In today’s digital age, the photography industry has significantly evolved, requiring professionals to wear many hats, including managing their own finances. As a result, accounting software tailored to the unique needs of photographers has become increasingly important.

These specialized tools not only help with managing expenses and tracking billable hours, but also allow for smooth collaboration with clients, ensuring a seamless experience for both parties.

When selecting the best accounting software, photographers must consider their specific business needs, the size of their customer base, and their financial management goals. By taking these factors into account, photography professionals can find the most suitable accounting software to help them efficiently streamline their financial processes and focus on their creative work.

Why is accounting software for photographers crucial to their business?

Accounting is crucial for photographers and their businesses to maintain financial stability and growth. It helps them track income, expenses, and profitability, which are essential elements for making informed decisions.

Utilizing accounting software tailored for photographers can significantly simplify these tasks and provide valuable insights into their business performance.

Accounting software for photographers, like FreshBooks and ShootQ, offers industry-specific features such as invoicing, expense tracking, and online payment solutions. These software solutions help photographers save time, reduce manual errors, and streamline their financial processes.

Photographers face several unique financial challenges that make using specialized accounting software essential:

Project-based income: Photography businesses often work on a project basis, which can lead to inconsistent cash flow. Accounting software helps photographers manage and track income from multiple projects, ensuring accurate financial records.

Variable expenses: Photographers incur various types of expenses, such as equipment purchase, rentals, travel, and outsourcing costs. A dedicated accounting software categorizes and tracks these expenses, enabling better budgeting and expense management.

Tax management: Proper accounting enables photographers to correctly calculate taxes and identify deductible expenses, minimizing their tax liability. Software like QuickBooks Online automatically updates tax rates, helping photographers stay compliant with tax laws.

Time tracking: Billing clients accurately for time and effort is critical for photographers. Some accounting software, like FreshBooks Cloud Accounting, include time-tracking features, which allow photographers to log billable hours and generate accurate invoices.

Accounting software provides photographers with a comprehensive solution to their unique financial challenges. By using such tools, photography businesses can better manage their finances, streamline their processes, and ultimately focus on their creative work.

What are the key features that should be included in software for photographers?

Since photographers face several unique financial challenges and requirements, there are key features that you will want to make sure is included in your software solution.

Invoicing and payments

Accounting software for photographers provides easy-to-use tools for creating professional invoices and accepting payments. These features enable photographers to send customized invoices to clients, automatically track payments, and simplify their cash flow management. Additionally, a mobile app can help manage invoices, client documents and payments on the go, ensuring prompt and efficient billing.

Expense tracking and management

Photographers need to keep track of various expenses such as equipment, travel, and software subscriptions. Accounting software helps them categorize, track, and manage these expenses, allowing for better financial planning and control. Some good accounting software options also offer mileage tracking, time tracking, and bill management to make it easier to maintain comprehensive records.

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. Try free for 30 days!

Get Started TodayIncome and revenue tracking

Monitoring income and revenue is crucial for photographers in order to maintain their financial stability. Accounting software enables them to track all income sources, including client payments, print sales, and royalty fees. This data can be analyzed to highlight trends, identify profitable revenue streams, and optimize workflows to maximize profitability.

Client and project management

Photographers often work with numerous clients and projects simultaneously, making client and project management essential. Accounting software allows them to track client details, project information, and payment history in one place. This helps simplify communication, streamline project workflows, and maintain professional relationships.

Integration with other business tools

Top accounting software for photographers offers integration with other business tools and platforms, such as customer relationship management (CRM) systems and calendar apps. This allows photographers to sync their contacts, appointments, and tasks with their accounting software, improving efficiency and minimizing the need for duplicate data entry. Checkout our article about Best App for Business Expenses: Top 5 List to make budgeting and making good financial decisions easier than ever.

What are the best accounting software options for photographers in 2023?

There are quite a few accounting software options available, each with their unique features and benefits tailored for photographers.

