If the IRS lost your tax return, don’t panic. We’ve got you.

In this guide, we’ll cover everything you need to know and the steps to take to finally receive your lost tax refund.

1. Get it right the first time

When you start amending returns, making changes, and increasing the amount of paperwork the IRS has to do, mistakes are much more likely to happen.

The best way to prevent a missing refund is to make sure you filed your original return accurately.

Preventing confusion is the key to avoiding a lost tax return.

2. Wait 16 weeks

It could take 16 weeks for your refund money to come through no matter if you chose to receive a check in the mail or to get your tax refund electronically.

The fastest turnaround time to receive a tax refund is 21 days, but this isn’t the norm.

So wait 16 weeks before tearing out your hair.

3. Check Where’s My Refund?

While you’re waiting, you can check the status of your return by visiting Where’s My Refund? on the IRS website.

Where’s My Refund, IRS site, allows you to check on the status of your refund.

Be sure it’s been longer than 24 hours if you filed your tax forms electronically. Additionally, it should be longer than 4 weeks if you filed by postal mail.

When using the “Where’s My Refund” site, provide your social security number, filing status, and the exact amount of your refund.

Once you’ve done that, you’ll be given a date to be on the lookout for your return. Your return will either be deposited into your bank account or a check will be sent through the mail.

4. Opt for Power of Attorney

So what happens when you wait 16 weeks, you check Where’s My Refund?, and the IRS has no record of monies owed?

For those working with a tax professional, sign over Power of Attorney so they can investigate the missing money.

Power of attorney template from LegalTemplates.net

Be sure to keep copies of any and all correspondence you’ve received from the IRS, especially the letter indicating the amount of your return.

If the IRS mailed you a check, but you haven’t received it, look into filing a claim and opening an investigation of the missing money.

The IRS can issue a replacement check if your check was lost in the mail.

If the check was cashed by someone else, you might have identity theft or fraud on your hands.

5. Don’t count on those tax return dollars

Finding a lost refund can be a long, drawn-out process and could take months to resolve.

It’s best not to rely on your tax return dollars for important expenses and instead think of your refund as more of a surprise bonus.

What are the steps to take if my tax refund got stolen or lost?

Step 1. Check the status of your refund.

Go to irs.gov/refunds.

Step 2. Use form 3911 to begin a trace of your refund.

You can report the missing refund check with form 3911.

Step 3. Get the IRS’s next-action steps for your refund trace.

After you find out whether the check has been lost or stolen, the IRS will tell you how to proceed.

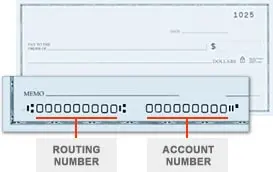

a. If you chose a direct deposit for your tax refund

For direct deposit refunds, your bank or financial institution will receive a notice within 6 weeks from the Treasury Department’s Bureau of the Fiscal Service verifying where your deposit went.

Direct deposit refunds for IRS refund checks.

b. If you chose paper check refunds for your tax refund

So long as the check has not been cashed, you will get an IRS replacement check in about 6 weeks.

Paper check refunds for IRS refund check.

c. If your refund check was cashed

You will receive a claim package within 6 weeks to fill in and send to the Bureau of the Fiscal Service.

If the check is found to have been forged, a replacement refund check will be issued.

d. If your claim is denied

You will receive a denial letter from the Bureau of the Fiscal Service letting you know how you can appeal their decision.

How do I file a 3911 form to ask for a new refund?

If you filed a 1040 form but you never received your refund check, you can use a 3911 form to ask for a new refund.

Watch this tutorial on how to file a 3911 form.

How to file a 3911 form if you had a lost refund check, by Jason D. Knott.What if the IRS lost my tax return and wants the original?

If you sent your tax return and are expecting a refund, but the IRS lost it, you may receive letter 4903 from the IRS.

IRS letter 4903 is sent when the IRS doesn’t receive a tax return by the deadline or has no record of your tax return.

This letter requests that you respond within 10 days to file a return.

If you do not file a return within the 10 days you received IRS letter 4903, the IRS may file a return on your behalf along with fees and penalties.

You don’t want to be penalized, so be sure to file a duplicate tax return either by e-filing through tax software, such as TurboTax, or by mail using IRS Form 1040.

The How to File page on the IRS has more information to help you file a second tax return.

TurboTax lost my tax return, and I can’t access it at IRS

If you suspect that TurboTax lost your tax return, it may be due to using the wrong user ID or TurboTax account.

TurboTax homepage

If you’re sure you’re using the right account, try the methods below:

Method 1: Attempt to access your return on TurboTax

To locate your tax returns on TurboTax, do the following:

Sign into the account you used to file

Select “Tax Home”

Choose “Your tax returns & documents”

Select the tax filing year

Click “Download/print return (PDF)”

If your return has expired, you will see a link detailing how to gain access to your old tax return.

Method 2: File IRS Form 4506

If you aren’t able to find your tax return in your TurboTax or IRS account, you’ll need to fill out form 4506. You can use IRS form 4506 to request a copy of your tax return.

To request a copy of your tax return, do the following:

Follow the instructions on the form

Mail the form to your local IRS address

Not sure which address to use? You can find your local IRS address listed on the second page of form 4506.

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic approach to receipt tracking for tax season. Try free for 30 days!

Get Started TodayFrequently asked questions: The IRS lost my tax return

How will I know if the IRS received my tax return?

The Where’s My Refund tool will help you track your refund. Find it on IRS.gov or on their mobile app, IRS2Go App.

Most tax refunds are sent out within 3 weeks. However, some exceed this time period if your tax return requires further assessment.

To use Where’s My Refund? to check on the status of your tax return, input the following:

Individual Taxpayer Identification Number (ITIN) or social security number (SSN)

Tax filing status listed on your return: single, qualifying widow(er), head of household, married filing jointly, etc.

The exact refund total that was on the tax return After inputting your information, you’ll be moved to a Refund Status Results screen where you will see the following information:

Return received

Refund approved

Refund sent

Check Where’s My Refund once a day for updates.

What if my tax return was lost in the mail?

Call the IRS at 800-829-1954 (toll-free).

You will be directed to use their caller support or you can ask for an IRS rep. For more information, go to IRS.gov’s dedicated page “Where’s My Refund?” You can also use their mobile app to start tracking your refund. For married joint filers, you will need to use Form 3911 to get the replacement process started.

How do I call the IRS and speak to an agent if I entered the correct account and routing numbers, but the IRS made an error in depositing my refund?

The number provided by IRS.gov is 800-829-1040 to speak with an IRS rep. You can call Monday to Friday, between 7 a.m. to 7 p.m., Pacific Time.

Bonus infographic: What to do if the IRS lost your tax return

The IRS Lost My Tax Return: 5 Steps to Take

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!