Realtors are so busy following leads, showing properties, closing deals and processing documents, it’s impossible to keep up with everything without a little help. That’s where accounting software tailored for real estate businesses and specifically designed for a real estate agent's needs comes in.

Accounting software minimizes manual tasks by automating some of the business operations. The challenge is finding the right accounting software for your real estate business.

In this guide, we’ve reviewed the benefits and features of each, so you can narrow down your options and choose the best real estate accounting software for your needs.

What is real estate accounting?

Real estate accounting is the buying, selling, leasing and managing of real estate. Real estate accounting is tracking income, expenses and assets of real estate investments, complying with regulations and providing financial reports for decision making. Meeting real estate accounting needs involves specialized tools for property value assessment, rental income tracking, and multi-property management. Real estate accounting software can help real estate agents with tracking commissions, managing expenses, and other specific needs.

Key components of real estate accounting

Income and revenue tracking:

Rental income: Rent roll, lease agreements and payment schedules.

Sales income: Revenue from property sales, profit/loss from property transactions.

Expense management:

Operating expenses: Daily operating expenses like property maintenance, utilities, insurance, property management fees.

Capital expenditures: Major investments in property improvements or renovations.

Property valuation and depreciation:

Valuation: Regularly valuing properties for financial reporting and decision making.

Depreciation: Applying depreciation methods to allocate cost of property over its useful life for tax planning and financial reporting.

Compliance and taxation:

Tax compliance: Meeting all tax obligations, property taxes, income taxes, real estate transfer taxes.

Regulatory compliance: Adhering to local, state and federal regulations for real estate transactions and financial reporting.

Financial reporting and analysis:

Financial statements: Balance sheets, income statements, cash flow statements to see the financial health of real estate investments.

Performance metrics: Occupancy rates, net operating income (NOI), return on investment (ROI), cap rates to evaluate real estate assets.

Budgeting and forecasting:

Budget preparation: Budget for property operations, maintenance and capital improvements.

Financial forecasting: Forecasting future financial performance based on historical data, market trends and strategic planning.

Accounts receivable and payable:

Accounts receivable: Incoming payments from tenants and others.

Accounts payable: Outgoing payments to vendors, contractors and service providers.

Importance of real estate accounting

Real estate accounting is important for:

Financial visibility: Gives stakeholders a clear view of financial performance.

Regulatory compliance: Complies with financial regulations and tax laws to minimize legal risks.

Investment management: Manages and optimizes real estate investments with financial insights.

Operational efficiency: Tracks expenses, budgets and forecasts financial needs.

What are the top realtor accounting software in 2024?

There are so many accounting software options out there it’s hard to decide which one to choose.

Below we’ve reviewed the top 10 to help narrow down your search.

1. Shoeboxed - Best app for scanning and organizing receipts

Shoeboxed is the #1 receipt scanner and is used by over a million businesses, including realtors.

Digitizes receipts and documents

Shoeboxed turns physical receipts into digital data for expense reporting, tax preparation and audits. Realtors can use Shoeboxed as a receipt scanning app or a service.

Mobile app version

With the app, realtors can take a picture of the receipt or document with their mobile device and Shoeboxed’s app will upload all receipts and store them in one place - your designated Shoeboxed account. The app features OCR data extraction technology that converts printed text into searchable data.

Magic Envelope service

Or, if you want to outsource your scanning, realtors can mail receipts in a postage paid envelope or The Magic Envelope to Shoeboxed’s processing facility for free. At the processing facility, the receipts will be scanned into your Shoeboxed account.

For realtors who are always on the go, this envelope can be conveniently kept on your car dashboard where you can fill it with receipts as expenses incur such as gas, supplies etc. That way, you'll never lose or misplace a receipt.

Never lose a receipt again 📁

Join over 1 million businesses organizing & scanning receipts, creating expense reports, and reclaiming multiple hours every week—with Shoeboxed.✨

Get Started TodayGmail plug-in

Realtors can also forward receipts from their email to their Shoeboxed account, use a Gmail plug-in to auto-import e-receipts in your inbox and send them to your Shoeboxed account or drag and drop receipts into the cloud using a desktop or laptop.