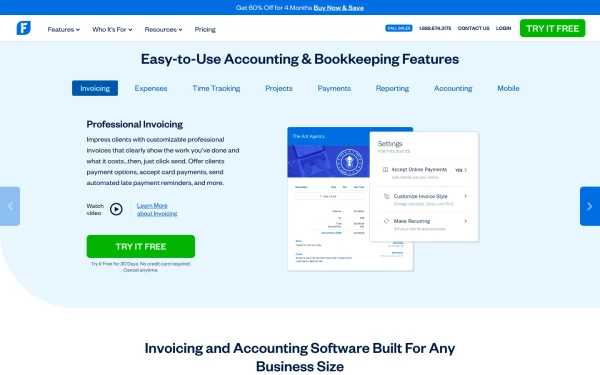

FreshBooks

FreshBooks is the most popular choice among the best accounting software for photographers when it comes to managing finances. It offers an intuitive and clean interface, time-tracking features, expense management, the creation of insightful financial reports, secure online payments, and invoicing capabilities. Photographers can easily manage their projects and clients while keeping track of their expenses.

Pros:

Time and mileage tracking included in all plans

Robust invoicing features

Clean interface

Cons:

Limited users

Lowest tier plan does not include double-entry accounting

Pricing:

Lite: $8.50/month

Plus: $15/month

Premium: $27.50/month

Select: Customized pricing

Shoeboxed

Shoeboxed is the best accounting apps for business receipts. They specialize in digitizing and organizing receipts, making it easier for photographers to keep track of their expenses. Its integration with accounting software like QuickBooks, Xero, and Wave simplifies the bookkeeping process for photographers.

Shoeboxed’s Magic Envelope

Their Magic Envelope service allows photographers to outsource the scanning of their receipts. Simply stuff your receipts into the provided postage-prepaid envelope, and you’ll get all your receipts scanned into your account and the data verified by their team.

Pros:

Scans receipts and documents directly from your phone

Categorizes expenses

Built-in mileage tracker

Con:

Plans purchased through Shoeboxed’s mobile app do not include the Magic Envelope service

Pricing:

The Digital Download Only Starter Plan is $4.99/month, up to $19.99/month for the Pro digital plan.

Plans that include the Magic Envelope start at $18/month, up to $54/month. Plans that include the Magic Envelope are available for purchase on desktop only.

30-day free trial.

Break free from manual data entry ✨

Use Shoeboxed’s Magic Envelope to ship off your receipts and get them back as scanned data in a private, secure cloud-based account. 📁 Try free for 30 days!

Get Started TodayQuickBooks Online

QuickBooks Online is a widely used accounting software for photographers that streamlines financial record-keeping. It offers various QuickBooks Online features such as variety of add-ons, invoicing, expense tracking, and tools for financial reports, making it suitable for businesses of various sizes.

Pros:

Robust inventory management in the upper tiered plans

More than 750 app integrations

Comprehensive reporting starting with more than 50 reports

Cons:

Monthly plans are more expensive than most alternatives

Limited users with each plan

Automatic time tracking is an additional cost

Pricing:

Simple Start: $30/month

Essentials: $55/month

Plus: $85/month

Advanced: $200/month

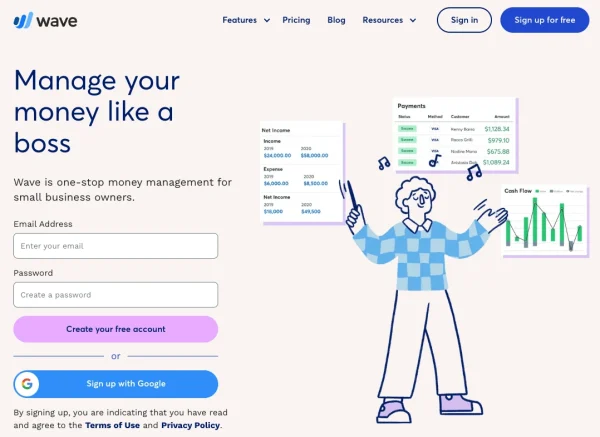

Wave

Wave’s home page

Wave is the best free accounting software. Their double entry accounting software for photographers offers unlimited invoices, online payment processing, automated reminders, expense tracking, and receipt scanning features. It provides a simple, user-friendly interface for managing financial tasks even without an accounting background and allows for integration with third-party payment services.

Pros:

Very user-friendly

Excellent workflow automation

Cost-effective

Cons:

Limited scalability

Mobile apps aren’t very comprehensive

Pricing:

Invoicing: $0/month

Accounting: $0/month

Mobile receipt feature: $8/month

Payroll: $40/month

Advisors: $149/month

Xero

Xero is one of the best accounting software options when it comes to features. They even offer a feature to manage inventory. Their accounting software provides a range of features for managing a photography business, including invoicing, bank reconciliation, and detailed financial reporting. It also integrates with various third-party apps to increase efficiency.

