The U.S. Census Bureau reports that business applications in May 2024 were 423,945, indicating the potential for new business formations remains robust.

As a startup, your biggest priority is to get your business up and running and then watch it grow. Running a business and experiencing business growth is attainable, but it can only be done with an efficient system to record and organize your finances.

A good bookkeeping system is the seed of any business, and if nurtured, it can grow and turn your business into a world of possibilities.

Why is good bookkeeping so important for startups?

Good business practices from the start are essential, and this starts with your bookkeeping. A structured accounting system is the foundation of your business and helps you develop good financial habits that will benefit your startup in the long run.

Your bookkeeping system is more than just a record keeper. It’s a tool to guide your business decisions. Using your finances, you can see where you can reduce expenses, increase profit, and give your business the best chance of success.

Streamlined business accounting platforms for startups can significantly simplify financial management, making it easier to maintain accurate records and make informed decisions.

Having a financial plan to manage your startup’s finances is not just necessary; it’s a source of empowerment. Understanding accounting for startups gives you a complete picture of your finances and how they relate to your business.

It equips you with the power to make informed financial decisions, take control of your business’s financial health, and steer your startup toward success.

Do startups need a bookkeeper?

Creating and maintaining financial records is part of startup accounting. Most startups don’t need a third-party bookkeeper initially.

It’s a good idea for the business owner to do the books for the first year to understand how accounting works in their industry and how different accounting methods and financial aspects affect the business.

After the first year, it’s wise to hand the books over to someone else who can handle the bookkeeping. This decision allows small business owners to focus on running and growing the business.

In the meantime, accounting software designed for your industry can make the process easier and less overwhelming. Additionally, using dedicated business bank accounts makes the accounting process that much easier.

How does the business entity I choose affect my bookkeeping?

Before you set up your accounting system, you must choose a business entity. This will affect your bookkeeping, mainly when it comes to taxes.

1. Sole proprietorship

A sole proprietorship is not considered a separate business entity, meaning your business liabilities and assets are not separate from you personally. You are liable for the business obligations and debts. So, sole proprietorships are good for low-risk businesses.

2. Limited liability company (LLC)

An LLC protects personal assets and is good for medium to higher-risk businesses. LLCs have lower tax rates than corporations because profits and losses pass through your income taxes.

3. C Corporation

A C corporation is separate from its owners. Corporations provide the most protection for a business owner’s assets. Here, you will see a big difference in the bookkeeping.

Corporations require more detailed and complex accounting, reporting, and operational processes. Corporations can raise capital by selling stock, which also has an impact on the bookkeeping process.

4. S Corporation

S corps are for business owners who want to avoid double taxation. With C corps, profits are sometimes taxed twice: when the business earns a profit and when dividends are paid to shareholders taxed on their returns.

S corps profits can pass through to the owner’s tax return, so they are not subject to corporate rates.

5. Partnership

Partnerships are for businesses with multiple owners or professionals. With partnerships, profits pass through personal returns.

Accounting and bookkeeping services can advise on the type of accounting method that would work best for your business.

How do I choose an accounting method?

You will also need to decide which accounting method your business will use. The choice is between cash accounting or an accrual accounting method.

Cash accounting

Cash basis accounting is the simplest. With a cash basis, income is tracked when received, and expenses are recorded when paid.

Accrual accounting

Accrual-basis accounting accounts for money and expenses when earned. It’s slightly more complex but gives a better view of the business in the future. It’s good for businesses with accounts payable and accounts receivable.

What should bookkeeping for startups include?

Bookkeeping for startups entails financial data and provides up-to-date and accurate financial reports to manage cash flow and business growth.

Here are a few things that we suggest to maximize the startup business’s performance.

1. Open a business bank account

A business owner should open a business bank account separate from their personal account to ensure proper business accounting. This way, you can avoid mixing investor funds or business expenses with your funds.

Having business funds in a separate business bank account will make tax time much easier when you or your accountant try to track down business deductions and credits.

