Let’s face it. Paper clutter can be a real drag. You stress about searching for that one piece of paper as well as losing time. And every misfiled document can cost $125 in lost productivity.

To regain control of your space and eliminate those paper piles, it’s time to declutter paper from the office.

How did I end up with so much paper clutter?

Did you know that Americans use 85 million tons of paper a year? That’s 650 pounds per person! It’s no wonder you could end up with so much paper clutter.

While in the United States, the paper recycling rate is 68%, some Americans can still find it difficult or inconvenient to do so. This way of thinking is another reason you could have gathered so much paper over a lifetime.

Whatever the reason, identifying the root causes lets you take meaningful actions to avoid the expected results. We have the solution for you to organize paper clutter.

The 4 simple steps for decluttering paperwork

Not sure how to declutter paperwork effectively? Follow the paper decluttering tips below:

Step 1. Divide papers into 2 piles: throw away or keep.

You can take two actions: keep or throw away the paper.

Using Kondo’s method of filing as inspiration, you have two separate files for your papers:

a) papers to keep

b) papers to throw away

In the next couple of steps, we will go into more detail about what to do for each paper.

Step 2. Archive important and infrequently used papers.

Some examples of these documents are:

medical records

birth certificates

bank or credit card statements information

school forms

any legal documents

One of the simplest methods to archive papers is to use a paper filing cabinet, which can hold many papers without taking up too much space. Their physical filing method allows you to easily separate your papers into different categories such as home, car, school, tax documents, etc.

However, physically filing papers away can be tedious work. So you can opt for a digital filing system for more convenience.

Break free from paper clutter ✨

Use Shoeboxed’s app and scanning service to scan receipts and organize your wallet and office. Try free for 30 days!

Get Started TodayStep 3. Properly recycle papers you don’t want.

For easier paper disposal, have a designated paper recycling bin. This bin allows the paper to be as clean as possible for recycling.

Depending on where you live, there might be additional rules to dispose of your papers such as bundling up the papers with string. So check with your local government to see their recycling rules.

Additionally, according to various online resources, there are different ways to dispose of shredded paper. One source says you can recycle shredded paper, while another says you can not. So check your local recycling plant to see if they will accept shredded paper.

Step 4. Shred personal or sensitive documents.

Experts believe there is a new victim of identity theft every 22 seconds. Using a paper shredder is one of the ways to protect your identity and reduce the risk of becoming a victim.

To properly dispose of your shredded paper, check with your local recycling facility to see if they accept shredded paper.

Shredding sensitive information with a shredder, Exhibit Indexes

How do I declutter special documents like bank statements, etc.?

After looking at the four steps, there are a few special documents that you should consider.

a. Bank statements

For the most part, you should have access to your bank statements, either a hard or a digital version, for one year. After that, any old bank statements should be shredded as they could have some personal and financial information.

Any tax-related documentation should be kept for three years.

b. Receipts

Keeping track of receipts is extremely important as it lets you see how much money you are spending, acts as your proof of purchase, and helps with your tax returns.

Receipt management software can help you keep track of receipt finances. To help declutter your physical receipts, Shoeboxed’s Magic Envelope allows you to stuff all your receipts in a pre-paid envelope.

This method eliminates your physical clutter and outsources the receipt scanning process. Afterward, all your receipts’ information will be in your Shoeboxed account for you to view.

What else can Shoeboxed do?

Shoeboxed has been voted as the best receipt scanner app for tax season by Hubspot and given the Trusted Vendor and Quality Choice awards by Crozdesk.

A quick overview of Shoeboxed's award-winning features:

a. Mobile app and web dashboard

Shoeboxed’s mobile app lets you snap photos of paper receipts and upload them to your account right from your phone.

Shoeboxed also has a user-friendly web dashboard to upload receipts or documents from your desktop.

