Managing a farm's finances requires meticulous record-keeping and organization. Farmers often have a variety of expenses ranging from seed and fertilizer costs to equipment maintenance and labor wages.

A farm expenses spreadsheet is a crucial tool for farmers. It enables them to track their spending in real-time and make informed decisions about their agricultural operations. It also simplifies the preparation of financial statements and tax filings.

Utilizing an Excel spreadsheet for farm financial records can be a starting point for farmers new to financial management or looking to streamline their current system.

Best free farm expense spreadsheet templates

We’ve hand-picked the following templates as they offer organized sections and categories accommodating various farm-related transactions, allowing for an efficient record-keeping experience.

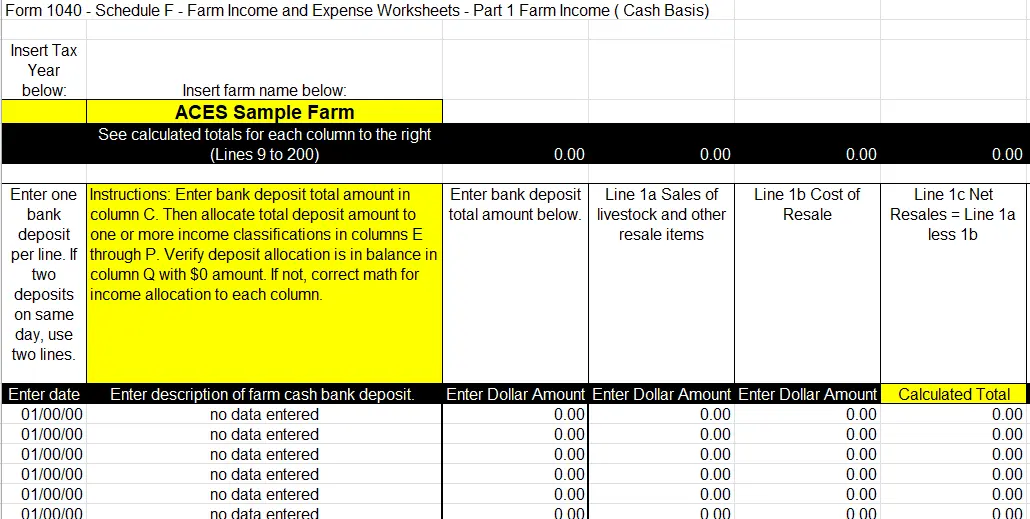

1. Farm Expense Spreadsheet for Taxes (IRS Form 1040 - Schedule F)

This template, designed by the Farm and Agribusiness Management, is directly aligned with the IRS Form 1040 - Schedule F, ensuring that one's farm finance management stays in line with tax requirements.

Tailored for improved financial record-keeping, this Excel template has three critical components: Income, Expense, and Profit Summary. It's part of a series designed to aid Alabama producers, but it's versatile enough for use in various farming operations.

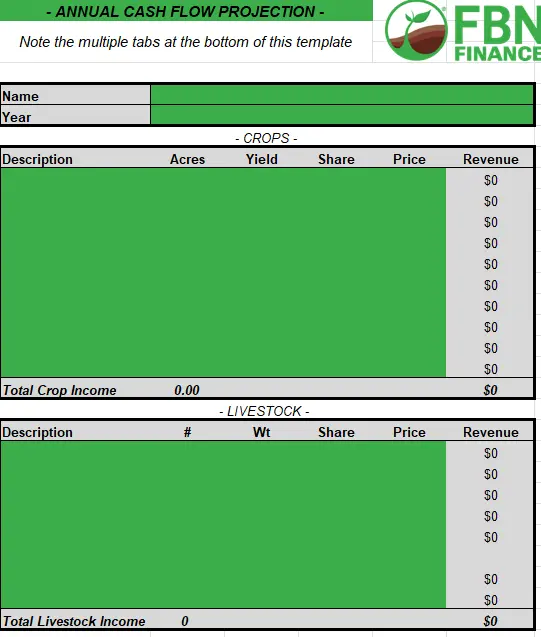

2. FBN's Cash Flow Projection Template

FBN® Finance has created a robust spreadsheet that puts farmers in control of their finances throughout the year. This template has 3 tabs—Income, Expense, and a Summary tab—and is excellent for annually mapping out a farm's budget, tracking expenses, and forecasting finances.