Mileage tracking

A great feature for realtors is that they can log expenses on the go from anywhere and use their phone’s built-in GPS for accurate business mileage tracking.

Shoeboxed will create a trip summary that includes the date, editable mileage and trip name and tax-deductible and rate information and add it to the categorized expenses.

Track mileage with Shoeboxed 🚗

Track mileage using your phone’s built-in GPS for unmatched ease and accuracy. 💪🏼 Try free for 30 days!

Get Started TodayOrganizes and categorizes

Once uploaded, Shoeboxed will categorize the receipts into 15 different tax or custom categories.

Realtors can create custom tags and categories to suit their bookkeeping needs so they have tailored financial oversight of their business.

Receipts and documents become part of a searchable database so you can find what you need when you need it.

This auto-categorization saves time, reduces errors and helps track spending and manage budgets.

Expense reporting

Shoeboxed automatically generates expense reports with attached receipts so realtors can see where they are spending, plan budgets and do financial analysis.

Shoeboxed generates tax-friendly reports of deductible expenses so that realtors can file taxes accurately and efficiently.

Integrates with accounting software

Shoeboxed integrates with accounting software like QuickBooks, Xero and Wave to transfer and sync data.

Shoeboxed syncs digitized receipts and expense reports to your accounting software so bookkeeping and tax time for realtors is a breeze.

IRS-accepted

Receipts are generated in a format the IRS accepts so tax time is smoother and audit proof.

Shoeboxed tracks deductible expenses so realtors can claim all eligible deductions.

Accurate and organized records makes responding to audits and inquiries from tax authorities or investors easier.

Shoeboxed has been voted as the best receipt scanner app for tax season by Hubspot and given the Trusted Vendor and Quality Choice awards by Crozdesk.

Free sub-users

With a Shoeboxed account, realtors can add unlimited free sub-users so colleagues and accountants can access Shoeboxed and work on bookkeeping and accounting tasks.

Different levels of access and permissions can be set for each user so sensitive financial data is protected.

Shoeboxed is a great tool for individuals and businesses looking to simplify their receipt management and expense tracking. Its auto-extraction, integration with popular accounting software and IRS accepted format makes it perfect for tax time and compliance.

Pros:

Digital receipt capture: Users can take photos of receipts with their mobile device or email digital receipts to their Shoeboxed account. The app also supports scanning paper receipts with prepaid envelopes sent to Shoeboxed for processing.

Auto categorization: Receipts are auto-categorized into expense categories so expenses are easy to organize and track.

Data extraction: Shoeboxed extracts critical information from receipts such as vendor name, date, amount and payment method so you don’t have to manually enter data.

Expense reports: Generates detailed expense reports that can be customized and exported for accounting purposes.

IRS-accepted: Receipts are stored in a format the IRS accepts so tax time is smoother and audit proof.

Deductible tracking: Tracks deductible expenses so you can claim all eligible deductions.

Seamless syncing: Integrates with popular accounting software like QuickBooks, Xero and Wave so data can be transferred and synced.

Collaboration: Multiple users can access and manage the account so team members can work on bookkeeping tasks.

Permissions: Different levels of access and permissions can be set for each user so sensitive financial data is protected.

Cons:

The mileage tracking is not automatic. Users will need to start and stop the tracker manually.

Pricing:

Shoeboxed has several plans to fit your needs:

Startup plan:

$18/month (billed annually)

Professional plan:

$36/month (billed annually)

Business plan:

$54/month (billed annually)

Hit the road with Shoeboxed 🚗

Stuff receipts into the Magic Envelope while on the road. Then send them in once a month to get scanned. 💪🏼 Try free for 30 days!

