Whether you’re a single owner-operator or manage a fleet of 20 trucks, the right trucking accounting software can make all the difference when it comes to properly managing your finances and prepping for tax season.

If you’re here, you’re probably wondering, “Is QuickBooks good for trucking business accounting?”

This article aims to answer all of your questions about QuickBooks for trucking business finances.

We’ll also review alternative trucking software so you can make the right choice for your trucking dispatch company.

Can you use QuickBooks for a trucking company?

QuickBooks Online is used by millions of businesses across various industries.

You can technically use QuickBooks for trucking, but specially designed QuickBooks trucking software doesn’t actually exist.

QuickBooks is used in the trucking industry and hundreds of other industries, and by millions of users. Its popularity makes it easy for owner-operators to gravitate towards, but it wasn’t designed with truck drivers in mind.

QuickBooks doesn’t offer trucking-specific features such as dispatch management, fleet management tools, or other industry-specific tools, but that doesn’t totally rule it out as an option.

In the next few sections, we’ll look at how QuickBooks can be used as trucking management software and why you might want to opt for another solution.

How can QuickBooks benefit trucking companies?

Before we dive into QuickBooks’ drawbacks, let’s discuss how QuickBooks Online can benefit small businesses in the trucking industry.

1. QuickBooks is easy to learn and popular with accountants

No matter if you’re planning to use QuickBooks yourself or are looking to hire an accountant, QuickBooks is pretty versatile and doesn’t have a huge learning curve—but that doesn’t mean there’s no learning curve.

If an accountant is out of the question, you’ll spend a few hours going through QuickBooks’ training and reading their materials to get the hang of the software.

The good news is that accountants are often already familiar with QuickBooks, so if you plan to outsource accounting, the transition will be smooth.

2. There are plenty of QuickBooks accounting features

QuickBooks is an all-in-one accounting software that lets businesses:

Create and send invoices. Customize invoices, track the invoice status, send payment reminders, and get paid online.

Track expenses and manage receipts. Integrate your bank account to track expenses or use the receipt-scanning app to upload expense receipts.

Manage and pay bills. Manage bills incurred and pay online.

Calculate tax deductions. QuickBooks automatically detects tax deductions from your expenses so you can reduce your tax liability.

Run reports. According to QuickBooks you can, “Use cash flow statements, balance sheets, and income statements to gain insights into your finances.”

Track miles. Use QuickBooks’ mileage tracking app to log the time spent on the road.

And more!

3. QuickBooks Payroll makes it easy to pay employees

Payroll is one of QuickBooks’ most popular features.

QuickBooks accounting software also offers payroll so you can manage payments to employees and your business expenses in one place.

Both federal and state payroll taxes are taken care of with QuickBooks and there’s even a workforce portal for employees to access their W2s, paystubs, and more.

Though it’s not designed to be trucking accounting software, QuickBooks can still be a viable option if you have complex accounting needs.

Why might companies look for an alternative to QuickBooks?

While QuickBooks has features that can benefit those in the trucking industry, it also has a lot of useless features—at least for truckers.

QuickBooks was created as an accounting software solution for companies across various industries, so features that might benefit other businesses, like e-commerce management, won’t necessarily work for truckers.

Here’s why you might want to do 180 from QuickBooks:

1. QuickBooks isn’t trucking accounting software

Need a way to manage your fleet? Want to dispatch loads? Looking for driver safety and international fuel tax agreement compliance features?

You’re out of luck.

With the lack of industry-specific features, getting QuickBooks to meet all of your needs as a trucker or dispatcher will be a challenge, and in some cases, impossible.

2. The number of users is limited

QuickBooks only allows for up to 25 users per account, and to get to those 25 users, you have to purchase QuickBooks’ most expensive plan.

This isn’t the best option for fleets with more than 25 drivers, and the previous plans only allow for 1, 3, and 5 users.

TIP: Shoeboxed lets you add an unlimited number of FREE sub-users to your account. This spells good news for managing the expenses of a sizable fleet.

