Managing one business can seem overwhelming at times, not to mention multiple businesses.

Finding the best accounting software for multiple businesses that cater to the needs and priorities of each business will make multi-tasking much simpler.

The key is finding accounting software that streamlines financial operations, offers quick insight into the financial status of each entity, and can manage day-to-day accounting tasks for each business.

With the ideal solution, business owners can manage multiple businesses more efficiently and make well-informed decisions for the continued growth and success of the businesses as a whole.

What is the accounting process for multiple entities?

When considering accounting software for multiple business accounts, you need to ask yourself if you’re going to keep separate books for each business or if you’re going to consolidate all companies into one set of financial statements.

The answer to that question will determine which software you should consider.

If you’re going to keep separate books for each company, then you will want to find accounting software that you can add multiple businesses to without having to set up a different account for each one or pay an exorbitant fee to add.

If you’re going to consolidate financial statements, just keep in mind that the accounting software will typically need to be more sophisticated and therefore, will be more expensive.

What are the essential features of accounting software for multiple businesses?

By carefully examining the features and capabilities offered by various accounting software options, entrepreneurs can find the perfect fit that caters to the unique needs of multiple businesses.

1. Expense tracking

A crucial feature of accounting software for multiple businesses is the ability to track expenses efficiently.

This allows users to easily track and categorize expenses, leading to better financial management, especially when tax time rolls around and if being audited.

Some accounting software even offers receipt scanning capabilities, simplifying the process of tracking expenses while on the go.

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. Try free for 30 days!

Get Started Today2. Invoicing

Invoicing is an essential component of any business accounting software where multiple businesses are involved.

A robust invoicing feature should allow users to effortlessly create, manage, and customize invoices for their different businesses.

Invoices should also provide the option of paying directly from the invoice which facilitates smoother transactions when you’ve got payments coming from different venues.

3. Cash flow management

Effective cash flow management is essential for the financial health and growth of multiple businesses.

You should be able to easily detect an updated balance of any business at any given time.

The accounting software for multiple businesses should help users monitor cash flow, provide insight into income and expenses, and forecast future cash flow trends.

Managing cashflows accurately depends heavily on accounting software, particularly in the context of e-commerce. As an added advantage, outsourced accounting services for ecommerce can help monitor cash flow, provide insight into income and expenses, and forecast future cash flow trends.

4. Bank reconciliation

Bank account reconciliation, especially if you have different bank accounts tied to each business, is an essential feature for maintaining accurate financial records for making crucial business decisions.

Accounting software should allow users to efficiently match transactions from bank statements with records in the software, identify discrepancies, and swiftly resolve any issues.

5. Mobile app

Accounting software should offer a mobile app that enables businesses to access and manage their many expenses on the go.

The app should consist of at least all the basic financial features, be user-friendly, and maintain high-security standards.

6. Reporting

The reporting feature of accounting software is crucial in providing a comprehensive view of financial information for each company.

Accounting software should generate customizable and detailed business reports on aspects like profit and loss, balance sheets, and cash flow by business and as a whole.

These reports are valuable for making informed business decisions so that you can experience growth across the board.

7. Payroll

An intuitive payroll feature is essential for managing employee payments, taxes, and benefits in multiple businesses.

The software should automate the payroll process, ensure compliance with tax regulations, and provide necessary reporting for taxes.

8. Mileage tracking

For businesses with vehicle usage, mileage tracking is vital to ensure accurate reimbursement and tax deductions.

Accounting software with a mileage tracking feature should log trips, calculate business-related distance traveled, and generate reports for easy claim filing.

9. Time tracking

Time tracking features help businesses manage employee working hours, billable hours, and project-based work.

Accounting software should offer easy-to-use time-tracking functions, enabling accurate project budgeting and cost tracking.

10. Project accounting

Project accounting focuses on tracking the financial performance of individual projects among your various businesses.

Accounting software should provide project-level financial data, including expenses, revenues, and profitability, facilitating appropriate resource allocation and project management.

11. Inventory management

For businesses dealing with inventory across multiple businesses, accurate inventory tracking is crucial.