To download the template, you'll be asked to provide your name, email address, and telephone number, and then you can download it for free.

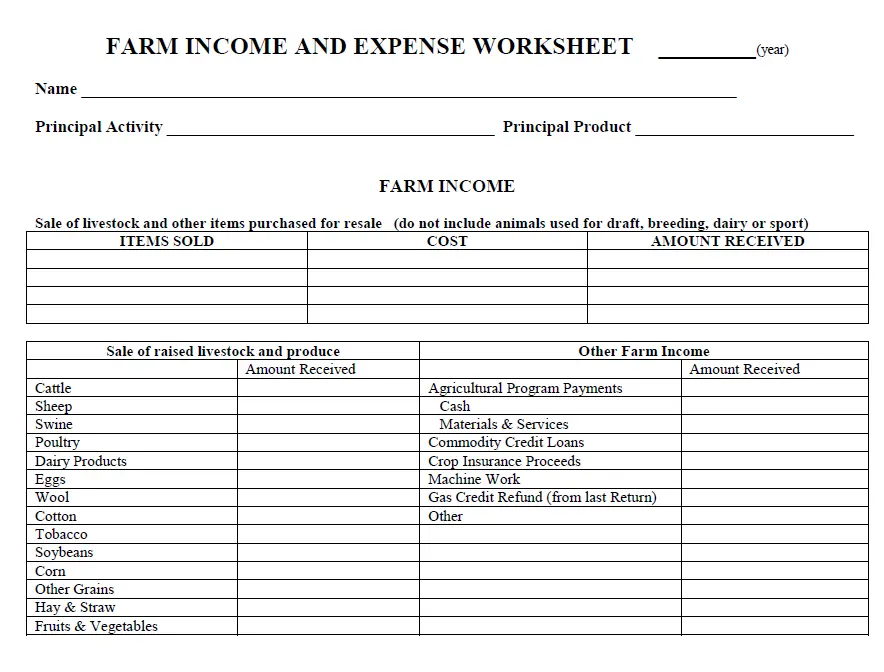

3. Farm income and expense worksheet

This worksheet detailing common farm categories can serve as a whole farm budget tracker or an expense tracker for the year or month.

It also has sections that cover income from items sold and the sale of produce and livestock.

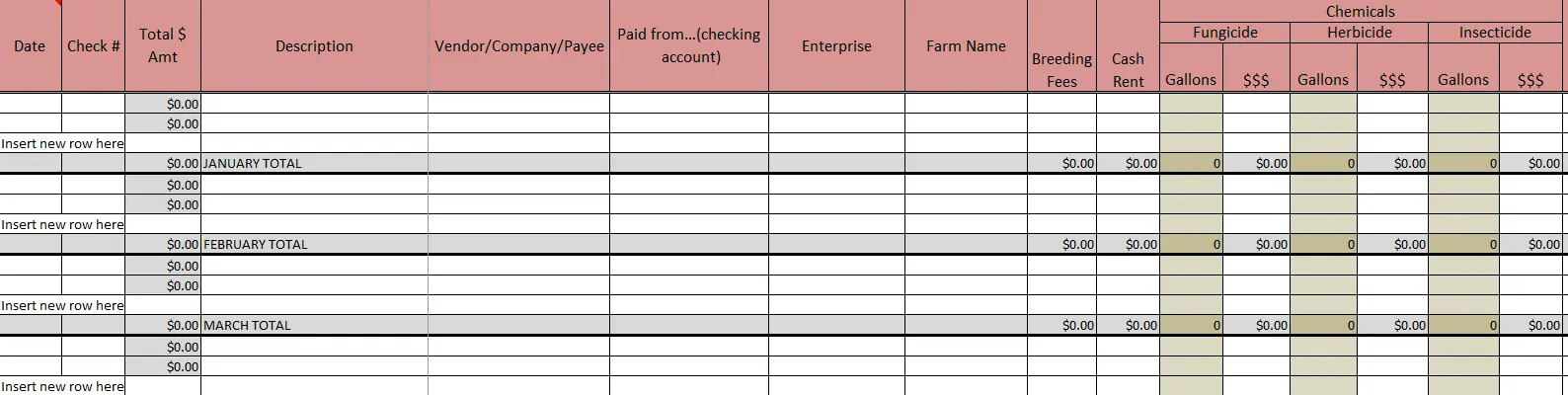

4. Missouri Farm Record Book (Excel)

MU Extension provides an Excel-based record book with features to keep track of income, expenses by vendor, and cash flow summaries, among others. This comprehensive tool is handy for detailed financial analysis over time. It provides the necessary structure to maintain organized records and can be