3. The receipt scanner leaves a lot to be desired

Though it seemed promising, users aren’t totally satisfied with QuickBooks’ receipt scanner.

QuickBooks’ receipt scanner is finicky, so tracking expenses on the go may prove to be more of a headache than you anticipated.

There have been numerous complaints about the QuickBooks Online mobile app from users, and according to them, the QuickBooks receipt scanning app:

Recognizes backgrounds as part of receipts.

Creates low-resolution black-and-white images.

Only captures corners of receipts.

Captures blurry images despite ideal lighting and background conditions.

TIP: Use Shoeboxed to capture clear images of your receipts every time.

Pros

Desktop and mobile app versions.

Multiple pricing tiers to choose from.

Advanced accounting features.

Create and send invoices.

Manage and pay bills.

Track miles and time.

Pay employees and make contractor payments.

Cons

Not meant to be used as trucking accounting software (lacks industry-specific features).

You’ll pay for features that aren’t needed for your trucking company.

Payroll is an additional fee.

The receipt scanner is finicky.

Pricing

Simple Start: $30/month.*

Essentials: $60/month.*

Plus: $90/month.*

Advanced: $200/month.*

Payroll: Starts at $45/month* + $6 per employee.

*Get 50% off for the first 3 months.

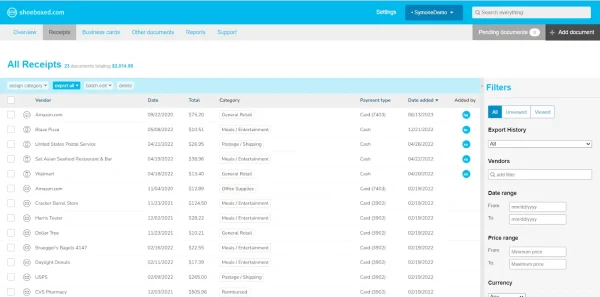

Shoeboxed compared to QuickBooks

Shoeboxed is trusted by small businesses all over the world.

Shoeboxed is a receipt-scanning app and service that lets truckers manage expenses and digitize receipts right from their cabins.

Though it doesn’t have the complex accounting features that QuickBooks offers, it does have a proven track record of simplifying trucker expense management.

Shoeboxed is used and trusted by truckers and trucking businesses all over the country.

So, what makes Shoeboxed popular with truckers?

Shoeboxed’s Magic Envelope is a favorite among trucking companies.

Shoeboxed offers a service called the Magic Envelope that lets users outsource their receipt scanning and management, and it’s why Shoeboxed is loved by truckers nationwide.

This service is unique only to Shoeboxed, and you won’t find it even in the best trucking accounting software!

When you opt for a plan that includes the Magic Envelope, you’ll receive a postage-pre-paid envelope in the mail each month.

Truckers that use Shoeboxed recommend taking the Magic Envelope along on trips. Whenever they stop for a bite to eat, to fuel up, or to find lodging, they just stuff the receipt in the Magic Envelope.

At the end of the month, they mail their receipts to the Shoeboxed facility to be scanned and uploaded to their account under 15 editable tax categories.

Let Shoeboxed do the scanning for you!

It’s that easy. Get started today!

Hit the road with Shoeboxed ⛟

Stuff receipts into the Magic Envelope while on the road. Then send them in once a month to get scanned. Expense reports don’t get easier than this! 💪🏼 Try free for 30 days!

Get Started TodayWhat are Shoeboxed’s other features, and how do they help trucking companies?

Though Shoeboxed is mainly used by truckers for its Magic Envelope service, there are other features that can benefit trucking businesses of all sizes.

1. Mobile app and web dashboard

Shoeboxed is first and foremost a receipt-scanning app. It lets truckers snap photos of their receipts on the go and automatically pulls the information using advanced OCR technology.

The receipt info is then organized in the user’s account under 15 editable tax categories.

