Accounting software is essential for keeping track of expenses, income, and other key financial aspects of a consulting business.

Most accounting software for consultants comes with built-in features like invoicing, time tracking, and expense management, providing an all-in-one solution for financial management.

Other options offer integration with other essential business tools, like CRMs for sales reps and project management software, further enhancing their utility for consultants.

Here, we will examine which accounting system is best based on the different needs.

Why is accounting software for consultants crucial to their business?

One of the main benefits of using accounting software for consultants is the ability to streamline business processes and save valuable time.

1. Enhances efficiency

Consultants often handle multiple clients, projects, and invoices simultaneously.

Having reliable and user-friendly accounting software streamlines the entire process, ensuring accurate tracking and reporting of financial information.

2. Saves time

Another significant benefit of using accounting software is the time saved on manual tasks.

Consultants can automate invoicing, online payments, and late payment reminders, ultimately leading to faster payments and improved cash flow.

This automation allows consultants to focus their time and energy on their core business activities, such as developing strategies, providing expert advice, and growing their client base.

3. Establishes and maintains organization

Accounting software also helps consultants to stay organized.

As a consultant’s client roster grows, keeping track of accounts and client relationships becomes increasingly challenging.

A comprehensive accounting software solution enables consultants to not only manage their financial data but also to plan, manage, and collaborate on client deliverables, ensuring a seamless flow of information.

4. Ensures compliance

In addition, accounting software ensures compliance with tax regulations and reporting requirements.

Consultants need to be aware of their tax obligations and financial reporting requirements, which can vary depending on their location and the nature of their business.

Utilizing accounting software helps them to accurately calculate and file their taxes, avoiding penalties or costly mistakes.

5. Enhances decision-making

Finally, well-designed accounting software empowers consultants to make informed financial decisions.

By providing a clear overview of business performance, cash flow, and profitability, consultants can use their financial data to identify business strengths, weaknesses, and potential opportunities for growth.

Accounting software plays a crucial role in a consultant’s business by streamlining financial management, saving time, staying organized, ensuring compliance, and enabling informed decision-making.

What are the essential software features for consultants?

When selecting accounting software for consultants, it’s important to find one that offers a range of features tailored to the needs of a consulting business.

1. Invoicing

A crucial aspect of a consultant’s work is invoicing clients for the services provided.

Ideal accounting software should offer easy-to-use invoicing templates and be customizable to suit the unique requirements of the business.

Features such as recurring invoices, payment reminders, and efficient payment processing options will help consultants save time and receive payments promptly.

2. Time-tracking

Consultants often bill clients based on the hours worked on a project, so accounting software with an efficient time-tracking feature is essential.

Time tracking tools should enable tracking of billable hours and project time spent and offer seamless integration with invoicing.

3. Expense management

Keeping track of small business expenses is vital for consultants to maintain accurate records and manage the budget.

A good accounting system or software should support easy expense categorization, receipt scanning, and real-time monitoring of expenses to ensure consultants can make informed financial decisions.

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. Try free for 30 days!

Get Started Today4. Customizable workflows and integrations

Consulting businesses often require unique processes and systems to operate effectively.

As a result, accounting software should offer customizable workflows and integrations with other essential business tools, such as project management, customer relationship management (CRM), and document storage applications.

This adaptability streamlines processes and improves the overall efficiency of a consulting business.

5. Mobile app

Consultants need to manage their business finances on the go conveniently.

A mobile app for accounting software is crucial, enabling consultants to monitor their financial transactions, send invoices, and track time from anywhere.

Consider software with a user-friendly mobile app that provides you with quick access to essential features and ensures you stay on top of your business’s financial health while on the go.

9 best accounting software options for consultants in 2024

Choosing the best accounting software for consultants starts by thoroughly evaluating each option in terms of usability, scalability, and the specific features they provide.

Each software option offers its own unique set of advantages for consulting businesses.

1. QuickBooks Online

QuickBooks Online is a popular and powerful all-in-one cloud-based accounting solution for consultants that stands out among its competitors for its time-tracking capabilities.