5. Shoeboxed, the best farm expenses spreadsheet alternative

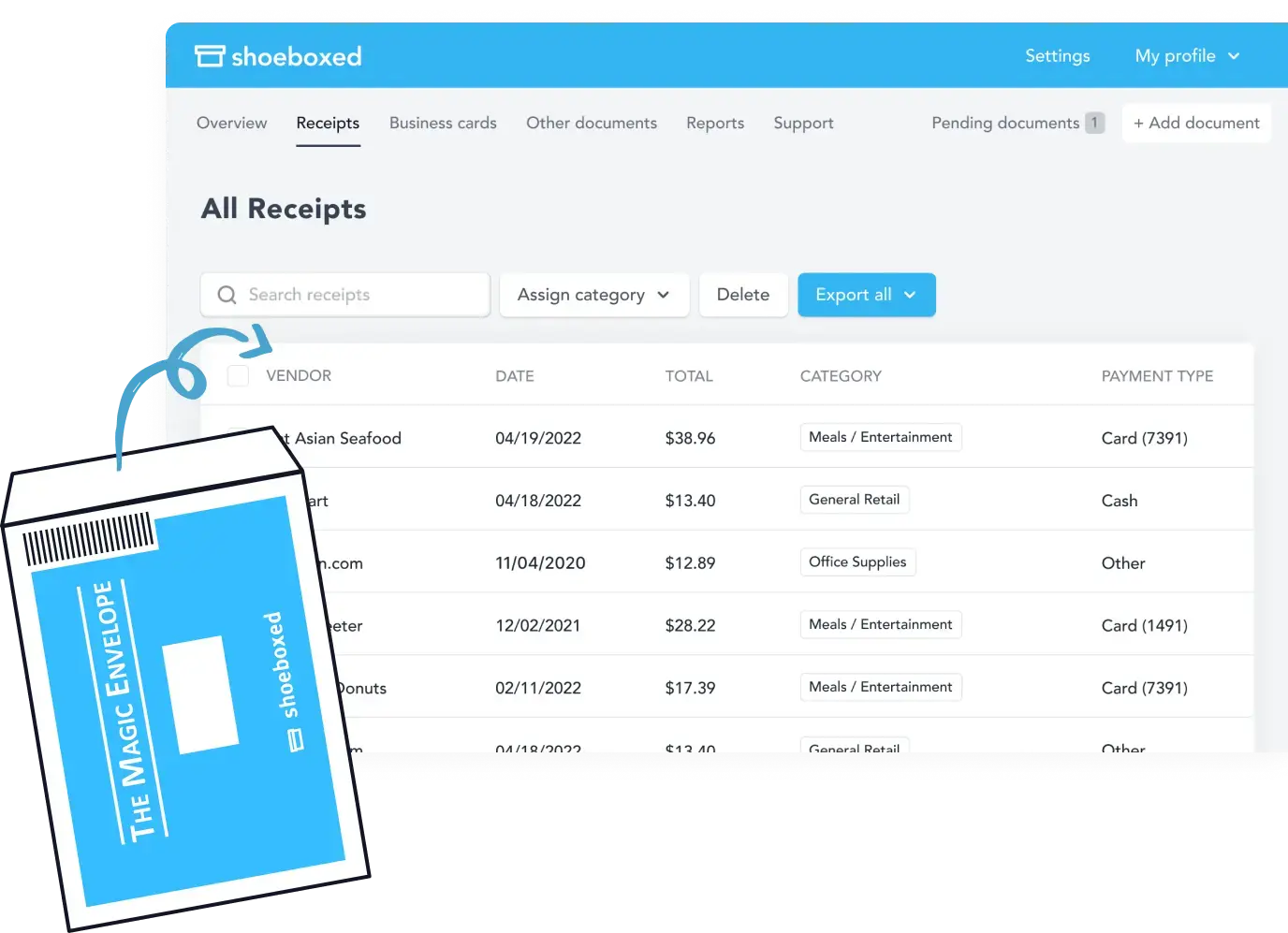

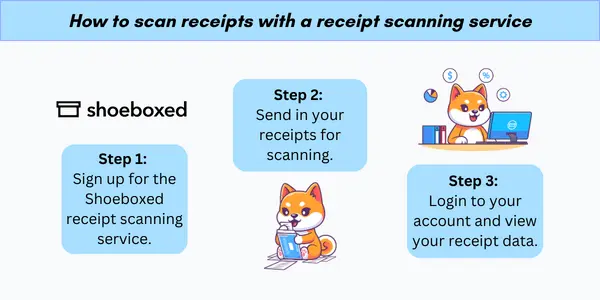

For farmers who are always on the go, a notable alternative to spreadsheets would be to use Shoeboxed’s Magic Envelope service to outsource manual entry of receipts and expenses.

Starting from $18 per month, you receive a postage-prepaid Magic Envelope that you can keep on your truck's dashboard. Simply stuff receipts into the envelope as you pay for gas, purchase supplies, and are out and about.

At the end of the month, send the Magic Envelope to Shoeboxed, and they’ll get all your data scanned and categorized into 15 common tax categories. Easy peasy.

Shoeboxed is the only receipt scanner app that will handle both your paper receipts and your digital receipts—saving customers up to 9.2 hours per week from manual data entry!

Break free from manual data entry 🚜

Use Shoeboxed’s Magic Envelope to ship off your receipts and get them back as scanned data in a private, secure cloud-based account. 📁 Try free for 30 days!

Get Started TodayWhat else can Shoeboxed do?

Shoeboxed has been voted as the best receipt scanner app for tax season by Hubspot and given the Trusted Vendor and Quality Choice awards by Crozdesk.

A quick overview of Shoeboxed's award-winning features:

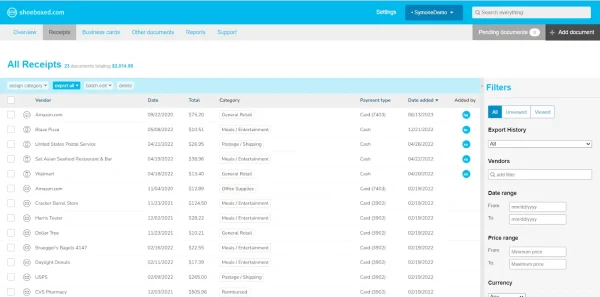

a. Mobile app and web dashboard

Shoeboxed’s mobile app lets you snap photos of paper receipts and upload them to your account right from your phone.

Shoeboxed also has a user-friendly web dashboard to upload receipts, warranties, contracts, invoices, and other documents from your desktop.

b. Gmail receipt sync feature for capturing e-receipts