The software should have features to track inventory levels, monitor sales trends, and provide insight into stock movement, helping the various businesses to optimize their supply chain efficiently.

12. Shareable master files

With multiple companies, it’s nice to be able to share key files among the different entities, especially when consolidating financial reports.

A shared chart of accounts makes it easier to generate financial statements that include all of the companies together.

A shareable vendor contact list is helpful if you use some of the same vendors among the different businesses.

13. Inter-entity accounting

With multi-company accounting software, it’s nice to be able to make transactions from one company to another.

What is the best accounting software for multiple entities in 2024?

The best accounting software for multiple businesses have been chosen based on their features, ease of use, scalability, multi-company support, and integration capabilities.

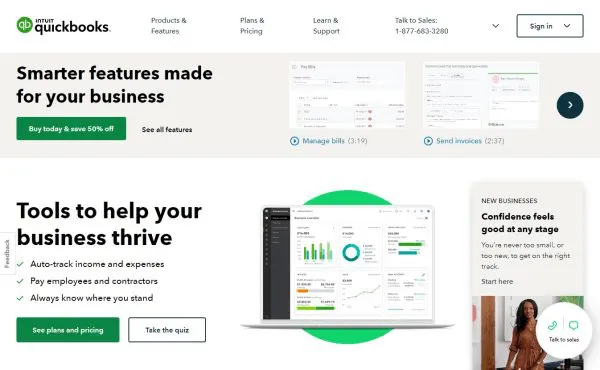

1. QuickBooks Online

Looking for an all-in-one online accounting software solution for multiple businesses?

QuickBooks Online is a popular cloud-based accounting software that offers full-service accounting to unlimited companies.

QuickBooks accounting for businesses

QuickBooks Online’s one license allows bookkeeping for unlimited businesses all under one login.

Under a single login, you can easily switch between companies, making each business easy to access.

While QuickBooks Online allows you to keep separate books for multiple entities, it does not allow you to prepare consolidated financial statements.

Consolidated financial statements typically require more sophisticated accounting software.

From my experience, some of QuickBook’s key features for managing multiple businesses include project tracking, inventory accounting, invoicing, expense tracking, and payroll management.

QuickBooks is a comprehensive accounting solution that allows for an unlimited number of organizations with up to 40 users.

Pros:

Multiple businesses can be accessed under one login.

Real-time financial synchronization for updated sales data and financial status.

Calculates quarterly tax estimates for multiple entities.

Manages sales tax for multiple businesses.

Integrates with other financial management tools, such as Shoeboxed.

Cons:

Doesn’t offer financial statements with all of the businesses consolidated.

Doesn’t support multiple currencies.

Pricing:

Simple Start – $9/month for the first 3 months*, then $30/month.

Essentials – $16.50/month for the first 3 months*, then $55/month.

Plus – $25.50/month for the first 3 months*, then $85/month.

Advanced – $60/month for the first 3 months*, then $200/month.

Add payroll for an additional cost.

30-day free trial.

*As of the writing of this review, plans are 70% off for the first 3 months. Discounts are subject to change.

Quickbooks Online: How to Manage Multiple Businesses within One Subscription by Income Digs2. Shoeboxed

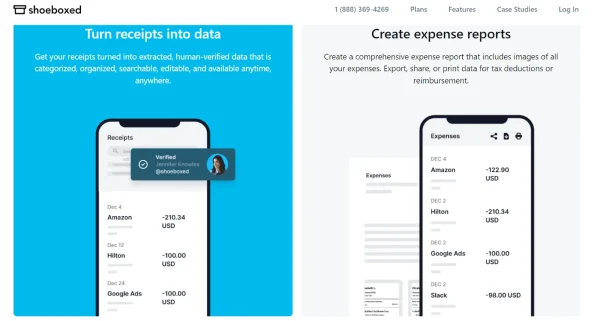

If you own multiple businesses, then you know the hassle of keeping up with hundreds of receipts from expenses and customers.

Shoeboxed is a receipt-scanning app and service that has helped over 1 million businesses manage their receipts, and it’s even Forbes’ “favorite business expense tracker app for scanning receipts.”

