In today’s fast-paced e-commerce landscape, eBay sellers need reliable and efficient e-commerce accounting software to manage their growing businesses.

Choosing the right software can greatly impact the overall success of a seller, enabling them to streamline their financial operations, automate tasks, track sales taxes, and gain valuable insights into the financial health of their business.

By investing in a robust accounting solution, eBay sellers can focus more on growing their business and less on manually managing their financial records.

In this review and guide, we’ll explore the best accounting software for eBay sellers, and compare their features, pros, and cons to help you make an informed decision.

Why is accounting software important for eBay sellers?

Accounting software plays a vital role in the success of an eBay business and helps sellers manage their finances efficiently, ensuring they’re well-informed about their profits and expenses.

By automating accounting tasks, such as invoicing, business expense tracking, and inventory management, sellers can focus more on growing their company.

1. Accounting software assists in managing multi-channel sales

One key aspect that drives the need for eBay accounting tools is the complexity of managing multi-channel sales.

eBay sellers often sell on other platforms, making it challenging to keep track of all transactions and inventory.

A suitable accounting system streamlines this process by consolidating data from various sales channels and providing real-time updates on financial performance. Other options for data consolidation include an eBay scraper, which offers a multitude of benefits ranging from price monitoring to customer review tracking and many more.

2. Software helps with inventory management

Inventory management is another crucial component for eBay businesses.

As an eBay business grows, managing inventory with spreadsheets can become time-consuming and prone to errors.

Accounting software helps maintain accurate inventory records, and some solutions even offer features like low-stock alerts and stock forecasting, allowing sellers to make more informed purchasing decisions.

3. Accounting software ensures tax compliance

Complying with tax regulations is essential for all businesses, including eBay sellers.

Accounting software can significantly reduce the risk of tax-related errors and penalties by automatically calculating taxes applicable to each sale, providing detailed tax reporting, and even assisting with tax filing.

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. Try free for 30 days!

Get Started TodayWhat are the key features to look for in the best accounting software for eBay sellers?

When searching for the ideal accounting software for eBay sellers, it’s crucial to consider the specific features and integrations necessary for managing an e-commerce business.

1. Ease of integration

The simplicity of the integration with eBay and other e-commerce platforms is fundamental for seamless financial management.

Some accounting software, such as Xero and QuickBooks, offers straightforward integration with various e-commerce apps, allowing sellers to consolidate their financial records across multiple eBay store platforms.

2. Real-time data

Real-time financial data synchronization is another significant feature that provides sellers with an accurate, up-to-date financial overview.

Software like QuickBooks can instantly sync eBay sales and transactions, granting users access to their financial information 24/7.

For inventory management, it’s essential to have a system that keeps track of sales across all channels within the accounting software.

Some solutions, like Xero, include built-in inventory tracking and management, even in their most affordable plans, allowing users to monitor stock levels in real time.

3. Tax management

Tax management and reporting capabilities can simplify the process of calculating, making, and recording estimated federal tax payments.

Programs like QuickBooks can assist in quarterly tax estimates and keeping tax obligations in check.

4. Usability and affordability

Consider usability and affordability when selecting the best accounting software for your eBay business.

User-friendly interfaces—coupled with reasonable pricing and multiple-user support—should be taken into account.

5. Double-entry accounting

Another important aspect to consider is whether the software offers double-entry accounting functionality.

Double-entry accounting is a system where every transaction affects the balance sheets of at least two accounts—one account is debited and another is credited.

This approach provides a more comprehensive and accurate view of your financial situation by ensuring that your accounts remain balanced.

6. Transaction categorization

Another key feature to look for in accounting software is the ability to easily record and categorize transactions.

The software should automatically track all your sales, purchases, payments, and other financial activities.

A user-friendly interface and seamless integration with eBay can significantly simplify this process, streamlining the management of both income and expenses.

7. Expense tracking

Expense tracking should also be a priority when choosing eBay accounting software.

Efficient expense tracking tools can help you monitor your business costs, identify tax-deductible expenses, and allocate resources more effectively.

