Whether you're self-employed or on a strict budget, saving paper receipts—and keeping those receipts organized—is often easier said than done.

In this post, we'll cover why it's important to save all your receipts for tax purposes, the best methods for storing receipts, and how to organize receipts electronically.

Why should you save your receipts?

Saving your receipts can reduce tax liability, help you track expenses, and get you reimbursed quicker.

People typically save their receipts for 3 reasons:

They're small business owners and the receipt is a business expense.

They're budgeting and save physical receipts to track expenses.

They're employed and can receive reimbursements for certain expenses.

1. Self-employment

Those who are self-employed need to save both paper receipts and electronic receipts.

Any business receipt that you attempt to deduct from your taxable income without proof of purchase can lead to issues with the IRS in the event of an audit.

2. Budgeting

When it comes to budgeting, a physical receipt can be a great way to visualize the money you have going out.

It's helpful to organize your receipts by category (groceries, entertainment, clothing, pets, utilities, etc.).

If you overspend, having itemized receipts makes it easier to audit your expenses and see which category you need to spend less in.

3. Reimbursements and deductions

For those who are employed, it's important to save any paper or digital receipts for business-related expenses.

The company you work for may have a reimbursement policy for any purchases you make on behalf of the business.

You may also be eligible to deduct any non-reimbursed expenses for the business you work for, including medical bills, childcare, and work-related expenses, depending on the state you reside in.*

*For informational purposes only. Consult a tax professional for advice during tax season.

Do you need to save your receipts for taxes?

If you plan to use a purchase for tax deduction purposes, you need to save the receipt to prove you bought the item. When you claim a purchase on your tax return and are audited without the receipt, the IRS may disallow the deduction.

You should save receipts for business expenses for at least 3 years, either as physical receipts or as digital copies.

Many small business owners will also keep receipt files and records for up to seven years for loss from worthless securities or bad debt deductions.

What receipts should I keep for taxes?

When you stay organized and keep good records, it makes it easier to maximize your tax-deductible expenses.

Below is a list of receipts you should keep for taxes:

1. Medical expenses

The following medical expenses that are paid towards yourself, your spouse, or dependants can be deducted during tax time:

Medical aids, such as eyeglasses, prescription medicine, or hearing aids.

Premiums for medical, vision, or dental.

Hospital stays.

Physical therapy, psychiatrist or psychologist sessions, or nursing care.

Parking fees, hotel stays for medical treatment, and mileage to and from doctor appointments.

2. Self-employment expenses

Self-employed individuals can deduct any expense related to the necessary running or betterment of their business:

Office supplies (pens, ink, stamps, printers, scanners, etc.).

Marketing expenses.

Materials.

Rent and utility bills.

Insurance costs.

Charitable donations.

Business meals and travel.

If you work from home, certain expenses may also be eligible for deduction, such as part of your internet, cell phone, or electricity bills, mortgage, and home office supplies.

3. Childcare expenses

You may also be able to receive a credit for child or dependant care if this care enables you to work or look for work:

Babysitter.

Daycare.

After-school programs.

Housekeeper.

Cook.

This credit is only available to collect for a dependant under the age of 13 or a disabled spouse or dependent who is unable to properly care for themselves.

Note: This is not an exhaustive list and is for informational purposes only. Refer to your tax preparer for advice.

What is the best way to save receipts?

No matter if it's business receipts or personal expenses, keeping track of your receipts is necessary if you want to manage your money and reduce your tax liability properly.

Here's a list of our 4 favorite ways to save receipts:

1. Use Shoeboxed

Join over 1 million users and start digitizing your receipts today!

Shoeboxed is a receipt-scanning app and service that turns receipts into digital data and prepares your expenses for tax time.

Whenever you make a purchase, you can use Shoeboxed to organize receipts electronically in 3 ways:

Gmail sync: Shoeboxed automatically grabs the receipts from your inbox and categorizes them in your account.

App + Web dashboard: Snap photos of receipts with the Shoeboxed mobile app and organize them right from your phone or use the web dashboard to scan receipts or upload them from your computer.

Magic Envelope: Outsource receipt scanning to the Shoeboxed team.

Let's go over each of these features and more below.

a. Gmail sync

Keeping tabs on your e-receipts and paper receipts can be time-consuming, which makes Shoeboxed's Gmail sync a convenient feature.

Shoeboxed will recognize receipts in your inbox and import them to your Shoeboxed account under 1 of the 15 tax categories, automatically pulling the data from your receipts and saving a virtual image of the expense.

