Rideshare driving can be a lucrative gig, but managing the logistics, from tracking mileage to optimizing routes and managing expenses, requires the right tools. Here, we'll explore the apps that cater to rideshare drivers and help you decide which app best suits your rideshare driving needs.

What key features should you look for in apps for rideshare drivers?

Features are the key ingredient to any app, but they are particularly essential to rideshare drivers because they can affect your business's bottom line.

When evaluating great apps tailored for rideshare drivers, you should consider the following essential features:

Mileage tracking

The app should provide accurate mileage tracking for tax deductions, profit analysis, reimbursements, and efficient routes.

Expense management

Look for apps that allow you to easily input and manage other expenses related to your rideshare business, such as gas prices, maintenance, car washes, etc. These should be easily categorizable and exportable for record-keeping and tax purposes. An app with expense management will save you a lot of headaches when tax season rolls around.

Tax compliance

Since rideshare drivers' tax obligations can be complex, apps that assist users with tax compliance—such as those offering detailed reports suitable for tax filings—are highly beneficial.

Having an accurate log of business mileage and other expenses is essential for regulatory compliance. If the IRS audits a driver’s tax return, drivers need well-kept mileage and expense records to provide the necessary documentation to substantiate the claimed deductions.

Fuel savings

Features that help find the cheapest fuel at gas stations along your route or provide cash back on fuel purchases can lead to significant money savings, especially given the amount of driving involved in rideshare work.

What are the best rideshare apps for 2024?

Here, we've chosen the best rideshare apps for 2024 based on their features.

1. Gridwise

Gridwise's standout feature is the ability to track earnings across various platforms.

Gridwise offers features designed to optimize earnings and streamline the management of rideshare driving-related expenses.

Some of these features include the following:

Automatically tracks earnings

One of its essential functions is the ability to automatically track earnings across various platforms, enabling drivers to see their income from different services in one consolidated view.

Tracks mileage

Gridwise features an automatic mileage tracker. The tracker automatically logs every mile you drive while the app is active, eliminating the need to start and stop recording or keep a written log manually.

Tracks expenses

The app tracks expenses related to rideshare driving, such as fuel, maintenance, and tolls. Gridwise helps you understand the actual cost of operating your vehicle.

Generates tax reports

For tax preparation, Gridwise generates detailed tax reports that simplify the process of filing returns, making it easier for drivers to claim all relevant deductions.

CSV export

The app supports the export of financial data in CSV format, allowing drivers to maintain backups of their records or use the data with other financial management tools.

Tracks peak airport times

Gridwise is a good app for airport rides because it tracks peak airport trip times for arrivals and departures.

Pros:

Tailored alerts help maximize earnings by suggesting where and when to drive.

Earnings tracking across different platforms provides a consolidated financial overview.

Cons:

Predominantly beneficial in urban areas with more events and airport traffic.

Relies on substantial data input from the user for maximum efficiency.

Pricing: Basic features are free, but premium features are available at $6.99/month or $59.99/year.

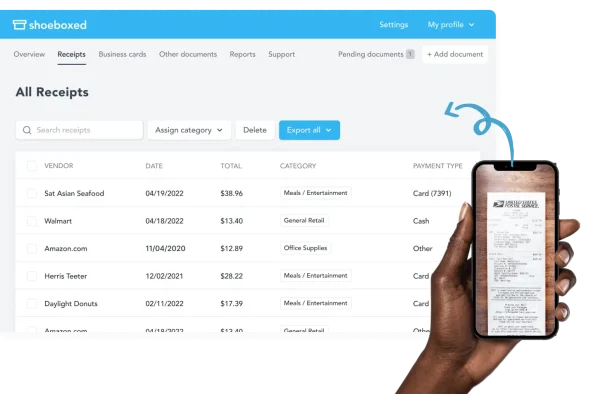

2. Shoeboxed

Shoeboxed is the best rideshare driver app for expense management and tax prep.

Shoeboxed is a versatile app that simplifies the process of expense tracking and tax prep for rideshare drivers. It's an expense-tracking tool that digitizes and categorizes receipts and logs mileage for reporting and reimbursement.

It has many features to help rideshare drivers make their jobs much more manageable.

Magic Envelope

Shoeboxed's standout feature is its Magic Envelope.

One of Shoeboxed's standout features is the Magic Envelope, which allows drivers to mail in physical receipts and other documents for digitization. The Magic Envelope service allows drivers to easily track expenses while on the road. Drivers can conveniently keep the Magic Envelope on their car dashboard and stuff it with receipts as they pay for gas, meals, etc.

Drivers can mail their receipts with the prepaid postage envelope, and Shoeboxed will do the rest. Once Shoeboxed receives the receipts, it will scan, human-verify, and upload them into the driver's account, which can be viewed online anytime, anywhere.

Magic Envelope

Hit the road with Shoeboxed 🚗

Stuff receipts into the Magic Envelope while on the road. Then send them in once a month to get scanned. 💪🏼 Try free for 30 days!

Get Started TodayMobile app

Shoeboxed's mobile phone app is incredibly easy to use while on the go.