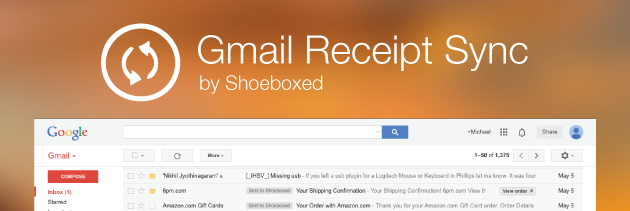

b. Gmail receipt sync feature for capturing e-receipts

Importing e-receipts to your Shoeboxed account is as easy as syncing your Gmail with Shoeboxed, using Shoeboxed's special Gmail Receipt Sync feature.

Shoeboxed’s Gmail Receipt Sync grabs all receipt emails and sends them to your account for automatic processing! These receipts are then labeled as Sent to Shoeboxed in your Gmail inbox.

In short, Shoeboxed pulls the receipt data from your email, including the vendor, purchase date, currency, total, and payment type, and organizes it in your account.

Your purchases will even come with images of the receipts attached!

c. Expense reports

Expense reports let you view all of your expenses in one cohesive document. They also make it simple to share your purchases with your accountant.

Shoeboxed makes it easy to export your yearly expenses into a detailed report. All expenses come with receipts attached.

You can also choose certain types of receipts to include in your expense report. Just select the receipts you want to export and click “export selected.”

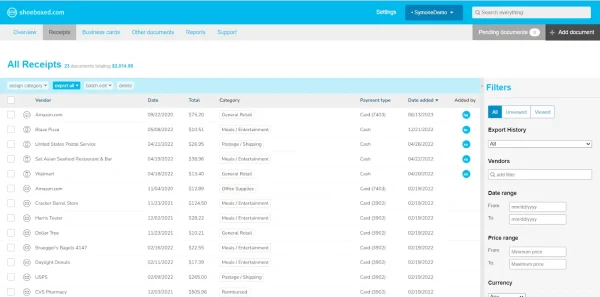

d. Search and filter

Call up any receipt or warranty in seconds with advanced search features.

Filter receipts based on vendors, date, price, currency, categories, payment type, and more.

e. Accounting software integrations

Export expenses to your accounting software in just a click.

Shoeboxed integrates with 12+ apps to automate the tedious tasks of life, including QuickBooks, Xero, and Wave Accounting.

f. Unlimited number of free sub-users

Add an unlimited number of free sub-users to your account, such as family members, employees, accountants, and tax professionals.

g. Mileage tracker for logging business miles

After you sign up for Shoeboxed, you can start tracking miles in seconds:

Open the Shoeboxed app.

Tap the “Mileage” icon.

Click the “Start Mileage Tracking” button.

And drive!

Whenever you start a trip, Shoeboxed tracks your location and miles and saves your route as you drive.

As you make stops at stores and customer locations, you can drop pins to make tracking more precise.

At the end of a drive, you’ll click the “End Mileage Tracking” button to create a summary of your trip. Each summary will include the date, editable mileage and trip name, and your tax deductible and rate info.

Click “Done” to generate a receipt for your drive and get a photo of your route on the map. Shoeboxed will automatically categorize your trip under the mileage category in your account.

h. The Magic Envelope

Outsource your receipt scanning with the Magic Envelope!

The Magic Envelope service is the most popular Shoeboxed feature, particularly for businesses, and lets users outsource their receipt management.

When you sign up for a plan that includes the Magic Envelope, Shoeboxed will mail you a pre-paid envelope for you to send your receipts in.

Once your receipts reach the Shoeboxed facility, they’ll be digitized, human-verified, and tax-categorized in your account.

Have your own filing system?

Shoeboxed will even put your receipts under custom categories. Just separate your receipts with a paper clip and a note explaining how you want them organized!

Break free from paper clutter ✨

Use Shoeboxed’s Magic Envelope to ship off your receipts and get them back as scanned data in a private, secure cloud-based account. 📁 Try free for 30 days!

Get Started Todayc. Utility bills

Water, gas, and electronic bills help establish residency at your address. So similar to bank statements, you should keep these documents for up to one year.

Additionally, you can compare each monthly statement to see how much you’re using.

d. Sentimental papers

When you are decluttering paper, it’s easy to find sentimental items. The KonMari method suggests tackling any sentimental items at the very end. Letting items go, such as kids’ school papers and handwritten letters, can be difficult.

After going through the first paper declutter, you can easily tackle any sentimental paper.