The best software options will allow you to capture and categorize receipts, log mileage, and track inventory costs.

Never lose a receipt again 📁

Join over 1 million businesses organizing & scanning receipts, creating expense reports, and reclaiming multiple hours every week—with Shoeboxed.✨

Get Started Today8. Invoicing capabilities

Next, consider whether the software offers robust invoicing capabilities.

The ability to create, send, and manage invoices is essential for any eBay seller.

Look for features like customizable invoice templates, automated reminders, and the option to accept multiple payment methods.

Quick and professional invoicing can improve your cash flow and enhance your overall customer experience.

9. Easy monitoring of income and expenses

Make sure that the software you choose enables you to easily monitor your income and expenses.

A comprehensive dashboard with real-time financial insights can help you analyze your business performance, identify trends, and make informed decisions.

This feature should include profit and loss reports, sales analytics, detailed financial reports, and expense summaries, providing you with a clear overview of your eBay business’s financial health.

10. Shipping integration

Shipping can be a complex aspect of an e-commerce operation, especially when dealing with different carriers and shipping destinations.

Top-notch eBay accounting software offers shipping integrations, allowing you to easily sync shipping information, track packages, and generate shipping labels.

In addition, various software programs can integrate with major carriers, simplifying the shipping process for your eBay and Amazon receipts and sales.

Taking these factors into account will help you select the best accounting software for your eBay business, allowing you to confidently manage your finances and grow your enterprise.

How To Do Bookkeeping As A EBAY Seller (Complete Beginners Guide) by Success With SamWhat is the best accounting software for eBay sellers in 2024?

1. QuickBooks Online

QuickBooks Online is one of the most popular and feature-rich accounting software solutions for eBay sellers.

QuickBooks Online accounting software

In our experience, we’ve found that QuickBooks is one of the best online accounting software options when it comes to features for small businesses, such as eBay sellers.

QuickBooks is extremely efficient in managing inventory, tracking sales data, calculating taxes, and forecasting profits.

QuickBooks Online syncs eBay sales data and transactions instantly for a real-time financial overview so you always have an updated inventory and financial status of your eBay business.

Another area in which QuickBooks stands out is its app.

The mobile app lets eBay sellers manage their finances and keeps them updated on their sales while on the go.

The app lets sellers create invoices, check cash flow, and track profit and loss reports at any time from anywhere.

Pros:

Real-time financial synchronization for updated sales data and financial status.

Calculates quarterly tax estimates.

Manages sales tax for eBay sellers.

Integrates with your eBay account.

Integrates with other financial management tools, such as Shoeboxed.

Cons:

Some features may be complex for beginners.

Does not include inventory management for eBay sellers in its cheapest plan.

Limitation on the number of users.

Pricing:

Simple Start – $9/month for the first 3 months*, then $30/month.

Essentials – $16.50/month for the first 3 months*, then $55/month.

Plus – $25.50/month for the first 3 months*, then $85/month.

Advanced – $60/month for the first 3 months*, then $200/month.

Add payroll for an additional cost.

30-day free trial.

*As of the writing of this review, plans are 70% off for the first 3 months. Discounts are subject to change.

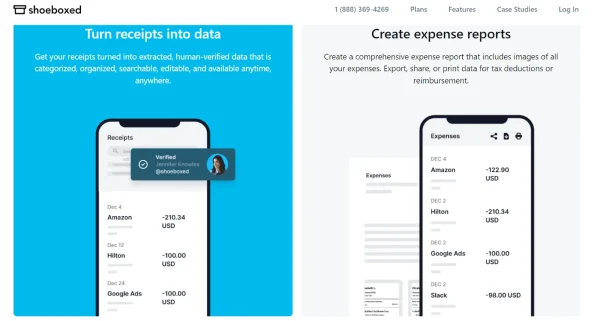

2. Shoeboxed

Tired of keeping up with all of those receipts from your inventory? With Shoeboxed, eBay sellers can easily manage their expenses and receipts, making tax time less stressful.