Pros:

Easy to navigate

Robust file sharing functionality

Hundreds of integrations

Cons:

Poor customer service

Restricted features in the lowest plan

Pricing:

Early: $6.50/month

Growing: $18.50/month

Established: $35/month

Zoho Books

Zoho Books’s home page

Zoho Books is an accounting solution for small businesses that offers a comprehensive set of features for photographers, including invoicing, expense management, and tools for financial reports. With its integrations and automation capabilities, photographers can focus on their creative work while efficiently managing their financial tasks.

Pros:

Makes following up with customers easier

Tools can be customized

Minimal learning curve

Cons:

Customer support could be better

Interface needs to be upgraded

Pricing:

Standard: $14/month

Professional: $23/month

Enterprise: $40/month

Ultimate: $52/month

Sage Business Cloud Accounting

Sage Business Cloud Accounting is accounting software for photographers that covers essential accounting processes such as invoicing, expense tracking, and tools for financial reports. With its cloud-based model, photographers can manage their business account finances from anywhere and collaborate with team members, making it one of the best accounting software for photographers on-the-go.

Pros:

User-friendly for non-accountants

Robust reporting

Cloud access for use anytime anywhere

Cons:

Interface needs to be improved

No time tracking

Pricing:

Sage Accounting Start: $10/month

Sage Accounting: $7.50/month

HoneyBook

HoneyBook is a CRM that offers photographers an all-in-one solution for client management, invoicing, and accounting. It helps track leads, organize workflows, and streamline communication with clients.

Pros:

Recurring payment feature

An easy to use dashboard with templates

Task reminders for leads and clients

Cons:

Doesn’t offer strong team collaboration features

Can’t export client data

Pricing:

Starter: $12.80/month

Essentials: $25.60/month

Premium: $52.80/month

ShootQ

ShootQ’s booking dashboard

ShootQ is a photography-specific software solution, offering accounting features alongside photo management tools. It helps photographers keep track of their expenses, contracts, and invoicing.

Pros:

Great contract management features

Access to workflow templates created by other photographers

Easy invoicing

Cons:

Complex and time-consuming set-up process

Clunky and outdated navigation system

Pricing:

Essential StartUp: $24/month

Pro Studio: $40/month

Enterprise: $67/month

Studio Ninja

Studio Ninja is a comprehensive and easy-to-use software tailored for photographers. It features an accessible task management system and also offers comprehensive invoicing, contracts, and scheduling, making it a one-stop solution for managing clients and financial tasks.

Pros:

Outstanding customer service

You can save a lot of time with their workflow creation

Software is extremely user-friendly

Cons:

There is some lag time

Software is not fully developed

Pricing:

Pro: $24.90/month

Master: $36.50/month

Sprout Studio

Sprout Studio’s home page

Sprout Studio is the best accounting software with a photography-specific CRM that offers invoicing, client management, and scheduling tools. It helps photographers stay organized and efficiently manage their business.

Pros:

Constantly updating software to make improvements

Great client portal

Excellent customer service

Cons:

Calendar feature is not easy to navigate

Lacks an automatic payment feature

Pricing:

Lite: $17.42/month

Basic: $33/month

Pro: $46.75/month

Unlimited: $63.25/month

Iris

Iris is one of the best accounting software options with an all-in-one platform for managing projects and finances. It includes invoicing software, expense tracking, and project management tools, making it a solid option for photographers.

Pros:

Automated workflows make sure nothing is falling through the cracks

Great for keeping clients and schedule organized

Automated emails

Cons:

Can’t schedule invoices

Needs more customization features

Pricing:

Basic: $25/month

Professional: $35/month

Professional Plus: $45/month

StudioCloud

StudioCloud’s home page

StudioCloud is a management software for photographers that combines accounting and bookkeeping features with CRM tools for a comprehensive business solution. It offers comprehensive invoicing with a payment tool for online bookkeeping reports, expense tracking, and calendaring tools to help photographers manage their business efficiently.

Pros:

Well thought out features

Ability to review and sign contracts online

Easy invoicing

Cons:

Customer service not up to par

Software is a bit cumbersome

Pricing:

Select an Add-on: $10 for each add-on a month

PartnerBoost: $30/month with annual subscription

EmployeeBoost: $60/month with annual subscription

How to choose the right accounting software for your photography business

There are several things to consider when choosing the right accounting software for your small photography business.