With Shoeboxed, owners can easily manage their expenses and receipts for each of their separate businesses, making tax time less stressful.

Shoeboxed’s mobile app is intuitive and easy to use

How can Shoeboxed help owners of multiple businesses?

For multiple businesses, Shoeboxed is an incredibly useful tool for organizing, digitizing, and managing receipts for expenses such as inventory, office supplies, advertising, equipment, repairs, and utilities for each business.

Shoeboxed can also digitize all of your business contacts or any other important document for any of your multiple businesses.

Mobile app

Those who own multiple businesses can simply scan their receipts from the mobile app, which are then human-verified and categorized for expense reports and tax deductions.

Business owners can simply use Shoeboxed’s app to snap photos of receipts on the go for business dinners and other expenses.

After the receipts are uploaded and in the user’s account, the user can then create custom categories for each of their expenses and filter by vendor, date, or category.

How can Shoeboxed’s Magic Envelope service help multi-business owners?

Shoeboxed’s Magic Envelope service outsources receipt-scanning

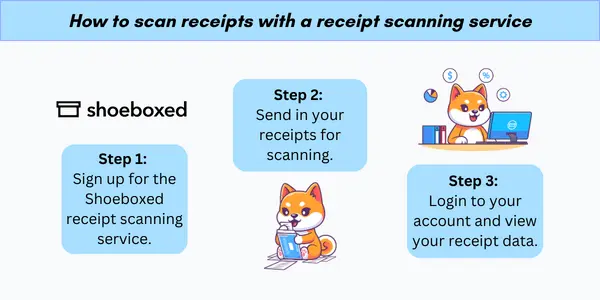

Besides the mobile app, Shoeboxed offers a mail-in receipt scanning service called the Magic Envelope.

With the Magic Envelope, business owners can send their business receipts in a postage-pre-paid envelope to Shoeboxed to be turned into digital data, human-verified, and uploaded to their account under 15 editable tax categories.

Shoeboxed is the only receipt scanner app that will handle both your paper receipts and your digital receipts—saving customers up to 9.2 hours per week from manual data entry!

Break free from paper clutter ✨

Use Shoeboxed’s Magic Envelope to ship off your receipts and get them back as scanned data in a private, secure cloud-based account. 📁 Try free for 30 days!

Get Started TodayTaxes and expense reports

The assigned categories make tax time much more efficient since the expenses are already separated.

All you have to do is pull the total for each category and plug the numbers into your return.

Business expense reports can also be easily created from the digital archive of expense data.

Expense reports come with receipts attached so you can see the photo along with the reported information.

Free sub-users

Business owners can also add an unlimited number of employees as free sub-users to their Shoeboxed account to scan customer or expense receipts.

Accountants can even be added to the account for free, as well!

Accounting software integrations

Shoeboxed’s key features include receipt scanning, expense tracking, and integration with accounting software like QuickBooks. After Shoeboxed organizes the receipts into a searchable online account, users can then sync their receipts with their QuickBooks Online account.

How To Send A Magic Envelope by Shoeboxed YouTubePros:

Automated receipt and expense tracking for each business.

Receipts for expenses or business cards can be scanned directly from your phone.

Integrations with popular accounting software such as QuickBooks to streamline all of your financial information.

Built-in mileage tracker to deduct the miles you spend on the road to multiple locations.

Categorizes expenses into 15 editable tax categories.

Sub-users such as employees, business partners, or accountants can be added to the account for free.

Cons:

Mobile app plans are digital only. Plans that include the Magic Envelope will have to be accessed from the website.

Pricing:

The Digital Download Only Starter Plan is $4.99/month, up to $19.99/month for the Pro digital plan.

Plans that include the Magic Envelope start at $18/month, up to $54/month. Plans that include the Magic Envelope are available for purchase on desktop only.

30-day free trial.

NOTE: Each business should be set up with its own account so the receipts are easier to track.

Never lose a receipt again 📁

Join over 1 million businesses organizing & scanning receipts, creating expense reports, and reclaiming multiple hours every week—with Shoeboxed.✨

Get Started Today3. SoftLedger

SoftLedger is a full-featured accounting software for multiple businesses that supports cryptocurrencies such as Bitcoin and Ethereum.

