Independent contractors like DoorDash drivers are responsible for their own expense tracking, which can be tedious but is essential for tax purposes.

Tracking every mile driven and expenditure incurred enables them to maximie their tax deductions, ultimately reducing their taxable income.

To simplify this process, DoorDash drivers can utilize expense tracking and mileage tracking apps that help to calculate accurate mileage deductions.

To that end, we've gathered the best mileage tracking and expense tracking apps for Dashers to consider. We've also compiled some best practices and uncovered expense types you can claim as a business deduction!

What to know about tracking expenses for DoorDashers

Expense tracking is a critical component for DoorDash Dashers, as it allows them to monitor business costs and optimize tax deductions.

The fundamental purpose of expense tracking is to maximize tax deductions, hence reducing taxable income.

Since Dashers operate as independent contractors, they must manage their finances and tax obligations diligently. An effective expense tracking system simplifies this process, making it less burdensome to claim deductions and adhere to IRS rules.

Key features of expense tracking tools

Mileage tracking: The cornerstone of most expense tracking tools for DoorDashers is its ability to track mileage accurately. A mileage log utilizes GPS to document every mile driven while working, which is crucial as the IRS requires detailed mileage records for deductions.

Expense management: In addition to mileage, these DoorDash expense tracker tools often include features to record and categorize other work-related expenses, such as parking fees or vehicle maintenance.

IRS compliance: To withstand scrutiny, the tracking solutions must offer features that make the records IRS compliant. This includes the ability for Dashers to produce thorough reports if ever audited.

Ease of use: A straightforward user interface ensures that Dashers can focus more on deliveries and DoorDash earnings and less on manual data entry. Some tracking apps also offer integration with tax software to streamline the filing process.

Best 5 expense trackers for DoorDash drivers

Choosing the right expense tracker can dramatically simplify tax preparation for DoorDash drivers. These apps assist in tracking mileage, expenses, and potential deductions, ensuring drivers maximize their savings and stay IRS compliant.

If you're looking for an app for DoorDash expense tracking, read on!

1. Gridwise—best for insights and multiple side gigs

Gridewise is a free GPS mileage tracking app that has great features if you drive for DoorDash or other meal delivery services, such as the following:

DoorDash

Uber Eats

Grubhub

And over a dozen more delivery apps.

Favorite features of this app include insights you get on your income, the best locations to work, and the most active delivery times so you can maximize and keep tabs on your earnings.

You can also compare your performance with the drivers near you to see where you can improve and make more money.

Gridewise also has features for tax prep, gas-saving and rewards, advanced insights, and more with the paid version.

Pros

Free version has everything you need to log your miles and track income and expenses effectively.

Unlimited automatic mileage tracking.

Insights into your income and expenses.

Find hot spots for meal delivery.

Great if you have multiple side gigs.

Cons

App has a lot of features so there’s a bit of a learning curve.

The paid subscription isn’t really necessary for DoorDashers (better for rideshare drivers).

Only works with specific companies, so you can’t log miles for other businesses.

Pricing

Free app

Get more out of the app for $9.99/month or $95.99/year (it’s tax-deductible!)

Download on IOS | Download on Android

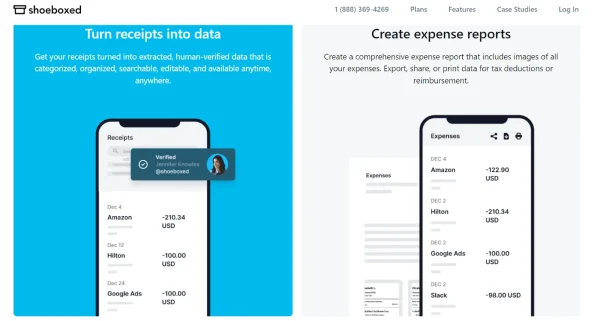

2. Shoeboxed—best for automated expense management and tax prep

Shoeboxed is our overall top pick for mileage tracking, receipt scanning, tax preparation, and expense reimbursement.

The app is ideal for Dashers with a serious DoorDash side hustle and features multiple ways to track miles and manage the expenses you incur while out on the road.

Shoeboxed’s free mileage tracker is convenient and straightforward to use, which is a must for those who drive for work.