Budget and pricing options

When selecting accounting software for photographers, it’s crucial to consider your budget and the available pricing options. Different software programs offer various features and price ranges, so it’s crucial to choose one that fits your finances and needs.

Some popular options include FreshBooks, Patriot, and Wave, which provide affordable solutions with features specifically designed for photographers. Be sure to compare pricing plans and look for deals or discounts to ensure you’re getting the best value for your investment.

Ease of use and customer support

Another essential factor when choosing accounting software for your photography business is ease of use and customer support. The software should be user-friendly and intuitive, enabling you to efficiently manage your finances, track expenses, and generate financial reports without the help of an accountant. Furthermore, a responsive and knowledgeable customer support team can make a significant difference, especially if you encounter technical issues or need assistance with specific features.

Customization and functionality

Photographers often require specialized features to adequately manage their businesses, such as project management tools, invoicing templates, and expense tracking. Therefore, it’s essential to find accounting software that offers customization and functionality tailored to your specific needs. ShootQ and StudioCloud are examples of premium accounting software created specifically for photographers, allowing for better organization and management of clients, projects, and finances.

Compatibility with business analytics and reporting tools

Lastly, to effectively analyze and make informed decisions about your photography business’s growth and profitability, it’s crucial to choose accounting software that is compatible with business analytics and reporting tools. The best accounting software should provide insights into your cash flow, expenses, and revenue trends, as well as offer encryption and data security features to protect your sensitive financial information. Additionally, consider cloud accounting options that enable real-time data access and collaboration with team members or financial advisors.

Selecting the right accounting software for your photography business involves considering your budget, desired features, and compatibility with analytics and reporting tools. By assessing these factors, you’ll be on track to streamline your finances and support your small photography business’s growth and success.

What are some additional tools and features for photographers?

There is no shortage of tools or features available to photographers. Here are a few more things you might want to consider.

Free accounting software solutions

Several free software options are available for photographers, offering a range of features to help manage income and expenses. Wave Financial, for example, provides a user-friendly platform that is tailored specifically for photography businesses. Other popular platforms include ShootQ, Honeybook, Studio Ninja, and Sprout Studio, each with its unique features and functionality.

CRM and client management tools

In addition to accounting software, photographers may benefit from utilizing customer relationship management (CRM) and client management tools to help manage their leads, clients, and projects efficiently. Some popular CRM options and photography studio management solutions that integrate with accounting software include Zoho Books and FreshBooks.

These tools can help photographers keep track of important client information, track inventory, send invoices, and collaborate with clients in one centralized platform. By streamlining these processes, photographers can spend more time focusing on their craft and less time on administrative tasks.

Tax and IRS compliance

Properly managing taxes and ensuring IRS compliance is crucial for any business, including photography studios. Accounting software like QuickBooks offers features to simplify tax preparation, such as real-time tracking of income, expenses, and deductions, as well as easy integration with bank accounts and online payment platforms like PayPal.

Photographers can also benefit from using dedicated tax software to help calculate accurate deductions and prepare tax returns, ensuring they adhere to IRS guidelines and avoid potential penalties. Tools like MileIQ can help track mileage and other relevant tax information to ensure accurate reporting.

Backup and encryption for financial data

Protecting sensitive financial information is crucial for photography businesses. That’s why it’s essential to use accounting software that provides backup and encryption features to keep your data secure. Many of the best options, such as Wave and FreshBooks, offer built-in encryption and backup services that ensure your financial data is safe from potential threats.

Photographers should explore various accounting options, CRM tools, tax software, and secure backup and encryption solutions to ensure their businesses run smoothly and efficiently while remaining IRS compliant and secure. Keep these factors in mind when selecting the tools and features that best suit your photography business’s unique needs.

How to streamline your photography business with accounting software

Integration tools can streamline your business and make it even more efficient.

Efficient financial management

Accounting software can significantly improve the financial management of your photography business. These tools offer a streamlined solution for recording financial records, tracking sales, managing payables and purchase orders, and invoicing billable clients.

Cloud-based software like StudioCloud can also integrate with your photography business’s CRM, making it easier to generate estimates and manage customer relationships. For small photography businesses, this level of integration can save both time and money.

