Are you a real estate professional feeling overwhelmed with your business finances and keeping up with the ever-changing regulations? If so, there are some things you need to know about the real estate accounting process.

In this post, we'll explore the importance of real estate accounting, the best practices for managing real estate finances, and how to streamline your real estate accounting system.

What is real estate accounting?

Real estate accounting refers to the niche field of accounting that records, analyzes, and communicates financial transactions involving real estate properties and operations. It typically includes a variety of revenue and expense streams unique to real estate service businesses, such as property management, sales, purchases, leasing, and investments.

In 2021, according to data from the IRS’s Statistics of Income, approximately 9.6 million tax returns were filed with rental property.

The main objective of real estate accounting is to ensure accurate financial reporting to stakeholders, including building owners, investors, lenders, and government agencies.

What are the best practices for establishing and maintaining a real estate accounting system?

Throughout the years, we have discovered the best practices for establishing and maintaining a real estate accounting system.

1. Choose an accounting method

There are generally two accounting methods to choose from: the cash method and the accrual method. With the cash method, any income received is recognized, and expenses deducted in the year they are paid. With the accrual method, income is recognized upon earning, and expenses are recognized in the year they occur.

Most realtors opt for the cash method because it aligns with real estate agents' purchasing and selling processes. Expenses occur immediately, and income is generally recognized at the closing of a sale or when rent is collected.

2. Set up double-entry bookkeeping

You'll want to implement a double-entry bookkeeping system for your business transactions, whichever method you choose. The double-entry bookkeeping method requires a debit and credit for every transaction.

With double-entry, you can monitor profits coming in through your expense accounts. It also offers an opportunity to verify your data entry. The debits and credits should balance to zero.

3. Separate your personal and business checking account

Separating business transactions from personal transactions makes your life so much easier. You should open a separate business checking account. This will help you quickly find business transactions when the time comes, especially at the end of the year when preparing your tax return.

4. Establish a chart of accounts

A chart of accounts separating income and expenses includes assets, equity, revenue, liabilities, and costs. It can be customized to meet the needs of real estate companies and property investors.

5. Track and categorize income and outgoing expenses.

Categorize and classify all real estate transactions under the related accounts. This will allow you to easily see where your money is coming from, how much money is going out, and to what source.

You'll better gauge where to make cuts if necessary and where the most profitable business activities are taking place. All this is crucial if you ever plan to see any growth in your business.

6. Anticipate predictable operating costs.

Cash flow may feel like a rollercoaster more than ever in the real estate industry, so you'll always want to ensure adequate business funds remain in your account to cover all expenses. Previous operating expenses can help predict and anticipate some of your upcoming expenses. Using that as a baseline, you can understand how much you should keep and hold in your account to cover necessary expenses.

7. Reconcile accounts

The act of reconciliation is necessary because it confirms the accuracy of your records and aligns with your bank account. If you reconcile monthly, then if you have an error, it will only compound over a short period versus snowball over the long haul.

8. Keep books updated

If you like to keep a vigilant eye on your cash flow, you should set aside time to enter all financial transactions and maintain updated books on a regular basis.

Updated books allow you to access your account balance in real-time, experience fewer data entry errors, generate accurate financial reports, pay bills on time, and will be less of a headache when it comes time to prepare your tax return.

9. Evaluate business performance monthly by generating accurate financial reports

This is where accurate financial reports, such as income statements, net cash flow reports, and capital expense reports, come into play. Constantly evaluate your monthly financial reports to monitor business performance and what's working and what's not. This will allow you to assess profit margin, help predict upcoming income and expenses, and keep you from losing track while working towards your real estate business growth and objectives.

10. Digitize and organize supporting documents

There should always be a supporting document for every income and expense transaction. Many rental property owners scan and upload their documents to a cloud-based storage system like Shoeboxed. Having supporting documents like receipts stored digitally will save you tons of time tracking receipts for tax returns and tax audits.

11. Use cloud-based accounting software

Cloud-based accounting software allows instant access to business financial data anytime and anywhere. It keeps all your financial information organized and in one location. It's easy to share information with team members or clients. It saves plenty of time when invoicing real estate clients and generating reports.

12. Outsource accounting tasks if needed

This is where an experienced real estate accountant with the expertise, background, and who stays current on all tax laws in real estate can be of great help. A real estate accountant will save you plenty of time and money in the long run.

13. Prepare sooner rather than later for tax season

Prepare the books for tax season on a monthly basis. This will make the tax process much easier and quicker.

A monthly bookkeeping cycle will give you plenty of time to optimize your deductions. This way, when you prepare your taxes, you'll have everything ready and in order. This will also help to prevent errors on your tax return.