QuickBooks Online is one of the most popular software options for Consultants

QuickBooks Online Advanced provides consultants with project-by-project profitability, real-time insights, and automated workflows.

This software offers a financial hub with a robust general ledger and end-to-end project management, as well as a revenue dashboard.

With its cloud collaboration and mobile app, colleagues, bookkeepers, and accountants can work in real-time and process and accept payments, enter time, and keep an eye on cash flow.

Consultants can also customize their workflow with seamless app integrations.

From our experience, QuickBooks Online is a top choice for consultants due to its time-tracking feature.

Employees can clock in and out from their mobile device or time can be tracked by client or service.

Employee timesheets automatically appear in QuickBooks Online which makes running payroll much quicker.

Automated employee timesheets streamline payroll and save money.

QuickBooks Time also efficiently charges for every minute spent consulting a client.

Automated time tracking by client or service streamlines the client invoicing process.

Pros:

Real-time collaboration and insights with colleagues, accountants, and bookkeepers.

Spot trends with a revenue dashboard.

Financial hub where every dollar can be tracked.

Easy invoicing including batch invoicing.

Integrates with other financial management tools, such as Shoeboxed.

Cons:

Some features may be complex for beginners.

Limitation on the number of users.

Pricing:

Simple Start – $9/month for the first 3 months*, then $30/month.

Essentials – $16.50/month for the first 3 months*, then $55/month.

Plus – $25.50/month for the first 3 months*, then $85/month.

Advanced – $60/month for the first 3 months*, then $200/month.

Add payroll for an additional cost.

30-day free trial.

Quickbooks Online Review: Quickbooks for Consulting Business by Capterra

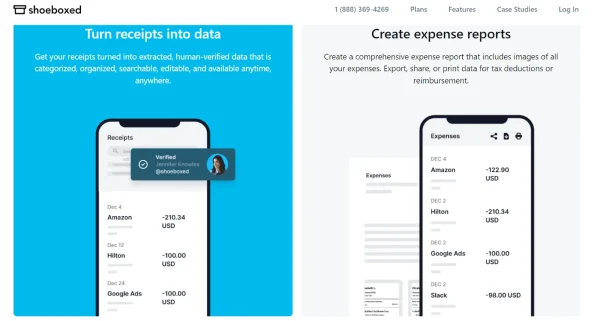

2. Shoeboxed

Shoeboxed is ranked by Forbes as the #1 best receipt tracking app.

Shoeboxed is trusted by over 1 million businesses to keep track of receipts and expenses for tax time.

Shoeboxed streamlines the process of expense tracking and calculating tax deductions.

This software organizes, digitizes, and manages receipts for expenses such as office supplies, advertising, and equipment for consultants, as well as any expenses spent on clients.

Shoeboxed’s app and Magic Envelope service

Consultants can use Shoeboxed’s app to scan receipts on the go or use the postage-pre-paid Magic Envelope to mail their receipts to Shoeboxed’s processing center.

If there’s a backlog of documents or receipts that need to be digitized, consultants can stick those in a box and tape the Magic Envelope to the outside of the box and Shoeboxed will still cover the postage.

Sending Shoeboxed’s Magic Envelope

Break free from paper clutter ✨

Use Shoeboxed’s app and scanning service to scan receipts and organize your wallet and office. Try free for 30 days!

Get Started TodayTax time

No matter if you’re using the app or the Magic Envelope, receipts are automatically uploaded to your account under 15 editable categories for tax deductions.

Consultants can also create custom categories for their expenses and filter by vendor, date, or category.

The assigned categories make tax time much simpler since the expenses are already separated and categorized. All you have to do is pull the total for each category and input the number into the tax return.

Expense reports

Shoeboxed CSV expense report example

Expense reports can easily be created from the digital archive of expense data and come with receipts attached so that the photo of the receipt can be viewed along with the reported information.

Free sub-users

Consultants can also add employees or accountants as free sub-users to their Shoeboxed account to scan client or expense receipts for the business.