The mobile phone app enhances usability by enabling drivers to snap pictures of receipts and business cards directly from their smartphones, automatically extracting and categorizing the relevant data.

Mileage tracker

One of Shoeboxed's features that benefits rideshare drivers is its mileage tracker.

The mileage tracker feature is specifically beneficial for rideshare drivers. It uses the driver's phone GPS to record every mile driven, and miles are then auto-categorized under mileage for reporting, reimbursements, and tax prep.

Track mileage with Shoeboxed 🚗

Track mileage using your phone’s built-in GPS for unmatched ease and accuracy. 💪🏼 Try free for 30 days!

Get Started TodayReceipt organization

Shoeboxed automatically categorizes receipts.

Once the driver's receipts are uploaded, Shoeboxed automatically separates expenses into 15 different tax categories, making tax prep a cinch.

Gmail sync

Shoeboxed automatically pulls electronic receipts from Gmail and syncs them with the other expenses already categorized on Shoeboxed.

Integration with Gmail syncs expenses directly from the user’s email, capturing electronic receipts and invoices, which helps organize and sync digital purchases and online transactions.

Shoeboxed creates comprehensive expense reports.

Shoeboxed also generates detailed expense reports with receipt images attached, which can be customized and exported. This makes it easier for drivers to manage finances and prepare for tax season.

Integrations

Shoeboxed integrates with Wave, Xero, and Quickbooks.

Shoeboxed's app integrates with accounting software like QuickBooks and Xero. This streamlines financial management across all platforms.

Pros:

Scans and automatically organizes receipts for easy expense management and tax prep.

The digital copies created by Shoeboxed are accepted by the Internal Revenue Service and CRA, which means they are suitable for tax filing purposes.

The mileage tracker is incredibly easy to use.

The Magic Envelope makes keeping up with and managing receipts and expenses easy.

Miles are auto-categorized under mileage.

For tax time, receipts for mileage, auto repairs, and other business expenses are filtered and categorized.

Cons:

The mileage tracker needs to be started and stopped manually.

Pricing: Starts at $18/month for the startup plan.

Shoeboxed demo

3. Stride

Stride is one of the best free apps for rideshare drivers.

The Stride app is tailor-made for rideshare drivers looking to simplify their financial management and maximize their tax deductions.

Some of Stride's key features include the following:

Mileage tracker

The app features a comprehensive mileage tracker that automatically logs every mile driven for business, ensuring no deductible distance is missed.

Expense tracker

The app includes an expense tracker where drivers can record costs, such as vehicle maintenance and fuel.

Automatically maximizes mileage deductions

Stride excels in automatically calculating the maximum mileage deductions available and applying the current IRS rates and rules when filing tax returns.

IRS-ready tax report

The app generates tax reports that consolidate all tracked data into a format that simplifies tax filing.

Pros:

Automatic mileage tracking simplifies record-keeping for IRS deductions.

Offers additional tax support services for the tax season.

Cons:

It is mainly helpful for tax purposes, not for daily operational needs.

Requires annual subscription for full benefits.

Pricing: Free for basic mileage tracking.