SoftLedger accounting software for businesses

SoftLedger is one of the few accounting software programs that consolidate companies into one set of financial statements across multiple entities.

Not only does it consolidate businesses, but it also allocates income and expenses that are shared among the different companies.

SoftLedger is also one of the few systems that support cryptocurrency.

This accounting software tracks the gain and losses from crypto automatically and integrates with crypto exchanges so that business owners of multiple companies can view real-time transactions and values.

SoftLedger features an application programming interface (API) that allows the software to be modified to meet the accounting needs of multiple businesses.

The software is modified by creating or programming software connections for desired integrations.

Other features include automated accounts payable, approval workflows, and accounts receivable, as well as real-time financial reporting and inventory and cash flow management.

Pros:

Consolidates financial statements across subsidiaries to eliminate intercompany transactions.

Supports cryptocurrency transactions such as Bitcoin.

API allows software to be modified in order to meet specific accounting needs.

Inventory management.

Cons:

The lowest tier is limited to 5 companies and 3 users.

Doesn’t offer a mobile app.

Developer skills are required for customizing software.

Pricing: Not available on the website. Request pricing.

4. Wave

Wave provides free accounting and invoicing services for an unlimited number of businesses.

Wave accounting.

The free features for multiple businesses include a chart of accounts, accounts payable, accounts receivable, banking features, and financial reports.

Wave also offers sales and income tax tracking and the option to add sales tax to invoices, bills, estimates, and other transactions.

This software program generates 16 different kinds of accounting reports, but the drawback is that there are no features to customize reports.

If any of your multiple businesses fall into the e-commerce sector, Wave seamlessly integrates with platforms such as Shopify.

Wave also offers additional features for a fee such as payment options, mobile receipts, payroll, and advisors.

This is a great free accounting software option for multiple small businesses looking for a cost-effective option and a simple solution for tracking income and expenses.

Pros:

Free software for multiple entities.

Simple interface with easy-to-navigate features between businesses.

Automatic data backups.

Cons:

Limited integrations for multiple entities.

Lacks advanced features like inventory management.

Pricing:

Invoicing: $0/month.

Accounting: $0/month.

Mobile receipt feature: $8/month.

Payroll: $40/month.

Advisors: $149/month.

5. FreshBooks

If you’re looking for online accounting software where you can oversee the finances for each business from one central hub, then you should consider FreshBooks.

FreshBooks provides multiple business owners with financial insights at just a glance.

FreshBooks accounting software for multiple businesses

From my experience in accounting firms that help owners manage multiple businesses, software that provides a clear, quick overview of financial insights of each company from one main location is a must.

FreshBooks allows you to create multiple small business accounting software profiles under one account.

In that one account, business owners can just switch back and forth between the different companies, making it easy to access any of your businesses.

In my experience, invoicing is one of FreshBooks’ best features for managing multiple entities.

Invoices can be created for each business’s unique branding and their auto billing allows for recurring invoices, which saves a tremendous amount of time when dealing with multiple companies.

The mobile app also allows you to toggle between different businesses so that you can keep track of all of your businesses from anywhere.

Other features include time tracking, online payments, expense management, mobile mileage tracking, accountant access, financial reporting, business performance, dashboards, tax reports, and project management, with payroll as an add-on for an additional fee.

Pros:

User-friendly interface for multiple businesses.

The mobile app is available for iOS and Android to check on all businesses from anywhere.

Integration with numerous third-party apps.

Invoices that can be tailored to each individual business.

Sales tax management for multiple entities.

Online payments.

Cons:

Limited inventory and payroll features.

Restricted multi-currency support.

Limited users.

Pricing:

Lite: $8.50/month for the first 3 months, then $17/month.

Plus: $15/month for the first 3 months, then $30/month.

Premium: $27.50/month for the first 3 months, then $55/month.

Select: Customized pricing.

6. Gravity Software

Do you have multiple entities with advanced accounting needs?

Gravity Software is a cloud-based accounting software solution on the Microsoft Power Platform.