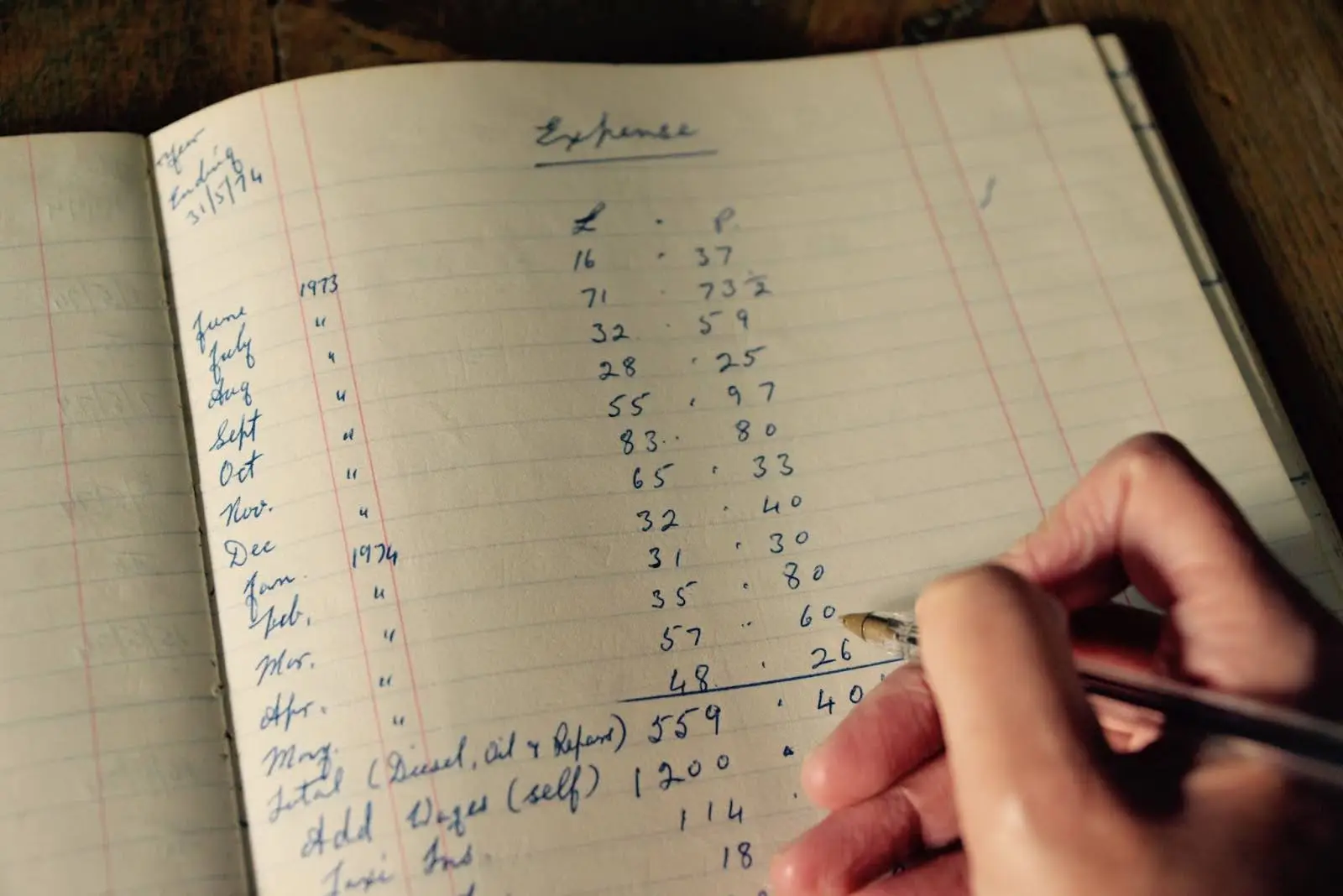

2. Record all financial transactions

Every financial transaction in a business must be accounted for and recorded. A company is like a puzzle. Every transaction is a piece of the puzzle. You’re not going to get the whole picture if you’re missing a piece of that puzzle.

All the transactions together give a snapshot of a business’s financials. If one of those transactions is missing or incorrect, you’re not getting the whole picture or an accurate account.

For example, if you forget to record a sale, your revenue will be understated, and you may make incorrect business decisions. So, it’s absolutely crucial to record every transaction to be categorized and translated into financial statements to show cash flow and the business’s financial status.