Importing e-receipts to your Shoeboxed account is as easy as syncing your Gmail with Shoeboxed, using Shoeboxed's special Gmail Receipt Sync feature.

Shoeboxed’s Gmail Receipt Sync grabs all receipt emails and sends them to your account for automatic processing! These receipts are then labeled as Sent to Shoeboxed in your Gmail inbox.

In short, Shoeboxed pulls the receipt data from your email, including the vendor, purchase date, currency, total, and payment type, and organizes it in your account.

Your purchases will even come with images of the receipts attached!

c. Expense reports

Expense reports let you view all of your expenses in one cohesive document. They also make it simple to share your purchases with your accountant.

You can also choose certain types of receipts to include in your expense report. Just select the receipts you want to export and click “export selected.”

d. Search and filter

Call up any receipt or warranty in seconds with advanced search features.

Filter receipts based on vendors, date, price, currency, categories, payment type, and more.

e. Accounting software integrations

Export expenses to your accounting software in just a click.

Shoeboxed integrates with 12+ apps to automate the tedious tasks of life, including QuickBooks, Xero, and Wave Accounting.

f. Unlimited number of free sub-users

Add an unlimited number of free sub-users to your account, such as family members, employees, accountants, and tax professionals.

g. Mileage tracker for logging business miles

After you sign up for Shoeboxed, you can start tracking miles in seconds:

Open the Shoeboxed app.

Tap the “Mileage” icon.

Click the “Start Mileage Tracking” button.

And drive!