Shoeboxed’s receipt web dashboard.

From the web dashboard, you can upload receipts from your computer files or automatically import digital receipts from your Gmail.

All of the expense data gathered from the app is accessible through Shoeboxed’s web dashboard and vice versa.

The seamless integration with the app and web dashboard makes it easy for fleet managers at the office to view the expenses of truckers on the road.

2. Unlimited free sub-users

Unlike other trucking accounting software options, Shoeboxed lets you add an unlimited number of FREE sub-users to your account.

That means you can add as many drivers to your account as needed and manage their expenses from a central dashboard. It also makes it easy to give your accountant access to your business expenses during tax season.

Just keep in mind that all of the users on an account will be able to see every expense uploaded.

If you don’t want employees to see certain expenses, you’ll have to create a separate account.

3. Mileage tracking

Shoeboxed’s mileage tracker.

Shoeboxed also has a free built-in mileage tracker that starts and stops tracking with a simple click.

As you drive, Shoeboxed tracks your location and miles and saves your route.

If you make any stops along your trip to grab lunch or fill up, you can still snap a photo and upload that receipt to your Shoeboxed account without stopping the mileage tracker.

At the end of a trip, Shoeboxed creates a summary that includes the date, editable mileage and trip name, and your tax deductible and rate information.

When you approve the summary, Shoeboxed will generate a receipt with your trip information, including a photo of your route on the map, and auto-categorize it under the mileage category.

4. Expense reports

Example of a CSV expense report.

Generate PDF or CSV file expense reports of expenses from trips to share with your fleet manager right from your phone or computer.

Expenses are automatically organized into neat reports with images of the receipts attached.

Reports are also helpful in the event of an audit and help to prove business purchases.

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. Try free for 30 days!

Get Started Today5. Digitize other documents

Shoeboxed isn’t just for receipts.

In fact, you can use Shoeboxed’s app and the Magic Envelope to digitize other documents relevant to your business, including:

Invoices.

Contracts.

Maintenance records.

Tax documents and financial data.

Vehicle titles and documents.

Shoeboxed is one of the best ways to keep a digital record of your most important business papers.

6. Software integrations

Shoeboxed integrates with a variety of software including Xero, Wave, ScanSnap, One Price Taxes, HP printers, and more.

Shoeboxed also integrates with QuickBooks to organize your receipts in your account and get your expenses tax-ready.

Why choose Shoeboxed over QuickBooks?

Shoeboxed is right for you if…

You’re looking for simplicity. You don’t need all the bells and whistles—just a straightforward way to manage your expenses.

Your business generates tons of receipts. The Magic Envelope takes the hassle out of receipt management.

You need to track the expenses of 25+ drivers. Shoeboxed’s unlimited free sub-users puts it ahead of QuickBooks.

You want to track expenses on the go. Shoeboxed’s receipt scanner is leaps and bounds ahead of QuickBooks’.

You’re just starting out. Shoeboxed is simpler to use and more budget-friendly.

Pros

Contact customer support to get a custom plan.

Use the Magic Envelope to save your receipts, ship them at the end of your route, and get them scanned into your account.

Accurate mileage tracking can be included in expense reports.

Great for fleet managers to keep track of driver expenses.

Add an unlimited number of users to your account for FREE.

Scan receipts on the go and never lose another receipt!

Store digital copies of business-related documents.

Integrate with QuickBooks and other software for tax reporting and accounting purposes.

Used and trusted by truckers.

Cons

Not a complete accounting software solution for truckers.

Pricing

The Digital Download Only Starter Plan is $4.99/month, up to $19.99/month for the Pro digital plan. (Magic Envelope service is not available with the mobile app plans.)

Plans that include the Magic Envelope start at $18/month, up to $54/month. (Available on desktop only.)

Other trucking accounting software alternatives

Still on the hunt?

Here are 3 trucking company accounting software alternatives to consider:

1. TruckingOffice – Best logbook system

TruckingOffice’s homepage.