Once you sign up for Shoeboxed, tracking miles is as easy as:

Opening the Shoeboxed app.

Tapping the “Mileage” icon.

Clicking the “Start Mileage Tracking” button.

And driving!

After clicking "start mileage tracking," Shoeboxed begins to track your location and miles and saves your route as you go.

(It’s a good idea to drop pins if you make stops along your trip. This helps to keep the mileage tracking precise.)

If you make any stops along the way and must pay for parking, for example, you can still snap a photo and upload that receipt to your Shoeboxed account without stopping the mileage tracker.

At the end of a trip, tap the “End Mileage Tracking” button.

Shoeboxed will create a trip summary that includes the date, editable mileage and trip name, and your tax-deductible and rate information.

Click “Done” to approve the summary and generate a receipt with your trip information, including a photo of your route on the map.

Shoeboxed will auto-categorize your trip under the mileage category for safekeeping.

Not only can you track the mileage you spend DoorDashing, but you can also snap photos of any receipts from parking, tolls, insulated bags, car inspections, repairs, and any other expenses directly related to your partnership with DoorDash.

Shoeboxed will digitize your paper receipts and automatically organize them under 15 tax categories to make tax time easier.

You can also edit these expense categories, and add tags and descriptions for each purchase to categorize your expenses further.

If you ever need to call up a particular receipt, you can find what you need with Shoeboxed’s advanced search and filter features that allow you to sort receipts based on date, vendor, payment type, and more.

When tax season rolls around, you can export the receipts related to your DoorDashing gig into a detailed expense report to give to your accountant.

Expense reports are also immensely helpful in the event of an audit and help protect your tail.

Shoeboxed’s expense reports come with receipts attached so you always have photo evidence of the money you spent.

Shoeboxed’s Magic Envelope service and how it works

Aside from the app features and mileage tracker, Shoeboxed also offers a service called the Magic Envelope. The Magic Envelope allows you to outsource your receipt scanning.

This is a fantastic tool for large-city-dwelling Dashers who rack up a lot of expenses by the end of the year.

When you opt for a plan that includes the Magic Envelope, Shoeboxed will send you a postage-pre-paid envelope each month for you to mail your receipts in.

Depending on how many receipts you have each month, 1 envelope may not be enough, in which case you can get another free of charge.

Once your receipts reach the scanning facility, the team at Shoeboxed will scan and digitize your receipts, check the data for accuracy, and upload them to your account under the tax categories.

You can also request that the team put your receipts under custom categories.

To do this, you would need to separate the receipts and attach a note with instructions on how to categorize your expenses.

Hit the road with Shoeboxed 🚗

Stuff receipts into the Magic Envelope while on the road. Then send them in once a month to get scanned. 💪🏼 Try free for 30 days!

Get Started TodayPros

The mileage tracker is easy to use.

You can edit the miles you drive after a trip.

Miles are turned into receipts for reporting and auto-categorized under mileage.

Filter your receipts for mileage, auto repairs, and other business expenses for tax time.

Track mileage and snap photos of receipts for expenses simultaneously.

Comprehensive PDF and CSV file expense reports with receipts attached.

Integrates with accounting software like QuickBooks and Xero.

Magic Envelope can be a great service for city-dwelling Dashers who receive lots of receipts for parking, tolls, and other expenses.

An unlimited number of free sub-users. This is good for adding your accountant or an auditor to your Shoeboxed account to review your expenses.

Cons

The mileage tracker isn’t automatic. You’ll have to start and stop the tracking process manually. On the bright side, this can help you separate business from personal trips!

Pricing

Start Up – $22/month OR $18/month (billed annually) for unlimited users + Magic Envelope service.

Professional – $45/month OR $36/month (billed annually) for unlimited users + Magic Envelope service.

Business Plan – $67/month OR $54/month (billed annually) for unlimited users + Magic Envelope service.

Starter Plan – $4.99/month for unlimited users (Digital Only plan. Doesn’t include Magic Envelope).

Light Plan – $9.99/month for unlimited users (Digital Only plan. Doesn’t include Magic Envelope).

Pro Plan – $19.99/month for unlimited users (Digital Only plan. Doesn’t include Magic Envelope).

Visit Shoeboxed’s pricing page to learn more about what all of the Digital + Magic Envelope plans offer.