Whenever you start a trip, Shoeboxed tracks your location and miles and saves your route as you drive.

As you make stops at stores and customer locations, you can drop pins to make tracking more precise.

At the end of a drive, you’ll click the “End Mileage Tracking” button to create a summary of your trip. Each summary will include the date, editable mileage and trip name, and your tax deductible and rate info.

Click “Done” to generate a receipt for your drive and get a photo of your route on the map. Shoeboxed will automatically categorize your trip under the mileage category in your account.

h. The Magic Envelope

Outsource your receipt scanning with the Magic Envelope!

The Magic Envelope service is one of Shoeboxed's most popular features, particularly for businesses, as it lets users outsource receipt management.

When you sign up for a plan that includes the Magic Envelope, Shoeboxed will mail you a pre-paid envelope for you to send your receipts in.

Once your receipts reach the Shoeboxed facility, they’ll be digitized, human-verified, and tax-categorized in your account.

Have your own filing system?

Shoeboxed will even put your receipts under custom categories. Just separate your receipts with a paper clip and a note explaining how you want them organized!

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. Try free for 30 days!

Get Started TodayHow to create your own farm expenses spreadsheet

A thoroughly crafted expense spreadsheet is pivotal for managing farm finances effectively. The nuances of its setup dictate the ease of future tax preparation and financial analysis.

1. Choose a spreadsheet program

Selecting the appropriate platform is crucial when setting up a spreadsheet for farm expenses.

Microsoft Excel is a widespread choice for expense reports. Alternatively, Google Sheets provides robust collaborative features, allowing multiple users to update information in real time.

2. Decide on the spreadsheet's layout and design

Ideally, the spreadsheet structure should mirror the IRS Form 1040 - Schedule F requirements for a streamlined tax filing process.

Typically, the first worksheet is allocated for logging all types of farm income, including but not limited to sales revenue and subsidies. This might be followed by successive worksheets for farm expenses, categorized by type, such as feed, seed, and equipment maintenance.

3. Record purchases

When recording purchases, it is critical to categorize each expense appropriately.

Use separate columns for the date, vendor name, item description, amount, and purpose. For instance, a Livestock Feed Purchase entry might include the transaction date, supplier's name, quantity purchased, cost, and which livestock type the feed is for.

4. Document sales

For documenting sales, one should meticulously note the particulars of each transaction.

Columns should detail the date of sale, buyer's name, type of product sold, quantity, and sale price. For example, a sale record could chronologically list the sales of Milk and Dairy products, including the liters sold and revenue generated on that specific date.

5. Track labor costs

Effective tracking of labor costs involves itemizing all labor expenses by date, name of the worker, hours worked, and the pay rate.

Including a brief description of the work done can also be beneficial. For instance, one might document an entry as "03/05/2024, John Smith, 6 hours, $15/hour, tractor maintenance."

You might also like:

Benefits of tracking farm expenses

Effective analysis and reporting using a farm expenses spreadsheet converts raw data into actionable insights for any farm business.

Analyzing expense trends uncovers patterns that can lead to cost savings and budget optimization.

Farmers can use spreadsheets to:

Categorize expenses—Feed, seed, equipment maintenance, etc.

Compare costs over time—Monthly, quarterly, annually.

Identify areas for improvement—Reducing waste, negotiating better prices, etc.

The right business spreadsheets can automatically calculate and organize relevant financial ratios, providing a detailed understanding of the farm's operational efficiency.

Hit the road with Shoeboxed ⛟

Stuff receipts into the Magic Envelope while on the road. Then send them in once a month to get scanned. Expense tracking doesn’t get easier than this! 💪🏼 Try free for 30 days!

Get Started TodayIn closing

Today, numerous farming apps and accounting software are available to assist farmers in managing their finances. These tools are designed to cater to the unique needs of the agricultural industry. They offer tailored features such as categorizations aligned with tax requirements and the ability to handle various income streams from crops, livestock, and other farm activities.

Effective data management is essential for maintaining accurate financial records on a farm.

Whether farmers opt for a basic template or a more advanced program that integrates with other financial software, the chosen application should help them save time so they can focus on other aspects of running a profitable farming business.

Tomoko Matsuoka is the managing editor for Shoeboxed, MailMate, and other online resource libraries. She covers small business tips, organization hacks, and productivity tools and software.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!