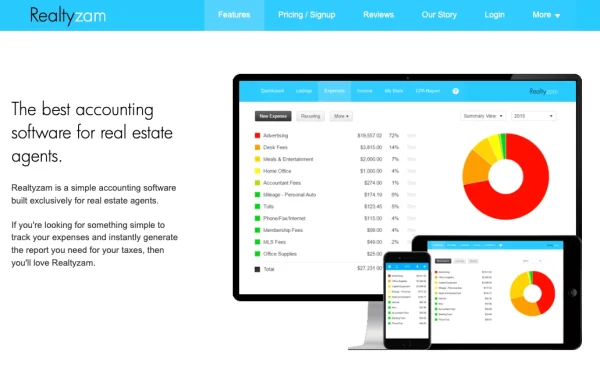

Get Started Today2. Realtyzam - Best software designed exclusively for real estate agents

Realtyzam is a practical accounting solution specifically tailored for real estate agents. It has a user-friendly interface, real estate-specific features like tracking commissions, managing expenses, mileage tracking, contract management, and tax support, along with financial reporting tools. It’s simple and easy to use, making it a good option for individual agents and small teams.

However, larger firms or those who need more advanced features may find it limited. While the cost is reasonable, the lack of a free plan and limited 3rd party integrations may be a drawback for some users.

Pros:

User-friendly: Realtyzam is known for its simple, easy-to-use interface designed for real estate agents. Agents can track expenses and income without needing to be accountants.

Quick setup: Setup is easy; get started with minimal effort. Perfect for agents who need to manage their finances efficiently without spending too much time learning new software.

Commission tracking: Realtyzam has commission tracking tools, which are essential for real estate agents. It can handle complex commission structures, splits, and adjustments.

Expense tracking: Users can categorize and track all business expenses, and agents can better monitor their spending and manage their finances.

Tax preparation: Realtyzam generates detailed financial reports for tax preparation, making tax filing a breeze for agents.

Profit and loss statements: Provides profit and loss statements agents can see their financial performance.

Mobile app: It has a mobile app to manage finances on the go; agents can update expenses and income anywhere.

Bank integration: Can connect to bank accounts to automatically import and categorize transactions, reduce manual data entry, and ensure accuracy.

Cons:

Scalability: Realtyzam is excellent for individual agents and small teams but may not have all the features of more prominent real estate companies or those that need more advanced accounting capabilities.

Basic features: Some users may find the feature set too basic compared to other accounting software, as it lacks advanced financial management tools.

No free plan: Realtyzam doesn't have a free plan, which may be a drawback for agents looking for cost-effective solutions. However, it does offer a free trial to try the software.

Monthly fee: The cost can add up over time, especially for agents who are just starting and have a limited budget.

Limited third-party integrations: Compared to other accounting software, Realtyzam has fewer integrations with third-party apps and services, which may be a limitation for users who use multiple tools for their business.

Support: Some users have reported that support responds slowly. Support availability and quality may not meet all user's needs.

Pricing:

Monthly Plan:

$11.58/month (billed annually)

$14.00/month (billed monthly)

3. Zoho - Best versatile real estate accounting software

Zoho is a versatile and affordable suite of business applications that can cater to different business needs, from CRM to accounting and project management. It includes customer relationship management (CRM) features, making it ideal for managing small and midsize businesses' payments, books, invoicing, billing, and financial accounting.

While it has many features and strong integration within its own ecosystem, it can be challenging to integrate with third-party apps. Customer support can be hit or miss, and sometimes, performance issues occur. The pricing is competitive, with options to suit different business sizes and needs.

Here are some of Zoho's mobile app features:

Receive payments

Send invoices

Enter bills

Upload or capture receipts

Track expenses

Enter payments

Categorize expenses

Track time

View reports

Pros:

Integrated ecosystem: Zoho has many seamlessly integrated applications, including CRM, project management, email hosting, accounting, and more. This allows businesses to manage multiple functions from one platform.

Customization: High degree of customization across applications so businesses can tailor the software to their needs.

Affordable pricing: Compared to other enterprise solutions, Zoho is relatively cheap, making it suitable for small—to medium-sized businesses.

Free versions: Many Zoho applications have free versions with limited features suitable for startups and small businesses.

Ease of use: Zoho applications are known for their user-friendly interfaces, which allow users to navigate and use the software without extensive training.

Mobile access: Most Zoho applications have mobile versions so users can access them on the go.