NOTE: The Start Up, Professional, and Business plans are only available on desktop. The Starter, Light, and Pro plans are available on the Shoeboxed mobile app only.

Download on IOS | Download on Android

Shoeboxed is the only receipt scanner app that will handle both your paper receipts and your digital receipts—saving customers up to 9.2 hours per week from manual data entry!

Stop doing manual data entry 🛑

Outsource receipt scanning to Shoeboxed’s scanning service and free up your time for good. Try free for 30 days! ✨

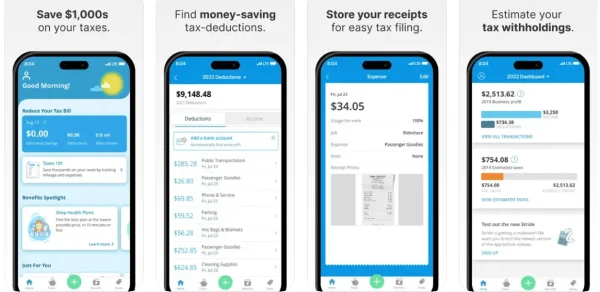

Get Started Today3. Stride—best free mileage tracker

Stride offers resources for finding health plans, including dental, vision, and life insurance, tax preparation help, receipt scanning, and mileage tracking.

The insurance resources are a helpful feature for those who plan to be self-employed for the long haul.

With Stride, you can take photos of your receipts for tax filing. When you snap photos of business receipts, you can edit the job and expense fields and add notes about the purchase for future reference.

The downside is that expenses aren’t super customizable and the features are basic compared to other receipt scanners, like Shoeboxed.

Pros

An unlimited number of free drives.

Find insurance that meets your needs as an independent contractor.

Estimated tax deductions on the miles you drive.

Link your bank account and automatically find write-offs.

User-friendly app that’s easy to navigate.

Simple start-and-stop tracking.

Cons

Doesn’t offer automatic mileage tracking. You’ll have to start and stop your trips manually.

The receipt scanning feature doesn’t have many options for customization.

Pricing

Free app

Download on IOS | Download on Android

4. Everlance—best for kickbacks

Everlance scores points for being partnered with DoorDash, which means that there's extra support available for independent contractors and self-employed individuals who are DoorDashing.

Everlance records your miles and creates reports so you can get reimbursed for business expenses.

Though Everlance is partnered with DoorDash, that doesn’t mean it’s exclusively for DoorDash.

Everlance allows users to track the mileage they spend working for companies such as Lyft, Uber, Instacart, Grubhub, other food services, and more.

You only have 30 free trips without the Premium version.

With Everlance Premium, users get expense tracking and tax help.

You can automatically track your expenses with Everlance by syncing your bank or card to your account or by manually adding an expense with a photo of your receipt attached (but that’s about as far as it goes with receipt capture).

When it comes to taxes, Everlance will calculate the estimated tax deductions for the miles you’ve driven and include other work expenses in your tax report.

You can then create expense reports, filter your miles and business expenses based on date, and export them via PDF, Excel, or CSV to your accountant during tax season.

Pros

Automatic tracking + manual tracking option.

Classify drives as personal or work-related.

Track expenses and upload photos of your receipts.

Get automatic mileage deduction estimates.

Create expense reports for tax time.

Get 20% off your first year with the DoorDash promo code.

Cons

Only 30 free trips without the Premium version. Other tracking apps offer unlimited miles for free.

You don’t get all of the features unless you have the paid subscription.

Receipt-scanning is sub-par compared to options like Shoeboxed.

Pricing

Free

Premium: $5/month (billed annually)

Download on IOS | Download on Android

Track mileage with Shoeboxed 🚗

Track mileage using your phone’s built-in GPS for unmatched ease and accuracy. 💪🏼 Try free for 30 days!

Get Started Today5. Hurdlr—best for battery life

If you’re worried about mileage apps with automatic tracking draining your battery life (which they do), then Hurdlr is your best bet.

Hurdlr is another great mileage and expense tracking app that was designed to not drain your phone’s battery, “even with heavy usage,” according to the brains behind Hurdlr.

If you opt for the Premium version, your world opens up to expense, income, and tax tracking.

For expense and income tracking, you can integrate your bank and payment methods with your Hurdlr account for efficient money management.