A chart of accounts, just like any other chart, shows you how much and where the money is going to.

3. Set up a chart of accounts

Revenue and expenses are categorized into accounts. The chart of accounts is a list of all the business’s accounts and reflects how much is where.

4. Reconcile accounts

Reconciliation is part of the bookkeeping process. Your financial records must match all your credit card and bank statements. Errors can paint an incorrect picture of your business’s financials, so it’s better to catch the mistake sooner rather than later. You don’t want the error to snowball month after month and be impossible to fix.

Remember, you’re not the only one who makes mistakes. Banks and financial institutions make mistakes, too. If everything reconciles correctly, you can ensure the statements' financials are accurate. Reconciling accounts is also a great way to detect fraud.

Staying on top of invoicing and paying bills will maximize your cash flow.

5. Invoicing and paying bills

Monitoring and staying on top of all bills and invoicing is crucial. Bills are entered into accounts payable, which can be tracked to ensure they are paid on time. The accounts payable account will tell you how much you owe and who you pay.

Bills must be paid on time so the business doesn’t get charged late fees, interest, or both, which would add unnecessary costs. You want to minimize whatever costs you can to maximize your profit.

Staying on top of invoicing is important because your invoicing process can impact your cash flow. Invoicing should be done when the service is complete, or the order is placed.

The sooner you send the invoice, the sooner you’ll get paid. The more consistent your revenue stream or incoming cash is, the better your cash flow will be. You should monitor account receivables and AP aging reports monthly and follow up on any accounts that are behind in payment.

An automated bill pay system that integrates with your accounting software will minimize data entry and keep track of all bills.

6. Financial statements

Financial statements are a summary of all business transactions for a specific period. Three main financial statements, including the balance sheet, income statement, and cash flow statement, should be prepared monthly.

a. Balance sheet

The balance sheet shows what the business owns and owes and the value of the business owner’s investments through assets, liabilities, and owner’s equity, respectively.

b. Income statement

The income statement shows the profit of the business for a specific period. The startup’s expenses and losses are subtracted from the revenue.

c. Cash flow statement

The cash flow statement shows the money flowing into and out of the startup. It shows how much cash is coming in, where it’s coming from, how much money is going out of the startup, and where it’s going.

Bookkeeping software will generate and print these monthly financial reports, making the process easier. Financial statements will show business owners what metrics impact the startup’s strategic business decisions.

7. Payroll

Payroll is time-sensitive, and this bookkeeping aspect involves multiple employees, employee turnover, varying hours, and certain expense deductions.

So, payroll should be outsourced or used as an automated payroll system that integrates with your bookkeeping software. This will make payroll much more efficient.

How can you simplify bookkeeping for startups?

You can simplify startup bookkeeping by automating receipt management, expense tracking, and financial reporting.

Here’s how.

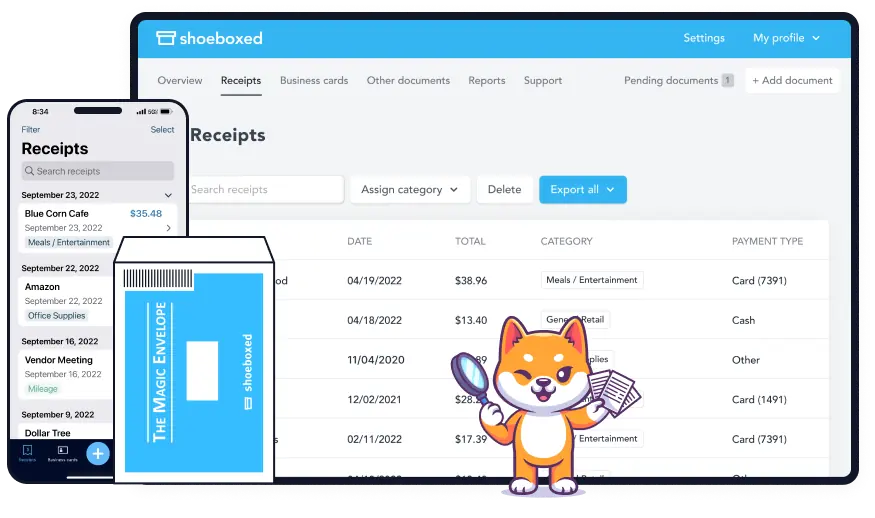

Shoeboxed

Shoeboxed is used by over a million businesses.