Shoeboxed’s mobile app allows you to manage your expense wherever you are.

For eBay sellers, Shoeboxed is an incredibly useful tool for managing inventory receipts and those for other expenses such as office supplies and shipping material.

Shoeboxed’s mobile app and mileage tracker

eBay sellers can simply scan their receipts from the mobile app, which are then human-verified and categorized for expense reports and tax deductions.

One of those tax write-offs is the business mileage deduction.

Since eBay sellers travel to mail and ship packages to their customers, sellers can use Shoeboxed’s free mileage tracker to get an accurate mileage calculation for the business mileage deduction.

These miles can be included in expense reports as proof of travel for work.

The Magic Envelope service

Besides the mobile app, Shoeboxed offers a mail-in receipt scanning service that’s unique only to Shoeboxed called the Magic Envelope.

With the Magic Envelope, eBay sellers can send their receipts in a pre-paid postage envelope to Shoeboxed to be turned into digital data, human-verified, and uploaded to a Shoeboxed account where it will be securely stored and categorized.

Shoeboxed’s key features include receipt scanning, expense tracking, and integration with accounting software like QuickBooks. After Shoeboxed organizes the receipts into a searchable online account, users can then sync their receipts with their QuickBooks Online account.

Sending a Shoeboxed’s Magical EnvelopePros:

Automated receipt and expense tracking.

Inventory receipts and other expenses can be scanned directly from your phone.

Integrations with popular accounting software such as QuickBooks to streamline all of your financial information.

Built-in mileage tracker to deduct the miles you spend on the road mailing orders.

Categorizes expenses into 15 editable tax categories.

Cons:

Mobile app plans are digital only. Plans that include the Magic Envelope will have to be accessed from the website.

Pricing:

The Digital Download Only Starter Plan is $4.99/month, up to $19.99/month for the Pro digital plan.

Plans that include the Magic Envelope start at $18/month, up to $54/month. Plans that include the Magic Envelope are available for purchase on desktop only.

30-day free trial.

Break free from paper clutter ✨

Use Shoeboxed’s Magic Envelope to ship off your receipts and get them back as scanned data in a private, secure cloud-based account. 📁 Try free for 30 days!

Try Free for 30 Days3. Xero

Xero offers user-friendly software for eBay sellers with little to no accounting knowledge, simplifying accounting tasks.

Xero is a platform robust with features.

Every plan in Xero includes automatic bank syncing, unlimited user access, invoicing, billing, inventory tracking, and sales tax calculations and tracking.

Xero is one of the few applications that include inventory tracking at every price tier.

The Xero features that are specifically helpful to eBay sellers include management of their eBay inventory, expense tracking, bank connections, bill payment, and customer management.

Aside from eBay, Xero integrates with 800+ business applications, including PayPal.

Pros:

User-friendly interface.

Integrates with PayPal and eBay.

Tracks eBay sellers’ inventory.

Cons:

Some advanced features may require add-ons.

Pricing:

Starter: $6.50/month for the first 3 months, then $13/month.

Growing: $18.50/month for the first 3 months, then $37/month.

Established: $35/month for the first 3 months, then $70/month.

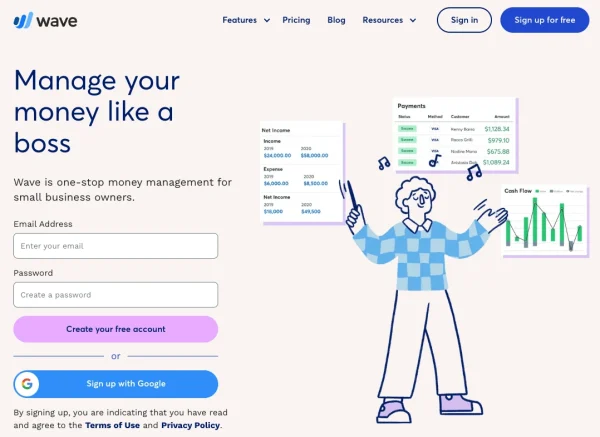

4. Wave Accounting

Wave Accounting is a cost-effective solution for small eBay businesses.