CRM: Zoho CRM has many features for sales automation, lead management, contact management, and analytics.

Data security: Zoho takes data security seriously through two-factor authentication, encryption, and regular security audits.

Compliance: Zoho complies with international standards and regulations, including GDPR, making it suitable for businesses that are concerned about data privacy.

Cons:

Third-party integrations: While Zoho's internal integrations are seamless, integrating with some third-party apps can be tricky and require additional tools or technical expertise.

Support: Some users find customer support slow and unresponsive, especially with the lower tier plans.

Self-service resources: While extensive online resources and forums exist, some users may need more direct support options.

Learning curve: Although the basic features are user-friendly, some advanced features and customizations can be complex and take time to learn and implement.

Speed and reliability: Some users have reported occasional performance issues that affect productivity, such as slow loading times or downtime.

Limited features in basic plans: The lower tier plans may not have all the advanced features that growing businesses need, so they may need to upgrade to higher plans.

Pricing:

Zoho has different pricing plans for its applications. Here's an overview of some of the leading products:

Standard: $14/user/month (billed annually)

Professional: $23/user/month (billed annually)

Enterprise: $40/user/month (billed annually)

Ultimate: $52/user/month (billed annually)

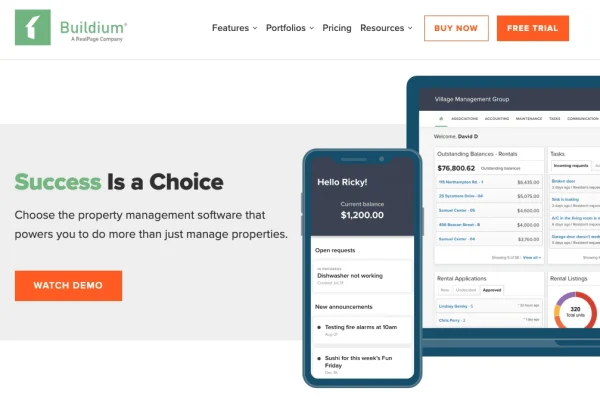

4. Buildium - Best all-in-one real estate accounting software

Buildium is powerful property management software for property managers and landlords of all sizes. It has robust accounting, tenant management, maintenance, and marketing features, making it an all-in-one tool.

However, the cost and complexity may be a consideration for smaller landlords or those with limited technical expertise. To get exact pricing and find the best plan for your business, contact Buildium directly for a custom quote.

Here are some of Buildium's property management features:

Residents can pay rent or fees online, view payment history, and set up recurring payments.

Track maintenance requests

Send announcements to associations or properties via text and email.

Post updates and news on the message board in the Resident Center

Share documents like floor plans, leases, financial reports in real-time, meeting minutes

Property inspection software is integrated with Buildium to do inspections on the go and sync all your data.

Track, log, and report on homeowners' violations

Renters' insurance policy management

Listings ads

Online rental applications

Showings

Tenant screening

eSignature for leasing

Pros:

All-in-one: Buildium has many features, including tenant and lease tracking, maintenance management, accounting, and communication tools. So, it's an all-in-one solution for property managers.

Easy to use: The platform is user-friendly, with an intuitive interface, so it's accessible for users with varying levels of technical expertise.

Robust accounting: Includes general ledger, accounts payable, accounts receivable, budgeting, and financial reporting.

Online payments: Allows online rent and vendor payments, reducing manual processing time and effort.

Tenant portal: This is a tenant portal where tenants can pay rent, submit maintenance requests, and communicate with property managers.

Lease tracking: Tracks lease expirations and renewals so property managers stay organized.

Work orders: Simplifies maintenance requests and work orders so property managers can assign tasks to vendors and track progress.

Vendor management: Manages vendor information and tracks expenses for maintenance and repairs.

Listing syndication: Syndicates rental listings to popular websites to increase exposure and attract tenants.

Website integration: Has customizable websites for property managers to showcase their properties and accept online applications.

Support: It offers multiple support options, including phone, email, and live chat, as well as a knowledge base and training resources.