It turns your receipts into digital data, automatically extracting data for reimbursements, expense reporting, tax preparation, and more.

Digitizes receipts and documents

Startups have many receipts and documents such as the following:

expense receipts

income and revenue documents

payroll and employee-related documents

vendor and supplier documents

banking and financial documents

tax and compliance documents

legal and corporate documents

funding and investor documents

operational documents

insurance policies

That’s a lot of paperwork to keep up with.

Digitizing these receipts and documents reduces paper clutter and manual entry and makes them easily accessible.

Mobile app

Scan an item using your mobile device’s camera and Shoeboxed’s app to digitize receipts and documents.

Shoeboxed’s OCR data extraction pulls critical information from receipts automatically, with no manual data entry and no errors.

The scanned data is uploaded to your Shoeboxed account and stored securely in the cloud. This makes it easily accessible from anywhere and reduces the risk of losing important paperwork.

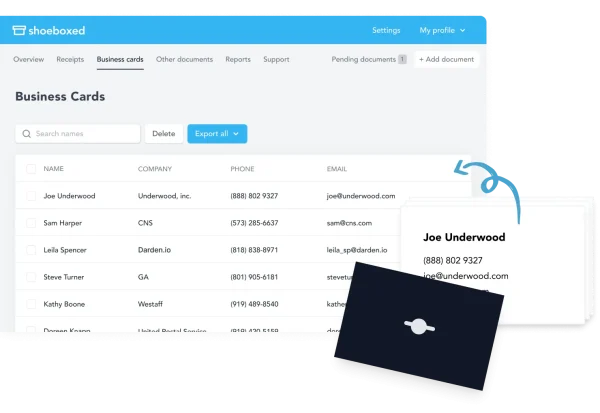

Business card management

Startups collect a lot of business cards from vendors, financial institutions, and potential clients and customers.

The Shoeboxed mobile app takes photos of business cards. The app will then extract and digitize the contact information.

All digitized business cards are stored in a central cloud-based database, so contact information is accessible anywhere.

The contact information that was extracted becomes searchable, so you can quickly find specific contacts when needed.

Shoeboxed allows you to export contact information to various CRM systems so all your business contacts are organized and accessible within your preferred customer relationship management tools.

Contacts can also be exported as CSV files and imported into other contact management systems or email clients.

Do business cards like a boss ✨

Use Shoeboxed’s app to organize business cards, receipts, and more. Try free for 30 days!

Get Started TodayMagic Envelope

Or, if you’re feeling overwhelmed with your startup and want to outsource your receipt and document management, Shoeboxed provides a free postage-paid Magic Envelope you can fill with a batch of receipts and mail to the processing center to scan, human-verify, and upload into your designated Shoeboxed account.

Shoeboxed is the only receipt scanner app that will handle both your paper receipts and your digital receipts—saving customers up to 9.2 hours per week from manual data entry!

Stop doing manual data entry 🛑

Outsource receipt scanning to Shoeboxed’s scanning service and free up your time for good. Try free for 30 days!✨

Get Started TodayGmail Plugin

The Shoeboxed Gmail plugin automatically detects and extracts receipts from your inbox and turns them into organized expense records.

The plugin categorizes expenses from email receipts to track and organize all business expenses.

Users who don’t have a Gmail account, can forward email receipts to their Shoeboxed account for automatic processing and categorization.

Organizes and categorizes

For receipt management, once uploaded, Shoeboxed organizes and categorizes receipts into tax or custom categories such as office supplies, utilities, travel expenses, etc.

Startups can create custom tags and categories to suit their bookkeeping needs, so they have a tailored financial oversight.

Receipts and documents become part of a searchable database so you can quickly find what you need when you need it.

This auto-categorization saves startups time, reduces errors, and helps track spending and manage budgets.

Turn receipts into data with Shoeboxed ✨

Try a systematic approach to receipt categories for tax time. Try free for 30 days!

Get Started TodayExpense reporting

Shoeboxed generates expense reports that give startups insight into their spending so they can plan budgets and perform financial analysis.