Wave accounting for eBay sellers.

Wave’s user-friendly platform offers some solid accounting features for eBay sellers such as free invoicing, unlimited users, basic reporting, and unlimited expense tracking.

Even with its basic reporting, Wave generates all the reports that an eBay seller would need such as cash flow statements, sales tax reports, and income statements.

Wave also integrates with third-party apps such as Etsy, Paypal, and Shoeboxed for more efficient receipt management.

If you have multiple eBay, Etsy, or Amazon shops, you can manage all of your businesses under a single Wave account.

Wave is a good option for eBay sellers on a budget.

Pros:

Free accounting and invoicing features.

User-friendly and intuitive interface.

Cost-effective with its free essential features.

Accepts online payments.

Cons:

Limited integrations compared to competitors.

Limited scalability.

Mobile apps aren’t very comprehensive.

Email-only customer service.

Pricing:

Invoicing: $0/month.

Accounting: $0/month.

Mobile receipt feature: $8/month.

Payroll: $40/month.

Advisors: $149/month.

5. FreshBooks

FreshBooks is a cloud-based accounting solution geared for eBay sellers who are looking for a simple, go-to software solution.

FreshBooks accounting software

FreshBooks allows eBay sellers to monitor their profits, track their sales tax, and create essential tax forms.

Other features include expense tracking, invoicing, and easy report generation, which makes financial management for eBay sellers a breeze.

Pros:

Simple and intuitive interface for eBay sellers with little accounting experience.

Easy report generation.

Accepts online payments from customers.

Recurring invoices for repeat customers.

Payment tracking.

Sales tax management.

Cons:

Limited automation features.

Limited users.

The lowest tier doesn’t include double-entry accounting.

Pricing:

Lite: $8.50/month for the first 3 months, then $17/month.

Plus: $15/month for the first 3 months, then $30/month.

Premium: $27.50/month for the first 3 months, then $55/month.

Select: Customized pricing.

6. Zoho Books

Zoho Books provides eBay sellers with a range of features, such as seamless data storage, inventory tracking, and process automation.

Use Zoho Books to track your eBay business’s inventory.

Zoho Inventory integrates directly with eBay, resulting in a detailed inventory management method including COGS and inventory tracking.

There’s also a sales tax module for eBay sellers where they can add custom tax rates based on the different states.

eBay sellers who sell on the international platform are well taken care of with international tax reporting capabilities.

Zoho Books is ideal for small to medium-sized eBay sellers.

Pros:

Easy to set up and use.

International tax support for eBay sellers selling on the international platform.

Multi-currency support.

Robust reporting options for eBay sellers.

Sales tax management.

Cons:

Integration with eBay and PayPal may require add-ons.

Initial learning curve.

Pricing:

Free

Standard: $15/month per organization.*

Professional: $40/month per organization.*

Premium: $60/month per organization.*

Elite: $120/month per organization.*

Ultimate: $240/month per organization.*

*Billed annually. Monthly plans are available.

See also: Zoho Alternatives: Unlocking New Business Possibilities

7. FreeAgent

FreeAgent simplifies accounting for eBay sellers while offering a wide range of user-friendly features.

FreeAgent accounting software

Some of its features include built-in stock management, multi-currency invoicing, and sales tax tracking and reporting.

Unlike many of its competitors, FreeAgent doesn’t limit the number of clients, invoices, or bills.

FreeAgent is a well-suited accounting solution for eBay merchants selling items overseas.

Pros:

Tax management tools included.

Multi-currency support.

Unlimited clients, invoices, and bills.

Built-in stock management.

Cons:

Limited integrations with external platforms.

Pricing:

$12/month for the first 6 months, then $24/month.

8. Sage Business Cloud Accounting

Sage Business Cloud Accounting caters to growing eBay businesses by offering secure cloud storage and a wealth of features.

