounting software that offers a mileage tracker. It’s the perfect choice for independent contractors or business owners looking for a complete expense management solution.

QuickBooks Self-Employed offers the following:

Receipt and expense tracking.

Tax deductions.

Invoice generation.

Payments and bank transfers.

Mileage tracking.

QuickBooks’ mileage tracker is automatic and has drive detection that starts tracking when you drive and ends when your trip does. The app also estimates deductions for your drives.

Pros:

Automatic mileage tracking.

Calculates tax deductions from drives.

Everything you need for self-employed bookkeeping.

Integrates with Shoeboxed for easy receipt management.

Cons:

Can be costly.

May have more features than you need. You can’t use the mileage tracker without getting the whole package.

The receipt-scanning feature is sub-par and tends to cut out parts of the receipts.

Pricing:

Self-Employed – $15/month.*

Self-Employed Tax Bundle – $25/month.*

Self-Employed Live Tax Bundle – $35/month.*

*Save 50% on your first 3 months when you sign up.

See also: How to Start an Uber Business: The Ultimate 10-Step Guide

Frequently asked questions

Is there a free version of MileIQ?

MileIQ offers a free version for individuals that allows users to track up to 40 free drives per month. The paid individual plan is $5.99/month for unlimited drives.

What are the best alternatives to MileIQ?

Shoeboxed, Stride, TripLog, and QuickBooks Self-Employed are the best alternative mileage tracker apps to MileIQ. They’re user-friendly, and each offers unique features that separate them from MileIQ. Shoeboxed, for example, tracks your expenses along with your miles.

How do I track miles on MileIQ?

MileIQ features automatic drive detection, so you don’t have to manually start and stop your trips. This mileage tracking app will even automatically classify a frequent drive as personal or business-related.

Conclusion

You can’t go wrong with any of the options in our MileIQ review, but when it comes down to it, MileIQ is definitely one of the best mileage tracker apps out there.

However, if you’re looking for an app to track your mileage and keep up with business-related expenses, give Shoeboxed a go!

Shoeboxed won’t track personal miles, which means you’ll have more control over your logbook, and you can snap pictures of any receipts you generate for business purchases during your trips.

Hannah DeMoss is a staff writer for Shoeboxed covering organization and digitization tips for small business owners. Her favorite organization hack is labeling everything in her kitchen cabinets, and she can’t live without her mini label maker machine.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!