Gravity Software cloud-based accounting tool

Gravity Software is a multi-entity accounting software solution for business owners transitioning from basic accounting software to more advanced solutions.

This software has features that will fit the bill for multiple legal entities or a single entity with multiple locations.

The navigation is intuitive and allows you to switch between entities without logging into separate accounts.

Gravity offers customizable screens and fields so that it has the flexibility to cater to diverse accounting needs.

This software features real-time financial reporting for multiple businesses so that you can quickly view the financial status of every entity.

Not only does it excel in multiple business functionality, but it also offers multi-currency conversions for international business bookkeeping.

Other features include a shared chart of accounts, consolidated financial reporting, shared master files, built-in Microsoft Dynamics 365 integration, and easy management of inter-company transactions.

Pros:

Seamlessly manages reporting, transactions, and a shared chart of accounts across multiple entities.

Designed to grow with your businesses.

Extensive support system with online help, video libraries, and a support portal.

Cons:

No payroll.

Microsoft Power licenses must be purchased.

Pricing:

Starter: $300/month first user.

Power Apps User: $280/month first user.

Nonprofit: $180/month first user.

7. Sage 50 Cloud

Sage 50 Cloud allows for various businesses to be consolidated into a single set of financial statements.

Sage 50 accounting software

With Sage 50, you can set up and manage multiple entities, consolidate financial statements, and reconcile intercompany transactions.

Consolidation includes subsidiaries in the U.S. or abroad.

Consolidating the financial statements of subsidiaries eliminates intercompany transactions since you’re only dealing with one main report.

The software even accounts for foreign currency translation.

Sage also offers project tracking and 150 customizable reports across multiple businesses.

Other features include cash flow, invoice management, online payments, banking, inventory management, job costing, and payroll.

Pros:

More affordable than many competitors offering consolidated financial statements.

Offers a plan with unlimited users.

Comprehensive reporting and inventory tracking.

Cons:

No built-in mileage or time tracker.

Limited third-party integrations for multiple entities.

Pricing:

Pro Accounting: $433.50/year*

Premium Accounting: $727.50/year*

Quantum Accounting: $1,207.50/year*

*As of this writing, plans are 25% off.

What is the best accounting software for expense tracking?

Winner: Shoeboxed

Shoeboxed is at the top of the list for expense tracking.

Those who own multiple businesses can simply scan their receipts from the mobile app, which are then human-verified and categorized for expense reports, reimbursements, and tax deductions.

Shoeboxed also provides a prepaid Magic Envelope that you can mail receipts, business cards, or any other important documents if you prefer not to scan from your phone.

Business owners who travel can use Shoeboxed’s free mileage tracker to get an accurate mileage calculation for the business mileage deduction.

What is the best accounting software for cash flow management?

Winner: Sage 50 Cloud

Sage 50 Cloud Accounting is a reliable option for managing cash flow and accounting tasks across different businesses.

This software provides solid capabilities for consolidating entities and shows the cash balance of the different business entities, how much cash is expected to come in, and the amount of cash expected to go out.

Which accounting software for multiple businesses has the best mobile app?

Winners: Shoeboxed, Sage 50 Cloud, and Freshbooks

Shoeboxed

Shoeboxed’s mobile app is ideal for tracking expenses and mileage.

Those who own multiple businesses can simply scan their receipts while on the go from the mobile app to be human-verified and categorized for expense reports and tax deductions.

Business owners who travel can also use Shoeboxed’s free mileage tracker to get an accurate mileage calculation for the business mileage deduction on their taxes.

You can even create PDF or CSV expense reports from the app!

Sage 50 Cloud

Sage Accounting’s mobile app offers advanced features such as real-time data synchronization, customizable dashboards, and secure access to financial reports.

The app also boasts invoicing functionality, expense tracking, and the ability to integrate with several third-party applications.

Freshbooks

With FreshBooks’ mobile app, users can easily track their billable hours, manage expenses, and create professional-looking invoices on the go.

Additionally, the app integrates with popular payment gateways, allowing users to receive payments more efficiently.

Which software is best for reporting?