Cons:

Pricing: Buildium can be costly, especially for smaller property management companies or individual landlords with small units.

Additional fees: Some features like electronic payments and premium support may cost extra.

Initial setup: Initial setup and customization of the platform can be time-consuming and may require technical help.

Complex features: While the interface is user-friendly, many features may require a learning curve to be used effectively.

Mobile app: While good for basic tasks, the mobile app may not have all the features of the desktop version.

Limited customization: Some users may find the options for reports and templates limited compared to other property management software.

Pricing:

Buildium has several pricing plans based on the number of units managed and the features needed. As of the latest update, here are the main plans:

Essential Plan: $55/month

Growth Plan: $174/month

Premium Plan: $375/month

5. FreshBooks - Easiest to use accounting software for realtors

Overall, FreshBooks is a good choice for small to medium-sized businesses looking for an easy-to-use, efficient, and feature-rich accounting solution. Its strengths in invoicing, expense tracking, and customer support make it perfect for freelancers, small business owners, and service-based businesses. But if you have more complex needs or a larger team, you should check if FreshBooks meets your needs or if you need a more advanced system.

The dashboard gives you easy access to reports such as:

Sales tax reports

Profit and loss

Expenses

Accounts aging

Invoices

Payments collected

Pros:

Ease of use: Simple and easy to use interface for real estate professionals to manage finances.

Invoicing and time tracking: Good for client invoices and billable hours.

Cons:

Limited features: It may not have as many features as other options.

Scalability: Better for smaller businesses and may not scale as well for larger real estate companies.

Pricing:

Lite: $7.60/month

Plus: $13.20/month

Premium: $24.00/month

Select: Contact FreshBooks

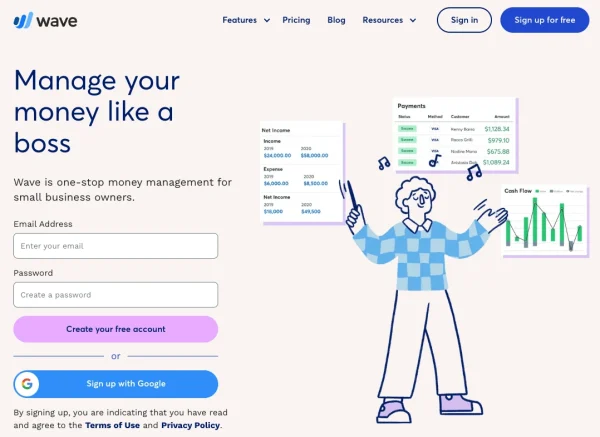

6. Wave Accounting - Best free real estate accounting software

Integrating Shoeboxed with accounting software like QuickBooks Online, Xero, FreshBooks, or Wave can streamline financial management for real estate professionals. These tools automate receipt management, expense tracking, and financial reporting so you can focus on real estate.

Wave Accounting is a free option. Like FreshBooks, Wave Accounting is suitable for self-employed agents or small brokerages just starting. The software will only cost you money if you use Wave Payments or their payroll app.

Wave has above-average invoicing, customer management, 12 financial reports, and bank feed integration.

Wave Accounting makes accounting easy and affordable for real estate professionals.

Pros:

Free basic plan: The free Plan includes invoicing, expense tracking, and financial reporting.

Shoeboxed integration: Integrates with Shoeboxed to manage receipts and expenses.

Ease of use: Simple interface for small businesses and independent contractors.

Cons:

Limited features: Not all features of paid accounting software.

Support: Limited support options compared to premium accounting solutions.

Pricing:

Free for basic features: payroll and payment processing extra.

See also: Shoeboxed vs. Wave: A Comprehensive Guide to the Differences

7. Xero - Best accounting software for business growth

One of the biggest reasons Xero is the best accounting software for real estate business growth is that it offers unlimited users on all its subscription plans.

Their plans offer a connection with your bank account, inventory management, reporting, purchase orders, files, contact management, sales tax management, and payment processing.