Alternatively, you can snap photos of your receipts or manually enter the amount of the expense or income.

You can also complete your Hurdlr tax profile to view your tax calculations.

Pros

Auto or manual mileage tracking.

Won’t drain battery life.

Reports that detail the miles you spent on the road.

Filters to sort your trips for expense reporting.

Link your bank account, Stripe, PayPal, Square, and more to auto-track expenses and income.

Account integrations with FreshBooks and other software.

Attach receipts to expenses or income statements.

Cons

Can only track expenses and income and receive tax estimates with the Premium version.

The receipt function isn’t as comprehensive as other options.

Pricing

Free

Premium for $100/year

Download on IOS | Download on Android

Categories of expenses to track for DoorDashers

Record keeping as a DoorDash driver means keeping accurate mileage reports, tracking vehicle related expenses, DoorDash mileage, etc.

Here's a list of expenses that DoorDashers should keep track of for maximizing tax deductions.

Maintenance: Regular tune-ups, oil changes, tire rotations, and repairs are necessary to keep the vehicle running efficiently.

Fuel: The cost of gas is a significant and ongoing expense directly related to the number of deliveries.

Insurance: Commercial or business-use car insurance may be required.

Taxes: Keep records of sales tax, property taxes, and vehicle registration fees.

Delivery supplies: Costs for items like insulated bags and phone mounts.

Platform fees: Any costs paid directly to DoorDash that are essential for providing delivery services.

Never lose a receipt again 📁

Join over 1 million businesses organizing & scanning receipts, creating expense reports, and reclaiming multiple hours every week—with Shoeboxed.✨

Get Started TodayBest practices for expense management

Effective expense management requires diligence and foresight. DoorDash drivers can leverage tools to simplify this crucial aspect of their business.

Adequate monitoring, secure data practices, and comprehensive reporting are essential components for efficient financial tracking.

1. Monitor and update regularly

Drivers must regularly monitor and update their expenses to ensure their records remain accurate and up-to-date.

This involves tracking fuel costs, vehicle maintenance, insurance, and any other business-related expenditures.

The use of an optimal mileage tracker for DoorDash drivers can facilitate this process and reduce the likelihood of errors during tax filing.

2. Data backup and security

Expense data is sensitive and must be securely backed up to prevent loss due to device failure or security breaches.

Drivers should adopt mileage trackers with robust security measures, such as Everlance, which offers automatic mileage and expense tracking along with data backup capabilities.

Having multiple backups, including cloud-based options, adds an extra layer of security.

3. Expense reporting and analysis

Finally, thorough expense reporting and analysis are invaluable.

By systematically categorizing expenses and analyzing spending patterns, drivers can identify areas to optimize, thus enhancing profitability.

Comprehensive tools can help drivers categorize expenses and generate reports, making it easier to visualize where and how they can adjust their spending behaviors.

Frequently asked questions

What is the standard mileage rate for DoorDash Dashers in 2024?

In 2024, the IRS allows Dashers to deduct 67 cents per mile as a business expense on their tax returns.

How can one track mileage and expenses for DoorDash?

Dashers have the option to use dedicated apps like Shoeboxed and Everlance. These apps automate the process of tracking business mileage and expenses in a manner compliant with IRS regulations.

Why is tracking mileage and expenses important for DoorDash drivers?

By keeping detailed records of their business expenses, DoorDash drivers can minimize their taxable income. This helps reduce their tax liability.

Can DoorDash drivers write off car expenses on their taxes?

DoorDash drivers can write off car-related business expenses, such as mileage, as they operate as independent contractors.

What should one look for in a mileage tracker app?

An effective mileage tracker app should be user-friendly, provide IRS-compliant reports, and automatically record trips for convenience. Options like Shoeboxed are popular among Dashers for managing expenses and preparing for tax season.

In closing

Managing expenses effectively is crucial for DoorDash delivery drivers, directly impacting their net earnings.

Dedicated apps like Shoeboxed help ease the process of tracking business mileage and expenses in a manner compliant with IRS regulations. And are a great way for DoorDash drivers to stay on top of mileage data and other expenses for business purposes.

Tomoko Matsuoka is managing editor for Shoeboxed, MailMate, and other online resource libraries. She covers small business tips, organization hacks, and productivity tools and software.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!