Other documents

Not only does Shoeboxed scan receipts, but it also scans client business cards or any other important documents.

Integration with QuickBooks

Shoeboxed’s key features include expense tracking with receipt scanning and integration with QuickBooks.

After Shoeboxed organizes the receipts into a searchable online account, users can then sync their receipts with their QuickBooks Online account.

Pros:

Automated receipt and expense tracking for consultants.

Receipts for expenses or clients’ business cards can be scanned directly from your phone.

Integrations with popular accounting software such as QuickBooks to streamline all of your financial information.

Sub-users such as employees, business partners, or accountants can also be added to the account for free so that they can scan client or expense receipts for the consulting business.

Categorizes expenses into 15 editable tax categories.

Cons:

Mobile app plans are digital only. Plans that include the Magic Envelope will have to be accessed from the website.

Pricing:

The Digital Download Only Starter Plan is $4.99/month, up to $19.99/month for the Pro digital plan.

Plans that include the Magic Envelope start at $18/month, up to $54/month. Plans that include the Magic Envelope are available for purchase on desktop only.

30-day free trial period.

Never lose a receipt again 📁

Join over 1 million businesses organizing & scanning receipts, creating expense reports, and reclaiming multiple hours every week—with Shoeboxed.✨

Try Free for 30 Days3. Xero

Xero is a comprehensive accounting software that is highly recommended for consultants who are looking for scalability.

Xero grows with your consulting business

Xero is a cloud-based accounting software solution for consulting businesses that is scalable and easy to use.

All three plans include unlimited users and it integrates with more than 1,000 apps.

Permission levels can also be set for each user.

Xero isn’t as expensive as QuickBooks Online and doesn’t charge extra for additional users which makes it a great, affordable option for growing businesses.

The dashboard provides insights such as overdue bills, outstanding bills, and total cash in and total cash out.

Reports are also customizable with options to add your own groupings and formulas.

Xero also offers effortless bank account reconciliation and multi-currency support and provides seamless integrations with other business applications.

There are limits on bills and invoices in the lowest tier with up to 20 invoices and up to 5 bill payments.

Pros:

User-friendly interface for consultants.

Seamless integration with more than 1,000 apps.

Customizable reports.

Strong invoicing and expense management features.

Cons:

Some advanced features may require add-ons.

Pricing:

Starter: $6.50/month for the first 3 months, then $13/month.

Growing: $18.50/month for the first 3 months, then $37/month.

Established: $35/month for the first 3 months, then $70/month.

See also: What Is the Best Tax Preparation Software for Professionals?

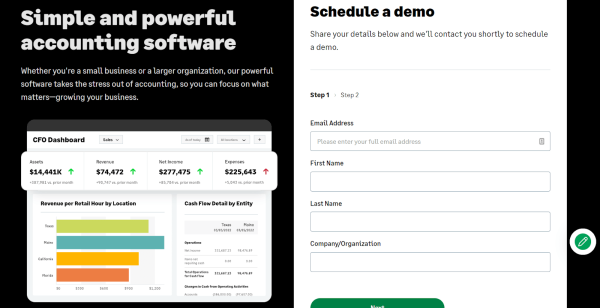

4. Sage Business Cloud Accounting

Sage Business Cloud Accounting is a user-friendly accounting software designed for unique integrations.

Sage offers an open API which allows consultants to customize their integrations

While Sage offers 40 integrations, which isn’t as many as others we reviewed, the thing that sets it apart is that it offers an open API.

This is one feature not offered by Sage’s competitors.

With the open API, software developers can create unique and customized integrations designed especially for consultants.

Sage offers customized invoices to match the consulting business’s branding and a mobile app that lets you create and send invoices, record expenses, and view graphs of your financial performance while on the go.

Sage offers more than 20 financial reports including balance sheets, aging accounts receivable, general ledger, trial balance, and profit & loss statements.

Other features include expense tracking and project management capabilities.

Pros:

Open API for customizable integrations for consultants.

Customizable invoices to match the branding of the particular consulting business.