Their Growing Plan also includes the following:

Sending online quotes and invoices to customers

Tracking bills that are due

Scheduling bill payments

Batch payments to suppliers

Bank reconciliation

Capturing receipts and bills with Hubdoc

Transaction coding

Insight into short-term cash flow

Business snapshots

The option to add Gusto for payroll management

As your business grows and you want to add more functionality, you can integrate Xero with over 800 third-party apps.

Xero is great for businesses starting out small and experiencing business growth, from onboarding new clients and additional employees to experiencing more complex accounting needs.

Pros:

User-friendly interface: Known for its easy-to-use interface and navigation.

Shoeboxed integration: Integrates with Shoeboxed to help real estate agents manage receipts and expenses efficiently.

Mobile app: Offers a powerful mobile app for on-the-go access.

Cons:

Learning curve: Initial setup and learning can be challenging for some users.

Cost: Pricing can be high, especially for small businesses needing advanced features.

Pricing:

Early: $3.75 monthly

Growing: $10.50/monthly

Established: $19.50/monthly

8. Quicken - Best for landlords managing a small number of properties

Quicken is recommended for landlords with 1-3 units and is one of the best alternatives to QuickBooks for rental properties.

Quicken is a full financial management tool for individuals and small businesses that need robust budgeting, investment tracking, and bill management. While it has many features, the cost and complexity can be a drawback for some users. However, it syncs across devices and gives detailed financial insights, so it's a great tool for managing personal and business finances.

Quicken's property management features include:

Property dashboard

Rental agreements

Rental rate

Maintenance

Security deposits

Move-in/move-out dates

Income and loss by property (reported on Schedule E on your tax return)

Besides accounting tools, Quicken has many other financial management and budgeting tools for real-time buyers.

Quicken not only tracks self-employed income but also retirement accounts and personal finances.

Pros:

All-in-one solution: Quicken has features for managing personal and small business finances, including budgeting, investment tracking, and bill management.

Detailed reports: Users can generate detailed financial reports to see income, expenses, net worth, and investment performance.

Customizable budgets: Users can create and customize budgets, track spending against the budget, and get alerts for overspending.

Spending categorization: Automatically categorizes transactions to see spending patterns and stay on budget.

Portfolio management: It has robust tools for tracking investments, monitoring portfolio performance, and staying up to date on market values.

Tax planning: This helps users prepare for taxes by tracking capital gains, investment income, and tax-deductible expenses.

Bill pay: Users can pay bills directly through Quicken to ensure timely payments and better cash flow management.

Alerts and reminders: Reminds users of due dates and upcoming bills.

Mobile app: Quicken's mobile app allows users to access their financial data on the go with real-time syncing between devices.

Cloud backup: Cloud backup options to protect financial data and be accessible from anywhere.

Cons:

Subscription model: Quicken is a subscription-based service, which can be expensive for some users compared to other personal finance software.

Extra fees: Some features like Quicken Bill Pay have extra fees.

Steep learning curve: New users will find the software complex and need time to learn its features.

Too many features: This can overwhelm users who only need essential financial management tools.

PC vs. Mac: The Mac version of Quicken has historically been behind the PC version in terms of features and updates, but recent versions have improved.

Desktop-based: This is primarily a desktop application, and although it has cloud syncing, it's not as convenient as fully cloud-based alternatives.

Limited support: Some users have reported poor customer support, long response times, and limited resolution options.

Pricing:

Quicken has several plans to suit different needs:

-

Quicken Simplifi:

$2 per month

-

Quicken Classic:

$5.99 per month

9. Lone Wolf Back Office - Best accounting software for brokers

Lone Wolf Back Office is a full-service solution for real estate professionals with transaction management, accounting, and reporting tools. While it has many benefits, including seamless integrations and ease of use, the cost and complexity may be a barrier for smaller firms or new users.

Lone Wolf Back Office has a complete brokerage package consolidating data for brokers, agents, staff, buyers, sellers, and other real estate professionals. The back office and accounting handle commissions, audit prep, agent billing, and accounting. Lone Wolf gives brokers insights into developing the best strategies for profitability and makes it easy to work from home.

Lone Wolf offers comparative market analysis, ritual listing presentations, and marketing, including ads on social media sites. It also offers a toolbox for virtual tours and digital title orders.