Winners: Sage 50, QuickBooks Online, Shoeboxed

Sage 50

Sage 50 is a popular choice because of its multi-entity consolidated financial reporting feature and 150 customizable reports.

Sage 50 is known for its robust reporting tools, allowing users to analyze the financial health of multiple businesses with ease.

QuickBooks Online

Another strong contender for multi-business owners is QuickBooks.

While QuickBooks does not prepare consolidated financial statements, reports update automatically, customized reports can be shared with an accountant, and you can import data from Excel for accurate data and flexible reporting.

Shoeboxed

Shoeboxed is at the top of the list for its expense reporting feature.

Once receipts are uploaded, digitized, and set up in the user’s account, business expense reports can easily be created from the digital archive of expense data.

Expense reports come with receipts attached so you can see the photo along with the reported information.

Shoeboxed can also be integrated into a company’s overall internal compliance and expense policies so that its tracking and expense management system is fully automated.

Which accounting solution is best for consolidating multiple entities with cryptocurrency transactions?

Winner: SoftLedger

SoftLedger is one of the few accounting software options that cater to multi businesses and multiple currencies.

SoftLedger is a full-featured accounting software for multiple businesses that supports cryptocurrencies such as Bitcoin and Ethereum.

This software tracks the gain and losses from crypto automatically and integrates with crypto exchanges so that business owners of multiple companies can view real-time transactions.

What is the best free accounting software for multiple businesses?

Winner: Wave

Wave provides free basic accounting and invoicing services for an unlimited number of businesses.

The free features for multiple businesses include a chart of accounts, accounts payable, accounts receivable, banking features, and financial reports.

Which accounting software offers the best overview of multiple accounts?

Winner: FreshBooks

FreshBooks provides multiple business owners with financial insights at just a glance.

This online accounting software allows you to oversee the business finances for each company from one central hub.

Which accounting software is best for advanced accounting needs?

Winner: Gravity Software

Not only does Gravity Software excel in multi-business functionality, but it also offers multi-currency conversions for international business bookkeeping.

Other features include a shared chart of accounts, consolidated financial reporting, shared master files, built-in Microsoft Dynamics 365 integration, and easy management of inter-company transactions.

Which accounting software is best for consolidated financial reporting?

Winner: Sage 50 Cloud

Sage 50 Cloud allows for various businesses to be consolidated into a single set of financial statements.

Consolidation includes subsidiaries in the U.S. or abroad, which eliminates intercompany transactions.

Frequently asked questions

What are the top accounting solutions for managing numerous companies?

There are several accounting software options suitable for managing multiple businesses. Some of the top choices include QuickBooks Online, Sage 50 Cloud Accounting, and SoftLedger.

How does QuickBooks Online handle pricing for multiple businesses?

QuickBooks Online offers different pricing tiers to accommodate businesses of varying sizes and complexities. The pricing structure is per business, meaning each company you manage will require its own monthly subscription fees. Prices range from affordable monthly plans for smaller businesses to more comprehensive packages for larger, more complex businesses.

Is FreshBooks capable of supporting multiple companies?

FreshBooks does allow users to manage multiple businesses but requires separate login credentials and subscriptions for each business. This preserves the privacy and financial data of each company while still providing the necessary accounting features and functionality for effective management.

Can Sage handle multi-company account management?

Yes, Sage 50cloud Accounting offers multi-company account management capabilities. With features such as consolidated financial reporting, Sage 50cloud provides users with the tools necessary to manage several businesses or subsidiaries within a single interface.

Conclusion

When it comes to managing multiple businesses, having the right accounting software is crucial for the success of each business.

If you want to keep separate books for each company, QuickBooks Online, Wave, or FreshBooks will be your best options.

If you want to consolidate financials, then you will be better off with SoftLedger, Gravity Software, or Sage 50 Cloud.

For managing all of the receipts, business cards, and any other documents, Shoeboxed is the favorite.

Caryl Ramsey has years of experience assisting in different aspects of bookkeeping, taxes, and customer service. She uses a variety of accounting software for setting up client information, reconciling accounts, coding expenses, running financial reports, and preparing tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!