What paperwork to keep when you declutter (list)

Birth certificates, marriage certificates, death certificates

Instruction manuals

Passports and ID cards

Tax documents (less than 3 years old)

Medical records

Deeds and contracts

School certificates and diplomas

Licenses

Outstanding and paid bills (less than 1 year old)

Mortgage papers

Receipts for taxes

Social Security cards

Adoption papers

Immigration papers

Vehicle registration and titles

Insurance policies

Home improvement records

Questions to ask yourself when decluttering

1. Will I need access to this information?

If you need the information on the paper, keep it. If you’re unsure about whether or not you’ll need the information, make a digital copy of the document and shred the paper.

2. Can I access the information on the paper elsewhere?

If you have a digital copy or online access to the information on the document, you may no longer need the paper copy.

3. Do I have duplicate copies?

If you have more than one copy of a document, you can shred the duplicates and create a backup on your computer.

Made a mistake in filling out your taxes and want a do-over? Check out our article here: Filing Duplicate Tax Returns? Here’s What to Know and Do.

5 tips to stop paper clutter from accumulating

1. Switch to a paperless format.

Working in the office can result in lots of paperwork. So, switch to a digital version for your documents. Your papers will be easier to store and take up less space. A digital filing system will help you declutter your office and make it easier for you to quickly locate documents using text search.

We suggest using paperless billing options for your utilities, bank statements, etc., as they come with the following three benefits.

No more physical copies in the mail, which means less paper clutter for you

Reduce and prevent identity theft, as mail is less likely to be stolen

Ability to access your documents online from any location

2. Unsubscribe or opt-out from junk mail.

In 2021, the USPS sent nearly 130 billion pieces of junk mail—so it’s easy to see where all the paper clutter comes from.

The Direct Marketing Association has a website where they will stop most promotional emails with a $4 processing fee for ten years. Then there is also OptOutPrescreen.com, where you can opt out from receiving credit card or insurance mail from four credit and insurance companies.

3. Set a Google reminder to help you clean out your bins regularly.

Developing a habit of cleaning out your recycling bin will help you create a system where you regularly declutter any paper.

Also, go through your files and throw away or delete any that are irrelevant or unnecessary.

4. Place a dedicated paper bin next to your office desk to remind you to recycle responsibly.

Properly shredding and recycling paper will reduce your risk of identity theft and minimize your environmental impact. Place a dedicated paper or shredded paper bin in your space to help you sort through everything.

A waste bin can be used as a paper recycling bin, Amazon

5. Hire a professional organizer.

Consider hiring a professional to help you find and create an organization method to prevent papers from accumulating again.

A professional organizer will help you go through the decluttering process and create a space that will be functional for you.

Frequently asked questions

How do you organize years of paperwork?

To organize years of paperwork, you’ll first want to separate them into piles. Divide your papers into the following categories:

1. Action: Papers in this pile require attention before they can be shredded (bills, tax documents, etc.)

2. Archive: These are papers you need to keep for your records such as taxes less than 3 years old, deeds, wills, birth certificates, and other important documents.

3. Household: Anything that you use frequently or will use soon such as coupons, recipes, and tax receipts. Use a checklist to help declutter your house.

4. Recycle: You can put papers that don’t contain sensitive information and that you won’t ever need again, such as junk mail, newspaper, and graded homework into your recycling bin.

5. Shred: This pile is for papers that do contain important information that you no longer need to keep such as bank statements, bills, and tax documents older than 3 years.

From there, you can organize the papers you need and destroy or recycle the papers you don’t.

How does Marie Kondo organize paperwork?

Kondo divides papers into papers to be dealt with and papers to keep. She also has subcategories for the papers to be saved: frequently used and infrequently used.

In closing

Decluttering papers can be a tedious and time-consuming task. However, once it’s over, you’ll feel refreshed.

You can always remember that the paper version of a document can be in a digital format for easier storing, searching, and retrieving.

Tammy Dang is a staff writer for Shoeboxed covering productivity, organization, and digitization how-to guides for the home and office. Her favorite organization tip is “1-in-1-out.” And her favorite app for managing articles and deadlines is Monday.com.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!