Mobile app that lets you keep up with the business’s financial performance while on the go.

Cons:

Can’t create recurring invoices.

Can’t schedule automatic reminders for payments.

Can’t track billable hours or add billable expenses.

Pricing:

Sage Accounting Start: $10/month.

Sage Accounting: $7.50/month for the first 6 months, then $25/month.

5. FreshBooks

FreshBooks accounting software is an intuitive accounting software that proves to be the best invoicing solution for consulting businesses.

FreshBooks offers professional invoicing features designed for consultants

In our experience, invoicing is one of FreshBooks’ best features for consulting businesses.

With FreshBooks, professional invoices can be created and customized by adding a company’s logo.

Deposits can be requested on invoices so that you can get paid upfront and not have to wait until the end of the consultation process.

Invoicing can also be set up with automatic reminders at customizable intervals.

Tracked time and expenses can easily be added to invoices with the FreshBooks invoice generator.

Other invoicing features include customized invoice payment terms, online payments, automatically calculated taxes, preferred currency, instant updates for paid invoices, and invoicing from anywhere with the mobile app.

Features outside of invoicing include time tracking, expense management, mobile mileage tracking, accountant access, financial reporting, business performance, dashboards, tax reports, and project management.

Pros:

Simple and intuitive interface for consultants.

Customizable invoicing for consulting businesses.

Accepts online payments, including deposits, from clients.

Recurring invoices for repeat clients.

Mobile app available for iOS and Android to check on consulting business from anywhere.

Integration with numerous third-party apps.

Cons:

Automation features are limited.

Number of users is limited.

Double-entry accounting isn’t included in the lowest tier.

Pricing:

Lite: $8.50/month for the first 3 months, then $17/month.

Plus: $15/month for the first 3 months, then $30/month.

Premium: $27.50/month for the first 3 months, then $55/month.

Select: Customized pricing.

6. Zoho Books

Zoho Books is another excellent accounting software option for consultants and stands out for having the best automation processes.

Zoho offers consultants a lot of built-in automation tools

Zoho’s strength is in its automation features.

Email alerts can be programmed, automated invoice reminders can be sent, and in-app notifications can be set up so that you don’t overlook any critical tasks.

Automation processes are also packed with tools for customization such as the ability to set up rules to automate workflows.

Customized tools can be built using Zoho’s coding language.

Zoho’s built-in business process automation tools set it apart from the other competitors that we reviewed.

Other features include professional-looking invoices for consultants, time tracking for accurate billing, customized consulting fees with price lists, budget overview with estimates, and expense management.

Pros:

Easy for consultants to set up and use.

Robust automation processes.

Customized automation tools can be built with Zoho’s special coding language.

Customized consulting fees with price lists.

Expense management for consultants.

Cons:

Cap on number of monthly transactions.

Cap on number of users.

Pricing:

Free.

Standard: $15/month per organization.*

Professional: $40/month per organization.*

Premium: $60/month per organization.*

Elite: $120/month per organization.*

Ultimate: $240/month per organization.*

*Billed annually. Monthly plans are available.

7. Wave

Wave is a free accounting software, making it an attractive option for consultants who are just starting out or on a tight budget.

Wave offers consultants all of the essential features for free

Wave offers accounting and invoicing features for free.

The free Wave accounting features include unlimited income and expense tracking, unlimited bank and credit card connections, basic accounting reports and financial statements, customizable sales taxes, and a dashboard for monitoring invoice statuses and cash balances.

The free Wave invoicing features include unlimited invoicing, automatic payment reminders, the ability to turn estimates into invoices, and the automatic syncing of invoicing and accounting.

Not all features are free, Wave does offer some services for a fee such as Wave Payroll, Wave Payments, and Wave Advisors.

While Wave offers plenty of free features, it does lack some advanced features and functionalities compared to the other software options listed.

Pros:

Free accounting and invoicing features for consultants.

User-friendly and intuitive interface.

Cost-effective for consultants on a tight budget with its free essential features.

Accepts online payments.