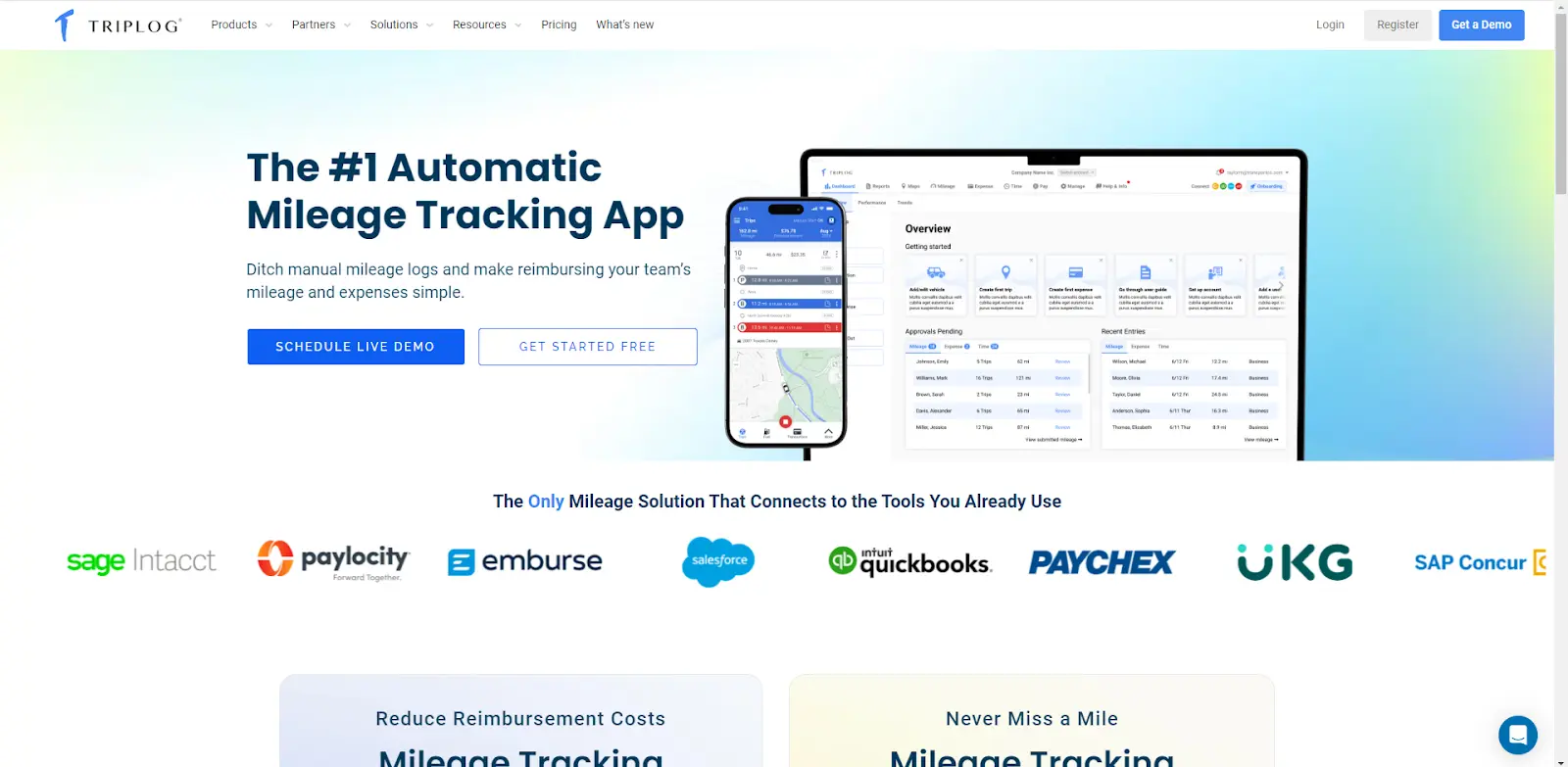

4. TripLog

TripLog easily distinguishes between business and personal travel.

TripLog offers a highly efficient solution tailored for rideshare drivers looking to manage their pay, mileage, and tax obligations easily.

TripLog's key features include:

Automatic mileage tracker app

The app features an automatic mileage tracker that seamlessly logs every mile driven, eliminating the need for manual entry and ensuring accurate tracking of distances.

Easy trip classifications

TripLog simplifies organizing trips with easy classification options, allowing drivers to quickly distinguish between business and personal travel.

Tax-compliant mileage reports

The app generates tax-compliant mileage reports that adhere to IRS guidelines.

Pros:

Comprehensive tracking features suitable for detailed expense management.

Can record trips using GPS, Bluetooth, or plug-n-go modes.

Cons:

It is more expensive compared to other mileage apps.

The interface may be complex for users who only need simple tracking.

Pricing: The lite plan is free, and the premium plan costs $5.99/month or $59.99/year.

Why is it essential for rideshare and delivery drivers to track miles and other expenses?

Mileage and expense tracking can benefit rideshare drivers in several ways.

Here’s a detailed look at why mileage and expense tracking is so important for rideshare drivers and those who deliver packages:

Tax deductions

For rideshare and delivery drivers, mileage and other related expenses can be deducted from their taxes, leading to substantial savings. The IRS allows drivers to deduct mileage using the standard mileage rate or the actual expense method.

Accurate expense records

Knowing how many miles were driven for business helps drivers maintain precise records and better manage their finances.

Reimbursements

Some rideshare or delivery services may offer reimbursements to pay for miles driven. Accurate tracking ensures that drivers receive all the reimbursements they're entitled to.

Profitability analysis

By tracking miles, drivers can calculate their earnings per mile and assess which types of rides or deliveries are the most profitable.

Proof of work

Detailed mileage logs can prove work done, particularly when disputes with customers, the service provider, or tax authorities occur.

Frequently asked questions

Will these rideshare apps work for Uber drivers, Uber Eats drivers, and Lyft drivers?

Yes, the rideshare apps mentioned in this article will benefit an Uber driver, an Uber Eats driver, and a Lyft driver. They all share the same requirements and features needed as a rideshare driver and other similar gig workers.

Can rideshare drivers use Google Maps?

A rideshare driver and passengers can use Google Maps for traffic updates, alternative routes, location sharing, street views, and finding amenities.

Are there other apps that are less essential for rideshare drivers but would be helpful?

There are other apps that are less critical, such as those that cater to rideshare drivers' own playlists, podcasts, and roadside assistance. A roadside assistance app connects you with service providers for a flat tire, a tow, or a locksmith.

In conclusion

Choosing the right apps can significantly impact managing a rideshare business. When selecting an app, rideshare drivers should consider their specific needs, budget, and personal preferences for managing the administrative aspects of their work. These features can help rideshare drivers maximize efficiency, make more money, and enhance the ride-sharing experience for the driver and their passengers.

Caryl Ramsey has years of experience assisting in different aspects of bookkeeping, taxes, and customer service. She uses a variety of accounting software for setting up client information, reconciling accounts, coding expenses, running financial reports, and preparing tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports, and more—with Shoeboxed.

Try Shoeboxed today!