Sage Accounting

Sage connects with just about any financial institution which makes monitoring cash flow easier and allows eBay sellers to see how much cash they have on hand at any point in time.

This accounting software can also send email invoices where the customer can pay a bill directly from the email.

Sage streamlines invoicing, expenses, and inventory management, and offers e-commerce businesses customizable reporting capabilities.

Pros:

Secure cloud storage.

Customizable reporting.

Invoice tracking.

Cons:

Sage Business Cloud Accounting may require additional integrations for an eBay business.

Pricing:

Sage Accounting Start: $10/month.

Sage Accounting: $7.50/month for the first 6 months, then $25/month.

9. WorkingPoint

WorkingPoint is a double-entry accounting software that’s designed especially for inventory-based retailers.

WorkingPoint accounting software

The dashboard provides a wealth of information such as the seller’s current banking status, overdue invoices, and expenses.

Quotes, bills, new invoices, or expenses can be created directly from the dashboard without having to navigate a tab.

WorkingPoint automatically updates inventory based on invoices so sellers will always know how much stock they have on hand.

Reports can be created to highlight top-selling inventory in addition to balance sheets, profit & loss statements, and cash flow statements.

WorkingPoint is a solid option for anyone with an eBay business.

Pros:

Easy expense tracking and invoice creation.

Double-entry accounting system.

Good customer support for sellers who need a little guidance.

Exceptional dashboard with sellers able to perform many functions directly from the dashboard.

Cons:

Limited integrations with eCommerce platforms.

Limited users.

Pricing:

Contact WorkingPoint for pricing details.

10. Kashoo

Kashoo delivers a simple, yet powerful accounting solution for small to medium-sized eBay businesses.

Kashoo is a cloud-based accounting software

Kashoo is a cloud-based solution tailored for eBay sellers who require features such as multi-currency support, bank reconciliation, user-friendly expense management, invoicing, and credit card payment options.

This accounting software integrates with Stripe for those eBay sellers who also sell merchandise in person.

Merchants can generate reports such as income statements, balance sheets, and sales tax to keep tabs on the financial health of their eBay business.

Kashoo is used by many eBay sellers who are looking for basic accounting features.

Pros:

Multi-currency support.

User-friendly expense management.

Great sales tax reporting.

Robust invoicing module with plenty of payment options.

Cons:

Limited integrations with eCommerce platforms.

Provides just basic functionality.

Not for high-volume sellers.

Pricing:

Trulysmall Accounting: $216/year ($18/month)

Kashoo: $324/year ($27/month)

Frequently asked questions

What accounting software integrates well with eBay?

There are several accounting software options that integrate well with eBay. Some of these popular options include QuickBooks Online and Xero.

How does QuickBooks Online work for eBay sellers?

QuickBooks Online is a popular accounting software that can be integrated with eBay using third-party tools. QuickBooks Online offers a range of features that are helpful for eBay sellers, such as multi-currency handling and inventory management. Integrating eBay with QuickBooks Online ensures real-time tracking of income, expenses, and inventory levels, thus making the bookkeeping process more efficient.

Can Xero be used for eBay seller bookkeeping?

Yes, Xero can be used for eBay seller bookkeeping. Although Xero doesn’t have a direct integration with eBay, it can be integrated using third-party applications. Xero’s user-friendly interface and cloud-based approach make it a practical choice for eBay sellers wanting a comprehensive bookkeeping software solution.

Conclusion

After trying out dozens of accounting software, we found that the best eBay accounting software options available on the market are Zoho Books, Sage, Wave, and Xero.

Shoeboxed is also a great choice for eBay sellers looking to keep track of their receipts for tax deductions on mileage, shipping costs and materials, and other business-related expenses.

These software solutions offer a range of features tailored for eBay sellers, such as automation, real-time financial tracking, and seamless integration with payment platforms like PayPal.

Caryl Ramsey has years of experience assisting in different aspects of bookkeeping, taxes, and customer service. She uses a variety of accounting software for setting up client information, reconciling accounts, coding expenses, running financial reports, and preparing tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!