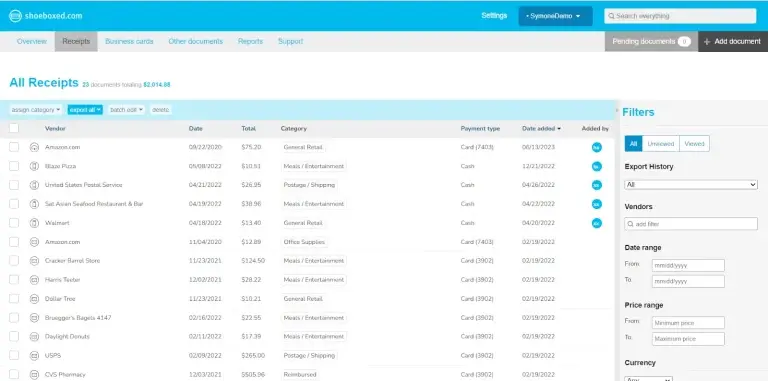

b. Mobile app and web dashboard

Demo account web dashboard.

Shoeboxed’s mobile app lets you snap photos of your receipts on the go.

Whenever you make a purchase, just open the app, take a picture, and Shoeboxed will digitize the data and upload the receipt to your account.

Receipts take up to 24 hours to process and are human-verified to ensure the data is accurate.

Shoeboxed also has a web dashboard that you can use to upload receipts or documents directly from your computer files.

c. Magic Envelope service

The Magic Envelope is the most popular feature for business owners and lets users outsource their receipt scanning and management.

When you sign up for a plan that includes the Magic Envelope, Shoeboxed will mail you a pre-paid envelope to send your receipts in each month.

Pro Tip: With the Magic Envelope, you can even mail in important business and tax documents, credit card statements, invoices, or any other document you want a digital copy of!

Once your receipts (or other paper files) reach the scanning facility, they'll be digitized, verified, and categorized under your account.

You can even request that receipts be filed under custom categories! Just separate your receipts and leave a note explaining where you want them to go.

d. Other features

Expense reports: Create detailed, customizable reports with images of receipts attached to expenses.

Search, filters, and custom categories: Advanced search function, filter receipts based on receipt information, categorize receipts under 15 tax categories, or create custom categories.

Accounting software integrations: Integrate with the accounting tools you already use, including QuickBooks, Wave Accounting, and Xero.

Unlimited free sub-users: Add an unlimited number of sub-users to your Shoeboxed account free of cost.

Never lose a receipt again ✨

Join over 1 million businesses scanning receipts, creating expense reports, and reclaiming multiple hours every week—with Shoeboxed.

Get Started Today2. Have a file folder

A file folder for receipts is the tried and true way of keeping good records.

Many people will have a folder at their office for business expenses and another in their home for other expenses.

You can file receipts by month or year and even have multiple folders for different buying categories, such as:

Groceries.

Bills.

Medical.

Entertainment.

Business trips and meals.

Utilities.

Business materials and supplies.

The main downside to this method is that the thermal paper receipts are printed on will smudge or fade over time and may even become illegible.

Not to mention, a fire, flood, or another disaster could result in destroyed receipt records.

3. A scanner and Google Drive

Google Drive homepage.

Google Drive is a digital way to store receipts and allows you to create files that can be accessed from anywhere—even when you're offline.

If you have a scanner in your business or home office, you can easily digitize your receipts and upload them to Google Drive from your computer files.

With Google Drive, you'll be able to access copies of your receipts from your phone or desktop and create separate digital folders to organize your expenses.

4. Use your accounting software

Accounting and tax software is another reliable option for storing receipts.

QuickBooks comes to mind because of its end-to-end accounting for small businesses and tax reporting features that include receipt scanning and organization.

Did we mention Shoeboxed integrates with QuickBooks to seamlessly track business expenses?

Break free from paper clutter ✨

Use Shoeboxed’s app and scanning service to scan receipts and organize your wallet and office. Try free for 30 days!

Get Started TodayFrequently asked questions

Is there a point to saving receipts?

You need to keep the receipts from the tax year if you want to capitalize on eligible deductions. If you claim an expense on your tax return without a receipt, the IRS may disallow the deduction.

What is the best way to save receipts?

Keeping receipts electronically is the best way to save receipts for tax purposes. A receipt scanner or scanning app, like Shoeboxed, helps you save time, reduce paper clutter, and keep track of expenses in the event of an audit.

Final thoughts

Saving your receipts can cover your tail if you’re ever audited, help you better budget your spending, and maximize your tax deductions.

If you're looking for an efficient way to keep track of your receipts, try Shoeboxed! Shoeboxed is the #1 way to digitize, store, and prepare receipts for tax season.

Hannah DeMoss is a staff writer for Shoeboxed covering organization and digitization tips for small business owners. Her favorite organization hack is labeling everything in her kitchen cabinets, and she can’t live without her mini label maker machine.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!