Cons:

Limited integrations compared to competitors.

Limited scalability.

Mobile apps aren’t very comprehensive.

Email-only customer service.

Pricing:

Invoicing: $0/month.

Accounting: $0/month.

Mobile receipt feature: $8/month.

Payroll: $40/month.

Advisors: $149/month.

8. Kashoo

Kashoo is an easy-to-use accounting software solution for consultants, providing all the essential features like invoicing, expense management, and financial reporting.

Kashoo’s updated interface makes it one of the most user-friendly platforms for consultants

Kashoo’s user interface was completely updated within the last couple of years and still remains one of the easiest accounting software solutions for consultants to navigate.

The simple interface begins with its setup process.

Consultants can quickly set up their businesses with tax details and bank accounts connected.

The new interface makes navigation intuitive and features easily accessible.

Other user-friendly features include dashboards with timely insights, quick invoicing, a ‘bills to pay’ feature, and a contacts feature where all clients and vendors can be tracked.

The reporting features fall a little short compared to the other competitors because Kashoo doesn’t offer sales reports or many customization features.

Pros:

Multi-currency support.

User-friendly navigation for consultants with easy access to features.

Easy setup process.

Invoicing module with plenty of payment options.

Cons:

No sales report.

Provides only basic functionality.

Not many customization features for reporting.

Pricing:

Trulysmall Accounting: $216/year ($18/month)

Kashoo: $324/year ($27/month)

9. NetSuite

NetSuite is a comprehensive solution for consultants who need their business data wherever they go.

NetSuite offers a comprehensive mobile app for consultants on the go

NetSuite’s mobile app provides real-time insights, important business event alerts, and the ability to approve reports and orders while on the go.

The app has an updated interface and improved search capabilities.

With NetSuite’s iPhone and Android mobile apps, billable time can be logged, expenses can be managed, the calendar can be managed and monitored, business calls can be logged, and files can be viewed, edited, and attached to records.

NetSuite also offers sophisticated features like multi-entity management, flexible billing, and real-time financial reporting.

However, NetSuite’s own pricing plans can be expensive compared to other software options, making it more suitable for larger businesses and experienced consultants.

Pros:

Comprehensive suite of applications for consulting business.

Cloud-based accounting for easy accessibility from anywhere.

Customizable and scalable.

Robust reporting and analytics tools for consultants.

Cons:

Not easy to implement or configure.

Not the best option for smaller businesses.

Pricing: Not available on the website.

Oracle NetSuite – NetSuite for Professional Services 101 Demonstration | February 2023 by Liberate I.T.Quick overview

Here’s a quick summary of the best accounting software for consultants.

What is the best accounting software for invoicing?

Winner: FreshBooks

FreshBooks was our top choice when it comes to excellent invoicing capabilities.

Notable features include customized invoices, online payments, automatically calculated taxes, preferred currency, instant updates for paid invoices, automatic payment reminders at customizable intervals, the ability to request deposits on the invoices, and invoicing can be done from anywhere with the mobile app.

What is the best accounting software for time tracking?

Winner: QuickBooks Online

QuickBooks Online Advanced is our top choice for professionals and consultants seeking effective time-tracking solutions.

Employees can clock in and out from their mobile device or time can be tracked by client or service.

Automated employee timesheets streamline payroll and save money and automated time tracking by client or service streamlines the client invoicing process.

What is the best accounting software for expense management?

Winner: Shoeboxed

Shoeboxed effortlessly streamlines the process of expense tracking and calculating tax deductions. It organizes, digitizes, and manages receipts for expenses such as office supplies, advertising, and equipment for consultants, as well as any expenses spent on clients.

Expenses are categorized into 15 editable tax categories for tax deductions.

Expense reports can easily be created from the digital archive of expense data and come with receipts attached so that the photo of the receipt can be viewed along with the reported information.

The assigned categories make expense reports and tax time a much more efficient process.

Consultants can also add employees or accountants as free sub-users to their Shoeboxed account to scan client or expense receipts for the business.