TruckingOffice is a 3-step system that lets you “Haul the load, track the details, and get paid.”

This software is made up of 2 parts consisting of the TMS (trucking management solution) software and the ELD (electronic logging device).

The TMS lets you create and dispatch loads, create and send invoices, and manage payments.

The ELD allows drivers to receive trip info, update the status of the load, upload expense receipts, mark loads as “delivered,” and upload documents.

Though they have a separate monthly cost, you’ll need to purchase both the TMS and ELD to get the most out of the software.

Pros

Invoice and track expenses and payments.

Seamless integration between TMS and ELD systems.

TMS has everything you need to manage loads.

ELD app can be accessed on any mobile device.

Cons

TMS and ELD have separate costs. We would have preferred a lump sum.

Pricing

TMS Basic Plan: $20-$75/month, depending on the size of your operation.

TMS Pro Plan: $30-$110/month, depending on the size of your business.

ELD: $23/month OR $240/year.

2. Rigbooks – Best for understanding profits

Rigbooks’ homepage

Rigbooks is a cloud-based trucking software designed to help businesses understand which loads are the most profitable.

With Rigbooks, you’ll get an overview of the cost of each load and can access features from any device, anywhere.

You also get the option to bill by load, mile, weight, or item.

Overall, Rigbooks is a good option if you’re looking for a way to reduce costs and increase profits by the mile.

Pros

Discover which loads are the most and least profitable.

Good for fleets of up to 10 trucks.

Budget-friendly monthly cost.

Multiple billing options.

Cloud-based software you can access on your phone, tablet, or computer.

Cons

Pricing is somewhat transparent, but there are no readily available pricing tiers. Contact Rigbooks for more pricing information.

Pricing

30-day free trial, then $19/month.

3. Q7 – Best for multiple features

Q7’s homepage

In their own words, Q7 is “Advanced end-to-end trucking business software designed from the ground up to help you manage your trucking company effectively and efficiently.”

…And they aren’t kidding. Q7 really is an end-to-end option with tons of features for the trucking industry.

Not only does Q7 offer tools for accounting, but it also has payroll, order management, truckload dispatch, billing freight brokers, brokerage dispatch, LTL dispatch, fleet maintenance, fuel and mileage tracking and reports, and safety compliance features.

Q7 comes with a driver mobile app to see current trips, upcoming assignments, stop arrivals, departures, and more.

Pros

End-to-end trucking software.

A slew of features to manage your operations.

Mobile app for drivers.

Safety, billing, dispatch, trucking payroll software, and more.

Cons

Though there’s a lot to offer, we think the software is pretty dated.

Can be complex to use. You’ll likely have to get assistance from Q7 to learn the ropes.

Pricing isn’t transparent.

Pricing

Request a demo for pricing information.

Frequently asked questions

How do trucking companies do bookkeeping?

Trucking companies either use the cash-based or accrual-based system and hire a bookkeeper to manage their finances or use trucking management software to track expenses. Trucking accounting software is the most affordable option for small trucking businesses.

What is the best software for small trucking business?

TruckingOffice, Rigbooks, Q7, and Shoeboxed are among the best software for small trucking companies due to their straightforward expense management, intuitive apps and interfaces, and scalability. Each of these software options is used and trusted by truckers.

To conclude

When it comes down to it, QuickBooks can be an accounting solution for owner-operators or trucking company managers.

Though it isn’t the best trucking accounting software in the world, we have to admit it has one of the top trucking payroll software solutions available and is a great way to create invoices, financial reports, and manage expense tracking.

That said, if you're just starting out as a trucking owner or operator, and you have a lot on your plate and you’re looking for a simple way to keep up with receipts and expenses, try Shoeboxed.

Hannah DeMoss is a staff writer for Shoeboxed covering organization and digitization tips for small business owners. Her favorite organization hack is labeling everything in her kitchen cabinets, and she can’t live without her mini label maker machine.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!