Mileage and business travel tracking

Shoeboxed has a mileage tracking feature that logs business trips so you can claim mileage deductions.

Detailed mileage reports can be generated to track and claim mileage deductions.

Track mileage with Shoeboxed 🚗

Track mileage using your phone’s built-in GPS for unmatched ease and accuracy. 💪🏼 Try free for 30 days!

Get Started TodayIntegrates with accounting software

Shoeboxed integrates with accounting software like QuickBooks, Xero, and Wave to transfer and sync data seamlessly.

Shoeboxed syncs digitized receipts and expense reports with your accounting software, making bookkeeping and tax time a breeze.

Tax preparation

Receipts are in a format accepted by the IRS, so tax time is smoother and audit-proof.

Shoeboxed tracks deductible expenses to ensure startups are claiming all eligible deductions.

It generates tax-friendly reports of deductible expenses so you can file taxes accurately and efficiently.

Compliance and audit readiness

Accurate and organized records make responding to audits and inquiries from tax authorities or investors easier.

Enhanced collaboration with free sub-users

With a Shoeboxed account, startups can add unlimited free sub-users so colleagues and accountants can access Shoeboxed and work on bookkeeping and accounting tasks.

Different levels of access and permissions can be set for each user so sensitive financial data is protected.

Streamlined financial processes

Shoeboxed is one platform for managing all documents, so you don’t need multiple tools and can work more efficiently.

Automating data entry and categorization frees up time for strategic planning and business growth.

Scalability

Shoeboxed grows with the business as you grow so that you can manage more receipts and expenses.

Detailed and accurate financials will attract investors by showing the profitability and stability of your startup.

Getting started is easy

1. Sign up for Shoeboxed.

2. Download the Shoeboxed app to capture receipts on the go.

4. Add team members as sub-users to work on bookkeeping tasks.

5. Set roles and permissions based on their responsibilities.

6. Integrate with accounting software (e.g., QuickBooks, Xero).

7. Upload receipts using digital receipt capture.

8. The platform will auto expense categorization and report generation.

9. Track mileage and business travel with mileage tracking.

10. Review financial reports and dashboards regularly.

By using Shoeboxed, startups can simplify bookkeeping, save time, track business finances accurately, and focus on growing the business.

What financial records should startups keep?

When starting and running a business, another important task is keeping track of supporting documents for all business transactions. There may come a time, like an audit, when you need to prove to the IRS that the financial information on your tax return is accurate and true.

Any documents that support tax credits, tax deductions, expense deductions, or taxable income on tax returns filed should be kept, such as:

Bank statements

Credit card statements

Receipts

Bills

Invoices

Canceled checks

W-2s

1099s

Tax returns from previous years

Proof of payments

Financial records and statements

Using a receipt scanner helps startups stay on top of critical documentation.

Do startups need an accountant?

A bookkeeper is justified after the business is up and running and established for a while. You will also want a professional accountant to do accounting work during tax season to help with tax requirements.

A CPA oversees the startup’s accounting, makes financial decisions for owners, files business taxes, keeps the startup compliant, and is a lifesaver if ever audited.

Frequently asked questions

Should a business owner hire an accountant for the startup’s accounting?

Regarding taxes, always hire a professional accountant. An accountant can help make financial decisions for the business, keep the company compliant, and help startups take advantage of all tax deductions and credits which will save them money in the long run.

Why is bookkeeping and accounting important for a startup?

Bookkeeping is essential for startups because it tracks their financial health and position and helps with cash management and flow.

What’s the benefit of startups using cloud accounting software?

Cloud accounting software simplifies the bookkeeping and accounting process and allows access to their financial records anywhere.

In conclusion

As a startup and business owner, an efficient bookkeeping system is your lifeline. Choose your business entity, an accounting method, and set up your accounting system and you’ll be up and running. Remember, there are professional accounting services that are trained and have the experience to help you get the most out of your business.

Caryl Ramsey has years of experience assisting in different aspects of bookkeeping, taxes, and customer service. She uses a variety of accounting software to set up client information, reconcile accounts, code expenses, run financial reports, and prepare tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple receipt capture methods: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad, and Android) to snap a picture while on the go—auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports, including IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports, and more—with Shoeboxed.

Try Shoeboxed today!