What is the best accounting software for customizable workflows?

Winner: Zoho

Zoho’s built-in automation tools set it apart from the other competitors that we reviewed.

Email alerts can be programmed, automated invoice reminders can be sent, and in-app notifications can be set up so that critical tasks don’t fall through the cracks.

The icing on the cake is that automation is also packed with tools for customization such as the ability to set up rules to automate workflows.

Customized tools can be built using Zoho’s coding language.

What is the best accounting software for integrations?

Winner: Sage Business Cloud Accounting

While Sage only offers 40 integrations, the thing that sets it apart is that it offers an open API.

This is one feature not offered by Sage’s other competitors.

With the open API, software developers can create unique and customized integrations designed especially for consultants.

What is the best accounting software for its mobile app?

Winner: NetSuite

NetSuite offers one of the best apps for both iPhone and Android.

NetSuite’s mobile app provides real-time insights, important business event alerts, and the ability to approve reports and orders while on the go.

With NetSuite’s iPhone and Android mobile apps, billable time can be logged, expenses can be managed, the calendar can be monitored, business calls can be logged, and files can be viewed, edited, and attached to records.

The app also offers sophisticated features like multi-entity management, flexible billing, and real-time financial reporting.

What is the best accounting software for consultants on a tight budget?

Winner: Wave

Wave offers consultants all the essential accounting and invoicing features for free.

The free Wave accounting features include unlimited income and expense tracking, unlimited bank and credit card connections, basic accounting reports and financial statements, customizable sales taxes, and a dashboard for monitoring invoice statuses and cash balances.

The free Wave invoicing features include unlimited invoicing, automatic payment reminders, the ability to turn estimates into invoices, and the automatic syncing of invoicing and accounting.

What is the most user-friendly accounting software for consultants?

Winner: Kashoo

The simple interface begins with its setup process and continues on with its navigational features.

Consultants can quickly set up their business with tax details and bank accounts connected and the new interface makes navigation intuitive and features easily accessible.

Other user-friendly features include dashboards with timely insights, quick invoicing, a ‘bills to pay’ feature, and a contacts feature where all clients and vendors can be tracked.

What is the best accounting platform for scalability?

Winner: Xero

Xero is a cloud-based accounting software solution for consulting businesses that is scalable and easy to use.

All three plans include unlimited users and it integrates with more than 1,000 apps.

Xero doesn’t charge extra for additional users which makes it a great affordable option for growing businesses.

Frequently asked questions

Are there professional services accounting software specifically designed for consultants?

Yes, there are professional services accounting software options specifically designed for consultants. For example, FreshBooks has features tailored for consultants, such as automated invoicing, client relationship management, and project profitability tracking. QuickBooks Online Advanced caters to consultants with its robust general ledger functionality and end-to-end project management tools. Shoeboxed specializes in expense management for consultants by organizing, digitizing, and categorizing expenses for tax deductions and expense reports.

Can a consultant effectively manage their books without using QuickBooks?

Although QuickBooks is a popular choice, consultants can effectively manage their books using other accounting software options. Alternatives like FreshBooks and Xero can provide similar features and functionality for invoicing, inventory management, expense tracking, bank reconciliation, and financial reporting. The key is to find a solution that best aligns with the consultant’s specific needs and workflow preferences.

What are some factors to consider when choosing accounting software for a consulting business?

When choosing accounting software for a consulting business, consider factors like ease of use, feature set, integration capabilities, scalability, and pricing. Additionally, it’s essential to assess individual business needs, such as multi-currency support or advanced reporting requirements.

Conclusion

Having the right accounting software is crucial for streamlining operations and efficiently managing financial tasks.

Taking the time to research and evaluate the available options of accounting software for consultants is well worth the investment, as it can significantly impact the growth and trajectory of a consulting practice in the long run.

Caryl Ramsey has years of experience assisting in different aspects of bookkeeping, taxes, and customer service. She uses a variety of accounting software for setting up client information, reconciling accounts, coding expenses, running financial reports, and preparing tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!