Lone Wolf Transactions integrates marketing, CRM, CMA, back office, forms, and eSignature to provide a complete transaction management solution for real estate brokerage.

Pros:

All-in-one: A complete suite for transaction management, accounting, and back office, a powerful tool for real estate professionals.

Transaction management: Robust transaction management tools for agents and brokers to manage deals from contract to close.

Seamless integration: Integrates with other real estate tools and MLS systems to increase functionality and reduce data entry.

QuickBooks integration: Synchronizes with QuickBooks for seamless financial data management and reporting.

Advanced accounting: Detailed accounting features for real estate, including commission tracking, trust accounting, and financial reporting.

Customizable reports: Customizable reporting options to generate financial and operational reports.

Intuitive design: Easy-to-use interface for agents and brokers to navigate and use the software.

Mobile access: Mobile access to manage transactions and accounting.

Customer support: Robust customer support, including training resources and help center to get the most out of the software.

Continuous updates: Regular updates to keep the software current with industry standards and regulations.

Cons:

Expensive for small businesses: This can be costly for smaller real estate firms, especially those with limited software budgets.

Extra fees: Some advanced features or integrations may have additional costs to add to the overall expense.

Steep learning curve: The software is comprehensive, so it can have a steep learning curve for new users and requires time and training to get the most out of it.

Initial setup: Setting up the software and customizing it to your business needs can take time and may require technical support.

Customization limitations: While it has customizable reports, some users may find the overall customization options for the interface and some features limited compared to other software.

Internet dependency: A cloud-based solution requires internet access to access all its features, which can be a drawback in areas with poor internet.

Pricing:

Lone Wolf's Back Office pricing is not published on its website as it varies based on the size and needs of the real estate firm.

10. QuickBooks Online - Best software for multiple agents and larger brokerages

QuickBooks Online is the best accounting software for multiple agents and larger brokerages. QuickBooks has many versions with accounting features, so it's a QuickBooks for everyone in the real estate industry.

QuickBooks tracks income and expenses, creates and sends invoices, organizes receipts, pays contractors and bills, and issues 1099s. The software has a built-in banking feed that downloads and categorizes transactions and reconciles accounts.

QuickBooks can manage commissions for real estate professionals by setting up one account or multiple sub-accounts. For an extra fee, QuickBooks has a payroll option for brokerages, or it can be integrated with a third-party payroll application.

QuickBooks Online has 50 to 100 financial reporting options depending on the pricing tier. The reports range from basic reports like profit and loss, balance sheets, and expenses to business analytics.

The mobile app is available for iOS and Android and has automatic mileage tracking.

Pros:

Full-featured: Invoicing, expense tracking, payroll, and financial reporting.

Shoeboxed integration: Integrates with Shoeboxed to import and categorize receipts.

Customizable: Customizable invoices, reports, and documents.

Cons:

Cost: It can be expensive for small real estate firms.

Complexity: Some users find it complex and may require training.

Pricing:

Simple Start: $15/month

Essential: $30/month

Plus: $45/month

Advanced: $100/month

Frequently asked questions

What is the best accounting software for real estate firms?

The best software will depend on your budget, your firm's size, specific needs, and which accounting features are most important to you.

Can realtors use QuickBooks?

Yes, QuickBooks is a good option for realtors.

QuickBooks is for real estate firms of all sizes and has many features realtors need, such as commission management, expense tracking, and many reports for insights and business analytics.

In conclusion

There is no one-size-fits-all when it comes to real estate accounting software.

Accounting software for real estate firms is designed for different business structures, types of real estate professionals, and levels of accounting—and they all come at different prices.

The key is choosing which is right for you and your business.

Caryl Ramsey has years of experience assisting in bookkeeping, taxes, and customer service. She uses various accounting software for setting up client information, reconciling accounts, coding expenses, running financial reports, and preparing tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple receipt capture methods: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad, and Android) to snap a picture while on the go—auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports, including IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports, and more—with Shoeboxed.

Try Shoeboxed today!