How can you streamline your real estate accounting system?

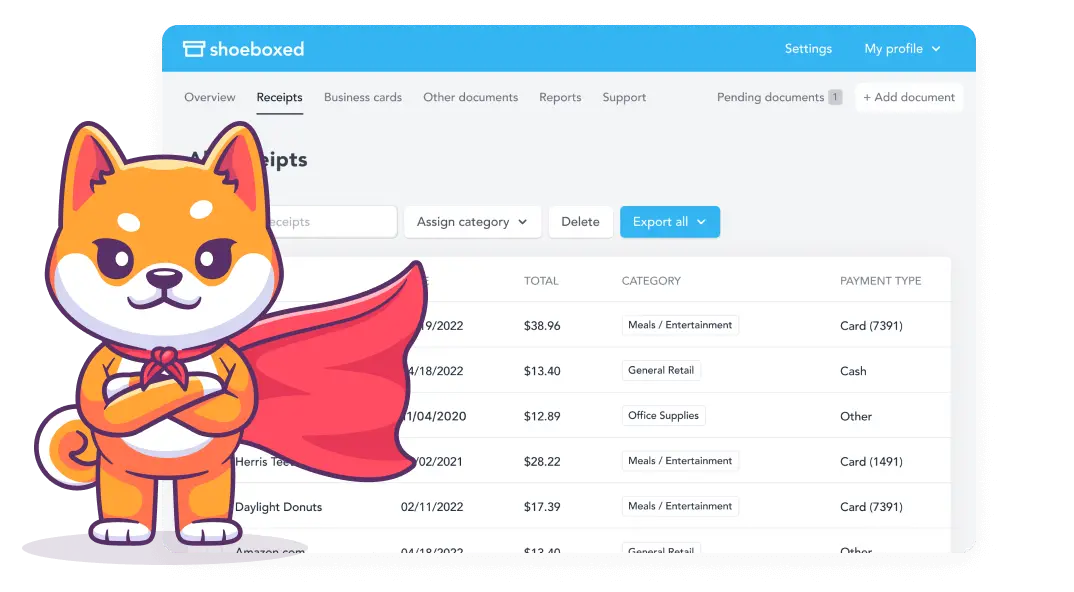

Use Shoeboxed to streamline your real estate accounting system.

Implementing tools like Shoeboxed can save real estate agents time and money by streamlining the real estate accounting process.

Shoeboxed is an expense management solution that significantly optimizes real estate accounting by digitizing and organizing receipts and documents.

Here's how Shoeboxed streamlines the real estate accounting process:

Digitizes physical receipts

Turn your receipts into digital data with automatic data extraction.

Shoeboxed scans and digitizes physical receipts and transforms them into stored digital files. This is especially helpful for realtors who prefer to keep their receipts organized and in one location.

Mobile phone app

Shoeboxed’s mobile phone app is perfect for real estate agents who are on the go.

Another feature that is helpful to real estate agents because of constantly being on the go is Shoeboxed's mobile phone app. With the app, realtors can utilize their smartphone camera to take a photo of the receipt, which will automatically upload to their Shoeboxed account.

Shoeboxed also offers a convenient web dashboard to upload receipts, contracts, invoices, and other documents from their desktop.

The Magic Envelope

Leave Shoeboxed’s free Magic Envelope in the car for receipts while on the road.

For realtors who are on the go and have no time to scan their receipts, Shoeboxed offers a free Magic Envelope. This is a prepaid postage envelope that professionals can fill with receipts and mail to Shoeboxed's processing center. There, the receipts are scanned, human-verified, and uploaded into their account. This is a great service for realtors who want to outsource their receipt management.

Drivers can conveniently leave The Magic Envelope on the dashboard of their car and fill it with receipts as expenses occur, such as gas, etc.

Hit the road with Shoeboxed 🚗

Stuff receipts into the Magic Envelope while on the road. Then, send them once a month for scanning. 💪🏼 Try free for 30 days!

Get Started TodayShoeboxed is the only receipt scanner app that will handle both paper and digital receipts, saving customers up to 9.2 hours per week from manual data entry!

Mileage tracker for logging business miles

Real estate agents can turn their mileage into digital data for taxes.

Once you sign up for Shoeboxed, you can start logging miles in seconds:

Open the Shoeboxed app.

Tap the "Mileage" icon.

Click the "Start Mileage Tracking" button.

And drive!

Shoeboxed tracks your location and miles whenever you start a trip and saves your route as you drive.