Improving cash flow and profitability

Properly managing the finances of your photography business is essential for improving cash flow and profitability. Accounting software can automate tasks such as tracking outstanding invoices, sending late payment reminders, and assessing late payment fees. In addition, many platforms offer customizable invoice templates, as well as integration with online payment services like Stripe, allowing your clients to make payments quickly and easily.

Beyond invoicing, accounting software provides insights into your business’s financial health through reports such as sales tax summaries and accounts aging. Identifying trends and potential areas of concern in business reports can help you make informed decisions to improve your business’s financial performance.

Reducing tax season stress

One of the most significant benefits of using accounting best bookkeeping software for your photography business is reducing stress during tax season. Accurate financial records are essential for filing your taxes, and bookkeeping software streamlines the process. Many platforms also offer features like online payments, sales tax tracking, and financial reports that can be easily exported and shared with your tax professional, making tax season much more manageable.

Contributing to long-term business success

Investing in reliable accounting software can contribute to the long-term success of your photography business by enabling efficient financial management, improving cash flow and profitability, and reducing stress during tax season. With the right financial tools now in place, you can focus on growing your business, honing your craft and providing exceptional service to your clients.

Frequently asked questions

What are the best accounting software tools for photography businesses?

There are several popular accounting tools that cater to photography businesses. Some of the top choices include FreshBooks and Wave Financial, both of which offer a range of features specifically designed for photographers. These tools can help manage income, expenses, invoicing, and financial reporting efficiently.

Which photo studio accounting software helps with invoicing?

Invoicing is a crucial aspect of managing a photography business. Softwares like FreshBooks can help create professional-looking invoices and estimates that reflect the brand. This, in turn, can help manage payments and reduce the need for chasing down checks.

How do bookkeeping solutions cater to photographers?

Photography-specific bookkeeping solutions like Wave Financial are tailored to manage the unique financial needs of photographers. These solutions often include user-friendly interfaces, integrated invoicing and receipt and payment tracking, and reporting tools to monitor the business’s financial health.

What features should a photography accounting spreadsheet have?

A photography accounting spreadsheet should cover the essentials, such as tracking income, expenses, tax deductions, and financial goals. Additionally, photographers may benefit from features such as accounts receivable management, inventory tracking, easy budgeting, and custom categories for various types of expenses related to their business.

Are there any specifically designed photo studio accounting software for photographers?

Yes, there are accounting programs specifically designed for photographers, such as FreshBooks and Wave Financial. These programs offer a range of features tailored to address the unique financial management needs of photography businesses, from invoicing clients to tracking expenses and income.

How do photography businesses keep track of expenses and income?

Photography businesses can keep track of business expenses and income using accounting software, spreadsheets, or a mix of both. Tools like Wave Financial and FreshBooks offer streamlined accounting solutions too, making it easier to manage finances. Additionally, regular review and reconciliation of financial records, along with proper categorization of expenses, can help maintain an accurate picture of the business’s performance.

In conclusion

The market offers a variety of accounting software designed specifically for photographers. Top options include FreshBooks, Patriot, Shoeboxed, Wave, ShootQ, StudioCloud, and Studio Ninja. Each of these applications caters to the unique needs of a photography business, ensuring streamlined financial management.

The importance of using the best accounting software tailored to photography businesses cannot be overstated. By automating essential tasks like invoicing, tracking expenses, and recording receivables, these applications save time and minimize errors. This allows photographers to focus on their core creative work while maintaining a solid grasp of their finances.

Certain features, such as ShootQ’s easy online payments, invoice creation and financial reporting tools, can provide a comprehensive picture of the business’s financial health. This helps photographers make informed decisions about pricing, expenses, and overall business growth.

Shoeboxed’s expense tracking system keeps track of all of the photographer’s receipts and automatically classifies them making filing taxes a much simpler process. Their mileage tracker keeps track of miles driven from one shoot location to the next.

Overall, selecting the most compatible and accurate accounting software is a crucial step for photographers looking to achieve a sustainable and successful business. By doing so, they can strike the right balance between managing their creative work and keeping their finances in check.

Caryl Ramsey has years of experience assisting in different aspects of bookkeeping, taxes, and customer service. She uses a variety of accounting software for setting up client information, reconciling accounts, coding expenses, running financial reports, and preparing tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!