As you make stops at stores and client locations, you can drop pins to make tracking more precise.

At the end of a drive, click the "End Mileage Tracking" button to create a trip summary. Each summary will include the date, editable mileage, trip name, tax-deductible, and rate info.

Click "Done" to generate a receipt for your drive and view a photo of your route on the map. Shoeboxed will automatically add your trip to your account's mileage category.

Organization and categorization

Shoeboxed has a systematic approach to receipt categories at tax time.

Shoeboxed's systematic approach to receipt categories is simple but valuable for organizing receipts. Critical information is OCR extracted from the printed text of the receipt and converted into searchable data. The data is automatically categorized into 15 tax or customized categories.

Turn receipts into data with Shoeboxed ✨

Try a systematic approach to receipt categories for tax time. Try free for 30 days!

Get Started TodayExpense reporting

You can create comprehensive expense reports with just a few clicks.

You can search, edit, organize, save, and manage receipts quickly for expense reporting and create custom reports from the web or mobile app with receipts attached for reimbursements or tax purposes.

You can also choose certain receipts to include in your expense report. To do so, select the receipts you want to export and click "Export selected."

Integrates with accounting software

Shoeboxed integrates with Wave, Xero, and QuickBooks.

Export expenses to your accounting software in just a click.

Shoeboxed integrates with 12+ apps, including QuickBooks, Xero, and Wave Accounting, to automate tedious life tasks.

IRS-accepted images

Shoeboxed is the ideal solution for real estate agents.

Shoeboxed offers IRS-accepted receipt images.

According to the IRS, they accept receipt images as valid tax records provided the receipt scans meet the following criteria: See "Rev. Proc. 97-22 (Recordkeeping – Electronic Storage System)":

Receipt scans must be identical to their original versions.

Each receipt image must be legible and readable.

In the case of an IRS audit, you must be able to produce hard copies of the scanned receipts (i.e., hard copies printed from scans).

Scanned documents must be stored in a secure place.

Shoeboxed meets all the requirements for creating an IRS-accepted digital archive of receipts. And all of our receipt scanner plans have no limits on online storage.

Unlimited number of free sub-users

With Shoeboxed, you can add unlimited free sub-users to your account, such as family members, employees, accountants, and tax professionals.

Shoeboxed demo

Why is real estate accounting so important?

We've found real estate accounting to be a critical aspect of your business for several reasons.

Accurate financial reporting

Real estate accounting provides stakeholders insight into real estate investments' financial performance and overall health. Accurate financial reporting offers transparency and accountability in business activities. This level of disclosure is paramount in fostering trust among investors, lenders, and government entities.

Informed decision-making

Real estate accounting generates detailed financial analyses and reports that equip property owners and investors with the information to make sound investment decisions and strategic business plans. Accurate financial data serves as an important input for decision-making, from purchasing a new property to determining whether to sell an existing property or make capital investments.

Compliance and risk management

Adherence to tax laws and other regulatory requirements is another vital area of real estate accounting. Practical accounting reduces the risk of legal noncompliance and penalties by ensuring that all financial transactions adhere to relevant rules and regulations. In addition, real estate accounting helps identify potential financial risks and establishes controls to minimize error or loss.

If you're uncomfortable with the financial process, you should seek a real estate accountant who can advise and handle the financial end of your real estate business.

Frequently asked questions

What are the benefits of using real estate accounting software?

Among the various benefits of real estate accounting software are automation of accounting activities, enhanced accuracy, better organizational structure of financial data, and improved reporting. The software aids in transaction management, monitoring of income and expenses, preparation of financial statements, and regulatory compliance. By streamlining many of the routine activities in the accounting function, the software saves time and reduces the likelihood of errors.

How does Shoeboxed help in managing real estate accounting?

Shoeboxed enhances real estate accounting by digitizing and organizing physical receipts and documents. Digital receipts simplify financial transaction tracking, expense categorization, expense reporting, and filing taxes. Automating routine tasks streamlines realtors' accounting functions and ensures accurate records and improved efficiency.

In conclusion

An efficient real estate accounting system is vital to the growth and success of your business because it ensures accurate financial reporting, compliance with regulations, and informed decision-making. An effective accounting process also allows your real estate business to benefit from tax-saving opportunities like tax deductions.

Caryl Ramsey has years of experience assisting in bookkeeping, taxes, and customer service. She uses various accounting software for setting up client information, reconciling accounts, coding expenses, running financial reports, and preparing tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple receipt capture methods: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad, and Android) to snap a picture while on the go—auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports, including IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports, and more—with Shoeboxed.

Try Shoeboxed today!